The top personal income tax (PIT) rate is a visible element of the modern tax/welfare state and a good indicator of tax system progressivity (Scheve and Stasavage Reference Scheve and Stasavage2016). The top income tax bracket not only raises tax revenues itself, but also indirectly affects the revenue-raising capacity of lower tax brackets by setting their maximum rates. Furthermore, the top rate is a useful instrument for limiting wealth accumulation by high-income earners (Piketty Reference Piketty2014). As inequality is a prominent academic research topic and talk of taxing the rich is increasingly common (Limberg Reference Limberg2019), a relevant question is how much freedom national governments have in setting their desired top rates. The existing evidence is ambiguous.

On the one hand, scholars have argued that income taxation is constrained by globalisation. Economic openness forces countries to compete for mobile tax bases in a ‘race to the bottom’, especially in corporate income tax (CIT) rates (e.g. Tanzi Reference Tanzi1995; Sinn Reference Sinn2003; Genschel and Schwarz Reference Genschel and Schwarz2011). The CIT acts as a ‘backstop’ of the PIT, preventing high-income earners from avoiding taxes through incorporation (Gordon and MacKie-Mason Reference Gordon, MacKie-Mason, Feldstein, Hines and Hubbard1995). CIT reductions erode this backstop function, and they may spill over to PIT rates, as governments may prefer to limit the differential between both rates in order to preserve tax system integrity (Ganghof Reference Ganghof2006).

On the other hand, there should be several domestic drivers of the top PIT rate, such as partisan politics and budgetary pressure. Additionally, increases in top rates in the aftermath of the 2008 financial crisis have been linked to fairness considerations among electorates (Limberg 2019; Reference Limberg2020). Moreover, the erosion of the CIT’s backstop function, as described above, may have been mitigated by a recent increase in shareholder-level dividend tax rates, facilitated by the successful combat of illegal capital flight (Ahrens et al. Reference Ahrens, Bothner, Hakelberg and Rixen2020).

The purpose of this article is to investigate the relative importance of these and other drivers of top PIT rate setting in the long run (1981–2018). To this end, I study tax reforms implemented by 226 cabinets in 19 OECD countries using linear regressions.Footnote 1

This article makes several contributions to the existing literature. First, it re-stresses the importance of statutory CIT rates in backstopping top PIT rates. Convincing evidence of this relation follows from Ganghof’s (Reference Ganghof2006) case studies of seven countries’ tax reforms between the 1980s and early 2000s. The present study makes a substantial contribution by including a larger number of countries and by extending the period of analysis further into the twenty-first century, covering the recent decline of CIT rates to a record low.

It also makes a methodological contribution by quantifying the effect of the CIT in the long run. This overcomes a pitfall of qualitative policy analysis, namely the difficulty in discerning the primary driving factors behind tax reforms, especially when government statements list multiple reasons for a reform’s implementation. Additionally, a regression approach allows me to quantify cross-country variation in potentially relevant institutional factors, such as redistribution preferences and labour market corporatism.

This paper also contributes to a broader literature on the political economy of tax systems. First, its integrated review of the determinants of top rate setting is of added value, because most of those factors have been tested only as determinants of average labour tax rates, labour/capital tax ratios, or electoral redistribution preferences. Second, many existing studies fail to control for CIT rate setting. This paper, instead, puts the recent, crisis-related PIT increases in a long-term perspective, arguing that governments will have little room to manoeuvre in their top rate setting when CIT rates keep falling towards the recently set minimum level of 15%.

I proceed as follows. After reporting the trends in OECD countries’ top rates during the last decades, I discuss the potential determinants of top rate setting, starting with domestic factors, then moving to transnational policy diffusion, and finally addressing the relation between the CIT and PIT. Next, I describe my dataset and empirical strategy, and I discuss the results, followed by several robustness checks. The final section concludes.

Top rates over time

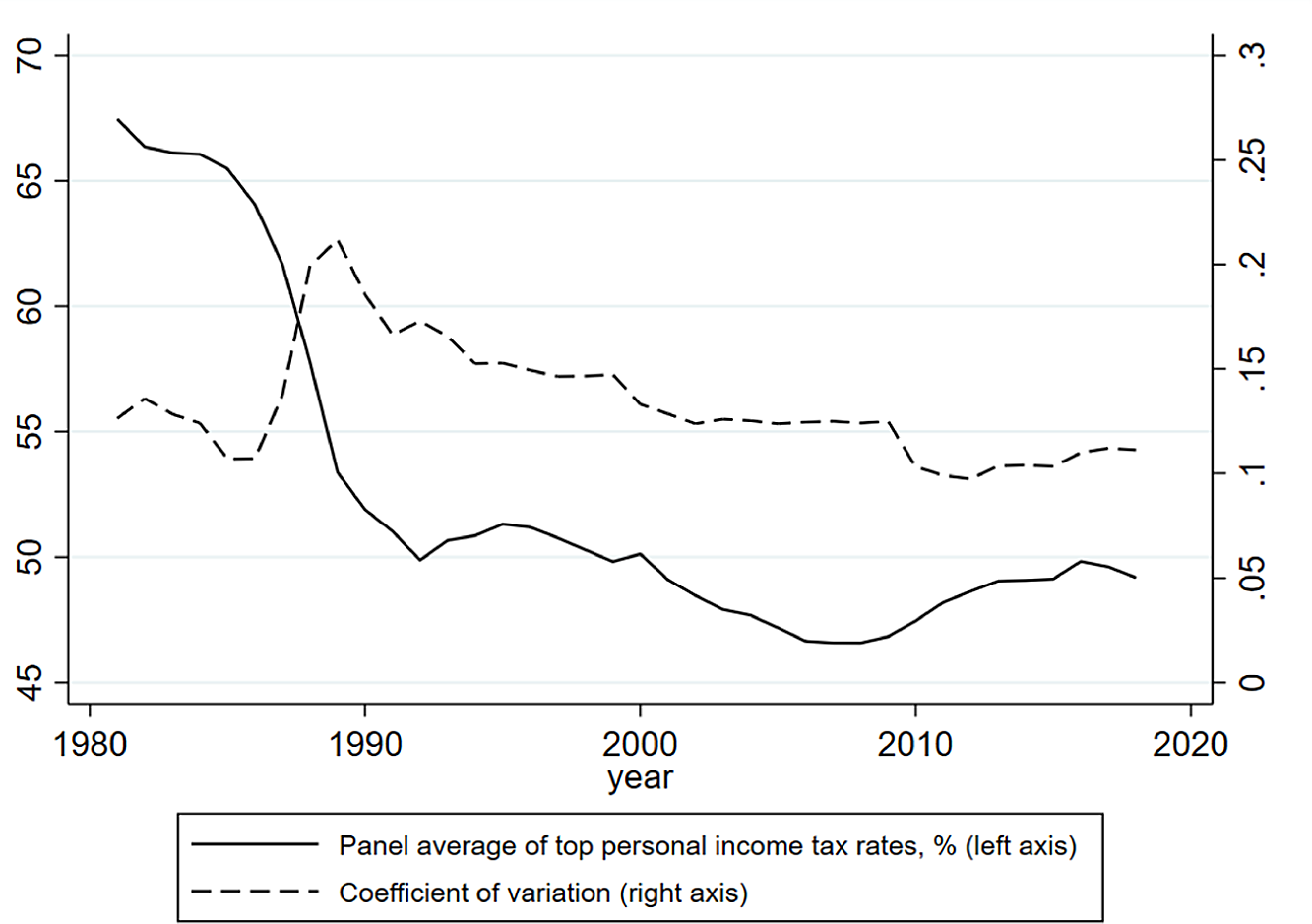

Until the early 1980s, high top PIT rates were the norm in advanced OECD countries. Figure 1 shows that the average top rate in this study’s data panel was 67% in 1981, and it documents a relatively small cross-national variability (measured by the coefficient of variation). Most OECD countries sharply reduced their top rates in the late 1980s or early 1990s. Cross-country differences in the timing of these reforms explain the divergence that is visible during this period. Rates continued to decline during the following decades, but were increased in several countries after the 2008 financial crisis. By 2018, the average top rate stood at 49%. The small cross-national variability, comparable to the level in the early 1980s, suggests that rates have moved from a high-level equilibrium towards a new, lower-level equilibrium (cf. Swank Reference Swank2016, p. 573).

Figure 1. Panel average and variation of top PIT rates, 1981–2018.

