Introduction

Blockchain technology is a decentralised, distributed ledger system that ensures secure, transparent, and tamper-resistant record-keeping without the need for a central authority. It operates on a peer-to-peer network where transactions are grouped into ‘blocks’ and cryptographically linked to form a ‘chain’, hence the term ‘blockchain’. While originally developed by the pseudonymous Satoshi Nakamoto to underpin the cryptocurrency ‘Bitcoin’, the technology’s applications extend far beyond digital currencies (Berg, Davidson and Potts Reference Berg, Davidson and Potts2019).

A key feature enabled by some blockchain platforms, such as Ethereum, is the notion of a ‘smart contract’. These are self-executing contracts with the terms of the agreement having been directly encoded into the software. These contracts automatically enforce and execute the terms of the contract if and when predefined conditions are met (Szabo Reference Szabo1997, Buterin Reference Buterin2014). This eliminates the need for intermediaries and reduces the potential for human error or malfeasance. There is, however, an important assumption here: the efficacy of smart contracts relies on them being error-free or ‘bug-free’. A bug-free smart contract will always execute as coded – although, perhaps, not necessarily as intended.

The rise of blockchain technology and smart contracts has enabled the creation of a new form of organisation: the decentralised autonomous organisation (DAO). Unlike traditional centralised autonomous organisations (CAOs), which rely on bureaucratic systems and human authority, DAOs are intended to operate without a central authority or management hierarchy. Instead, they are governed by smart contracts and voting by token holders, allowing for decentralised decision-making and autonomous operation.

The first significant DAO, ‘The DAO’, was launched in 2016 on the Ethereum blockchain as a venture capital fund, managed entirely through smart contracts and collective decision-making by token holders. Unfortunately, The DAO suffered a catastrophic exploit due to a vulnerability in its smart contracts, resulting in the loss of US$50 million worth of Ether (the native token on the Ethereum blockchain). Well-known DAOs include Uniswap (a decentralised finance protocol for exchanging cryptocurrencies on the Ethereum blockchain), MakerDAO (a DAO that allows users to create and manage collateralised loans through smart contracts), and ConstitutionDAO (formed in late 2021 with the sole purpose of purchasing an original copy of the US constitution). Certainly, there has been a lot of hype surrounding blockchain technology and DAOs and their potential to be disruptive to existing business practices and organisational forms (Davidson, De Filippi and Potts Reference Davidson, De Filippi and Potts2018, Davidson Reference Davidson2023).

Token holders are individuals or entities who own digital assets, ‘tokens’, that represent a stake in the DAO. These tokens can serve multiple functions: they may confer voting rights, represent ownership shares, or provide access to the DAO’s services. Importantly, token holders control the DAO treasury. The treasury usually holds the DAO’s assets, including cryptocurrencies and tokens. The DAO treasury is managed collectively by the token holders, who can propose and vote on how these funds should be utilised, invested, or distributed. In a DAO, major decisions are typically made through a voting process where token holders can propose changes, vote on proposals, and influence the DAOs direction.

This decision-making process can occur through ‘on-chain governance’, where votes and proposals are directly recorded on the blockchain, ensuring transparency and immutability. For example, a DAO might use on-chain governance to vote on protocol upgrades or fund allocations. DAOs that follow on-chain governance include Compound Finance DAO and Uniswap DAO. Alternatively, ‘off-chain governance’ involves decision-making processes that occur outside the blockchain, such as discussions on forums or social media platforms, before being implemented on-chain. An instance of off-chain governance might be a DAO using a Discord server to debate and refine proposals before they are formally submitted for an on-chain vote. DAOs that follow off-chain practices include MolochDAO and Yearn Finance DAO. See Davidson (Reference Davidson2024b) for more discussion on on-chain and off-chain DAO governance.

This paper addresses two questions: Have these new organisations emerged due to blockchain technology, or are they (simply) manifestations of the so-called electronic markets hypothesis? Secondly, and arguably more importantly, what are the circumstances that make DAOs viable as a unique organisational form? For example, the features of DAOs, smart contracts and token-holder voting, imply that DAOs would not incur agency costs as defined by Jensen and Meckling (Reference Jensen and Meckling1976). Indeed, Bellavitas, Fisch and Momtaz (Reference Bellavitis, Fisch and Momtas2023: 190) suggest, ‘agency costs could be dramatically reduced because the roles of principals and agents overlap’. One of the contributions this paper makes is in exploring that particular point in some detail.

The notion that internal corporate hierarchy can be reduced or even eliminated is not new. Foss and Klein (Reference Foss and Klein2022) outline the history of the idea of a ‘bossless company’ yet argue that the death of hierarchy and management is oversold. They suggest there are two arguments that underpin the notion of a bossless company: one being psychological and the other technological. Here we focus on the latter argument. As Foss and Klein (Reference Foss and Klein2022: 19) report the argument is that internal bureaucracy and management may become redundant because ‘transactions between firms or between workers can be handled seamlessly through electronic interfaces and managed by the blockchain’. Foss and Klein (Reference Foss and Klein2022: 283), however, do not subscribe to that view. They are happy to concede that technological change can result in changes in how authority and hierarchy operate; however, they explicitly reject the notion that technological change will render the management function obsolete. While their arguments are plausible and, even, compelling they do not explicitly discuss blockchain technology in detail, nor do they discuss DAOs at all.

