No CrossRef data available.

Published online by Cambridge University Press: 12 February 2016

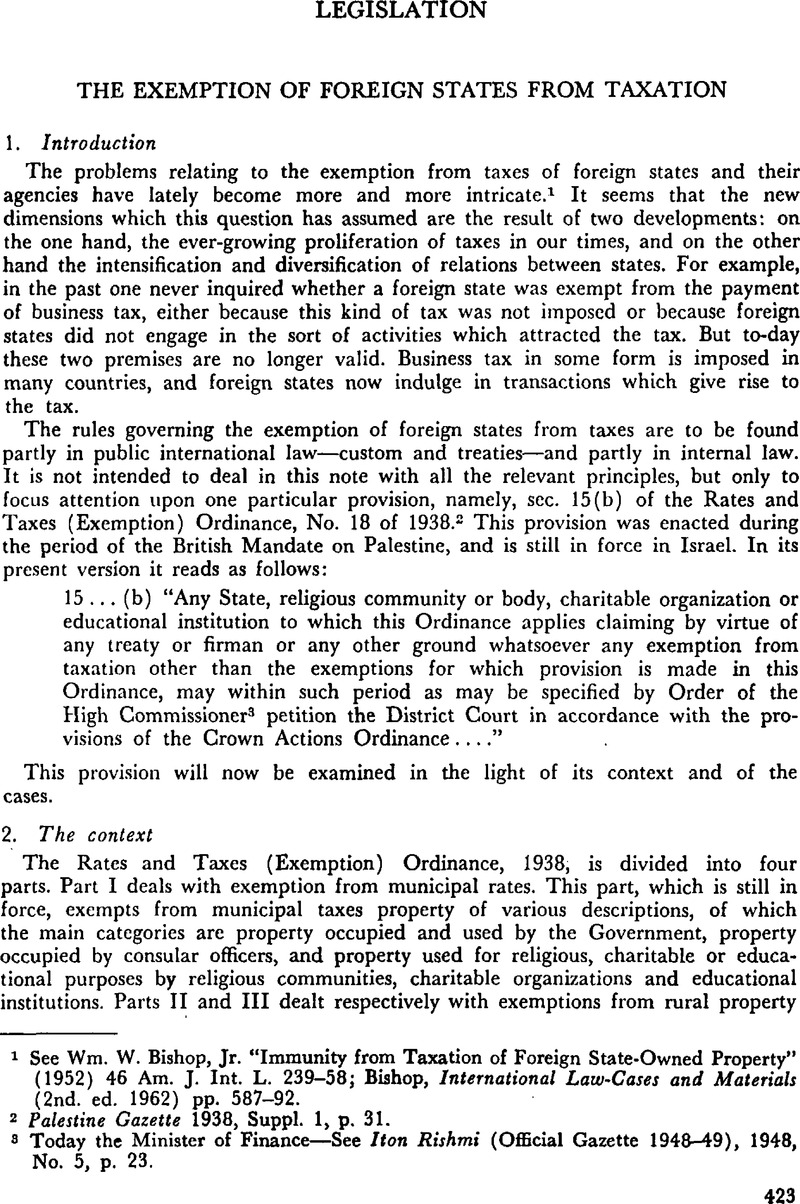

1 See Bishop, Wm. W. Jr., “Immunity from Taxation of Foreign State-Owned Property” (1952) 46 Am. J. Int. L. 239–58CrossRefGoogle Scholar; Bishop, , International Law-Cases and Materials (2nd. ed. 1962) pp. 587–92Google Scholar.

2 Palestine Gazette 1938, Suppl. 1, p. 31Google Scholar.

3 Today the Minister of Finance–See Iton Rishmi (Official Gazette 1948–1949), 1948, No. 5, p. 23Google Scholar.

4 15 L.S.I. 101.

5 Rates and Taxes (Exemption) (Amendment) Ordinance, No. 13 of 1941, P.G. 1941, Suppl. 1, p. 38.

6 Rates and Taxes (Exemption) (Amendment) Ordinance, No. 9 of 1943, P.G. 1943, Suppl. 1, p. 19.

7 Iton Rishmi 1948, No. 5, p. 23.

8 Urban Property Tax Ordinance, Drayton, The Laws of Palestine, chap. 147.

9 Rural Property Tax Ordinance, 1935, P.G. 1935, Suppl. 1, p. 1.

10 See supra.

11 It should be mentioned, however, that in one case the court expressed the opinion, in an obiter dictum, that even sec. 8(1) of the Urban Property Tax Ordinance of 1928, which dealt with exemptions of “any person”, referred “to general exemptions such as those enjoyed by charitable institutions, religious bodies and Consular Corps or the like … ” —Shapiro v. A.G., (1940) S.C.J. 133.

