Introduction

In 2015, the United States (US) Democratic Party decided to make a campaign for a significant increase in the federal minimum wage part of their national party platform. Previously, president Barack Obama had issued an executive order in 2014 to raise the minimum wage for federal government contractors and repeatedly called for a general minimum wage increase. By the end of 2015, raising the minimum wage had become one of the top issues for the American centre-left. Ten years earlier, the German social-democratic government under Chancellor Gerhard Schröder had implemented labour market reforms known as the Hartz reforms, some of which enabled workers to hold jobs at wages below the standards of previous collective agreements, which are normally a pillar of the German coordinated labour market (Kemmerling and Bruttel Reference Kemmerling and Bruttel2006, 98). While one left-of-centre government party decided to make increases in minimum wage stringency a top priority, the other engaged in an effective partial deregulation of the national wage floor. The positions of left-wing parties also change within countries over time, however, as became evident in Germany where, several years after having implemented the Hartz reforms, the German Social Democratic Party also made the introduction of a national minimum wage its top political priority, which became implemented when it joined a government coalition after the 2013 election (Meyer Reference Meyer2016, 30–31). This article theoretically and empirically investigates the reasons why we see such divergent patterns in the role of left-wing parties regarding labour market regulation, even within countries.

Labour market regulation, defined here as the formal, nonfiscal regulation of national labour markets, including hiring and firing regulations, the nature and stringency of minimum wage regulation, the formal support for collective bargaining systems and related policies, is both a timely and hotly debated topic both in both academic and policy circles. An oft-made argument is that high levels of labour market regulation have adverse effects on employment (Botero et al. Reference Botero, Djankov, La Porta, Lopez-De-Silanes and Shleifer2004; Feldmann Reference Feldmann2009) and economic growth (Djankov et al. Reference Djankov, McLiesh and Ramalho2006)Footnote 1 and could increase informal sector size (Schneider Reference Schneider2010). Differences in labour regulation have been singled out as a key explanation for the very different economic and employment experiences of the US and continental Europe in recent decades, where there has been extensive scholarly and policy debate in this area (Siebert Reference Siebert1997; Nickell and Layard Reference Nickell and Layard1999), a discussion and research agenda which is continuing (Dew-Becker and Gordon Reference Dew-Becker and Gordon2008).

Several Organisation for Economic Co-Operation and Development (OECD) countries have enacted labour market reforms in recent decades. After the financial crisis and subsequent European debt crises, labour market reforms have been singled out as one of the pillars of structural reforms, especially in Southern Europe. However, significant differences still exist between advanced economies with regards to labour market regulation and reform tendencies. Some countries have experienced a shift towards more deregulated labour markets, others display general inertia regarding labour market regulation, while others yet experience tandems in labour market deregulation, with deregulation followed by increased labour market regulation.

This article concerns the effects of partisanship on labour market regulation. It argues that some of the variation and patterns of change in labour regulation among and between developed democracies can be explained by the different stances of incumbent left-wing governments. In line with recent scholarship on partisanship and differences in public policies (Häusermann et al. Reference Häusermann, Picot and Geering2013), the argument is that the policy stance of left-wing governments is contingent on moderating factors. In this case, the actions of left-wing governments regarding labour market regulation are a function of government budgetary constraints, in the form of high government debt, and market income distribution.

The line of argument is that labour market regulation can serve redistributive functions. Governments can hold partisan preferences, and a left-wing government is interested in serving the interests of below-average-income citizens. Increased market inequality reduces the relative market income of below-average citizens while increasing the demands for redistribution from these citizens to whom left-wing government parties should be responsive. However, if the government is under high levels of perceived budgetary constraint as in the case of high government debt, increased fiscal redistribution is both financially and politically less viable for an incumbent left-wing government. Under such circumstances, redistribution through increased labour market regulation becomes an attractive option. Consequently, when an incumbent left-wing government is faced with an increase in market inequality but also faces high levels of government debt, the left-wing government will increase labour regulation.

The empirical part of this article investigates this theoretical argument using panel analyses of general labour market regulation in 33 OECD countries. The findings strongly support the theoretical argument. Increased market inequality causes left-wing governments to increase labour market regulation, but only when government debt levels are high.