Within the context of DAOs, Frolov (Reference Frolov2021, Reference Frolov2023) is sceptical too. Frolov (Reference Frolov2023: 156) describes the arguments made for DAOs as, ‘techno-utopian promises of eliminating traditional organisations with their hierarchies, high transaction costs, and opportunism’. While at (Reference Frolov2021: 33) he argues:

[DAOs] will never be completely horizontal and will inevitably include significant hierarchical features. They will not create a new economic order associated with dis-intermediated peer-to-peer interactions based on automatic enforcement of rules through smart contracts.

Frolov illustrates his argument by pointing to real-world situations where organisations described as being DAOs do not exhibit features of decentralisation or do have some form of internal management. Similarly, Schmidt and Wagner (Reference Schmidt and Wagner2019) report, however, ‘In reality, examples of successful blockchain applications are scarce’. Frolov may ultimately prove to be correct. Yet early observers of the joint-stock company were also sceptical of its potential for success. Adam Smith (Reference Smith1776 [1976]: 990), for example, pointed to what we now know as the principal-agent problem as being problematic for the success of that organisational form. Furthermore, DAOs as an organisational form are less than 10 years old. Feichtinger, Fritsch, Vonlanthen and Wattenhofer (Reference Feichtinger, Fritsch, Vonlanthen and Wattenhofer2023) suggest that they ‘are still very much re-inventing themselves’. That characterisation, however, is generous. DAOs are not so much ‘re-inventing’ themselves as actually inventing themselves. As a potentially new organisational form, DAOs are very much an experimental organisational form with trial and error being the dominant mechanism for that experimentation.

It is not clear, however, that DAOs are a novel organisational form – Berg, Davidson and Potts (Reference Berg, Davidson and Potts2019: 46), for example, describe them as being ‘the blockchain equivalent of a company’. If that view is correct, then DAOs may not be novel at all. They may simply be a variation of existing business and governance practices that are well-known and well-understood. In this light, DAOs could be seen as the digital evolution of traditional corporate structures rather than a revolutionary departure. Much like corporations, DAOs aggregate resources, align incentives, and facilitate cooperation towards a common goal, but they do so with blockchain technology as the underpinning infrastructure rather than legal contracts and bureaucratic management systems.

This paper explores the concept of DAOs and their potential impact on economic cooperation, coordination, transaction costs, information costs, and governance structures. In particular, the issue to be addressed is what advantage these structures must have over existing organisational structures in order to be a viable alternative to existing organisational structures. As Fama and Jensen (Reference Fama and Jensen1983) have argued, organisational structures must provide some or other benefit to survive. To answer this question, we examine DAOs from the perspective of the electronic markets hypothesis – it may well be that DAOs have emerged simply because the computer revolution has made them viable. It turns out, however, that while the electronic markets hypothesis does explain the emergence of multi-sided markets it does not seem to explain the emergence of DAOs. We then examine DAOs in the context of the Coasian theory of the firm – in particular, looking at the theories of Harold Demsetz (Reference Demsetz1988), Jensen and Meckling (Reference Jensen, Meckling, Werin and Wijkander1992), and Williamson (Reference Williamson1975, Reference Williamson1985, Reference Williamson1999).

Demsetz emphasises that organisational forms must manage information and knowledge costs in addition to managerial costs relative to market transaction costs. Jensen and Meckling suggest that the managers within organisations match workers with knowledge (not always knowledge workers) with the information necessary to make a decision or do a job of work. The cost associated with that task is the creation of agency costs. The suggestion is that DAOs are able to replicate that matching process by having contestable internal markets. The implication being that the existence of those internal markets and the presence of smart contracts results in a situation where agency costs do not manifest within DAOs. If that argument is correct, then that could explain why DAOs have an advantage over traditional centralised organisations. Williamson has provided a framework for classifying organisational governance structures – DAOs, as they are described, are a combination of both market governance and hierarchical governance but are not ‘hybrid’ organisations as envisaged by Williamson. ‘Hybrids’ in his framework are franchise organisations, joint ventures, or strategic alliances.

The contribution this paper makes is in establishing the conditions whereby DAOs are likely to be a novel, and viable, form of economic organisation. The approach taken is to define a techno-optimistic view of DAOs and then examine whether that view of DAO is viable. Building on Davidson, De Filippi and Potts’ (Reference Davidson, De Filippi and Potts2018) definition of DAOs and incorporating that into Williamson’s (Reference Williamson1999) framework, I argue that DAOs must perform well in ‘Incentive Intensity’, ‘Cooperative Adaptation’, and ‘Adaptive Integrity’. Furthermore, token-holder voting and smart contracts must substitute for centralised authority, and the internal control mechanisms within DAOs, i.e. smart contracts and (internal) contestable markets, must fully suppress agency costs. These conditions are onerous. I also argue that DAOs are uniquely associated with blockchain technology and are not simply an extrapolation of the (ongoing) revolution in computer technology. While the technical and coordination challenges associated with writing bug-free smart contracts are not trivial – these challenges include human error, immutability of smart contracts once deployed (especially in ‘on-chain governance’ contexts), and the difficulty of accurately capturing contractual intent in computer code – they are also not economic problems per se. They do, however, add complexity to DAOs as an organisational form. In this paper, I mostly abstract from these more technical issues.

The outline of the paper is as follows. In section ‘From CAOs to DAOs’, I discuss what DAOs are and compare them to centralised organisations. Of particular interest in this section is whether the ‘de’ in decentralised actually matters? What does it mean to be ‘decentralised’ as opposed to ‘centralised’? Section ‘The electronic markets hypothesis’ has a discussion of the electronic markets hypothesis. Have DAOs emerged simply as a result of the computer revolution or are they uniquely associated with blockchain technology? Section ‘Information costs and transaction costs’ discusses the theories of Demsetz and Jensen and Meckling and how they might be applied to DAOs. A conclusion follows.

