INTRODUCTION

I've been asked to comment on this collection of three papers, each of which offers deep insights into the forces affecting the auto industry, particularly as concerns the relative positions of incumbent auto firms with respect to new electric vehicle entrants. Taken as a whole, the papers open a lens on the changes roiling the automotive sector. In this essay, I'll attempt to widen the aperture and provide a framework for a more systemic analysis of the forces reshaping the industry and the prospects for new entrants.

MANAGING UNDER CONDITIONS OF DEEP UNCERTAINTY

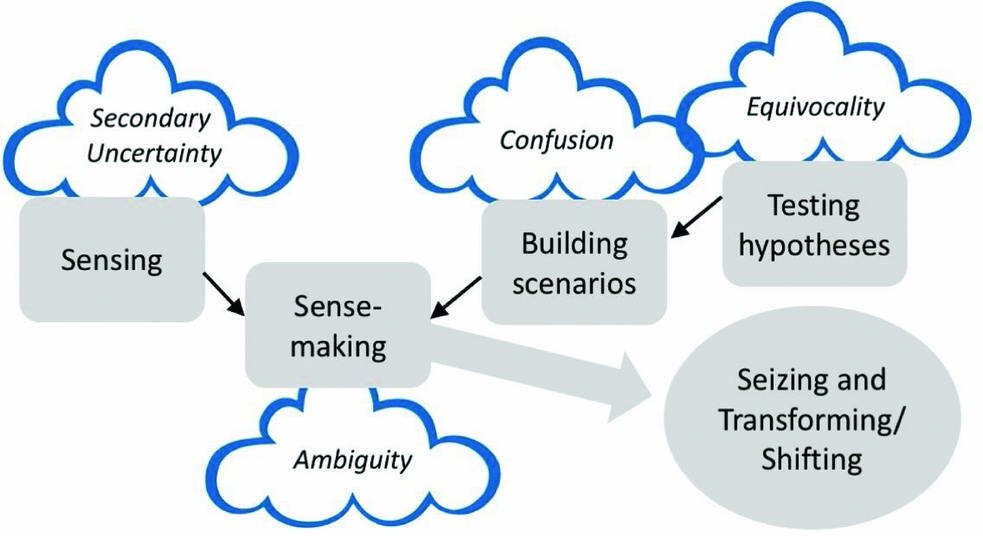

Incumbents and would-be entrants into the auto industry of the future are presently confronting deep uncertainty. Whereas everyday risk can be managed by assessing expected returns based on assumed probabilities, uncertainty involves the unknown and the unknowable. This makes predictions pointless; but a structured approach can still produce insights.

A firm's ability to manage under uncertainty is critical. The dynamic capabilities framework was crafted to help managers understand how firms can profit when uncertainty is ubiquitous (Teece, Peteraf, & Leih, Reference Teece, Peteraf and Leih2016). It calls on managers to sense and make sense of emerging shifts in the environment, rapidly seize potential opportunities, and transform their organizations to maintain environmental fitness.

In dynamic capabilities terms, uncertainty can be addressed by strong ‘sensing’, which ensures the earliest possible detection of unforeseen changes in the business environment. For example, incumbent auto firms have all made investments in Silicon Valley, forming alliances with a range of technology companies, in order to gain position in, and a better understanding of, the key technologies that are allowing and requiring transformation. These arrangements can accelerate learning and secure access to complementary technologies and other assets needed to compete as the industry evolves.

Uncertainty actually has different dimensions that can be addressed by different mechanisms for sensing and sensemaking. Koopmans (Reference Koopmans1957), for example, divided uncertainty into two components. Primary uncertainty is unforeseeable, consisting of random changes in the state of the world. Secondary uncertainty, on the other hand, arises from a lack of communication across decision-making centers within an organization or a network. Direct sensing, such as opening lines of communication among divisions or partners, can reduce secondary uncertainty, as can vertical integration (Helfat & Teece, Reference Helfat and Teece1987).

A different form of uncertainty is what March calls ‘ambiguity’, when ‘alternative states are hazily defined’ (March, Reference March1994: 178). Ambiguity of this kind can be addressed through what I've referred to elsewhere as sensemaking (Teece, Reference Teece1998). This involves inductive reasoning, leading to explanations for the available (sensed) facts that are probably (but not definitely) true (Weick, Reference Weick1995).