Domestic politics, institutions, and economics

The literature has identified several political, institutional, and economic factors that may influence the top rate. Many of those are related to national policy-making, where the PIT is a relatively politicised tax.

In partisan politics, the left generally places more emphasis on income equality than the right, and left-wing voters are more supportive of tax progressivity (Roosma et al. Reference Roosma, Van Oorschot and Gelissen2016). One would therefore expect left-wing governments to raise the top rate. If the right, instead, prioritises economic efficiency, it might lower the top rate to reduce its work disincentive. There is some supportive evidence that left-wing governments (Cusack and Beramendi Reference Cusack and Beramendi2006) or Christian democratic governments (Swank and Steinmo Reference Swank and Steinmo2002) tend to increase the average effective labour tax rate.

While government ideology may reflect short-term fluctuations in the electorate’s redistributive preferences, countries also vary in their long-term electoral demand for income redistribution, as some cultures are more egalitarian than others. Egalitarian norms among the electorate affect capital tax rates by increasing the political costs of rate reductions (Basinger and Hallerberg Reference Basinger and Hallerberg2004; Plümper et al. Reference Plümper, Troeger and Winner2009). It is plausible that those norms affect top labour tax rates in a similar way.

Recent studies have identified two main explanatory factors behind the electorate’s redistributive preferences (see generally: Berens and Gelepithis Reference Berens, Gelepithis, Hakelberg and Seelkopf2021). On the one hand, taxpayers are economically self-interested and aim to maximise their lifetime income. Support for tax progressivity, therefore, decreases with income and increases with the risk of income loss (Barnes Reference Barnes2015). Relatedly, support for tax progressivity is higher in welfare states that emphasise insurance against income loss, as opposed to generic transfers to the poor (Berens and Gelepithis Reference Berens and Gelepithis2019). On the other hand, tax preferences are also shaped by taxpayers’ normative ideas about whether people deserve their incomes in the light of their efforts or contributions to society. For instance, Limberg (2019; Reference Limberg2020) argues that demand for higher top rates increased in the aftermath of the 2008 financial crisis because the rich were perceived as unfair beneficiaries of the poorly regulated financial markets. Furthermore, taxpayers’ willingness to fund the welfare state depends positively on the perceived work effort and reciprocal contributions of welfare beneficiaries and on taxpayers and beneficiaries sharing a cultural background (Van Oorschot Reference Van Oorschot2006; Rueda Reference Rueda2018). Taxpayers tend to stereotype elderly, sick, and disabled people as the most deserving groups, the unemployed as less deserving, and immigrants as the least deserving (Van Oorschot Reference Van Oorschot2006). Thus, population composition and welfare spending may affect voters’ tax preferences.

Zooming out from preferences and ideas, it has been argued that political institutions affect their translation into actual tax policy, with majoritarian and consensus democracies producing divergent outcomes. Consensus democracies are characterised by proportional representation, fragmented political landscapes, and coalition governments. They generally allow for better representation of pro-welfare groups than majoritarian systems, which may produce right-wing landslide victories (Döring and Manow Reference Döring and Manow2017) or be dominated by big-tent parties that appeal to the median voter (Cusack and Beramendi Reference Cusack and Beramendi2006). Additionally, Hays (Reference Hays2003) argues that coalition governments lead to higher labour/capital tax ratios, because they often include at least one right-wing party that aims to limit the capital tax burden. In sum, it is plausible that consensus democratic institutions have an upward effect on the top PIT rate.

Cross-country heterogeneity also exists in the institutional structure of economic systems, as measured by the degree of labour market corporatism (Hall and Soskice Reference Hall, Soskice, Hall and Soskice2001). The corporatist deal between labour and capital tends to involve job security, egalitarian wage setting, and generous welfare provisions in return for wage moderation and relatively low capital taxes. This implies an expensive welfare state, financed primarily with high labour taxes (Cusack and Beramendi Reference Cusack and Beramendi2006). Both labour and capital have an interest in maintaining their corporatist compromise, which makes tax reductions less likely (Swank Reference Swank2016). Thus, corporatism should positively affect the top PIT rate.

Finally, it is necessary to account for budgetary and economic factors. Not only a short-term budget deficit, but also a longer-term demographic burden (i.e. the share of citizens dependent on social security transfers, such as the elderly) may limit a government’s ability to cut taxes or may induce tax increases (Cusack and Beramendi Reference Cusack and Beramendi2006). Temporary budget surpluses, instead, appear to be used predominantly to cut taxes (Haffert and Mehrtens Reference Haffert and Mehrtens2015). What matters here is the top bracket’s relevance in the income tax system. The height of its income threshold determines the number of affected taxpayers and hence the budgetary consequences of a reform (Ganghof Reference Ganghof2006). Relatedly, top rate setting may be influenced by macroeconomic conditions. When economic growth is low, governments might cut marginal tax rates as a growth-friendly policy. On the other hand, as mentioned, severe economic crises may increase popular demand for tax progressivity, as they decrease people’s perceptions of high incomes as deserved and fair (Limberg 2019; Reference Limberg2020).

Transnational policy diffusion

While PIT policy should depend on domestic factors, it may also diffuse across borders. One possible mechanism is tax competition. Tax competition has been studied mainly in the context of CIT reductions, which are driven by the tax-sensitivity of investments and paper profits (Genschel and Schwarz Reference Genschel and Schwarz2011). Although countries compete for corporate capital simultaneously, there is also evidence suggesting that countries react to the first move of a so-called Stackelberg leader, where the USA plays that role (Swank Reference Swank2016; Altshuler and Goodspeed Reference Altshuler and Goodspeed2015). In any case, competition is conditioned by several domestic factors. One is country size: smaller nations set lower rates, because they have less domestic tax revenues to lose (Kanbur and Keen Reference Kanbur and Keen1993). Countries’ competitive policies are also mediated by fairness norms and budgetary pressure (Plümper et al. Reference Plümper, Troeger and Winner2009). Furthermore, consensus democracy and corporatism inhibit the implementation of neoliberal (low-rate and broad-base) tax reforms in response to USA corporate tax cuts (Swank Reference Swank2016).

It is not entirely clear whether PIT competition exists and works analogously. One precondition would be that rich taxpayers’ location decisions are sensitive to PIT rates. Most of the existing evidence comes from within-country migration being affected by unequal regional tax rates (e.g. Agrawal and Foremny Reference Agrawal and Foremny2019), but arguably, regional migration should be less burdensome than emigration. Empirical research on international mobility is scant because of the lack of detailed data combining migration patterns with income levels and tax rate schedules (Kleven et al. Reference Kleven, Landais, Muñoz and Stantcheva2020) – an issue that also affects the present study. Akcigit et al. (Reference Akcigit, Baslandze and Stantcheva2016) do find a positive migration response of top inventors to the 1986 top rate reduction in the USA, and Egger and Radulescu (Reference Egger and Radulescu2009) find that country-specific migration between 49 nations is higher when income tax progressivity is lower in the host country than in the home country. Kleven et al. (Reference Kleven, Landais, Muñoz and Stantcheva2020), however, find no negative relation between top marginal tax rates and the share of rich foreigners in the populations of 26 countries.

Even if people’s location decisions are indeed tax-sensitive, it does not necessarily follow that governments will compete via PIT rates. For one thing, it is unlikely that revenue and human capital inflows would offset domestic revenue losses, as domestic taxpayers generally outnumber migrants and expatriates. Furthermore, competition through targeted tax policies probably overshadows top-rate competition. Many developed nations have implemented preferential income tax regimes for high-skilled foreigners (Kleven et al. Reference Kleven, Landais, Muñoz and Stantcheva2020), and those strongly affect those individuals’ location decisions (e.g. Kleven et al. Reference Kleven, Landais, Saez and Schultz2014; Akcigit et al. Reference Akcigit, Baslandze and Stantcheva2016). Arguably, the existence of those special regimes actually reduces countries’ incentives to compete via general top rate setting because the relatively elastic incomes of foreigners drop out of the general tax base. Second, many nations have fully or partially dualised their income taxes, removing personal capital income from their progressive labour tax rate schedules and taxing it at preferential rates instead. It is plausible that rich people’s location decisions are guided more by those capital tax regimes than by the PIT – Kleven et al. (Reference Kleven, Landais, Muñoz and Stantcheva2020) provide anecdotal evidence. Wealth and gift taxes, as well as non-tax factors, may also play a larger role, but little is known about their effects.