From CAOs to DAOs

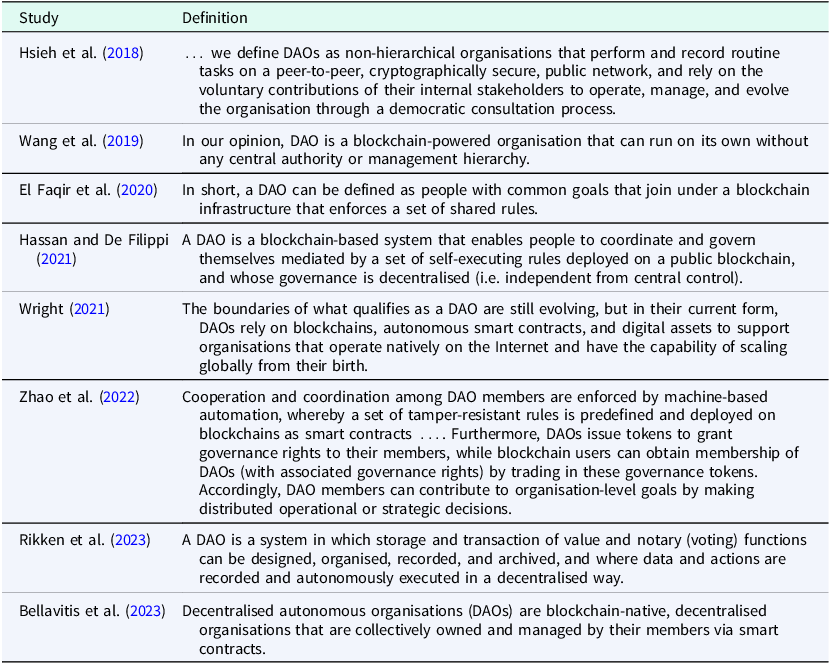

Table 1 below contains several definitions of DAOs drawn from the recent literature. In all these definitions there are five common features. Primarily, they operate without a central authority or management hierarchy, underlining their decentralised nature. Their autonomy is a fundamental attribute, emphasised by the capability of DAOs to function independently based on pre-set rules. These rules are typically encoded as smart contracts, enabling automated and tamper-resistant operation. The use of blockchain technology is a universal element across all definitions, showcasing its crucial role as the underlying infrastructure enabling DAO functionalities. In theory, it may be possible to devise a decentralised organisation using some other technology than blockchain, such as a distributed database or some other centralised infrastructure. At the time of writing, however, there is no substitute technology that can provide the transparency, automation, and trustless environment that blockchain can provide. Additionally, most definitions mention the significant role of tokens in DAO governance structures, granting voting rights and organisational influence to their holders, thereby ‘democratising’ the decision-making process.

Table 1. Selected definitions of DAOs

Each of the definitions, however, also adds a distinctive feature. Hsieh et al. (Reference Hsieh, Vergne, Anderson, Lakhani and Reitsig2018) include voluntary contributions from stakeholders as a significant aspect of DAOs while El Faqir et al. (Reference El Faqir, Arroyo and Hassan2020) specifically mention common goals drawing people together. Hassan and De Filippi (Reference Hassan and De Filippi2021) include the point of DAOs enabling people to coordinate and govern themselves in achieving common goals. Wright (Reference Wright2021) introduces the idea of scalability. Zhao et al. (Reference Zhao, Ai, Lai, Luo and Benitez2022), Rikken et al. (Reference Rikken, Janssen and Kwee2023), and Bellavitis et al. (Reference Bellavitis, Fisch and Momtas2023) all highlight the underlying technology; machine-based automation, the ideas of value storage, transaction, and notary functions, and finally smart contracts.

The modern for-profit corporation, non-profit organisations and, even, some government agencies can be described as being centralised autonomous organisations. There is astonishing variation within these organisational forms as well. The modern corporation, for example, may manifest itself as being a sole-proprietary, or as a partnership, or as private company, or as public company. Each of these organisational forms has differing legal entitlements and consequences. Not-for-profit organisations may be anything from a charity, to a think-tank, to a religious organisation. For almost any form of cooperative human behaviour, there is a form of organisation to facilitate that behaviour. The issue of some importance then is what unique characteristics do DAOs have that existing organisation forms do not have? Of course, there may be more than one such characteristic, but for DAOs to survive as a unique organisational form, there must be at least one such characteristic (Fama and Jensen Reference Fama and Jensen1983).

In the first instance, both CAOs and DAOs are organisations. They facilitate cooperation and coordination amongst different individuals who have some or other common goal or purpose. CAOs and DAOs also tend to be autonomous – they ‘self-govern’ by some internal system of rules. CAOs usually achieve internal self-governance via bureaucratic systems. Bureaucracy has become to be considered a pejorative term, yet as Mises (Reference Mises1944) explains bureaucracy plays an important role in all organisations. By contrast, DAOs achieve self-governance via a series of smart contracts and voting by token holders. There are both advantages and disadvantages to bureaucracy and smart contracts for both CAOs and DAOs. Traditional bureaucracies, for example, offer structured, regulated environments with clear lines of authority, but they may lack flexibility, discourage innovation, and concentrate power. On the other hand, DAOs with smart contracts offer efficiency, transparency, and decentralised control, but they face technical and coordination challenges.