12 On the problem in general, see Wedderburn, K. W., “Sovereign Immunity of Foreign Public Corporations” (1957) 6 Int. and Comp. L.Q. 290–300CrossRefGoogle Scholar; Sucharitkul, Sompong, State Immunities and Trading Activities in International Law (1959) pp. 104–61Google Scholar (“Immunities in respect of state Agencies”); Harvard Research in International Law, “Competence of Courts in Regard to Foreign States” (1932) 26 Am. J. Int. L. Suppl. 716–25Google Scholar (Article 26 and Comment).

13 Cited from The Orthodox Patriarchate v. Municipal Corporation of Jerusalem (1940) S.C.J. 497. This finding was, however, overruled by the Privy Council on appeal: The Orthodox Patriarchate v. Municipal Corporation of Jerusalem (1943) A.L.R. 800.

14 (1943) A.L.R. at 801 and 802.

15 (1940) S.C.J. 497.

16 The Orthodox Patriarchate v. A.G., mentioned in The Apostolic Throne of St. Jacob v. A.G. (1940) S.C.J. 357.

17 See “Objects and Reasons”, published with the Bill, P.G., 1937, p. 889, on p. 895.

18 Custodian of Absentee Property v. Samra (1956) 10 P.D. 1825; Reiczuk v. A.G. (1959) 13 P.D. 959. On the attitude of the courts during the Mandate, see Rosenblatt v. The Registrar of Lands, Haifa (1947) A.L.R. 499.

19 See Klinghoffer, H., Administrative Law, vol. 1, 1957, p. 79 (in Hebrew)Google Scholar.

20 See e.g. sec. 21 of the Extradition Law, 1954, 8 L.S.I. 144.

21 Shimshon Ltd. v. A.G. (1950) 4 P.D. 143.

22 Replies from Governments to Questionnaire of the International Law Commission, U.N. Doc. A/CN.4./19 (1950), Yearbook of the International Law Commission, II, 206–18 (Memorandum by the Ministry for Foreign Affairs of Israel on the Law of Treaties, especially on 215); Rosenne, Sh., “Israel and the International Treaties of Palestine” (1950) 77 Journal du droit international (Clunet), 1140Google Scholar.

23 Supra n. 17.

24 There is no definition of the term firman in the Ordinance. According to the Encyclopaedia Britannica (Sub. verb.), a firman is “an edict of an oriental sovereign”. The term is “used specially to designate decrees, grants, passports, etc., issued by the Sultan of Turkey and signed by one of his ministers”.

25 For references, see supra, n. 13.

26 e.g. The Apostolic Throne of St. Jacob v. A.G., (1940) S.C.J. 357.

27 See supra, n. 13, (1940) S.C.J. 497.

28 Supra, n. 17.

29 Supra, n. 16.

30 Supra, n. 2.

31 Supra, n. 5.

32 Supra, n. 6.

33 P.G 1943, Suppl. 2. p. 721.

34 Supra, n. 7.

35 On the capitulations, see references in Oppenheim-Lauterpacht, , International Law—A Treatise, vol. I (8th ed., 1955), p. 683, note 2Google Scholar.

35a It might be interesting to compare these measures with those adopted by many developing countries to encourage foreign investment.

36 See Mandate for Palestine, prepared by the Department of State, Washington, Division of Near Eastern Affairs (1927) p. 14; Stoyanovsky, J., The Mandate for Palestine (1928), p. 192–194Google Scholar.

37 (1948) 1 L.S.I. 7.

38 See Akzin, B., “The Prerogative in the State of Israel” (1950) 7 HaPraklit 566–71 and 590–95Google Scholar, on pp. 590–91, and the cases cited there.

39 e.g. Rates and Taxes (Exemption) Ordinance (Amendment) Law, 1954, 8 L.S.I. 117Google Scholar.

40 Secs. 6–13 have been repealed by sec. 67 of the Property Tax and Compensation Fund Law, 1961, 15 L.S.I. 101Google Scholar.

41 Municipality of Tel-Aviv-Yaffo v. Director of Property Tax and Compensation Fund (1964) 18 P.D. 524, at 529–32.