In a rapidly evolving business situation, the problem is likely to be less one of ignorance or of ambiguous futures than of confusion about the direction(s) in which the present is evolving. A useful approach is abductive reasoning, which involves building a narrative around what is going on and its likely outcomes (Weick, Reference Weick1995: 99). Jeff Bezos has Amazon's senior strategy team read multi-page memos rather than look at bullet-pointed slides because ‘the narrative structure of a good memo forces better thought and better understanding of what's more important than what, and how things are related’.[Footnote 1] A narrative thus provides a frame for sensemaking and determines which factors are deemed important for further consideration. All strategies are designed to fit a cognitive frame, but when an existing frame ceases to account for observed facts, it needs to be replaced.

The type of uncertainty where multiple interpretations of the facts can be supported is known as ‘equivocal’ (Weick, Reference Weick1979). To manage through equivocality, a manager needs to generate multiple hypotheses about the path of industry evolution, then run ‘contests’ amongst them. The ‘winning’ hypothesis can then become the basis for a narrative.

In today's global economy filled with complex, interdependent systems, most of these varieties of uncertainty are present. The processes of sensing, sensemaking, building narratives, and generating and testing hypotheses (which, in the dynamic capabilities framework, are all part of a firm's ‘sensing’ capabilities) can be used together as a means of reaching a sufficient level of certainty to formulate a strategy (Figure 1). This is a potentially powerful process. An organization's ‘reasonable interpretation’ of its environment ‘may shape the environment more than the environment shapes the interpretation’ (Daft & Weick, Reference Daft and Weick1984: 287).

Figure 1. Management Under Uncertainty: Sensing and Sensemaking

As entrepreneurs and entrepreneurial managers (Teece, Reference Teece2016) move from making sense out of uncertainty to enacting a strategy, the process will inevitably entail some trial and error. When new evidence contradicts a chosen narrative, new hypotheses must be developed. The ‘lean startup’ paradigm (Ries Reference Ries2011), which calls for testing new ideas in the market and ‘pivoting as needed’, can be applied in companies of all sizes. It's usually better to act and learn than to sit on the sidelines.

In short, uncertainty is not just about unknowable unknowns. Business intelligence and other forms of sensing can support the process of sensemaking. This process, whether done intuitively or formally, can help incumbent auto firms analyze what the Tesla phenomenon says about the future of the industry. The price for misdiagnosing the future evolutionary or revolutionary path of an industry can be colossal, as former cell phone giant Nokia discovered. The fates of regional or national economies is also at stake.

THE DEBATE AS IT STANDS

Perkins and Murmann (Reference Perkins and Murmann2018) use a Tesla case study to estimate the cost of entry into the industry. Their calculation shows that the cost of designing and producing an electric vehicle (EV) is easily within reach of the cash-rich tech giants, especially Alphabet or Apple in the US and Alibaba, Baidu, or Tencent in China, that are already positioning themselves with an array of autonomous and intelligent vehicle projects. They are effectively hypothesizing that such an entry might occur.

Lu (2018) shifts the frame, noting that entry barriers are falling not just in terms of cost but also because the bases of competition are shifting. Consumers will be more concerned with the ‘experience’ of personal transportation than with the quality of a particular vehicle, which creates opportunities for IT firms with know-how in the creation of compelling human-machine interfaces. He sees the emergence of EVs as an opportunity for Chinese automobile companies to establish a more equal footing with their well-established global rivals in the internal combustion engine (ICE) auto industry.

Unlike Perkins and Murmann (Reference Perkins and Murmann2018), however, neither MacDuffie (Reference MacDuffie2018) nor Lu (2018) expects the IT giants to enter because this would still involve mastering sophisticated manufacturing in which they have no current experience. They see the big tech firms as much more likely to continue collaborating with established auto OEMs that are strong in manufacturing but less experienced in software and machine learning.