The rest of the article is structured as follows. The next section establishes the theoretical argument for the joint effect of government partisanship, inequality and government debt on labour market regulation. The data and estimation method used to test the theoretical prediction are then described. The following section describes the results from the test of the theoretical prediction. The final section discusses the results.

Theory

The basic theoretical argument for why we should experience different approaches to labour market regulation under left-wing governments contingent on inequality and government debt levels is that higher market inequality, which widens the gap between the citizens with the average income and those with below average income, increases the relative value of government spending for below-average-income citizens in line with classical models of redistributive politics (Meltzer and Richard Reference Meltzer and Richard1981). In accordance with a partisan preferences’ approach to politics, left-wing governments should be relatively more responsive to the preferences of the below-average-income citizen than non-left-wing governments. Consequently, it will adjust its policy profile in the area of public spending to changes in inequality, while a non-left-wing government will not. The notion that left-wing and non-left-wing parties react differently to increased inequality is in line with previous empirical findings (Pontusson and Rueda Reference Pontusson and Rueda2010; Tavits and Potter Reference Tavits and Potter2015) and general assumptions in the partisan politics literature (Hibbs Reference Hibbs1977; Iversen and Soskice Reference Iversen and Soskice2006).

A left-wing government facing higher market inequality should then attempt to increase fiscal transfers to the below-average-income citizens. High government debt levels, however, constrain the ability of the government to redistribute more fiscal transfers to below-average-income citizens due to the need to meet interest payment obligations and the need to appear fiscally responsible, which it is assumed is also a concern of any incumbent government, including left-wing governments.Footnote 2 This need to appear fiscally responsible also inhibits the use of increased tax revenue to finance increased public transfers, as increased tax revenue is more likely to go towards bringing down government debt in line with findings suggesting that left-wing governments do indeed use increased tax revenue to balance the public budget during times of fiscal consolidation (Tavares Reference Tavares2004).

Instead, labour market regulation can be used as a distributive tool instead of explicit transfer payments. Labour regulation can reduce the effect of inequality on below-average-income citizen market income, since labour regulation can secure a higher income share from average productivity for the below average income citizens through employment protection, minimum wage laws, capping how many hours can be legally worked a week and other types of labour regulation. Note that labour regulation will not necessarily benefit the very poor in many cases, including those permanently and temporarily outside the labour market. However, the key assumption here is that a left-wing government is attentive towards the welfare of the below-average-income citizens, which is not necessarily the very poor but in many cases citizens with about the median income. Consequently, the left-wing government’s choice between representing the interests of labour market outsiders and labour market insiders (Lindvall and Rueda Reference Lindvall and Rueda2014) is not an issue for this theoretical argument.

Increased labour market regulation has the adverse effect of reducing average income, as labour regulation lowers average productivity potential in line with some empirical findings (Besley and Burgess Reference Besley and Burgess2004, 93–94), which is why it will be less preferred as a tool to redistribute to the below-average-income citizens than pure fiscal transfers. This issue becomes less of a concern for a left-wing government under high levels of market inequality, however, as greater inequality will mean that productivity gains are disproportionally captured by the citizens with the highest incomes. Under high levels of inequality, a left-wing government should then be more willing to sacrifice average economic efficiency to achieve higher welfare for the below-average-income citizens, which will not be the case if income inequality is low and the productivity loss by higher regulation is therefore also felt by the below-average-income citizens.

Summing up, the above line of argument implies that when a left-wing government faces high debt levels and increased levels of market inequality, it will increase – or at least not decrease – labour market regulation due to redistributive concerns for the below-average-income citizen.

