No CrossRef data available.

Article contents

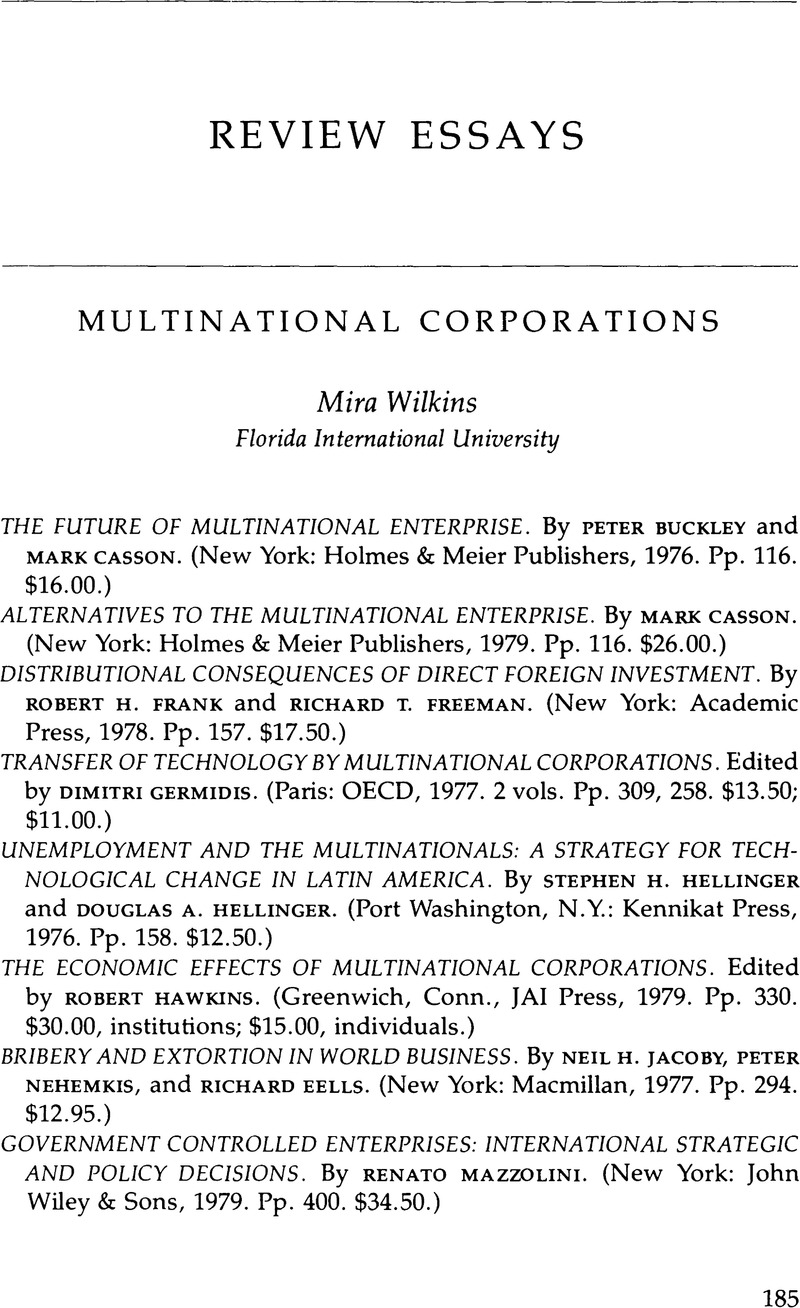

Multinational Corporations

Review products

Published online by Cambridge University Press: 24 October 2022

Abstract

- Type

- Review Essays

- Information

- Copyright

- Copyright © 1982 by the University of Texas Press

References

Notes

1. For bibliographies, I have found especially useful, although now slightly out-of-date, the United Nations, Economic and Social Council, Commission on Transnational Corporations, Research on Transnational Corporations, E/C.10/12 and E/C.10/12 Add 1 (1976). Helga Hemes, ed., Multinational Corporations: A Guide to Information Sources (Detroit, Mich.: Gale Research Co., 1977) is very selective. Oceana Publishers (Dobbs Ferry, N.Y.), which handles works on international law, has a Bibliography of Multinational Corporations and Direct Foreign Investment by Eric Brownsdorf and Scott Reimer (1979), which is advertised as containing ten thousand books and articles (1970–79). A supplement is announced for 1980. For economists, the notes in Casson's Alternatives to the Multinational Enterprise contain an up-to-date introduction to key sources on multinational corporations.

