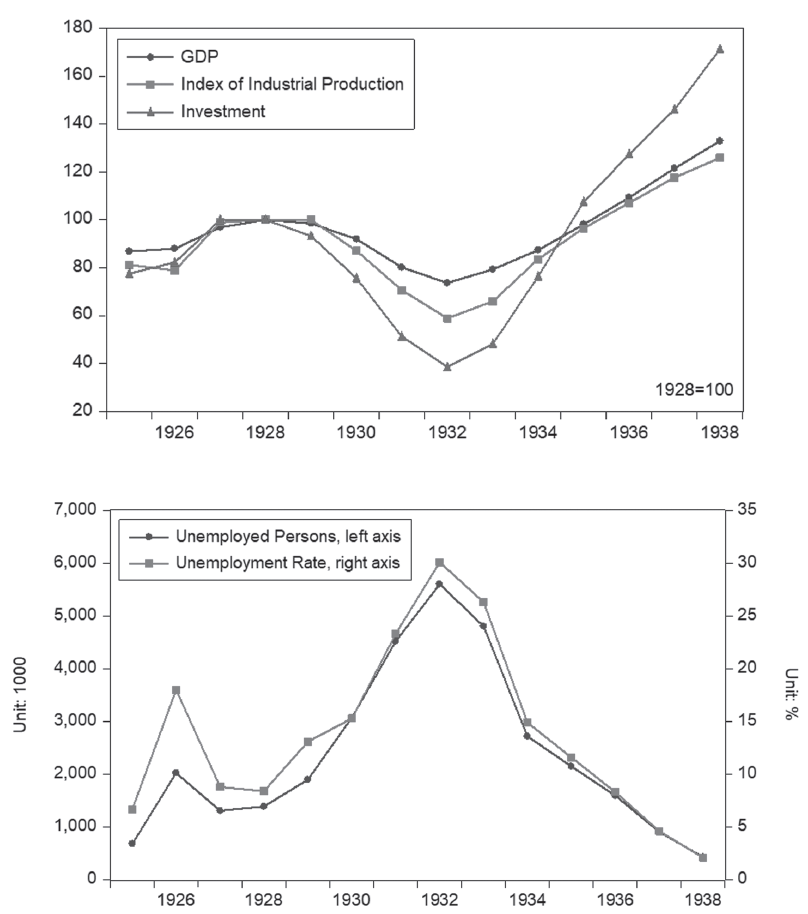

The Great Depression hit Germany harder than other industrialized countries. Between 1928 and 1932, the country’s GDP declined by 26 percent, its index of industrial production by 41 percent, and investment by 62 percent (see Figure 1). The number of unemployed persons rose from 1.4 to 5.6 million, with the unemployment rate gaining from 8 percent to 30 percent. The sharpest decline in economic activity corresponded to the largest increase in unemployment during the 1930–1932 period. Germany’s economy began to recover in 1933, and economic activity and unemployment returned to their 1928 levels by 1936.

Figure 1 GERMANY’S ECONOMIC INDICATORS, 1925–1938

Notes: GDP, Index of Industrial Production, and investment have been normalized so that their values in 1928 are equal to 100.

Sources: GDP (Ritschl and Spoerer Reference Ritschl and Spoerer1997); Index of Industrial Production (Palgrave Macmillan Ltd., eds. 2013); investment (Ritschl 2002a); unemployed persons (Rahlf Reference Rahlf2015); unemployment rate (Rahlf Reference Rahlf2015).

In the midst of this severe recession, Heinrich Brüning—the Weimar Republic’s Reichskanzler from April 1930 to May 1932, who was known as the “hunger chancellor”—adopted a series of austerity policies that increased tax rates while at the same time cutting state welfare benefits and civil service pay. Although foreign exchange controls (Devisenbewirtschaftung) were introduced by the middle of July 1931, Germany never abandoned its Reichmark’s parity against gold in favor of floating, even after Great Britain left the gold standard in September 1931.

In this paper, we reassess the debate ignited by Knut Borchardt, namely, the question of whether floating the Reichsmark would have yielded better outcomes. The dismal German economy during the Great Depression played a pivotal role in the Weimar Republic’s political demise. Up until 1979, the prevailing view—in the Keynesian tradition—blamed Brüning’s policy choices for the catastrophic economic outcomes and subsequent political radicalization (Ritschl 2003a). That view is echoed by authors who argue that Germany’s steadfast adherence to the gold standard was a policy mistake that ensured the spread of the Great Depression (Temin 1989; Eichengreen Reference Eichengreen1992). However, Borchardt (Reference Borchardt and Borchardt1979) first challenges this interpretation of Germany’s slump by suggesting that Brüning had almost no room to maneuver in terms of economic policy. By the time the need for government intervention was finally recognized, it was too late to reverse course, and so the worst-case scenario transpired. Moreover, no suitable means for initiating countercyclical policies were available. This proposition, named the Borchardt hypothesis, has initiated a research stream that analyzes alternative policy options applicable to Germany’s economic slump. This strand of the literature, to name a few, begins with Borchardt (Reference Borchardt and Borchardt1979) and continues with Krohn (Reference Krohn1982), Borchardt (1983a, 1983b), James (Reference James1983), Holtfrerich (1996), Ritschl (2002a), and Straumann (2019).

Borchardt was certainly not isolated in his thinking. Ritschl (2003b) points out that there was a consensus over deflation, as the policy of deflation did not begin with Heinrich Brüning, but almost a year earlier, and it did not end with Heinrich Brüning, but rather nearly a year later. James (Reference James1983) suggests that the financial collapse in the summer of 1931 constrained the German government’s policy options. A related view emphasizes that the deflationary policies during the slump were typical austerity policies designed to avert a foreign debt crisis when access to further foreign credit was limited (Ritschl Reference Ritschl1998). The Borchardt hypothesis occupies an emotional place in German historiography, as it ultimately comes down to the question of the shared responsibility for the rise of the National Socialists. The hypothesis is not just a debate about economic history and is not Germany-specific as it is also relevant today for emerging markets about what their policy responses should be when undergoing a similar style of recession.

Eichengreen (1994) suggests that devaluing the Reichsmark would not have helped in light of Germany’s current account deficits, foreign debt, political instability, and memory of the 1923 hyperinflation. However, Holtfrerich (1996) argues that Brüning could have followed the British pound sterling and devalued the Reichsmark in September 1931, saving the German economy from further deflationary policies. To our knowledge, Schiemann (Reference Schiemann1980) is the only scholar who explores the effects of a Reichsmark devaluation on the German economy. Schiemann examines the counterfactual case in which the Reichsmark was first devalued by 20 percent in September 1931, when Britain devalued the pound sterling. The estimate of Schiemann is not derived from a formal economic model but is rather primarily based on the price elasticities of demand for imports and exports. Furthermore, the transmission of the effects of devaluation to the other sectors of the economy is based on ad hoc assumptions.

In government circles and at the Reichsbank, the decision in favor of adhering to gold parity was almost never controversial. In fact, both the German government and the Reichsbank deliberately presented floating the Reichsmark as a horrific vision in order to demonstrate the dangers of any currency experiment (Borchardt 1984). There were three main arguments against devaluation, of which the first was fear of inflation. Whether rightly or wrongly influenced by past experiences with inflation, departing from parity against gold was regarded as an inflationist policy. Second, Germany was a debtor country. Its government, banks, and corporations held a massive amount of short-term foreign debt, and the country was still making reparation payments for WWI. A devaluation would have greatly increased that debt burden. The third argument was that Germany had only limited sovereignty with regard to its currency affairs because the parity of the Reichsmark was fixed by international agreements. A change in the Reichsmark parity would be perceived as violating the Young Plan and would expose Germany to the possibility of economic and even military sanctions.