This article is not the first to theorise and test the political determinants of labour market regulation. Several pieces of research in political science and political economy have attempted to assess the causes of the differences in the labour market regulation of advanced economics.Footnote 3 Recent scholarship includes Becher (Reference Becher2010), Potrafke (Reference Potrafke2010) and Avdagic (Reference Avdagic2013). However, much of the literature on the determinants of labour market policies is concerned with welfare state aspects of the labour market (e.g. unemployment benefits) rather than pure labour market regulation. Another strain of this literature is concerned with how and whether labour market reforms differently affect labour market insiders who hold steady, often well-protected jobs versus labour market outsiders who are more loosely connected to the formal labour market, and why countries differ in their adoption of reforms related to this area (Davidson and Emmenegger Reference Davidson and Emmenegger2013). Since both labour market insiders and outsiders are potentially important left-wing party constituencies, the role of left-wing parties has been an important part of this research agenda.Footnote 4 However, none of the studies above takes the issue of government fiscal constraint into closer consideration, when assessing whether and how left-wing parties influence labour market regulation.

The article’s theoretical argument also bears some resemblance to part of the political economy literature, which also investigates the tradeoff between labour market regulation and explicit public transfers as tools of social protection (Di Giacchino and Sabani Reference Di Giacchino and Sabani2009; Boeri et al. Reference Boeri, Conde-Ruiz and Galasso2012; Di Giacchino et al. Reference Di Giacchino, Sabani and Tedeschi2014). However, these authors do not provide a more systematic test of the implications of their theoretical argument at the macro-level, whereas this article specifically argues and tests under which conditions policymakers prefer labour market regulation to fiscal transfers. Another related and widely cited theoretical paper on why policymakers sometimes choose to distribute via distortionary policies is Acemoglu and Robinson (Reference Acemoglu and Robinson2001), who model the choice of redistributive tools as a question of special interest politics rather than partisanship.Footnote 5 The next section describes the data used to test the argument that a left-wing government faced with high debt levels and an increased levels of market inequality will increase labour market regulation.

Data and estimation

This section contains description of the data and estimation method used to test. The data set consists of an unbalanced panel of 33 OECD countries observed in the years 1985, 1990, 1995 and 2000–2012, where data on labour market regulation is available. Countries that are not OECD members at the start of the panel enter the data set when they become OECD members. The next subsection describes the data and variables in greater detail.

Measuring labour market regulation

As labour market regulation is the dependent variable of interest, how to quantitatively measure the extent of labour market regulation/deregulation becomes a crucial question. Various international organisations, including the OECD, publish quantitative assessments of the level of labour market regulation, but the OECD’s regularly updated data focusses primarily on employment protection levels. However, labour market regulation is arguably a broader concept than merely employment protection. In a study of labour market deregulation and globalisation in OECD countries, Potrafke (Reference Potrafke2010) uses an OECD data set for labour market regulation covering the years 1982–2003. However, this OECD data for labour market regulation also includes factors such as unemployment benefits’ replacements rates and benefits duration, which are related more to fiscal redistribution than to pure regulation. As this article argues that fiscal redistribution and labour market regulation are related but separate factors, the measure of labour market regulation must exclude public transfers and other types of more direct fiscal redistribution.

To capture the broadest potential aspects of labour market regulation while maintaining the focus on nonfiscal sources of labour market regulation in line with the theoretical model, I use an index of labour market regulation that is a component in the Economic Freedom IndexFootnote 6 published for the years 1985, 1990, 1995 and 2000 and onwards by the Fraser Institute, a Canadian think tank. The index measuring labour market regulation ranges in values from 0 to 10, lower values denoting higher levels of labour market regulation. I rescale the index in order to make higher values denote higher levels of labour market regulation. The labour market regulation score is based on country scores on six indicators relating to labour market regulation:

∙ Hiring regulation and the existence and stringency of a minimum wage.

∙ Hiring and firing regulations.

∙ Centralised collective bargaining.

∙ Hours regulation.

∙ Mandated cost of worker’s dismissal.

∙ The existence and length of conscription.

Data for these indicators come from a variety of sources including the World Bank, World Economic Forum and various other sources (Gwartney et al. Reference Gwartney, Lawson and Hall2015, 212–214). The labour market regulation index from the Economic Freedom Index has been used in other cross-national research on the effect of labour market regulation (Feldmann Reference Feldmann2009; Freeman Reference Freeman2009, 31).

