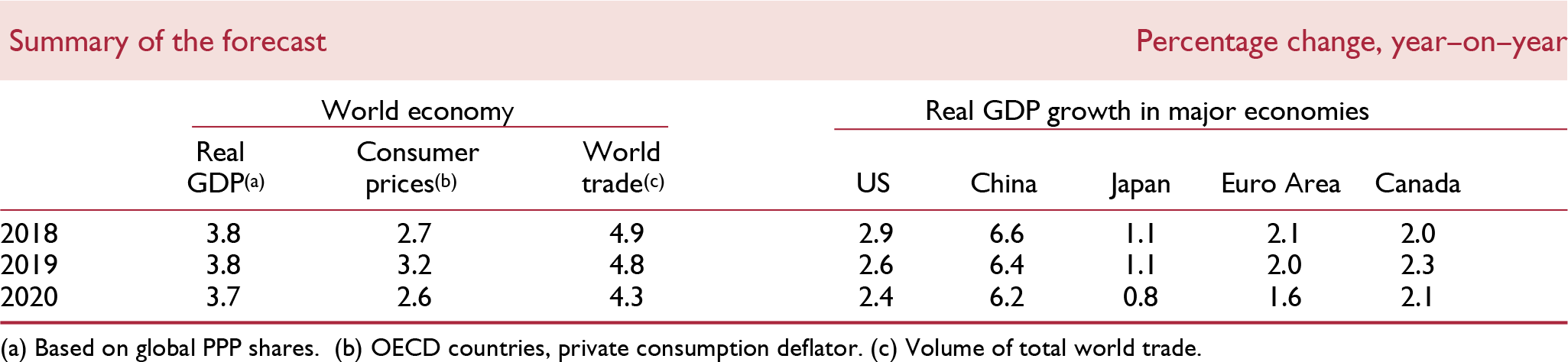

We expect growth this year and next to be at a pace close to, but slightly below, 4 per cent. Relatively strong growth does, however, mask some important uncertainties.

If relatively robust growth in the advanced economies continues, signs of increased capacity use and labour market tightness could mount with inflationary pressures building. We expect monetary authorities to be able to unwind policy accommodation gradually and do not expect to see growing inflationary pressures but the possibility of a less gradual path cannot be ruled out.

More restrictive monetary policy in the advanced economies could, especially if it is accompanied by a stronger US dollar, start to place pressures on those in other economies who have built up debt, especially if it is in US dollars. The increase in debt in the expansion phase could act as a transmission mechanism for slowing activity growth.

In addition, the period of stronger global growth and the reduction in unemployment rates in advanced economies may, of themselves, have boosted confidence effects in both economies and financial markets. While these would be regarded as positive, they could lead to a building of potential downside risks. Concerns have been expressed by some about the strong run in equities and the increase in private sector indebtedness creating potential vulnerability to a negative shock.

A key development in the international economy over the past year has been the increase in protectionist rhetoric and tariffs by the US. This has led to retaliatory measures. While there has been some positive news recently with the initial USMCA agreement, it looks likely that the period of increased trade tensions has not ended. The potential is to slow the rate of world trade and economic growth. At present such effects are not substantial, but there remains considerable uncertainty around how this situation will develop.

Even with all the global economic and geo-political environmental uncertainties, we expect growth in the near term to continue at a pace above 3.5 per cent a year, which marks something of a mini-peak in the global growth cycle. We continue to expect the pace of growth to run at around 3.5 per cent a year in the medium term, with the slowing from the current experience reflecting demographic trends generally and a reduction in growth in China as that economy continues its long-term development.