Introduction

Farming diversification is a well-known strategy to manage risks. Integrated Crop-Livestock Systems (ICLS), a form of on-farm diversification, has gained ground as a sustainable intensification solution to meet increasing global food demand (FAO, 2010). Integrated crop-livestock systems consist of interactions between crop and animal production that are exploited disjointedly or simultaneously across time and space and that impose unique challenges (de Moraes et al., Reference de Moraes, de Faccio Carvalho, Anghinoni, Lustosa, de Andrade Costa and Kunrath2014). The greater complexity, higher costs and higher labour inputs of ICLS require greater technical, economic and multidisciplinary knowledge (Martin et al., Reference Martin, Moraine, Ryschawy, Magne, Asai, Sarthou, Duru and Therond2016; Poffenbarger et al., Reference Poffenbarger, Artz, Dahlke, Edwards, Hanna, Russell, Sellers and Liebman2017). Along with that, ICLS could be discouraged by many factors such as soil and climate conditions, global markets, subsidies, governmental policies and lack of an agricultural work force (Ryschawy et al., Reference Ryschawy, Choisis, Choisis, Joannon and Gibon2012; Komarek et al., Reference Komarek, Li and Bellotti2015). Integrated crop-livestock systems are also affected by farmers’ attitudes towards changes and farming experience (Alary et al., Reference Alary, Corbeels, Affholder, Alvarez, Soria, Valadares Xavier, da Silva and Scopel2016). These aspects present risks for the successful management and implementation of ICLS. Thus, considering the FAO's promotion of ICLS, management of these risks has become necessary to enable the success of farms that currently use ICLS and, additionally, to enable new ICLS adopters to be successful.

The investigation of integrated risk management is a continuing concern within agricultural risk management. Kostov and Lingard (Reference Kostov and Lingard2003) point out that rural space and production integration risk management should be integrated and more process-oriented. In this sense, Lien et al. (Reference Lien, Hardaker and Flaten2007), Leppälä et al. (Reference Leppälä, Murtonen and Kauranen2012) and van Winsen et al. (Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013) propose models to manage risk in the agricultural field, but they do not address how to manage integrated risks as a portfolio; neither do they emphasize ICLS. Recently, the integration of financial, technical support and social networks was raised as a factor to encourage ICLS implementation (Asai et al., Reference Asai, Moraine, Ryschawy, de Wit, Hoshide and Martin2018). Asai et al. (Reference Asai, Moraine, Ryschawy, de Wit, Hoshide and Martin2018) suggest that there is a need for integrative risk management, particularly for ICLS. Leppälä et al. (Reference Leppälä, Murtonen and Kauranen2012) further suggest the adaptation of enterprise risk management (ERM) to the agricultural field.

Enterprise risk management is an integrative approach for managing risks across an enterprise (COSO, 2004). Bromiley et al. (Reference Bromiley, McShane, Nair and Rustambekov2015) define three core elements of ERM: (i) risks are managed as a portfolio; (ii) incorporation of both traditional and strategic risks; and (iii) risks are managed, as well as mitigated, as a competitive advantage. The first core element provides both a natural hedge and cost saving by avoiding individual risk mitigation (Eckles et al., Reference Eckles, Hoyt and Miller2014). The value of this concept increases with consideration of the integration of traditional and strategic risks. As stated in the second core element, instead of only handling traditional risks (e.g. production yield and input costs), ERM proposes the conjoint management of strategic risks (e.g. product trends and customer preference). This provides an advantage because ERM aligns risk management to enterprise management (Callahan and Soileau, Reference Callahan and Soileau2017). In addition to this, the third core element of ERM sheds light on both sides of a risk. An event can be understood as a threat or as an opportunity depending on the manager's perspective. For example, while a rise in livestock food prices could characterize a risk for many farms, a farm with the capacity to produce an alternative feed could profit from these circumstances, either by producing feed or by selling advisory services. This perspective expands the concept of risk since it encompasses both positive and negative impacts on the farm (Fraser and Simkins, Reference Fraser and Simkins2016). Therefore, ERM presents an integrative and coherent risk management perspective that might provide ICLS farmers with natural hedge detection, strategic orientation, threat reduction and opportunity detection.

To the best of the knowledge applied to the current work, no previous study has investigated the use of the ERM approach to manage the integrated risks of ICLS. Given the ICLS need for integrative risk management that simultaneously embraces ICLS implementation and the variety of risks that surrounds it, ERM seems to be a reasonable solution. The aim of the current research was therefore to develop an ERM method designed for ICLS. It is expected that this method will lead farmer adoption of ICLS through an integrated risk management process, resulting in a higher possibility of success as a business.

Materials and methods

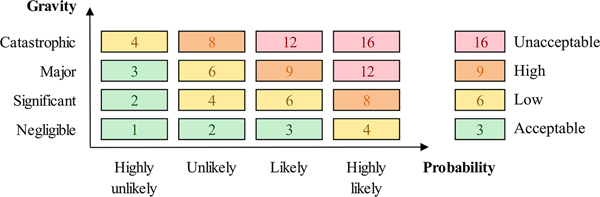

Among the most widespread frameworks for ERM implementation (COSO, 2004; ISO, 2009), COSO (2004) stands out due to its broader scope, dissemination and adherence (Hayne and Free, Reference Hayne and Free2014), and was therefore used as a primary reference for the current paper. To develop the method, Design Science Research (DSR) was used as the research strategy (Aken et al., Reference van Aken, Chandrasekaran and Halman2016). There are increasing applications of DSR in the agricultural field (van der Merwe et al., Reference van der Merwe, Liebenberg and de Vries2014; Verdouw et al., Reference Verdouw, Wolfert, Beulens and Rialland2016; Missimer et al., Reference Missimer, Robèrt and Broman2017), but DRS has broader use and acceptance as an important and legitimate research paradigm for information systems (Gregor and Hevner, Reference Gregor and Hevner2013). Peffers et al. (Reference Peffers, Tuunanen, Rothenberger and Chatterjee2007) stand out among the reviewed literature as a DSR development method. Therefore, the development of the ERM to ICLS method was based on the five steps proposed by Peffers et al. (Reference Peffers, Tuunanen, Rothenberger and Chatterjee2007) and shown as column headers in Fig. 1. These steps were chosen because they support the development of new methods. The sequence of these steps is cyclic, allowing for improvements based on the lessons learned during development. At each restart, a new stage begins that results in a new version of the method under development.

