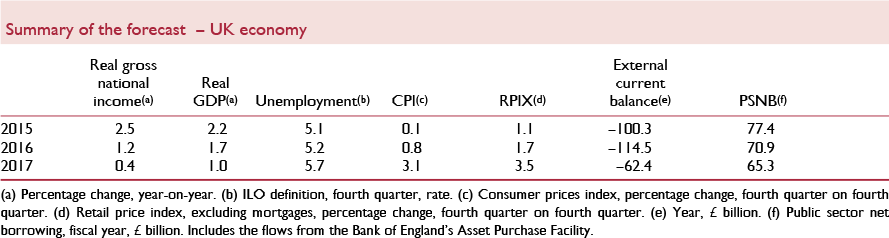

Following the vote to leave the EU, we have seen heightened uncertainty and a depreciation of sterling. In the near term, we also expect a tightening of financial conditions and a spike in inflation. These factors will slow GDP growth from 1.7 per cent in 2016 to just 1 per cent in 2017. The unemployment rate is expected to rise from 4.8 per cent in the second quarter of this year to a peak of around 5¾ per cent in the middle of 2017.

Both consumer spending and private sector investment are expected to decline in 2017. This is partially offset by a positive contribution from net trade as the fall in sterling improves the competitiveness of UK exporters. The downturn is expected to be temporary, with growth prospects ameliorating in 2018 and beyond. While we estimate that the economy will shrink in 2016Q3, a ‘technical’ recession is not our modal forecast. But there is an elevated risk of further deterioration in the near term. The probability of such a recession occurring has increased significantly since our previous forecast. We estimate that there is around an evens chance of a recession at some point during the period 2016Q3 to 2017Q4, inclusive.

This forecast is based on a significantly looser path for monetary policy than we had assumed in May. We now expect a 25 basis point reduction in Bank Rate at the August meeting of the Monetary Policy Committee, and a further 15 basis point reduction at their November meeting. This conventional response could well be combined with further quantitative easing. Our analysis suggests these policy instruments could offset a negative shock to the economy of up to approximately 1½ per cent of GDP. A more extreme downturn than this would require the use of additional policy instruments.

Our forecasts for government borrowing have changed substantially from those published just three months ago. We now expect an absolute surplus to be achieved only in 2021–22. The economic downturn will generate a significant increase in the magnitude of borrowing between 2016–17 and 2020–21, amounting to at least a cumulative £47 billion (an annual average of £9.5 billion or 0.5 per cent of GDP). Gross government debt, as a percentage of GDP, is expected to increase from 89 per cent at the end of 2015 to just over 90 per cent of GDP by the end of 2017.