Introduction

Mergers and acquisitions (M&A) are a commonly occurring business phenomenon, yet they frequently result in suboptimal post-deal performance (Christensen, Alton, Rising, & Waldeck, Reference Christensen, Alton, Rising and Waldeck2011). The persistence of these negative outcomes is puzzling given the size of the financial stakes, the availability of data, and the amount of academic literature on the topic. Prior research has examined the reasons behind suboptimal M&A performance outcomes, suggesting causes ranging from misaligned organizational-fit (Datta, Reference Datta1991; Vaara, Junni, Sarala, Ehrnrooth, & Koveshnikov, Reference Vaara, Junni, Sarala, Ehrnrooth and Koveshnikov2014), cultural differences (Monin, Noorderhaven, Vaara, & Kroon, Reference Monin, Noorderhaven, Vaara and Kroon2013), managing change (Barratt-Pugh & Bahn, Reference Barratt-Pugh and Bahn2015), and non-complementary competences (Hitt, Harrison, & Ireland, Reference Hitt, Harrison and Ireland2001). Other research suggests contextual factors are important for improving M&A outcomes (King, Wang, Samimi, & Cortes, Reference King, Wang, Samimi and Cortes2021). Taking a context-driven approach (Galvin, Reference Galvin2014) can help account for the heterogeneity of different M&A factors such as the pursuit of capabilities (Arndt, Reference Arndt2019; Kaul & Wu, Reference Kaul and Wu2016), synergy creation (Feldman & Hernandez, Reference Feldman and Hernandez2021), organizational learning (e.g., Cuypers, Cuypers, & Martin, Reference Cuypers, Cuypers and Martin2017; Devers, Wuorinen, McNamara, Haleblian, Gee, & Kim, Reference Devers, Wuorinen, McNamara, Haleblian, Gee and Kim2020), or innovation (e.g., Ahuja & Katila, Reference Ahuja and Katila2001; Han, Jo, & Kang, Reference Han, Jo and Kang2018; Puranam, Singh, & Chaudhuri, Reference Puranam, Singh and Chaudhuri2009). Subsequent meta-analyses (King, Dalton, Daily, & Covin, Reference King, Dalton, Daily and Covin2004; King et al., Reference King, Wang, Samimi and Cortes2021) show that conglomerates, related acquisitions, and firm capabilities appear to be important overarching moderators for M&A financial performance.

However, collectively the results of this body of prior literature have been more inconclusive than accumulative, leading to calls for scholars to develop better understanding of the antecedents, moderators, and context (King et al., Reference King, Wang, Samimi and Cortes2021). Such inconclusive results from previously varied and mixed applications of strategic management theory to capture and explain the dynamic nature M&A phenomenon (Devers et al., Reference Devers, Wuorinen, McNamara, Haleblian, Gee and Kim2020) indicate a clear need for its further refinement, extension, and examination to better clarify the conditions and limits of its predictive potential for M&A performance outcomes. One opportunity to provide some clarity is to take the M&A context into account. Many contextual factors ‘make less clear’ how firms are able to achieve successful M&A outcomes. Those include accounting for pre-M&A antecedents such as multiple M&A motives (Rabier, Reference Rabier2017), prior experience (e.g., Zorn, Sexton, Bhussar, & Lamont, Reference Zorn, Sexton, Bhussar and Lamont2019), and factors affecting the post-merger integration (PMI) process (e.g., Graebner, Heimeriks, Huy, & Vaara, Reference Graebner, Heimeriks, Huy and Vaara2017; Smollan & Griffiths, Reference Smollan and Griffiths2020).

Pre-M&A capabilities leveraged with acquired complementary capabilities provides one opportunity for firms to both achieve pre-determined M&A outcomes while overcoming PMI issues. Prior literature discusses different terms for capabilities such as generic, organizational, dynamic, ordinary, heterogeneous, and homogeneous (Drnevich & Kriauciunas, Reference Drnevich and Kriauciunas2011). In this study, we focus on the fluidness of capabilities across the two categories of dynamic and ordinary as discussed in Winter (Reference Winter2003). Teece (Reference Teece2007) defines dynamic capabilities (DC) as a higher-order capability that refers to a firm's capacity to sense and seize new opportunities, which enables firms to do the ‘right things, at the right time’ (Teece, Reference Teece2014, p. 331) and to reconfigure resources and competencies (i.e., ordinary capabilities). Ordinary capabilities in contrast are about ‘doing things right’ and are defined as a ‘firm's fundamental business’ (Teece, Reference Teece2007, p. 516) with a focus on administrative, operational, and governance functions (Teece, Reference Teece2014). The combination of both a firm's competence (ordinary capabilities) as well as DC can provide a holistic, systematic perspective (Teece, Reference Teece2018) to bridge the complexity valley of future strategic decisions and opportunities. Recent research presents an opportunity to further expand the DC framework to understand how firms' acquisitions of either dynamic or ordinary capabilities (Čirjevskis, Reference Čirjevskis2019; Rios, Reference Rios2021; Schriber & Löwstedt, Reference Schriber and Löwstedt2020; Teece, Reference Teece2020).

Another contextual element that adds to the complexity of understanding both how capabilities and M&A can affect firm outcomes is the level of uncertainty. Uncertainty as a context can be considered a multi-level construct, referring to uncertainty regarding a specific M&A transaction (Kanungo, Reference Kanungo2021), or more broadly within an industry, across industries, or related to global macroeconomic conditions (Jalonen, Reference Jalonen2012). Uncertainty has a special place within the strategic management literature in that multiple theoretical frameworks define boundary conditions based upon the ‘type of uncertainty.’ For example, uncertainty as a result of a fast moving digital, innovative economy poses new implications for firm and industry boundaries (Teece, Reference Teece2020; Witschel, Baumann, & Voigt, Reference Witschel, Baumann and Voigt2022) or as it relates to macroeconomic conditions within a specific industry (e.g., Dess & Beard, Reference Dess and Beard1984; Fainshmidt, Wenger, Pezeshkan, & Mallon, Reference Fainshmidt, Wenger, Pezeshkan and Mallon2019) or across borders (e.g., Zamborsky, Sullivan-Taylor, Tisch, & Branicki, Reference Zamborsky, Sullivan-Taylor, Tisch and Branicki2022). Teece (Reference Teece2020) points out that as firms' boundaries blur, references to DC such as responsive learning and recombination of resources is just as important as contractual issues. Taken a step further, with the context of globalization and the expansion of digital globalization including digital marketplaces, currencies, etc. (e.g., Contractor, Reference Contractor2022; Ingršt & Zámborský, Reference Ingršt and Zámborský2020; Marano, Tallman, & Teegen, Reference Marano, Tallman and Teegen2020), we see industry and country-level boundaries blur and thus firms may need to adapt their strategies and motives for how to achieve and maintain competitive advantage. Our study integrates these literature studies to address how the acquisition of dynamic and ordinary capabilities literature studies (Teece & Leih, Reference Teece and Leih2016; Teece, Peteraf, & Leih, Reference Teece, Peteraf and Leih2016) may enable firms to better respond to uncertainty and influence firm outcomes within the context of M&A (Bhagwat, Dam, & Harford, Reference Bhagwat, Dam and Harford2016; Lin & Liu, Reference Lin and Liu2012).

