1. Introduction

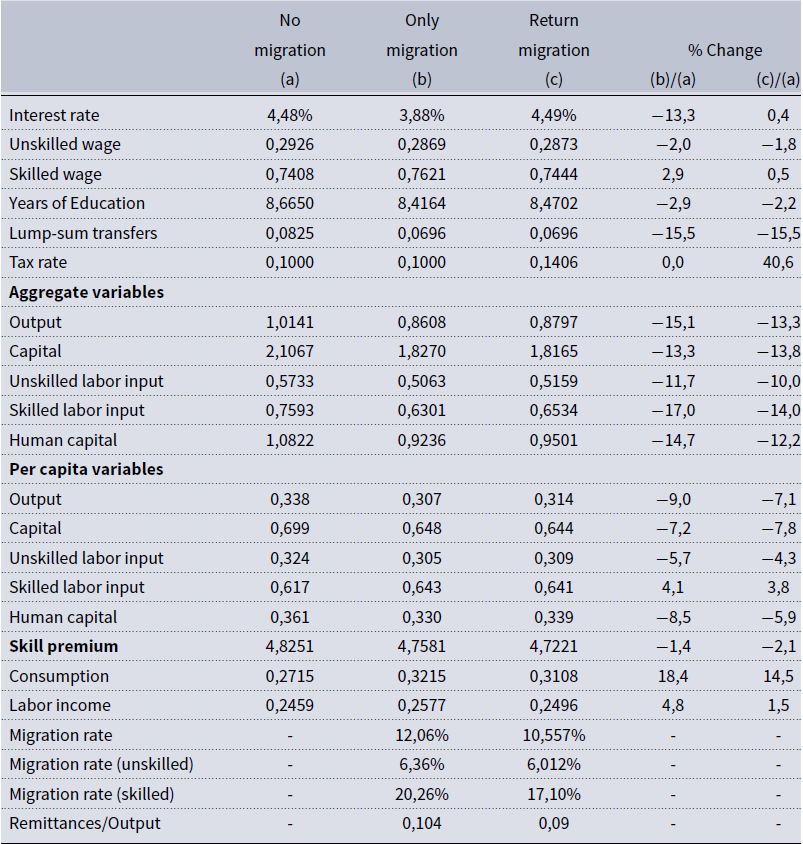

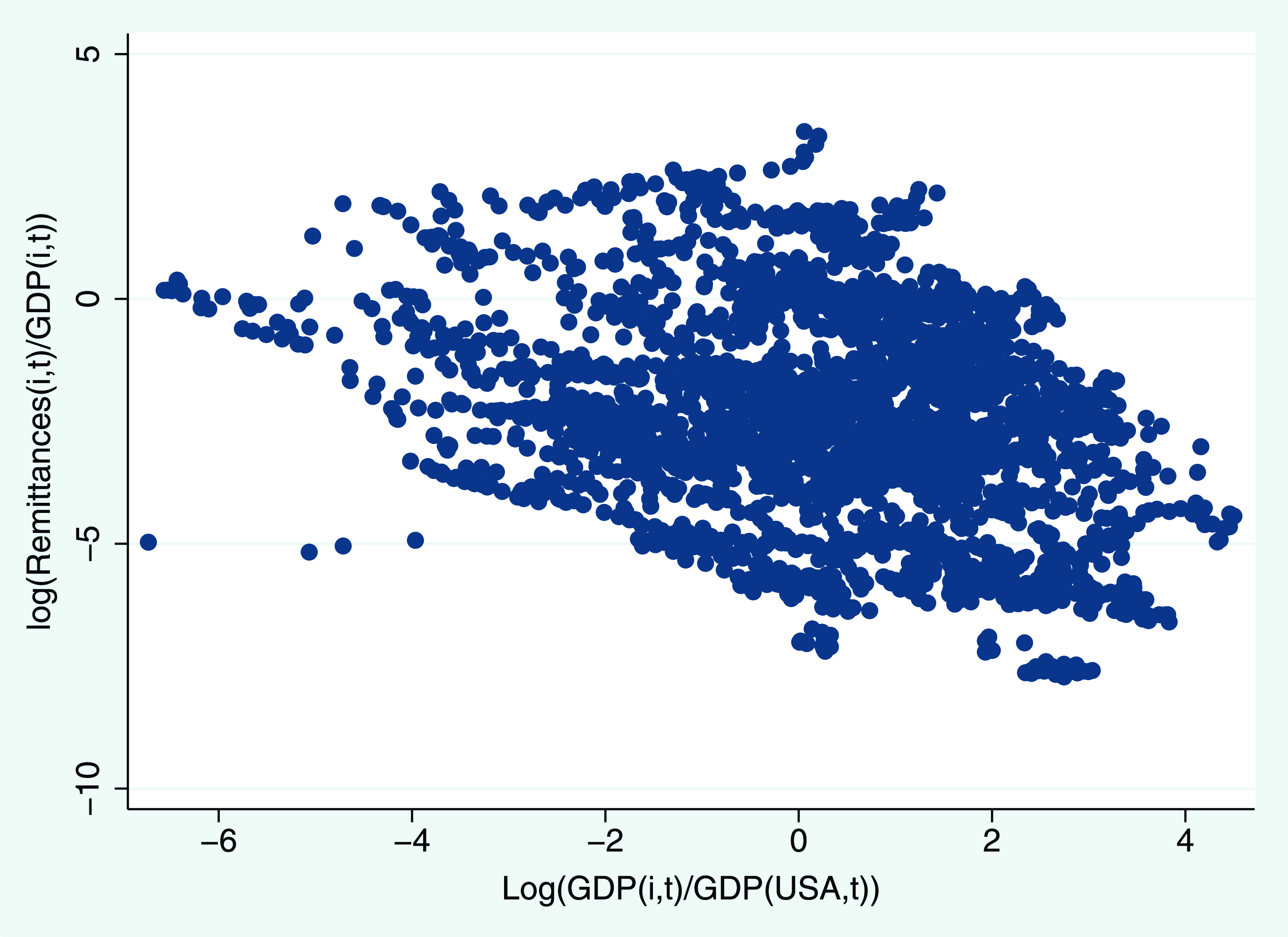

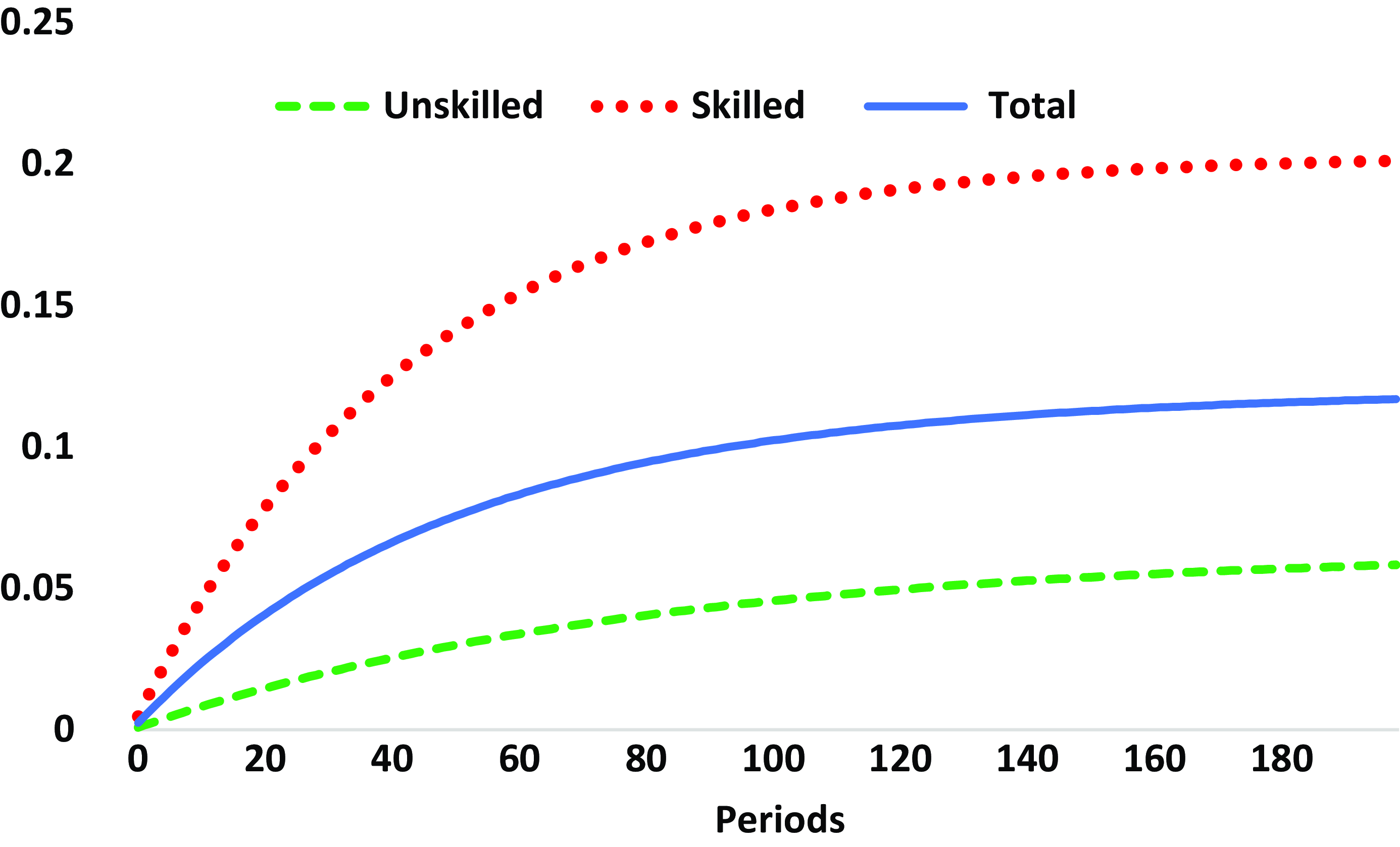

Recent migration literature has highlighted four recurring features from the perspective of the source country: first, Migration constitutes a significant portion of the population, with examples such as Mexico, Peru, Guatemala, and El Salvador where more than 10% of the population resides abroad. Second, migrants maintain economic ties with their home country by regularly sending remittances to their relatives. These remittances play a crucial role in the economies of source countries, amounting to an average of around 5% of GDP in 2005. Notably, there is substantial variability in the volume of remittances received by different countries, as illustrated in Fig. A2. In 45 economies out of a sample of 155 countries, remittances accounted for more than 5% of GDP in 2005. The significance of remittances as a source of external resources for developing economies was emphasized in World Bank reports from 2006 (World Bank (Reference Bank2006)). According to these findings, remittances rank as the second largest source of external resources for developing economies, surpassed only by Foreign Direct Investment. Remarkably, remittances surpass the combined total of foreign aid resources received by these economies. Third, skilled migration is prevalent among migrants, with the skilled migration rate being nearly 5,8 times higher than the average unskilled migration rate. This phenomenon, often termed as “brain drain” in the literature, is a common occurrence in many developing economies, as depicted in Fig. A1. Fourth, return migration has emerged as a significant trend for source countries, with approximately

![]() $10-20\%$

of migrants returning to their birthplace after a period of migration, according to OECD reports in 2008 (OECD (2008)).

$10-20\%$

of migrants returning to their birthplace after a period of migration, according to OECD reports in 2008 (OECD (2008)).