A second important mechanism of transnational diffusion is the copying of tax policies adopted by other governments or promoted by policy experts. In particular, it has been argued that countries copied a neoliberal (low-rate and broad-base) tax reform model in the 1980s and 1990s, after they had become dissatisfied with the multitude of deductions and tax expenditures that made their existing systems unnecessarily complex and prone to tax avoidance (Steinmo Reference Steinmo2003). This neoliberal diffusion was fostered by the spread of efficiency ideas among tax policy-makers in the OECD (Swank Reference Swank1998), but it is also plausible that countries directly responded to the 1986 USA tax reform (Tanzi Reference Tanzi1987; Steinmo Reference Steinmo2003). In most nations, neoliberal ideas probably affected corporate and personal taxes alike, as both suffered from inefficiencies. Moreover, their rate-setting should be connected, because both share income as a tax base.

The backstop argument

The connection between the CIT and PIT is generally described as a backstop function: the former supports the progressivity of the latter. When the CIT rate is set far below the top PIT rate, this incentivises high-income business owners and independent professionals to earn their income through corporations and reduce their tax burdens (Gordon and MacKie-Mason Reference Gordon, MacKie-Mason, Feldstein, Hines and Hubbard1995; Slemrod Reference Slemrod2004; Ganghof Reference Ganghof2006). To illustrate, suppose that a country has a 20% CIT rate and a 60% PIT rate. It then needs an effective 50% tax rate on distributed corporate profits, in order to tax owner-managers on par with wage earners and sole proprietors: 1-(1–0.2)*0.5 = 0.6. This situation creates two problems.

First, shareholder taxes have economic and political costs. Capital gains taxes and dividend taxes may discourage the distribution of profits and hence distort the reinvestment of capital (Auerbach Reference Auerbach1991; Zodrow Reference Zodrow1991). And inheritance taxes on the bequest of shares can reduce the profitability and longevity of family firms (Tsoutsoura Reference Tsoutsoura2015). Unsurprisingly, most countries tax owner-managers of corporations more leniently than wage earners and sole proprietors. In 2016, top marginal rates in the OECD, taking into account both corporate- and individual-level taxation, averaged 42.5% on wages (OECD 2020b; own calculations), 40.4% on dividends, and 35.4% on capital gains (Harding and Marten Reference Harding and Marten2018). Furthermore, many countries treat the transfer of shares in family firms preferentially. If at least one shareholder tax is more lenient than the PIT, incorporation is an attractive tax avoidance strategy.

Second, even aligning top marginal wage and shareholder tax rates does not prevent owner-managers from retaining profits inside their corporations and avoiding the payment of shareholder taxes altogether. When an owner-manager needs their earnings for private consumption, one strategy to minimise taxable dividends is to borrow money from the firm. Alternatively, they can consume business-related goods within the firm (such as mobile phones, computers, meals, cars, or business trips).

In systems with a large PIT-CIT differential, the only way to effectively prevent profit retention in corporations is to tax imputed dividends, regardless of actual dividend distributions. Fairness issues aside, such a tax requires complex calculations. And it works only for closely held corporations with active owners because the government cannot observe all corporate profits behind citizens’ world-wide passive shareholdings. Resultingly, shareholders may use avoidance strategies to remain below the legal threshold of active ownership and escape the imputed dividend tax. This was a reason why Norway abolished such a tax in 2006 (Alstadsæter Reference Alstadsæter2007).

In sum, to preserve tax system integrity, the only option is to limit the PIT-CIT differential. Governments have good reasons to do so: the abovementioned avoidance strategies reduce horizontal equity, because wage earners, independent professionals, and business owners are not equally able to incorporate; and they reduce vertical equity because income shifting is primarily beneficial for people in the top tax bracket. These equity issues may cause voter resentment. Barring income shifting, voters may also disapprove of a tax rate differential in and of itself because it signals unequal treatment.

On the other hand, governments may also deliberately maintain a tax rate differential. Taxes on various forms of capital income – e.g. interest, returns to owner-occupied housing, and corporate profits – have different political or economic costs, but setting unequal rates generally induces substantial tax arbitrage; governments may therefore choose to set a low and uniform capital and CIT rate, whereas equity and budget considerations may call for a higher rate on labour income (Ganghof Reference Ganghof2006).

In some instances, governments may even prefer income shifting towards the corporate form. When income shifters have high labour supply elasticities, they should be more productive under a lenient CIT regime, and this may increase social welfare (Selin and Simula Reference Selin and Simula2020). And as the remaining labour tax base will then be less elastic, the revenue-maximising top PIT rate should increase (Kotakorpi and Matikka Reference Kotakorpi and Matikka2017).

A government’s eventual tax rate setting will depend on its weighing of these considerations, such that every country has its own optimal tax rate differential in a closed-economy setting. However, a real-life open economy faces corporate tax competition. In this study’s data panel, the average CIT rate has declined from 48.1% in 1981 to 25.6% in 2018, meaning that the recent international agreement on a minimum rate of 15% will not immediately halt the continuous downward trend.