Fig. 1. Process of adaption of ERM to ICLS. Polygons depict the five steps, while the red rectangles portray research methods and white rectangles depict results from each step. Colour online.

In the first stage, the first version of the proposed method relied on a literature review. Additionally in this stage, the problem to be solved by the method was detailed and the objectives of the adaptation of ERM to ICLS were defined. The first-version method was tested in a pilot study which enabled internal evaluation and subsequent improvements for the second version of the method.

In the second stage, interviews with experts resulted in revisions to the objectives and design for development of the second version of the method. This version was applied to four ICLS farms in case-studies. Twenty practitioners implemented the method and responded to a survey to evaluate the feasibility and usefulness of the method. This evaluation was used to refine the third version of the method.

Stage 3 presents the final version of the method that was applied in the previous case studies. Limitation of the final method and potential uses were discussed in a final evaluation. The interviews with experts, pilot study, case-studies and survey methodological procedures are detailed below.

The results section is structured according to Peffers et al. (Reference Peffers, Tuunanen, Rothenberger and Chatterjee2007) sequence steps (Fig. 1). Problem Identification is the first sub-section followed by Objective of the Solution, and Method Design and Development, which presents the evolvement of the three versions of the method. The next sub-section presents a detailed description of the third version of the method and is followed by the last sub-section, entitled Demonstration.

Literature review

The literature review method followed the guidelines in Kitchenham and Charters (Reference Kitchenham and Charters2007). Thus, the keywords ‘risk management’ were searched in the Web of Science, Scopus and Wiley Online Library databases in combination with one of the following keywords: ‘agribusiness’, ‘agriculture’, ‘farm’ or ‘integrated crop-livestock system’. The year of publication of the COSO (2004) Internal Control – Integrated Framework was considered a milestone for ERM dissemination. Thus, only articles published between 2004 and 2015 were included in the Stage 1 literature review, which included articles that address at least three of the eight ERM components identified in COSO's integrated framework.

Interview with experts

Five agricultural risk experts were interviewed as part of the evaluation of the first version of the proposed method to adapt ERM to ICLS. According to Cooper and Schindler (Reference Cooper and Schindler2014), experts must be selected based on their experience and knowledge. An expert was considered to be a person who had conducted research or work in the risk and agricultural field for more than 15 years. The experts were familiar with farmer perspectives based on their experience and background, and also based on knowledge of third-party experiences. Interviews were conducted individually, using open questions, and also by presenting the first-version method and its demonstration in the pilot study to illustrate how the method worked (Zikmund et al., Reference Zikmund, Babin, Carr and Griffin2012). This research procedure allowed specialists to point out possible points of improvement and to propose links between steps and actions of the proposed method. This evaluation resulted in changes in the second-version method that made it more comprehensive and practical for ICLS risk management. The interviews lasted between 40 and 120 min and were recorded during late 2016 and early 2017. Profiles of the experts are shown in Table 1.

Table 1. Experts’ profiles

a Federal University of Rio Grande do Sul.

b Farroupilha Federal Institute.

c Brazilian Agricultural Research Corporation.

Pilot study and case-studies

The pilot study and case-studies were used to demonstrate the first and second versions of the method, respectively, and to support further improvements. They took place in the state of Rio Grande do Sul, Southern Brazil. Although the selected farm sizes were larger than usual ICLS farms, they reflected typical farm sizes in the state and their size and respective administrative structure enabled ERM implementation. In addition, according to Wauters et al. (Reference Wauters, van Winsen, de Mey and Lauwers2014), farm size does not affect perceived risk probability, impact and influence, except with respect to risk attitude. Larger farms tend to be less risk-averse than smaller ones. Moreover, evaluating the method with larger farms stimulated ICLS adoption for a greater amount of farmland, with FAO's encouragement to adopt this sustainable intensification (FAO, 2010).

The first version of the method was demonstrated in a pilot study to better understand its potential and fragilities and to support method presentation to experts. The pilot study was applied to an ICLS farm integrating soybean and beef production on 1 300 ha in the municipality of Quevedos.

For the case-studies, 20 farmers were instructed to implement the second version of the method at four ICLS farms. The instruction consisted of 32 h training and a step-by-step document to guide implementation of the proposed method, supported by computer-based tools. The farmers had bachelor's degrees with an average of 67.8 agricultural education credits, and their average age was 37.3 (±6.4) years old. The case-study farms (Table 2) were selected to represent different original activities prior to ICLS implementation and have existing structured information management practices. Along with the farm owner, four other practitioners joined the farmer to put the proposed risk management method into practice for 2 months. The authors did not interfere during the application of the method (e.g., to identify ICLS risk events), in order to assess its feasibility and usefulness from the farmers’ point of view. Interference by researchers might influence the practitioners’ application, perception and following evaluation. After implementation, the farmers presented and discussed the method implementation and its results.