A notable issue in migration literature is the strong correlation among the characteristics of international migration, including high migration rates, brain drain, remittances, and return migration. This correlation poses challenges for empirically identifying the effects of policies that impact these different aspects of migration. As a result, empirical studies often focus on individual aspects separately, as noted in the literature review. Given the difficulty of empirically studying these interconnected stylized facts, our paper addresses this gap by constructing a theoretical model that captures them within a dynamic general equilibrium framework. In this model, migration decisions are made at the household level, and the stylized facts emerge endogenously. This enables us to conduct simulations to evaluate the effects of economic policies on migration, brain drain, and the return of migrants. Moreover, modeling migration within a dynamic general equilibrium framework allows us to examine the effects of high migration on prices, such as wages and interest rates, and the secondary effects these changes may trigger in migration patterns. For instance, an influx of highly qualified migrants could lead to wage increases due to a shortage of skilled labor, thereby incentivizing further migration (and return migration) by providing additional resources to cover migration costs. Furthermore, the general equilibrium analysis enables us to identify the role of the government and the externalities generated by skilled migration on non-migrant households, including the depletion of human capital and the reduction in available workers. Importantly, the joint modeling of these various aspects of migration within a dynamic general equilibrium context has received limited attention in the literature.

The paper makes two primary contributions. First, it expands upon the neoclassical model to account for key empirical features of migration from the perspective of the source country. These features include brain drain, remittances, and return migration. In the model, multi-member families with varying skill levels are subject to un-insurable idiosyncratic labor productivity shocks. A negative shock may prompt migration, with the household selecting one member to migrate. Upon returning to the home country, the migrant worker possesses enhanced human capital. On the production side, a representative firm utilizes capital, skilled, and unskilled labor to produce output, with production exhibiting capital-skill complementarity.

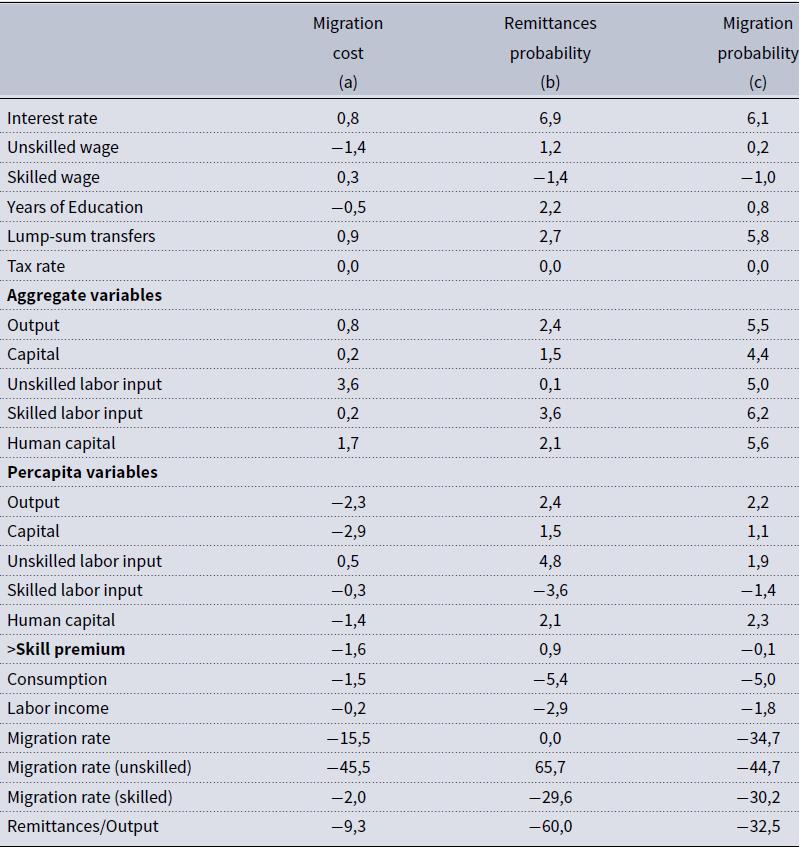

Second, we utilize the model to explore specific economic effects of migration. These include: (a) Examining the general equilibrium effects of skilled migration and remittances. This analysis is intriguing as it sheds light on how skilled migration and remittances can influence resource allocation in the economy through changes in prices. Furthermore, by considering the general equilibrium nature of counterfactual scenarios, we uncover insights that previous literature may have overlooked. For instance, we investigate how migration impacts families without migrants. (b) Assessing the welfare effects of migration, which sparks discussions about the political and economic implications of migration. (c) Investigating whether the combined effects of remittances and return migration can sufficiently offset the negative consequences of brain drain. Given that the model encompasses skilled migration, remittances, and return migration, it serves as a natural framework for addressing this issue. (d) Analyzing the effectiveness of policy interventions aimed at mitigating the impacts of skilled migration. Specifically, we focus on policies targeting skilled return migration, migration costs, remittances, and the probability of migration (see Table A1).

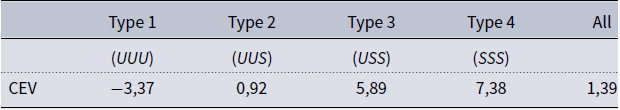

The study concludes that migration, when modeled within a general equilibrium framework, yields substantial economic and welfare effects, particularly in countries where skilled migration (brain drain) and remittances play a significant role. Overall, migration is found to enhance the total welfare of households. However, these effects exhibit considerable heterogeneity: while migration benefits the most skilled households, it diminishes welfare for the least skilled households. This disparity arises from the fact that most migrants are skilled workers who can afford migration costs. Due to capital-skill complementarity, a reduction in skilled workers diminishes returns on capital and wages for unskilled workers. Importantly, these findings underscore the general equilibrium effects of migration, which impact households even in the absence of migrants abroad.

One endogenous result of the paper is brain drain, which aligns with the positive-selection hypothesis of migration as tested by Chiquiar and Hanson (Reference Chiquiar and Hanson2005) using data from Mexico.Footnote 1 According to their study, Mexican immigrants, although typically less educated than US natives, boast higher average levels of education than residents of Mexico. Remarkably, if Mexican immigrants in the United States were compensated based on prevailing skill prices in Mexico, they would likely occupy the middle and upper segments of Mexico’s wage distribution.

Return migration is a prominent feature of migration literature, wherein approximately 20% of migrants return to their source country, often with enhanced human capital (brain gain) and increased productivity, which subsequently benefits the source country’s economy. Additionally, some migrants opt not to return and instead send remittances, which also have a positive impact on the source country’s economy. Using our model we demonstrate that the combined effects of return migration and remittances may not fully counterbalance the impact of skilled migration in terms of GDP and human capital. While skilled migration may yield positive welfare effects on average, there exists significant heterogeneity in its impact, with unskilled households experiencing negative welfare effects. These findings underscore the complexities of migration dynamics and the nuanced effects it can have on source countries. Despite the potential benefits of skilled migration, careful consideration must be given to its distributional effects and its overall impact on economic outcomes.

The remainder of the paper is structured as follows: Section 2 provides a comprehensive review of the existing literature. Section 3 outlines the model economy, detailing its key components and assumptions. Section 4 establishes the concept of competitive equilibrium within the framework of the model. Section 5 elucidates the calibration procedure employed to ensure the model’s alignment with empirical evidence. Section 6 presents the results of our analysis, highlighting key findings and insights derived from the model. Finally, in Section 7, we offer concluding remarks summarizing the main findings of the study.

2. Literature review

The migration of skilled workers can indeed have detrimental effects on the source country’s economy, given that education and human capital are vital determinants of long-term economic growth (Lucas (Reference Lucas1998)). Specifically, when a trained or educated individual migrates, the country loses the investment made in their education. Early migration literatureFootnote 2 has extensively highlighted this phenomenon as a negative consequence for developing economies, as it exacerbates the scarcity of skilled workers. However, other literatureFootnote 3 suggests that migration can also yield positive economic implications for source countries, potentially offsetting the initial negative effects of skilled migration. According to this body of research, migration prospects can stimulate investment in education due to the higher returns available abroad (Mountford (Reference Mountford1997), Vidal (Reference Vidal1998), Beine et al. (Reference Beine, Docquier and Rapoport2001), Chen (Reference Chen2006), Docquier and Rapoport (Reference Docquier and Rapoport2007)). Our approach incorporates these driving forces and suggests that, on average, migration may indeed have positive effects on the source economy.

The role of migration and remittances as a household strategy to cope with idiosyncratic shocks has been extensively explored in the migration literature, notably by Lucas and Stark (Reference Lucas and Stark1985) and Rosenzweig and Stark (Reference Rosenzweig and Stark1989). This body of work supports the notion that households utilize migration and remittances to smooth consumption and mitigate risk exposure in developing economies. Empirical evidence also corroborates this claim, as income and remittances exhibit a negative relationship. We contribute additional evidence supporting the insurance function of remittances by examining the relationship between the source country’s relative income (measured as the source country GDP to host country GDP ratio) and the remittances-GDP ratio. Through regression analysis controlling for country-specific fixed effects, we find a negative relationship between these two ratios, consistent with the insurance hypothesis of remittances (see Fig. A3).

In our analysis, we conceptualize migration as a family decision, recognizing that household consumption smoothing due to migration is captured by considering multi-member households. This approach aligns with the literature emphasizing emigration as a family decision (Mincer (Reference Mincer1978)). Moreover, there is a growing body of literature employing a multi-member household framework to analyze migration decisions within a general equilibrium framework (Chort and Senne (Reference Chort and Senne2018)).

Several empirical studies have extensively documented the multifaceted role of remittances. From an aggregate perspective, remittances contribute to economic growth, investment, and aggregate savings (Fajnzylber and López (Reference Fajnzylber and López2007)). Examining the microeconomic dimension, researchers such as Fajnzylber and López (Reference Fajnzylber and López2007) and Acosta (Reference Acosta2006) demonstrate how remittances influence the allocation of time and resources within households, illustrating reductions in work hours in countries like El Salvador and Nicaragua. Additionally, this body of literature has investigated the impact of remittances on income distribution, poverty alleviation, output, and overall economic growth. Another strand of research focuses on examining the combined effects of remittances and skilled migration within a unified framework. Studies in this domain have generated significant econometric evidence highlighting the substantial economic effects of both brain drain and remittances in developing economies (Faini (Reference Faini2007), Docquier and Rapoport (Reference Docquier and Rapoport2007), among others). These studies shed light on the complex interplay between remittances, skilled migration, and their implications for economic development and welfare outcomes.

An issue that has received partial attention in the migration literature is the indirect effect of skilled workers’ departure, which operates through an externality channel. The premise behind this issue is that the reduction in the human capital stock due to skilled migration may lead to a decrease in the returns to other factors in the economy, such as physical capital and labor (Hall and Jones (Reference Hall and Jones1999)). Also, the existence of externalities associated with human capital may justify public policy interventions aimed at mitigating the impacts of brain drain. Our approach contributes to this aspect of the migration literature by incorporating the externality channel of skilled migration into our analysis. We explicitly account for the indirect effect of skilled workers’ departure through this externality channel. This aspect is highlighted in existing literature; for example, Delogu et al. (Reference Delogu, Docquier and Machado2018) investigate the externality effect of migration on tertiary education in source countries using a multi-country dynamic model. Similarly, Biavaschi et al. (Reference Biavaschi, Burzyński, Elsner and Machado2020) employ a multi-country dynamic model to examine the welfare effects of skilled emigration from a global perspective, capturing the externality effect of skilled emigration, which results in a composition effect varying according to the characteristics of the countries involved (source and host).