It is in decentralisation that CAOs and DAOs are most different. Decentralisation is the process of dispersing decision functions, powers, or people away from a central authority. Now it is true that successful CAOs, at scale, tend to decentralise decision-making (Williamson Reference Williamson1975, Reference Williamson1985, but see Freeland Reference Freeland2001 and Langois (Reference Langois2023) for a nuanced historical argument). In the context of DAOs, however, decentralisation refers to the lack of a single point of control or authority. Instead, control and decision-making power are spread out among the members or token holders of the organisation, typically through a voting system based on ownership of governance tokens. Unlike CAOs, DAOs are characterised by a lack of hierarchy. In principle, there is no management function within DAOs where resources are directed by authority or fiat. This is a radical departure from conventional organisational structures where decision-making authority often rests with a small executive group or an individual leader.

This radical differentiation between CAOs and DAOs is apparently facilitated and underpinned by blockchain technology, which provides a transparent and tamper-resistant medium for executing decisions and tracking ownership of governance tokens. It is important to recognise that, at the time of writing, the claim that blockchain technology can substitute for managerial and bureaucratic control is an empirical claim that, as yet, remains to be verified. As indicated above, Foss and Klein (Reference Foss and Klein2022) appear sceptical; they write (2022: 21–22):

While the internet, cheap and reliable wireless communication, Moore’s law, miniaturization, information markets, and other technological miracles have induced sweeping changes in manufacturing, retail, transportation, and communication, the laws of economics are still the laws of economics, human nature hasn’t changed, and the basic problem of management and business – how to assemble, organize, and motivate groups of people and resources to produce the goods and services consumers want – is the same as it ever was.

There is another path to examining DAOs. Humans cooperate via different institutional forms – some cooperation occurs with organisational forms such as firms and government (hierarchy) while other forms of cooperation occur through markets. Davidson et al. (Reference Davidson, De Filippi and Potts2018: 654) define DAOs in that fashion – DAOs combine different mechanisms for cooperation into a single structure:

A [DAO] is a self-governing organisation with the coordination properties of a market, the governance properties of a commons and the constitutional, legal and monetary properties of a nation state. It is an organisation, but it is not hierarchical. It has the coordination properties of a market through the token systems that coordinate distributed action, but it is not a market because the predominant activity is production, not exchange.

Davidson et al. (Reference Davidson, De Filippi and Potts2018) base their argument on the notion that blockchain technology is a new institutional technology as opposed to being a new general-purpose technology. It is not (just) the case that blockchain technology will allow people to do things faster or cheaper, but rather it will allow them to do entirely new things or old things differently than before. Again, however, the challenge is whether blockchain technology enables the emergence of an organisational form that is radically decentralised, i.e. an organisational form that has no central authority or management.

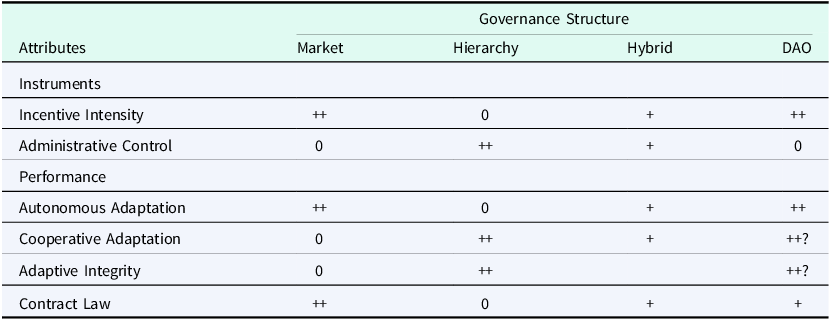

Davidson et al. (Reference Davidson, De Filippi and Potts2018) are very much influenced by Williamson (Reference Williamson1975, Reference Williamson1985) and his distinction between markets and hierarchy. Their definition of DAOs, however, introduces a new element to DAOs – in this view, DAOs combine the properties of markets and organisations to produce both private and public goods. They could be what Williamson (Reference Williamson1985) defines as being a ‘hybrid’ – although the examples of hybrids that he offers (strategic alliances, joint ventures, franchising, and the like) are not autonomous in the way DAOs are autonomous. Table 2 below is adapted from Williamson (Reference Williamson1999: 314 and 336) and adds a column where the governance attributes of DAOs are included. As per Williamson’s (Reference Williamson1975, Reference Williamson1985) theory, markets and hierarchy are mirror images of each other, while hybrids can be viewed as being an organisational compromise. In terms of Williamson’s (Reference Williamson1975, Reference Williamson1985) argument (the Instruments panel) DAOs are more like Markets than they are Hierarchy.

Table 2. Attributes of governance structures

Key: ++ Strong; + Semi-Strong; 0 Weak.

Source: Adapted from Williamson (Reference Williamson1999), Author.

Williamson (Reference Williamson1993: 119) argues, building on Hayek’s (Reference Hayek1945) insight, that adaption to change is an important organisational attribute. He distinguishes between two forms of adaptation: ‘Autonomous Adaptation’ and ‘Cooperative Adaptation’. These two attributes are shown in the performance panel in Table 2.

Autonomous adaptation occurs when individual economic actors make spontaneous adjustments in response to market signals, such as changes in relative prices. This form of adaptation aligns closely with Hayek’s (Reference Hayek1945) view of the market as a decentralised mechanism that enables individuals to respond to new information effectively, even with limited knowledge of the broader system. Each actor independently modifies their behaviour to maximise outcomes based on personal incentives and the information at hand, making autonomous adaptation particularly efficient in environments where transactions are straightforward and can be managed without hierarchical intervention.

