No CrossRef data available.

Article contents

World Overview

Published online by Cambridge University Press: 01 January 2020

Abstract

- Type

- The World Economy

- Information

- Copyright

- Copyright © 2015 National Institute of Economic and Social Research

Footnotes

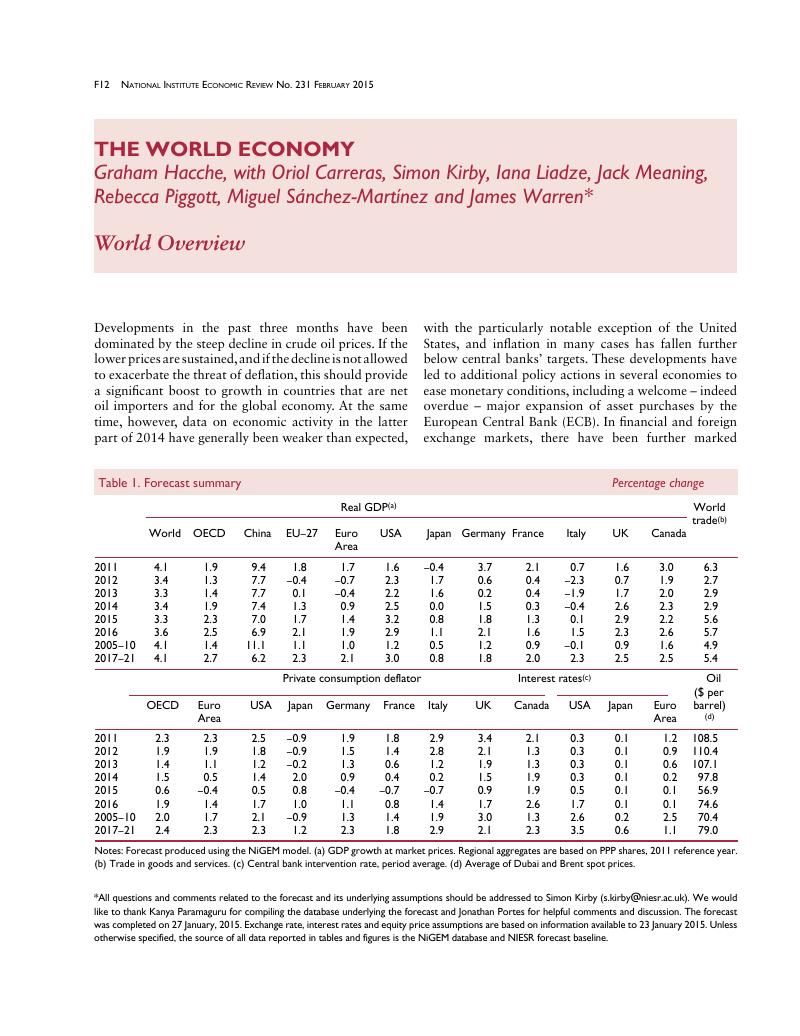

We would like to thank Kanya Paramaguru for compiling the database underlying the forecast and Jonathan Portes for helpful comments and discussion. The forecast was completed on 27 January, 2015. Exchange rate, interest rates and equity price assumptions are based on information available to 23 January 2015. Unless otherwise specified, the source of all data reported in tables and figures is the NiGEM database and NIESR forecast baseline.

References

Notes

1 In particular, we have for this Review adopted the IMF's new 2011 purchasing power parity (PPP) weights for international aggregation, replacing the former 2005 PPP weights. The new weights are larger than the old for relatively fast growing emerging market and developing economies, thus raising global GDP growth rates.

2 Between the end of 2013 and late January 2015, The Economist index of prices of industrial materials fell by 14 per cent in US dollar terms, which may be accounted for largely by the 16 per cent effective appreciation of the US dollar in this period. By contrast, oil prices fell by 53 per cent. Only the price of iron ore (not included in The Economist index), among the major industrial commodities, has come close to the recent decline in the price of oil, with a fall of 50 per cent in the same period. This has been attributed largely to the slowing of investment activity in China and increased supply from Australia.

3 Benchmark rates in Denmark were lowered by a further 25 basis points to −0.75 per cent, effective from 6 February.