This present research formalizes and examines these arguments while using an open-economy dynamic model as an analytical framework, calibrating the model to the Weimar economy. To factor foreign currency debt into assessing the macroeconomic effects of exchange rate policies, our model accounts for the perverse balance sheet effects of devaluation when a country has a high level of such debt. In particular, the real exchange rate declines following an external shock—a dynamic that holds for both fixed and flexible exchange rates. In the short run, flexible exchange rates result in a steeper real devaluation and exacerbate the fall in an economy’s net worth, thus driving up the cost of borrowing abroad and depressing both domestic investment and aggregate demand. It is possible for these balance sheet effects to be so large that they more than offset any advantages of a flexible exchange rate.

Our empirical analysis with robustness checks finds that, first of all, floating the Reichsmark would not have led to high inflation. We estimate the inflation rates would never exceed an annualized rate of 5 percent had Germany floated the Reichsmark.

Second, notwithstanding Germany’s foreign debt, floating the Reichsmark would have reduced the decline in German GDP during 1930–1932 by half. The decline in employment would have been one-fifth of that by adhering to Reichsmark parity.

Third, a unilateral external default and float—even though it would have excluded Germany from contemporary international capital markets and made it subject to economic sanctions—would have yielded a smaller loss in real GDP and employment and caused no concern about hyperinflation.

From our theoretical framework, if Brüning had been willing to float the Reichsmark, then the German economy would have stabilized. In comparison with Germany, those countries that did shift their attention to stabilizing internal prices recovered sooner from the Great Depression; they also managed to avoid banking crises (Grossman Reference Grossman1994). Brüning’s policy might have been based on a misguided doctrine, which Temin (1989) refers to as the “gold standard mentality,” that solidified Brüning’s adherence to gold parity even when the German economy was in the midst of a severe recession, or perhaps Brüning deliberately pursued a deflationary policy in order to escape the burden of reparations, as Holtfrerich (Reference Holtfrerich1982) suggests. By deepening the crisis, Brüning intended to make the government insolvent and convince the Allies that Germany needed further relief from reparation payments. In any case, Brüning’s room for maneuvering within the country’s economic policy was less restricted than implied by the Borchardt hypothesis.

At the same time, we emphasize that creditors’ debt policy toward Germany did play a role. Whether floating the Reichsmark would have helped depends not only on the willingness and ability of Brüning but also on the facilitation of Germany’s creditors, for example, by granting debt relief or debt extension. This is because floating the Reichsmark would not have succeeded unless Germany’s foreign debt level (relative to its economy’s net worth) could be kept below a certain threshold. The facilitation of Germany’s creditors would also help reduce the high levels of uncertainty characterizing economic conditions. Even if Brüning had been willing and able to float the Reichsmark, the effects of such a policy would be limited or non-existent without the agreement of Germany’s creditors. The question of Weimar economic policy during the Great Depression should not be addressed, as it conventionally is, in terms of German domestic concerns; rather, it must be viewed from the perspective of international policy coordination. Only then will it be possible to offer a correct interpretation and pertinent in-depth discussion of alternative policies that include all the relevant players. This aspect of the problem has been ignored by both sides of the debate over the Borchardt hypothesis. Our paper echoes Straumann (2019) in arguing that the international perspective is at the heart of this issue; that is, both Germany and its creditors failed to come to grips with the rapidly worsening economic and political situation in the country.

Our paper belongs to the literature discussing the macro-level performance of Germany’s interwar economy. The topics most often addressed include postwar hyperinflation (Holtfrerich 1986; Feldman Reference Feldman1993; Balderston 2002), the “distributional” conflict (Schuker Reference Schuker1988; Borchardt 1991), the role of reparations (Gomes Reference Gomes2010), the 1931 banking and payments crisis (James 1986; Ferguson and Temin Reference Ferguson and Temin2003; Schnabel Reference Schnabel2004; Straumann 2019), the beginning of Germany’s recession (Temin Reference Temin1971; Falkus Reference Falkus1975; Balderston Reference Balderston1977; Fisher and Hornstein 2002; Ritschl 2002b), and the role of international capital flows (Kindleberger Reference Kindleberger1973; McNeil Reference McNeil1986; Schuker Reference Schuker1988; Ritschl Reference Ritschl1998; Accominotti and Eichengreen Reference Accominotti and Eichengreen2016; Ho and Yeh Reference Ho and Yeh2019). In contrast to Ho and Yeh (Reference Ho and Yeh2019), which deals primarily with the effects of Germany’s interwar capital flows on its business cycles, our paper deals with alternative policies, especially regarding exchange rate policy, that were available to Heinrich Brüning between 1930 and 1932.

Our paper also belongs to the strand of literature that employs formal models to study counterfactual policies. With regard to the pre-1914 and interwar gold standard, for example, Fagan, Lothian, and McNelis (Reference Fagan, Lothian and McNelis2013) assess the extent to which economic volatility in the classical gold standard era would have been lower had a modern Taylor rule been in place; Chen and Ward (Reference Chen and Ward2019) discuss whether the elimination of a countercyclical monetary policy would have given rise to higher output volatility during the pre-1914 gold standard period; Payne and Uren (Reference Payne and Uren2014) speculate on how the Australian economy would have performed during the Great Depression if policymakers had pursued modern-day practices; and Ho and Lai (Reference Ho and Lai2016) demonstrate that China would have suffered from output loss and deflation in the Great Depression’s early years if the country had been on the gold standard. With respect to more recent events, Leigh (Reference Leigh2009) investigates whether alternative interest rate policies could have helped Japan avoid its “lost decade,” and Del Negro et al. (Reference Del Negro, Eggertsson, Ferrero and Kiyotaki2017) describe what would happen to U.S. output and inflation in the counterfactual scenario of the absence of non-standard open-market operations during the Great Recession. Our paper contributes to the gap in the literature by examining a compelling historical case that has not previously been studied via an open economy dynamic model as our analytical framework.

GERMAN ECONOMIC POLICIES UNDER BRÜNING

Heinrich Brüning took office on 30 March 1930, when the German economy had already been in recession for more than a year. During his term of office, he issued a series of emergency decrees that included cuts in public expenditures, reductions in civil servants’ salaries, increases in taxes, and cuts in wages, retail prices, and rents. Online Appendix 1 describes German economic policies under Brüning in detail. Figure 2 illustrates the extent of Brüning’s austerity measures. Between 1930 and 1932, per capita public expenditures and transfers (including all levels of government) declined by 29 percent. Despite government efforts to increase tax rates and contributions to unemployment insurance, per capita government revenue fell by 24 percent during this period.Footnote 1

Figure 2 GERMANY’S PUBLIC FINANCES IN PER CAPITA TERMS, 1925–1938

Notes: Government expenditures and transfers as well as government revenue are first divided by the population and then normalized so that their values in 1930 are equal to 100.

Sources: Government expenditures and transfers (Ritschl 2002a); government revenue (Ritschl 2002a); population (Statistisches Bundesamt 1972).

Interpretations of Brüning’s deflation policy tend to focus on why an expansionary policy was not pursued.Footnote 2 On the one hand, it has been suggested that Brüning had almost no room for maneuvering with regard to economic policy (Borchardt Reference Borchardt and Borchardt1979, 1983a, 1983b). At least until early 1931, most still believed in the economy’s ability to self-heal. Not until the Credit-Anstalt crisis in May and Germany’s financial crisis in July was the necessity of government intervention first recognized, but by that time it was too late to reverse the situation. Additional foreign borrowing was impossible because Germany could not find any willing lenders. Furthermore, foreign loans (especially from France) were strongly opposed by President von Hindenburg and also ran counter to the Brüning government’s foreign policy. Loan expansion by the central bank would have violated regulations of the Reichsbank as they reflected international contracts that entailed special rules arising out of the reparations settlements, first the Dawes Plan and then the Young Plan.