By contrast, cooperative adaptation requires intentional and coordinated efforts among economic actors, often facilitated by hierarchical governance structures. This type of adaptation is essential in situations where transactions are complex and interdependencies among actors are significant (see also Williamson Reference Williamson2002). The potential costs of misalignment in such scenarios are high, necessitating a level of coordination and shared understanding that cannot be achieved through market mechanisms alone. Hierarchies within firms enable this cooperative adaptation by ensuring that all components of the organisation are aligned towards common goals, allowing for deliberate and purposeful adjustments in response to changes.

In the context of DAOs, the challenge lies in replicating the cooperative adaptation typically facilitated by hierarchical structures, but without relying on centralised authority. For DAOs to emerge as a novel and viable organisational form, and to survive in the long run, they must demonstrate the ability to engage in cooperative adaptation through decentralised means. This requires that smart contracts and token-based voting systems within DAOs achieve ‘conscious, deliberate, purposeful cooperation’ (Williamson Reference Williamson1993: 119) among participants. While autonomous adaptation may naturally occur within DAOs due to the decentralised nature of blockchain technology, the real test of their viability lies in their capacity to facilitate cooperative adaptation effectively, ensuring that decentralised decision-making processes can align participants’ actions towards collective objectives in a manner that is both efficient and reliable.

Williamson (Reference Williamson1999) further makes the argument that the provision of public goods (he uses the somewhat extreme example of foreign policy) requires a high level of ‘adaptive integrity’. Adaptive integrity, in this context, refers to an organisation’s ability to navigate changing circumstances while preserving its core principles and objectives. It implies managing a trade-off between flexibility, which allows for responsiveness to environmental shifts, and stability, which ensures that the organisation’s fundamental values and goals remain intact. Williamson specifically highlights the role of ‘probity’ – the integrity and ethical conduct expected in the execution of transactions – in maintaining adaptive integrity. While the necessity for higher probity in public goods provision compared to private goods may not be immediately apparent, Williamson (Reference Williamson1999: 332) suggests that the complex, high-stakes nature of (some) public goods, such as foreign policy, demands greater levels of probity to ensure that actions taken in the public interest are carried out with the highest standards of loyalty and rectitude.

In market governance situations, probity is typically enforced through contract law or consumer protection law, which governs market transactions by establishing clear rules and consequences for opportunistic behaviour. Within formal organisations, however, a ‘probity hazard’ arises – this refers to the risk that individuals or groups within the organisation might engage in behaviour that, while not strictly illegal or in breach of contractual obligations, undermines the ethical standards, integrity, or mission of the organisation. This hazard represents a significant cost, as it can lead to actions that compromise the organisation’s credibility, efficiency, or public trust. To mitigate this risk, organisations implement policies and procedures designed to enforce probity, ensuring that all actions align with the organisation’s goals and objectives. Here probity is enforced via employment law.

In the context of DAOs, the challenge of maintaining adaptive integrity falls onto the operation and execution of the smart contracts. It is unlikely that token holders will be in a position to maintain probity and adaptive integrity. It is here that the problems of token-holder control (discussed in more detail below) become problematic.

Token holders may have divergent interests that do not necessarily align with the long-term objectives or foundational values of the DAO. For example, some token holders might prioritise short-term financial gains over the sustained growth and stability of the DAO. In many DAOs, governance decisions suffer from low turnout, Bellavitis, Fisch and Momtas (Reference Bellavitis, Fisch and Momtas2023: 195) report that two-thirds of token holders do not vote on DAO proposals. This lack of participation often results in a concentration of decision-making power in the hands of a few token holders (known as ‘whales’), potentially allowing them to influence outcomes in ways that do not reflect the collective will or best interests of the broader community. For example, in July 2024 there was a successful vote where assets from the Compound Finance DAO were to be diverted to another protocol called ‘goldCOMP’ (Reynolds Reference Reynolds2024). While the transaction was reversed, it did highlight a governance flaw in the Compound Finance DAO. Low voter participation may also be exacerbated by the complexity of proposals being voted on and the coordination challenges associated with getting a diverse and decentralised voter base to vote on issues in a timely manner.

The task of maintaining adaptive integrity must fall to smart contracts. By automating the enforcement of rules and reducing the potential for human error or malfeasance, smart contracts can theoretically perform the function of ensuring probity within a DAO. The effectiveness of smart contracts, however, in maintaining adaptive integrity depends on their design and implementation. In particular, are these contracts sufficiently ‘complete’ to cater to manage the trade-offs in the competing demands of flexibility and stability, align incentives among participants, and mitigate the risk of opportunistic behaviour? Here too, however, there is a major problem. As Williamson (Reference Williamson1985) explains, contracts are incomplete for good reason. In the first instance, bounded rationality is a problem, exacerbated by the complexity and uncertainty of the economic environment. The authors of smart contracts face the same constraints as the authors of any other contract. As Davidson (Reference Davidson2024a) has highlighted, the advent of Artificial Intelligence does not change this situation much.