Table 2. Case-studies of the second version of the method and farm characteristics

The method application was evaluated by the degree of detail reached by each practitioner's group and through a survey. Practitioners responded to a questionnaire that measured the usefulness and feasibility of the method. In addition to answering open questions, practitioners scored their method-related actions on a Likert-type scale ranging from 1 (not useful or not feasible) to 5 (very useful or very feasible). The questionnaire responses had a Cronbach's alpha coefficient of 0.97, which denotes a very good reliability (Zikmund et al., Reference Zikmund, Babin, Carr and Griffin2012). These evaluations were used to refine the second version of the method, resulting in its third version, which was implemented again at the same farms by the practitioners.

Results

Problem identification

The literature review resulted in 57 selected articles from the original set of 1996 retrieved articles. The articles reported on a variety of agricultural production systems that included crop (46 articles), livestock (nine articles) and mixed farming (two articles). None of the articles reported ERM use for ICLS. Moreover, the risk management applications addressed in the articles were heterogeneous (e.g., finance, insurance, disaster, strategy, enterprise), revealing an incipient approach to ERM.

Although ERM was not explicitly declared in the studies, the use of ERM was tracked through their implementation of the eight components of COSO's integrated framework as identified in the literature review. The most frequently addressed COSO component in the articles was risk response (45 articles), followed by risk identification (23 articles), evaluation (20 articles), internal assessment (14 articles), and goal setting (seven articles). Less than six articles considered control, communication, or monitoring components, which were classified as operational components by Hoag (Reference Hoag2011). Some articles reported more than one COSO component. Operational and strategic components (internal assessment and goal setting) received little emphasis and were reported in seven and 17 articles, respectively. The focus of risk management on agriculture was tactical and not holistic, presenting an opportunity for the development of a more integrative approach.

Hoag (Reference Hoag2011) was the only author to propose a systematic method to manage agricultural risks, embracing seven of the COSO components. The work of Spratt (Reference Spratt2004) also comprises the same number of components, but the author did not reveal the risk management method and covered only one risk event. Similarly, Flaten et al. (Reference Flaten, Lien, Koesling, Valle and Ebbesvik2005) and Shannon and Motha (Reference Shannon and Motha2015) did not specify the risk management method applied. In spite of Leppälä et al. (Reference Leppälä, Murtonen and Kauranen2012) and van Winsen et al. (Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013) proposing a method to manage risk in the agricultural field, neither of these articles covered ERM steps, nor did they emphasize crop-livestock systems. Leppälä et al. (Reference Leppälä, Murtonen and Kauranen2012) noted that ERM could provide good results for agricultural risk management, but that it would require adaptation to farms. The remaining 51 articles presented specific risk management tools.

No adaptations of the ERM method to ICLS or to other agricultural practices were found, with the exception of the generic strategic approach applied by Hoag (Reference Hoag2011). Hence, a sequence of actions based on ERM was developed to manage risk in ICLS.

Objective of the solution

Based on the main methods for management of agricultural risk, mentioned in the previous sub-section, the objectives of an adaptation of ERM to ICLS were identified. According to Leppälä et al. (Reference Leppälä, Murtonen and Kauranen2012), the method should be (i) simple, (ii) relevant, (iii) holistic, (iv) systematic and (v) visual. Interviewed experts reiterated that the risk management method should be simple to implement and should add value to the farm. Enterprise risk management literature, and more specifically Hoag (Reference Hoag2011), reinforced the importance of holistic and systematic objectives. The experts agreed that the integrative approach of ERM fits the ICLS working mode. van Winsen et al. (Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013) and Leppälä et al. (Reference Leppälä, Murtonen and Kauranen2012) also suggested that risk management should encompass (vi) risk quantification. On the other hand, the experts highlighted that farmers tend to be less accustomed to handling quantitative data, which might present barriers to the method adoption. Therefore, they suggested that the method should be (vii) flexible in allowing the use of quantitative and qualitative data. Thus, the ICLS integrative risk management method should combine both of these characteristics to be more user-friendly and to enable the management of quantitative risks.

Method design and development

The design and development of the method evolved over three stages with a different method version in each stage. In summary, the first version was designed based on the literature review, the second version was based on the expert interviews and the third was based on the case-studies and practitioners’ evaluations. The method is divided into three phases (strategic, tactical and operational), providing a holistic approach to risk management (Hoag, Reference Hoag2011). The phases reflect COSO's components (COSO, 2004) through seven steps: (i) Internal Environment; (ii) Risk Preference; (iii) Risk event identification and analysis; (iv) Risk Evaluation; (v) Risk Response; (vi) Monitoring and Control and (vii) Objective Setting. In a change from COSO, and based on a substantial amount of literature (Akcaoz and Ozkan, Reference Akcaoz and Ozkan2005; Flaten et al., Reference Flaten, Lien, Koesling, Valle and Ebbesvik2005; Greiner et al., Reference Greiner, Patterson and Miller2009; Turvey and Kong, Reference Turvey and Kong2009; Schaufele et al., Reference Schaufele, Unterschultz and Nilsson2010; Hoag, Reference Hoag2011; Sookhtanlo and Sarani, Reference Sookhtanlo and Sarani2011; Broll et al., Reference Broll, Welzel and Wong2013; Tudor et al., Reference Tudor, Spaulding, Roy and Winter2014; Wauters et al., Reference Wauters, van Winsen, de Mey and Lauwers2014), the second step was created to address the willingness to take risks. During the expert interviews in the second stage of method development, it was suggested splitting the first step in order to also consider Objective Setting: thus, this was included as a seventh step. The tactical phase contained the core steps of risk management and the operational phase was composed of a single step that comprised the COSO components of risk control, communication and monitoring, since there was little evidence of such components in the reviewed literature. At the step level, actions were created to drive the risk management process. In total, 20 risk management actions were created during the development of the method, resulting in 16 actions in the third version. The method development is depicted in Fig. 2.

Fig. 2. Process flow of the method versions.