Explanatory variables

The key explanatory variable is an interaction between three variables: left-wing control of government, market inequality and government debt. In line with the theoretical prediction, the interaction enables me to observe a potential effect of left-wing partisanship on labour market regulation contingent on inequality and government debt level. Left-wing government is measured by a dummy taking the value 1 if the leader of the government is from a left-wing party based on the Database of Political Institutions (Beck et al. Reference Beck, Clarke, Groff, Keefer and Walsh2001). Market inequality is measured using the well-known Gini coefficient, and the data are taken from the Standardized World Income Inequality Database (Solt Reference Solt2009). When measuring market inequality, the Gini coefficient for income is calculated before government taxes are subtracted from the income of each household and before potential government transfers are added to each household’s income. Market inequality thus measures the level of inequality before government redistribution impacts the overall income distribution. This is different from the net inequality measure, where the Gini coefficient is measured using each household’s final income after government taxes and transfers. Using market inequality rather than net inequality enables the measurement of the effect of market-based pressure for redistribution in line with the theoretical argument rather than observing potential changes in redistribution, which could be an issue with using the net inequality measure. Finally, government debt is measured in terms of the gross government debt taken from the International Monetary Fund’s (IMF’s) World Economic Outlook Database.

Control variables

To control for the potential confounders of government debt, inequality and potentially also government ideology, I employ a number of economic controls. The first control is the log of gross domestic product (GDP) per capita to control for level of economic development, which is potentially endogenous to labour market regulation (Botero et al. Reference Botero, Djankov, La Porta, Lopez-De-Silanes and Shleifer2004, 1366). The second control variable is growth of GDP, which could potentially affect both government debt and inequality and be endogenous to labour market regulation. Both GDP per capita and GDP growth are from the World Bank Database. The final control is the unemployment rate, which is also potentially endogenous to labour market regulation. The relationship between labour regulation and unemployment and whether stricter labour market regulation increases structural unemployment remain huge topics in the labour and comparative economics literature (Siebert Reference Siebert1997; Botero et al. Reference Botero, Djankov, La Porta, Lopez-De-Silanes and Shleifer2004; Freeman Reference Freeman2009). Furthermore, for the purpose of this article, it would be reasonable to expect that unemployment levels would affect a government’s propensity to increase or decrease labour market regulation. While high unemployment could induce a government to introduce labour market reforms in order to try to lower structural unemployment, relaxing employment protection in the face of high unemployment could be deemed politically unpopular by the government. The unemployment rate variable is taken from the IMF World Economic Outlook Database.

As a final political control, I use the distance between political veto actors to control for the potential policy-stability-inducing effect of disagreement between several decisionmakers.Footnote 7 Several studies have found veto actor dynamics to matter for labour market reforms (Becher Reference Becher2010; Avdagic Reference Avdagic2013) and other types of economic deregulation (Smith and Urpelainen Reference Smith and Urpelainen2016). It might thus be argued that the composition of government, both regarding the number and ideology of potential coalition parties, could labour market regulation levels. I follow Avdagic (Reference Avdagic2013, 440) and use the checks Footnote 8 variable from the Database of Political Institutions (Beck et al. Reference Beck, Clarke, Groff, Keefer and Walsh2001) as a proxy for the number of and ideological distance between government veto actors. As a final control, I add a dummy for whether the country is currently under an IMF programme. IMF programmes frequently come with reform conditions,Footnote 9 which often concern labour market deregulation. Furthermore, the occurrence of an IMF programme is probably endogenous to the level of government debt.Footnote 10 Descriptive statistics for all of the variables can be seen in Table 1.

Table 1 Descriptive statistics

Note: GDP=gross domestic product; IMF=International Monetary Fund.

Estimation

To estimate the effect of left-wing government control contingency on inequality and government debt, I conduct a series of fixed-effect ordinary least squares regressions with the labour market regulation index as the dependent variable. Fixed effects estimations allow me to analyse deviations from the country average and thus within-country variation in labour market regulation. They also enable me to hold the historical legacyFootnote 11 and deeper cultural aspects (Alesina et al. Reference Alesina, Algan, Cahuc and Giuliano2015) of the different countries constant, which might also affect the level of labour market regulation. In order to address issues of autocorrelation, standard errors are clustered at the country level. The regression equation can be seen in Equation 1:

Regulation is the level of labour market regulation in country i at time t. The first item on the right side is the interaction between left-wing partisanship, market inequality and government gross debt. C is the constituting items of the three-variable interaction, while V is a vector of controls.