A further challenge is that many DAOs function with what is known as ‘on-chain governance’. This form of governance relies exclusively on blockchain-based smart contracts and automated processes and offers a high degree of transparency and enforceability. Decisions are made and executed directly on the blockchain, which ensures that all actions are recorded and immutable, thereby reducing the potential for human intervention and error. The smart contracts, however, may also be immutable. The rigidity inherent in immutable smart contracts, however, can pose challenges to flexibility. The DAO may struggle to accommodate unforeseen circumstances or complex adaptations that require nuanced judgement, potentially compromising the DAO’s ability to maintain stability in the face of change. By contrast, some DAOs operate what is known as ‘off-chain governance’. This introduces an element of human discretion and deliberation, allowing for more flexible decision-making processes. Yet this simply returns us to the challenges of token holders voting to maintain probity.

This discussion raises a critical question: Can DAOs, through smart contracts or token-holder governance, effectively replicate the adaptive integrity traditionally maintained by hierarchical structures in formal organisations? While on-chain governance offers the advantage of strict rule enforcement and transparency, it may lack the adaptability required for complex decision-making. Conversely, off-chain governance provides the necessary flexibility but may struggle with maintaining the same level of integrity and alignment of incentives as hierarchical structures. Therefore, the ability of DAOs to preserve adaptive integrity may ultimately depend on how they integrate and balance these governance approaches, ensuring that their core objectives are upheld while remaining responsive to the dynamic nature of their operating environment.

The electronic markets hypothesis

As Foss and Klein (Reference Foss and Klein2022: 20) suggest, the argument for ‘bossless’ organisations is often an extrapolation:

The claims that are made on behalf of the new narrative range from heavy-handed extrapolations of real trends from a few cherry-picked examples to wild speculation.

One promising path to examine DAOs is to extrapolate from a literature that was originated by Thomas Malone in the late 1980s and early 1990s (Malone, Yates and Benjamin Reference Malone, Yates and Benjamin1987, Reference Malone, Yates and Benjamin1989, and Malone and Rockart Reference Malone and Rockart1991). To be fair – this extrapolation is neither ‘heavy-handed’ nor ‘wild speculation’.

Malone and his co-authors proposed a framework for understanding how information technology affects the coordination of economic activity and the structure of organisations. They argued that information technology is not just a computing tool, but a coordination tool that can lower the costs and increase the efficiency of communication and coordination amongst economic actors. They analysed how information technology influences the choice between different coordination structures, such as hierarchies and markets. They predicted that information technology will lead to a shift from hierarchical to market-based coordination, especially for products that are not asset-specific and have simple product descriptions. Taken at face value, that prediction seems consistent with the emergence of DAOs some 30 years later.

They also suggested that information technology would enable new forms of electronic markets and electronic hierarchies, as well as value-adding alliances among companies. Advancements in coordination technology would initially prompt a reduction in coordination costs. This first-order effect would see a substitution from human-led coordination to coordination by information technology. As costs associated with coordination decrease, organisations will tend to favour the efficiency and precision of technology-driven coordination over traditional human-led processes. Due to this reduction in coordination costs, a second-order effect would see an expansion in the total amount of coordination being utilised across the economy. Indeed, the increase in demand for coordination, they argued, could dominate the first-order effect of substituting human-led processes with technology. The third order would see a transition towards employing organisational structures that require more intensive coordination.

These three effects give rise to the so-called ‘Electronic Markets Hypothesis’. This hypothesis posits that information technology will reduce the transaction costs of using markets, such as search costs, bargaining costs, and monitoring costs, and thus make markets more attractive than hierarchies for coordinating economic activity. The Electronic Markets Hypothesis implies that information technology will reduce the benefits of vertical integration and encourage the formation of specialised firms that can compete or cooperate in electronic markets. The Electronic Markets Hypothesis also suggests that information technology will create new kinds of electronic markets that can offer convenience, cost savings, and choice to customers, and that can disrupt conventional marketing and distribution patterns. The Electronic Markets Hypothesis predicts that electronic markets will evolve from biased, to unbiased, to personalised markets, depending on the degree of information asymmetry and customisation involved. This means that as electronic markets develop and mature, they will become more sophisticated in their ability to match buyers and sellers, and to provide customised products and services to individual customers.

That is, more or less, what has happened. In a retrospective analysis, Alt and Klein (Reference Alt and Klein2011: 43) argue:

The past twenty years have seen a dramatic rise of the electronic marketspace …. IT and electronic markets have shaped new industries and transformed entire sectors. This applies to e-business companies (e.g. eBay, Amazon) as well as to software companies (e.g. Microsoft, SAP) and IT service providers (e.g. Google, telecom companies).

The challenge for us, however, is that all of those examples are very large centralised traditional organisations, with a large hierarchy. They provide more examples and successful electronic markets and conclude: ‘All examples … are centralized markets with a market provider acting as intermediary between buyers and sellers’ (Alt and Klein Reference Alt and Klein2011: 46). It seems that the electronic markets hypothesis is seen to explain the emergence of multi-sided markets, but not the kind of decentralisation associated with DAOs. Reimers, Guo and Li (Reference Reimers, Guo and Li2019: 287) describe online platforms as being ‘firms whose product is the organisation of a market’.

Within the electronic markets literature, there is one paper (Kollman, Hensellek, de Cruppe and Sirges Reference Kollmann, Hensellek, de Cruppe and Sirges2020) that speculates about the emergence of ‘blockchain-enabled electronic marketplaces’. They suggest that blockchain technology would be useful in a ‘renaissance of cooperative business model structures in a digital context’ (Kollman et al. Reference Kollmann, Hensellek, de Cruppe and Sirges2020: 281) but they warn that blockchain technology does not solve the problem of incomplete contracts (Reference Kollmann, Hensellek, de Cruppe and Sirges2020: 282).