The pilot study, experts and practitioners agreed that the sequence of actions was coherent and reasonable. On the other hand, it was verified that actions to quantify risks that are too laborious should be avoided, to keep the farmers motivated (van Winsen et al., Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013). The method development revealed that experts tend to detail the method in more precise and explicit actions. They contributed detail to the Internal Environment step and to create the Objective Setting step and its actions. In contrast, the practitioners preferred a more practical and less detailed method. Thus, simpler actions in the second-version method were merged, resulting in a third version that was similar to the first one. This catenation revealed that ERM and agricultural risk literature converge to practitioner's preferences, suggesting that the method was suitable for ICLS practices.

Description of actions in the third version of the method

In the following sub-sections, the steps and actions in the third version of the method are detailed to provide step-by-step guidelines to implement this method. For clarity and tracking purposes, step and action reference numbers (given in parentheses) correspond to those presented in Fig. 2, which are described sequentially below.

Internal environment (I)

COSO (2004) establishes that Internal Environment is responsible for determining how an enterprise behaves towards risks by understanding its culture, integrity, values and administrative council. This description suits corporations and is, to some extent, different from ICLS circumstances, where risk behaviour remains in the owner's domain. Agricultural risk management literature addresses this topic in a more tangible and feasible way. The Internal Environment step was unfolded in three actions:

Business understanding (1): This action aims to contextualize risk management within its implementation environment. Thus, business structure is presented in terms of products, field areas, production methods, original activity prior to ICLS, business units and other relevant characteristics for agricultural production.

Strategic analysis (18): Once the ICLS physical characteristics are understood, the business strengths, weaknesses, opportunities and threats (SWOT) are defined to support risk identification and objective setting actions. The next action details the business in an approach designed to simplify subsequent risk management actions.

Business main processes mapping (2): This action aims to dissociate the business into units and main processes to guide objective setting and simplify risk identification by focusing on process macro activities (e.g., crop production, animal production, purchase and sales) of each business unit (e.g., crop or livestock) (COSO, 2004). Use of a flow chart is recommended to conduct the process flow mapping, which should avoid too much detail.

Once processes are mapped and objectives are set, the impact of each activity on the objective is measured on a 1–5 scale, with 5 indicating the greatest impact on the objectives. This evaluation allows farmers to understand which macro activities are more important for the achievement of the objectives. This importance is calculated with Eqn (1):

where M j = average importance of macro activity j among m macro activities, ![]() ${O}^{\prime}_i\; $ = importance of objective i among n objectives, detailed in Eqn (2)a nd A ij = impact of macro activity j on the objective i

${O}^{\prime}_i\; $ = importance of objective i among n objectives, detailed in Eqn (2)a nd A ij = impact of macro activity j on the objective i

This quantification is used for method integration across strategic actions. A matrix can be used to support the importance calculations of the macro activities.

Risk preference (II)

Risk preference is also addressed as risk attitude or the willingness to take risks. It is a useful concept in the strategic phase to understand how much risk the farmer is willing to accept their decisions.

Risk preference determination (4): This preference is measured by response to a single question, measured on a scale of 1 (very risk averse) to 5 (very willing to take risks). Farmers’ backgrounds and past decisions can be used to support this answer. This action uses a psychometric scale (Wauters et al., Reference Wauters, van Winsen, de Mey and Lauwers2014) and supports objective setting and assessment of risk management alternatives by addressing the adequacy of risk response (COSO, 2004; Hoag, Reference Hoag2011).

Objective setting (VII)

Objectives must be aligned to the business strategy and to the willingness to take risks. The strategic analysis provides direction on what must be achieved by the ICLS, its business units and its processes adjusted to the farmer's risk preference. After the experts suggested detailing this step in three actions, the practitioner responses induced the merging of objective setting and objective ranking into a single action.

Objective setting (3) and ranking (19): Objectives can be related to production, finances, personal satisfaction, quality, lifestyle, etc. (van Winsen et al., Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013). The Balanced Scorecard tool can be used in farms with high maturity levels of risk management to associate objectives with the business strategy (Beasley et al., Reference Beasley, Chen, Junez and Wright2006). To support risk analysis, objectives are ranked according to their impact in the strategic analysis. They are classified on a 1–5 scale, where 5 represents the most important objective to the strategy. The relative importance of the objective (O’) is calculated by Eqn (2).

where ![]() ${O}^{\prime}_i\; $ = relative importance of objective i among n objectives and O i = importance of objective i among n objectives.

${O}^{\prime}_i\; $ = relative importance of objective i among n objectives and O i = importance of objective i among n objectives.

Based on the objectives, goals to monitor objective accomplishment over time are determined in the Monitoring action (Hoag, Reference Hoag2011). Objectives also contribute to qualitative evaluation and assessment of risk response alternatives. The strategic phase support steps in the tactical phase. Risk event identification relies on process maps and business units.

Risk event identification and analysis (III)

Risk events are episodes that can trigger an effect that will exert a positive or negative influence on a business objective. For example, la niña is a climatic risk event that can reduce the productivity of non-irrigated crops (Pereira et al., Reference Pereira, Hasenack, Pereira, Dewes, Canellas, Oliveira and Barcellos2018). The first action is to identify these events, then evaluate and finally prioritize them.

Risk event identification (5): This action focuses on identifying events regardless of their impact or probability. These risk events can arise from external or internal factors (COSO, 2004; Hardaker et al., Reference Hardaker, Lien, Anderson and Huirne2015). There are many tools to identify risks. Leppälä et al. (Reference Leppälä, Murtonen and Kauranen2012) present a farm risk map covering 90 internal and external events. Risk identification is based on strategic analysis, objectives and process mapping.