![]() $\varphi _{i} $

is the country-fixed effect, while γ

t

is the year-fixed effect, which are included to control for a potential time trend in labour market regulation in the analysed countries. ε is the error term.

$\varphi _{i} $

is the country-fixed effect, while γ

t

is the year-fixed effect, which are included to control for a potential time trend in labour market regulation in the analysed countries. ε is the error term.

When estimating the above regression, all of the explanatory variables are measured in the same year as the dependent variable. However, concerns might be raised about the timing of changes in the explanatory variables and their subsequent effect on labour market regulation. In order to address this issue in Appendix A,Footnote 12 the core results are redone lagging all explanatory variables one year. However, these results are mostly similar to those of the main analysis.

Results

The results from the panel analyses can be seen in Table 2. In the first two columns, the potential effect of partisanship contingent on either government debt and inequality is investigated but without the three-variable interaction. The results from this initial investigation suggest that higher government debt is associated with higher levels of labour market regulation in line with other findings, which have also suggested a correlation between government debt and regulation (Berggren and Bjørnskov Reference Berggren and Bjørnskov2017). This effect is not magnified by left-wing government partisanship as the interaction between debt and left-wing government is actually negative and statistically insignificant. In Column 2, the left-wing government dummy is interacted with market inequality and neither this interaction nor its constituting terms seem to have any statistically significant effect on labour market regulation. Left-wing governments do not seem to increase labour market regulation significantly more than other types of government when debt increases or inequality is higher. However, following the line of argument from the theoretical section, we ought to expect neither higher debt nor higher inequality to increase labour market regulation under a left-wing government independent of each other.

Table 2 Results

Notes: Dependent variable is labour market regulation. Standard errors clustered by country in parentheses.

GDP=gross domestic product; IMF=International Monetary Fund.

*, **, ***Significance level 0.10, 0.05, 0.01, respectively.

Turning to the test of the central argument of this article – that left-wing governments facing both high debt and higher inequality will increase labour market regulation – in Column 3, the index of labour market regulation is regressed on the interaction between left-wing government, market inequality and government debt. For the single variables in this interaction, both left-wing government and government debt have statistically significantly positive coefficients, whereas inequality in itself is not statistically significant. The interaction between left-wing government and government debt has a negative coefficient. Apparently, when not faced with the redistributive pressure from increased market inequality, left-wing governments do not react to increased levels of government debt by increasing labour market regulation, which is in line with the key theoretical argument that it is the redistributive concerns arising from changes in market income inequality which drive left-wing governments’ labour market regulation policies under the constraint imposed by high government debt. The interaction between left-wing government and inequality and between inequality and government debt are also negative but only the latter is statistically significant. The latter coefficient suggests that, under non-left governments, increased market inequality actually reduces the effect of government debt on labour market regulation. Looking at the key variable of interest, the three-variable interaction between left-wing government, government debt and inequality has the expected positive sign with an effect that is statistically significant at p>0.05. Interpreting the coefficients of these different variables together, they seem to provide evidence in favour of the theoretical argument. In the case of a coincidence between a left-wing government, higher inequality and a high level of government debt, the level of labour market regulation increases. The theoretical argument of this article thus seems strengthened by the initial finding.

In order to test the sensitivity of the initial findings in Columns 4–8, I add the control variables one by one. In Column 4, the log of GDP is added to the specification, which has, in discordance with the theoretical expectation, a negative but not statistically significant effect. In the fifth column, I add the GDP growth variable, which does not seem to affect labour market regulation statistically significantly. Column 6 adds the control for the level of unemployment. Unemployment seems to have a nontrivial and statistically significant positive effect on the labour regulation index, indicating that an incumbent government would be less inclined to deregulate labour markets in the case of high unemployment and might even expand regulation in this area.

