Crossref Citations

This article has been cited by the following publications. This list is generated based on data provided by

Crossref.

Giannone, Domenico

Lenza, Michele

Pill, Huw

and

Reichlin, Lucrezia

2011.

Interest Rates, Prices and Liquidity.

p.

195.

Goodhart, C. A. E.

and

Ashworth, J. P.

2012.

QE: a successful start may be running into diminishing returns.

Oxford Review of Economic Policy,

Vol. 28,

Issue. 4,

p.

640.

Bholat, David

and

Gray, Joanna E.

2012.

Organizational Form as a Source of Systemic Risk.

SSRN Electronic Journal,

Cobham, D.

2012.

The past, present, and future of central banking.

Oxford Review of Economic Policy,

Vol. 28,

Issue. 4,

p.

729.

COBHAM, DAVID

and

KANG, YUE

2012.

FINANCIAL CRISIS AND QUANTITATIVE EASING: CAN BROAD MONEY TELL US ANYTHING?*.

The Manchester School,

Vol. 80,

Issue. s1,

p.

54.

Ashworth, J.

2013.

The New Palgrave Dictionary of Economics.

p.

1.

Bholat, David

and

Gray, Joanna

2013.

Organizational Form as a Source of Systemic Risk.

Economics,

Vol. 7,

Issue. 1,

2013.

Un New Deal pour l’Europe.

p.

295.

Migiakis, Petros M.

and

Louri, Eleni (Helen)

2015.

Determinants of Euro-Area Bank Lending Margins: Financial Fragmentation and ECB Policies.

SSRN Electronic Journal ,

Louri, Helen

and

Migiakis, Petros M.

2016.

Bank Lending Margins in the Euro Area: The Effects of Financial Fragmentation and ECB Policies.

SSRN Electronic Journal,

Ashworth, J.

2016.

Banking Crises.

p.

251.

Carreras, Oriol

and

Piggott, Rebecca

2016.

Macroprudential Tools, Transmission and Modelling.

SSRN Electronic Journal ,

Li, Boyao

Xiong, Wanting

Chen, Liujun

and

Wang, Yougui

2017.

The impact of the liquidity coverage ratio on money creation: A stock-flow based dynamic approach.

Economic Modelling,

Vol. 67,

Issue. ,

p.

193.

Xiong, Wanting

Li, Boyao

Wang, Yougui

and

Stanley, H. Eugene

2018.

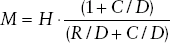

The Versatility of Money Multiplier Under Basel III Regulations.

SSRN Electronic Journal ,

Fontana, Giuseppe

and

Passarella, Marco Veronese

2018.

Alternative Approaches in Macroeconomics.

p.

77.

Xiong, Wanting

and

Wang, Yougui

2018.

The impact of Basel III on money creation: a synthetic theoretical analysis.

Economics,

Vol. 12,

Issue. 1,

Costabile, Lilia

and

Nappi, Eduardo

2018.

Financial Innovation and Resilience.

p.

17.

Louri, Helen

and

Migiakis, Petros M.

2019.

Bank lending margins in the euro area: Funding conditions, fragmentation and ECB's policies.

Review of Financial Economics,

Vol. 37,

Issue. 4,

p.

482.

Davis, E. Philip

Liadze, Iana

and

Piggott, Rebecca

2019.

Assessing the macroeconomic impact of alternative macroprudential policies.

Economic Modelling,

Vol. 80,

Issue. ,

p.

407.

Xiong, Wanting

Li, Boyao

Wang, Yougui

and

Stanley, H. Eugene

2020.

The versatility of money multiplier under Basel III regulations.

Finance Research Letters,

Vol. 32,

Issue. ,

p.

101167.