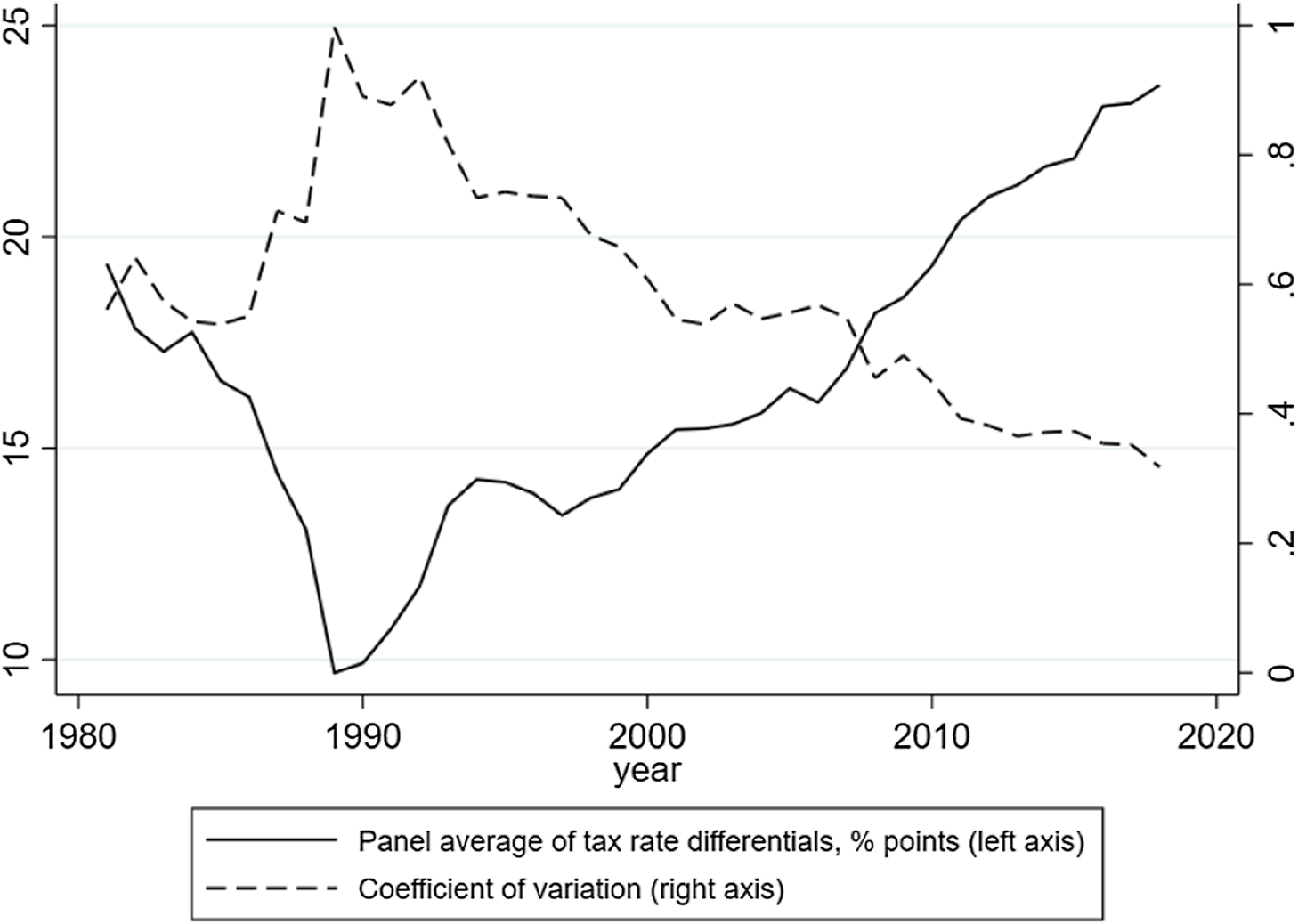

Ganghof (Reference Ganghof2006) describes the resulting policy dilemma faced by governments as they cut their CIT rates: keeping the top PIT rate constant implies that the rate differential increases, which hurts tax system integrity; and maintaining the existing differential implies that the top rate must be reduced, which hurts tax system progressivity. Ganghof presents case-study evidence of seven countries’ responses to this dilemma between the mid-1980s and early 2000s. He shows that many top rate reductions were indeed related to CIT rate setting. To ensure optimal tax system integrity, New Zealand even aligned both rates at 33% (see also: Christensen Reference Christensen2012). Other countries implemented less radical reforms, generally because of budgetary and political constraints. As their CIT rates declined due to international competitive pressure, their tax rate differentials increased. Figure 2 documents the average tax rate differential in this study’s data panel through time. Starting at 19.3 percentage points in 1981, it was sharply reduced to 9.6 percentage points in 1989 as countries cut their top rates. Since then, it has risen steadily to 23.5 percentage points in 2018, with cross-country variation sharply declining. The latter may indicate that countries’ PIT rates similarly experience the downward pull of the CIT on the one hand, and upward budgetary and political pressure on the other.

Figure 2. Panel average and variation of PIT–CIT rate differentials, 1981–2018.

Unsurprisingly, recent empirical evidence shows that owner-managers both exploit differences between taxes on dividends, capital gains and wages, and retain profits inside corporations (Alstadsæter and Jacob Reference Alstadsæter and Jacob2012, p. 58). De Mooij and Nicodème (Reference De Mooij and Nicodème2008) estimate that these strategies account for 12 to 21% of total CIT revenues in a panel of 17 European countries. Profit retention appears to be the main strategy (Le Maire and Schjerning Reference Le Maire and Schjerning2013; Bettendorf et al. Reference Bettendorf, Lejour and Van ’t Riet2017; Miller et al. Reference Miller, Pope and Smith2021). It follows that the differential between PIT and CIT rates, rather than shareholder tax rates, should be at the heart of the issue, because shareholder taxes become less relevant when corporate profits are retained (especially when owner-managers consume goods within the firm). Illustratively, while the alignment of top marginal dividend and labour tax rates in Norway should prevent income shifting to the corporate form, Alstadsæter et al. (Reference Alstadsæter, Kopczuk and Telle2014) find evidence of substantial tax-free saving and consumption in holding corporations, precisely because the CIT rate is relatively low.

Anecdotal evidence illustrates that PIT avoidance remains a contributing factor in tax policy-making. For instance, the Norwegian government addressed it in its 2015 tax reform proposal, arguing that employers’ social security contributions made earning wages less attractive than earning shareholder income. The government was reluctant to increase the marginal tax rate on dividends, fearing tax avoidance and even emigration (Solberg government 2015, p. 13). Since 2016, it has implemented some moderate cuts in the PIT rate of around 0.2 percentage points each year. In Sweden, where the top PIT rate was already reduced by 5 percentage points in 2020, an advisory committee attached to the Ministry of Finance proposed another reduction of the same magnitude, which would tackle income shifting towards corporations (Eklund Reference Eklund2020, p. 17). The Dutch government implemented a stepwise top-rate reduction of 2.45 percentage points between 2018 and 2021. The importance of aligning marginal rates on wage and shareholder incomes had been stressed by an independent advisory committee, and it was explicitly mentioned in the reform’s explanatory memorandum (Rutte III government 2018, para. 5.9). This rate alignment had been a main goal of the current system (Kok II government 1999, para. 5), and tax scholars stressed that it had been undermined by several CIT reductions (e.g. Caminada and Stevens Reference Caminada and Stevens2017). However, the government publicly sold the reform with arguments relating to “making work pay” (e.g. Rutte III government 2018, para. 5.1).

The latter example illustrates the difficulty in distinguishing a reform’s primary goals from its coincidental advantages as listed in explanatory memorandums and government statements, and thus in obtaining convincing qualitative evidence about the drivers of PIT rate setting using case studies. This difficulty highlights the complementary added value of this study’s regression approach: it can quantify the effects of these drivers relatively easily.

Hypotheses

To this end, I translate the discussed theory and evidence on the backstop argument into six hypotheses. As highlighted by Ganghof (Reference Ganghof2006), governments that cut the CIT rate generally choose a policy option on a continuum between two extremes: keeping the PIT rate constant or keeping the tax rate differential constant and hence reducing both rates parallelly. When several subsequent governments choose the former option, the differential increases. A large differential should eventually incentivise the government to cut the PIT rate in order to improve tax system integrity. Thus, my first two hypotheses are as follows.

Hypothesis 1: The size of the tax rate differential encountered by a government at its investiture is negatively related to the change in the top PIT rate during this government’s incumbency.

Hypothesis 2: Government-specific changes in CIT and PIT rates are positively related.

These hypotheses are premised on the exogeneity of CIT rate setting. In reality, however, the CIT–PIT relation may be bidirectional, or it may be influenced by third factors, causing endogeneity problems. For instance, governments may find it politically costly to reduce one tax without cutting the other, or they may be favourably disposed towards cutting taxes in general – recall the spread of neoliberal policy ideas. Furthermore, governments could reduce the tax rate differential by raising the CIT rate instead of cutting the PIT rate. In that case, large differentials could have a dampening effect on CIT competition. Finally, small businesses could theoretically avoid corporate taxes by switching to the personal tax base, which would stimulate governments to cut the CIT rate. I apply a twofold strategy to mitigate these endogeneity concerns. First, I exploit the time dimension of the data to test the unidirectionality of the CIT-PIT relation.

Hypothesis 3: The size of the tax rate differential encountered by a government at its investiture has no effect on this government’s subsequent CIT rate setting.

Evidence in favour of both hypotheses 1 and 3 would suggest that past CIT rate setting, through the size of the tax rate differential, Granger causes PIT rate setting, but not vice versa.Footnote 2 Such evidence would leave intact the possibility that a third factor influences the relation between government-specific changes in both rates. However, the latter scenario is less likely when that relation is absent in a large sub-group of countries. In particular, I expect the relation to hold only in countries that aim to tax corporate and personal income comprehensively at an (approximately) equal rate. Those countries must adjust both rates parallelly to maintain their (approximate) tax rate alignment. In that case, their top rate reductions should not be caused by the rate differential but by the change in the CIT rate. In countries with a large tax rate differential, instead, there should be less urgency to adjust both rates simultaneously; any cuts in the PIT rate are likely to result from the differential having increased over time (as formulated in hypothesis 1). I translate these assumptions into the following hypotheses.

Hypothesis 4: A smaller tax rate differential at the beginning of a government’s term causes a stronger positive relation between this government’s changes in CIT and PIT rates.

Hypothesis 5: In countries with large tax rate differentials, government-specific changes in CIT and PIT rates are unrelated.

Any evidence in favour of the latter hypothesis further mitigates the abovementioned endogeneity concerns.

Finally, I expect that changes in the top rate are not driven by top marginal rates on shareholder income. Admittedly, in the examples above, Norway and the Netherlands seem to be interested primarily in aligning their top labour and dividend tax rates, rather than their labour and corporate rates. But as explained, this is a surrogate solution for tax system integrity, as profit retention will remain a problem. The real reason behind PIT avoidance, and resultingly, behind top rate reductions, should be the low CIT rate. The lack of detailed, internationally comparable data on capital gains taxes confines the focus of my hypothesis to dividend taxation.

Hypothesis 6: The differential between the top rate on dividend income (including corporate taxes) and the top PIT rate, encountered by a government at its investiture, does not affect this government’s top PIT rate setting.

