1. Introduction

Financial education has proven to be very effective to both increase financial knowledge and positively affect financial choices (Kaiser et al. Reference Kaiser, Menkhoff, Lusardi. and Urban2022). Virtually, all governments that have developed a financial inclusion strategy have included financial education as a key component. However, the challenge of reaching vulnerable adult populations persists. On one hand, it is difficult for large-scale financial education programs to achieve high levels of take up (Bruhn et al. Reference Bruhn, Lara Ibarra. and McKenzie2014). Even those in greater need of the content may fail to attend in person or even online sessions due to competing uses of their time. On the other hand, national governments tend to face budget restrictions that limit the scope of their work. Even though financial education programs tend to be cost-effective (Kaiser et al. Reference Kaiser, Menkhoff, Lusardi. and Urban2022), they still compete for resources with investments in other sectors such as education, health, or social protection.

The literature supports the intergenerational impact of parental human capital on children’s outcomes. However, the reverse link has been relatively unexplored, despite the potential that children may have to deliver information and knowledge and, ultimately, influence household choices. This paper argues that investing in school-based financial education is a cost-effective way to reach adults. Leveraging data from a large-scale randomized experiment with public high schools in Peru (Frisancho Reference Frisancho2022), this study investigates whether financial education programs delivered in the classroom have spillover effects on parental financial outcomes. Relying on credit bureau records on over 10,000 parents of the children in the experimental sample, this paper supports the presence of intergenerational spillover from children to parents, specially within poorer households and among the parents of daughters.

The data used in this paper come from an impact evaluation of a school-based financial education program targeting grades nine through eleven. The experimental sample included almost 20,000 students in 300 schools from six regions of the country who were tested and surveyed twice during the 2016 academic year, before and after the delivery of the lessons. Parents were not directly targeted by the intervention and were thus not tested on their financial knowledge or surveyed on their financial habits. However, baseline survey records include the full name of the students’ parent or guardian. These identifiers were provided to EQUIFAX, a private credit bureau, who used both first and last names to match parents with their credit records in October 2019. Credit bureau records provide information on credit access and delinquency for the parents of the children in the experimental sample more than 3 years after the intervention was launched.

Financial education lessons in school yield limited average spillover effects on parental financial outcomes, but they lead to sizable intergenerational spillovers from children to parents within poorer households. On average, parents of treated students significantly increase their current debt levels 3 years after the intervention took place, but this effect does not survive multiple hypothesis testing. The positive spillover effects are more salient and robust among parents from poorer households for whom the treatment reduces default probability by 26%, increases credit scores by 5%, and increases current debt levels by 40%.

Heterogeneous treatment impacts by sex of the student suggest that parents are more receptive to girls in relation to money management advice. The financial education lessons have stronger spillover effects among the parents of daughters, who exhibit a significant 6.7% increase in their credit score and a 28% decrease in the size of the portfolio in arrears. The spillover effects among parents of boys are mostly muted; the only significant effect of the treatment is a 3.3 percentage point reduction in the probability of holding outstanding debt.

This study contributes to the scarce literature that studies the role of children in parental human capital accumulation. Two notable studies rely on quasi-experimental variation in education investments to measure the degree of upward intergenerational transmission of human capital (Kuziemko Reference Kuziemko2014; Lundborg and Majlesi Reference Lundborg and Majlesi2018). This study exploits credible random variation in children’s human capital levels to provide evidence on the intergenerational transmission of financial skills from high schoolers to their parents.

This study builds on Bruhn et al. (Reference Bruhn, de Souza Leão, Legovini, Marchetti. and Zia2016), the only other study providing experimental evidence on spillovers from students to parents in terms of financial outcomes, and goes a step forward in at least three ways. First, this study tracks parents over a longer period of time, with over 3 years between the treatment delivery and the measurement of financial outcomes. This longer-term view gives more time to allow the newly acquired knowledge to be shared with the parents and have youth participate more actively in the household’s financial choices. Second, this study focuses on credit bureau administrative records that overcome misreporting biases present in self-reported survey data. Third, the focus on credit and repayment outcomes complement the results in Bruhn et al. (Reference Bruhn, de Souza Leão, Legovini, Marchetti. and Zia2016), who look at the spillover effects of school-based financial education on parents’ probability of preparing a budget, probability of saving, and the share of income saved.

The remainder of this article is organized into five sections. Section 2 goes over the related literature. Section 3 presents the experimental design and describes the data sources. Section 4 presents the estimation strategy, and the main results and Section 5 concludes.