We compare the acquisition of DC and ordinary capabilities in relation to environmental uncertainty in order to improve the predictive potential of strategic management theory for M&A performance outcomes. Our rationale for taking such a context-driven approach is to highlight the important potential of and boundary conditions of M&A acquired capabilities for performance outcomes under uncertainty. Given that ordinary capabilities may also be considered endogenous to DC (Schriber and Löwstedt, Reference Schriber and Löwstedt2020; Teece, Reference Teece2020), the role of the uncertainty around firms' acquisition of these capabilities combined with DC could help explain the inconclusive and mixed M&A performance outcomes (Devers et al., Reference Devers, Wuorinen, McNamara, Haleblian, Gee and Kim2020; King et al., Reference King, Wang, Samimi and Cortes2021).

Our contribution in this study is to bring additional clarity and complementarity the DC framework within the M&A context and for conditions of high environmental uncertainty. We show how accounting for both ordinary and DC-influence causal antecedents of M&A performance outcomes should improve the predictive power of future research. From our findings we also present practical implications for strategic decision makers both pre- and post-acquisition. During times of uncertainty, firms need to systematically approach how both short- and long-term outcomes are met by potential M&A activity, whether it be for ordinary, dynamic, or both types of capabilities. In our contribution we highlight the complementary nature of dynamic and ordinary capabilities and reinforce a mindset shift to account for both in times of uncertainty to manage short- and long-term implications. While perhaps together both capabilities offer the most predictive power, their integrated effects remain under theorized and examined in the M&A and environmental uncertainty contexts (Čirjevskis, Reference Čirjevskis2019, Reference Čirjevskis2021; Fainshmidt et al., Reference Fainshmidt, Wenger, Pezeshkan and Mallon2019; Pezeshkan, Fainshmidt, Nair, Frazier, & Markowski, Reference Pezeshkan, Fainshmidt, Nair, Frazier and Markowski2016).

Theory review and development

M&A theoretical background

Scholars have examined a number of strategic management theories to provide insights into which acquisitions are more successful than others. Early M&A work leveraged such theoretical lenses as Pfeffer and Salancik's (Reference Pfeffer and Salancik1978) resource-dependence theory (RDT), Oliver Williamson's transaction-based economics (TCE; Williamson, Reference Williamson1979), and Michael Porter's I/O economics-based competitive framework (Porter, Reference Porter1980). More recently, M&A research has leveraged theory lenses from the resource-based view (RBV) popularized by Jay Barney and numerous contemporary scholars (Barney, Reference Barney1991; Wernerfelt, Reference Wernerfelt1995), and the DC perspective (e.g., Eisenhardt& Martin, Reference Eisenhardt and Martin2000; Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007; Teece, Reference Teece2014; Teece & Pisano, Reference Teece and Pisano1994; Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997). All of these theoretical lenses are directly applicable for explaining and predicting some of the relationships, activities, and outcomes taking place in the M&A context.

For example, Porter's I/O economics-based competitive framework (Porter, Reference Porter1980) might theorize M&A activity as a means of increasing power over buyers or suppliers (in the case of vertical integration), as a means of increasing barriers to entry, and/or as a means of reducing competitive rivalry. In conjunction with these explanations, TCE (e.g., Rindfleisch & Heide, Reference Rindfleisch and Heide1997; Williamson, Reference Williamson1979) provides another explanation for M&A activity and outcomes. For example, M&A provides the potential for strategic conflict (and hold-up) if acquisitions can raise rivals’ costs or provide the firms exclusive arrangements where additional benefits can be gained, especially if the resulting acquisition is part of a diversification strategy (DeYoung, Evanoff, & Molyneux, Reference DeYoung, Evanoff and Molyneux2009). Similarly, RDT, the second most utilized theory in M&A research after TCE (Hillman, Withers, & Collins, Reference Hillman, Withers and Collins2009), outlines that M&A motives can include: reducing competition, that is, acquiring a competitor; managing dependence of firm resources, that is, acquiring a supplier; or diversification of operations; lessening the dependence on exchanges (Pfeffer, Reference Pfeffer1976, p. 39).

RBV (e.g., Barney, Reference Barney1991; Wernerfelt, Reference Wernerfelt1995) scholars might theorize M&A activity as a means of gaining access to valuable, rare, and imperfectly imitable (previously external) resources. Such resource-based lenses have been utilized to predict the limitations of diversified growth (via internal development and M&A), as well propose that a focus on specific resources may better explain firm performance (Mahoney & Pandian, Reference Mahoney and Pandian1992). However, prior research also indicates that private information, luck, and private synergy offer additional paths to achieving superior rents from M&A activity (Barney, Reference Barney1991; Mahoney & Pandian, Reference Mahoney and Pandian1992). These paths indicate that a DC perspective could perhaps help explain M&A activity even more effectively, as accounting for internal integration and reconfiguration processes may relate to M&A motives and performance (e.g., Haleblian, Devers, McNamara, Carpenter, & Davison, Reference Haleblian, Devers, McNamara, Carpenter and Davison2009; Rabier, Reference Rabier2017).

For example, DC scholars theorize through a process perspective that M&A activity is a means to enhance ‘the firm's ability to integrate, build, and reconfigure internal and external competencies to address rapidly changing environments’ (Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997, p. 516). Referring to the capabilities perspective as a process that (when utilized by firms) can enhance existing (ordinary or operational) and enable new (dynamic) resource configurations for both short- and long-term competitive advantage. However, such advantages are inherently unpredictable and even more difficult to sustain given the dynamic environments in which they are frequently developed and leveraged (Eisenhardt & Martin, Reference Eisenhardt and Martin2000). The DC perspective requires a firm to assess and reassess its environment and anticipate and adapt to rapid change in order to maintain competitive advantage (Teece, Reference Teece2014). Therefore, this perspective may be particularly useful in determining (and perhaps predicting) the probable outcomes of an acquisition to gain new knowledge (e.g., Castro-Casal, Neira-Fontela, & Álvarez-Pérez, Reference Castro-Casal, Neira-Fontela and Álvarez-Pérez2013), or to learn a new product or capability outside a firm's current knowledge base (Dwyer & Kotey, Reference Dwyer and Kotey2016). Along the lines of these types of theory applications to explain activities, relationships, and outcomes in the M&A context, we seek to further examine and compare two categories of capabilities, dynamic and ordinary.