Return migration has garnered increased attention in recent years, fueled by the fact that approximately one-fifth of migrants return to their birth country following a migration spell (OECD (2008)). The economic implications of this phenomenon are substantial, as return migrants have the potential to bolster the human capital of the source country—a phenomenon known as brain gain. Studies indicate that, on average, return migrants exhibit a 20% increase in their human capital compared to their pre-migration levels. Mayr and Peri (Reference Mayr and Peri2008) demonstrate that the human capital gain of return migrants in the host economy serves as a significant driver of return migration. Moreover, return migration has the potential to counteract the brain drain effects of skilled migration. The economic effects of return migration have been extensively studied from both theoretical and empirical perspectives. A key question addressed by this literature concerns the magnitude of the economic implications of return migration and whether these effects, along with remittances, are sufficient to offset the negative consequences of skilled migration. While the current literature has provided some insights into this question, the debate remains ongoing and the approaches employed are often limited. One notable limitation of the existing return migration literature is its reliance on partial equilibrium analysis.Footnote 4 By incorporating the most important channels through which migration influences economic outcomes, our approach extends the return migration literature by offering insights into the significance of the return migration channel within a general equilibrium framework. This enables a more comprehensive understanding of the economic impacts of return migration and its potential to mitigate the adverse effects of skilled migration.

Meghir et al. (Reference Meghir, Mobarak, Mommaerts and Morten2019) provide insights into the potential welfare gains for rural households in Bangladesh through policies that encourage migration. Their study employs a structural partial equilibrium model that incorporates temporary migration, including full return migration. They demonstrate that policies promoting migration could lead to a significant improvement in the welfare of rural households, estimated at 12,9%. One key aspect of their findings is the consideration of risk in migration decisions. The study suggests that if migration is perceived as risky, implementing a temporary subsidy could incentivize migration by improving risk sharing mechanisms. This subsidy enables individuals to engage in profitable temporary migration, thereby enhancing their welfare and contributing to overall economic well-being in rural areas of Bangladesh.

A notable feature highlighted in the literature review is that the study of migration has predominantly been approached from an empirical and/or partial equilibrium perspective. However, there is a growing body of literature that examines international migration, brain drain, and return migration within a general equilibrium framework.Footnote 5 Theoretical advancements in this direction have been made, with efforts focusing on applying the two-period life-cycle Overlapping Generations (OLG) model to the migration literature. Galor and Stark (Reference Galor and Stark1990, Reference Galor and Stark1991) are among the pioneering researchers who introduced this framework, paving the way for further theoretical developments in understanding the broader economic implications of migration dynamics.

Despite significant advancements in migration research, the comprehensive analysis of the welfare effects of migration remains an area that requires further attention. Understanding the welfare implications of migration policies and dynamics is vital for making informed decisions and formulating effective policies.

The papers closely related to ours include Vidal (Reference Vidal1998), Docquier and Rapoport (Reference Docquier and Rapoport2007), Chami et al. (Reference Chami, Cosimano and Gapen2006), and Di Giovanni et al. (Reference Di Giovanni, Ortega and Levchenko2015). Vidal’s work constructs a general equilibrium model based on Galor and Stark (Reference Galor and Stark1990, Reference Galor and Stark1991). However, our approach differs in that we utilize a fully specified general equilibrium model with heterogeneous agents, rather than a two-period life-cycle representative agent OLG model. Vidal explores the effect of migration on human capital formation and output analytically, demonstrating that migration can incentivize human capital formation in the source country, potentially fostering economic growth. On the other hand, Docquier and Rapoport (Reference Docquier and Rapoport2007) analyze the consequences of skilled migration for source countries using a one-period representative agent general equilibrium model. They find that an optimal high-skilled migration rate is positive and discuss the effects of migration and education policies on human capital. Their analysis suggests that policies restricting the international mobility of high-skilled individuals could diminish the long-run level of human capital stock and output. Chami et al. (Reference Chami, Cosimano and Gapen2006) evaluate the optimality of labor income taxes and monetary growth in the presence of remittances using a general equilibrium model with representative agents. However, their model lacks certain features crucial to the migration literature, such as human capital considerations, migration decisions, and agents heterogeneity. Our study aims to bridge these gaps by employing a fully specified general equilibrium model with heterogeneous agents, allowing for a comprehensive analysis of the welfare and economic implications of migration dynamics, including human capital and migration decisions.

Di Giovanni et al. (Reference Di Giovanni, Ortega and Levchenko2015) propose an alternative approach to studying migration within a general equilibrium framework. Their paper assesses the welfare impact of observed levels of migration and remittances using a quantitative general equilibrium multi-sector model of the world economy, calibrated to aggregate and firm-level data. While this model offers an alternative method to evaluate the general equilibrium and welfare effects of migration in a framework that includes international trade, there are differences compared to our approach. They use country averages as the unit of analysis, and their welfare measure is the average income of workers rather than the CEV. Additionally, their model does not incorporate a competitive transition when evaluating the welfare effects of migration. Aubry et al. (Reference Aubry, Burzynski and Docquier2016) also adopt a multi-country model of migration within OECD countries. They demonstrate that the welfare effects of migration vary heterogeneously across OECD countries. This study contributes to understanding the nuanced impacts of migration within specific regional contexts, shedding light on how different countries may experience diverse welfare outcomes in response to migration flows.

3. The model

Our model builds upon the stochastic neoclassical growth model with heterogeneous agents and incomplete markets, as established by Aiyagari (Reference Aiyagari1994). We extend Aiyagari’s framework to incorporate key features relevant to economies where migration, remittances, return migration, and brain drain play significant quantitative roles. Here are the main features of the model:

-

Migration in Incomplete Markets: We analyze migration within an incomplete market setup, allowing us to explore the insurance aspect of migration and remittances.

-

Household-Level Migration Decisions: Recognizing that migration decisions are often made at the household level, we incorporate optimal migration decisions into our model.

-

Inclusion of Human Capital: We explicitly consider the human capital of workers, acknowledging the importance of skills and education in migration dynamics and economic outcomes.

-

Schooling Externality: To capture the negative impact of brain drain on worker productivity, we introduce a schooling externality. This justifies potential policy interventions to address brain drain.

-

Endogenous Remittances: We model remittances as endogenous, allowing households with migrants abroad to decide on the optimal amount of remittances to send.

-

Competitive Firms with Capital-Skilled Labor Complementarity: Firms operate under competitive conditions with a production function characterized by capital-skilled labor complementarity.

-

Stylized General Equilibrium Framework: We integrate these features into a stylized general equilibrium framework to analyze the interactions between migration dynamics and economic outcomes comprehensively.

By incorporating these elements, the model provides a comprehensive framework for studying the complex interplay between migration and economic dynamics in economies where migration-related factors are significant.

3.1 Environment

The model structure consists of a small open economyFootnote

6

populated by infinitely lived risk-averse workers. Agents discount future consumption using

![]() $\beta ^{\ast }$

as the subjective discount factor. The number of households in this economy remains constant, normalized to 1 for simplicity. Additionally, households are assumed to be born and die at a constant rate

$\beta ^{\ast }$

as the subjective discount factor. The number of households in this economy remains constant, normalized to 1 for simplicity. Additionally, households are assumed to be born and die at a constant rate

![]() $\phi$

each period, ensuring a stable aggregate population.Footnote

7

Newborn households start with no assets. In this setup, the effective discount factor is represented as

$\phi$

each period, ensuring a stable aggregate population.Footnote

7

Newborn households start with no assets. In this setup, the effective discount factor is represented as

![]() $\beta =(1-\phi )\beta ^{\ast }$

.

$\beta =(1-\phi )\beta ^{\ast }$

.

In this economy, heterogeneity exists at the household level, primarily in terms of household size. The number of workers in each household varies based on the migration state. In the non-migration state, each household comprises

![]() $n$

workers, whereas in the migration state, it consists of

$n$

workers, whereas in the migration state, it consists of

![]() $n-1$

workers. Additionally, workers are heterogeneous ex ante based on their skill level. We consider two skill levels: unskilled workers, indexed as “

$n-1$

workers. Additionally, workers are heterogeneous ex ante based on their skill level. We consider two skill levels: unskilled workers, indexed as “

![]() $U$

,” and skilled workers, indexed as “

$U$

,” and skilled workers, indexed as “

![]() $S$

.”

$S$

.”

Households exhibit ex ante heterogeneity due to the distribution of skills within each household. With

![]() $n$

workers per household, and each worker being either skilled or unskilled, there can be up to

$n$

workers per household, and each worker being either skilled or unskilled, there can be up to

![]() $n+1$

distinct household types based on this distribution of skills.Footnote

8

We let

$n+1$

distinct household types based on this distribution of skills.Footnote

8

We let

![]() $i$

,

$i$

,

![]() $i\in \{1,2,\ldots,n+1\}$

, denote the

$i\in \{1,2,\ldots,n+1\}$

, denote the

![]() $i$

-th household type and

$i$

-th household type and

![]() $j$

,

$j$

,

![]() $j\in \{1,2,\ldots,n\},$

denote the

$j\in \{1,2,\ldots,n\},$

denote the

![]() $j$

-th household member.

$j$

-th household member.

In the model, each individual has one unit of time available, which must be allocated to work. The gross labor income of the

![]() $i$

-th household is represented by:

$i$

-th household is represented by:

![]() $\sum _{j=1}^{n}w_{ij}h_{ij}z_{ij}$

, where

$\sum _{j=1}^{n}w_{ij}h_{ij}z_{ij}$

, where

![]() $w_{ij}$

is the wage per efficiency units of hours of work for the

$w_{ij}$

is the wage per efficiency units of hours of work for the

![]() $j$

-th household member in the

$j$

-th household member in the

![]() $i$

-th household type. Likewise,

$i$

-th household type. Likewise,

![]() $h_{ij}$

denotes the human capital stock and

$h_{ij}$

denotes the human capital stock and

![]() $z_{ij}$

is the idiosyncratic productivity shock. Both the wage and the human capital can only take two values, depending on the worker’s skill level:

$z_{ij}$

is the idiosyncratic productivity shock. Both the wage and the human capital can only take two values, depending on the worker’s skill level:

![]() $w_{ij}\in \{w_{U},w_{S}\}$

and

$w_{ij}\in \{w_{U},w_{S}\}$

and

![]() $h_{ij}\in \{h_{U},h_{S}\}$

.

$h_{ij}\in \{h_{U},h_{S}\}$

.

In this economy, the government plays a dual role. It taxes the total income of workers at a rate

![]() $\tau$

and returns the collected tax revenues to each household in the form of lump-sum transfers. It’s important to note that this distortionary tax affects both labor income and the return on savings. Additionally, transfers consist of a lump-sum transfer

$\tau$

and returns the collected tax revenues to each household in the form of lump-sum transfers. It’s important to note that this distortionary tax affects both labor income and the return on savings. Additionally, transfers consist of a lump-sum transfer

![]() $\Lambda _{1}$

to each household and return migration transfers

$\Lambda _{1}$

to each household and return migration transfers

![]() $\Lambda _{2}$

.

$\Lambda _{2}$

.