2. Literature review

Human capital accumulation models usually assume away that offspring’s human capital may have spillover effects on parents or other adults in the home. While there is extensive literature on the intergenerational transmission of human capital from parents to children including (Black et al. Reference Black, Devereux. and Salvanes2005; Carneiro et al. Reference Carneiro, Meghir. and Parey2013; Hanushek Reference Björklund, Salvanes, Hanushek, Machin and Woessmann2011; Oreopoulos et al. Reference Oreopoulos, Page and Stevens2003; Sacerdote Reference Sacerdote2005), much less is known about a potential reverse link, where children’s education or health status influence parental outcomes.

Two notable exceptions rely on quasi-experimental variation in children’s education investments to assess their impact on parental human capital. Lundborg and Majlesi (Reference Lundborg and Majlesi2018) rely on the variation introduced by a compulsory schooling reform in Sweden to study the causal effect of children’s schooling on their parents’ longevity. The authors do not find an average impact of children’s education on their parents’ longevity, but they identify heterogeneous effects by gender: female schooling increases the longevity of fathers, particularly in poorer households. In turn, Kuziemko (Reference Kuziemko2014) shows that children’s acquisition of human capital can also discourage adults living with them to make a similar investment. Exploiting variation in compliance with a school reform that replaced bilingual education with English immersion, the authors find that English instruction increased children’s English proficiency, but reduced that of the adults living with them. This result suggests that adults lean on their children’s English skills instead of trying to learn the language themselves.

More recently, Bruhn et al. (Reference Bruhn, de Souza Leão, Legovini, Marchetti. and Zia2016) have focused on the specific case of financial skills. They rely on experimental variation in children’s financial literacy, which is introduced by a financial education program targeting high school students in Brazil, and measure upward spillovers. The authors rely on parents’ self-reported records collected through a survey a year after the treatment delivery and find meager impacts of school-based financial education on parental financial behavior. Footnote 1

Another strand of this literature focuses on the role of children in household choices. Dauphin et al. (Reference Dauphin, El Lahga, Fortin. and Lacroix2011) test the predictions of the collective model using expenditures data in the UK and show that adolescents living with their parents influence household consumption choices. This effect is stronger among children ages 16 to 21 and daughters, irrespective of their age. Belo et al. (Reference Belo, Ferreira. and Telang2016) rely on instrumental variables to test if the provision of broadband to schools fosters household Internet adoption in Portugal. The authors find that broadband use in schools led to a year-over-year increase of 3.5 percentage points in Internet adoption in households with children.

3. Experimental design

3.1 Context

The PISA 2015 assessment of financial literacy exposed the poor levels of financial literacy among youth in Peru. Fifteen-year-old students in Peru scored below the average of the 10 OECD countries and economies that were assessed in 2015. In fact, Peru ranked next-to-last, only surpassing Brazil. Almost half of students in Peru performed at level 1 (compared to 22% among OECD countries and economies), which is below the baseline level of proficiency in financial literacy that is required to participate in society. Only 1% of students in Peru are top performers (compared to 12% on average across OECD countries and economies) (OECD 2015).

Peru’s poor performance in financial literacy is one of the drivers of low levels of financial inclusion, particularly among poor and informal segments of society. While gaps in access persist, the demand for financial services is still limited. This is partly explained by distrust in financial institutions as well as low levels of financial literacy that only deepen trust issues. Footnote 2

In 2015, the Peruvian government launched the National Financial Inclusion Strategy, which included, as a high-priority goal, the provision of financial education as a key policy to foster usage of financial services. A key sub-goal in this agenda was the delivery of school-based financial education to all primary and secondary students by 2021.

3.2 The intervention

Following the launch of Peru’s National Financial Inclusion Strategy in 2015, the Ministry of Education (MINEDU), the Superintendency of Banks and Insurance (SBS), and the Center of Studies (CEFI) of the Peruvian Association of Banks joined forces to develop and implement a financial education program targeting high school students in grades 9 through 11. The program was implemented in full-day public high schools in urban areas in six regions of the country: Lima and Callao, Arequipa, Piura, Junin, Puno, and San Martin.

The treatment consisted of the delivery of financial education lessons during the regular school day. Teachers of the course “History, Geography, and Economics” (HGE) were asked to deliver the lessons during their regular lecture time. The suggested number of hours required to cover all the lessons in the workbooks varied by grade: 16 h in 9th grade, 24 h in 10th grade, and 32 h in 11th grade.

The implementation partners developed materials and activities to support teachers in the delivery of the lessons. First, they developed workbooks following a grade-specific curriculum and using a mix of case analysis, exercises, group activities, and homework. The 9th grade curriculum focused on the differences between needs and resources as well as on budgeting. Tenth graders focused on financial products and services and forward-looking choices, while 11th graders covered topics on becoming a responsible financial consumer and access to/usage of personal information in financial markets. Second, teachers were provided with a hard copy of a teaching guide covering all grades. Finally, teachers were encouraged to attend a 20-h training offered over the course of 5 days. Training participants received transport subsidies, a full meal during each session of the training, and a completion certificate that counted towards the evaluation of their performance.