Short-term benefits to acquisitions of capabilities

If an organization is seeking additional or complimentary (ordinary or operational) capabilities to lower its operation costs and/or improve its efficiencies (Helfat & Winter, Reference Helfat and Winter2011; Newey, Verreynne, & Griffiths, Reference Newey, Verreynne and Griffiths2012), it may employ a local search and seek to acquire types of operational capabilities from similar firms (Arndt & Pierce, Reference Arndt and Pierce2018). This reasoning aligns with TCE logic, which combines economics with aspects of organization theory in an interdisciplinary approach, to form a more modern counterpart of institutional economics (Williamson, Reference Williamson1979). For example, in the pursuit of cost efficiency gains firm takes actions to expand firm boundaries (Dyer, Reference Dyer1996; Williamson, Reference Williamson1991), which can include acquisitions. The independent decision to build internally versus acquire externally still prevails among organizational mindsets (Santos & Eisenhardt, Reference Santos and Eisenhardt2009). The motives for related-diversification types of M&A activity appear to be linked to the acquisition of physical, knowledge-based, and internal financial resources (Chatterjee & Wernerfelt, Reference Chatterjee and Wernerfelt1991; Coff, Reference Coff1999).

The acquisitions between organizations for ordinary capabilities, or more static capabilities (Teece, Reference Teece2020), would include products, technologies, customers, and/or direct competitors that are similar to their core competencies (Capron, Mitchell, & Swaminathan, Reference Capron, Mitchell and Swaminathan2001). Acquisitions for ordinary capabilities can occur for a variety of reasons including not only vertical integration, but also for acquiring technological capabilities or resources for improving operational efficiency (Datta, Pinches, & Narayanan, Reference Datta, Pinches and Narayanan1992; Kusewitt, Reference Kusewitt1985; Moatti, Ren, Anand, & Dussauge, Reference Moatti, Ren, Anand and Dussauge2015). In addition, acquiring ordinary capabilities can provide an organization the further opportunity of operational gains over competitors (Gulbrandsen, Lambe, & Sandvik, Reference Gulbrandsen, Lambe and Sandvik2017).

Acquisitions for more static, core resources such as ordinary capabilities are transparent and easy for the market to evaluate in the short term (Kusewitt, Reference Kusewitt1985). For example, investors are able to easily evaluate the acquisition of additional complementary, operational capabilities from current suppliers or customers by a firm (e.g., Jacobides & Winter, Reference Jacobides and Winter2005; Kim & Finkelstein, Reference Kim and Finkelstein2009) and often can be acquired at lower premiums than capabilities not core-related (Flanagan & O'Shaughnessy, Reference Flanagan and O'Shaughnessy2003). We reason that firms seeking to increase their vertical integration and/or operational efficiency (i.e., through using M&A activity to expand their firm boundaries to extend day-to-day ‘ordinary’ operational capabilities [Winter, Reference Winter2003]) would be less subject to rent dissipation through opportunism and should expect to observe higher levels of operational efficiency than their less vertically integrated competitors. In addition, the acquisition of a new, but closely related product/service could have an almost immediate impact on operational efficiency and can reduce organizational costs (Gerbaud & York, Reference Gerbaud, York, Finkelstein and Cooper2007; Qaiyum & Wang, Reference Qaiyum and Wang2018). We also expect that the market should be able to quickly recognize the value potential in these opportunities, and therefore would view such M&A activity more favorably in the initial year after the acquisition. Thus, stated formally, we would expect the following relationship:

Hypothesis 1a: Firms seeking to improve their performance through ordinary capabilities will be valued positively by the market in the short run (ceteris paribus).

In comparison, firms may opt to make acquisitions outside the organization's competency or knowledge-base (Grant, Reference Grant1996; Teece & Pisano, Reference Teece and Pisano1994) or also sometimes referred to as unrelated acquisitions (e.g., Bergh, Reference Bergh1997; Chatterjee & Wernerfelt, Reference Chatterjee and Wernerfelt1991). Research on DC (Teece & Pisano, Reference Teece and Pisano1994; Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997) provides useful insights for how organizations adapt and manage strategic changes such as through M&A activity (Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007). For example, an organization's M&A goal may be to extend its knowledge base to new areas by acquiring unique resources or capabilities to provide a new source of competitive advantage (Barney, Reference Barney1991; Castro-Casal, Neira-Fontela, & Álvarez-Pérez, Reference Castro-Casal, Neira-Fontela and Álvarez-Pérez2013) depending on the type of industry environment (Helfat & Peteraf, Reference Helfat and Peteraf2003; Teece, Pisano, & Shuen, Reference Teece, Pisano and Shuen1997). In comparison with TCE where opportunism is a central concept and is especially important for assessing economic activity that involves transaction-specific investments in human and physical capital (Williamson, Reference Williamson1979), DC helps explain mixed performance outcomes of unrelated acquisitions (e.g., Bergh, Reference Bergh1997), where the sole purpose is not for gaining external financial resources (Chatterjee & Wernerfelt, Reference Chatterjee and Wernerfelt1991). Likewise, while the acquisition of ordinary capabilities potentially through vertical integration offers protection of specific assets against opportunistic behavior and for dependence-balance to help enhance firm performance (Heide & John, Reference Heide and John1988), in changing dynamic environments for example where the industry is shifting, this level of protection may not be sufficient. It is perhaps, based on these types of applicability arguments, that Teece (Reference Teece2007) notes that ‘transaction costs, the locus of capabilities (inside or outside the enterprise), and appropriability regimes as three relevant classes of factors driving enterprise boundary decisions’ (p. 1331) such that for acquisitions for DC is more appropriate.

DC-based explanations suggest firms may be motivated to pursue M&A activity as means to acquire capabilities, which enable them to do something new (i.e., develop new products or processes, access new markets, etc.; e.g. Dwyer & Kotey, Reference Dwyer and Kotey2016; Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007; Teece, Reference Teece2009). The ‘value-add’ potential of new DC to the firm is however assessed in the short term by the market as an ‘unknown’ (Gerbaud & York, Reference Gerbaud, York, Finkelstein and Cooper2007; Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007). Given the inability for the market to assess this unique ability or organizational fit with a firm's current ordinary capabilities, in the short term, it will likely err on the side of undervaluing the contribution potential of the M&A activity. For example, the market will presume that for such firms, we should expect to observe lower levels of operational efficiency (Gerbaud & York, Reference Gerbaud, York, Finkelstein and Cooper2007; Qaiyum & Wang, Reference Qaiyum and Wang2018). Thus, we would expect that the market should not be able to recognize the value potential in the opportunities for improved operational effectiveness, and therefore would view such M&A activity less favorably in the short term. Thus, stated formally, we would expect the following relationship:

Hypothesis 1b: Firms seeking to improve their performance through acquisitions of dynamic capabilities will be valued negatively by the market in the short run (ceteris paribus).