Veto actor distance is added in the seventh column as an additional political control variable. It does not seem to be a statistically significant predictor of labour market regulation. Finally, I add the dummy for IMF involvement in Column 8. While this variable has the expected negative sign, it is not statistically significant at conventional levels. The inclusion of these various control variables does not fundamentally change the size effect or the statistical significance of the interaction between left-wing government, inequality and government debt. The theoretical argument – that dynamics of debt, inequality and government partisanship shape labour market regulation – seems further strengthened. In all of the estimations, the sizes of the within-country R 2 are relatively high, which suggests that the model explains a large proportion of the within-country variation in labour market regulation.Footnote 13

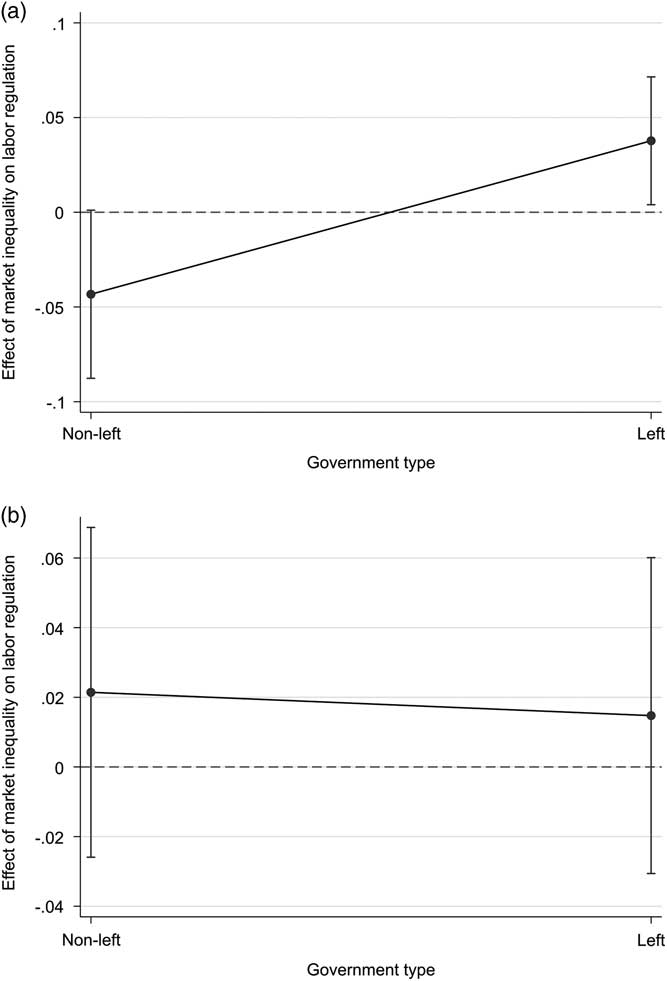

The relationship between left-wing government control, inequality and debt is visualised in Figure 1, which is based on the estimate in Column 3 of Table 2 and shows the marginal effect of market inequality contingent on government type at different levels of government debt. As evident from Figure 1a, when government debt is high, which is defined as government debt above 60% of GDP,Footnote 14 increased inequality under left-wing government partisanship causes an increase in the level of labour market regulation. Under low levels of government debt (Figure 1b), there is no statistically significant effect of inequality on labour market regulation under a left-wing government and no difference between left-wing and non-left-wing governments.

Figure 1 Effect of inequality on labour market regulation contingent on partisanship and government debt: (a) high debt level and (b) low debt level. Note: High debt level is defined as general government debt exceeding 60% of gross domestic product. Vertical lines show 90% confidence intervals.

The effect size is not large but not negligible either. In the case of a government debt level of 60% of GDP (about panel average) and a left-wing incumbent government, an increase in market inequality from the lowest observation in the panel to the panel mean increases labour market regulation with one-third standard deviation. While under lower levels of government debt and under non-left-wing governments, rising market inequality has either no or no positive effect on labour market regulation. In line with the theoretical argument, when high debt levels inhibit the expansion of fiscal redistribution, left-wing governments use labour market regulation to cushion the effect of increased inequality.