All intervention activities were conducted during 2016. Teachers’ training workshops took place between mid-February and March. The delivery of the lessons occurred during the second semester of the 2016 academic year, August through December. Students were tested on their financial knowledge and surveyed twice, in May, November, and December. Credit bureau data on parents (or guardians) were requested from EQUIFAX, a private credit bureau in Peru, in October 2019.

After certain logistic restrictions were imposed by the implementation partners, there were 308 eligible public schools for the pilot. This sample was stratified by region, and schools were paired by their similarity within each of the six strata. Footnote 3 The final experimental sample consisted of 150 matched pairs. Within each pair, schools were randomly assigned to either the control or the treatment group.

3.3 Data and measurement

This section provides a brief description of the main data sources used in this study. Section B.1 in the Appendix provides more details and references for each of the scales used.

Survey data were collected for students in the 300 schools in the experimental sample. Within each school, one classroom from each targeted grade was chosen at random. The main study sample is comprised of data from almost 20,000 students in 900 classrooms. The baseline survey collected basic information on socioeconomic characteristics of the household and parental supervision, in addition to a number of scales trying to measure soft skills, preferences, school engagement, and financial behavior. The information on household assets that was collected in the students’ baseline survey was used to construct an asset index as a proxy of socioeconomic status (SES). Low (high) SES is defined as having an asset index below (above) the median in the sample of parents.

The baseline instrument also collected the names and last names of the student’s parent or legal guardian. Notice that in Peru, most individuals have two first names and two last names, a paternal and a maternal surname. Footnote 4 While 17,784 students provided at least one identifier, 17,170 provided names as well as paternal and maternal last names. Footnote 5 These identifiers were provided to EQUIFAX, who used them to match parents with their credit records in October 2019.

EQUIFAX collects credit information from all banks and most microfinance institutions operating in the country. Their records cover all individuals in Peru who have reached legal age, irrespective of previous access to credit from financial institutions or other creditors. EQUIFAX’s records capture an individual’s credit standing at the time of the search. This snapshot provides information on loan balances by repayment status of the loan (i.e., current and past-due debt), source of the funds (i.e., type of lender), and type of loan (i.e., productive versus non-productive loans). Additionally, the data include a credit score prepared by the SBS in relation to financial obligations with banks and other formal lenders. The credit bureau’s data also capture negative records corresponding to delinquency on bills from non-financial institutions (e.g., cell phone, water, electricity, gas), taxes, or credit card balances. These negative signals stay active in the bureau’s database until either the pending balance has been paid off or 5 years have passed since the service provider has reported a late or missed payment. EQUIFAX records also contain basic demographic information such as sex, date of birth, civil status, and education level.

The match rate between the baseline survey and EQUIFAX records is 76%, equivalent to 13,076 parents. This is relatively successful if one keeps in mind that the matching algorithm was only based on text variables, first names, and last names.Footnote 6 The majority of the records matched, 61%, correspond to fathers. This responds to a higher propensity of the students to report fathers rather than mothers in the baseline survey.

The main analysis sample in this paper follows (Frisancho Reference Frisancho2022), who focuses on all students with records in the follow-up survey and exam. This translates into 11,090 parents/guardians from students coming from 296 high schools. Balancing tests for students and parents using this sample are presented in Table A.1. In general, the randomization was successful: no significant differences are detected across treatment and control groups. Table A.1 also provides a few descriptive statistics on the parents’ sample. Over 60% of the sample corresponds to fathers. The average parent is 50 years, old and 55% of the parents have at least completed secondary schooling. Only 9% of the parents in the analysis sample have completed tertiary education (i.e., university or technical degree).

Table 1. Treatment impacts on student participation in household finances

Note: Dependent variables are defined as indicator variables that are equal to one when the students’ self-reports that she talks to parents about household finances or helps them to prepare a household budget in the endline survey. Low (high) SES is defined as having an asset index below (above) the median in the sample of parents. Stars denote significance levels (* 10%; ** 5%; *** 1%) based on unadjusted p-values. Daggers denote significance levels based on the Romano-Wolf adjusted p-values (

![]() $\dagger$

10%,

$\dagger$

10%,

![]() $\dagger\dagger$

5%,

$\dagger\dagger$

5%,

![]() $\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: grade, sex, currently working, received financial education lessons in the past, ratio of household members to bedrooms, asset index, high level of parental supervision, lives with both parents, and has dinner with parents each day of the week. The value of the dependent variable at baseline is also included as a control.