Method and data

Dependent variable and model structureFootnote 3

I estimate the effects of the theoretical determinants of top PIT rate setting in 19 OECD countries between 1981 and 2018. Following Schmitt (Reference Schmitt2016), Garritzmann and Seng (Reference Garritzmann and Seng2016) and Ahrens et al. (Reference Ahrens, Bothner, Hakelberg and Rixen2020), I estimate regression models with cabinet periodisation. These should conform better to political reality than conventional country-year models, because governments generally draft one tax plan, instead of deciding on new reforms each year (Ahrens et al. Reference Ahrens, Bothner, Hakelberg and Rixen2020). Country-year data incorrectly record reforms that involve stepwise tax cuts over several years (Jensen and Lindstädt Reference Jensen and Lindstädt2012). They do capture reforms with a one-year time frame, but in these cases, the other cabinet years will add redundant observations with no variance in several variables. This may bias the coefficients (Garritzmann and Seng Reference Garritzmann and Seng2016). Moreover, governments tend to schedule reforms at dissimilar time points during their terms; they may delay reform implementations (Jensen and Lindstädt Reference Jensen and Lindstädt2012); and their reaction speed to changed economic circumstances may differ. Country-year models need a complex and error-prone lag structure to capture such differences for all countries and variables, whereas the timing of reforms is less important in cabinet-based models (Schmitt Reference Schmitt2016).

Still, cabinet-based models would fail to capture long-term reforms over multiple governments. This would be especially problematic when the speed of PIT and CIT reforms differs. For instance, the Granger causality between CIT cuts and subsequent PIT cuts would be false when PIT cuts were decided upon much earlier.Footnote 4 Therefore, I briefly examine whether tax cut announcements and implementations substantially deviate on an aggregate level.Footnote 5 As reported online, almost all PIT and CIT rate changes occur in the first two years following a tax cut announcement, and their average reforms are completed in 1.71 and 1.57 years, respectively. This finding reduces concerns about biases resulting from implementation lags, especially because I exclude cabinets that have served for less than one year – those are often caretaker governments which are unlikely to implement major reforms (Schmitt Reference Schmitt2016).

The dependent variable measures the change in the top PIT rate during a government’s incumbency. I use the statutory rate faced by individuals in the highest income tax bracket, at the combined central and sub-central government level, including uncapped surcharges, social premiums, and payroll taxes.Footnote 6 Data are retrieved from the OECD’s Tax Database (OECD 2020b); a special OECD project collecting pre-2000 tax data (Johansson et al. Reference Johansson, Heady, Arnold, Brys and Vartia2008); Piketty et al. (Reference Piketty, Saez and Stantcheva2014); and government statistics agencies or tax administrations.

The abovementioned sources provide conventional country-year panel data. To obtain cabinet-periodised data, I combine them with cabinet composition data (Armingeon et al. Reference Armingeon, Wenger, Wiedemeier, Isler, Weisstanner and Knöpfel2020b). In parliamentary systems, a cabinet is defined as a government with constant parliamentary support and portfolio division among coalition partners. For example, Tony Blair’s ten-year Labour government in the UK consisted of three cabinets, because two elections changed the government’s initial parliamentary majority. I follow the same definition for semi-presidential systems in which the government depends on the approval of the legislature. In full presidential systems, I classify presidencies as single-party cabinets. I assign country-year data to cabinets, based on their years of incumbency: a cabinet taking office in 2014 and leaving office in 2016 would have the country-years 2014, 2015, and 2016 assigned to it, and the dependent variable would measure the change in the top rate between 2014 and 2016 (see Ahrens et al. Reference Ahrens, Bothner, Hakelberg and Rixen2020, p. 573). As this merging process retains the information on countries and investiture years, the resulting panel data allow for the use of country and year dummies when appropriate.

Tax system variables

Two main explanatory variables measure the effect of the CIT rate. One denotes the positive differential between the PIT and CIT rate in a cabinet’s first year of incumbency (to test hypothesis 1).Footnote 7 The other denotes the change in the CIT rate during this cabinet’s term (hypothesis 2). To test whether this CIT rate change has a stronger effect on the dependent variable in countries with a smaller tax rate differential (hypotheses 4 and 5), I will add an interaction term of both explanatory variables in a separate estimation. In another set of models, I estimate these relations in the opposite direction to test hypothesis 3: I regress the change in the CIT rate on the PIT-CIT rate differential and on the change in the PIT rate. CIT rate data are retrieved from the OECD (2020b), Johansson et al. (Reference Johansson, Heady, Arnold, Brys and Vartia2008) and Devereux et al. (Reference Devereux, Griffith and Klemm2002), and reflect the combined central and sub-central rate.

To measure the effect of dividend tax rate setting (hypothesis 6), I include the positive differential between the top PIT rate and the top statutory rate on dividend income in a cabinet’s first year of incumbency. This measure includes taxes at both the corporate and the shareholder level and takes into account relief systems that prevent double taxation. Furthermore, I add the change in the shareholder-level dividend tax rate during a cabinet’s incumbency. Data are retrieved from the OECD (2020b) and Johansson et al. (Reference Johansson, Heady, Arnold, Brys and Vartia2008). Note that these are two separate time series: the 1981–1999 data from Johansson et al. have not been verified by the OECD, which provides data for the years 2000–2018. Although the time series align very well, the results should thus be treated with some caution. I will test the effects of the dividend tax rate in separate regressions.Footnote 8

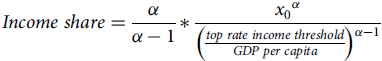

I include two control variables that describe other relevant aspects of the tax system. First, to control for the top bracket’s relevance, I include the income share of taxpayers that it affects in the government’s year of investiture. This income share depends not only on the top bracket’s income threshold relative to the average income, but also on the shape of the income distribution. Following Akgun et al. (Reference Akgun, Cournède and Fournier2017), I use a virtual income distribution that is similar in all countries; this proxy avoids endogeneity, as real-life income distributions are affected by the top rate through labour supply decisions. The income share of taxpayers who are affected by the top rate equals:

$$Income\;share = {\alpha \over {\alpha - 1}}*{{{x_0}^\alpha } \over {{{\left( {{{top\;rate\;income\;threshold} \over {GDP\;per\;capita}}} \right)}^{\alpha - 1}}}}$$

$$Income\;share = {\alpha \over {\alpha - 1}}*{{{x_0}^\alpha } \over {{{\left( {{{top\;rate\;income\;threshold} \over {GDP\;per\;capita}}} \right)}^{\alpha - 1}}}}$$

This equation follows a Pareto law; the Pareto coefficient α equals 2 (following Ruiz and Woloszko 2016, as cited in Akgun et al. Reference Akgun, Cournède and Fournier2017), and the term

![]() ${x_0}$

is a scaling parameter, set to 0.1. The Pareto law describes the right end of an income distribution: a downward, convex curve with an asymptotic tail. Hence, for the number of affected taxpayers, it makes a much larger difference whether the top bracket starts at 2 versus 3 times the average income, than whether it starts at 12 versus 13 times the average income. This makes the income share equation a more realistic control variable than the tax bracket threshold in and of itself, which would imply a linear effect. And because of the Pareto parameter that describes the income distribution, the equation is also more realistic than the ratio of GDP per capita over the top bracket’s income threshold. Threshold data are retrieved from the same sources as PIT data. GDP per capita in current local currency units is retrieved from the World Bank (2020).

${x_0}$

is a scaling parameter, set to 0.1. The Pareto law describes the right end of an income distribution: a downward, convex curve with an asymptotic tail. Hence, for the number of affected taxpayers, it makes a much larger difference whether the top bracket starts at 2 versus 3 times the average income, than whether it starts at 12 versus 13 times the average income. This makes the income share equation a more realistic control variable than the tax bracket threshold in and of itself, which would imply a linear effect. And because of the Pareto parameter that describes the income distribution, the equation is also more realistic than the ratio of GDP per capita over the top bracket’s income threshold. Threshold data are retrieved from the same sources as PIT data. GDP per capita in current local currency units is retrieved from the World Bank (2020).

Second, it is necessary to control for convergence of the dependent variable, as high taxes are more likely to be reduced than low taxes. I include the PIT rate in a cabinet’s first year of incumbency, transformed into a standardised index based on yearly averages.Footnote 9 Given the evolution of tax policy ideas (Steinmo Reference Steinmo2003) and the possibility of PIT competition, its relative height should be more important than its absolute height in a context of convergence. Furthermore, including its absolute height would cause a multicollinearity problem with the PIT-CIT rate differential. When the CIT rate is low, a high PIT rate necessarily implies a large rate differential, such that one variable may absorb the effect of the other.Footnote 10 It turns out that the standardised index of the PIT rate is less correlated with the tax rate differential.Footnote 11

While the top rate’s standardised start value controls for countries’ simultaneous convergence towards the sample mean, potentially as a result of competition or policy emulation, I will also test the role of the USA as a Stackelberg leader in separate models (Swank Reference Swank2016). To this end, I include the positive differential between a country’s top rate and the US top rate in a government’s first year, and the preceding yearly change in the US top rate.