Moreover, MacDuffie (Reference MacDuffie2018) is skeptical that barriers to entry for manufacturing have actually fallen. While Tesla was able to carve out an enviable position at the high end, a small-volume luxury success should not be treated as an indicator of the prospects and cost for a mass-market entry. Tesla's current difficulties in ramping up production of its mass-market Model 3 show that producing lower-cost cars in high volume is a very different proposition from limited production of luxury vehicles.

A handful of new EV entrants, including Byton, EVelozcity, Faraday Future, Lucid, and Nio, all with Chinese investors or owners, are also in the wings, but most have yet to deliver more than a handful of vehicles. One of the most amitious is Nio, which has sold thousands of units of its mid-priced electric SUV in China, all of which are being manufactured in a factory owned by an existing auto company known as JAC Motors.

Until an EV-only entrant achieves mass-market acceptance and high-volume manufacturing, it will be hard to argue that lower barriers to entry for EV design and manufacture pose a threat to incumbents.

A WIDER PERSPECTIVE: FOUR PARADIGM SHIFTS

None of the above contradicts the notion that concurrent waves of change are creating potential inroads for new entrants that may pose a serious challenge to established automotive manufacturers. Until recently, automotive has been one of the paradigmatic ‘mature’ industries, in which the key technological questions have been settled since the 1930s (e.g., Abernathy & Clark, Reference Abernathy and Clark1985). The industry now faces multiple sources of ambiguity about its potential evolution. In this section, I will undertake a brief sensing exercise before turning to a first pass at sensemaking.

Each of the three papers about Tesla's significance for the industry alludes to the expanding capability requirements in the auto industry, but none of them address these directly. The competitive bases in the auto sector are changing not just in terms of technology, but also in terms of business model and markets. These ‘softer’ capabilities are often underplayed in academic treatments, although the car companies themselves are acutely aware that they now face capability ‘gaps’ that they need to close (Teece, Reference Teece2017). A radical business model innovation can be as disruptive and challenging a change for rivals as any competence-destroying technological development.

Each new capability must be thought of in terms of its distance from existing capabilities on the three dimensions of technology, business model, and market. The greater the distance, the more effort needed to master the capability – and the greater the risk that a new entrant could emerge from an industry where the capability is already in use.

There are at least four sources of change currently sweeping across the industry, most of which were alluded to by the three papers. It is worth separating out each of the four for analytical purposes.

Electric Vehicles (EVs)

Because of the nature of its powertrain, an electric vehicle has fewer moving parts, which means it is less likely to suffer mechanical failure and needs less frequent service. The main input is a battery, which accounts for a third or more of the total parts cost. As battery makers continue to reduce the cost per kilowatt-hour, the economics of owning an EV become increasingly attractive for consumers.

For car companies, EV technology wipes away the value associated with the portion of their capabilities centered on engine design. While this represents a competence-destroying discontinuity (Tushman & Anderson, Reference Tushman and Anderson1986), the capabilities needed for designing an electric powertrain aren't entirely foreign to the experience of ICE-based car manufacture and have already been internalized by most car makers.

EVs remain a small part of the auto market. Much of their share to date has been driven by government mandates and subsidies, which are expanding in some jurisdictions and shrinking in others. A mass uptake of EVs faces a complementary asset challenge because consumers report in surveys that they want to see charging stations widely available and/or EV range-per-charge increased. The availability of charging stations could eventually leap ahead if the right entrepreneurial business model helps accelerate the rollout of the charging infrastructure.

Autonomous Vehicles (AVs)

Autonomous vehicles are a partial solution for one of the great challenges of modern life, namely the time lost during long commutes. According to 2017 data from the Census Bureau, workers, of whom three quarters travel alone by car, spend over 200 hours getting to and from work each year.[Footnote 2] In a fully autonomous vehicle, commute time could be converted to personal or work time, effectively restoring weeks to the average commuter's year. The hardware and especially the deep-learning, real-time control software for autonomy are outside the competences of most car manufacturers, so they have each been forming alliances with one or more of the companies offering autonomy solutions, as noted in the essays. To the extent that autonomy leads to a transition in car ownership from consumers to sharing services, the market for cars will be more fleet-oriented than it is today, which would weaken some of the advantage that incumbent auto firms hold in terms of markets.