$\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: grade, sex, currently working, received financial education lessons in the past, ratio of household members to bedrooms, asset index, high level of parental supervision, lives with both parents, and has dinner with parents each day of the week. The value of the dependent variable at baseline is also included as a control.

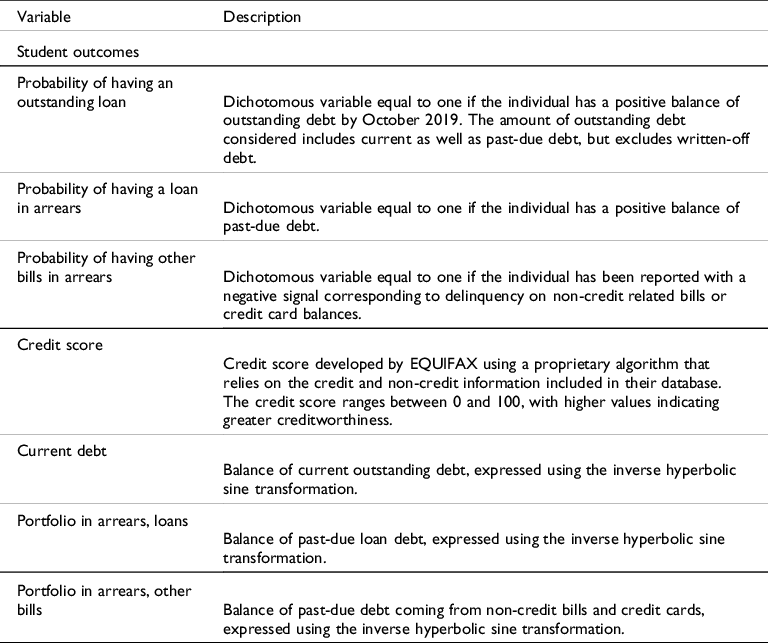

Relying on EQUIFAX’s records, seven outcomes are constructed to measure parental access to credit (probability of having an outstanding loan), repayment outcomes (probability of having a loan or other bills in arrears), credit worthiness (credit score), and level of indebtedness (current and past-due debt, the latter divided by loans and other bills in arrears). The outcomes focusing on access to credit and repayment measure the impacts on the extensive margin. In turn, the variables that assess the level of indebtedness capture the effects on the intensive margin and are thus measured conditional on having an outstanding loan or being in arrears on a non-credit bill or a credit card statement. Footnote 7 All debt variables are expressed using the inverse hyperbolic sine transformation. This is more convenient than using logarithmic transformation as the inverse hyperbolic sine is defined at zero.

See Appendix Table B.1 for more details on the definition of the outcome variables. Table B.2 presents basic descriptive statistics of the distribution of the outcome variables in the control group. Over a third of the parents have an outstanding loan, and only 5% of them have a loan in arrears. In the control group, the average credit score is 62.6 out of 100, but the standard deviation is considerable, at 47.73.

Table 2. Treatment impacts on parents’ credit and delinquency outcomes

Note: Credit and default outcomes measured in October 2019. Debt amounts are measured in US dollars and expressed using the inverse hyperbolic sine transformation. Stars denote significance levels (* 10%; ** 5%; *** 1%) based on unadjusted p-values. Daggers denote significance levels based on the Romano-Wolf adjusted p-values (

![]() $\dagger$

10%,

$\dagger$

10%,

![]() $\dagger\dagger$

5%,

$\dagger\dagger$

5%,

![]() $\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. Correction for multiple testing implemented for two families of outcomes: (i) probability of having debt, probability of having loan arrears, probability of having arrears from other bills, and credit score; and (ii) current debt, debt arrears in loans, and debt arrears from non-credit obligations. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: student’s grade, household asset index, and sex, age, and education level of the parent.

$\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. Correction for multiple testing implemented for two families of outcomes: (i) probability of having debt, probability of having loan arrears, probability of having arrears from other bills, and credit score; and (ii) current debt, debt arrears in loans, and debt arrears from non-credit obligations. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: student’s grade, household asset index, and sex, age, and education level of the parent.

4. Results

4.1 Estimation strategy

The impact of the financial education program on parents’ credit and repayment outcomes is measured as the difference across treatment arms, captured from an intention-to-treat (ITT), OLS regression:

where

![]() ${y_{ijp}}$

denotes credit outcomes of parent

${y_{ijp}}$

denotes credit outcomes of parent

![]() $i$

from a student in school

$i$

from a student in school

![]() $j$

and pair

$j$

and pair

![]() $p$

. The impact of the treatment is measured by

$p$

. The impact of the treatment is measured by

![]() $\beta $

, the coefficient of the indicator of treatment status,

$\beta $

, the coefficient of the indicator of treatment status,

![]() ${T_{jp}}$

, which is equal to one whenever the school was randomized into the treatment group and zero otherwise. All regressions include additional individual and background characteristics,

${T_{jp}}$

, which is equal to one whenever the school was randomized into the treatment group and zero otherwise. All regressions include additional individual and background characteristics,

![]() ${X_{ijp}}$

, as controls, and a set of dummies,

${X_{ijp}}$

, as controls, and a set of dummies,

![]() ${d_{jp}}$

, identifying the pair of schools matched.