Robustness tests

The above results suggest substantial evidence in favour of the argument that left-wing government control, high government debt and increased inequality might jointly increase labour market regulation. However, as always with observational studies one should be wary of an overconfident causal interpretation of the above results. Especially, left-wing government control, government debt and inequality might be endogenous to factors also related to labour market regulation but not previously controlled for. Imprecisely measured variables and potential outliers might also weaken the validity and generalisability of the results. In order to address these issues and to test the robustness of the above finding and the general validity of the theoretical argument, in this section I conduct a number of robustness tests concerning both the measurement of the key dependent variable, potentially omitted variables and the issues of outliers.Footnote 15

First, I address the issue of the measurement of the dependent variable. Concerns might be raised that several of the indicators of the aggregate labour regulation index from the Economic Freedom Index are not well suited or targetable as redistributive tools. To address this concern, I redo the full analysis from Table 2 in Table 3, Column 1, but replace the full labour regulation index with an index, which is the average score of four of the six labour regulation index indicators (hiring regulation and the existence and stringency of a minimum wage, hiring and firing regulation, hours regulation and the mandated cost of worker’s dismissal). These are all items that can be more directly influenced by an incumbent government and clearly hold distributional properties. Replacing the full index with this limited labour market regulation index yields the same results as the main analysis, which provides evidence in favour of the main theoretical argument about how an incumbent left-wing government might use labour regulation as a distributive tool under high debt and inequality.

Table 3 Robustness tests

Notes: Dependent variable is labour market regulation except in Column 1. Standard errors clustered by country in parentheses.

GDP=gross domestic product; IMF=International Monetary Fund.

*, **, ***Significance level 0.10, 0.05, 0.01, respectively.

I then turn to address the issues of potentially omitted variables from the main analysis. First, since previous research suggests that the influence of trade unions might significantly affect the nature and propensity of labour market reforms,Footnote 16 I control for the potential organisational power of national unions by including a measure of union density from the Comparative Political Dataset (Armingeon et al. Reference Armingeon, Isler, Knöpfel, Weisstanner and Engler2015) as an additional control. However, the introduction of this variable in Column 2 of Table 3 does not change the size effect and statistical significance of the key interaction between left-wing government control, inequality and government debt. Furthermore, the union density variable itself is statistically insignificant.

I then address the issue of government revenue. As noted in the theoretical section, even if a left-wing government is able to raise further public revenue (e.g. through increased taxation), in times of high debt the government will put this extra revenue towards consolidating public finances. When also faced with increased inequality, a left-wing government will use labour market regulation as an alternative redistributive tool rather than putting the extra tax revenue towards additional public transfers. However, this argument has only rested on one assumption thus far. So in order to hold the aspect of public revenue constant in Column 3 of Table 3, I add a control of public revenue as a percentage of GDP from the IMF’s World Economic Outlook Database. However, adding this control does not change the size effect or statistical significance level of the key interaction variable in any significant way.

I then address the issue of the postfinancial crisis years. As noted in the introduction, the labour market reform issue became particularly salient in many European countries in the aftermath of economic and fiscal crisis following the global financial crisis of 2008, and the experiences of many countries during this period might be driving many of the previous results. In order to account for this in Column 4 of Table 3, I add a dummy that takes the value 1 in the years after 2008. While this dummy seems to have a substantial and statistically very significantly negative effect on labour market regulation, it does not seem to change the core results.

Additionally, I address the issue of potential outliers. There is massive variation among the countries included in the study with regards to their levels of government debt and especially changes in this variable over the analysed period. One concern might be that extreme values on the debt variable are driving the above results. In order to address this issue in Column 5 of Table 3, I exclude all observations with debt to GDP above 120, which is approximately 2 standard deviations over the panel mean. However, this sample restriction does not change the size or statistical significance of the key three-variable interaction between left-wing government, inequality and government debt. Finally, to alleviate concerns that the results could be driven by very country-specific experiences, I redo the main estimation removing one country at the time from the analysis. Even with these sample restrictions, the main results stay robust.Footnote 17

The above results would appear to provide robust evidence in favour of the article’s theoretical argument. However, an additional concern might be raised that the relevant factor for the debt-contingent effect of government partisanship on labour market regulation might not be inequality but rather unemployment, as earlier evidence from the partisan politics literature suggests that left-wing governments respond with looser fiscal policy under higher levels of unemployment than other types of government (Cusack Reference Cusack1999). Taking this perspective, high government debt might also inhibit further fiscal stimulus and make higher levels of labour market regulation attractive for an incumbent left-wing government. Thus, the market inequality effect might merely be a proxy for the effect of high unemployment levels. To explore whether this might be the case, in Table 4, I conduct a proxy test adding to the estimate in Table 2, Column 8 an interaction between unemployment, government debt and left-wing government to test whether the apparent debt and partisan contingent effect of inequality is just reflecting a debt and partisan contingent effect of unemployment on labour market regulation.

