The effects of the coronavirus global pandemic have rippled through many lives and have upended aspects of health care, transportation, and the economy in virtually every country. The energy materials and renewable generation and conversion market, which includes battery-powered electric vehicles, grid storage, and personal electronic devices, is no exception.

As businesses shut down worldwide, road traffic ground to a standstill, and the demand for electric automobiles plunged. Quarantines and stay-at-home orders barred workers from operating battery and automobile production facilities, shuttered mines and refineries, and froze shipments of manufactured goods. Economic uncertainty and mass layoffs have curtailed consumer spending and have driven down the demand for top-of-the-line mobile phones and tablets. These factors threaten the vitality of energy-storage materials and the long-term growth of renewable sources. Responses to this crisis, including government policies, emerging energy storage and manufacturing technologies, and persistence of the research community, will lay a significant imprint on whether the long-term effects of COVID-19 are mitigated or exacerbated.

The demand for lithium-ion batteries (LIBs) is immense: Their market was pegged at USD$36.7 billion in 2019 and is projected to hit USD$129.3 billion by 2027. The ubiquity of LIBs stems from research-driven efficiency improvements and an extensive worldwide manufacturing and distribution industry that, through improvements in scale and processing, has driven down battery prices by 87% in the last decade. Although the United States is one of the biggest consumers of LIBs, it only produces 12% of the annual 316 GWh of lithium cell manufacturing capacity. China remains the largest manufacturer and accounts for 73% of annual LIB production.

This disparity in manufacturing correlates with the constituent critical elements that enable high performance in state-of-the-art LIBs. Lithium and cobalt serve key functions in battery cathodes and electrolytes. China dominates the production of rare-earth elements (63%) and, effectively, controls 80% of the global supply chain of these materials. While the Democratic Republic of Congo mines 70% of the world's supply of cobalt, China holds major financial ownership. Australia produces 55% of the world's lithium and exports the majority of it to China. Subsequently, the resulting supply chain stretches around the world and involves numerous production facilities, domestic and international freight transport networks through countless ports of entry, and thousands of workers. While lithium and cobalt elements are the most widely recognized vulnerable links in the LIB manufacturing process, the supply of graphite, which typically functions as the anode, is equally at risk. Its refinement into industrial-grade sheets and powders is also primarily centered in China. Furthermore, nickel and manganese, which also constitute critical components in battery assemblies, are reprocessed in only a few locations around the world.

China's role as the lynchpin of battery manufacturing and distribution reverberated worldwide as it endured complete shutdowns during the first few months of the COVID-19 pandemic. Its lead times for production of almost all goods more than doubled because of quarantine measures, and the shutdowns equally affected LIB fabrication. Major Chinese LIB manufacturers CATL and BYD announced extended production delays. Large mining centers around the world shuttered their doors and restricted the movement of personnel. Extraction of cobalt, in particular, was significantly hampered by quarantine measures. The Argentinian government, and some others, designated mining sectors as essential businesses in order to mitigate shutdowns. However, domestic and international travel restrictions hindered the labor supply that is required to fully operate all production facilities.

Many countries imposed travel restrictions on material flow in and out of China, which significantly reduced the customer base for a large number of industrial electric-powered tools. Although many production plants resumed operations, they remain vulnerable to repeated shutdowns as pandemic waves reemerge. Even in the best-case scenario, the battery supply chain will require at least six months to ramp production up to pre-COVID-19 levels, and prevailing economic downturn conditions will likely retain the supply chain in its sluggish state well into 2021.

