No CrossRef data available.

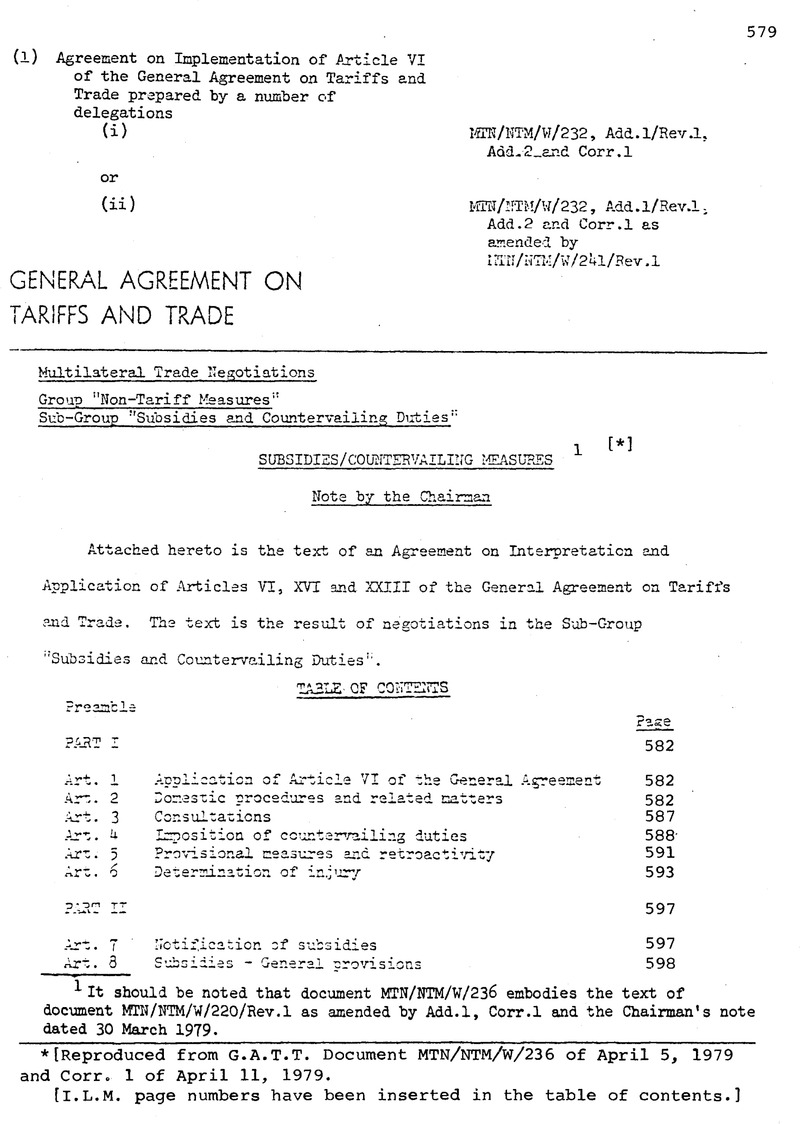

It should be noted that document MTN/NTM/W/236 embodies the text of document MTN/NTM/W/220/Rev.l as amended by Add.l, Corr.l and the Chairman's note dated 30 March 1979.

* [Reproduced from G.A.T.T. Document MTN/NTM/w/236 of April 5, 1979 and Corr. 1 of April 11, 1979.

[I.L.M. page numbers have been inserted in the table of contents.]

page 580 note 1 The term “signatories” is hereinafter used to mean parties to this Agreement

page 580 note * This Agreement has been prepared and advanced by the delegations of Austria, Brazil, Bulgaria, Canada, Colombia, European Communities, Finland, Hungary, Japan. Mexico, Norway, Poland, Sweden, Switzerland, United Kingdom on behalf of Hong Kong the United States and Yugoslavia.

page 581 note 1 wherever in this Agreement there is reference to “the terms of this Agreement” or the “articles” or “provisions of this Agreement” it shall be taken to mean, as the context requires, the provisions of the General Agreement as interpreted and applied by this Agreement.

page 582 note 1 The provisions of both Part I and Part II of this Agreement may be invoked in parallel: however, with regard to the effects of a particular subsidy in the domestic market of the importing country, only one form of relief (either a countervailing duty or an authorized countermeasure) shall be available.

page 582 note 2 The term “countervailing duty” shall be understood to mean a special duty levied for the purpose of off-setting any bounty or subsidy bestowed directly or indirectly upon the manufacture, production or export of any directly or indirectly upon the manufacture, production or export of any merchandise, as provided for in Article VI:3 of tha General Agreement.