Table 4 Proxy test: unemployment

Notes: Dependent variable is labour market regulation. Standard errors clustered by country in parentheses.

GDP=gross domestic product; IMF=International Monetary Fund.

*, ** Significance level 0.10, 0.05, 0.01, respectively.

The results do not suggest any statistically significant effect of the interaction between left-wing partisanship, high government debt and high unemployment, since this three-variable interaction is not statistically significant despite having the expected positive sign. The three-variable interaction between left-wing government, government debt and market inequality retains its size effect and statistical significance level from Table 2. The results lend further support to the theoretical model and the argument that the joint effect of left-wing government, government debt and market inequality can explain changes in national labour market regulation.

Discussion

The extent of labour market regulation continues to be a top policy question in many countries but the causes of variance in labour market regulation both within and between countries remain open to inquiry. This article has argued that some of the variation in labour market regulation can be explained by the role of left-wing parties in labour market regulation. Labour market regulation can reduce economic efficiency but also serves as a redistributive tool. Thus, when left-wing governments are faced with increased demand for redistribution due to higher market inequality but simultaneously faced with budget constraints due to high levels of government indebtedness, they will use increased labour regulation as redistribution.

Panel data for 33 OECD countries shows strong support for the theoretical argument. Labour market regulation is unaffected by market inequality when government debt is low but left-wing governments seem to increase labour market regulation under rising inequality if government debt is high.

The findings in this article provide a potential explanation for often-lagging labour market reforms in times of high government indebtedness, which often follow financial and other economic crisesFootnote 18 (Reinhart and Rogoff Reference Reinhart and Rogoff2011). Given that fiscal consolidations carried out in the context of less regulated labour markets could be less economically costly (Alesina and Ardagna Reference Alesina and Ardagna2013, 9), the results of this article suggest that countries facing high government debt levels, extensive labour market regulation and increases in income inequality could be caught in a vicious reform sclerosis equilibrium under left-wing governments; a situation where the left-wing government is being forced to embark on fiscal austerity due to high indebtedness but is unable to introduce economic reforms, which might cushion the effect of austerity policies since labour market policies the only way a left-wing government can redistribute to its core constituency.Footnote 19

The article also contributes to the broader discussion regarding the relationship between partisan politics and inequality (Boix Reference Boix2010, 493) and is of relevance for the discussion of the effect of inequality on economic growth (Banerjee and Duflo Reference Banerjee and Duflo2003). It especially provides a micro-founded explanation for the results from studies that have found an effect of inequality on economic performance contingent on government partisanship (Bjørnskov Reference Bjørnskov2008).

The area of labour market regulation seems to be one policy area where different combinations of partisan orientation and economic factors can produce various different policy outcomes. Future research could explore the extent to which this also goes for other areas of government public policies. The article’s main theoretical argument that tinkering with regulation levels becomes an attractive area for partisan politics when the government faces budget constraints might thus have wider implications. For an example, we might expect right-wing governments to use deregulation within certain policy areas (e.g. environmental protection and labour standards) to redistribute to their core constituency, such as private businesses and entrepreneurs, when the state of government finances makes tax cuts and tax deductions to these interests less possible.Footnote 20 Future research might thus investigate how partisanship and conditional economic and institutional factors impact the nature of public regulation between and within countries beyond labour market policies.

Acknowledgements

The author would like to thank Mathias Heinze Pedersen, Brett Meyer and seminar participants at Hertie School of Governance as well as the editor and three anonymous reviewers for help, suggestions and advice. All errors remain the authors own.