The photovoltaic solar industry has grown 58% every year since 2010, as prices for solar panels have dropped 70% in the past decade, mostly due to increased manufacturing. The battery industry seems to be following a similar trajectory. Several decades of lithium-ion battery production for consumer electronics has given the industry time to optimize manufacturing. Now battery factories are growing: In the United States, the automaker Tesla recently opened a factory the company says will eventually produce 35 GWh of lithium-ion batteries. Other Gigawatt-hour scale battery factories are reportedly being built in Asia. As production increases, the cost of Li-ion batteries is decreasing faster than expected, falling 8% annually for packs used by leading battery electric vehicle manufacturers.

“Today’s storage industry resembles the solar industry a decade ago,” said David Hochschild, commissioner of the California Energy Commission. The experience at energy storage conferences today resembles that at earlier solar conferences, he said, and entrepreneurs and executives from the solar industry are working in energy storage. Some energy industry experts and battery researchers hope that cheaper batteries, combined with appropriate incentives and business models, could help electric vehicles and renewable energy markets grow. Others argue, however, that growth patterns in the solar industry do not translate directly to the battery industry, in part due to the inherent operating and manufacturing complexities of batteries. Although the solar model does not currently apply to the development and commercialization of next-generation batteries, it may be useful as these batteries are tested and deployed.

In the solar industry, one factor that decreased costs of photovoltaic panels was increased production, particularly in China. Other cost reduction factors include efficiency improvements and automated manufacturing. Innovation, automation, and scale can also reduce costs for the battery industry, said Hochschild. Demand for better lithium-ion batteries in mobile phones and laptop computers has driven improvements in efficiency and energy density, factors also useful for the growing electric vehicle and residential utility industry.

But basic economies of scale—cost decreases as supply increases to meet demand—have different impacts on solar panels and batteries because the cost of the materials inside each device also impacts the retail price. Most solar panels are made from polycrystalline silicon, for which the starting silicon precursors are widely available. The components of a lithium-ion battery, however, are more complex, including metal alloy electrodes, electrolyte salts dissolved in organic solvents, and an ionically conductive polymeric separator. The composition of the cathode and electrolyte can differ depending on the power and energy needed for a particular application. Other components of a battery, such as graphite, aluminum and copper foil, organic solvents, and polymer separator, are commodity materials produced at low cost.

The cost of the cathode material, typically a lithium-cobalt-nickel oxide, could be reduced, though researchers have been working on that for years, said Jay Whitacre, Carnegie Mellon University. Interestingly, the cobalt component of the cathode may eventually increase battery prices. Compared to silicon in solar panels, cobalt is a relatively scarce element, and although little is needed in each lithium-ion battery, increased demand for cobalt due to increased battery production could cause cobalt prices to increase, said Whitacre.

Another factor that separates batteries from solar panels is that batteries are functionally more complex than photovoltaics. Battery operation involves ion transport through a battery volume to transfer energy at electrodes, while light hitting the single semiconductor of solar panels generates electrons that travel through a thin solid. The complex design needed for battery operation means manufacturing impacts the application, lifetime, and reliability of batteries more than for solar panels. Wei Wang, at Pacific Northwest National Laboratory, described batteries as a dynamic ecosystem. As lithium-ion batteries charge and discharge, lithium ions travel across the polymer separator between the two halves of the cell and insert into the electrodes. This insertion causes mechanical stress and strain in the electrode, which needs to be balanced to keep the electrode material from failing prematurely. Also, the heat generated in reactions at the electrodes needs to be dissipated for thermal balance. Complex electronic circuits that protect the battery from voltage or temperature spikes, while keeping solar panels cool, involve a simple, low-tech solution—elevating them from the rooftop.

The health of a battery ecosystem starts with manufacturing, said Wang. The porosity, uniformity, homogeneity, thickness, and surface evenness of the electrode all impact battery performance, along with the thickness of the ion-permeable separator and the purity of other components. Manufacturing tolerances during battery production and quality control processes also impact the system. Without strict controls, lithium-ion batteries could lose capacity quickly, or even catch fire if the problems are severe enough.

Batteries are intended to be durable goods, lasting up to 10 years in an electric vehicle or several decades as stationary power storage. It has taken several decades of development to understand the processes inside a lithium-ion battery that impact its lifetime, said Whitacre. Failure mechanisms include temperature increase beyond the tolerance limit, side reactions inside the battery, and materials degradation due to expansion and contraction. These mechanisms can vary depending on how a battery is used, and some may only appear after several years of charging and discharging. There’s enough knowledge now to complete meaningful accelerated lifetime testing on lithium-ion batteries, said Whitacre. But accelerated testing can also create problems: too much acceleration can introduce new failure mechanisms that would not happen under normal operation, said Menahem Anderman, Total Battery Consulting.

The manufacturing and lifetime testing challenges for batteries bring context to the progress of next-generation batteries, under development to potentially deliver more performance at lower cost. Because batteries are a manufacturing- and materials-intensive technology, their innovation path is fairly slow compared to technologies such as consumer electronics and semiconductor chips, said Whitacre. Companies developing next-generation batteries will have to relearn manufacturing processes and discover factors that impact a battery’s lifetime and reliability. That process can take five to ten years, and it’s not clear that any next-generation technology has started down that path yet, said Whitacre.

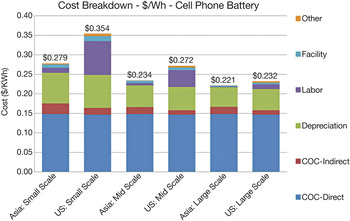

Cost modeling showing the effect of scaling on battery costs, the cost breakdown (COC = cost of capital), and the minimal cost disadvantage of manufacturing in the United States for large highly automated plants. Modeling was performed for a new technology without a strong supply chain or established volume manufacturing in Asia. The Asia numbers were obtained with data from the Philippines, and US numbers from San Jose, Calif., data. Credit: Venkat Srinivasan, in collaboration with industry.

Next-generation batteries, beyond lithium-ion, resemble the solar industry about two decades ago, when many solar technologies were under consideration, almost none had been deployed, and no dominant technology had emerged, said George Crabtree at Argonne National Laboratory. Although the solar model does not apply to these new batteries yet, it may be useful once they undergo further testing and deployment. “Experience will determine their capabilities and appropriate use cases, from which incentives and business plans will emerge,” said Crabtree.

The role of incentives in the solar industry could also model policies to encourage storage adoption. Renewable energy standards, as well as tax credits and equipment leases that helped defray upfront costs, were important in the solar industry. Policies involving batteries need to account for the two roles they can play in an energy system: storing renewable energy generated at off-peak times and regulating the peaks and valleys of power that renewable energy injects into the grid. In California, a state mandate of 1.3 GW of energy storage installed by 2024 is testing ways to integrate storage systems with the current electrical grid. Other policies that could help the battery industry include incentivizing electric vehicles and establishing the electrical grid pricing systems that allow users to defray extra charges when using storage at high demand times. “It’s better to save an electron and use it later, if you can do so efficiently and you’re paid appropriately for it,” said Danny Kennedy, director of the California Clean Energy Fund. “But the rules have to allow for that.”