${d_{jp}}$

, identifying the pair of schools matched.

The Romano-Wolf correction is implemented for each family of outcomes to deal with potential issues of simultaneous inference (Romano and Wolf Reference Romano and Wolf2005). The Romano-Wolf correction controls the familywise error rate (FWER), that is, the probability of rejecting at least one true null hypothesis in a family of hypotheses under test. The Romano-Wolf correction returns adjusted p-values that do not suffer from inflated rates of Type I error and take into account the dependence structure of test statistics (Clarke et al. Reference Clarke, Romano. and Wolf2020).

4.2 Treatment impacts

Results from the PISA 2018 financial literacy assessment indicate that 89% of 15-year-old students in Peru obtain information about money matters from their parents, guardians, or other adults (OECD 2020). The PISA 2018 survey data also provide an overview of the topics that students tend to discuss with their parents. Almost 85% of the Peruvian students discuss about money for things that the student wants to buy, while around 80% talk about the family budget and the students’ own saving decisions. About 73% discuss students’ own spending decisions, and only 62% talk about news related to economics and finance.

Data from the students’ endline survey show that patterns captured for the sample are aligned with the PISA 2018 survey: 76% of the students talk to their parents about the household’s finances and/or budget while 72% of them help their parents prepare a household budget (see last line in Table 1). The shares of students who participate in household finances are relatively higher among less advantaged households: in low SES households, 80% of the students talk to their parents about finances and 78% of them help with budgeting. In turn, these shares amount to 73% and 67%, respectively, among higher SES households.

The treatment has a very limited impact on students’ participation in household finances. There is a modest average effect on the probability of talking to parents about household finances equivalent to 1.2 percentage points (or 1.6%) and a null effect on the likelihood of helping parents with the construction of household budgets. This may be explained in part by the high baseline levels of the outcome variables.

These high baseline levels of interaction between students and parents suggest the potential of students to be bearers of financial knowledge. Even if the treatment does not increase their participation in household finances, the existing interactions may become richer and more useful for the parents. If students increase their knowledge about personal finances due to the treatment, they may be able to transfer at least part of these gains to their parents. Indeed, Frisancho (Reference Frisancho2022) shows that students experience significant financial literacy gains: relative to the control group, scores in the financial literacy exit exam increased by 0.16 SD in the treatment group. This additional financial knowledge may generate spillovers on parental financial behavior due to increased quality of the information exchanged with parents.

Table 2 shows that the treatment had limited average spillover effects. The financial education program did not lead to significant changes in parents’ credit or repayment outcomes on the extensive margin (see columns 1–3). Nevertheless, the treatment yields a significant increase in the size of current outstanding debt among those with outstanding loans, which is equivalent to a 16.6% increase (see column 5). Even though the effects on credit scores (column 4) and arrears (column 6) are quite noisy, the direction and magnitude of the coefficients support the existence of positive intergenerational effects. However, none of these results survive multiple hypothesis testing, which suggests that the effect on current debt is likely to be a type 1 error.

The results presented here complement, and are aligned with, the evidence presented by Bruhn et al. (Reference Bruhn, de Souza Leão, Legovini, Marchetti. and Zia2016). The authors find that, relative to their counterparts in the control group, parents of treated students were more likely to correctly answer financial knowledge questions related to interest rates and inflation. Moreover, they identify small impacts on financial behavior almost a year after the treatment delivery, both on the probability of saving and the probability of keeping a household monthly budget. Unfortunately, this study did not have further follow-up surveys or administrative records that allow the authors to measure spillover effects after a longer period of time between the treatment delivery and the measurement of financial behavior. They also fail to measure financial outcomes in relation to credit and repayment outcomes.

As Table 1 already showed us that students from households with a lower asset index are more likely to talk to their parents about household finances, Footnote 8 it is natural to test if there are differential spillover effects by SES. Table 3 repeats the main analysis, but for two separate samples of parents from households with low and high SES, as measured by an asset index.