However, presumably the unique ability of the acquirer to incorporate the (resources and) capabilities of the acquisition into its capability portfolio provides support for the short- and long-term performance implications for the organization (Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007). Given time to integrate and assess, we should be able to expect that firms engaging in M&A activity for DC may be able to recognize the value contribution potential of their expanded capability portfolios through improved operational effectiveness which in turn should lead to higher relative performance. One class of DC particularly well suited for such value creation from M&A activity is acquisition-based DC, defined as the processes a firm uses to obtain new resources through business acquisitions (Capron & Anand, Reference Capron, Anand, Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007). An example of a type of firm that might have such capabilities is serial acquirers that execute numerous acquisitions each year (e.g., Laamanen & Keil, Reference Laamanen and Keil2008; Trichterborn, Knyphausen-Aufseß, & Schweizer, Reference Trichterborn, Knyphausen-Aufseß and Schweizer2016). One concern over the benefits of additional M&A activity is the potential hazard of taxing managers' capacity for integration and thus negatively affecting firm performance (Zorn et al., Reference Zorn, Sexton, Bhussar and Lamont2019). The amount of post-acquisition integration effort and time limits the benefits a firm can achieve within the first few years' post-acquisition. In an acquisition of DC where differences such as in industry, culture, and processes may be accentuated (e.g., Rottig, Reus, & Tarba, Reference Rottig, Reus and Tarba2014), and thus difficulty to integrate the firms would increase. In such case, we would expect that short-run firm performance of DC acquisitions to be lower than ordinary capability acquisitions, which are typically static and more related to core operations functions such as operations or governance (Teece, Reference Teece2014). Thus, more formally, we hypothesize:

Hypotheses 2a and 2b: Firms seeking to improve their performance through dynamic capabilities will show decreased short-run firm performance over firms acquiring ordinary capabilities (ceteris paribus).

Long-term benefits to acquisitions of capabilities

From the DC perspective, capturing new firm value may be inherent in the ability to acquire and uniquely integrate an external offering of a DC like a new technological innovation, and subsequently the value to the organization is not only the technology itself but also executing the process to incorporate it (Čirjevskis, Reference Čirjevskis2017, Reference Čirjevskis2019; Kaul & Wu, Reference Kaul and Wu2016; Peng, Lockett, Liu, & Qi, Reference Peng, Lockett, Liu and Qi2022). The returns on the incorporation of a new process (DC) may however not be fully beneficial to the organization in the short run (Arndt & Bach, Reference Arndt and Bach2015; Qaiyum & Wang, Reference Qaiyum and Wang2018) and require a longitudinal perspective. For example, even in regular PMI activities, the typical integration period is over 1 year (Bauer & Matzler, Reference Bauer and Matzler2014). Given ‘the effect of speed on M&A success depends on the level of external/internal relatedness of the merging firms,’ and the acquisition of ordinary capabilities is more associated with relatedness of business functions than DC, PMI speed is more important and impactful for ordinary capability deals (Homburg & Bucerius, Reference Homburg and Bucerius2006, p. 360). We propose the difference between integrating a target organization for a related product/service (ordinary capabilities) differs from integrating a new process or capability (DC).

As Helfat et al. (Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007) note that M&A, as a firm strategic change, is more successful if the firm acquires, or already possesses, an acquisition-based DC. Likewise, prior research also supports the argument that process performance improves as firms engage in more acquisitions (Bingham, Eisenhardt, & Furr, Reference Bingham, Eisenhardt and Furr2007; Haleblian & Finkelstein, Reference Haleblian and Finkelstein1999). If the acquiring firm possesses an acquisition capability and has developed internal knowledge and learning to successfully integrate, the level of M&A uncertainty and impact should be lower. Applying these DC perspectives to M&A activity, firms with higher levels of DC, such as acquisition-based, overall should fare better in the long-term than other firms pursuing M&A activity.

Additionally, if the acquiring firm is related through a process improvement or technological innovation for example, the encompassing DC would enable the faster, easier post-acquisition integration. Ahuja and Katila (Reference Ahuja and Katila2001) point out that a moderate level of relatedness to the acquiring firm for technological acquisitions and ‘absolute size of the acquired knowledge base has a positive impact on innovation output, while relative size of the acquired knowledge base reduces innovation’ (p. 215). The identification of M&A activity by the relatedness of the patents across the firms aligns with the acquisition potential for a technological DC (Ahuja & Katila, Reference Ahuja and Katila2001) for future long-term benefits to firm innovation. However, the relationship between relatedness and innovation needs expansion to include not only the how but the what (Newey, Verreynne, & Griffiths, Reference Newey, Verreynne and Griffiths2012) by taking into account industry differences between the organizations as well as the environmental uncertainty (Lin & Liu, Reference Lin and Liu2012; Singh, Charan, & Chattopadhyay, Reference Singh, Charan and Chattopadhyay2022).

Overall, the integration of a new process/capability implies more dynamic changes and thus would require potentially additional time to structurally integrate and additional costs due to disruptions (Puranam, Singh, & Chaudhuri, Reference Puranam, Singh and Chaudhuri2009). While the integration time could be reduced by having an acquisition capability as discussed above, not organizations will and some capabilities may be more difficult to incorporate than others. Thus, we would expect that, all else being equal, firm performance would reflect these value differences, and therefore firms focusing on DC acquisitions over the long term, would experience higher levels of performance due to their increased integration capabilities, relative to their more vertically integrated/less capability diversified competitors. Thus, stated formally, we would expect the following relationship:

Hypotheses 3a and 3b: Firms acquiring dynamic capabilities will have a higher relative performance in the long term than will firms acquiring ordinary capabilities (ceteris paribus).

Acquisitions of capabilities and uncertainty

One potential moderator alluded to earlier that may influence both short- and long-term performance implications of M&A activity is environmental uncertainty. The relationship between environmental uncertainty, generally conceptualized through the specific constructs of munificence, dynamism, and complexity (Dess & Beard, Reference Dess and Beard1984; Keats & Hitt, Reference Keats and Hitt1988), and M&A outcomes are highly recognized within the literature (e.g., Coff, Reference Coff1999; Heeley, King, & Covin, Reference Heeley, King and Covin2006). Munificence refers to the level of resources in the environment (Dess & Beard, Reference Dess and Beard1984), while dynamism is characterized as volatility and unpredictability (uncertainty; Miller & Friesen, Reference Miller and Friesen1983). Complexity includes the heterogeneity and range of environmental factors considered in strategic decision making (Duncan, Reference Duncan1972).

When investing in ordinary capabilities, the contribution potential of operational efficiency is theoretically linked to the degree of resources available to the firm in its environment (Fainshmidt et al., Reference Fainshmidt, Wenger, Pezeshkan and Mallon2019). For example, acquisitions of similar firms, within the same industry, are one alternative to manage within highly uncertain environments, however, is limited to firms with the resources to do so (Bowen & Jones, Reference Bowen and Jones1986). Similarly, consider the role of munificence when investing in a lesser-known capability or higher risk circumstances. Under high munificence, firms were more likely to engage in cross-border versus lower risk domestic acquisitions (Zakaria, Fernandez, & Schneper, Reference Zakaria, Fernandez and Schneper2017). In assessing potential technology investments, those resources that constitute strategic assets of predictable value (i.e., are known) or will help in their pursuit of growth are more likely under environments of high munificence (Amit & Schoemaker, Reference Amit and Schoemaker1993; Heeley, King, & Covin, Reference Heeley, King and Covin2006). Thus, in an environment with high munificence, either closely related industry acquisition investments (i.e., known investments to improve operational efficiency) or investment in new rent producing opportunities in emerging domains should be more likely to contribute positively to firm performance (Heeley, King, & Covin, Reference Heeley, King and Covin2006).