Some suggest, on the other hand, that Brüning’s deflation policies were pursued deliberately. Brüning’s approach, which was characterized by an anti-parliament attitude hostile to the welfare state, accommodated the demands of industrialists who complained that rising wages, national debt, and interest rates were destroying corporate profitability (Plumpe Reference Plumpe2016, pp. 197–226). By this account, Brüning followed a senseless economic policy for irrelevant and chiefly political reasons: in domestic policy, he intended to make radical changes in, or even to overturn, the social security system that was legally created in 1927; as for foreign policy, he attempted to end reparations payments and believed that Germany’s economic misery would convince the Allied powers of its insolvency (Sanmann Reference Sanmann1965; Mommsen Reference Mommsen and Jasper1976; Schulz 1980; Holtfrerich Reference Holtfrerich1982). The implication is that, instead of eliminating the reparations debt, Brüning could have made full employment and economic growth his main priority, in which case the recession might have been mitigated. We now investigate which views are most plausible using an open-economy dynamic model, calibrated to the Weimar economy.

ANALYTICAL MODEL

Main Features

The analytical model we employ is an extension of the one proposed by Céspedes, Chang, and Velasco (Reference Céspedes, Chang and Velasco2003, 2004, 2005). We introduce balance sheet effects into a standard model of the open economy that incorporates a shock to world real interest rates and a shock to world demand for the country’s exports. Balance sheet effects arise because of real devaluation; they not only reduce domestic net worth but also increase the country risk premium on foreign debt and thus the cost of capital. Online Appendix 2 describes the model in more detail and also presents our derivation of the equilibrium conditions and the solution method.

Several factors motivate our choice of this analytical model. First, it is a general equilibrium-optimizing dynamic model that makes explicit the connections among exchange rates, balance sheets, and the capacity to borrow and invest. The model specifies the channels through which a shock is transmitted to the whole economy. Thus, our approach constitutes an advancement over previous studies, wherein analyses are of the “narrative” type and are not specific about transmission mechanisms. Moreover, we can design the relevant counterfactual scenarios and examine the arguments for and against floating the Reichsmark.

Second, the model incorporates both fixed and flexible exchange rates. Balance sheet effects interact with external shocks, from which it follows that the economy’s response to external shocks depends on whatever exchange rate regime is in place. Despite the existence of conventional expenditure-switching effects (referring to a switch in expenditure toward home goods in response to exchange rate movements), balance sheet effects can magnify the impact of adverse external shocks. In the end, devaluation may be either expansionary or contractionary, as explained momentarily. These aspects of the model allow us to evaluate the relative advantages—under the circumstances that prevailed during 1930–1932—of staying with parity or floating the Reichsmark.

Our model does not account for the introduction of capital controls. Their introduction could have provided an alternative to currency devaluation for a government that wished to gain monetary policy autonomy but did not want to leave the gold parity. However, Brüning did not take advantage of this freedom from international constraints to adopt an expansionary policy after introducing capital controls. Instead, he continued to contract and resorted to a change in domestic prices rather than a change in the exchange rate to combat the recession, as if Germany was still on the gold standard (Eichengreen and Temin Reference Eichengreen and Temin2010). There was little doubt at home or abroad that capital controls were an emergency measure (Ellis 1940). For our primary purpose of analyzing whether devaluation rather than deflation was the better adjustment mechanism, we thus ignored capital controls without igniting significant concerns. We nevertheless admit that our model cannot analyze the effects of capital controls on the volume of foreign loans, the cost of foreign borrowing, and the consequences for domestic aggregate demand. Moreover, the model is unable to answer whether Brüning could have used this freedom from international constraints to expand the economy. We believe these issues deserve a separate in-depth treatment.

We illustrate here the main features of the model by simplifying it to two periods and assuming that prices and wages are pre-set for one period. Lower case letters denote variables presented in percentage deviation from the no-shock steady state. The model can be summed up in a system of three equations analogous to the IS-LM-BP framework. Starting from the IS curve, which is the equilibrium condition in the goods market:

where y is output of home goods, i is investment, x is world demand for domestic goods, and e is the real exchange rate. The coefficients α i, α x, and α e are positive and are combinations of the model parameters.Footnote 3 Capturing the expenditure-switching effects, a real devaluation (an increase in e) raises y.

We next consider the LM curve, which represents the equilibrium condition in the money market:

where m is the value of money, and β y and β i are positive coefficients. Money demand declines when investment rises because money demand in the current period depends inversely on consumption in the next period, and the latter is increasing in investment in the current period. A change in the relative prices of foreign to domestic goods (e) alters the monetary value of consumption and thus changes the money demand.

The non-standard feature of the model is the BP curve, which represents equilibrium in the international loan market and is obtained by combining the international arbitrage equation (interest parity), the equation for the risk premium, and the net worth equation:

$$\begin{array}{l}i = \frac{{ - 1}}{{\left( {1 - \alpha + \alpha {\chi ^{ - 1}} + \mu } \right)}}\hat \rho + \frac{{\mu \left( {1 + \frac{{\bar S\bar D}}{{\bar P\bar N}}} \right)}}{{\left( {1 - \alpha + \alpha {\chi ^{ - 1}} + \mu } \right)\left[ {1 - \left( {1 - \alpha } \right)\left( {1 - {\vartheta ^{ - 1}}} \right)} \right]\vartheta }}y\\ \quad\quad\quad\quad\quad\quad\quad+ \frac{{\left[ {\gamma - \mu \left( {1 - \gamma + \frac{{\bar S\bar D}}{{\bar P\bar N}}} \right)} \right]}}{{\left( {1 - \alpha + \alpha {\chi ^{ - 1}} + \mu } \right)}}e,\end{array}$$

$$\begin{array}{l}i = \frac{{ - 1}}{{\left( {1 - \alpha + \alpha {\chi ^{ - 1}} + \mu } \right)}}\hat \rho + \frac{{\mu \left( {1 + \frac{{\bar S\bar D}}{{\bar P\bar N}}} \right)}}{{\left( {1 - \alpha + \alpha {\chi ^{ - 1}} + \mu } \right)\left[ {1 - \left( {1 - \alpha } \right)\left( {1 - {\vartheta ^{ - 1}}} \right)} \right]\vartheta }}y\\ \quad\quad\quad\quad\quad\quad\quad+ \frac{{\left[ {\gamma - \mu \left( {1 - \gamma + \frac{{\bar S\bar D}}{{\bar P\bar N}}} \right)} \right]}}{{\left( {1 - \alpha + \alpha {\chi ^{ - 1}} + \mu } \right)}}e,\end{array}$$

where

![]() $$\hat \rho $$

is the world interest rate.Footnote

4

Parameter α is the capital share in the production of home goods, χ is elasticity of world demand for home goods, μ is the sensitivity of the country risk premium with respect to the ratio of foreign debt to net worth, ϑ is elasticity of substitution between home goods,

$$\hat \rho $$

is the world interest rate.Footnote

4

Parameter α is the capital share in the production of home goods, χ is elasticity of world demand for home goods, μ is the sensitivity of the country risk premium with respect to the ratio of foreign debt to net worth, ϑ is elasticity of substitution between home goods,

![]() ${{\bar S\bar D} \mathord{{\vphantom {\bar S\bar D} /{\bar P\bar N}}}}$

is the steady-state ratio of foreign debt to net worth, and γ is the share of home goods in the production of consumption. As conventionally the case is, investment is decreasing in the world interest rate. What is new about the BP curve are the terms y and e. Higher output increases net worth and reduces the risk premium, thus increasing investment. This is true only if the risk premium depends on the ratio of foreign debt to net worth (μ > 0).