The idiosyncratic productivity of household members is correlated, meaning that if one member experiences a positive productivity shock, it’s likely that the others will also be affected similarly. This correlation is captured by the joint household productivity process

![]() $Z_{i}$

, where

$Z_{i}$

, where

![]() $Z_{i}=[z_{i1},\ldots,z_{in}],$

follows a continuous vector autoregressive (VAR) process

$Z_{i}=[z_{i1},\ldots,z_{in}],$

follows a continuous vector autoregressive (VAR) process

![]() $Z_{i}^{\prime }=\varrho Z_{i}+\upsilon _{i},$

where

$Z_{i}^{\prime }=\varrho Z_{i}+\upsilon _{i},$

where

![]() $\upsilon \sim N(0,\Sigma )$

,

$\upsilon \sim N(0,\Sigma )$

,

![]() $\Sigma$

is the varianze-covarianze matrix, and

$\Sigma$

is the varianze-covarianze matrix, and

![]() $\varrho$

denotes the autoregressive coefficient of each worker’s productivity process.

$\varrho$

denotes the autoregressive coefficient of each worker’s productivity process.

The human capital of each individual

![]() $h_{ij}$

is determined by a production function:

$h_{ij}$

is determined by a production function:

![]() $h_{ij}=\varphi \exp (\phi _{0}s_{ij}+\phi _{1}\overline{S})$

. Here,

$h_{ij}=\varphi \exp (\phi _{0}s_{ij}+\phi _{1}\overline{S})$

. Here,

![]() $s_{ij}$

represents the years of education,

$s_{ij}$

represents the years of education,

![]() $\overline{S}$

is the average years of education in the economy,

$\overline{S}$

is the average years of education in the economy,

![]() $\varphi$

is a scale parameter for standardization of human capital,

$\varphi$

is a scale parameter for standardization of human capital,

![]() $\phi _{0}$

represents the private return to education, and

$\phi _{0}$

represents the private return to education, and

![]() $\phi _{1}$

captures the externality induced by the average years of education in the economy. Introducing the concept of private return to education to capture individual-level heterogeneity in the loss of human capital due to skilled migration is an addition to the model. This approach allows for a better understanding of the effects of migration on human capital, as it accounts for the differential effects on individuals based on their education levels. Moreover, by incorporating the notion of private returns, we are also recognizing the potential negative externalities associated with skilled migration, which can have broader implications for the economy beyond just the individuals directly involved in migration. Even though education is exogenous in the model the formulation captures the externality of the average human capital loss due to endogenous skilled migration. Furthermore, the introduction of this schooling externality provides a rationale for implementing policies aimed at preventing or mitigating the negative effects of skilled migration.

$\phi _{1}$

captures the externality induced by the average years of education in the economy. Introducing the concept of private return to education to capture individual-level heterogeneity in the loss of human capital due to skilled migration is an addition to the model. This approach allows for a better understanding of the effects of migration on human capital, as it accounts for the differential effects on individuals based on their education levels. Moreover, by incorporating the notion of private returns, we are also recognizing the potential negative externalities associated with skilled migration, which can have broader implications for the economy beyond just the individuals directly involved in migration. Even though education is exogenous in the model the formulation captures the externality of the average human capital loss due to endogenous skilled migration. Furthermore, the introduction of this schooling externality provides a rationale for implementing policies aimed at preventing or mitigating the negative effects of skilled migration.

The model captures the schooling externality channel of migration, wherein skilled migration influences aggregate schooling levels. However, an inherent limitation is that the education decision is treated as exogenous. Consequently, the model may overlook additional education effects associated with migration and remittances. For instance, remittances can positively impact education by supporting children’s educational expenses and fostering higher schooling levels in the economy. This is supported by literature such as Stark (Reference Stark1991), and Rapoport and Docquier (Reference Rapoport and Docquier2005). However, empirical evidence also suggests potential negative effects of migration on education. For example, migration of family members may discourage children’s educational progress due to the prospect of seeking employment abroad, which may not require or reward educational credentials from the home country. Studies like Pederzini and Meza (Reference Pederzini and Meza2008), McKenzie and Rapoport (Reference McKenzie and Rapoport2011) have found that rural youth in migrant households are less likely to attend school and may have lower educational attainment compared to those in non-migrant households. Therefore, while migration and remittances may have positive impacts on education through financial support, they can also have negative consequences on schooling participation and attainment. Thus, the endogenous effects of migration and remittances on education are complex and could be offset in aggregate terms by the mixed effects they exert.

Households have the option to save, with only one asset available for this purpose denoted by

![]() $a$

, where

$a$

, where

![]() $a\in A$

and

$a\in A$

and

![]() $A$

represents a compact set defining the savings state space. However, households face borrowing constraints, implying that their savings must be non-negative

$A$

represents a compact set defining the savings state space. However, households face borrowing constraints, implying that their savings must be non-negative

![]() $(a\geq a$

,

$(a\geq a$

,

![]() $a=0)$

. As a result, households can only finance their expenses—including consumption, migration costs, and savings—using their labor income or the interest generated by their accumulated wealth. This incomplete market scenario arises because there is only one asset available for households to use in insuring against idiosyncratic shocks.

$a=0)$

. As a result, households can only finance their expenses—including consumption, migration costs, and savings—using their labor income or the interest generated by their accumulated wealth. This incomplete market scenario arises because there is only one asset available for households to use in insuring against idiosyncratic shocks.

The household utility is represented by

![]() $u(c)$

and it is strictly increasing and concave in consumption (

$u(c)$

and it is strictly increasing and concave in consumption (

![]() $u^{\prime }(c)\gt 0$

and

$u^{\prime }(c)\gt 0$

and

![]() $u^{\prime \prime }(c)\lt 0)$

. The instantaneous utility of a household without migrants abroad, referred to as the “stayer household,” is specified by the following functional form.

$u^{\prime \prime }(c)\lt 0)$

. The instantaneous utility of a household without migrants abroad, referred to as the “stayer household,” is specified by the following functional form.

Each stayer household makes optimal decisions every period regarding per capita consumption, savings, and migration. Migration is regarded as a family decision, meaning that each stayer household chooses to send one of its family members abroad.Footnote

9

Every period, a stayer household receives a migration offer, the probability of which depends on the household’s type (

![]() $p_{i}$

). The migration cost is denoted by

$p_{i}$

). The migration cost is denoted by

![]() $\Delta$

and is paid from the household budget during the migration period.

$\Delta$

and is paid from the household budget during the migration period.

The incorporation of migration probability by skill type into the model underscores the importance of institutional arrangements and policy frameworks in shaping migration patterns and brain drain dynamics. By allowing for differential migration opportunities based on skill level, the model reflects real-world phenomena such as quota systems that prioritize skilled migration in many host countries. The emphasis on skilled workers receiving more migration opportunities aligns with observed trends where host countries often have policies favoring skilled or high-demand workers for immigration. Such quota systems or skill-based selection criteria reflect the perceived economic benefits of attracting skilled labor, which may contribute to brain drain concerns for source countries.

Introducing a migration technology that incorporates both a common migration cost and skill-specific migration offers is a realistic approach to capture the complexities of migration decisions, particularly in contexts with high heterogeneity among workers. The migration cost by itself does not generate enough migration rate by skill type (as we shown in the sensitivity analysis section). By considering both factors, the model can accurately represent the factors influencing individual migration decisions and the overall migration rate by skill type. The migration offer by skill type allows for a more accurate representation of migration dynamics, as it acknowledges that not all individuals may have the opportunity to migrate even if they desire to do so. This mirrors real-world scenarios where individuals may be willing to migrate but are constrained by factors such as access to migration opportunities.