Table 3. Treatment impacts on parents’ credit and delinquency outcomes, by SES

Note: Credit and default outcomes measured in October 2019. Debt amounts are measured in US dollars and expressed using the inverse hyperbolic sine transformation. Low (high) SES is defined as having an asset index below (above) the median in the sample of parents. Stars denote significance levels (* 10%; ** 5%; *** 1%) based on unadjusted p-values. Daggers denote significance levels based on the Romano-Wolf adjusted p-values (

![]() $\dagger$

10%,

$\dagger$

10%,

![]() $\dagger\dagger$

5%,

$\dagger\dagger$

5%,

![]() $\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. Correction for multiple testing implemented for two families of outcomes: (i) probability of having debt, probability of having loan arrears, probability of having arrears from other bills, and credit score; and (ii) current debt, debt arrears in loans, and debt arrears from non-credit obligations. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: student’s grade, household asset index, and sex, age, and education level of the parent.

$\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. Correction for multiple testing implemented for two families of outcomes: (i) probability of having debt, probability of having loan arrears, probability of having arrears from other bills, and credit score; and (ii) current debt, debt arrears in loans, and debt arrears from non-credit obligations. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: student’s grade, household asset index, and sex, age, and education level of the parent.

Contrasting the treatment impacts reported in Panel A and Panel B shows that average spillover effects were hiding important heterogeneity. The treatment led to a 26% reduction in the probability of default on loans among low SES households. Relative to their control counterparts, parents in the treatment group from low SES households also experienced an increase in their credit scores of 5%. Finally, this group also exhibits significant treatment impacts on the intensive margin: current debt levels significantly increased by 40%. There is also a considerable drop in the size of the portfolio in arrears, but this effect is too noisy to become significant. In turn, the spillover effects of financial education on parental credit outcomes are almost muted in high SES households. While the direction of the effects is mostly aligned with those recorded among parents from low SES households, all coefficients are smaller and are not statistically significant. Footnote 9

Greater usage of credit among low SES households suggests that their credit usage was not constrained by the credit market, but that it was instead limited due to their own demand. The material provided in the financial education program teaches children about the workings of the financial market and focuses on the way in which financial products and services can contribute to better management of personal finances. The material also provides students with examples about situations in which the use of credit is not advised and other cases in which it is welfare-improving. The transmission of this information to parents clearly affected the intensity of their use of credit. A positive average treatment effect on current debt suggests that poorer households had the possibility to rely more on credit before the treatment, but they were probably not aware that they could do so and/or were not able to identify productive uses of these services. The accompanying negative effect on the size of the loan portfolio in arrears confirms that the expansion of credit among poorer households was healthy and did not lead to over-indebtedness.

This result is aligned with cross-country evidence from Grohmann et al. (Reference Grohmann, Klühs and Menkhoff2018). They show that usage of financial services is positively correlated with a country’s financial literacy level. More importantly, the average marginal effect of financial literacy on usage is higher for countries with lower private credit to GDP ratios.

Lundborg and Majlesi (Reference Lundborg and Majlesi2018) show that the effects of children on parental human capital may be gendered, as they find that daughters’ education significantly impacted fathers’ longevity. This source of heterogeneity may also be relevant in the case of financial skills if daughters and sons interact differently with parents about money matters. While the treatment did not have differential effects on students’ participation levels on household finances by sex (see Table A.2 in the Appendix), it may be that parents are more receptive to boys, since money management is traditionally associated with masculine traits. Alternatively, since adolescent girls are in general more mature than boys of the same age, their views and advice may be better received by parents.

Table 4 presents the treatment impacts on parental credit outcomes by the sex of their offspring. The results show that the financial education program has stronger spillover effects among the parents of daughters. The treatment leads to a significant 6.7% increase in the credit score of the parents of female students. Within this sample, important changes in the loan portfolio are also recorded: the size of the portfolio in arrears goes down by 28%, while the amount of current debt increases by 18% (though this last effect is not significant). Parents of girls also record a slight decrease in the probability to have past-due debt. Among the parents of boys, most of the effects are muted. The only significant effect of the treatment is a reduction in the probability of holding outstanding debt by 3.3 percentage points.

Table 4. Treatment impacts on parents’ credit and delinquency outcomes, by students’ sex

Note: Credit and default outcomes measured in October 2019. Debt amounts are measured in US dollars and expressed using the inverse hyperbolic sine transformation. Low (high) SES is defined as having an asset index below (above) the median in the sample of parents. Stars denote significance levels (* 10%; ** 5%; *** 1%) based on unadjusted p-values. Daggers denote significance levels based on the Romano-Wolf adjusted p-values (

![]() $\dagger$

10%,

$\dagger$

10%,

![]() $\dagger\dagger$

5%,

$\dagger\dagger$

5%,

![]() $\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. Correction for multiple testing implemented for two families of outcomes: (i) probability of having debt, probability of having loan arrears, probability of having arrears from other bills, and credit score; and (ii) current debt, debt arrears in loans, and debt arrears from non-credit obligations. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: student’s grade, household asset index, and sex, age, and education level of the parent.