${{\bar S\bar D} \mathord{{\vphantom {\bar S\bar D} /{\bar P\bar N}}}}$

is the steady-state ratio of foreign debt to net worth, and γ is the share of home goods in the production of consumption. As conventionally the case is, investment is decreasing in the world interest rate. What is new about the BP curve are the terms y and e. Higher output increases net worth and reduces the risk premium, thus increasing investment. This is true only if the risk premium depends on the ratio of foreign debt to net worth (μ > 0).

In the model, investment is the main component of the aggregate demand and plays an important role in the output process. Investment may be increasing or decreasing in the real exchange rate. A higher e (real exchange rate) today means a lower expected real depreciation between today and tomorrow and hence cheaper foreign borrowing by the interest arbitrage condition. This is captured by the first part of the coefficient of variable e in Equation (3). However, the balance sheet effects push in the opposite direction because a higher real exchange rate means a higher value of debt payments, hence producing lower net worth and higher risk premiums.Footnote

5

This is captured by the second part of the coefficient of variable e. Balance sheet effects prevail when the sensitivity of risk premiums μ is high and the stock of foreign-currency debt relative to the economy’s net worth

![]() ${{\bar S\bar D} \mathord{{\vphantom {\bar S\bar D} /{\bar P\bar N}}}}$

is large.

${{\bar S\bar D} \mathord{{\vphantom {\bar S\bar D} /{\bar P\bar N}}}}$

is large.

Here is the intuition behind why currency devaluation can be contractionary. If expenditure-switching effects dominate, then a real devaluation is expansionary. Yet for a high ratio of foreign debt to net worth and for a high sensitivity of the country risk premium to that ratio, balance sheet effects dominate, and so a real devaluation becomes contractionary. This aspect of the model suggests that Brüning and Weimar’s policymakers, in the face of high foreign debt and extremely sensitive investor sentiment, might have had a good reason not to allow the devaluation of the Reichsmark even though the recession was deepening.

The exchange rate regime comes to play a role because the response of the real exchange rate to an external shock differs in the case of fixed versus flexible exchange rates. This difference is the key factor determining the relative stabilization properties of fixed and flexible exchange rates. The real exchange rate needs to depreciate following negative demand shocks in order to restore equilibrium, which happens regardless of the exchange rate regime. In the short run, the response of the real exchange rate is greater under a flexible exchange rate, although there is no difference in the long run. It follows that balance sheet effects (here, the reduction in net worth) are greater under a flexible than under a fixed exchange rate. The advantage of a flexible exchange rate over a fixed one declines with any increase in balance sheet effects. In Online Appendix 3, we detail the model’s features using the impulse response functions of selected variables.

The model makes several key assumptions. First, entrepreneurs borrow from abroad to finance their investments. We employ this assumption in order to make the model close to the situation in Germany at that time. The German hyperinflation during 1922–1923 wiped out almost the entire domestic savings and destroyed domestic capital markets, rendering it extremely difficult for entrepreneurs to raise capital through domestic capital markets. Instead, they had to resort to foreign capital markets. As a result, the post-stabilization period starting in 1925 witnessed a great inflow of foreign capital that the German banks used to supply credit to industry (Adalet Reference Adalet2003). Capital inflows and outflows were among the main driving forces of Germany’s business cycle between 1925 and 1931 (Ritschl 2012; Accominotti and Eichengreen Reference Accominotti and Eichengreen2016). The assumption that entrepreneurs borrow from abroad to finance investment makes the German domestic interest rate (expected return on capital) in the model determined by the interest parity. This assumption is also consistent with the fact that Germany’s position as a heavy borrower of foreign money, especially short-term capital, made its economy sensitive to disturbances in international capital markets.

Second, the model assumes that all debt contracts are denominated in foreign currency. This assumption aptly describes Germany’s situation then. The country’s foreign debt consisted of commercial debt and reparations. The reparation burden was owed in gold-based foreign currency (Ritschl 2013). For commercial debt, the dollar was the principal currency of denomination. According to Papadia and Schioppa (Reference Papadia and Schioppa2020, tables 1 and 7), the ratio of commercial debt to total debt was 33.6/67.6, and only 10.7 percent of German foreign commercial debt was denominated in domestic currency (Reichsmark) as of November 1931. Given that only a single-digit percentage (about 5.3 percent) of foreign debt was owed in domestic currency, it is straightforward for the model to assume that all of Germany’s debt contracts were denominated in foreign currency.

Third, the model assumes that the price of imported goods is fixed and is normalized to one in terms of foreign currency. Imports are freely traded, and the Law of One Price holds, so that the domestic price of imports is equal to the nominal exchange rate. Following Mussa (Reference Mussa1986) and Cecchetti and Schoenholtz (Reference Cecchetti and Schoenholtz2017), the real exchange rate is defined as the price of foreign goods in terms of domestic goods.

One may reasonably question whether the model’s proposed mechanism—namely, running from an economy’s net worth to the risk premium and the cost of foreign borrowing and then to domestic investment—was relevant to Germany’s circumstances during the early 1930s, especially when the supply of international capital was drying up. However, we believe that the mechanism is relevant to our paper’s inquiry. The onset of the Great Depression was certainly responsible for a collapse in international lending. For example, German net capital imports declined from 1.425 billion Reichsmark in 1929 to 1.236 billion in 1930 and to 657 million in 1931, then actually turned negative at –749 million in 1932 (Bundesbank 1976, p. 328). Not until 1933 was it widely acknowledged that international lending had come to a total standstill.

Moreover, the Brüning cabinet had—during the period studied herein—pursued the goal of maintaining and later restoring Germany’s access to international capital markets (Ritschl 2012). Under the standstill agreement of July 1931, short-term debt was frozen while still being fully honored, and long-term debt was unaffected. This standstill agreement was viewed as being transitory. The risk premium of German bonds traded in New York also indicates that Germany’s policies vis-á-vis its debt remained credible throughout this period (see Ritschl 2012, who cites the work of D. Doemeland-Narvaez). Because German policymakers hoped to access international credit markets and reintegrate Germany into the world economy, the focal mechanism definitely figured in their choice of an exchange rate regime.

Calibration of Parameters

Online Appendix 3 (Table A2) reports the values assigned to the models’ parameters, most of which we calibrate using data on Germany’s interwar years. The choice of parameter values otherwise follows Céspedes, Chang, and Velasco (Reference Céspedes, Chang and Velasco2003, 2004, 2005), whose values are calibrated for emerging markets. We take this approach because Germany’s situation in the 1920s (as a capital importer that incurred high levels of foreign debt) is argued to have been similar to emerging markets that suffer from the “original sin” problem (Eichengreen and Hausmann Reference Eichengreen and Hausmann2005).Footnote 6 Robustness checks of parameter values will be made in Online Appendix 4, especially for parameters calibrated by limited data and for parameters that are crucial for our results.

