No CrossRef data available.

Published online by Cambridge University Press: 04 April 2017

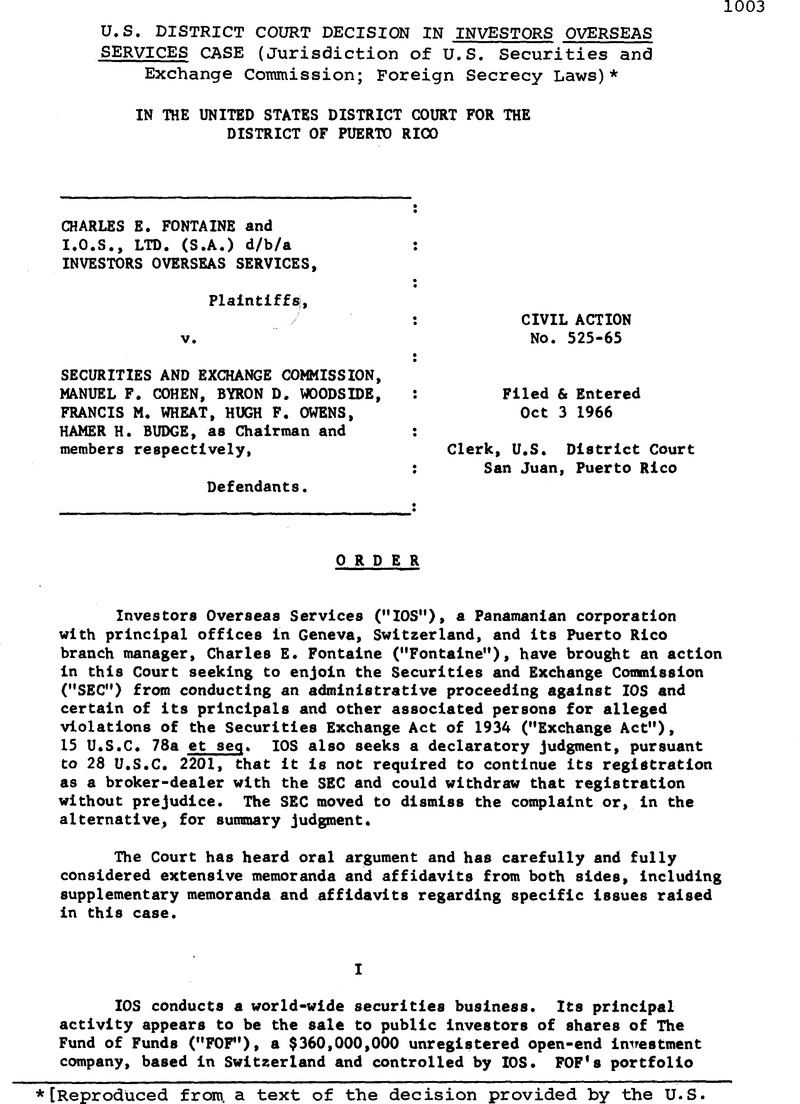

[Reproduced from, a text of the decision provided by the U.S. Securities and Exchange Commission. A memorandum of the S.E.C. on foreign secrecy laws and the application of the U.S. Securities and Exchange Act appears at page 1016.]

1/ 15 U.S.C. 78dd(b), which provides:

(b) The provisions of this title or of any rule or regulation thereunder shall not apply to any person insofar as he transacts a business in securities without the jurisdiction of the United States, unless he transacts such business in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate to prevent the evasion of this chapter.

2/ Plaintiff also sought similar declaratory relief with respect to a subpoena duces tecum which an SEC staff member had served upon Fontaine. That part of the complaint dealing with the subpoena is dismissed for the reasons stated in this Court’s order of January 31, 1966 dismissing plaintiffs’ Motion to Quash the Subpoena.