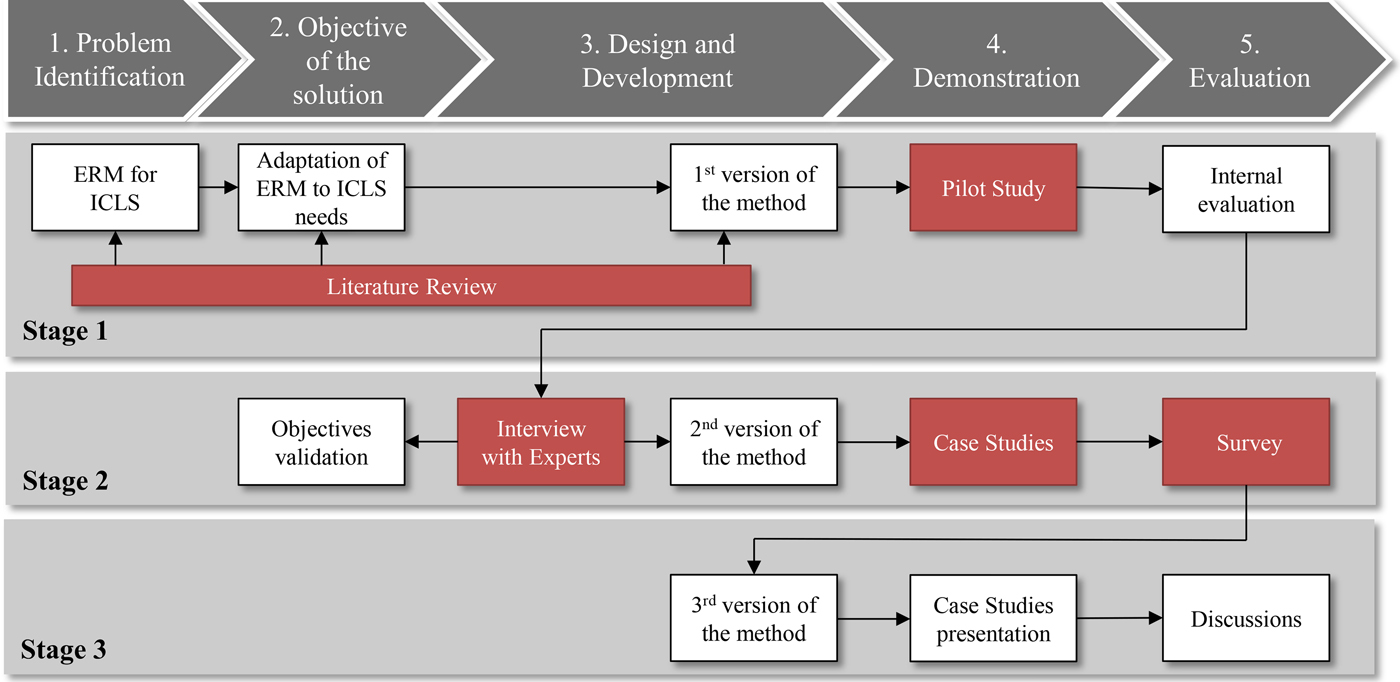

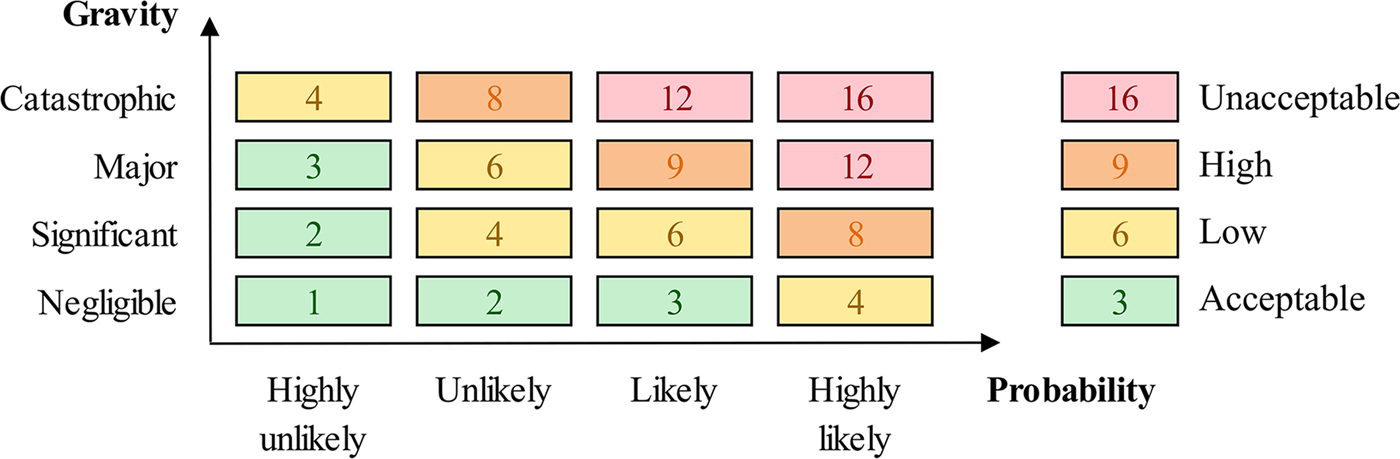

Risk probability and impact analysis (6): To prioritize risk events, their probability and impact must be estimated. Strategic actions support this evaluation. A scale ranging from 1 (very low) to 4 (very high) is used to estimate probability (P) and impact (I), which may be positive or negative. Impacts are defined based on how the risk event can affect a macro activity. This level must be justified in writing to record the justification, which will support future evaluation. Probability must be estimated based on the chance of event occurrence in the ICLS planning horizon. The same probability is set for all processes that the risk event can affect, although the impact may vary across them. To facilitate future evaluation, practitioners must determine an update frequency for risk event occurrence probabilities. Table 3 presents probability and impact scales.