EMPIRICAL RESULTS

External Shocks Affecting the German Economy

In the spirit of business cycle accounting, as proposed by Chari, Kehoe, and McGrattan (Reference Chari, Kehoe and McGrattan2007) and Brinca et al. (2016), we first recover the structural shocks by using quarterly real GDP and real exports for the country. The measured shocks are fed back into the model—one at a time—so that we can assess how much of the observed changes in real GDP and real exports can be attributed to each of the shocks. These two variables are used because they satisfy the “invertibility” condition for the inversion filter (see Online Appendix 2) and are directly relevant to our empirical analysis.Footnote 7

The quarterly real GDP in 1913 market prices is taken from Ritschl (2002a, table C.2). It is interpolated from annual real GDP using the method of Chow and Lin (Reference Chow and Lin1971), where the index of gross production value—constructed by the Institut für Konjunkturforschung and taken from Wagemann (Reference Wagemann1935)—serves as the indicator for interpolation. The real export series is obtained by deflating the value of exports by the cost-of-living index. That index and also the value of exports are taken from Wagemann (Reference Wagemann1935). Because of the short data span, both real GDP and real exports are transformed using the growth rate (in other words, instead of the Hodrick-Prescott filter). We assume a fixed exchange rate when recovering the structural shocks.

The left panel of Figure 3 plots the two observables and the fitted series obtained from inputting the constructed shocks into the model. For each of the observables, the fitted series is identical to the actual series—an indication that the inversion filter is working properly. The right panel of Figure 3 reports the shocks to export demand and to the world interest rate.

Figure 3 GERMAN REAL GDP, REAL EXPORTS, AND STRUCTURAL SHOCKS

Notes: There are two series plotted on the left panel of Figure 3.

Sources: Authors’ calculation. See the section “External Shocks Affecting the German Economy” of the main text.

The shocks led export demand to deteriorate continuously starting in early 1930 when the effects of the Great Depression reached Germany. Export demand fell sharply in 1932 and never returned to its former level. The resulting decline in export earnings depleted Germany’s foreign exchange reserves, which motivated Hjalmar Schacht to undertake bilateral clearing agreements with countries in central Europe and South America in September 1934. By spring 1938, more than half of Germany’s foreign trade was carried out under such arrangements (Neal Reference Neal1979). Shocks to the world interest rates started increasing in the fourth quarter of 1928, at roughly the same time that the U.S. Federal Reserve decided to raise interest rates while attempting to limit speculation in U.S. securities markets. Shocks to the world interest rates increased dramatically in the third quarter of 1931, coincident with Germany’s twin crises. They were muted somewhat after 1932, when the Bank of England sharply reduced interest rates, which fell from 6 percent in October 1931 to 2 percent in July 1932 and remained at that level until the end of the sample period.

The upper panel of Figure 4 plots the actual and predicted real GDP when we use either the export demand shock only or the world interest rate shock only. This figure shows that the prediction based solely on export demand has a similar trajectory to that of the actual series. In fact, it accounts for much of the decline in real GDP during the Great Depression years. However, shocks to export demand cannot explain the recovery of German real GDP that started in the third quarter of 1933. The prediction based solely on the interest rate shock also explains some of the real GDP fluctuations before 1931. Although it cannot explain Germany’s economic recession in 1932, it does help explain Germany’s GDP recovery. The lower panel of Figure 4 plots the prediction of real exports. Export demand shocks account for all of the variation in real exports because real exports in the model are represented by an exogenous variable that is driven only by export demand shocks. In contrast, world interest rate shocks play no role in that variation.

Figure 4 PREDICTION OF GERMAN REAL GDP AND REAL EXPORTS USING A SINGLE STRUCTURAL SHOCK

Notes: The y-axis in all graphs of Figure 4 refers to a one-year percentage change (in decimal).

Sources: Authors’ calculation. See the section “External Shocks Affecting the German Economy” of the main text.

Table 1, which translates Figure 4 into numbers, gives the correlation (and the associated p-value) between the actual and predicted series. The prediction based on export demand alone positively and strongly correlates with real GDP, where the correlation coefficient is 0.45 (p = 0.00). The prediction based on the interest rate alone also exhibits a statistically significant correlation with real GDP; here, the coefficient is 0.43 (p = 0.01). These correlation coefficients are even larger when the sample is restricted to the period from 1930 to 1934. The prediction based on the export demand perfectly correlates with real exports, since said exports are completely explained by export demand shocks; the prediction based on the interest rate positively correlates with real exports, even though shocks to the world interest rate explain none of the variation in real exports.

Figure 4 and Table 1 both suggest that the shock to export demand and the shock to world interest rate were equally influential in driving the variation in Germany’s real GDP during our study period. The finding is consistent with the economic history of Germany during the Great Depression. Schmidt (Reference Schmidt1934), Kindleberger (Reference Kindleberger1973), Eichengreen (Reference Eichengreen1992), and Accominotti and Eichengreen (Reference Accominotti and Eichengreen2016) attribute the economic decline in Germany to the slowdown in capital exports from the United States, which began in the summer of 1928 when the Federal Reserve’s measures to check the stock market boom caused a rise in U.S. real interest rates. The decline in the value and volume of exports after 1929 was also among the main factors for the deterioration of economic conditions in the Weimar Republic (Balderston 1983). During 1929–33, Germany saw declines in exports of 50 percent with falls in GDP of 15 percent (Grossman and Meissner 2010). Hence, both shocks will be considered in the subsequent analysis.

Table 1 CORRELATION BETWEEN ACTUAL AND PREDICTED REAL GDP AND EXPORTS

Notes: Numbers in parentheses are p-values.

Source: Authors’ calculation.

Would Floating the Reichsmark Have Led to Inflation?

The dominant economic issue in debates over devaluation is the question of inflationary effects. Given Germany’s experience with hyperinflation and the associated collapse in the mark’s value during 1921–1923, devaluation has become synonymous with inflation, thereby making fear of inflation the most important reason for not abandoning parity (Borchardt 1984). At the secret conference of the Friedrich List-society (16–17 September 1931) that discussed the possibilities for an active economic stimulating program through investment and credit expansion, Ernst Stern compared the then German economy to the position of poor Odysseus. A storm brought his ship near the Scylla (referring to internal unrest and political tension). A way had to be found to get the ship out of the vicinity of the Scylla, but it must not fall into the hands of the Charybdis (referring to inflation psychosis) (Borchardt and Schötz Reference Borchardt and Schötz1991, p. 254). Germany was not the only country in the same situation. Across Europe, politicians and bankers as well as business and union leaders feared that devaluation would lead to inflation and were reluctant to deliberately devalue their currencies in the 1930s (Straumann Reference Straumann2009). It was exactly this concern over inflation that led policymakers to consider a policy of internal deflation (in other words, by lowering domestic prices and production costs) as a substitute for devaluation and one that could achieve the same purpose of making German exports more competitive.

In light of our model and the recovered structural shocks, we start by examining whether these inflation concerns were justified. Our simulation starts in the second quarter of 1930 (denoted 1930Q2) and ends in the last quarter of 1934 (1934Q4). For purposes of this simulation, the initial observation, namely, the first quarter of 1930, is assumed to represent the steady state. The simulation starts in the next quarter by feeding the recovered structural shocks into the model.Footnote 8

Table 2 reports the mean and standard deviation of the simulated CPI inflation rates under alternative exchange rate regimes. Table 2 also reports the actual inflation rates, computed using the quarterly CPI provided by Ritschl (2002a), along with the simulated ones. We can see that the actual inflation rates are close to those simulated under fixed exchange rates. For example, the average of actual inflation rates for the period 1930Q2–1932Q2, which corresponds roughly to the period under the Brüning government, was –7.65 percent while the average of simulated inflation rates under a fixed exchange rate is –6.06 percent. The standard deviations of the actual and simulated inflation rates are 3.11 and 2.77, respectively. This result is not surprising when one considers that Germany was on a fixed exchange rate during the simulation period.

Table 2 SIMULATED CPI INFLATION RATE UNDER FIXED AND FLEXIBLE EXCHANGE RATES

Notes: Actual CPI inflation rate is the annualized inflation rate computed using the quarterly CPI index provided by Ritschl (2002a). SD = standard deviation.