$\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. Correction for multiple testing implemented for two families of outcomes: (i) probability of having debt, probability of having loan arrears, probability of having arrears from other bills, and credit score; and (ii) current debt, debt arrears in loans, and debt arrears from non-credit obligations. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: student’s grade, household asset index, and sex, age, and education level of the parent.

All in all, these results suggest that school-based financial education can have a multiplier effect on the adults surrounding the direct beneficiaries, particularly when focusing on specific sub-groups. The sizeable impacts on the credit outcomes of parents from poorer households and with female offspring confirm that there is an intergenerational transmission of knowledge within the household. Natural interaction of the parents with their teenage children seems to ease access to financial knowledge for parents of sub-groups of students in the treatment group. While this study was not able to measure the impact on the knowledge of parents, the treatment effects on parental financial literacy in Bruhn et al. (Reference Bruhn, de Souza Leão, Legovini, Marchetti. and Zia2016) suggest that adults are not leaning on their children to make choices, but that instead they are learning with them and applying this knowledge when making household financial choices.

The heterogeneous results by SES highlight the opportunity that school-based financial education programs provide when trying to reach vulnerable segments of the population. On one hand, poorer individuals usually have lower levels of financial literacy (Lusardi Reference Lusardi2015). On the other hand, adults in poorer households are more likely to hold informal jobs and depend on variable revenue sources that imply high opportunity costs when directly targeting them as beneficiaries of financial education programs. Targeting their children provides a cost-effective mechanism to reach those facing relatively greater knowledge gaps.

The heterogeneous results by sex of the offspring suggest that daughters tend to be a more effective channel to transmit financial knowledge and information to parents. This result is interesting since the PISA 2018 results show that girls in Peru outperformed boys in reading, but were outperformed by boys in mathematics (Avvisati et al. Reference Avvisati, Echazarra, Givord and Schwabe2020). Daughters' greater influence over parental financial choices may thus be related to other household internal dynamics that position them as having a stronger voice in family money matters. These gendered effects, aligned with Lundborg and Majlesi (Reference Lundborg and Majlesi2018), may also be driven by the traditional view of women as being better suited to provide care to children and aging parents.

Notice that the spillovers identified may be context specific, since a high share of high school students report that they either discuss household finances with their parents or directly contribute to the preparation of a family budget. Nevertheless, this is still a novel and valuable result since these spillover effects manifest in the absence of any direct guidance or instruction for students to share the content of the financial lessons with the adults in the household. This suggests that school-based financial education programs that explicitly involve parents (either through homework or by providing them with useful material relying on the children as messengers) may be effective in providing financial knowledge and information to adults.

5. Conclusion

Since the 2008 financial crisis, the financial literacy agenda has become much more salient and has received increasing support from multilateral organizations, governments, and the private sector. While considerable progress has been made in providing financial education to children and youth in educational institutions, the challenge of reaching vulnerable adult populations persists. First, funding shortages limit both public and private large-scale initiatives. Second, capturing the interest of adults is quite complicated, as they may perceive low net returns due to high opportunity costs.

This paper puts forward an alternative way to reach adults, particularly the most vulnerable for whom a bad financial choice may have larger negative effects on welfare. Leveraging data from a large-scale experiment with public high schools in Peru and credit bureau records on over 10,000 parents of the targeted youth, this paper supports the presence of intergenerational spillovers from children to parents. The positive spillover effects are more salient and robust among parents from poorer households: among them, the treatment reduces default probability by 26%, increases credit scores by 5%, and increases current debt levels by 40%. The treatment also has stronger effects among the parents of daughters, who experience a significant 6.7% increase in their credit score and a 28% reduction in their loan portfolio in arrears.

These results highlight the opportunity that school-based financial education programs provide when trying to reach adults in vulnerable segments of the population in a cost-effective way. They also uncover important household dynamics that suggest that boys and girls have differential voices within the household in relation to money matters. Moreover, this paper contributes to the experimental evidence that shows robust and cost-effective returns to the investment in financial education programs. Frisancho (Reference Frisancho2022) showed that the effects of the Peruvian financial education program on teachers were sizeable. This paper shows that other adults interacting with the children, that is, their parents, may also rip some of the gains of the provision of financial education. This only makes the case for financial education stronger.

A. Appendix

Table A.1 Balance check in the endline sample

Note: Data from the baseline survey and exam for the sample of students present at the exit survey and exam. Test for joint covariates orthogonality

![]() $p - value = 0.5269$

. Significance levels (* 10%; ** 5%; *** 1%) captured through OLS estimation accounting for clustered (school) standard errors. Standard errors (deviations) of coefficients (control means) are in parentheses.