page 582 note 3 The term “initiated” as used hereinafter means procedural action by which a signatory formally commences an investigation as provided in paragraph 3 of this Article.

page 583 note 1 Under this Agreement the term “injury” shall, unless otherwise specified, be taken to mean material injury to a domestic industry, threat of material injury to a domestic industry or material retardation of the establishment of such an industry and shall be interpreted in accordance with the provisions of Article 6.

page 583 note 2 As established in Part V of this Agreement and hereinafter referred to as the Committee.

page 583 note 3 For the purpose of this Agreement ‘party’ means any natural or juridical person resident in the territory of any signatory.

page 584 note 1 Any “interested signatory” or “interested party” shall refer to a signatory or a party economically affected by the subsidy in question.

page 584 note 2 Signatories are aware that in the territory of certain signatories disclosure pursuant to a narrowly-drawn protective order may be required.

page 585 note 1 Signatories agree that requests for confidentiality should not be arbitrarily rejected.

page 585 note 2 Because of different terms used under different systems in various countries the term “finding” is hereinafter used to mean a formal decision or determination.

page 587 note 1 It is particularly important, in accordance with the provisions of this paragraph, that no affirmative finding whether preliminary or final be made without reasonable opportunity for consultations having been given. Such consultations may establish the basis for proceeding under the provisions of Part VI of this Agreement.

page 588 note 1 As used in this Agreement “levy” shall mean the definitive or final legal assessment or collection of a duty or tax.

page 588 note 2 An understanding among signatories should be developed, setting out the criteria for the calculation of the amount of the subsidy.

page 589 note 1 The word “may” shall not be interpreted to allow the simultaneous continuation of proceedings with the implementation of price undertakings, except as provided in paragraph 5(b) of this Article.

page 593 note 1 Determinations of injury under the criteria set forth in this Article shall be based on positive evidence. In determining threat of injury the investigating authorities, in examining the factors listed in this Article, may take into account the evidence on the nature of the subsidy in question and the trade effects likely to arise therefrom.

page 593 note 2 Throughout this Agreement the term “like product” (“produit similaire”) shall be interpreted to mean a product which is identical, i.e. alike in all respects to the product under consideration or in the absence of such a product, another product which, although not alike in all respects, has characteristics closely resembling those of the product under consideration.

page 594 note 1 As set forth in paragraphs 2 and 3 of this Article.

page 594 note 2 Such factors can include inter alia, the volume and prices of nonsubsidized imports of the product in question, contraction in demand or changes in the pattern of consumption, trade restrictive practices of and competition between the foreign and domestic producers, developments in technology and the export performance and productivity cf the domestic industry.

page 595 note 1 The Committee should develop a definition of the word “related” as used in this paragraph.

page 597 note 1 In this Agreement, the term “subsidies” shall be deemed to include subsidies granted by any government or any public body within the territory of a signatory. However, it is recognized that for signatories with different federal systems of government, there are different divisions of powers. Such signatories accept nonetheless the international consequences that may arise under this Agreement as a result of the granting of subsidies within their territories.

page 598 note 1 The term injury to domestic industry is used here in the same sense as it is used in Part I of this Agreement.

page 598 note 2 Benefits accruing directly or indirectly under the General Agreement include the benefits of tariff concessions bound under Article II of the General Agreement.

page 598 note 3 Serious prejudice to the interests of another signatory is used in thi Agreement in the same sense as it is used in Article XVT:1 of the General Agreement and includes threat of serious prejudice.

page 598 note 4 Signatories recognize that nullification or impairment of benefits may also arise through the failure of a signatory to carry out its obligations under the General Agreement or this Agreement. Where such failure concerning subsidies is determined by the Committee to exist, adverse effects may, without prejudice to paragraph 9 of Article 18 below, be presumed to exist. The other signatory will be accorded a resonable opportunity to reout this presumptions.

page 599 note 1 The term “displacing” shall be interpreted in a manner which takes into account the trade and development needs of developing countries and in this connection is not intended to fix traditional market shares.

page 599 note 2 The problem of third country markets so far as certain primary products are concerned are dealt with exclusively under Article 10 below.

page 599 note 3 For definition of “certain primary products” see footnote to Article 10 below.

page 599 note 4 For purposes of this Agreement “certain primary products” means the products enumerated in Note Ad Article XVI of the General Asreement Section 3, paragraph 2, with the deletion of the words “or any mineral”.

page 604 note 1 Any time periods mentioned in this Article and in Article 13 may be extended by mutual agreement.