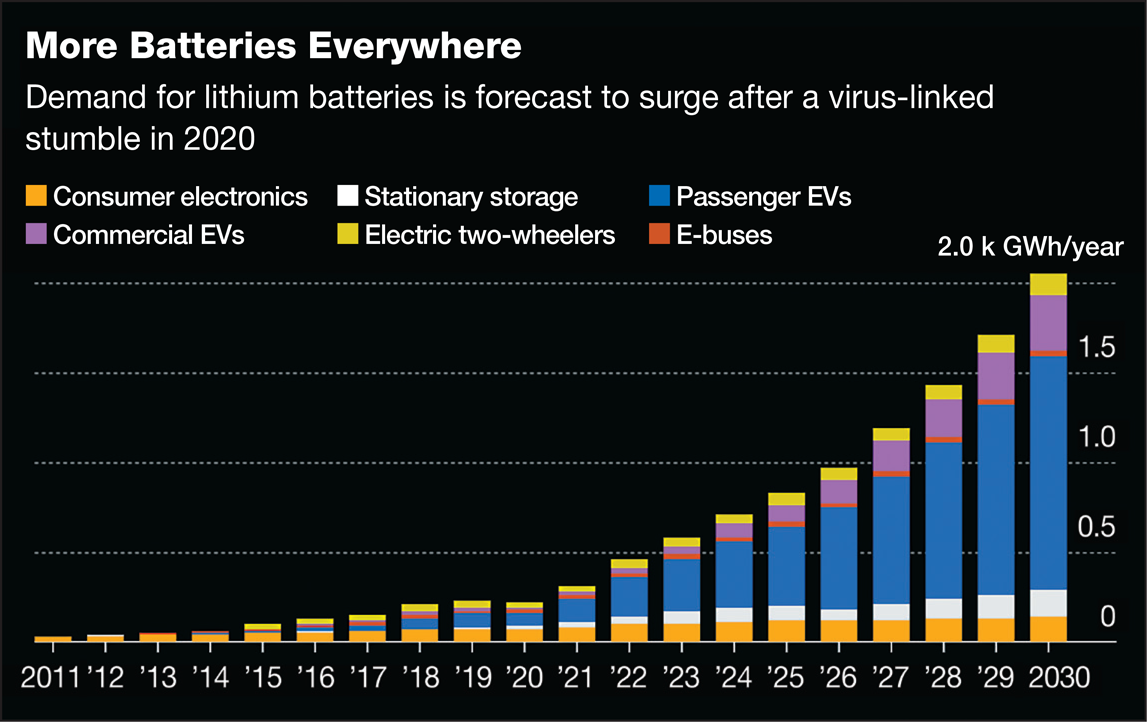

Notwithstanding this grim forecast, several key forces have retained strength and vitality in the energy-storage materials market. First, an oversupply of raw materials in 2019 has kept production of cathodes and anodes steady in the remaining operating plants. Sam Jaffe, the managing director of Cairn ERA, assessed the projected manufacturing for the rest of the year: “On the manufacturing side, there will be little change to the production of batteries. Q1 (first quarter of the year) and Q2 saw drops in production as Asian factories shut down. But Q3 and Q4 won't be supply-limited. Production will be lower than in 2019, but that has more to do with the expected drop in consumer demand than in production capabilities.” Second, interest in electric vehicles remains strong. Although the pandemic shrunk the overall auto-mobile market by 23%, electric vehicles fared better with a reduction of only 18%. This is driven by an overall push for governments in Europe and Asia to decarbonize transportation and minimize greenhouse gas emissions. Furthermore, the electric vehicle field is expanding beyond personal automobiles and is likely to soon encompass trucks and mass transit vehicles. The demand for electric vehicles is expected to consistently climb and is projected to hit 500 million cars—more than 30% of the entire worldwide market—by 2040. Many economists and investors anticipate that such rapid growth will offset pandemic-related demand drawdowns, and that the automobile market (and, by extension, the automobile battery market) will follow a V-shaped recovery trend. “I remain optimistic. The effects should be short-term,” said Y. Shirley Meng, from the University of California, San Diego. “Our willingness to fight the climate crisis is unstoppable— not hindered even by this pandemic.”

Overview of the global demand for batteries and its expected growth in different sectors in the coming decade. Source: BloombergNEF, https://europe.autonews.com/automakers/virus-crisis-halts-ev-battery-boom-now (accessed 7/28/2020).

Supply chain disruptions and anticipated demand shrinkage forecast a decrease of battery shipments to carmakers by 14% in 2020. Since LIBs constitute 40–60% of the overall vehicle costs, manufacturers are taking notice and adjusting their production processes. Two-thirds of North American commercial sectors, including LIB manufacturers, have either implemented or announced plans to pull at least a portion of their supply chains out of China in response to pandemic-related shutdowns. Immediate production shifts from China to Japan and South Korea are actively taking place. Plans are in motion to develop additional battery production facilities in Europe as well.

Many governments are providing economic stimuli to offset the impact of collapsed battery material supply chains and bolster the use of renewable energy. “EV sales will be down about 20% in 2020 versus 2019,” said Jaffe. “They will come roaring back in 2021 as global subsidy programs start to come into effect.” France will offer about USD$9 billion in recovery funds to its auto sector, largely aimed to incentivize electric vehicle use. Germany's stimulus package includes about €5.6 billion for the sector. China, for its part, is accelerating its “One Belt, One Road” initiative to streamline production and supply chain management of lithium and cobalt production for battery manufacturing.