3/ In the Order for Proceeding, the SEC’s staff alleges:

1. That IOS and the other respondents had violated Sections 5(a) and 5(c) of the Securities Act of 1933, 15 U.S.C. 77o(a) and 77£(c), and Section 7 of the Investment Company Act, 15 U.S.C. 80a-7, by the use of the means and instruments of interstate commerce to offer to sell, sell and deliver after sale, shares in an IOS Investment Program pursuant to which FOF interests are sold, when no registration statement was in effect under the Securities Act and when neither FOF nor the IOS investment [sic] Program had registered pursuant to Section 8 of the Investment Company Act, 15 U.S.C. 80a-8. The Order also sets forth numerous deficiencies in IOS offering materials which would not have been permitted had the securities been registered;

2. That IOS and other respondents violated Section 17(d) of the Investment Company Act, 15 U.S.C. 78q(d), and Rule 17d-l thereunder, 17 CFR 240.17d-l, in connection with an offering of securities of a corporation, Ramer Industries Inc., by effecting joint transactions therein between persons affiliated with a registered investment company in contravention of rules prescribed by the Commission;

3. That Investors Continental Services, Ltd., willfully violated Section 17(a) of the Securities Exchange Act, 15 U.S.C. 78q(a), and IOS, among others, willfully aided and abetted such violation by failing to keep and preserve a certain communication required to be preserved under Rule 17a-4 pursuant to that Act, 17 CFR 240.17a-4, and that IOS willfully violated Section 17(a) of that Act, aided and abetted by others of the respondents, by failing to furnish to the Commission upon demand certain books and records required to be kept by IOS relating to transactions effected by IOS for customers who are citizens of the United States; and

4. That IOS’s activities with respect to the direction of brokerage and the “give-up” of brokerage commissions to brokers and dealers designated by IOS (which resulted in statements in prospectuses and proxy material of registered investment companies not in accordance with the facts) and with respect to reciprocal business from which IOS derived substantial benefits, are relevant to the public interest.

4/ Pursuant to Section 15(b)(6) the Commission has adopted Rule 15b6-l17 CFR 240.15b-6, which provides:

“If a notice to withdraw from registration is filed by a broker or dealer pursuant to section 15(b), it shall become effective on the 30th day after the filing thereof with the Commission, unless prior to its effective date The Commission institutes a proceeding pursuant to section 15(b) to revoke or suspend the registration of such broker or dealer or to impose terms and conditions upon such withdrawal. If the Commission institutes such a proceeding, or if a notice to withdraw from registration is filed with the Commission at any time subsequent to the date of the issuance of a Commission order instituting proceedings pursuant to section 15(b) to revoke or suspend the registration of the broker or dealer filing such notice, and during the pendency of such a proceeding, the notice to withdraw shall not become effective except at such time and upon such terms and conditions as the Commission deems necessary or appropriate in the public interest or for the protection of investors.”

5/ (S.D. Fla., 1942) 2 S.E.C. Jud. Dec. 719, 721.

7/ See Section 25(a) of the Securities Exchange Act, 15 U.S.C. 78y(a).

8/ The following is the official French text of/Article 273 found in Titre Triezième of Le Code Pénal Suisse, 3 Recueil Systématique des Lois et Ordonnannces 1848-1947 263:

(French text omitted)

No official translation of the Article into the English language is available. IOS has translated Article 273, as a part of the Opinion of its expert Robert Turretinni, as follows:

“Industrial Espionage

Anyone seeking to discover an industrial or commercial secret for the purpose of making it known to a foreign official or private body, or to a foreign private enterprise, or to their agents.

Anyone who makes known an industrial or commercial secret to a foreign official or private body, or to a foreign private enterprise or to their agents. will be punished with imprisonment or, in serious cases, committed to a penitentiary. Furthermore, the Judge may award a fine.”

The translation submitted by Dr. Schoch, the SEC’s expert, differs in no material respect from the above.