2. Louis Wolf Goodman, “Horizons for Research on International Business in Developing Nations,” LARR 15, no. 2 (1980):225–40.

3. For evidence to the contrary, see Mira Wilkins, The Emergence of Multinational Enterprise: American Business Abroad from the Colonial Era to 1914 (Cambridge, Mass.: Harvard University Press, 1970) and The Maturing of Multinational Enterprise: American Business Abroad from 1914 to 1970 (Cambridge, Mass.: Harvard University Press, 1974).

4. At least as far as the books under review are concerned. In the early 1970s, this was a major topic of discussion, and it is still talked about at professional meetings. Apparently, definitional disputes are far from dead. See, for instance, the acerbic comments of P. Hvoinik, of the USSR Academy of Sciences, in The CTC Reporter (Spring 1980), wherein he pushes authors to distinguish between the “true” transnational corporations (the “giant” enterprises) and the many other firms with operations abroad.

5. Compare, for example, Solomon's presentation with that of the even-handed summary of Everett E. Hagen, The Economics of Development, 3d ed. (Homewood, Ill.: Richard D. Irwin, 1980), pp. 91–97, 314–23.

6. Stephen Hymer's 1960 Ph.D. dissertation at M.I.T. has been published as The International Operations of National Firms (Cambridge, Mass.: M.I.T. Press, 1976). The dissertation was widely circulated and cited in the sixteen years before publication. R.E. Caves, “International Corporations,” Economica 38(1971):1–27. Charles Kindleberger, American Business Abroad (New Haven, Conn.: Yale University Press, 1969). Raymond Vernon, “International Investment and International Trade in the Product Cycle,” Quarterly Journal of Economics 80 (1966):190–207, and his Sovereignty at Bay (New York: Basic Books, 1971).

7. R.H. Coase, “The Nature of the Firm,” Economica, N.S. 4 (1937):386–405.

8. Robert Z. Aliber, “A Theory of Direct Foreign Investment,” in Charles Kindleberger, ed., The International Corporation (Cambridge, Mass.: M.I.T. Press, 1970), p. 20. See also, Wilkins, The Maturing, p. 565, n. 9. Oliver Williamson's Corporation Control and Business Behavior (Englewood Cliffs, N.J.: Prentice Hall) appeared in 1970 and in some ways sets the stage for this approach.

9. Based on figures in Wilkins, The Emergence, p. 110. In Britain, in 1901, contemporaries thought U.S. direct investment was substantial (p. 215).

10. For a good summary introduction to the dependency literature, see Peter Evans, Dependent Development: The Alliance of Multinational, State, and Local Capital in Brazil (Princeton, N.J.: Princeton University Press, 1979).

11. Reprinted in Hans Singer, International Development (New York: McGraw-Hill, 1964), pp. 161–72.

12. John Fayerweather, International Business Management (New York: McGraw Hill, 1969). Mazzolini also relies heavily on Yair Aharoni, The Foreign Investment Decision Process (Boston, Mass.: Graduate School of Business Administration, Harvard University, 1966).

13. See Buckley and Casson, The Future of Multinational Enterprise, pp. 37–38, for an explanation of how discriminatory transfer pricing based on a derived demand curve for an intermediate product would maintain the average price of the factor, remove the incentive to substitute against it, and increase the profits of the seller of the product without reducing those of the buying unit.

14. Ibid. Also, the “transfer price” issue has implications far beyond the topic of technology transfer. A sizable proportion of world trade now involves transactions between units within a MNC. I have not seen in the general literature any systematic analysis of the overall effects on international prices of these intracompany transactions.

15. There are a number of research projects now in process on government-owned companies, the most important of which is headed by Raymond Vernon at Harvard University.