Mass rollout of fully autonomous (‘Level 5’) vehicles is likely at least a dozen or more years away. It will move faster in jurisdictions where governments can bring common standards to the highway infrastructure as well as to vehicles. The acceptance of autonomous vehicles in the US has been hampered by the recent fatal accidents involving cars with software from Tesla and Uber. But, because of the potential benefits, it's a matter of ‘when’ not ‘if’ fully autonomous vehicles will be accepted by consumers and in widespread, although by no means universal, use.

Connected Cars

Automobile connectivity, which allows vehicles to access the Internet or other networks, will open new, as yet unforeseen, opportunities that will lead to business model innovation and new markets. Connectivity is already built in to some vehicles. Smart dashboard displays enable on-board shopping and entertainment, route planning, and instant ride sharing. The always-on 3G connection in Tesla's vehicles permits over-the-air software updates that can provide new functionality and/or avoid some recalls. Cars will increasingly support OEM or third-party apps that provide new services and revenue streams (and business models). This requires supplementary competences in software and/or creating a platform for third-party apps. The tech giants, particularly Alphabet (Android Auto) and Apple (CarPlay), are already well positioned to exploit this part of the driving experience because of their entrenched smart device ecosystems. Car makers like Ford and GM began turning from outsourced software to in-house provision several years ago in order to better prepare for the new competitive requirements (Shacklett, Reference Shacklett2012).

Personal Mobility Services

Transportation-as-a-service (TaaS, also known as mobility-as-a-service) refers to a business model in which consumers rent the usage of a vehicle as needed (along the lines of what Uber and Lyft currently provide) rather than owning vehicles themselves. The emergence of TaaS has the potential to change the economics of the auto industry, and it is another field of innovation where the tech giants can potentially provide valuable complementary assets.

There are different directions in which the industry could evolve to support TaaS. Vehicle sales could be primarily to fleets owned by car-hire firms rather than to consumers. Or consumers might ‘subscribe’ to a brand of car rather than buy an individual car. General Motors, for example, is already experimenting with a new model of car ownership that, for a monthly fee, allows customers to switch in and out of different models of Cadillac up to 18 times a year (Colias, Reference Colias2017). Other car makers are experimenting with car-share services, such as Daimler's Car2Go, which allows one-way usage. The risk of commodification of the automobile looms large behind these efforts. The technologies involved are an extension of the software and data analytics developed for connectedness; but switching the consumer relationship from vehicle sales to frequently recurring interactions would wipe out much of the manufacturers’ existing business model and marketing know-how.

SENSEMAKING: THE CHALLENGES FOR INCUMBENTS

In this section, I begin the task of sensemaking by looking at how the four innovation-driven paradigm shifts are challenging incumbent auto firms. As noted in the three papers, paradigm shifts create opportunities for new entrants who could grow into potent rivals. Evidence suggests, for example, that new personal mobility business models, including centrally-owned shared vehicles like Zipcar and person-to-person sharing of consumer-owned vehicles are already eroding individual vehicle ownership (Shaheen, Martin, & Bansal, Reference Shaheen, Martin and Bansal2018).

Auto executives have thus been forced to look beyond their frames of reference and begin testing new ideas about how and where they can construct a new advantage. Experimentation is needed to develop any level of certainty in the face of equivocality about which technologies, business models, and markets will prove the most valuable. Tesla, for example, experimented with both battery swapping and fast-charging options for Tesla drivers passing through the rural expanse separating northern and southern California. In 2016, it closed the battery swapping station in favor of investing in more charging stations.

Confusion about the business implications of the four new paradigms is heightened by the complementarities and collisions among them. EVs, it has been claimed, require less maintenance and can cover more mileage in their lifetime than ICE cars (Arbib & Seba, Reference Arbib and Seba2017). This makes EVs well-suited to the TaaS model, which is predicated on more intensive use of vehicles than the current personal ownership model. A connected autonomous EV will be able to take itself to a wireless charging station then travel to where it's needed.

Car manufacturers are scrambling to discover what unique selling points they can offer, placing multiple bets to avoid becoming interchangeable parts in someone else's business model. France's PSA Group is even pursuing a ‘post-OEM’ model in the US, where it doesn't currently sell cars, adopting instead a car-sharing aggregator business model embodied in its Free2Move app.