Source: Authors’ calculation.

Table 2 shows that the flexible (respectively fixed) exchange rate tends to be associated with inflation (respectively deflation). The standard deviation of CPI is also larger under the flexible exchange rate. Simulated inflation rates under the flexible exchange rate never exceed 9 percent and are about 4 percent (on average) for the period 1930Q2–1932Q2 and also for the period 1930Q2–1934Q4. This scale of inflation is far below what German policymakers had feared and was enough to discourage them from floating the Reichsmark. The country’s experience with hyperinflation in 1923 explains the emergence of fears of inflation among Germans during the Great Depression (Borchardt 1985; Eichengreen Reference Eichengreen1992). Before running into uncontrollable hyperinflation in 1923, consumer prices had increased by about 35 times between 1919 and 1922 (Jordà, Schularick, and Taylor Reference Jordà, Schularick, Taylor, Eichenbaum and Jonathan2017). The wholesale price index at the end of 1923 was 814 million times that at the end of 1922 (Graham Reference Graham1930, p. 106). Between 1924 and 1929, the post-stabilization period and Germany’s Roaring Twenties, the price index for the cost of living rose by an average annual rate of 4 percent (Borchardt 1990). An inflation rate of 4 percent can safely be considered to be below the value of inflation that German policymakers feared.

Self-fulfilling inflation was extremely likely in the German context. Fear of inflation may have led domestic firms to increase their current prices, and if those increases were accommodated by the Reichsbank, then hyperinflation could arise. We make some adjustments to the baseline model toward the end of evaluating whether fear of inflation could become self-fulfilling under a flexible exchange rate. Thus, we assume that the general price level is directly affected by expected changes in the nominal exchange rate. In log-deviation form, the relationships among the general consumption price level (q t), the nominal exchange rate (s t, which is equal to the price of imported goods), and the price of domestically produced goods (p t) can now be formulated as:

where ∇t is the expectations operator. The last term in this equation reflects a reduced-form method for capturing the idea that the central bank may accommodate inflation expectations (but without making the transmission mechanism explicit).

There are two reasons why we use expected changes in the nominal exchange rate as a proxy for inflation expectations. First, the inflation rate in some currency crisis models is closely linked to the rate at which the exchange rate changes. Second, Germany’s experience of postwar hyperinflation made devaluation synonymous with inflation, and this is exactly what concerned its policymakers when debating whether or not to float the Reichsmark. We also consider an alternative model specification, Equation (5), in which we replace expected changes with current changes—in the nominal exchange rate—in Equation (4). This specification is based on the assumption that realized exchange rate depreciation is rapidly transmitted to the general price level:

To calibrate parameter κ, we use the German wholesale price index and the dollar/mark exchange rate for 1914–1923 from Holtfrerich (1986). We use data from January 1914 and June 1922 (in other words, before inflation metastasized into hyperinflation) to estimate the value of κ. The value so obtained is about 0.5, which is the same as when we used only the data for the period from January 1919 to June 1922. Hence, we set the value of κ to 0.5.

Given that adjustment in the model’s specification, we reexamine the question of whether floating the Reichsmark would have led to high inflation. The results are reported in the second panel of Table 2. For the model specification in which expected changes in the nominal exchange rate enter CPI, the mean of the simulated CPI inflation rates is close to the benchmark case of a flexible exchange rate. There is one difference. The standard deviation of the simulated CPI inflation rates becomes smaller, as it decreases from 3.68 percent to 1.70 percent for the period 1930Q2–1932Q2. The reason is that the nominal exchange rate is expected to return to its steady-state value, so adding the term κ∇t(s t+1 – s t) to Equation (4) actually dampens, rather than amplifies, the fluctuation in the general consumption price level.

For the model specification in which current changes in the nominal exchange rate enter CPI, the volatility of the nominal exchange rate is simply transmitted into the CPI’s trajectory; hence, the standard deviation of the simulated CPI inflation rates is about twice that in the benchmark case. Even so, the mean of the simulated inflation rates is only slightly higher than in the benchmark case and never exceeds an annualized rate of 5 percent. Such a scenario is far removed from hyperinflation—a term that normally describes a situation where the prices of goods and services increase by more than 50 percent each month. In conclusion, the widely shared belief that floating the Reichsmark would have led to high inflation is not warranted. Brüning, haunted by memories of hyperinflation, was reluctant to float the currency because he feared a return to hyperinflation (Eichengreen and Temin Reference Eichengreen and Temin2010). The expectations inspiring this fear could have been very real at that time, but it was, as the British economist Ralph Hawtrey put it, like shouting “Fire, fire in Noah’s flood.”

Would Floating the Reichsmark Have Stabilized Output?

We next examine whether floating the Reichsmark could have helped stabilize the German economy. The Young Plan of 1930 forbade a devaluation of the Reichsmark. This monetary and foreign policy link between the Reichsmark and gold, which was based on the reparations treaty, was emphasized by Reichsbank President Hans Luther during the Great Depression: “Above all, however, the Young Plan explicitly required the retention of the gold value of the Reichsmark and thus clearly prohibited any devaluation” (Schiemann Reference Schiemann1980, p. 46). That said, concerns about the Young Plan provisions played no role in the German government’s decision to continue adhering to the gold parity of its Reichsmark; rather, the main concerns were the possibility of overreaction (stemming from Germany’s hyperinflation experience) and the payments due on foreign debt (Büttner Reference Büttner1989). Whereas the United States and especially France, were against a devaluation, Britain and the Bank for International Settlements (BIS) encouraged Germany to follow the British example and devalue its currency. Thus, floating the Reichsmark—as evaluated here and as discussed by Borchardt (1984), Eichengreen (1994), and Holtfrerich (1996)—was a policy that Brüning could have pursued.

We simulate and report the cumulative deviation from the steady state of the following variables for the period 1930Q2–1932Q2: real GDP, employment, and the real exchange rate. Figure 5 shows that, in terms of real GDP, floating the Reichsmark would have been a better policy than maintaining the Reichsmark’s external value. The cumulative loss in real GDP under a flexible exchange rate is 0.40, or about half of that under a fixed exchange rate (0.83). As Figure 1 reveals, Germany’s GDP declined by about 18 percent between 1930 and 1932. Real GDP in prices from 1911 declined from 53.545 billion Reichsmark in 1930 to 42.891 billion in 1932 (Ritschl and Spoerer Reference Ritschl and Spoerer1997). Floating its currency would not have enabled Germany to avoid the recession, but the country’s decline in GDP during 1930–1932 would have been reduced by half, to about 9 percent.

Figure 5 PERFORMANCE OF ALTERNATIVE EXCHANGE RATES IN RESPONSE TO HISTORICAL SHOCKS

Notes: Figure 5 reports the cumulative log-deviation from the steady state of the following variables: real GDP, employment, and the real exchange rate. Note that the y-axis of Figure 5 is in decimal. Fixed (benchmark) and float (benchmark) denote the scenarios of fixing and floating the Reichsmark as discussed in the section “Would Floating the Reichsmark Have Stabilized Output?,” respectively. Fixed (no default), default and float, and default and repeg denote the scenarios of fixed, default and float, and default with a one-time devaluation as discussed in the section “Would Floating the Reichsmark Coupled with a Debt Default Have Been a Better Choice?,” respectively. Access to foreign borrowing is limited for these three scenarios. The scenario fixed (benchmark) denotes access to foreign borrowing, while access to foreign borrowing through the scenario fixed (no default) is limited. Fixed (no default) is plotted twice for ease of comparison.