So while the Malone electronic markets hypothesis seems very promising in explaining DAOs, at present it is very successful at explaining the emergence of platforms where a market is organised by a hierarchy and not where a hierarchy is supplanted by a market.

Information costs and transaction costs

It is apparently easy to construct ‘just so’ stories that explain the emergence of various organisational structures. Benkler (Reference Benkler2002: 403) suggests:

Before going into why peer production may be less costly than property/market-based production or organizational production, it is important to recognize that if we posit the existence of such a third option it is relatively easy to adapt the transaction-costs theory of the firm and the comparative institutional cost theory of property to include it. We would say that when the cost of organizing an activity on a peered basis is lower than the cost of using the market or hierarchical organization, then peer production will emerge.

In this section, I will argue that DAOs constitute ‘peer production’ but Benkler’s suggestion is too easy. It is important, and necessary, to demonstrate the margins where the ‘costs of peering’ outperform the costs of hierarchy and not simply assert that they must do so.

Benkler (Reference Benkler2002: 399–404) makes the argument that peer production is especially important in the information economy. This economy is somewhat different from the industrial economy for four specific reasons. First, information has (some) public good characteristics in that it is non-rival. Furthermore, the primary input to the information economy, viz., information, is also the primary output. Second, the physical costs of information production have declined, as has, thirdly, the communication costs of exchanging information. Finally, the human input to information production, viz. human capital is highly heterogeneous and often specific to an individual. The second and third characteristics of information were discussed in the section ‘The electronic markets hypothesis’. Here we will focus on the organisational consequences of information heterogeneity and specific knowledge.

Harold Demsetz (Reference Demsetz1988) incorporated the notions of information and knowledge into the Coasian theory of the firm. Following Coase (Reference Coase1937), Demsetz agrees that the boundary of the firm is established by the relative transaction costs (i.e. costs of using the market) and management costs (i.e. the costs of organising resources within the firm). Demsetz (Reference Demsetz1988), however, argues that the standard Coasean analysis neglects information and knowledge. Knowledge itself is ‘costly to produce, maintain, and use’ (Demsetz Reference Demsetz1988: 157). Common knowledge allows for greater specialisation and division of labour. Demsetz’ important insight is that economic organisation must take into account that specialised knowledge must be produced, maintained, and used in the production of goods and services. This leads him to the (as he admits, rough and ready) definition that ‘the vertical boundaries of a firm are determined by the economics of conservation and expenditures on knowledge’ (1988: 159).

Jensen and Meckling (Reference Jensen, Meckling, Werin and Wijkander1992) make the argument that economies have the problem of dispersed knowledge (Hayek Reference Hayek1945) and the problem of decentralised decision-making rights. Further, they argue that capitalist economies solve this problem (dispersed knowledge and decentralised decision-making) by colocation. This occurs in practice by decision rights being alienable. Jensen and Meckling (Reference Jensen, Meckling, Werin and Wijkander1992: 112) recognise that their argument makes the existence of firms problematic – but they resolve this problem by simply appealing to Coase (Reference Coase1937) and Williamson (Reference Williamson1975). Firms tend not to make their internal decision rights alienable – but firms must offer other advantages. Firms do decentralise their internal decision-making (Williamson Reference Williamson1975) but that in turn also results in costs. The management of the firm must both decentralise decision-making to ensure the best decisions are being made by the people with the best information and knowledge to do so, and they must do so in a manner that ‘fosters desirable behaviour’ (Jensen and Mecking Reference Hayek1992: 115).

In Jensen and Meckling’s terminology, the decentralisation decision within CAOs can give rise to so-called agency problems (see also Jensen and Meckling Reference Jensen and Meckling1976).

Jensen and Meckling (Reference Jensen, Meckling, Werin and Wijkander1992: 116) then set out the optimal level of decentralisation within the organisation as the trade-off between ‘costs due to poor information’ which decline as the organisation becomes more decentralised, and ‘costs due to inconsistent objectives’ (or agency costs – ‘the sum of the costs of designing, implementing, and maintaining appropriate incentive and control systems and the residual loss resulting from the difficulty of solving these problems completely (Jensen and Meckling Reference Jensen, Meckling, Werin and Wijkander1992: 115)) which rise as the level of decentralisation increases.

I now apply these insights to DAOs. Clearly, DAOs as an organisational form exist to house information and knowledge. The internal processes of DAOs are, in principle, fully transparent and the internal market is (fully) contestable. Those individuals with the best knowledge to undertake specific tasks within a DAO can bid for the work. The wisdom of crowds (in this case the token holders) allocates tasks. In theory, this results in two effects: Costs due to poor information and knowledge should fall very rapidly resulting in faster decentralisation (this result is also consistent with the electronic markets hypothesis) than otherwise would be the case. The second argument is that agency costs within DAOs are suppressed because token holders are making the decisions and not delegating to management.

This is an important and profound insight: for DAOs to be decentralised, as claimed, agency costs (as defined by Jensen and Meckling Reference Jensen and Meckling1976, Reference Jensen, Meckling, Werin and Wijkander1992) must be suppressed.