page 604 note 2 In making such recommendations, the Committee shall take into account the trade, development and financial needs of developing country signatories.

page 605 note 1 It is understood that after this Agreement has entered into force, any such proposed commitment shall be notified to the Committee in good time.

page 607 note 1 Constructed value means cost of production plus a reasonable amount for administration, selling and any other costs and for profits.

page 609 note 1 In this connection, the Committee may draw signatories' attention to those cases in which, in its view, there is no reasonable basis supporting the allegations made.

page 609 note 2 This does not preclude, however, the uore rapid' establishment of a panel when the Committee so decides, taking into account the urgency of the situation.

page 610 note 1 The parties to the dispute would respond within a short period of time, i.e., seven working days, to nominations of panel members by the Chairman of the Committee and would not oppose nominations except for compelling reasons.

page 610 note 2 The term “governments” is understood to mean governments of all member countries in cases of customs unions.

page 612 note 1 This paragraph is not intended to preclude action under other relevant provisions of the General Agreement, where appropriate.

page 613 note 1 The term “governments” is deemed to include the competent authorities of the European Economic Community.

page 614 note 1 At the first such review, the Committee shall, in addition to its general review of the operation of the Agreement, offer all interested signatories an opportunity to raise questions and discuss issues concerning specific subsidy practices and the impact on trade5 if any, of certain direct tax practices.

page 618 note 1/ For the purpose of this Agreement:

The term “direct taxes” shall mean taxes on vages, profits, interest, rents, royalties, and all other forms of income, and taxes on the ownership of real property.

The term “import charges” shall mean tariffs, duties, and other fiscal charges not elsewhere enumerated in this note that are levied on import

The term “indirect taxes” shall mean sales, excise, turnover, value added, franchise, stanp, transfer, inventory and equipment taxes., border taxes and all taxes ether than direct taxes and inpart charges.

“Prior stage” indirect taxes are those levied on goods or services used directly or indirectly in making the product.

“Cumulative” indirect taxes are multi-stagedtaxes levied vhere there is no mechanism for subsequent crediting of the tax if the goods or services subject to tax at one stags of production are used in a succeeding stage of production.

“Remission” of taxes includes the refund or rebate of taxes.

page 619 note 2/ The signatories recognize that deferral need not amount to an export subsidy vhere, for example, appropriate interest charges are collected. The signatories further recognize that nothing in this text nrejudses the disposition by the Contracting Parties of the specific issues raised ir. GATT document 1/1-22.

The signatories reaffirm the principle that prices for goods in transactions between exporting enterprises and foreign buyers under their or under the same control should for tax purposes be the prices vhich vould be charged between independent enterprises acting at arm's length. Any signatory may draw the attention of another signatory to administrative or other practices vhich may contravene this principle and vhich result in a significant saving of direct taxes in export transactions. In such circumstances the signatories shall normally attempt to resolve their differences using the facilities of existing bilateral tax treaties or other specific international mechanisms, without prejudice to the rights and obligations of signatories under the general Agreement, including the right of consultation created in the preceding sentence.

Paragraph (e) is not intended to limit a signatory from taking measures to avoid tne double taxation of foreign source income earned by its enterprises or the enterprises of another signatory.

Where measures incompatible with the provisions of paragraph (e) exist, and where major practical difficulties stand in the way of the signatory concerned bringing such measures promptly into conformity with the Agreement, the signatory concerned shall, without prejudice to the rights of other signatories under the General Agreement or this Agreement, examine methods of bringing these measures into conformity within a reasonable period of time.

In this connection the European Economic Community has declared that Ireland intends to withdraw by 1 January 1981 its system of preferential tax measures related to exports, provided for under the Corporation Tax Act of 1976, whilst continuing nevertheless to honour legally binding commitments entered into during the lifetime of this system.

page 620 note 3/ Paragraph (h) does not apply to value-added tax systems, and border- tax adjustment in lieu thereof and the problem of the excessive remission of value-added taxes is exclusively covered by paragraph (g).

page 620 note 4/ The signatories agree that nothing in this paragraph shall prejudge or influence the deliberations of the panel established by the GATT Council on 6 June 1978 (C/M/126).

page 620 note 5/ In evaluating the long-term adequacy pf premium rates, costs and losses of insurance programmes, in principle only such contracts shall be taken into account that were concluded after the date of entry into force of this Agreement.

page 620 note 6/ An original signatory to this Agreement shall mean any signatory which adheres ad referendums to the Agreement oft or before 30 June 1979.