In a stable environment, the need to acquire new, unknown capabilities is less valued by the market (Levitt & March, Reference Levitt and March1988) and is shown to correlated negatively with firm performance (e.g., Hill & Rothaermel, Reference Hill and Rothaermel2003). As firms undertake DC investments as part of a firm's exploration activities, undertaking these activities during stable times of abundant resources versus during highly turbulent times, result in poorer performance (e.g., Lant, Milliken, & Batra, Reference Lant, Milliken and Batra1992). For example, if a firm faces a strategic choice on how to expand in an environment through acquisition with plentiful resources, the acquisition of a known choice related to core capabilities is seen as less risky than acquiring a more unknown quantity for a capability (Coff, Reference Coff1999; Gerbaud & York, Reference Gerbaud, York, Finkelstein and Cooper2007). Firms opting to invest in a lesser-known quantity even within an environment of resource abundance still face the increased uncertainty of M&A and thus increased costs to the transaction (Boeh, Reference Boeh2011; Coff, Reference Coff1999; Kanungo, Reference Kanungo2021). Thus, stated formally, we would expect the following relationship:

Hypotheses 4a and 4b: An environment of high munificence will positively moderate the longer-term performance of firms pursuing acquisitions of ordinary capabilities and negatively moderate the longer-term performance of firms pursuing acquisition of dynamic capabilities (ceteris paribus).

However, the contribution potential of operational efficiency is theoretically inversely related to the degree of dynamism and complexity in the firm's environment. Similarly, from DC-based perspectives, the contribution potential of DC is theoretically linked (i.e., economies of scope and flexibility) to the degree of dynamism in the environment (Li & Liu, Reference Li and Liu2014). Given DC rely on rapidly creating situation-specific new knowledge (Eisenhardt & Martin, Reference Eisenhardt and Martin2000), organizations that are already operating in dynamic environments may be better enabled to adapt and change and thus able to gain a competitive advantage (Greenwood & Hinings, Reference Greenwood and Hinings1996; Klarner & Raisch, Reference Klarner and Raisch2013). Thus, in an environment with high dynamism and complexity, acquisition of ordinary capabilities (i.e., to improve operational efficiency) as compared to DC should be less likely to contribute positively to firm performance. Conversely, from DC-based perspective, the contribution potential of DC is theoretically directly related to the degree of dynamism and complexity in the firm's environment (Helfat et al., Reference Helfat, Finkelstein, Mitchell, Peteraf, Singh, Teece and Winter2007; Teece, Reference Teece2007). Firms operating in dynamic environments and taking on new capabilities do face potential issues in maximizing the value. For example, the absorptive capacity, ‘defined as a firm's ability to acquire, assimilate, transform, and exploit new knowledge’ (Wales, Parida, & Patel, Reference Wales, Parida and Patel2013, p. 622) can limit a firm's ability to incorporate the new capabilities acquired through acquisition if the firm has already undertaken other initiatives and the acquisition takes more integration resources than expected. In comparison with other firms that choose to explore known opportunities during turbulent times, firms open to change and forward-thinking will make strategic investments in DC and thus have a higher likelihood of longer-term performance. In regards to environmental complexity, which implies an increase number of rivals when high, firms' strategic decisions must take into account more factors and thus increase in variability (Lin & Liu, Reference Lin and Liu2012) and likelihood of investing (e.g., M&A activity) in more novel capabilities (Nelson & Winter, Reference Nelson and Winter1982). The expected result of those strategic actions however would require additional time to show an effect on firm performance (Zajac & Bazerman, Reference Zajac and Bazerman1991). Overall, in an environment with high dynamism and complexity, acquisition investments in DC will be more likely to contribute positively to firm performance in the aggregate. Stated formally, we would expect the following relationship:

Hypotheses 5a and 5b: An environment of high dynamism and high complexity will negatively moderate the longer-term performance of firms pursuing acquisitions of ordinary capabilities and will positively moderate the longer-term performance of firms pursuing acquisition of dynamic capabilities (ceteris paribus).

Methods

Sample

We construct our sample for testing our hypotheses from Thompson Reuters's SDC Platinum database similar to other recent studies (e.g., Kim & Jin, Reference Kim and Jin2017; Song, Zeng, & Zhou, Reference Song, Zeng and Zhou2021). The use of archival data is most appropriate as it allows for longitudinal analysis over several years and allows us to capture a large number and variety of firms across industries. We restrict our sample to competed deals of publicly traded US acquirers and public or private US targets between 1990 and 2016 and required that the acquirer take a majority stake in the target firm after deal completion. We do so to limit the sample to a single country to reduce the potential confounding effects of differing tax, regulatory, industrial, and public policy among different countries. We then merged the targets and acquirers with the COMPUSTAT database to obtain firm and industry level financial data (discussed later for usage in specific measures). We calculated the market reaction to deal announcement (as cumulative abnormal returns [CARs]), by merging our set of acquires with Center for Research on Security Prices. Our final sample panel consisted of 4,110 M&A deals.

Dependent variables

We construct two short-term measures and one long-term measure of post M&A deal performance. Our short-term measures consist of one market reaction measure and one accounting based measure of deal performance. We calculated market reaction as the CAR three trading days prior to the deal announcement to 255 trading days (one trading year) following the deal announcement using an event study approach (McWilliams & Siegel, Reference McWilliams and Siegel1997). Abnormal returns are calculated based on the Fama–French three factor model (Fama & French, Reference Fama and French1993). This model controls for three risk factors that are significant in predicting future returns: market correlation, firm size, and firm growth opportunities. Our model estimation period was one trading year and ends 46 trading days prior to each M&A event. Zollo and Meier (Reference Zollo and Meier2008) performed a similar analysis and found that short-term event study measure did not affect any of the M&A measures including firm performance. Our second measure of short-run M&A performance short-term firm performance is calculated as the change in return on assets (ROA) from the most recent fiscal year end prior to deal announcement to the subsequent fiscal year end.

Given that the process of change within an M&A deal can have delayed internal effects (e.g., employees) that ultimately may have unexpected long-term financial costs implications (Cartwright & Cooper, Reference Cartwright and Cooper1992), we include long-term financial performance as our third dependent variable. This measure was calculated as the change in acquirer ROA from the fiscal year end subsequent to the deal announcement to the fiscal year 3 years following the deal announcement date. For each of the change in ROA variables, we also controlled for the level of ROA in the fiscal year prior to the deal, as the current level of ROA is a significant predictor of changes in ROA in the future.

Independent and moderator variables

To examine the variation in return outcomes across the dynamic versus ordinary capabilities difference spectrum, we construct the variable deal distance. In our integration and combination of dynamic and ordinary capabilities for the M&A context, we utilize the type of M&A transaction to help distinguish the organization's primary goal. For our purposes, we define acquisitions between organizations for ordinary capabilities that are similar across products, technologies, customers, and/or direct competitors (Capron, Mitchell, & Swaminathan, Reference Capron, Mitchell and Swaminathan2001). In comparison, acquisitions for DC we refer to an acquisition outside the organization's competency or knowledge-base (Grant, Reference Grant1996; Teece & Pisano, Reference Teece and Pisano1994) or also sometimes referred to as an unrelated (e.g., Bergh, Reference Bergh1997; Chatterjee & Wernerfelt, Reference Chatterjee and Wernerfelt1991).