$p - value = 0.5269$

. Significance levels (* 10%; ** 5%; *** 1%) captured through OLS estimation accounting for clustered (school) standard errors. Standard errors (deviations) of coefficients (control means) are in parentheses.

Table A.2 Treatment impacts on student participation in household finances, by students’ sex

Note: Dependent variables are defined as indicator variables that are equal to one when the students’ self-reports that she talks to parents about household finances or helps them to prepare a household budget in the endline survey. Stars denote significance levels (* 10%; ** 5%; *** 1%) based on unadjusted p-values. Daggers denote significance levels based on the Romano-Wolf adjusted p-values (

![]() $\dagger$

10%,

$\dagger$

10%,

![]() $\dagger\dagger$

5%,

$\dagger\dagger$

5%,

![]() $\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: grade, currently working, received financial education lessons in the past, ratio of household members to bedrooms, asset index, high level of parental supervision, lives with both parents, and has dinner with parents each day of the week. The value of the dependent variable at baseline is also included as a control.

$\dagger\dagger\dagger$

1%) resulting from 1000 bootstrap replications. OLS estimates, standard errors clustered at the school level are reported in parentheses. All specifications include a set of dummy variables that correspond to the matched pairs of schools and the following set of controls: grade, currently working, received financial education lessons in the past, ratio of household members to bedrooms, asset index, high level of parental supervision, lives with both parents, and has dinner with parents each day of the week. The value of the dependent variable at baseline is also included as a control.

B. Data appendix

B.1 Data sources

Survey data. Survey and exam data were collected in the 300 schools of the experimental sample, both at baseline and endline. Within each school, one classroom per grade was chosen at random.

Students’ baseline survey collects basic information on socioeconomic characteristics of the household, students’ future aspirations, parental supervision, truancy, and the number of hours the student works per week. The survey also measures students’ school engagement Footnote 10 and collects data on previous exposure to financial education programs. Financial behavior is measured in the survey through several constructs: holding savings, budgeting, consumption and saving habits, and financial autonomy. Footnote 11 The survey also measured monthly cash flows derived from different income sources including allowances, gifts from family and friends, and labor. Additionally, the questionnaire gathers information on five personality constructs and preferences that may influence financial choices: conscientiousness, self-control, intertemporal preferences, impulsiveness, and risk aversion. Conscientiousness, which is closely related to deliberative thinking, was measured using the Big Five Scale for this attribute (John Reference Pervin, John, John and Srivastava1999). Self-control is measured by Tangney et al. (Reference Tangney, Baumeister. and Boone2004)’s scale, which attempts to measure people’s ability to control their impulses in general, not only those related to financial behavior. Impulsiveness is measured by the Barratt Impulsiveness Scale (Orozco-Cabal et al. Reference Orozco-Cabal, Rodrguez, Herin, Gempeler. and Uribe2010), which reflects six correlated first-order constructs (attention, motor, self-control, planfullness, cognitive complexity, perseverance, and cognitive instability), which in turn, form three second-order factors (attention, motor, and non-planning). The survey focuses on the attention and non-planning factors only. Time inconsistency is defined as in Ashraf et al. (Reference Ashraf, Karlan. and Yin2006). These preferences and personality traits are measured relying on extensively tested scales that are specifically designed to be self-rated.

The design of the questionnaire was challenging task as it included several educational and psychological scales, as well as financial literacy questions. The instrument required several rounds of piloting and in-depth interviews with adolescents to adapt well-known scales to Peruvian high schoolers.

Credit bureau records. EQUIFAX collects credit information from all banks and most microfinance institutions. Their data contains records on all individuals at or above legal age, irrespective of previous access to credit from financial institutions or other creditors.

EQUIFAX’s data used in this study corresponds to a single snapshot of credit behavior in October 2019. The records gathered include information on loan balances by repayment status of the loan (i.e., current and past-due debt), source of the funds (i.e., type of lender), and type of loan according to intended purpose (i.e., productive loans funding micro-enterprise and small business and non-productive loans including consumption loans, credit card debt, mortgages, and auto financing). The credit bureau’s data also capture negative records corresponding to delinquency on non-credit related bills (e.g., cell phone, water, electricity, gas, etc.), taxes, or credit card balances. Negative signals from non-credit bills stay active in the bureau’s database until the pending balance has been paid off or until 5 years have passed since the service provider has reported a late or missed payment. By law, EQUIFAX has to stop disclosing negative records after this exposure period expires, even if the debt has not been collected.

B.2 Variables

Table B.1. Variables and description – Outcome variables

Table B.2. Outcome variables: Descriptive statistics in the control group