Sources: Authors’ calculation. See the sections “Would Floating the Reichsmark Have Stabilized Output?” and “Would Floating the Reichsmark Coupled with a Debt Default Have Been a Better Choice?” of the main text.

Floating the Reichsmark would also have resulted in less unemployment. The decline in employed labor under the flexible exchange rate is 0.16, compared to 0.90 under the fixed exchange rate. Recall from Figure 1 that the number of unemployed people rose from 3.1 million in 1930 to 5.6 million in 1932. If Germany had floated its currency, then unemployment would have increased only by some 0.5 million, instead of by 2.5 million, during 1930–1932. On the eve of the 31 July 1932 general election, in which the Nazi Party made significant gains and became, for the first time, the largest party in the Reichstag, the number of unemployed persons was about 5.4 million (Overy Reference Overy1987). The unemployment disaster was indeed a core component of Nazi rebukes of the Weimar government in 1931–1932, and it was against the background of this crisis that the Nazi Party rapidly expanded its electoral success. If Germany had floated the Reichsmark, then the number of unemployed would have been about 3.6 million and would never have exceeded 5.4 million. Of course, in that case, Germany’s political development after mid-1932 might have been very different.

Figure 5 also shows that the real exchange rate would have depreciated regardless of whether the Reichsmark had been floated or held fixed. Floating the Reichsmark results in a larger real depreciation, which facilitates economic adjustments. Moreover, the benefits of real depreciation outweigh the associated costs of balance sheet effects due to a reduction in net worth. In short, had the German government been willing to let the Reichsmark float, the Great Depression’s impact on its national income and employment would have been substantially reduced.Footnote 9

Would Floating the Reichsmark Coupled with a Debt Default Have Been a Better Choice?

Even if most of the Allied powers were against floating the Reichsmark, the German government could still have resorted to unilateral default and devaluation. During the Great Depression, the countries of Bolivia, Chile, Colombia, Costa Rica, Guatemala, and Nicaragua defaulted and abandoned the gold standard (Bordo and Meissner Reference Bordo and Meissner2020). For the modern period from 1975 to 2013, Na et al. (Reference Na, Schmitt-Grohé, Uribe and Yue2018) document that it is typical for a large increase in depreciation to occur at the time of default. Focusing on the interwar debt crisis, Eichengreen and Portes (Reference Eichengreen and Portes1990) find that defaulting countries recovered more quickly from the Great Depression than did countries that resisted default. It would therefore be instructive to consider the counterfactual scenario of a nominal devaluation accompanied by a unilateral external default.

In the spirit of the sovereign debt literature, we make two adjustments to the model so that it can accommodate the case of a unilateral external default. First, we exclude the economy from international capital markets: D t = D t+1 = 0. This may seem like a strong assumption, but it is not so unreasonable given that our simulation horizon is fairly short (approximately three years). Cruces and Trebesch (Reference Cruces and Trebesch2013) find that, after defaulting, it takes countries on average 13.1 (respectively 15.4) years to regain partial (respectively full) access to capital markets. Second, we posit that the economy will lose a proportion φ of its output. Hence, the aggregate production function becomes

$${Y_t} = \left( {1 - \varphi } \right)\frac{1}{{{\Delta _{p,t}}}}\frac{1}{{{\Delta _{w,t}}}}AK_t^\alpha L_t^{1 - \alpha },$$

$${Y_t} = \left( {1 - \varphi } \right)\frac{1}{{{\Delta _{p,t}}}}\frac{1}{{{\Delta _{w,t}}}}AK_t^\alpha L_t^{1 - \alpha },$$

where Y t denotes aggregate output, K t is aggregate capital, L t is aggregate labor, A is the level of technology, and Δp,t and Δw,t are indices for price and wage dispersion, respectively. This expression reflects that a default would make Germany vulnerable to sanctions stipulated by the Versailles Treaty and the Young Plan (Ritschl 2012). Empirical studies document that defaults cause an annual output loss that ranges from 5.5 percent to 13 percent (Borensztein and Panizza Reference Borensztein and Panizza2009).

The German historical data preclude a direct calibration of φ, since Germany did not default during the period we study—although Hitler’s government acquiesced in early June 1933 to Hjalmar Schacht’s urging and initiated default proceedings on the country’s long-term foreign debt (Tooze Reference Tooze2006). However, we cannot use Germany’s post-1933 default experience to calibrate φ because the economy subsequently recovered and also was affected by many compounding factors: the country’s embrace of autarky, the Nazi rearmament, and public works programs financed via deficit spending. It is simply unreasonable to attribute all the output variation observed in this period to the sovereign default of 1933 and then to derive the average annual output cost of that default. For these reasons, we take the value of φ from the literature.

Running a standard growth regression by using panel data for 83 countries from 1972 to 2000 and assuming the long-run growth rate to be 1.5 percent, Borensztein and Panizza (Reference Borensztein and Panizza2009) find that a default causes the output level to remain forever 5.5 percent below the pre-default trajectory, even though output gradually returns to its long-run growth rate. Here, we follow Borensztein and Panizza (Reference Borensztein and Panizza2009) and assume that the output cost of default is 5.5 percent per year, setting φ = 0.055.

We consider two post-default exchange rate regimes. The first one is a float. Na et al. (Reference Na, Schmitt-Grohé, Uribe and Yue2018) show that default tends to be accompanied by currency devaluation, but that the currency stabilizes shortly thereafter. Hence, we also consider the alternative of devaluing and then repegging at a lower currency value. In accordance with Na et al.’s empirical finding, which is based on a sample of 70 countries and 117 default episodes, we assume that the exchange rate devalues a currency by 45 percent before the re-peg. A 45 percent devaluation is comparable to the average of the U.K. and U.S. experiences in the 1930s: the pound sterling was initially devalued by some 25 percent when Britain abandoned the gold standard on 21 September 1931; and when the U.S. dollar was finally stabilized in 1934, it represented less than 60 percent of its former gold content (Eichengreen and Sachs Reference Eichengreen and Sachs1985).

The model specification just described explicitly assumes that foreign debt is zero (D t = D t+1 = 0). By definition, the country risk premium is non-existent. As an alternative to imposing the restriction of zero foreign debt, we also experiment with a model specification in which the value of μ (viz., the country risk premium’s sensitivity to the ratio of foreign debt to net worth) is increased enough that the equilibrium foreign debt level merely approaches zero; we observe that increasing μ also raises the steady-state risk premium. Our other assumptions remain the same. These two model specifications yield nearly identical results.

We report the simulated inflation rate in Table 2’s subpanel entitled “Unilateral External Default.” We simulate and compare three scenarios: fixed, default and float, and default with one-time devaluation (repeg). By “fixed,” we mean a no-default scenario with fixed exchange rates and extremely limited access to international markets; a scenario that strongly resembles Germany’s situation in the early 1930s. In fact, the simulated inflation rate under this scenario is a good approximation of the actual inflation rate, especially for the 1930Q2–1932Q2 period. The other two scenarios involve defaulting and lead to a loss of output. The default-and-float scenario results in a slightly higher inflation rate than the benchmark case but does not even approach hyperinflation. In the scenario involving default and a repeg, there is greater deflation than in the benchmark case; in terms of inflation stability, this scenario leads to the least desirable outcomes.

Figure 5 shows that, compared with a policy of not defaulting while maintaining the Reichsmark’s value, the default-and-float policy yields a smaller loss in real GDP and employment. In contrast, a policy of default combined with a one-time devaluation of the Reichsmark is far less desirable, because it incurs an almost identical real GDP loss as the “fixed” (no-default) policy but leads to even more unemployment.