Socio-economic variables

Given the budgetary consequences of top rate adjustments, I include the government’s budget balance (Armingeon et al. Reference Armingeon, Wenger, Wiedemeier, Isler, Knöpfel, Weisstanner and Engler2020a). To control for longer-term demographic pressure on the budget, I follow Cusack and Beramendi (Reference Cusack and Beramendi2006) by adding a measure of a country’s demographic burden, i.e. the added shares of elderly people and unemployed people (Armingeon et al. Reference Armingeon, Wenger, Wiedemeier, Isler, Knöpfel, Weisstanner and Engler2020a). I relegate the testing of alternative measures of population composition and welfare spending to the online appendix, in order to prevent overspecification – see infra. To capture short-term and long-term economic performance, respectively, I include the GDP growth rate and the natural log of GDP per capita (World Bank 2020). As competitive tax policy may depend on country size (Kanbur and Keen Reference Kanbur and Keen1993), I include the natural log of the total population (Armingeon et al. Reference Armingeon, Wenger, Wiedemeier, Isler, Knöpfel, Weisstanner and Engler2020a).

Political and institutional variables

A final set of control variables accounts for political and institutional factors. Assuming that the aggregate amount of income redistribution reflects the structural redistributive preferences of an electorate, I follow Plümper et al. (Reference Plümper, Troeger and Winner2009) by including the absolute difference between the Gini coefficients before and after taxes and transfers (Solt Reference Solt2020). To account for the effects of government ideology, I include the share of left-wing cabinet positions (Armingeon et al. Reference Armingeon, Wenger, Wiedemeier, Isler, Weisstanner and Knöpfel2020b). I also add an index of consensus democracy by Armingeon et al. (Reference Armingeon, Wenger, Wiedemeier, Isler, Knöpfel, Weisstanner and Engler2020a).Footnote 12 I measure corporatism by constructing an index that closely resembles the one used by Van Vliet et al. (Reference Van Vliet, Caminada and Goudswaard2012). The index adds standardised scores of four variables, denoting: country-wide wage coordination; routine involvement of unions and employers in social and economic policy-making; an index denoting the centralised power of the main union confederation; and the union density rate. These data are retrieved from Visser (Reference Visser2019).

Cabinet duration, time trends, and endogeneity

Assuming that a longer period of incumbency increases a government’s ability to implement tax reforms, I include the natural log of its days in power (Ahrens et al. Reference Ahrens, Bothner, Hakelberg and Rixen2020). I control for time trends by adding period dummies that each cover three years.Footnote 13 To prevent endogeneity and reverse causation, the control variables refer to values in a cabinet’s first year.

Results

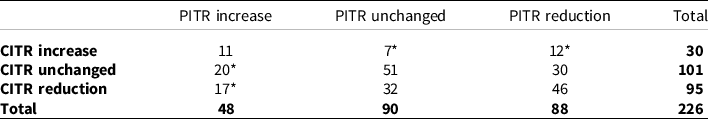

As a prelude to the regression results, Table 1 reports the directions in which the panel’s 226 governments have changed their PIT and CIT rates. It shows that tax reform is rather common, with over 77% of governments changing one or both rates. The distribution of reform patterns tentatively points in the direction of the hypotheses. The most common pattern is a simultaneous reduction of both rates (by 46 governments), in line with hypothesis 2. Additionally, 32 + 30 = 62 governments cut either of both, as follows from hypothesis 1. Those three patterns comprise 48% of the sample. The cells marked with an asterisk (*) denote patterns that negate the hypotheses, and comprise 25% of the sample.Footnote 14

Table 1. Distribution of cabinets’ tax reform patterns

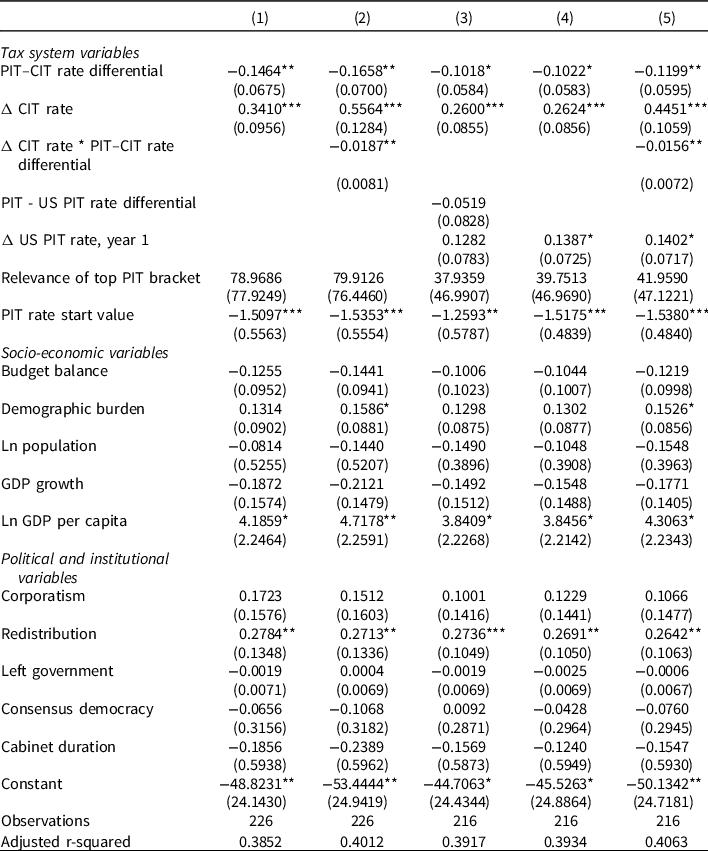

Table 2 reports the regression results of changes in top PIT rates. Model 1 shows that the CIT is a strong determinant of top rate setting, as predicted in hypotheses 1 and 2. First, an existing differential between the two rates is related to a remarkably large decline of the PIT rate: the average differential of 16.6 percentage points would result in a 2.4 percentage-point reduction. Second, every percentage-point change in the CIT rate is related to a simultaneous 0.34 percentage-point change in the PIT rate in the same direction.Footnote 15

Table 2. Effects on cabinets’ changes in top PIT rates

Period dummies included. Eicker–Huber–White standard errors in parentheses.