Table 3. Probability and impact scale

Risk ranking (7): Risk events must be prioritized according to their impact, probability and macro activity importance. This prioritization is calculated through Eqn (3):

$$R_k = P_k \times \left( {\mathop \sum \limits_{\,j = 1}^m M_j \times I_{\,jk}} \right)$$

$$R_k = P_k \times \left( {\mathop \sum \limits_{\,j = 1}^m M_j \times I_{\,jk}} \right)$$where R k = risk of event k, P k = probability of event k, I jk = impact of event k on j macro activity and M j = average importance of macro activity j among m macro activities.

Figure 3 presents criteria to classify risk events. The gravity dimension is the product of I and M, where M intensifies or reduces risk event impacts according to the importance of the macro activity for the achievement of the objectives.

Fig. 3. Risk event classification according to probability and gravity. Adapted from: Marcelino-Sadaba et al. (Reference Marcelino-Sadaba, Perez-Ezcurdia, Echeverria Lazcano and Villanueva2014). Colour online.

Unacceptable and high risks should be evaluated through qualitative or quantitative analysis to manage them with appropriate priority and precision. Unacceptable risks, if not managed, can frustrate strategic objectives. On the other hand, low and acceptable risks can be monitored and ignored, respectively.

Risk evaluation (IV)

This step deepens the understanding of how the main risk events affect the business objectives. Qualitative or quantitative analyses are employed to explore these effects.

Qualitative analysis through cognitive mapping (8): The main risk events are expressed in a cause-effect diagram referred to as a cognitive map (van Winsen et al., Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013). This tool connects risk events, effects and impacts on the objectives. The purpose of this diagram is to express visually the relationship between risks and objectives, helping the farmer to understand the importance of risks. Cognitive mapping does not depend on the quantitative evaluation, which is an advantage for the assessment of qualitative risks. This tool is useful when there is a complex system to manage and when there is a lack of quantitative data or incomplete scientific knowledge (Özesmi and Özesmi, Reference Özesmi and Özesmi2004). The experts instructed that cognitive mapping should be direct, avoiding excessive indirect relationships to help guarantee method feasibility. This tool supports risk identification, quantitative risk evaluation and the Risk Response step, allowing for the management of risks without quantification.

Quantitative evaluation (10) and production simulation (9): Experts dedicated little attention to the Production Simulation action, causing it to merge with the subsequent and more discussed action: Quantitative Evaluation. The main quantitative risk events are measured to better understand their impact on objectives. A production simulation might be used to support risk evaluation. Sensitivity analysis, scenario analysis or Monte Carlo simulation are tools used to evaluate financial risks. The financial impact supports the Risk Response step and is measured using information on cash flow and profit.

Risk response (V)

This step determines solutions to the risk events assessed previously. The combination of actions to risk response aims to manage risks as a portfolio. Therefore, it favours natural hedge and is cost-saving by avoiding individual risk mitigation. For example, if currency increase hampers crop costs, and if currency decline hampers livestock costs at the same proportions and intensity, there is no point in mitigating these risks individually. At the enterprise level, these two risks might cancel out, making ICLS insensitive to currency variation. This means that risks from every part of the farm are managed in an integrated manner.

Risk response alternatives identification (11): The purpose of this action is to designate risk management alternatives for each main risk event. The alternatives vary between risk acceptance, mitigation, reduction, or transference.

Risk response alternatives assessment (12): Each alternative risk is assessed based on financial and objective impacts. In other words, the costs and benefits of the alternatives must be considered to support the alternative selection. Finally, each alternative is classified on the risk preference scale of 1 (very risk averse) to 5 (very willing to take risks) to fit the ICLS farmer's risk preference.

Risk response plan setting (13): Based on the alternative assessment and risk preference, alternatives are selected for each risk event. The selected alternatives should fit the farmer's willingness to take risks to prevent excessive or insufficient risk-taking. Risk preference provides a means to balance and guide alternative selection.

Cognitive map conclusion (14): To summarize risk response, the Cognitive Map is complemented with the selected risk alternatives. The purpose of this action is to summarize and present risk management in a visual manner.

Monitoring and control (VI)

This step focused on procedures to support risk response implementation. To this end, a control plan, an information system and a monitoring system are defined to ensure that an adequate risk response is implemented over time. Operational actions received fewer comments by experts and practitioners, which may suggest a decision fatigue bias. Furthermore, the last actions were exploited less than the initial ones in the case studies. This behaviour was also noted in the usefulness and feasibility evaluation. Thus, Monitoring and Control actions were merged.

Risk management control (15) and risk communication (16): Considering the fatigue bias, the Risk Communication action was merged with the Risk Control action, which also enables information dissemination. The method evaluation by survey supports this decision. The feasibility scores of the Risk Control and Risk Communication actions were the same (3.44:5.00) and their usefulness scores (3.94:5.00 and 4.00:5.00, respectively) differed slightly.

Risk control consists of assigning a person to be responsible for each risk response, including risk treatment and management. To control risk events, the 5W2H tool was used to guide risk management. The cognitive map was used to communicate risk management at the farm visually.

Risk monitoring (17) and monitoring goal setting (20): The Monitoring Goals Setting action was merged with Risk Monitoring. This merge reinforces the link between the strategic and operational phases, emphasizing the cyclic approach to risk management (Hoag, Reference Hoag2011). Setting monitoring goals after risk response also provide a more accurate perspective on what is more relevant to monitor.