As Feng Lu observed, incumbent car makers in the West must also pay particular attention to how the innovations impact their position in China. The major global car companies had a comfortable lead in ICE technology. Their wealth of experience in design, integration, and large-scale manufacturing may also give them a source of advantage over entrants, but less so over the best of the integrated Chinese firms, such as Geely, owner of the Volvo brand since 2010. In AVs, connected cars, or mobility services, the playing field is a lot more level than what auto incumbents have been used to. And China has made clear that it intends to promote national champions for EVs and for artificial intelligence, including AV technology.

Incumbents will need to adapt, but the problem is to know which technology combinations are worth developing. And changes in business models and market focus will require investing in organizational transformation, such as adopting ‘agile’ methods for the development of consumer-facing software or reconfiguring longstanding arrangements with car dealerships (Leih, Linden, & Teece, Reference Leih, Linden, Teece, Foss and Saebi2015).

To encompass the new capabilities in their offerings, the car companies have made a number of critical make/buy/ally decisions as to whether capabilities such as vehicle autonomy need to be brought in-house. Most car companies have opted to form partnerships in that area because it's too challenging to match the wealth of data-driven learning that the companies with a head start have already achieved. However, it is not clear whether the hardware and software required for AVs will be available at competitive rates or will become a bottleneck asset that drains profits from the automotive value chain (Teece, Reference Teece1986). On the other hand, the deep uncertainty facing car companies favors flexibility, making alliances a much safer route (Teece et al., Reference Teece, Peteraf and Leih2016). The tech giants in the US and China, also seem to have decided that alliance formation is the best way to participate for the time being.

TESTING HYPOTHESES

Table 1 summarizes the key points about the gaps that incumbent auto manufacturers face with respect to the new capabilities they need to own or access. The farther the new capability is from the traditional capability set, the more likely new entrants from other industries will be able to establish a foothold or even a stronghold.

Table 1. Distances to new capabilities from traditional car manufacturer capabilities

Note: ‘Zero’ indicates that the capability for the new technology does not represent a change for incumbent car makers.

As the table shows, many of the gaps are not so large, and most car companies have been making progress in addressing all of them. The twin dangers of this effort are that a car company is either (1) too wedded to its existing activities to commit sufficient resources to transformation or (2) too distracted by the launch of new activities to properly maintain its existing business.

With this framework in mind, we can now return to the central questions from the three articles. Perkins and Murmann (Reference Perkins and Murmann2018) hypothesized that the barriers for a new entrant to replicate the capabilities to design and manufacture a car had fallen, at least for EV-only entrants. As MacDuffie (Reference MacDuffie2018) observes (and as Tesla's travails demonstrate), the skills involved are still considerable, even if the advent of new manufacturing and powertrain technologies has lowered the bar in some ways. The technology of vehicle manufacturing is not difficult to know, but it is hard to master. Chinese firms, with years of foreign cooperation and considerable government support, have steadily brought their operational capabilities closer to the global best-practice frontier.

As Perkins and Murmann (Reference Perkins and Murmann2018) note in their conclusion, the auto industry is at risk of substantial ‘value migration’ away from its existing capabilities toward platforms owned by one or more of the tech giants for autonomous driving or transportation-as-a-service. The purpose of this essay has been to show more systematically the factors affecting the relative prospects of incumbent car makers and new entrants. Tech firms definitely see the opportunity where their strengths complement those of the car makers. The eventual value distribution depends on the relative attractiveness of the platforms offered by car manufacturers and the tech firms, on the willingness of (some) car makers to become reliant on one of the tech giants for critical parts of the value chain, and on consumer demand for particular design or branding features. As MacDuffie (Reference MacDuffie2018) notes, the ferment in this area will continue for some time. Consumers will ultimately make the key decisions that determine which platforms and firms come to dominate the new competitive spaces.