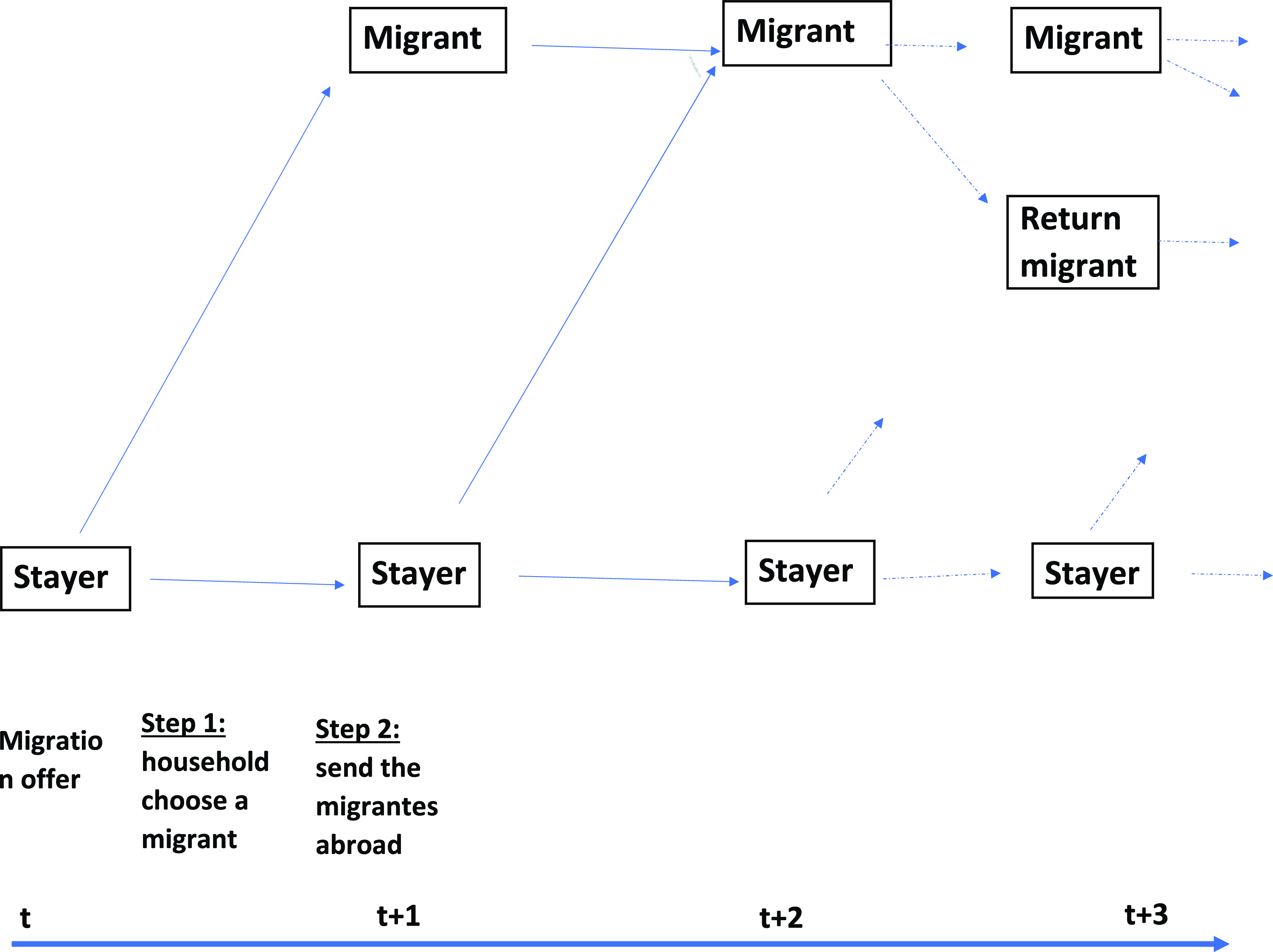

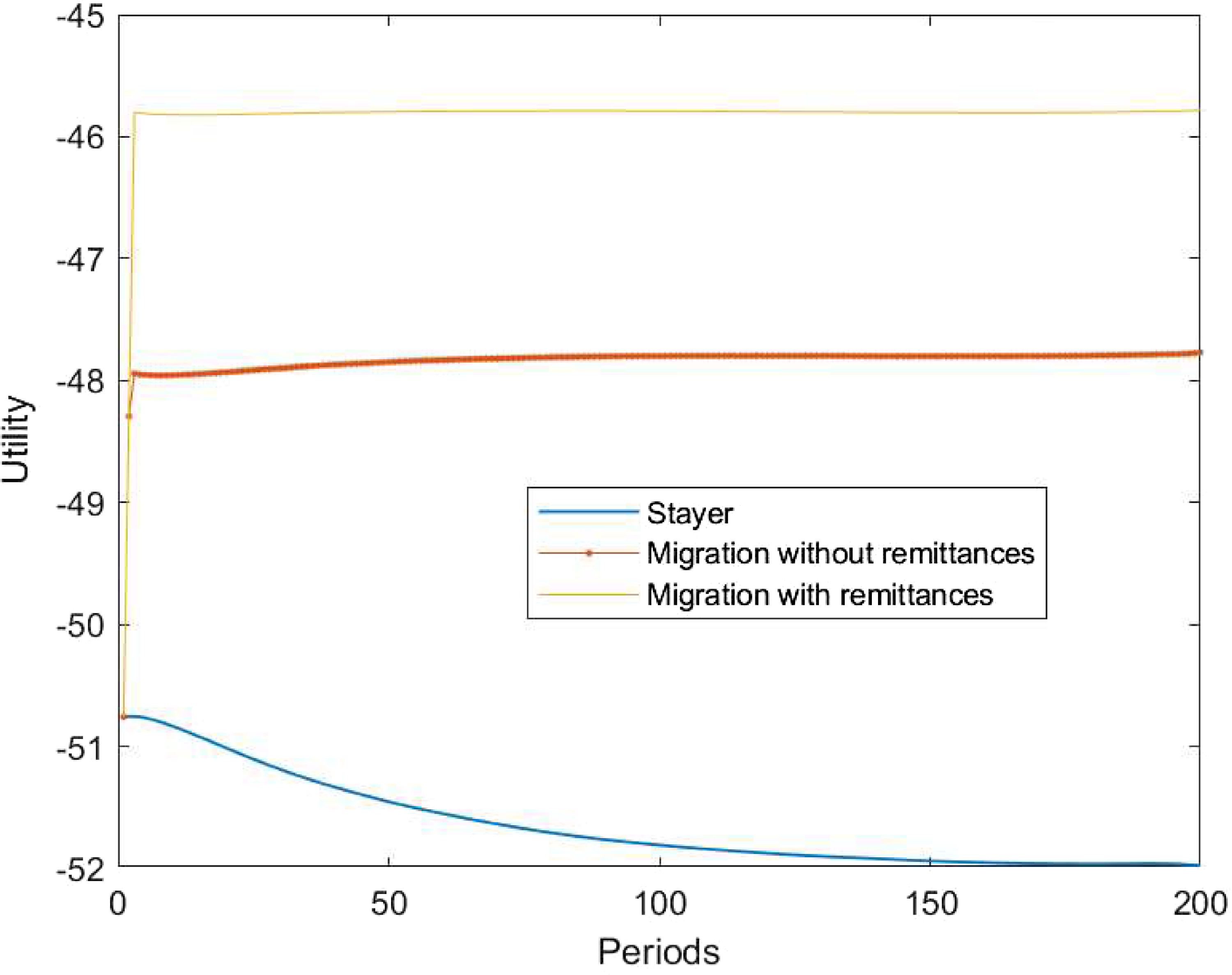

The migration decision is based on a two-step comparative advantage mechanism. In the first step, the household chooses the potential migrant from among members of the family. It is done by comparing the household lifetime value of migration for each member. At this stage, the current productivity shock as well as the future expected productivity shocks for each household member is known such that the household may know which household member has the best comparative advantage to migrate in terms of the household lifetime value of migrating. Given that productivity shocks are discretized, it may be the case that two (or more) household members may have the same skill and productivity shock such that both may have the same lifetime value. In such a case the household decides to send abroad one member randomly. In the second step, and once the migration offer arrives, the household decides to send abroad the potential migrant if the offer is good enough in terms of the household lifetime utility.Footnote

10

(See Fig. 1 for a graphic description of the migration decision process). Labor income abroad is exogenous. We let

![]() $\overline{w}_{U}$

denote unskilled migrants’ labor income and

$\overline{w}_{U}$

denote unskilled migrants’ labor income and

![]() $\overline{w}_{S}$

denote skilled migrants’ labor income.Footnote

11

$\overline{w}_{S}$

denote skilled migrants’ labor income.Footnote

11

Figure 1. Timing of the household migration decision process.

Note: Stayer is a household without migrants and Migrant is a household with a migrant abroad. Return migration is allowed after 2 periods of migration.

A migrant household values the utility of each of its members, including the member that works abroad. We denote by

![]() $\widetilde{c}$

the consumption of the migrant worker, and the instant utility of a migrant household is represented by the following functional form.

$\widetilde{c}$

the consumption of the migrant worker, and the instant utility of a migrant household is represented by the following functional form.

We consider that the migration decision period is a special one. The first-period migration problem differs from the remaining periods since during this period remittances are zero. This assumption makes the model more realistic. During the first period, the migrant must assimilate to the new labor market conditions in the host economy. Additionally, they must spend resources to cover some expenditures like installation costs as well as job search efforts in the host economy. These features would reduce the ability to generate income during the migration period and therefore may limit the migrant’s ability to send remittances. The assumption also allows us to set up the return migrant problem, in this case, return migration is allowed only after one period of migration.

The decision on remittances is made by the household and depends on the prevailing economic conditions in both the source and the host country. We believe that households with a migrant abroad face uncertainty surrounding the remittances that they could potentially receive. We introduce the variable

![]() $R$

, which denotes the migrant’s option to send remittances.

$R$

, which denotes the migrant’s option to send remittances.

![]() $R$

can take two values:

$R$

can take two values:

![]() $R=0$

if the migrant has the option to send remittances and

$R=0$

if the migrant has the option to send remittances and

![]() $R=1$

otherwise. The uncertainty of remittances is captured by the probability of sending remittances, denoted by

$R=1$

otherwise. The uncertainty of remittances is captured by the probability of sending remittances, denoted by

![]() $\pi _{re}$

,

$\pi _{re}$

,

![]() $\pi _{re}=\Pr ob(\textrm{R}=1)$

. Formally,

$\pi _{re}=\Pr ob(\textrm{R}=1)$

. Formally,

![]() $R$

is a two-state stochastic variable that follows an independent and identically distributed (

$R$

is a two-state stochastic variable that follows an independent and identically distributed (

![]() $i.i.d.$

) process.Footnote

12

The migrant may send remittances every period except during the migration period. Additionally, once the remittances option is realized, the household decides on the optimal monetary value of remittances through the policy rule

$i.i.d.$

) process.Footnote

12

The migrant may send remittances every period except during the migration period. Additionally, once the remittances option is realized, the household decides on the optimal monetary value of remittances through the policy rule

![]() $Re(.)$

. Note that labor income abroad (

$Re(.)$

. Note that labor income abroad (

![]() $\overline{w}_{U}$

,

$\overline{w}_{U}$

,

![]() $\overline{w}_{S}$

) and

$\overline{w}_{S}$

) and

![]() $\pi _{re}$

summarize the economic conditions in the host economy; good economic conditions may translate into both higher remittances and a higher probability of sending back remittances.

$\pi _{re}$

summarize the economic conditions in the host economy; good economic conditions may translate into both higher remittances and a higher probability of sending back remittances.

Introducing a remittance probability parameter in the model is a realistic way to account for the observed phenomenon where not every household with a migrant abroad receives remittances. This acknowledges the various barriers and constraints, both financial and institutional, that may affect the ability of migrants to send remittances back to their home countries. The inclusion of remittance probability allows the model to capture the complexities of the remittance process, which can be influenced by factors such as the level of financial development and inclusion in the host country, as well as regulatory and institutional arrangements affecting remittance channels. For example, migrants may face high transaction costs, limited access to banking services, or legal restrictions on remittance transfers, all of which can affect the likelihood of remittance transmission. By incorporating remittance probability as a parameter, the model can simulate different scenarios reflecting varying levels of ease or difficulty in sending remittances, thereby providing insights into the potential impacts of policy interventions aimed at reducing barriers to remittance transfers.

In the model, migrants are allowed to return after staying at least one period in the host country. Return migration is incentivized by a cash transfer policy, denoted as

![]() $(\Lambda _{2})$

, which is conditional on the returning migrant’s skill level. These transfers are funded by distortionary income tax revenues. In this setup, the government has an interest in promoting skilled return migration, as increasing the average human capital of the economy can lead to welfare improvements through the externality channel. Moreover, it is assumed that return migrant transfers are permanent. This assumption aligns with many return migration policies worldwide, which often provide support to return migrants for extended periods.

$(\Lambda _{2})$

, which is conditional on the returning migrant’s skill level. These transfers are funded by distortionary income tax revenues. In this setup, the government has an interest in promoting skilled return migration, as increasing the average human capital of the economy can lead to welfare improvements through the externality channel. Moreover, it is assumed that return migrant transfers are permanent. This assumption aligns with many return migration policies worldwide, which often provide support to return migrants for extended periods.

Return migration is modeled as an absorbing state, meaning that once a migrant worker returns, they remain in the source country indefinitely. Finally, output production occurs in a competitive market environment with a constant returns to scale production function, similar to the framework described by Krusell et al. (Reference Krusell, Ohanian, RÌos-Rull and Violante2000). We will explain in detail the production process later.