The definition of monitoring goals is important to monitor risks and their impact on the organizational objectives. This identification of key risk indicators (KRI) improves farm capacity to react early to risk changes. Without KRI definition, small and relevant changes may not attract manager attention, incurring a potential loss or opportunity squandered. Along with KRI, it is also important to define specific dates to update risk statuses. Risk monitoring consists of being aware of facts that could affect the achievement of farm objectives. This monitoring activity could be shared with company employees by addressing KRI information updates with them. When changes occur, communication should trigger a new risk assessment for a proactive reaction. Risk monitoring actions interconnect with other method actions to make risk management a cyclic process.

Demonstration

The third version of the method was demonstrated in four case-studies and their results are summarized by the steps presented in Table 4. Considering the internal environment, farm production systems were similar: they integrated soybean and beef production with one or more other cultures. Practitioners agreed that increasing food demand and proximity to buyers were business opportunities, while costs, lack of irrigation and corruption scandals were considered threats. These risks were related to production processes, which were mapped and supported objective setting. The farmers’ major objectives were profit, personal satisfaction and production maximization, although risk preference varied among the farms. In contrast to the findings of Wauters et al. (Reference Wauters, van Winsen, de Mey and Lauwers2014), farm size tended not to influence risk preference, which suggests that the willingness to take risks was an idiosyncratic and independent farm characteristic. The main risks identified were related to climate, production, market and institutional aspects. The same risk sources were identified by other authors (Flaten et al., Reference Flaten, Lien, Koesling, Valle and Ebbesvik2005; Lien et al., Reference Lien, Flaten, Jervell, Ebbesvik, Koesling and Valle2006; Akcaoz et al., Reference Akcaoz, Ozcatalbas and Kizilay2009, Reference Akcaoz, Kizilay and Ozcatalbas2010). Institutional risks gained more attention due to a Brazilian police operation named Carne Fraca, which revealed a corruption scandal in the meat industry that affected the entire Brazilian agricultural sector, showing the effects of this type of risk.

Table 4. Summary of the method implementation in four demonstration farms

a Numbers denote objective priority.

b Numbers in parentheses denote risk score in terms of gravity and probability.

Farm IV ranked risks higher than the other farms, revealing the influence of its risk preference on risk ranking. Actually, this sensitivity to risk undermined risk event prioritization because every risk was scored equally highly. Despite this, the qualitative importance of risks was highlighted by the Cognitive Map, and the most relevant ones were assessed quantitatively by sensitivity or scenario analysis. Financial and production planning, insurance and future price contracts were the main risk responses selected. These propositions were monitored, communicated and controlled through planning, meetings and incentives to intensify ICLS use.

Discussion

The present study was designed to develop a method to manage risk in ICLS. Its development advances the study of Hoag (Reference Hoag2011). The strategic phase included process mapping and considered strategic aspects beyond the financial ones. The tactical phase proposed broader risk identification based on the risk event list (Leppälä et al., Reference Leppälä, Murtonen and Kauranen2012); contemplation of ERM concepts; qualitative analysis of risks (van Winsen et al., Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013) as well as quantitative; and added a cognitive map to Hoag's (Reference Hoag2011) procedures for risk response. The use of communication tools, as emphasized by Spratt (Reference Spratt2004), stands out as a distinct procedure in the operational phase. Additionally, the method also advances the studies of Hoag (Reference Hoag2011) and Spratt (Reference Spratt2004) by proposing the management of multiple risks simultaneously instead of focusing on just one. The main difference from previous research lies in the integrative risk management of multiple risks, its alignment with strategy, and the consideration that a risk might be considered an opportunity.

Advantages of the method application

First, the method is farmer-driven. It provides a systematic and holistic stepwise risk management focused on simplicity and value addition for its users. This solves the problem of how to manage a myriad of risks and ICLS challenges to encourage the use of this agricultural mode. The ERM approach addresses these needs by integrating a variety of risks, operational and strategic risk management, and by considering that risks can represent an opportunity. This perspective differs from that in previous agricultural risk management literature (Hoag, Reference Hoag2011; Leppälä et al. Reference Leppälä, Murtonen and Kauranen2012; van Winsen et al. Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013; Hardaker et al. Reference Hardaker, Lien, Anderson and Huirne2015) and adds value to the business by avoiding the negative effect of risks and by enabling the farmer to foresee opportunities as stated by Bromiley et al. (Reference Bromiley, McShane, Nair and Rustambekov2015). In practice, this approach increases the likelihood of achieving better results on the farm, as verified by Callahan and Soileau (Reference Callahan and Soileau2017) at the operational performance.

Second, where risk identification and its relationships with strategy and processes might be unclear, the method presents an explicit integration of these elements. Risk identification and its assessment are grounded by process mapping (Fraser and Simkins, Reference Fraser and Simkins2016). Quantification of risk event severity is based on its impact on macro activities and objectives that are more related to business strategy than in other risk management methods (Leppälä et al., Reference Leppälä, Murtonen and Kauranen2012; Komarek et al., Reference Komarek, Li and Bellotti2015). To further understand the relationship between risks, objectives and activities without further quantification, the use of Cognitive Mapping is proposed since it enables the assessment of qualitative risks and offers a more user-friendly approach. The combination of these tools provides flexibility in the evaluation process and ‘the information to make well informed decisions’ (van Winsen et al., Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013).

Third, the method also considers that risk management strategies may vary according to farmers’ willingness to take risks, which confirms the findings of Flaten et al. (Reference Flaten, Lien, Koesling, Valle and Ebbesvik2005) and Greiner et al. (Reference Greiner, Patterson and Miller2009). Thus, risk preference supports objective setting and risk response alternative selection. Objectives are set according to the risk appetite (COSO, 2004) and risk responses are selected considering the farmer's risk aversion. This characteristic enables proposal of a risk management method that is personalized to the different ICLS's profiles.