We compute deal distance as a categorical variable based on differences in the acquirer and target six-digit NAICS industry codes, and the value of the measure increases as the industry difference between the acquirer and target increases. For deals where the NAICS code of the acquirer–target pair match, deal distance takes on a value of 1. Deals where only the last two digits of the pair vary, deal distance takes on a value of 2. Deals where the last four digits of the pair vary, deal distance takes on a value of 3. Deals where all six digits of the pair vary, deal distance takes on a value of 4.

As we discussed earlier, we are also interested in the potential moderating effects of Munificence, Dynamism, and Complexity on returns and deal type. Our measures for Munificence and Dynamism follow Dess & Beard's (Reference Dess and Beard1984) use of sales regression and slope, and complexity is the Herfindahl index by the four digit SIC code. We calculate Complexity as the Herfindahl index of sales for the four digit SIC industry classification of the acquirer. These measures, however, are limited given the calculation is based on one industry. So, to take into account firms that are acquiring outside their industry, the acquirer industry was used for the uncertainty measure. While not trying to underscore the complexity for firms that do business in multiple industries (Hill & Hoskisson, Reference Hill and Hoskisson1987), for our purposes if an acquirer spans industries uncertainty was calculated for the primary industry reported in the COMPUSTAT database. An added benefit of using orthogonal industry classifications in our analysis is that the industry classification of the main variable of interest deal distance will not induce unnecessary multicollinearity in models that include our mediator variables.

Control variables

We also include a standard set of controls across our models. Because COMPUSTAT is restricted to publicly traded firms, our control set is restricted to acquirer characteristics available from COMPUSTAT. We control for the sizeFootnote 1 of the acquirer (Total Assets) and the market to book value of equity (Market/Book Equity) because each of these firm characteristics has been shown to predict short-run and long-run returns (Fama & French, Reference Fama and French1993). The variable Operating Income/Sales, calculated as operating earnings prior to depreciation scaled by top line revenue (Moatti et al., Reference Moatti, Ren, Anand and Dussauge2015), is used to assess operating efficiency gains post-M&A provides a comparison to long-term performance for ordinary versus DC deals. For ordinary capability deals that show positive firm performance, operating costs should remain the same or decrease. M&A Deal Count is measured as the number of acquisitions completed by the acquirer in our sample. In reference to the organizational learning literature, the knowledge and skills acquired through previous acquisitions would degrade and would not be considered something utilized on a consistent basis to provide an advantage to an organization (Laamanen & Keil, Reference Laamanen and Keil2008; Reus, Reference Reus, Finkelstein and Cooper2012; Trichterborn, Knyphausen-Aufseß, & Schweizer, Reference Trichterborn, Knyphausen-Aufseß and Schweizer2016). Thus, to account for the degradation of knowledge, M&As completed 5 years or earlier from the current M&A were not included in the total for acquisition capability. We also control for the financial distress for the acquirer using the indicator variable Distress Dummy, which takes on a value of 1 if the acquirer has a market to book value of equity of less than 1 in the fiscal year prior to acquisition. Finally, we control for the transaction value of the deal (Deal Size).

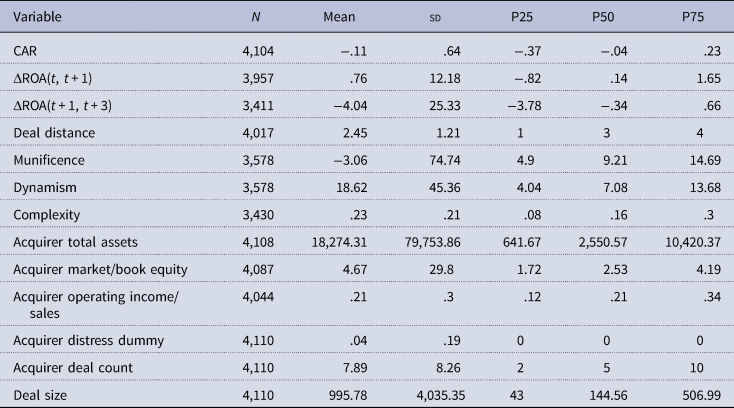

We report the description of our main variables in Table 1. In Table 2 we report summary statistics of our main variables split by dynamic (panel A) and ordinary capability deals (panel B). In Table 3 we report a correlation matrix for our main variables. We winsorize all ratio variables at 1% on both ends of their distribution.

Table 1. Variables and definitions

Table 2. Summary statistics

Table 3. Correlation matrix

Results

Prior to running our regression analyses, we visually inspected all of our data through graphs (i.e., such as histograms, box plots, etc.), and per accepted protocols (Belsley, Kuh, & Welsch, Reference Belsley, Kuh and Welsch2005; Cohen, Cohen, West, & Aiken, Reference Cohen, Cohen, West and Aiken2003), we examined and eliminated (where appropriate) any score from the data set we identified as an outlier through various metrics such that they were greater than recommended values. Additionally, P–P plots were also used to check normality of the data.

We tested our hypotheses employing firm-fixed effects ordinary least squares (OLS) regression models in Stata on our data set. After taking into account the control variables in the first models, we assessed our initial analysis on the direct relationship between industry distance and short- and long-term performance in step 2. We then used the Process procedure to test the proposed moderation relationships as outlined in Figure 1 to determine the significance and amount of the change in R 2. For the full analysis, see Table 4Footnote 2.

Figure 1. Acquisition of capabilities with environmental uncertainty model.

Table 4. Regression results

Robust p value in parentheses.

***p < .01, **p < .05, *p < .1.

In hypotheses 1a and 2a we propose that ordinary capability (DC) acquisitions will experience relatively higher (lower) short-term performance. We test these two hypotheses simultaneously using the following OLS model:

The market reaction dependent variable in model 1 is the CAR of the acquirer over the 1-year trading window (−3,255) around the announcement date of deal i. The independent variable of interest in this model is deal distance which takes on higher categorical values as the industry distance, a proxy for the relatedness representing core operational functions of the firms, between the acquirer and target increases. Hypotheses 1a and 2a predict a negative sign on the deal distance coefficient. We also include our matrix of control variables discussed in the prior section: Total Assets, Market/Book Equity, Operating Income/Sales, Distress Dummy, and Deal Count for the acquiring firm. To control for time trends in our data we also include year fixed effects in our model.

We report the results from model 1 in the first two columns of Table 4. Heteroskedastic robust p-values are reported below the coefficient estimates. In column 1 the model with the full control set, but without deal distance. In column 2 we add deal distance to the model. The coefficient estimate on deal distance (−.019, p-value = .027) suggests the market systemically discounts deals with a larger industry distance. For a one-unit increase in deal distance, the short-run market return is lower by 190 basis points. This finding supports hypotheses 1a and 1b at the 5% level.