The United States has attempted to address its critical material supply chain deficiency for years, and the government is pursuing various legislative efforts and research programs to combat this problem. In June 2020, the US Senate Energy and Natural Resources Committee held a hearing that examined the impact of COVID-19 on mineral supply chains. It is part of Congress’ broader goal of enacting the American Mineral Security Act, which seeks to secure a steady supply chain of materials of national importance, including those for energy storage. Although no direct federal stimulus programs are on the horizon, the Federal Reserve has enacted multiple financial tools that will augment investment pathways and facilitate capital funding for renewable energy projects and production facilities in the United States.

End-of-life disposal and recycling supply chain for battery materials also affects their viability. Lithium and cobalt compounds are environmentally hazardous, and industrial processes that neutralize and reclaim usable constituents are expensive. While the United States produces millions of tons of electronic waste each year, no recycling centers for them exist inside the country. The recycling chain that ships expended batteries for reprocessing stretches across the world and is equally vulnerable in the face of pandemic-related interruptions. Market analysts have yet to factor these costs into their economic prognoses for batteries, and shutdown of recycling centers may hinder battery disposal and raise costs for users. University of California, San Diego Professor Zheng Chen, a subject matter expert in battery recycling, assessed the situation: “Most EV batteries are still new, and the market for recycling is not really large now. The chemicals, precaution, and complicated process used for recycling contribute largely to its high cost. Li-ion batteries will use less and less cobalt, the economic return from recycling might not be sufficient. LIBs are categorized as hazard class 9 goods, so shipping them is unsafe and expensive. So I do not think any of these will incentivize the recycling operations to ship around the world.”

As the energy-storage materials community looks ahead, many R&D efforts that had been underway before this pandemic may add resilience to the supply chain and mitigate interruptions. Nascent technologies may minimize—or eliminate—weaker links in the materials supply chain. Materials research spans broad efforts, such as redox flow batteries, nickel-zinc sponge electrodes, and anodes comprised of silicon. The latter approach also decreases the dependency of LIB production on aforementioned graphite and leverages decentralized industrial capabilities that are available in the United States. Recent research into cobalt-free cathodes has also shown promising results. “Breakthroughs, such as cobalt-free layered oxides, spinel, and olivine material varieties introduced in the field will be implemented in actual products,” said Meng. Significant efforts are underway to leverage machine learning and inverse design in order to accelerate the pace of materials discovery and reveal efficient and readily available alternatives to existing LIB components.

On the production side, advances in additive manufacturing (three-dimensional printing) and artificial intelligence drive increased automation of the battery fabrication process. The next generation of factories that leverage these technologies will be able to maintain operations with fewer in-house personnel and become more resilient in the face of future quarantine measures.

The successes of these research efforts hinge on the ability of scientists in national laboratories, industry, and universities to advance their research. The COVID-19 pandemic shuttered laboratories, emptied classrooms, and precluded scientists from exchanging ideas at conferences. While remote work arrangements may improve individualized productivity in the short term, most researchers agree that extended shutdowns will negatively impact scientific progress across the board. Moreover, as funding agencies shift their resources to develop treatment and preventative measures against the coronavirus, they divest from other research activities, including energy-storage materials. University of Maryland Professor Eric D. Wachsman, who leads the Maryland Energy Innovation Institute, describes the immediate effect: “I am already seeing a shift in priority and resources toward pandemic-related research, from new funding opportunities from agencies not typically associated with health care, to even my own university, which while facing major budget cuts and potential furloughs next year, is reallocating existing resources to catalyze new pandemic-oriented research.” Fundamental breakthroughs in energy materials fields take years or even decades to reach the marketplace. It remains unclear, especially in the absence of a global push akin to the current drive to develop a COVID-19 vaccine, whether most promising present-day research can transform the LIB supply chain in time before the pandemic subsides.

The ongoing COVID-19 pandemic is unprecedented in scope and impact in modern times, and as it ravages our communities, its full, long-term effects remain unknown. Its shutdown of vital material supply chains is but one of several headwinds that battery- and energy-storage technologies face in the coming decade. Worldwide oil prices, which plunged to record lows earlier this year, made gasoline-powered automobiles more attractive to consumers. Fluctuating tariffs, shifts in economic and environmental policies, and protracted trade conflicts between the governments of the United States and China had already strained raw material supply chains and shifted certain production and recycling facilities to Japan and Europe. Nevertheless, demand for electric energy storage remains high for cars and personal electronics, and renewable energy efforts depend on accessible battery banks in their overarching goal to decarbonize the energy supply, decentralize it, and make it more affordable. In spite of aforementioned challenges, numerous entities are finding approaches to add resilience to the battery materials and manufacturing supply chain and, in the long term, are aiming to develop breakthroughs that may reconstruct it altogether.