3.2 Recursive representation

3.2.1 Household problem

Denote by

![]() $V(a,\Theta,Z;\,i)$

the lifetime value function of a type

$V(a,\Theta,Z;\,i)$

the lifetime value function of a type

![]() $i$

stayer household, where

$i$

stayer household, where

![]() $a$

accounts for the household’s asset position, and

$a$

accounts for the household’s asset position, and

![]() $\Theta =\{h_{i1},h_{i2}\ldots,h_{in}\}$

is the household’s stock of human capital. Similarly,

$\Theta =\{h_{i1},h_{i2}\ldots,h_{in}\}$

is the household’s stock of human capital. Similarly,

![]() $Z=\{z_{i1},z_{i2},\ldots z_{in}\}$

is the household’s idiosyncratic productivity shock, and

$Z=\{z_{i1},z_{i2},\ldots z_{in}\}$

is the household’s idiosyncratic productivity shock, and

![]() $\Theta _{-k}=\{h_{i1},\ldots h_{ik-1},h_{ik+1},\ldots,h_{in}\}$

represents the household’s stock of human capital when the

$\Theta _{-k}=\{h_{i1},\ldots h_{ik-1},h_{ik+1},\ldots,h_{in}\}$

represents the household’s stock of human capital when the

![]() $k$

-th family member has migrated. Likewise

$k$

-th family member has migrated. Likewise

![]() $Z_{-k}$

is the household’s productivity shock when the

$Z_{-k}$

is the household’s productivity shock when the

![]() $k$

-th member has migrated.Footnote

13

$k$

-th member has migrated.Footnote

13

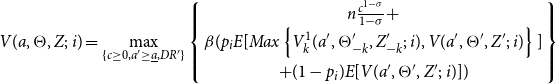

The stayer household problem. The problem of a household with no migrants abroad has the following recursive representation:

\begin{equation} V(a,\Theta,Z;\,i)=\max _{\{c\geq 0,a^{\prime }\geq \underline{a},DR^{\prime }\}}\left \{ \begin{array}{c} n\frac{c^{1-\sigma }}{1-\sigma }+ \\ \beta (p_{i}E[Max\left \{ V_{k}^{1}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime };\,i),V(a^{\prime },\Theta ^{\prime },Z^{\prime };\,i)\right \} ] \\ +(1-p_{i})E[V(a^{\prime },\Theta ^{\prime },Z^{\prime };\,i)])\end{array}\right \} \end{equation}

\begin{equation} V(a,\Theta,Z;\,i)=\max _{\{c\geq 0,a^{\prime }\geq \underline{a},DR^{\prime }\}}\left \{ \begin{array}{c} n\frac{c^{1-\sigma }}{1-\sigma }+ \\ \beta (p_{i}E[Max\left \{ V_{k}^{1}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime };\,i),V(a^{\prime },\Theta ^{\prime },Z^{\prime };\,i)\right \} ] \\ +(1-p_{i})E[V(a^{\prime },\Theta ^{\prime },Z^{\prime };\,i)])\end{array}\right \} \end{equation}

Subject to

\begin{eqnarray*} nc+a^{\prime } &= &(1-\tau )\sum _{j=1}^{n}w_{ij}h_{ij}z_{ij}+\Lambda _{1}+(1+(1-\tau )r)a \\ Z^{\prime } &=&\varrho Z+\nu ;\text{ }\nu \sim N(0,\Sigma ) \\ \Theta ^{\prime } &=&\Theta \\ V_{k}^{1}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime };\,i) &=&Max\{V_{j}^{1}(a^{\prime },\Theta _{-j}^{\prime },Z_{-j}^{\prime };\,i)\}_{j=1}^{n} \end{eqnarray*}

\begin{eqnarray*} nc+a^{\prime } &= &(1-\tau )\sum _{j=1}^{n}w_{ij}h_{ij}z_{ij}+\Lambda _{1}+(1+(1-\tau )r)a \\ Z^{\prime } &=&\varrho Z+\nu ;\text{ }\nu \sim N(0,\Sigma ) \\ \Theta ^{\prime } &=&\Theta \\ V_{k}^{1}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime };\,i) &=&Max\{V_{j}^{1}(a^{\prime },\Theta _{-j}^{\prime },Z_{-j}^{\prime };\,i)\}_{j=1}^{n} \end{eqnarray*}

![]() $\qquad \qquad$

$\qquad \qquad$

![]() $V_{k}^{1}(a,\Theta _{-k},Z_{-k};\,i)$

denotes the lifetime value of a type

$V_{k}^{1}(a,\Theta _{-k},Z_{-k};\,i)$

denotes the lifetime value of a type

![]() $i$

household in which its

$i$

household in which its

![]() $k$

-th family member migrated at the beginning of the current period. As we mentioned before, the migration decision implies a two-step procedure. In the fist step, the family chooses its potential migrant by a comparative advantage mechanism; formally, the

$k$

-th family member migrated at the beginning of the current period. As we mentioned before, the migration decision implies a two-step procedure. In the fist step, the family chooses its potential migrant by a comparative advantage mechanism; formally, the

![]() $k$

-th family member is the potential migrant if

$k$

-th family member is the potential migrant if

![]() $V_{k}^{1}(a,\Theta _{-k},Z_{-k};\,i)=Max\{V_{j}^{1}(a,\Theta _{-j},Z_{-j};\,i)\}_{j=1}^{n}$

. In the second step, the household faces the migration decision, which is made by comparing the household’s lifetime value of staying in the source country with the household’s lifetime value when the potential migrant migrates.

$V_{k}^{1}(a,\Theta _{-k},Z_{-k};\,i)=Max\{V_{j}^{1}(a,\Theta _{-j},Z_{-j};\,i)\}_{j=1}^{n}$

. In the second step, the household faces the migration decision, which is made by comparing the household’s lifetime value of staying in the source country with the household’s lifetime value when the potential migrant migrates.

![]() $DR(.)$

represents the household’s migration decision rule at the beginning of the current period:

$DR(.)$

represents the household’s migration decision rule at the beginning of the current period:

![]() $DR(.)=1$

if migration is the best option,

$DR(.)=1$

if migration is the best option,

![]() $V_{k}^{1}(a,\Theta _{-k},Z_{-k};\,i)\gt V(a,\Theta,Z;\,i)$

, and

$V_{k}^{1}(a,\Theta _{-k},Z_{-k};\,i)\gt V(a,\Theta,Z;\,i)$

, and

![]() $DR(.)=0$

otherwise.

$DR(.)=0$

otherwise.

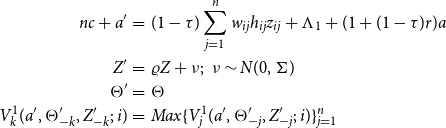

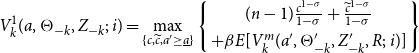

First-period migration problem. The problem of a type

![]() $i$

household in which its

$i$

household in which its

![]() $k$

-th member migrated at the beginning of the period has the following recursive represen tation:

$k$

-th member migrated at the beginning of the period has the following recursive represen tation:

\begin{equation} V_{k}^{1}(a,\Theta _{-k},Z_{-k};\,i)=\max _{\{c,\widetilde{c},a^{\prime }\geq \underline{a}\}}\left \{ \begin{array}{c} (n-1)\frac{c^{1-\sigma }}{1-\sigma }+\frac{\widetilde{c}^{1-\sigma }}{1-\sigma } \\ +\beta E[V_{k}^{m}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime },R;\,i)]\end{array}\right \} \end{equation}

\begin{equation} V_{k}^{1}(a,\Theta _{-k},Z_{-k};\,i)=\max _{\{c,\widetilde{c},a^{\prime }\geq \underline{a}\}}\left \{ \begin{array}{c} (n-1)\frac{c^{1-\sigma }}{1-\sigma }+\frac{\widetilde{c}^{1-\sigma }}{1-\sigma } \\ +\beta E[V_{k}^{m}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime },R;\,i)]\end{array}\right \} \end{equation}

Subject to

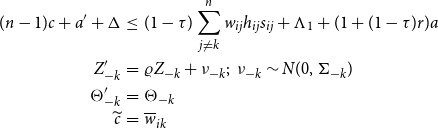

\begin{eqnarray*} (n-1)c+a^{\prime }+\Delta &\leq &(1-\tau )\sum _{j\neq k}^{n}w_{ij}h_{ij}s_{ij}+\Lambda _{1}+(1+(1-\tau )r)a \\ Z_{-k}^{\prime } &=&\varrho Z_{-k}+\nu _{-k};\text{ }\nu _{-k}\sim N(0,\Sigma _{-k}) \\ \Theta _{-k}^{\prime } &=&\Theta _{-k} \\ \widetilde{c} &=&\overline{w}_{ik} \end{eqnarray*}

\begin{eqnarray*} (n-1)c+a^{\prime }+\Delta &\leq &(1-\tau )\sum _{j\neq k}^{n}w_{ij}h_{ij}s_{ij}+\Lambda _{1}+(1+(1-\tau )r)a \\ Z_{-k}^{\prime } &=&\varrho Z_{-k}+\nu _{-k};\text{ }\nu _{-k}\sim N(0,\Sigma _{-k}) \\ \Theta _{-k}^{\prime } &=&\Theta _{-k} \\ \widetilde{c} &=&\overline{w}_{ik} \end{eqnarray*}

![]() $\ \qquad \qquad \qquad \qquad$

$\ \qquad \qquad \qquad \qquad$

![]() $V_{k}^{m}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime },R;\,i)$

denotes the lifetime value of a type

$V_{k}^{m}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime },R;\,i)$

denotes the lifetime value of a type

![]() $i$

household in which its

$i$

household in which its

![]() $k$

-th member had migrated sometime before the current period. We include

$k$

-th member had migrated sometime before the current period. We include

![]() $R$

as a state variable in this case, since the optimal monetary value of remittances is chosen conditional on the realization of the opportunity to send remittances.

$R$

as a state variable in this case, since the optimal monetary value of remittances is chosen conditional on the realization of the opportunity to send remittances.

Migration problem. The problem of a type

![]() $i$

household in which its

$i$

household in which its

![]() $k$

-th member lives abroad has the following recursive representation:

$k$

-th member lives abroad has the following recursive representation:

\begin{equation} V_{k}^{m}(a,\Theta _{-k},Z_{-k},R;\,i)=\max _{\{c,\widetilde{c},a^{\prime },\textrm{Re},DR2\}}\left \{ \begin{array}{c} (n-1)\frac{c^{1-\sigma }}{1-\sigma }+\frac{\widetilde{c}^{1-\sigma }}{1-\sigma } \\ +\beta E[\max \{V_{k}^{m}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime },R^{\prime };\,i);V_{k}^{re}(a^{\prime },\overline{\Theta }_{k}^{\prime },Z^{\prime };\,i)\}]\end{array}\right \} \end{equation}

\begin{equation} V_{k}^{m}(a,\Theta _{-k},Z_{-k},R;\,i)=\max _{\{c,\widetilde{c},a^{\prime },\textrm{Re},DR2\}}\left \{ \begin{array}{c} (n-1)\frac{c^{1-\sigma }}{1-\sigma }+\frac{\widetilde{c}^{1-\sigma }}{1-\sigma } \\ +\beta E[\max \{V_{k}^{m}(a^{\prime },\Theta _{-k}^{\prime },Z_{-k}^{\prime },R^{\prime };\,i);V_{k}^{re}(a^{\prime },\overline{\Theta }_{k}^{\prime },Z^{\prime };\,i)\}]\end{array}\right \} \end{equation}

Subject to

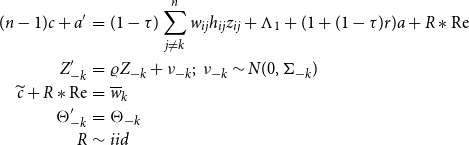

\begin{eqnarray*} (n-1)c+a^{\prime } &= &(1-\tau )\sum _{j\neq k}^{n}w_{ij}h_{ij}z_{ij}+\Lambda _{1}+(1+(1-\tau )r)a+R\ast \textrm{Re} \\ Z_{-k}^{\prime } &=&\varrho Z_{-k}+\nu _{-k};\text{ }\nu _{-k}\sim N(0,\Sigma _{-k}) \\ \widetilde{c}+R\ast \textrm{Re} &= &\overline{w}_{k} \\ \Theta _{-k}^{\prime } &=&\Theta _{-k} \\ R &\sim &iid \end{eqnarray*}

\begin{eqnarray*} (n-1)c+a^{\prime } &= &(1-\tau )\sum _{j\neq k}^{n}w_{ij}h_{ij}z_{ij}+\Lambda _{1}+(1+(1-\tau )r)a+R\ast \textrm{Re} \\ Z_{-k}^{\prime } &=&\varrho Z_{-k}+\nu _{-k};\text{ }\nu _{-k}\sim N(0,\Sigma _{-k}) \\ \widetilde{c}+R\ast \textrm{Re} &= &\overline{w}_{k} \\ \Theta _{-k}^{\prime } &=&\Theta _{-k} \\ R &\sim &iid \end{eqnarray*}

The problem of a migrant household includes a decision on remittances (

![]() $Re$

), which is conditional on the realization of the opportunity to send remittances. If the migrant is allowed to send remittances

$Re$

), which is conditional on the realization of the opportunity to send remittances. If the migrant is allowed to send remittances

![]() $(R=1)$

, then the household will decide on the optimal monetary value of the transfer; otherwise, remittances are zero, and the migrant abroad consumes his income. Additionally, the migrant budget constraint holds with equality (thus, consumption + remittances = wage abroad); hence the underlying assumption is that the migrant cannot save beyond the possibility to send remittances.