We model the direct impact of deal distance, and the moderating impact of industry dynamism, complexity, and munificence on short-term financial performance using the following OLS model:

In model 2, the dependent variable is the change in ROA for the acquiring firm from the fiscal year prior to the deal announcement to the fiscal year after the deal announcement. The independent variables of interest are deal distance and the interaction terms between deal distance and dynamism, complex, and munificence. Like model 1, we also include our matrix of controls and year fixed effects. We report the coefficients and robust p-values of model 2 and variations in Table 4, columns 3 and 4. Our hypotheses predict that the direct relationship between deal distance and short-term performance will be negative. In column 3 we estimate the model with just the control set and year fixed effects. In column 4 we add deal distance and the interaction terms to the model. The coefficient on the munificence interaction term is positive and significant at the 1% level (.027, p-value = .001). The coefficient on the dynamism interaction term is positive and significant at the 1% level (.042, p-value = .000). The coefficient on the complexity interaction term is negative and significant at the 5% level (−1.587, p-value = .020). While we don't find support for the direct relationship between short-term performance and deal distance, the interaction terms on munificence and complexity are consistent with our hypothesis. These results suggest that for dynamic (ordinary) capability deals, munificence positively (negatively) mitigates short-run performance and complexity negatively (positively) mitigates short-run performance. Interestingly, dynamism has a positive (negative) mitigating impact on short-run performance for dynamic (ordinary) capability distance deals.

We model the direct impact of deal distance, and the moderating impact of industry dynamism, complexity, and munificence on short-term financial performance using the following OLS model:

In model 3, the dependent variable is the change in ROA for the acquiring firm from the fiscal year following the deal announcement to three fiscal years following the deal announcement. Again, the independent variables of interest are deal distance and the interaction terms between deal distance and dynamism, complex, and munificence. Similar to our prior models, we include our standard control set and year fixed effects. We report the coefficients and robust p-values of model 3 and variations in Table 4, columns 5 and 6. Our hypotheses predict that the direct relationship between deal distance and long-term performance will be positive. We also predict that the dynamism and complexity (munificence) interaction terms will be positively (negatively) related to long-term performance. In column 5 we estimate the model with just the control set and year fixed effects. In column 6 we add deal distance and the interaction uncertainty terms to the model. The coefficient on the munificence interaction term is negative and significant at the 1% level (−3.24, p-value = .000). The coefficient on the dynamism interaction term is negative and significant at the 1% level (−.237, p-value = .000). The coefficient on the complexity interaction term is positive and significant at the 5% level (−3.354, p-value = .041). These results support our hypothesis that over the long run, acquiring DC leads to higher long-run performance. We also find support for our moderators, munificence, and complexity. Munificence has a negative (positive) mitigating impact on long-run performance for acquiring dynamic (ordinary) capabilities, while complexity has a positive (negative) mitigating impact on long-run performance for acquiring dynamic (ordinary) capabilities. Contrary to our hypothesis, we find that dynamism has a negative (positive) mitigating impact on long-run performance for acquiring dynamic (ordinary) capabilities.

Overall, our results suggest that short-term market returns significantly different between ordinary and DC acquisitions, with ordinary capability acquisitions valued higher by the market. Thus, we find support for hypotheses 1a and 1b such that ordinary capability acquisitions are valued more favorably by the market and DC acquisitions are valued less favorably by the market. In assessing the difference between financial performance in our hypotheses 2 and 3, we find that there is no significant difference between the short-run financial performance by capability type. However, DC acquisitions significantly outperform ordinary capability acquisitions on a long-run accounting basis (5.582, p-value = .000).

In assessing our hypothesized moderator effects of uncertainty (hypotheses 4 and 5), our results have mixed support. Our models suggests that both munificent and dynamic environments positively (negatively) moderate the relationship between deal distance and short-run (long-run) financial performance, while complex environments negatively (positively) moderate the relationship between deal distance and short-run (long-run) financial performance. Our results support prior findings that positive short-term return of DC acquisitions during dynamic times based on firms achieving a competitive advantage through acquiring DC (Bhagwat, Dam, & Harford, Reference Bhagwat, Dam and Harford2016; Li & Liu, Reference Li and Liu2014; Lin & Liu, Reference Lin and Liu2012), which may supersede the effect of the munificent environment. This also aligns with prior findings of firms investing in any capabilities whether dynamic and stable environments show positive effects on long-term firm performance (Karna, Richter, & Riesenkampff, Reference Karna, Richter and Riesenkampff2016). Likewise, investing in ordinary capabilities acquisitions during times of high munificence aligns with our proposal that firms looking to acquire novel and complementary assets perform better in the long-term (Datta, Pinches, & Narayanan, Reference Datta, Pinches and Narayanan1992; Hitt, Harrison, & Ireland, Reference Hitt, Harrison and Ireland2001; Kusewitt, Reference Kusewitt1985; Moatti et al., Reference Moatti, Ren, Anand and Dussauge2015). The change in coefficient values of all three uncertainty variables in both effect size and direction such that all are stronger for long-term performance is interesting and provides an opportunity for future research explore the differences the short versus long-term environmental factors at play.

Discussion

While the DC framework can explain (in part) how competitive advantage may be achieved and perhaps sustained for a period of time, in general, its specific individual application and use within the M&A context for both dynamic and ordinary capabilities is relatively lacking. Through this study we provide important insights for how additional moderators can provide new directions for empirical testing to help solve the enigmatic nature of what makes an M&A successful (King et al., Reference King, Wang, Samimi and Cortes2021), exploring the boundaries of the DC framework (Teece, Reference Teece2020). Taking into account the context of M&A and environmental uncertainty, we highlight the importance of the concerns over risk, resource constraints, and dynamic environments as an example for how the DC framework's application can provide additional explanation. The role of corporate risk illustrates one example of how ‘managers confronting the need for resources choose between a slower process of further enhancing their own organization's capabilities, or acquiring those capabilities rapidly, but at high investment costs, through a merger’ (Ring & Van de Ven, Reference Ring and Van de Ven1992, p. 487). As firms look to balance resource availability, dynamic and complex times, and potential uncertainties of M&A activity, we highlight the importance of accounting for contextual factors an assessing acquisition of ordinary and DC, as scholars look to further expand on the DC framework.

Theoretical implications

Through this study, we make several contributions. We highlight the need to incorporate context to capture the dynamic nature of a phenomenon such as M&A activity and provide insights into both scholars and practitioners for how depending on the organization's objectives: either ordinary or DC can lend to either short- or long-term success. Also, accounting for uncertainty (e.g., Lin & Liu, Reference Lin and Liu2012) within the organizational and industry landscape is needed to appropriately capture the context. In an effort to expand on and explain additional empirical implications of DC, we adopt a contextual approach (Arndt, Reference Arndt2019; Galvin, Reference Galvin2014; King et al., Reference King, Wang, Samimi and Cortes2021). Building on prior capabilities and M&A literature (e.g., Gulbrandsen, Lambe, & Sandvik, Reference Gulbrandsen, Lambe and Sandvik2017; Kaul & Wu, Reference Kaul and Wu2016), we show how we can address boundary conditions of DC framework through incorporating a specific dynamic context and uncertain phenomena.