This suppression of agency cost could occur because the internal incentives are maintained by contestable internal markets (i.e. managerial discretion is eliminated), and the control systems are a series of smart contracts (i.e. there is no deviation between expected behaviour and actual behaviour). It is trivial to observe that a smart contract cannot ever operate opportunistically and as such cannot (itself) be the source of agency costs as envisaged by Jensen and Meckling. If this view is correct, then the residual loss should be low. Applying the Jensen and Meckling logic (that builds on Demsetz) to DAOs, it appears that complete decentralisation can be achieved if, and only if, agency cost are suppressed within the DAO structure. The important point here is that contrary to Bellavitas, Fisch and Momtas (Reference Bellavitis, Fisch and Momtas2023) who argue that DAOs ‘could’ reduce agency costs, those costs must be suppressed. The techno-optimist claim being made for DAO is not that they have smaller hierarchies than do CAOs, but rather that they have no hierarchy.

This insight, that agency costs are suppressed (if indeed they are) in DAOs by their very structure, rests on a very important assumption. That assumption is that collective decision-making is ‘efficient’. A second assumption is that the smart contracts are error-free and execute as intended. This second assumption may or may not be trivial. That smart contracts are error-free and execute as intended is not an economic problem per se (although it could result in huge financial losses), but there is a possibility that smart contracts might be error-free but (still) not execute as expected. Davidson (Reference Davidson2021) and Davidson (Reference Davidson2024c) discuss the issue of decision rights within DAOs – who gets to propose, ratify, implement, and monitor the deployment of smart contracts. To the extent that all these decisions are made by (‘inefficient’) collective decision-making DAOs may be exposed to substantial agency costs and governance risks.

There is a large literature that suggests that collective decision-making is not as ‘efficient’ as might be hoped. Mancur Olsen (Reference Olsen1965), for example, has argued that in the absence of ‘coercion or some other special device to make individuals act in their common interest, rational self-interested individuals will not act to achieve their common or group interests’ (Reference Olsen1965: 2, emphasis original). Contrary to Olsen’s view, however, it could be argued that tokens serve the role of being that ‘special device’ that leads to cooperative behaviour within DAOs. It is not clear how valid that argument would be; modern corporations have shareholders who hold shares, analogous to tokens, and the free-riding problem that Olsen identifies as being problematic in collective decision-making bedevils corporate governance as much as it bedevils political governance (see Davidson Reference Davidson2024c for a discussion of the distinction between corporate governance and political governance in the cryptoeconomics context).

A third assumption, often overlooked in discussions of DAOs, is that decentralisation itself leads to more equitable and transparent governance. Proponents of DAOs frequently argue that decentralised structures inherently disperse power and reduce the likelihood of elite capture or collusion (see Atzori Reference Atzori2017). This assumption, however, warrants closer scrutiny. In practice, DAOs often exhibit significant centralisation of decision-making power among a small group of large token holders – so-called ‘whales’ – who can dominate voting outcomes due to their disproportionate token ownership. This phenomenon mirrors well-known issues in corporate governance, where institutional investors and majority shareholders can wield outsized influence, effectively sidelining minority shareholders. In the context of DAOs, this dynamic may be exacerbated by the pseudonymity and borderless nature of blockchain networks, where the identity and motives of major token holders remain opaque. Furthermore, the liquidity of tokens can lead to speculative behaviour, with short-term profit motives overriding long-term governance objectives. As a result, DAOs may face governance challenges similar to, if not more pronounced than, those encountered in traditional organisations. If decision-making becomes concentrated in the hands of a few large token holders, the DAO’s decentralised promise could devolve into a new form of centralised control, undermining the very rationale for its existence.

Conclusion

The emergence of DAOs, representing a new form of collective action, challenges traditional organisational forms. DAOs are enabled by blockchain technology, which allows for the creation of self-enforcing smart contracts that coordinate the actions of dispersed and anonymous token holders. DAOs can be understood as a response to the problems of collective action and agency costs that arise in CAOs. By reducing the need for intermediaries and centralised authority, DAOs can lower the transaction costs and information asymmetries that hamper efficient resource allocation and value creation. Moreover, by aligning the interests and incentives of all participants, DAOs can mitigate the conflicts of interest and moral hazard that plague traditional principal-agent relationships. These claims suggest that DAOs are a radical and novel organisational form.

These claims, however, rest on an assumption: That agency costs within DAOs are suppressed by internal markets and smart contracts. A more sophisticated version of this argument would be that the costs of operating internal markets within DAOs (collective actions costs) and the costs of setting up the smart contracts are lower than agency costs within CAOs. If that assumption is empirically valid then DAOs are a novel and viable form of organisation. In the same way that Ronald Coase (Reference Coase1937) was able to establish the boundaries of the firm, this paper is able to establish the nature of DAOs. Of course, Coase was writing about organisational forms that were known to exist and known to be viable. DAOs by contrast have been in existence for less than 10 years and are, not yet, known to be viable organisational forms in the long term as a novel organisational form. What this paper has done is to highlight the conditions that must be met for DAOs to be viable. As Davidson (Reference Davidson2024d: 4) points out:

It is not clear how DAOs resolve poor information problems (or what Hayek would define as being a knowledge problem). Hierarchies solve this problem through colocation. How DAOs solve this problem – without resorting to hierarchical solutions is a matter of ongoing research.

As Frolov (Reference Frolov2021, Reference Frolov2023) suggests, it might be the case that DAOs cannot resolve the knowledge problem without resorting to hierarchy. To date, it would appear that DAOs are not outperforming CAOs – certainly not when it comes to viable commercial operations.

Acknowledgements

This research has been supported by an Ethereum Foundation Grant FY23-1053. I would like to thank Darcy Allen and Aaron Lane for the helpful comments on a previous version of this paper.

This paper has been written with the assistance of ChatGPT, Claude, and Perplexity (see Berg Reference Berg2023).