$(R=1)$

, then the household will decide on the optimal monetary value of the transfer; otherwise, remittances are zero, and the migrant abroad consumes his income. Additionally, the migrant budget constraint holds with equality (thus, consumption + remittances = wage abroad); hence the underlying assumption is that the migrant cannot save beyond the possibility to send remittances.

![]() $V_{k}^{re}(a^{\prime },\overline{\Theta }_{k}^{\prime },Z^{\prime };\,i)$

is the lifetime value of a type

$V_{k}^{re}(a^{\prime },\overline{\Theta }_{k}^{\prime },Z^{\prime };\,i)$

is the lifetime value of a type

![]() $i$

household in which its

$i$

household in which its

![]() $k$

-th member has returned from migration. The household also decides over the return migration policy rule

$k$

-th member has returned from migration. The household also decides over the return migration policy rule

![]() $DR2(.)$

, which can take two values,

$DR2(.)$

, which can take two values,

![]() $DR2(.)=0$

if return migration is an optimal choice and

$DR2(.)=0$

if return migration is an optimal choice and

![]() $DR2(.)=1$

otherwise.

$DR2(.)=1$

otherwise.

![]() $\overline{\Theta }_{k}=\{h_{i1,}\ldots h_{ik-1,}\overline{h}_{ik,}h_{ik+1,}\ldots h_{in,}\}$

represents the human capital stock of a family when its

$\overline{\Theta }_{k}=\{h_{i1,}\ldots h_{ik-1,}\overline{h}_{ik,}h_{ik+1,}\ldots h_{in,}\}$

represents the human capital stock of a family when its

![]() $k$

-th member returns from the host country.

$k$

-th member returns from the host country.

Return migration problem. The problem of a return migrant household, whose

![]() $k$

-th member has returned, has the following recursive representation.

$k$

-th member has returned, has the following recursive representation.

Subject to

\begin{eqnarray*} nc+a^{\prime } &\leq &(1-\tau )(\sum _{j\neq k}^{n}w_{ij}h_{ij}z_{ij}+w_{k}\overline{h}_{k}z_{k})+(1+(1-\tau )r)a+\Lambda _{1}+1_{[\Xi _{ik}=S]}\Lambda _{2} \\ Z^{\prime } &=&\varrho Z+\nu ;\text{ }\nu \sim N(0,\Sigma ) \\ \overline{\Theta }_{k}^{\prime } &=&\overline{\Theta }_{k} \end{eqnarray*}

\begin{eqnarray*} nc+a^{\prime } &\leq &(1-\tau )(\sum _{j\neq k}^{n}w_{ij}h_{ij}z_{ij}+w_{k}\overline{h}_{k}z_{k})+(1+(1-\tau )r)a+\Lambda _{1}+1_{[\Xi _{ik}=S]}\Lambda _{2} \\ Z^{\prime } &=&\varrho Z+\nu ;\text{ }\nu \sim N(0,\Sigma ) \\ \overline{\Theta }_{k}^{\prime } &=&\overline{\Theta }_{k} \end{eqnarray*}

where

![]() $V_{k}^{re}(a,\overline{\Theta }_{k},Z;\,i)$

denotes the value of a household with a return migrant. The two terms

$V_{k}^{re}(a,\overline{\Theta }_{k},Z;\,i)$

denotes the value of a household with a return migrant. The two terms

![]() $\Lambda _{2}$

and

$\Lambda _{2}$

and

![]() $1_{[\Xi _{ik}=S]}$

capture the government’s return migration policy:

$1_{[\Xi _{ik}=S]}$

capture the government’s return migration policy:

![]() $\Lambda _{2}$

is the monetary transfer for return migrants and

$\Lambda _{2}$

is the monetary transfer for return migrants and

![]() $1_{[\Xi _{ik}=S]}$

Footnote

14

is an indicator function that is equal to one only when the returning migrant is skilled (

$1_{[\Xi _{ik}=S]}$

Footnote

14

is an indicator function that is equal to one only when the returning migrant is skilled (

![]() $\Xi _{ik}=S)$

. We consider that the migrant may gain in terms of human capital during his migration spell. The human capital of the returning migrant is denoted by

$\Xi _{ik}=S)$

. We consider that the migrant may gain in terms of human capital during his migration spell. The human capital of the returning migrant is denoted by

![]() $\overline{h}_{k}$

and it is proportional to the before-migration stock of human capital (

$\overline{h}_{k}$

and it is proportional to the before-migration stock of human capital (

![]() $\overline{h}_{k}=\zeta h_{k})$

. The term

$\overline{h}_{k}=\zeta h_{k})$

. The term

![]() $\zeta \gt 1$

represents the human capital gain during the migration spell.Footnote

15

Finally, we assume that the returning migrant worker will stay in the source country; in terms of the model it means that return migration is an absorbing state.

$\zeta \gt 1$

represents the human capital gain during the migration spell.Footnote

15

Finally, we assume that the returning migrant worker will stay in the source country; in terms of the model it means that return migration is an absorbing state.

The state of the economy, denoted by

![]() $\Omega$

, includes all possible values of the state variables: wealth, human capital, productivity shock, migration status, and remittances. Additionally, an index variable

$\Omega$

, includes all possible values of the state variables: wealth, human capital, productivity shock, migration status, and remittances. Additionally, an index variable

![]() $M$

, where

$M$

, where

![]() $M\in{0,1}$

, is included to track the current migration status of each household: households without migrants are denoted by

$M\in{0,1}$

, is included to track the current migration status of each household: households without migrants are denoted by

![]() $M=0$

, and those with a migrant abroad are denoted by

$M=0$

, and those with a migrant abroad are denoted by

![]() $M=1$

. Then, the policy rules that solve the household problem can be represented in the following manner:

$M=1$

. Then, the policy rules that solve the household problem can be represented in the following manner:

![]() $a^{\prime }(\Omega ;\,i)$

,

$a^{\prime }(\Omega ;\,i)$

,

![]() $c(\Omega ;\,i)$

,

$c(\Omega ;\,i)$

,

![]() $\widetilde{c}(\Omega ;\,i)$

,

$\widetilde{c}(\Omega ;\,i)$

,

![]() $DR(\Omega ;\,i)$

, and

$DR(\Omega ;\,i)$

, and

![]() $\textrm{Re}(\Omega ;\,i)$

.

$\textrm{Re}(\Omega ;\,i)$

.

3.2.2 Production

Production takes place in a competitive environment. There is a continuum of firms that have access to a nested CES production function as used in Krusell et al (Reference Krusell, Ohanian, RÌos-Rull and Violante2000).

where

![]() $\chi$

and

$\chi$

and

![]() $\eta$

are the share parameters. The parameters

$\eta$

are the share parameters. The parameters

![]() $\delta$

and

$\delta$

and

![]() $\rho$

govern the elasticity of substitution between unskilled labor input and physical capital, and between skilled labor input and physical capital, respectively.

$\rho$

govern the elasticity of substitution between unskilled labor input and physical capital, and between skilled labor input and physical capital, respectively.

![]() $K$

is the aggregate capital stock that depreciates at a constant rate

$K$

is the aggregate capital stock that depreciates at a constant rate

![]() $\delta _{k}$

,

$\delta _{k}$

,

![]() $H_{U}$

is the aggregated efficiency units of unskilled labor and

$H_{U}$

is the aggregated efficiency units of unskilled labor and

![]() $H_{S}$

is the aggregated efficiency units of skilled labor. This type of production function reflects complementarity between capital and skilled labor, as well as between capital and unskilled labor. The complementarity between capital and skilled labor may be higher than the complementarity between capital and unskilled labor. This feature allows the model to capture a well-documented aspect of the brain-drain literature: the departure of skilled workers can negatively impact the source country by reducing the return to capital due to the scarcity of skilled labor. Aggregate variables are computed by summing up the corresponding variables at the individual level.

$H_{S}$

is the aggregated efficiency units of skilled labor. This type of production function reflects complementarity between capital and skilled labor, as well as between capital and unskilled labor. The complementarity between capital and skilled labor may be higher than the complementarity between capital and unskilled labor. This feature allows the model to capture a well-documented aspect of the brain-drain literature: the departure of skilled workers can negatively impact the source country by reducing the return to capital due to the scarcity of skilled labor. Aggregate variables are computed by summing up the corresponding variables at the individual level.

Aggregated variables are computed from individual policy rules and by using the measure (size) of each worker. The measure of households of type

![]() $i$

is denoted by

$i$

is denoted by

![]() $\alpha _{i}$

and it is computed from the stationary distribution

$\alpha _{i}$

and it is computed from the stationary distribution

![]() $\mu _{i}(\Omega ),$

$\mu _{i}(\Omega ),$

![]() $\int \limits _{\Omega }d\mu _{i}(\Omega )=\alpha _{i}$

. The total measure of households is normalized to one:

$\int \limits _{\Omega }d\mu _{i}(\Omega )=\alpha _{i}$

. The total measure of households is normalized to one:

![]() $\sum \limits _{i=1}^{n+1}\alpha _{i}=1$

. Furthermore, given that the economy is inhabited by households of different sizes, the number of persons is represented by

$\sum \limits _{i=1}^{n+1}\alpha _{i}=1$

. Furthermore, given that the economy is inhabited by households of different sizes, the number of persons is represented by

![]() $N=\sum \limits _{i=1}^{n+1}\alpha _{i}N_{i}$

, where

$N=\sum \limits _{i=1}^{n+1}\alpha _{i}N_{i}$

, where

![]() $N_{i}$

represents the number of persons of type

$N_{i}$

represents the number of persons of type

![]() $i$

. The latter is computed by adding up the persons of both the stayers’ and the migrants’ households:

$i$

. The latter is computed by adding up the persons of both the stayers’ and the migrants’ households:

![]() $N_{\tau }=\int \limits _{\Omega,M=0}nd\mu _{i}(.)+\int \limits _{\Omega,M=1}(n-1)d\mu _{i}(.)$

. The aggregate stock of physical capital is obtained from

$N_{\tau }=\int \limits _{\Omega,M=0}nd\mu _{i}(.)+\int \limits _{\Omega,M=1}(n-1)d\mu _{i}(.)$

. The aggregate stock of physical capital is obtained from

![]() $K=\sum \limits _{i}\alpha _{i}\left \{\int a^{\prime }(\Omega ;\,i)d\mu _{i}\right \}$

.Footnote

16

Similarly, aggregate labor in efficiency units of each skill type

$K=\sum \limits _{i}\alpha _{i}\left \{\int a^{\prime }(\Omega ;\,i)d\mu _{i}\right \}$

.Footnote

16

Similarly, aggregate labor in efficiency units of each skill type

![]() $(H_{U},H_{S})$

is computed by aggregating the efficiency units of labor provided by each type of worker. This aggregation considers both the idiosyncratic productivity shock and the human capital stock of each worker.