Given the research focusing on the acquisition of ordinary capabilities in comparison with DC is relatively understudied, which constrains how scholars might interpret acquisition integrations and outcomes, our findings show that context does matter and more research is needed. For example, M&A's dependency on gains from similar production and marketing operations (i.e., operational capabilities; Helfat & Winter, Reference Helfat and Winter2011) elicits more resistance from employees leading to increased integration costs than those M&As focused on complementary benefits (DC; Larsson & Finkelstein, Reference Larsson and Finkelstein1999). This finding contrasts the abundance of studies focused on the positive benefits of acquiring DC (e.g., Čirjevskis, Reference Čirjevskis2021; Kaul & Wu, Reference Kaul and Wu2016). However, the choice of M&A within the context of horizontal growth shows that organizations still invest in M&A even though growing organically is associated with higher operational efficiency (Moatti et al., Reference Moatti, Ren, Anand and Dussauge2015). To fully understand how M&A performance is affected, scholars need to account for the potential acquisition of both ordinary and DC, as well as how they might benefit each other (Teece, Reference Teece2020).

Managerial implications

Given the high failure rate of M&A (e.g., Christensen et al., Reference Christensen, Alton, Rising and Waldeck2011), having a better understanding of the factors at play in M&A outcomes and the associated practical applications could benefit executives to increase their chances of success. In practice, managers should clearly identify the type of capabilities they are looking to both utilize and gain through an M&A, which enables the strategic selection of potential target organizations across industries as well as access and communicate the expected appropriate post-merger implementation strategy and timeline. For example, firms acquiring DC across industries and country-borders should account for both their internal organizational capability and resources to integrate as well as the current macroeconomic conditions. Thoughtfully incorporating the competitive landscape and industry conditions including environmental uncertainty should also provide managers who are engaging in pre-M&A activities potential valuation estimates for meeting their overall M&A motives and objectives, short and long term. For example, executives making acquisitions for DC may want to opt for more communication during the M&A announcement to offer more explanation of expected synergies and thus off-set a potential negative market reaction by investors (Gerbaud & York, Reference Gerbaud, York, Finkelstein and Cooper2007; Song, Zeng, & Zhou, Reference Song, Zeng and Zhou2021).

Future research and limitations

While M&A can provide a faster, more certain, and less expensive way to achieve an organization's objectives, the risks including additional manager attention (Yu, Engleman, & Van de Ven, Reference Yu, Engleman and Van de Ven2005), increased organizational complexity (Larsson & Finkelstein, Reference Larsson and Finkelstein1999), and higher organizational learning curve (Zollo & Singh, Reference Zollo and Singh2004), requires greater investment. Additionally, while we include a previous M&A deal count as well as operational efficiency in our analysis to account for previous M&A experience and integration capability, we cannot control with certainty the success of the integration, which can impact long-term performance (e.g., Graebner et al., Reference Graebner, Heimeriks, Huy and Vaara2017; Zorn et al., Reference Zorn, Sexton, Bhussar and Lamont2019). Future research may consider additional analysis like discourse analysis for indicators of M&A communications, acquisition purpose, and integration capability to compare to our archival measures. Doing so could provide insights into additional variables such as those in Helfat and Martin's (Reference Helfat and Martin2015) call for more research on the impacts of managerial human capital, cognition, and social capital in combination on strategic change and firm performance. The roles of such dynamic managerial capabilities (DMC) within the context of strategic change and M&A could also be considered. In the interest of shareholders and stakeholders in the subsequent firm performance post-acquisition, DMCs could also play both an important theoretical and practical role (Durán & Aguado, Reference Durán and Aguado2022; George, Karna, & Sud, Reference George, Karna and Sud2022). Additional survey data on post-M&A organizations could provide needed subjective data and qualitative interviews and observations could provide further multi-method validity and increased insights into the roles DC, DMC, and uncertainty play in M&As.

Additional considerations in the assessment of organizations performing dynamic and ordinary capabilities acquisitions include taking into account variables like similar managerial style (Helfat & Martin, Reference Helfat and Martin2015) or knowledge-based resources (Castro-Casal, Neira-Fontela, & Álvarez-Pérez, Reference Castro-Casal, Neira-Fontela and Álvarez-Pérez2013; Riviezzo, Reference Riviezzo2013). In this case, the combination of similarity and complementarity aligns with gaining operational efficacy (as defined by TCE) and the addition of new resources and capabilities described by DC (and RBV). Therefore, an acquisition of a similar organization could result in high levels of synergy and broad organizational benefits (Larsson & Finkelstein, Reference Larsson and Finkelstein1999), which may be a further differentiator in long-term firm performance not accounted for in our model. The choice to pursue an M&A can also reflect ‘the similarity of different industries’ human capital or skill requirements,’ which provides another explanation for the likelihood of target choice that is or appears unrelated (Neffke & Henning, Reference Neffke and Henning2013, p. 297). Additionally, the role DMCs play within M&A has a positive relationship with firm performance through integration activities such as communications (Bresman, Birkinshaw, & Nobel, Reference Bresman, Birkinshaw and Nobel1999), leader characteristics, and attitudes (McDonald, Westphal, & Graebner, Reference McDonald, Westphal and Graebner2008). These types of insights might suggest that DC can offer perhaps the potential for better understanding M&A performance outcomes in certain circumstances. Future research could consider assessing this particular level of analysis to provide further evidence of the M&A activity within both the acquisition of dynamic and ordinary capabilities.

Our findings are not without limitations, however. First in assessing the long-term firm performance many other factors could be in play not included in our controls and thus could provide another explanation for our findings. Additionally, our use of financial performance representing long-term firm performance represents the accounting perspective and could misrepresent the true performance. Our study is also limited to M&As of firms that are located in the USA, publicly traded, and performed a domestic acquisition. Extending this study to include international and multi-national acquisitions would add robustness to the generalizability to our findings. Finally, the focus on macroeconomic conditions for environmental uncertainty encompasses munificence and high dynamism and complexity, but other combinations of uncertainty or other ways to assess M&A as well as environmental uncertainty such as by event-based analysis or surveys could provide additional contextual insights.

Conclusion

Through this study, we offer a comparison of the implications of the acquisition of dynamic and ordinary capabilities given the context of environmental uncertainty. Our findings generally support the theoretical underpinnings of the DC framework by associating ordinary versus DC acquisition with short- and long-term firm performance. Our findings show that acquisitions by firms that are outside their industry, while they have lower short-term market returns, do better in the long term in a complex environment while controlling for acquisition experience. The role of market performance when taking into account the potential purpose of the M&A, that is, acquiring new DC, helps explain why previous short-term event studies did not find any impacts of short-term performance (Zollo & Meier, Reference Zollo and Meier2008). Similarly, aligning with prior research that firms will invest in operational capabilities during a more stable environment (i.e., high munificence), acquisitions result in higher long-term performance. Thus, extending the DC frameworks to account for acquisition of capabilities and environmental uncertainty helps better explain market valuation and long-term performance outcomes. Continuing research to further explain the additional roles of dynamic and ordinary capabilities, including potential microfoundation implications (Araújo, Kato, & Del Corso, Reference Araújo, Kato and Del Corso2022), should provide new insights into the outcomes of dynamic and complex phenomena such as M&As.