No CrossRef data available.

Article contents

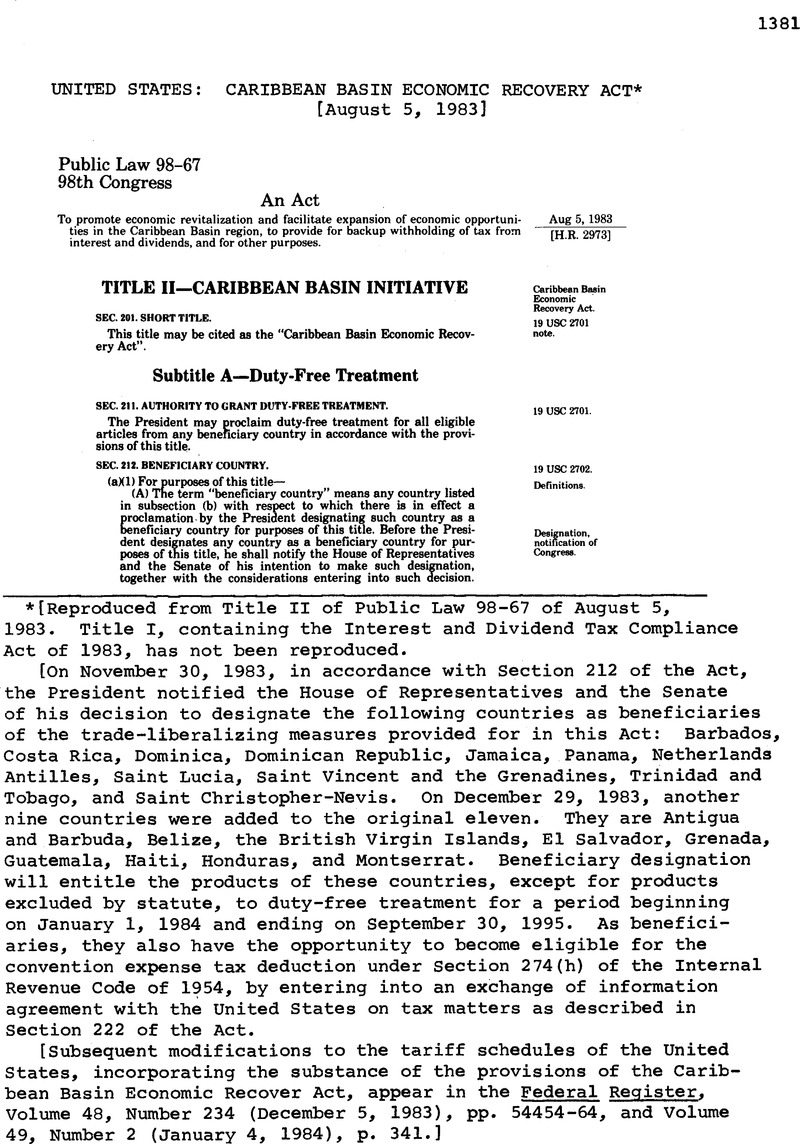

United States: Caribbean Basin Economic Recovery Act*

Published online by Cambridge University Press: 04 April 2017

Abstract

- Type

- Legislation and Regulations

- Information

- Copyright

- Copyright © American Society of International Law 1983

Footnotes

[Reproduced from Title II of Public Law 98-67 of August 5,1983. Title I, containing the Interest and Dividend Tax Compliance Act of 1983, has not been reproduced.

[On November 30, 1983, in accordance with Section 212 of the Act,the President notified the House of Representatives and the Senateof his decision to designate the following countries as beneficiariesof the trade-liberalizing measures provided for in this Act: Barbados,Costa Rica, Dominica, Dominican Republic, Jamaica, Panama, NetherlandsAntilles, Saint Lucia, Saint Vincent and the Grenadines, Trinidad andTobago, and Saint Christopher-Nevis. On December 29, 1983, anothernine countries were added to the original eleven. They are Antiguaand Barbuda, Belize, the British Virgin Islands, El Salvador, Grenada,Guatemala, Haiti, Honduras, and Montserrat. Beneficiary designationwill entitle the products of these countries, except for productsexcluded by statute, to duty-free treatment for a period beginningon January 1, 1984 and ending on September 30, 1995. As beneficiaries,they also have the opportunity to become eligible for theconvention expense tax deduction under Section 274(h) of the InternalRevenue Code of 1954, by entering into an exchange of informationagreement with the United States on tax matters as described inSection 222 of the Act.

[Subsequent modifications to the tariff schedules of the UnitedStates, incorporating the substance of the provisions of the CaribbeanBasin Economic Recover Act, appear in the Federal Register,Volume 48, Number 234 (December 5, 1983), pp. 54454-64, and Volume49, Number 2 (January 4, 1984), p.341.]

References

* [Reproduced from Title II of Public Law 98-67 of August 5,1983. Title I, containing the Interest and Dividend Tax Compliance Act of 1983, has not been reproduced.

[On November 30, 1983, in accordance with Section 212 of the Act,the President notified the House of Representatives and the Senateof his decision to designate the following countries as beneficiariesof the trade-liberalizing measures provided for in this Act: Barbados,Costa Rica, Dominica, Dominican Republic, Jamaica, Panama, NetherlandsAntilles, Saint Lucia, Saint Vincent and the Grenadines, Trinidad andTobago, and Saint Christopher-Nevis. On December 29, 1983, anothernine countries were added to the original eleven. They are Antiguaand Barbuda, Belize, the British Virgin Islands, El Salvador, Grenada,Guatemala, Haiti, Honduras, and Montserrat. Beneficiary designationwill entitle the products of these countries, except for productsexcluded by statute, to duty-free treatment for a period beginningon January 1, 1984 and ending on September 30, 1995. As beneficiaries,they also have the opportunity to become eligible for theconvention expense tax deduction under Section 274(h) of the InternalRevenue Code of 1954, by entering into an exchange of informationagreement with the United States on tax matters as described inSection 222 of the Act.

[Subsequent modifications to the tariff schedules of the UnitedStates, incorporating the substance of the provisions of the CaribbeanBasin Economic Recover Act, appear in the Federal Register,Volume 48, Number 234 (December 5, 1983), pp. 54454-64, and Volume49, Number 2 (January 4, 1984), p.341.]