9/ The following is the official French text of Art. 47(B) found in Chapitre XIV of the Loi Fédérale sur les banques et les caisses d’épargne, 10 Recueil Systématique des Lois et Ordonnances 1848-1947 342:

(French text omitted)

No official translation of this Article into the English language is available. IOS has translated Article 57(b), as a part of the opinion of its expert Robert Turettinni, as follows:

“Anyone who intentionally,

* * *

in his capacity as an executive or employee of a bank, auditor, or assistant auditor, or as a member of the banking commission, or as an official or employee of its secretariat violates the discretion which he is bound to observe by virtue of the law on professional secrets, or who induces or attempts to induce anyone to commit this infraction.

shall be punishable by a maximum fine of 20,000 Swiss francs or a maximum of six months imprisonment, or both.

If the person concerned has acted through negligence, the penalty shall be a maximum fine of 10,000 Swiss francs.” The translation submitted by Dr. Schoch, the SEC’s expert differs in no material respect from the above.

10/ Specifically, Dr. Schoch concludes:

“1. It is likely that Article 273 of the Swiss Penal Code would not be applied so as to preclude IOS from producing its books and records relating to transactions with, or for, United States citizens, for inspection by the Commission in accordance with IOS’s express undertaking to do so, which was filed by IOS as a condition of its registration.

“2. It is likely that Swiss law would not be violated if IOS under these circumstances produced its books and records relating to securities transactions with or for United States citizens pursuant to an order of a United States Court enforcing a demand for such books and records under the provisions of the Securities Exchange Act.

“3. Whether IOS is subject to Section 47(b) of the Swiss Banking Act is a question of fact depending purely upon whether IOS has been certified as a bank or bank-like institution by the Swiss Federal Banking Commission. No such showing has been made.

“4. There is no rule of Swiss law which would prevent IOS from closing its branch office in Geneva and removing its operations, together with its books and records, to some other country whose laws would raise no doubts as to the permissibility of the production of its books and records under these circumstances.”

11/ Dr. Turrettini concluded:

(French text omitted)

The English translation of the above portions of Dr. Turrettini’s opinion submitted by IOS, is as follows:

“On the basis of this Article [Article 273], I conclude that it is not possible for I.O.S., Ltd. (S.A.), Geneva Branch, to allow access to a foreign organization, even an official one, to particulars of its own business, under penalty of its officers being subject to imprisonment and a fine.

“It should be noted that prosecution would be automatic, and that it would not be necessary for a complaint to be made.

* * *

“It appears indeed that I.O.S., Ltd. (S.A.), Geneva Branch, is constituted as a financial company having the characteristics of a bank by virtue of the activity in which it overtly engages.

“Therefore, I.O.S., Ltd. (S.A.) must strictly observe the imperative regulations expressed by this law [Article 47(b)].

* * *

“Consequently, you [IOS] may not, without violating Swiss law, submit your files without restriction to the Securities and Exchange Commission, unless relieved of such obligation to secrecy by your clients.

* * *

“To conclude the foregoing, I shall reply briefly as follows to the first two questions put to you by the Judge of the District Court of Puerto Rico:

“1. There is an obvious and serious conflict between the Swiss Penal Code and demands made upon you by the Securities and Exchange Commission.

“2. A decision of a United States court which is contrary to the Swiss Penal Code may not be complied with by your company without exposing it, as well as its executives, to civil and criminal prosecution by the Swiss judicial authorities.”

12/ See First National City Bank v. Internal Revenue Service, (2 Cir. 1959) 271 F.2d 616, 620, certiorari denied, (1960) 361 U.S. 948, 80 S. Ct. 402, 4 L. Ed. 2d 381.

13/ Kerr Steamship Co. v. United States, (2 Cir., 1960) 284 F.2d 61 judgment vacated with direction to dismiss as moot, 369 U.S. 422, 82 S. Ct. 874, 7 L. Ed. 2d 847.