The results presented in Table 2 and Figure 5 suggested that a unilateral default on external or reparations debt was a viable option for the German government. In Germany, both the extreme right and the Communist Party advocated for outright default. So why did Germany not pursue unilateral default? The reason is that the Brüning government was hoping for a return to international financial markets; the drying up of foreign capital was viewed as a temporary state of affairs. Germany was also afraid of being exposed to trade disruptions and to the type of sanctions that had led to the 1923 Ruhr crisis. These potential threats associated with a unilateral default were vague but could nevertheless be far-reaching. It was from 1933 onward, when the disintegration of international finance and trade seriously reduced Germany’s opportunity cost of default, that the country began reneging on its debt.

The Allies’ Debt Policy and the German Decision to Float the Reichsmark

In the previous section, we reported that floating the Reichsmark would have resulted in less of an output loss than a policy of maintaining the Reichsmark’s external value. This finding depends crucially on the steady-state ratio

![]() ${\psi\equiv({\bar S\bar D} \mathord{{\vphantom {\bar S\bar D} /{\bar P\bar N)}}}}$

of foreign debt to net worth, which we calibrated to 6.0 by using data on foreign commercial debt from Papadia and Schioppa (Reference Papadia and Schioppa2020) and, as a measure of the net worth of German firms, the market value of firms listed on the Berlin Stock Exchange (see Online Appendix 3). It can be shown that the performance of a flexible exchange rate deteriorates monotonically as ψ increases. Once ψ exceeds 13.2, the flexible and fixed exchange rate policies would incur the same loss in real GDP. Any further increase in the value of ψ corresponds to a floating of the Reichsmark would result in a higher output loss than that of adhering to parity—contra the results we present for the benchmark case.

${\psi\equiv({\bar S\bar D} \mathord{{\vphantom {\bar S\bar D} /{\bar P\bar N)}}}}$

of foreign debt to net worth, which we calibrated to 6.0 by using data on foreign commercial debt from Papadia and Schioppa (Reference Papadia and Schioppa2020) and, as a measure of the net worth of German firms, the market value of firms listed on the Berlin Stock Exchange (see Online Appendix 3). It can be shown that the performance of a flexible exchange rate deteriorates monotonically as ψ increases. Once ψ exceeds 13.2, the flexible and fixed exchange rate policies would incur the same loss in real GDP. Any further increase in the value of ψ corresponds to a floating of the Reichsmark would result in a higher output loss than that of adhering to parity—contra the results we present for the benchmark case.

In 1931, the market was rife with uncertainty. The Hoover Moratorium, which suspended reparations and all political payments, was meant to last only one year. No one knew whether stock market capitalization, which represents net worth, would stabilize thereafter or continue to decline. Remember that German reparations debt was of an equal scale to its commercial debt during 1928–31 (Papadia and Schioppa Reference Papadia and Schioppa2020). Germany’s stock market capitalization fell by 29 percent between 1929 and 1930 and by 43 percent between 1930 and mid-1931. The probability that the value of ψ would exceed the critical value of 13.2 is low, but this is not a probability-zero event.

Brüning kept insisting on his policy of deflation until the end of his tenure as chancellor. An anecdote often cited is that Brüning and Reichsbank President Hans Luther secretly planned a 20 percent devaluation of the Reichsmark, but only after Germany’s reparation debt was canceled (Holtfrerich 2016, p. 17). Some regard this anecdote as evidence that Brüning stubbornly subordinated the economic goal of “reflating” Germany’s economy to his policy goal of ending reparations (Holtfrerich 1990). Here, we suggest that Brüning’s preference to end reparations (which amounted to foreign currency debt) before devaluing the currency might well have reflected legitimate economic considerations. As our simulations indicate, if foreign currency debt is high, then exchange rate flexibility may be insufficient to deliver the promised output stability. In contemporaries’ proposals for currency deprecation, that policy was tied to the elimination (or restructuring) of foreign debt. Borchardt reports that journalist Felix Pinner, while proposing the float of the Reichsmark, suggested waiting for a suitable moment: “This moment might come when the impending reparation negotiations had come to a successful close” (Borchardt 1984, p. 481).

Creditors’ debt policy toward Germany did come into play because the German conundrum of whether (or not) to float the Reichsmark was closely related to the policies of the Allied powers. There were two reasons why such currency floating depended heavily on the Allies’ debt policy toward Germany. First, a benevolent policy (e.g., debt relief) could prevent pushing Germany beyond the safe region, in which floating the Reichsmark provides a viable alternative. It also helps to hold back the highly uncertain economic conditions. Second, since currency floating works better when the value of ψ is small, a benevolent policy would allow Germany to maximize its benefit from floating the Reichsmark once the value of ψ was in the “safe” zone.

This preferred scenario did not come to fruition. It was not that the Allies did not offer sporadic assistance programs when Germany fell into a slump, but rather that these programs were proposed by each country individually, without prior coordination and without consideration of the programs’ impact on the other creditor countries.Footnote 10 Once these offers failed, no attempt was initiated to collectively provide an alternative plan via international institutions such as the BIS. Brüning’s pursuit of an aggressive foreign policy further restricted Germany’s opportunities to secure foreign loans (Tooze Reference Tooze2006).

The world economy in the 1930s, as Temin and Vines (Reference Temin and Vines2013) indicate, sank into the Great Depression due to the loss of British hegemonic power after WWI and the unwillingness of the United States, the new hegemon, to take over to restore the prosperity of the international economy. The coordination failure was not easy to overcome, as its deep reason was that international institutions after WWI suffered from a lack of reciprocal trust (Wolf Reference Wolf2010). Neither the Bank of England nor the Banque de France nor the Federal Reserve were willing to support Hans Luther’s final attempt to secure a central bank credit on the eve of the July 1931 twin crises (Straumann 2019). Such coordination would have saved all parties involved, especially Germany, from engaging in unilateral action associated with high risks.

The dysfunctional BIS nevertheless reminds us of something optimistic. Its original task of facilitating German reparations, as we mentioned before, quickly became obsolete. However, one can imagine what if it could have been activated earlier to coordinate the unilateral activities by France and the United States, to say nothing of its success in fostering cooperation among central banks after WWII (Toniolo Reference Toniolo2005).

CONCLUSION

This research offers a systematic assessment of whether floating the Reichsmark would have yielded better outcomes for interwar Germany. We bring two highly relevant considerations to the discussion of Brüning’s alternative policy. First, we account for the perverse balance sheet effects of devaluations when assessing the macroeconomic effects of exchange rate policies. Second, we highlight the importance of creditors’ debt policies toward Germany for the success of alternative policies. Whether such policies might have succeeded depends not only on factors peculiar to Germany but also on external factors. We find that floating the Reichsmark, or even a unilateral external default and float, would have been better than adhering to Reichsmark parity. The commonplace fear of inflation at that time was unwarranted.

Our results have implications for contemporary eurozone countries in that, for a crisis-ridden member such as Greece, the question of whether to remain in or to leave the eurozone resembles the question—faced by Germany in the early 1930s—of whether to continue with Reichsmark parity or instead to float the Reichsmark. Standard textbook treatments suggest that a policy of leaving the eurozone and then reintroducing and floating the national currency allows a country to regain its monetary sovereignty and stimulate its economy. Although that suggestion is not intrinsically wrong, it ignores the distinct possibility that currency depreciation will not operate as anticipated when foreign debt levels are high. Moreover, creditor countries can facilitate a debtor country benefiting from the reintroduction of its national currency by adopting a more lenient debt policy. We find these two factors—balance sheet effects and the role of international creditors—to be decisive in a country’s choice of policy, and hence they deserve more attention in debates regarding the current eurozone crisis.