*** p < 0.01, ** p < 0.05, * p < 0.1.

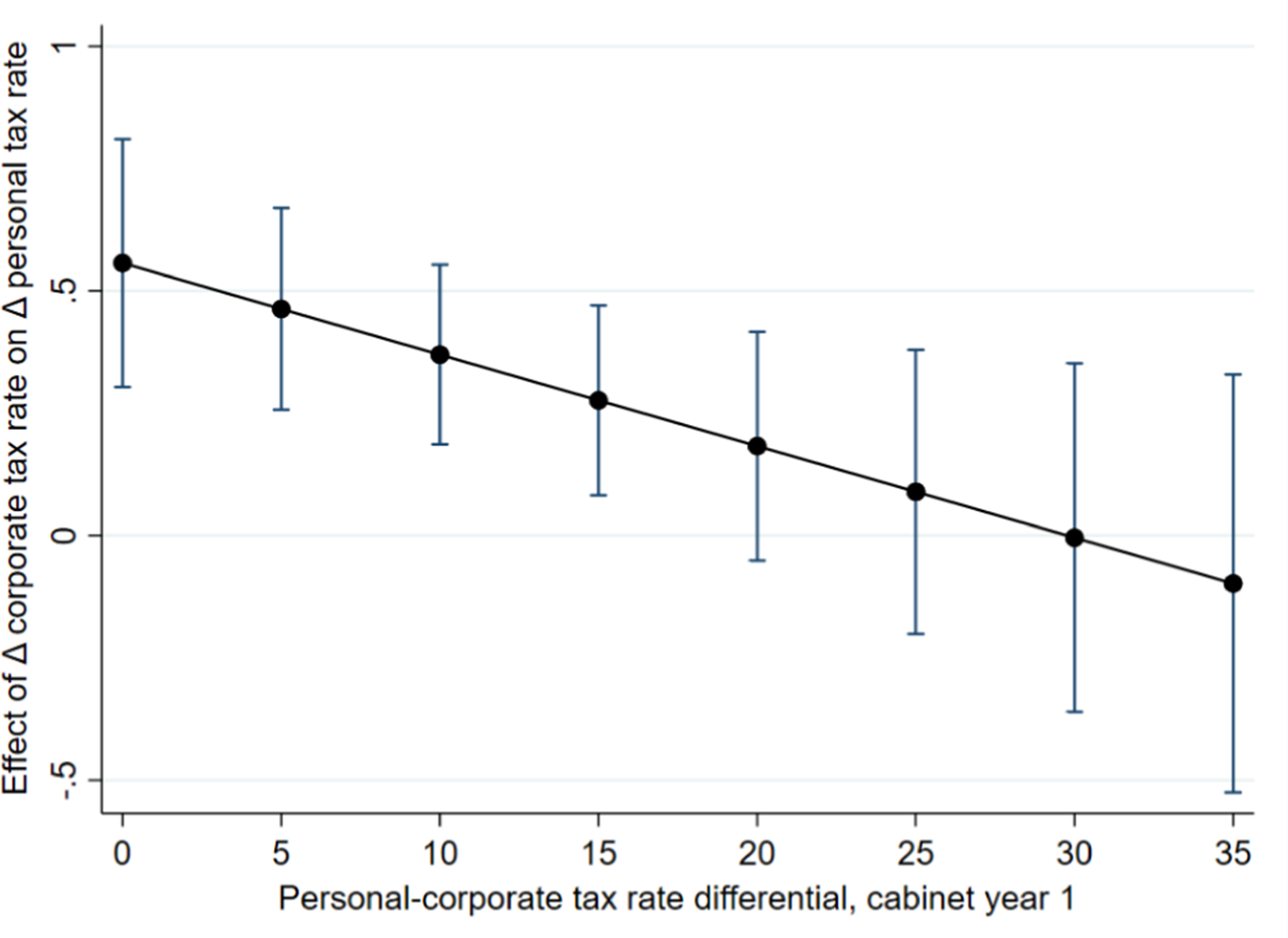

Model 2 adds an interaction term between these variables to test hypotheses 4 and 5. Its marginal effects are plotted in Figure 3 and conform to the expectations. In countries with a tax rate alignment (at the left end of the x-axis), a 1 percentage-point decline in the CIT rate is related to a substantial PIT rate reduction of 0.56 percentage points. In countries with a larger tax rate differential, the relation is weaker and pales into insignificance. Thus, as predicted, it is less urgent in systems with a large tax rate differential to adjust both rates simultaneously. Of course, this does not negate the backstop argument: when one government reduces only the CIT rate, a subsequent government may cut the PIT rate because it finds the differential too large. Notably, the effect of the differential remains significant in model 2.

Figure 3. Effect of Δ CIT rate on Δ PIT rate, conditional on the tax rate differential.

In both models, the significant and negative coefficient of the top rate’s start value shows that higher rates are reduced more than lower rates. Due to a lack of migration data, it is difficult to test whether this convergence is driven by competition or policy emulation, though the discussed literature suggests the latter. The insignificant and wrongly-signed coefficient of the population variable also negates the positive relation between tax rates and country size that would be indicative of tax competition (Kanbur and Keen Reference Kanbur and Keen1993). To additionally test US Stackelberg leadership, model 3 adds the domestic-US PIT rate differential and the change in the US PIT rate.Footnote 16 The coefficients are insignificant, but this may result from multicollinearity, as three variables in this model depend on the height of the top rate.Footnote 17 Models 4 and 5 therefore exclude the domestic-US PIT rate differential and only include the change in the US PIT rate, which now turns weakly significant. The effect seems to depend on variable specification: replacing the 1-year change with a 2-year change, or the change during a government’s term, yields insignificant coefficients (not reported). I thus regard the evidence for US Stackelberg leadership as weak.Footnote 18

The coefficients of most control variables point in the expected directions. Redistributive preferences have a significant and upward effect on top rate adjustments, and richer countries set higher rates. Moreover, it is plausible that government budget deficits and populations with large shares of elderly or unemployed people also have some upward effect, as their coefficients are close to the 10% significance level in most models. These findings partially confirm the financial and political constraints that governments face in reducing PIT rates, as identified by Ganghof (Reference Ganghof2006). The government ideology variable has no significant effect, which is notable, because partisan effects should be particularly pronounced in cabinet-based models (Schmitt Reference Schmitt2016).

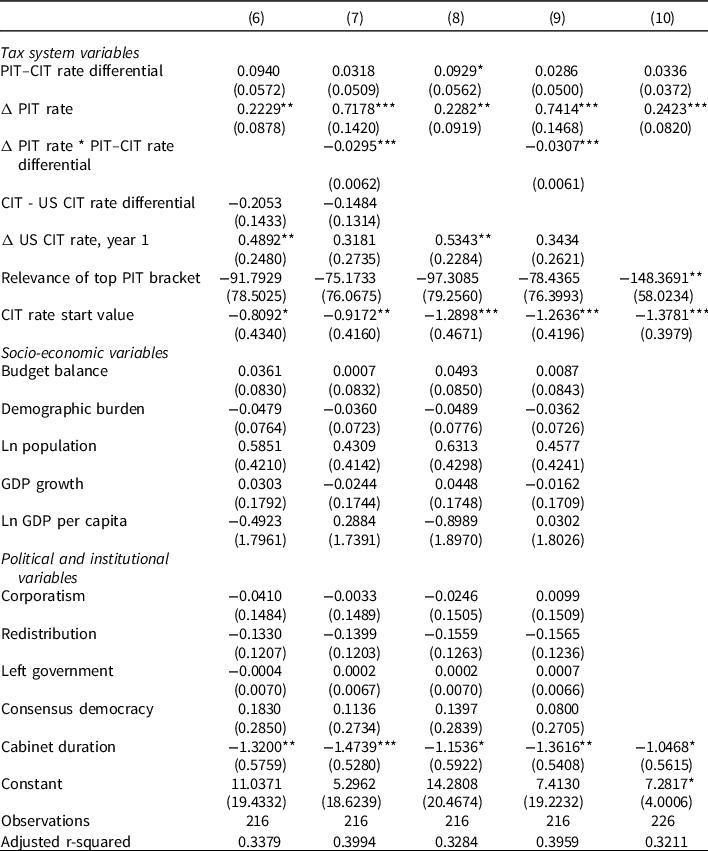

Table 3 presents the Granger causality tests, which reverse the original model, estimating the effect of the tax rate differential and the government-specific change in the PIT rate on CIT rate setting (hypothesis 3). In these models, I control for levels and changes of the US CIT rate, because there is strong evidence of US Stackelberg leadership in CIT policy (e.g. Swank Reference Swank2016). Model 6 shows that CIT rate changes are not driven by the prior tax rate differential. They do coevolve with changes in the PIT rate. However, as the interaction term in model 7 shows, this effect is partially driven by countries with a small tax rate differential changing both rates together: in a country with a 24.33 percentage-point differential, the estimated effect of PIT on CIT rate changes is zero (0.7178–0.0295 * 24.33). Following the approach of the original models 4 and 5, models 8 and 9 drop the domestic-US CIT rate differential to prevent multicollinearity. The coefficient of the PIT–CIT differential turns weakly significant in model 8 (p-value 0.100), but it is highly insignificant in model 9 with the interaction term (p-value 0.532).Footnote 19 Model 10 drops all non-tax and non-domestic control variables, to check whether these substantially affect the results – they do not. In sum, I find very weak evidence of CIT rates being influenced by the tax rate differential. This finding tentatively suggests that the differential has an exogenous effect in the original models.

Table 3. Effects on cabinets’ changes in CIT rates (Granger causality tests)

Period dummies included. Eicker–Huber–White standard errors in parentheses.