Boundaries of the method developed

This method is based on farmers’ declared information. There might exist undeclared risks, objectives and preferences by farmers (Flaten et al., Reference Flaten, Lien, Koesling, Valle and Ebbesvik2005). This lack of complete information is natural and necessary for the method feasibility. As stated above, simplicity is an important characteristic for method feasibility, however, it also imposes boundaries for the method. Otherwise, over-detailed information might lead to risk management of nothing instead of everything (Bromiley et al., Reference Bromiley, McShane, Nair and Rustambekov2015). The definition of these boundaries relies on the user of the method. It may also impose boundaries, the facts that risks are subjective, context-dependent in time and space, and might not be known.

Farmer knowledge of risk response alternatives might impose another boundary for this method. Farmers might not know all the alternatives for management of ICLS risks and associated risk characteristics as it was identified by Asai et al. (Reference Asai, Moraine, Ryschawy, de Wit, Hoshide and Martin2018) as beyond the farm level. This lack of information might lead to the inappropriate selection of alternatives. Therefore, a risk response specialist and public policies might be useful to support farmer decisions (Martin et al., Reference Martin, Moraine, Ryschawy, Magne, Asai, Sarthou, Duru and Therond2016).

Possible uses for the method developed

Enterprise risk management allows the use of risk management as a strategic tool to protect and create value for firms. The current paper developed an adaptation of this approach to ICLS practitioners, which disseminates the following ERM advantages to this field application: (i) ERM adoption tends to increase profit and reduce its volatility, thus creating value as verified by Eckles et al. (Reference Eckles, Hoyt and Miller2014); (ii) the method enhances risk communication throughout the farm, enabling proactive behaviour in the face of threats and opportunities; (iii) although risks are associated with uncertainties, the proposed method provides a structured and systematic approach to control risks, which contributes to providing a sense of command; and (iv) the method could be applied to develop business strategies to guide farmers’ decisions.

The method could also be used as a tool to encourage and support ICLS implementation, especially by large farms and for applications beyond farms (Martin et al., Reference Martin, Moraine, Ryschawy, Magne, Asai, Sarthou, Duru and Therond2016). This use supports FAO's encouragement to implement sustainable intensification (FAO, 2010). The current research demonstrates the application of this method in farms of large size, suggesting its use and suitability to ICLS. Extension agents, policymakers and researchers can determine specific actions to promote ICLS following ERM guidelines.

Apart from the ICLS context, the method might also be used in other agricultural production systems. The method better fits farms with more than one business unit and/or with a production system in which risk management is currently siloed. For example, the influence of climate change and price risks for the beef market, investigated by Pereira et al. (Reference Pereira, Hasenack, Pereira, Dewes, Canellas, Oliveira and Barcellos2018), is relevant information to integrate with risk management. In this context, the effort to implement the method is more plausible than in systems without these characteristics. The application of this method to simpler systems is not discouraged, but rather its study for these applications is encouraged.

Potential limitations of the method developed

Despite the efforts made during method development and the resulting changes and updates, it is known that as for any research, there are limitations to the proposed method and its development. First, regarding development, risk management must be considered as a long-term strategy (Kuethe and Morehart, Reference Kuethe and Morehart2012). In the current work, the evaluation of results was limited to only 1 year, which might conceal future successes and failures. Second, the survey sample size was low due to limitations in the number of practitioners interested in being instructed on the implementation and evaluation of the method. This limitation is softened by the method's considerable reliability. Third, one may argue that the farms represented in the case-studies are a small sub-set due to their size; nevertheless, it is important to highlight that these depict typical farms in the region. Furthermore, the field application of this method in large market-oriented farms may encourage ICLS implementation in other farms. Finally, there are ERM details related to corporate control that were not portrayed in the current study.

The current study provides an initial proposition to use ERM in agricultural systems, more precisely, for ICLS. It is relevant to consider that there are limitations in the developed method. First, it should be noted that the method does not consider specific and technical ICLS details such as soil characteristics and manure concentration. Second, the method uses Cognitive Mapping as a qualitative tool to assess and communicate risks, which implies the use of a simplified portrayal of reality (van Winsen et al., Reference van Winsen, de Mey, Lauwers, Van Passel, Vancauteren and Wauters2013). Third, risk preference and its relationship to objective setting and to alternative plan setting are qualitative. Future research may use a quantitative approach to increase accuracy in the definition of this relationship.

Final considerations

The design of ERM for ICLS fulfils a long-existing integration gap between these two leading research areas. Enterprise risk management manages risks as a portfolio across an enterprise, instead of a narrow and siloed management. This comprehensive approach of multiple risks meets ICLS needs to manage integrated resources, products and challenges. Crop and livestock The proposed method stands out because it links strategy to risk management through processes and enables qualitative and quantitative analysis. It also provides risk quantification to support Cognitive Map development. Moreover, the method considers risk preference to determine the risk management plan. All these aspects are designed based on ICLS. However, they are not restricted to this farming system. Other agricultural methods must be considered as opportunities to implement the method and spread ERM practices throughout the agricultural sector. Independent of the agricultural method, the proposed method can be implemented in future research to support rural development strategies and practices to reduce the negative impact of risks and to exploit the positive impacts.

risks are managed jointly and oriented strategically to add value to the farm. The most important contribution of the current study is to show how to manage risks for ICLS with an ERM approach. The proposed approach is based on the literature reviewed and was evaluated by five experts, four case-studies and 20 practitioners, resulting in a method that guides ERM implementation in ICLS.

Author ORCIDs

R. G. Faria Corrêa, 0000-0002-1106-7740.

Financial support

This study was supported by the Coordination for the Improvement of Higher Education Personnel/CAPES, Brazil.

Conflicts of interest

The authors declare that there is no conflict of interest that could be perceived as affecting the impartiality of the research reported.

Ethical standards

Not applicable