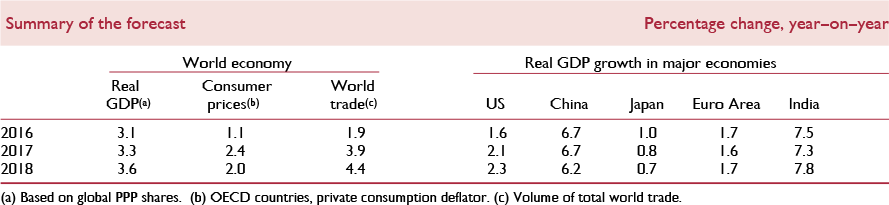

Global growth has strengthened moderately and become more broadly based, including within the Euro Area and among emerging market economies that have been suffering severe recessions. In the advanced economies, headline inflation has risen close to targets except in Japan, but core inflation has remained well short of targets except in the US. Activity is probably close to full employment levels in the US, Japan and Germany, although subdued wage inflation continues to raise questions about employment gaps. In the Euro Area, unemployment has recently fallen to 9.5 per cent, below the halfway point between its 2008 trough and its 2013 peak.

Among the major emerging market economies, Brazil remained in deep recession in late 2016 but an upturn is expected to begin this year. Russia seems to have started to recover from its recession. India's GDP growth has remained the fastest among the major economies despite last November's demonetisation. The gradual slowing of China's growth, interrupted in late 2016, is likely to resume this year.

There are currently unusual uncertainties about the interpretation of recent increases in business and consumer confidence in the US and several other advanced economies, economic policies in the US, prospective policies in the largest economies of the European Union, and geopolitical developments in the context of recent tensions. These imply significant upside and downside risks to our forecast. However, risks are skewed to the downside, with those that could derail the gathering momentum of global growth of particular concern.

One such risk is a possible reversal of recent gains in asset markets as a result of disappointed expectations about growth. Another is unexpectedly steep increases in US interest rates, which could result from proposed policies that would be likely to widen the budget deficit and increase inflationary pressure, with effects on asset markets and the US dollar's exchange rate, and repercussions on emerging market economies and global payments imbalances. A third risk is a US-led turn to protectionist trade policies. A fourth is increased danger of financial crises as a result of lighter regulation of the financial sector. There is also a risk of additional political obstacles to policies and reforms needed to improve the working of the monetary union in Europe and the broader EU economy