*** p < 0.01, ** p < 0.05, * p < 0.1.

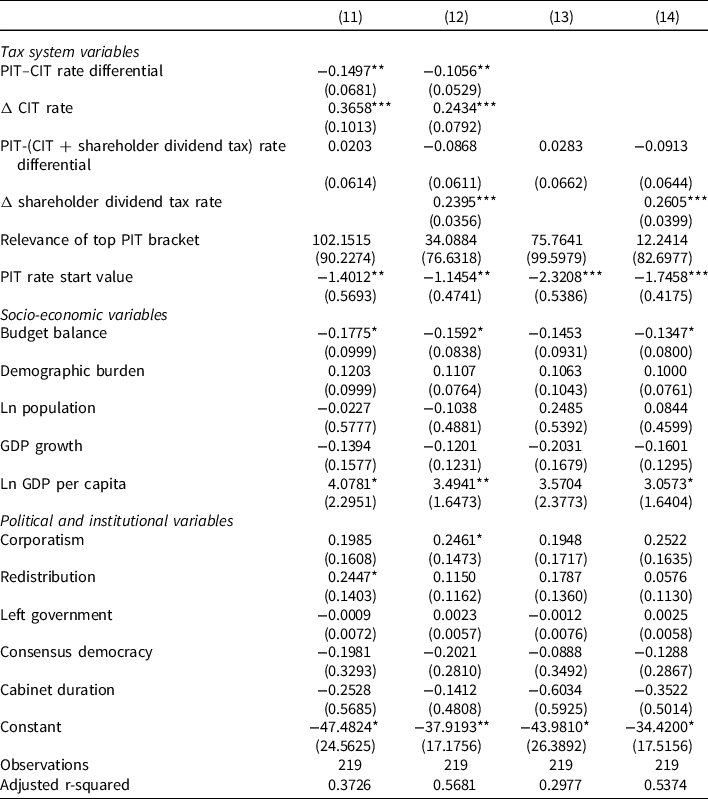

Models 11–14 in Table 4 test the effect of dividend tax regimes (hypothesis 6).Footnote 20 Model 11 includes the differential between the PIT rate and the combined corporate- and shareholder-level dividend tax rate in a cabinet’s first year. Model 12 additionally controls for the cabinet-specific change in the shareholder-level dividend tax rate. The reason for estimating these models separately is that PIT and dividend tax rates are likely to coevolve during a cabinet’s term, especially in synthetic systems that include labour and dividend income in one tax base (Ahrens et al. Reference Ahrens, Bothner, Hakelberg and Rixen2020) – this causes endogeneity problems which may affect the results of model 12. In both models, the PIT-dividend tax differential has no significant effect on PIT rate setting, while the coefficients of the CIT variables remain highly significant.Footnote 21 In models 13 and 14, I exclude the CIT variables to prevent any overspecification. The effects of the PIT-dividend tax differential remain insignificant. In sum, it appears that dividend tax regimes are unable to mitigate the downward effect of CIT competition on top PIT rates.

Table 4. Effects on cabinets’ changes in top PIT rates

Period dummies included. Eicker–Huber–White standard errors in parentheses.

*** p < 0.01, ** p < 0.05, * p < 0.1.

Robustness, additional variables, and alternative model specifications

The online appendix reports the results of several robustness checks and alternative model specifications. Models 15 through 22 add further control variables. I first test Limberg’s (Reference Limberg2019) claim that economic crises trigger top rate increases by activating societal fairness norms, especially when government debt rises. To this end, model 15 adds a dummy variable coded 1 if a government experiences a banking crisis during its term (Laeven and Valencia Reference Laeven and Valencia2018), and interacts it with the change in the debt-to-GDP ratio (Armingeon et al. Reference Armingeon, Wenger, Wiedemeier, Isler, Knöpfel, Weisstanner and Engler2020a). Model 16 includes the interest rate on 10-year government bonds, which was found by Lierse and Seelkopf (Reference Lierse and Seelkopf2016) to be a driver of tax reforms, as higher bond yields constrain debt-financed government spending. Model 17 controls for the effect of trade openness, which may stimulate the government to increase taxation and redistribution in order to protect citizens from the risks of globalisation (Rodrik Reference Rodrik1998). Trade openness is measured by the sum of imports and exports as a percentage of GDP (Armingeon et al. Reference Armingeon, Wenger, Wiedemeier, Isler, Knöpfel, Weisstanner and Engler2020a). Following Swank and Steinmo (Reference Swank and Steinmo2002), model 18 measures the strength of Christian democratic parties instead of left-wing parties.Footnote 22 The remaining models control for determinants of redistribution preferences, as discussed in the theoretical section. Model 19 includes the share of expenditures directed to welfare schemes that mainly benefit the poor (Berens and Gelepithis Reference Berens and Gelepithis2019), retrieved from the OECD’s Social Expenditure Database (OECD 2020a).Footnote 23 Model 20 includes an index of ethnic fractionalisation as a proxy for shared cultural backgrounds (Drazanova Reference Drazanova2020),Footnote 24 and model 21 splits the demographic burden into two variables measuring the respective shares of unemployed and elderly people (Armingeon et al. Reference Armingeon, Wenger, Wiedemeier, Isler, Knöpfel, Weisstanner and Engler2020a). Building on model 21, model 22 replaces the level of unemployment with its yearly change, to better capture fiscal stress. None of the additional variables have significant coefficients and the other results do not change substantially.

Next, I run alternative model specifications. In models 23 and 24, I check whether the coefficients of the tax variables in models 1 and 2 change when excluding the non-tax control variables; they do not, except for the interaction term in model 2 dropping slightly below the 10% significance level. To further check the exogeneity of the tax rate differential, I run a 2SLS instrumental variables regression in model 25, using as an instrument the differential between a country’s top PIT rate and an unweighted spatial lag of other countries’ CIT rates.Footnote 25 Its coefficient remains negative and highly significant. As a Wooldridge test detects country-specific autocorrelation in the original models,Footnote 26 I replace the Eicker–Huber–White standard errors with country-clustered standard errors in model 26. I have opted against this in the original models because of the relatively small number of countries. The results remain unchanged. As an alternative, in model 27, I use country dummies to perform a fixed-effects regression with heteroskedasticity-robust standard errors. The coefficients of the CIT variables remain highly significant. Model 28 accounts for slightly unbalanced panel data, due to missing values of the consensus democracy index for Greece, Portugal, and Spain in the early 1980s. The results do not change substantially when excluding these countries. In model 29, the non-tax control variables, except for the level of redistribution, refer to values in the first half of a cabinet’s term instead of its first year, following Schmitt (Reference Schmitt2016) and Ahrens et al. (Reference Ahrens, Bothner, Hakelberg and Rixen2020).Footnote 27 This model specification is less effective in preventing endogeneity, but it allows for more relevant variation. The results are similar. Models 30 and 31 use country-year data instead of cabinet-periodised data, with 1-year lags for all control variables.Footnote 28 The results hold.

Conclusion

Countries’ differentials between their PIT and CIT rates increase as a result of corporate tax competition. Recent evidence shows that those differentials induce substantial PIT avoidance through the corporate form. Governments should have multiple political and economic reasons to prevent such tax avoidance and limit the PIT–CIT differential. Thus, CIT competition should put downward pressure on PIT rates. Building on the evidence presented by Ganghof (Reference Ganghof2006), I have shown that CIT rate setting is indeed the main driving factor of top PIT rate setting by 226 cabinets in 19 OECD countries between 1981 and 2018. It has a more pronounced and more significant effect than several political, economic, and institutional control variables. It also overshadows the effects of dividend tax rates. The latter finding implies that the erosion of the CIT’s backstop function is unlikely to be mitigated by the recent dividend tax increases seen in several countries. Together with increasing tax rate differentials and converging top PIT rates in advanced OECD countries, these results suggest that governments have little room to manoeuvre in their top rate setting.

While this study’s regression approach complements the existing qualitative evidence on top rate setting, it also has some limitations. First, regression models cannot assess all relevant details of the political process, including the influence of veto players, which are difficult to capture in a single index. This calls for additional qualitative case studies of recent tax reforms. Second, while this study has shown that countries’ PIT rates converge, it could not fully disentangle the underlying processes of international policy diffusion, mainly due to a lack of migration data. In particular, identifying the channels of international competition for rich individuals is a fruitful area of future research. Another limitation is the measurement of shareholder taxes, which was confined to dividend taxation for reasons of data availability. However, shareholders may exploit lenient capital gains tax regimes instead of distributing dividends. Furthermore, statutory shareholder tax rates do not capture the presence of legal provisions preventing profit retention inside corporations. Thus, opportunities for future research include elucidating the effectiveness of such legal provisions in supporting PIT progressivity and compiling internationally comparable data on capital gains tax rates.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/S0143814X23000028

Data availability statement

Replication materials are available in the Journal of Public Policy Dataverse at https://doi.org/10.7910/DVN/VJKD8H

Acknowledgements

I would like to thank the editors of the Journal of Public Policy and three anonymous reviewers for insightful comments and suggestions that helped me to improve this article. Earlier versions of this article benefitted from comments by Koen Caminada, Lars van Doorn, Pierre Koning, Arjen Lejour, Olaf van Vliet, Henk Vording, and Hendrik Vrijburg. I also gratefully acknowledge the feedback from research seminar participants at the Leiden University Institute of Tax Law and Economics, and participants in the Tax Research Network’s Annual Conference at Cambridge University.

Funding

Not applicable.

Competing interests

The author declares none.