To conclude, it is not clear that ‘the success of Tesla has heralded a new era in the automobile industry’ in the fundamental way that Perkins and Murmann (Reference Perkins and Murmann2018) see it. At most, it heralds a new era for the EV sector, probably speeding the acceptance of the technology beyond what it would otherwise have been. Projections of future EV sales have indeed been rising, but, according to Bloomberg research, ICE-based cars are expected to account for at least half the market through 2040 (Shankleman, Reference Shankleman2017). That potentially allows a decade or more for the car makers to shift their asset base so as to continue to provide the products and services that the market demands. It remains to be seen which companies have enough organizational resilience and the strategic vision to forge a path through the new century.

A LOOK AHEAD: CAPABILITIES AND POSSIBLE OUTCOMES

This collection of papers was designed to provide insight into the hypothesis that the competitive landscape will be shaken up by a raft of well-heeled new entrants exploiting the auto industry's current technological transitions. I have applied a capability-based framework with which to analyze some of the numerous sources of uncertainty surrounding this question.

Tesla is the entry point for the discussion. It is deeply involved in the implementation of three of the four new technological paradigms identified earlier, not having yet pursued transportation-as-a-service.

Tesla has garnered a market capitalization of the same magnitude as that of GM or Ford, suggesting that it's seen by investors as part of a new ‘Big Three’. This is a tribute to the company's dynamic capabilities. Tesla's capabilities flow to a large extent from Elon Musk, one of the outstanding entrepreneurs of our time. He has succeeded not only with Tesla but also with the reusable rockets developed by another of his companies, SpaceX. Musk has also shown himself to be a masterful salesman, to potential customers and to investors alike.

However, the company's struggles to ramp high-volume manufacturing signals that it hasn't yet mastered ordinary capabilities. In theory, Tesla could reach out to an industry incumbent to access such capabilities under contract and/or through an alliance. However, Musk has been determined to build a vertically integrated company, going so far as buying a German factory automation firm in 2016, although its machines have apparently not yet been installed in California (Geuss, Reference Geuss2018). Musk also believes he can blend the Japanese kaizen improvement system with Silicon Valley culture by approaching the factory as if it were a software program, making changes on the fly to fix problems (Stoll, Reference Stoll2018). He may yet succeed.

China's Nio, discussed earlier, is probably the only other pure-EV entrant to rival Tesla at this time. It is reportedly building its own factory, where its next model will be assembled, and is preparing to begin exports to Europe, the second-largest market for EVs after China.[Footnote 3]

As for the incumbent auto firms, they all have strong, well-optimized ordinary capabilities, so their fates could swing substantially on how strong their dynamic capabilities prove to be. Strong dynamic capabilities can enable incumbents to close the capability gaps shown in Table 1 with differentiated solutions that build advantage over rivals. Venture capitalist Michael Moritz claims that entrepreneurial management, a key element of dynamic capabilities, is scarce in big companies, and that the auto companies ran into trouble because their managers ‘forgot to take care of the future’ (cited in Rose, Reference Rose2015).

But the problem is not strictly one of leadership. The established car companies also face an institutional problem that de-incentivizes long-term planning, namely the debilitating drag of the quarterly earnings syndrome. At the 2018 World Economic Forum, Carlos Ghosn, CEO of the Renault-Nissan-Mitsubishi Alliance, observed: ‘If you don't have strong quarterly results, you can't afford the luxury to have a long-term plan’.[Footnote 4] He noted that strategic initiatives for electric or autonomous vehicles typically require seven or eight years, but the median tenure of a CEO at a large-cap firm has fallen to five years (Marcec, Reference Marcec2018). While this article was in the proof stage, Elon Musk announced that he was exploring the possibility of taking Tesla private to escape these short-term pressures. CEOs of new entrants who are able to manage under uncertainty and who find patient investors (or who themselves own large shareholdings) have more freedom to pursue technologies, business models, and markets with long-term strategies that incumbents can find difficult to match.

As the firms in the auto industry grapple with manifold uncertainties in the years ahead, time will tell if Tesla or another new entrant is able to leverage the electric vehicle to build a mass-market auto company. If incumbents demonstrate strong dynamic capabilities and leverage their integration skills, they may still be able to lead and dominate the upcoming industry transformation. However, absent dynamic capabilities, they will surely flail and then fail.