$(H_{U},H_{S})$

is computed by aggregating the efficiency units of labor provided by each type of worker. This aggregation considers both the idiosyncratic productivity shock and the human capital stock of each worker.

3.2.3 The government

The government operates under a balanced budget constraint, where total expenditures (TRA) are equal to total revenues (TAX). Total revenue is derived from aggregated distortionary taxes on total income, including both labor income and savings returns. Total expenditure, on the other hand, encompasses aggregated lump-sum transfers (

![]() $\Lambda _{1}$

) and return migration transfers (

$\Lambda _{1}$

) and return migration transfers (

![]() $\Lambda _{2}$

). While the primary functions of the government involve taxes and transfers, it may also influence migration policy, remittances policy, and return migration policy. Through simulations, we can explore the impact of these policies on model outcomes.

$\Lambda _{2}$

). While the primary functions of the government involve taxes and transfers, it may also influence migration policy, remittances policy, and return migration policy. Through simulations, we can explore the impact of these policies on model outcomes.

4. The stationary competitive equilibrium

Definition 1.

A recursive competitive equilibrium consists of a set of policy rules for the household regarding consumption, savings, migration and remittances:

![]() $c\left \{ \Omega ;\,i\right \}$

;

$c\left \{ \Omega ;\,i\right \}$

;

![]() $\widetilde{c}\left \{ \Omega ;\,i\right \}$

;

$\widetilde{c}\left \{ \Omega ;\,i\right \}$

;

![]() $a^{\prime }\left \{ \Omega ;\,i\right \}$

;

$a^{\prime }\left \{ \Omega ;\,i\right \}$

;

![]() $DR\left \{ \Omega ;\,i\right \}$

;

$DR\left \{ \Omega ;\,i\right \}$

;

![]() $\textrm{Re}\left \{ \Omega ;\,i\right \}$

; a stationary probability measure of households

$\textrm{Re}\left \{ \Omega ;\,i\right \}$

; a stationary probability measure of households

![]() $[\mu _{i}]$

; aggregate factors, output and prices:

$[\mu _{i}]$

; aggregate factors, output and prices:

![]() $K,H,H_{U}, H_{S}, Y, r, w_{U,}, w_{S}, \overline{w}_{U}, \overline{w}_{S}$

; total tax revenues

$K,H,H_{U}, H_{S}, Y, r, w_{U,}, w_{S}, \overline{w}_{U}, \overline{w}_{S}$

; total tax revenues

![]() $TAX$

and total transfers

$TAX$

and total transfers

![]() $TRA$

; and household value functions,

$TRA$

; and household value functions,

![]() $V(.)$

;

$V(.)$

;

![]() $V^{1}(.)$

;

$V^{1}(.)$

;

![]() $V^{m}(.)$

, such that the following conditions hold:

$V^{m}(.)$

, such that the following conditions hold:

(i) Given

![]() $r,w_{U}, w_{S}$

, agents’ decision rules

$r,w_{U}, w_{S}$

, agents’ decision rules

![]() $\left \{ c(.);\, \widetilde{c}(.);\,a^{\prime }(.);\,DR(.);\,\textrm{Re}(.)\right \}$

solve the household problem (from 3) to (5).

$\left \{ c(.);\, \widetilde{c}(.);\,a^{\prime }(.);\,DR(.);\,\textrm{Re}(.)\right \}$

solve the household problem (from 3) to (5).

(ii) The goods market clears.

\begin{equation} F(K,H_{U},H_{S})-(1-\delta _{k})K=\sum \limits _{i=1}^{n+1}\alpha _{i}\left \{ \begin{array}{c} \int \limits _{\Omega }[\mathbf{1}_{[M=0]}nc(.)+\mathbf{1}_{[M=1]}(n-1)c(.)+a^{\prime }(.)+ \\ \mathbf{1}_{[DR=1]}\ast \Delta -\mathbf{1}_{[R=1]}\ast \textrm{Re}(.)]d\mu _{i}\end{array}\right \} \end{equation}

\begin{equation} F(K,H_{U},H_{S})-(1-\delta _{k})K=\sum \limits _{i=1}^{n+1}\alpha _{i}\left \{ \begin{array}{c} \int \limits _{\Omega }[\mathbf{1}_{[M=0]}nc(.)+\mathbf{1}_{[M=1]}(n-1)c(.)+a^{\prime }(.)+ \\ \mathbf{1}_{[DR=1]}\ast \Delta -\mathbf{1}_{[R=1]}\ast \textrm{Re}(.)]d\mu _{i}\end{array}\right \} \end{equation}

(iii) The factors market clears. Aggregate capital and aggregate labor are computed from individual decisions.

(iv) Firms maximize profits in a competitive market. Prices are defined by the following conditions.

(v) Government balances its budget: aggregate tax revenues are equal to total lump-sump transfers

(vi) Aggregate and individual years of education are consistent.Footnote 17

(vii) The law of motion of distribution is stationary.

We now turn to describing the calibration procedure.

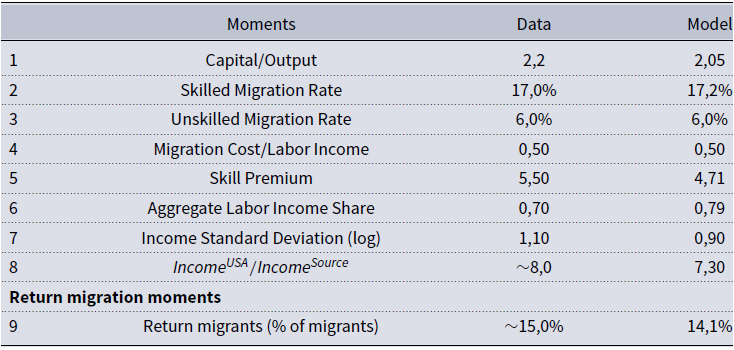

5. Calibration

We calibrate the parameters of the model to ensure that the stationary equilibrium closely mirrors key economic features of a typical small economy where migration, remittances, and brain drain are significant factors. Guatemala is economy that fulfills those requirements: First, the migration rateFootnote

18

in Guatemala is high, since around

![]() $11\%$

of the adult population lives abroad. Second, brain drain is important, since the skilled migration rate is around three times the unskilled migration rate. Finally, the yearly remittances flow in Guatemala represents around

$11\%$

of the adult population lives abroad. Second, brain drain is important, since the skilled migration rate is around three times the unskilled migration rate. Finally, the yearly remittances flow in Guatemala represents around

![]() $10\%$

of GDP during the period 2004–2009.

$10\%$

of GDP during the period 2004–2009.

We calibrate the parameters of the model following a two-step strategy. In the first step we solve the model without return migration, and in the second step we introduce return migration by using the parameters of the model with migration. The two-step procedure allows us to identify the return migration outcomes.

In the first step of our calibration strategy, the value of a group of parameters is chosen based on the fact that each of them is closely related to the value of a specific moment or target. Then, the simulated method of moments provides a systematic way to estimate the remaining parameters by matching additional moments or targets generated by the model with those observed in the data. We briefly explain our calibration strategy.

The length of time is one year. The probability of dying is chosen so that a worker spends on average 45 years working (

![]() $\phi =0,02)$

. The risk-aversion parameter is fixed at

$\phi =0,02)$

. The risk-aversion parameter is fixed at

![]() $\sigma =2,5$

, which is consistent with the common use in the neoclassical literature.

$\sigma =2,5$

, which is consistent with the common use in the neoclassical literature.

We follow a common procedure from the labor economics and migration literature and we relate skills with school attainment (Heckman et al. (Reference Heckman, Lochner and Taber1998), Docquier and Marfouk (Reference Docquier and Marfouk2005)). Workers in our model are 25 years or older and the number of skilled agents is approximated by the number of persons who finished secondary or high school education. Similarly, unskilled workers are those with, at most, a primary education. The number of workers per household is set at

![]() $n=3$

, which is consistent with the average number of working age persons per household in Guatemala.

$n=3$

, which is consistent with the average number of working age persons per household in Guatemala.

The measure of households of each type (

![]() $\alpha _{i}$

) is estimated from ENCOVI-2006.Footnote

19

Skilled workers are identified by their education level and the following rule is used to compute

$\alpha _{i}$

) is estimated from ENCOVI-2006.Footnote

19

Skilled workers are identified by their education level and the following rule is used to compute

![]() $\alpha _{\tau }$

. Type 1 is represented by those households in which the proportion of skilled workers is less than or equal to

$\alpha _{\tau }$

. Type 1 is represented by those households in which the proportion of skilled workers is less than or equal to

![]() $25\%$

(

$25\%$

(

![]() $\alpha _{1}=0,51)$

; type 2 is represented by those households in which the proportion of skilled workers is more than

$\alpha _{1}=0,51)$

; type 2 is represented by those households in which the proportion of skilled workers is more than

![]() $25\%$

but less than or equal to

$25\%$

but less than or equal to

![]() $50\%$

(

$50\%$

(

![]() $\alpha _{2}=0,04)$

; in type 3 the proportion of skilled workers is more than

$\alpha _{2}=0,04)$

; in type 3 the proportion of skilled workers is more than

![]() $50\%$

but less than or equal to

$50\%$

but less than or equal to

![]() $75\%$

(

$75\%$

(

![]() $\alpha _{3}=0,16)$

; and in type 4, the proportion of skilled workers is more than

$\alpha _{3}=0,16)$

; and in type 4, the proportion of skilled workers is more than

![]() $75\%$

$75\%$

![]() $(\alpha _{4}=0,29)$

. In the model, since each household has 3 members, household type is identified by the following rule: in household type 1 all members are unskilled, in household type 2 one member is skilled and two members are unskilled, in household type 3 two members are skilled and one member unskilled, and in household type 4 all household members are skilled.

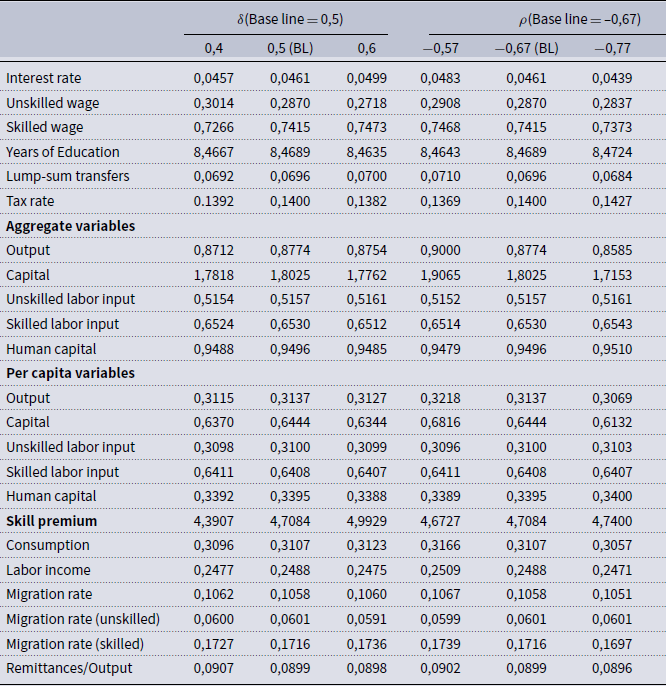

$(\alpha _{4}=0,29)$