No CrossRef data available.

Article contents

Prospects for Individual Economies

Published online by Cambridge University Press: 26 March 2020

Abstract

An abstract is not available for this content so a preview has been provided. Please use the Get access link above for information on how to access this content.

- Type

- The World Economy

- Information

- Copyright

- Copyright © 2013 National Institute of Economic and Social Research

References

Barrell, R.Holland, D.Hurst, I., (2013), ‘Fiscal multipliers and prospects for consolidation’, OECD Journal, Economic Studies, 2012, pp. 71–102.CrossRefGoogle Scholar

Barrell, R.Davis, E.P. (2007), ‘Financial liberalisation, consumption and wealth effects in seven OECD countries’, Scottish Journal of Political Economy, 54, pp. 254–67.CrossRefGoogle Scholar

Barrell, R.Pina, A. (2004), ‘How important are automatic stabilisers in Europe?’, Economic Modelling, 21, 1, pp.1–35.CrossRefGoogle Scholar

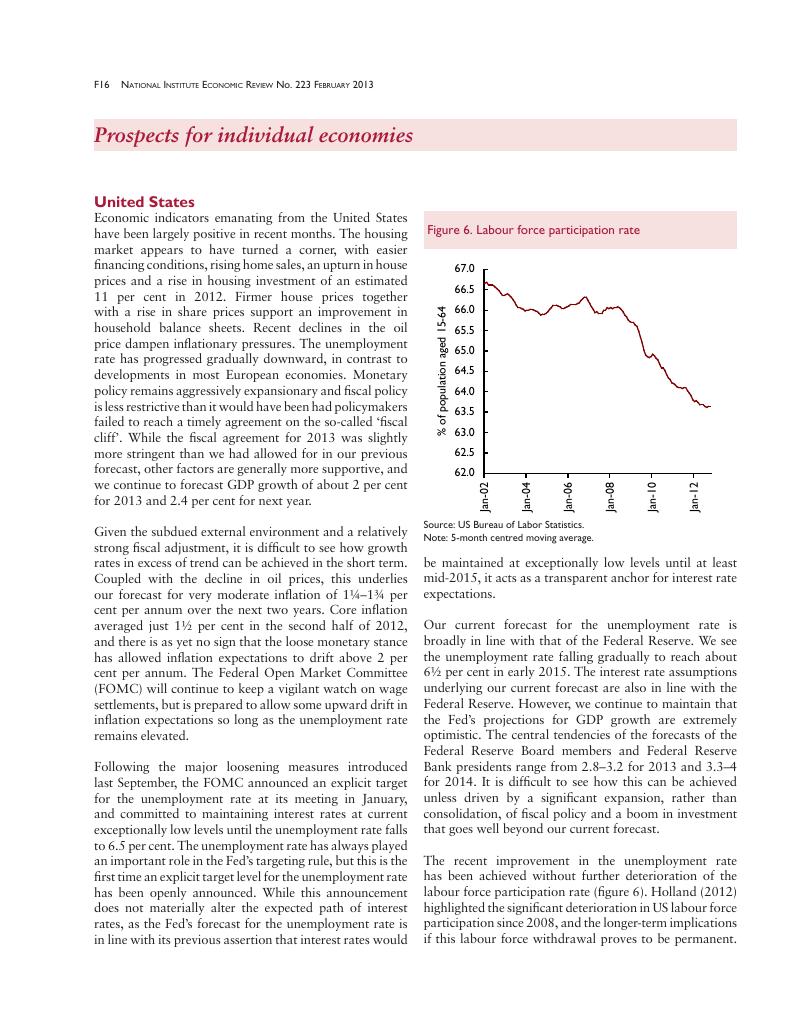

Holland, D. (2012), ‘Reassessing productive capacity in the United States’, National Institute Economic Review, 220, April, F38–44.CrossRefGoogle Scholar

OECD (1999), ‘The size and role of automatic fiscal stabilisers’, OECD Economic Outlook, 66, pp. 137–49.Google Scholar

OECD(2012), ‘Estimated additional capital needs in large euro area banks’, Box 1.5 in OECD Economic Outlook, 2012/2, p. 51.Google Scholar

Smyth, D.J. (1966), ‘Built-in flexibility of taxation and automatic stabilization’, Journal of Political Economy, 74(4), pp. 396–400.CrossRefGoogle Scholar