No CrossRef data available.

Published online by Cambridge University Press: 04 April 2017

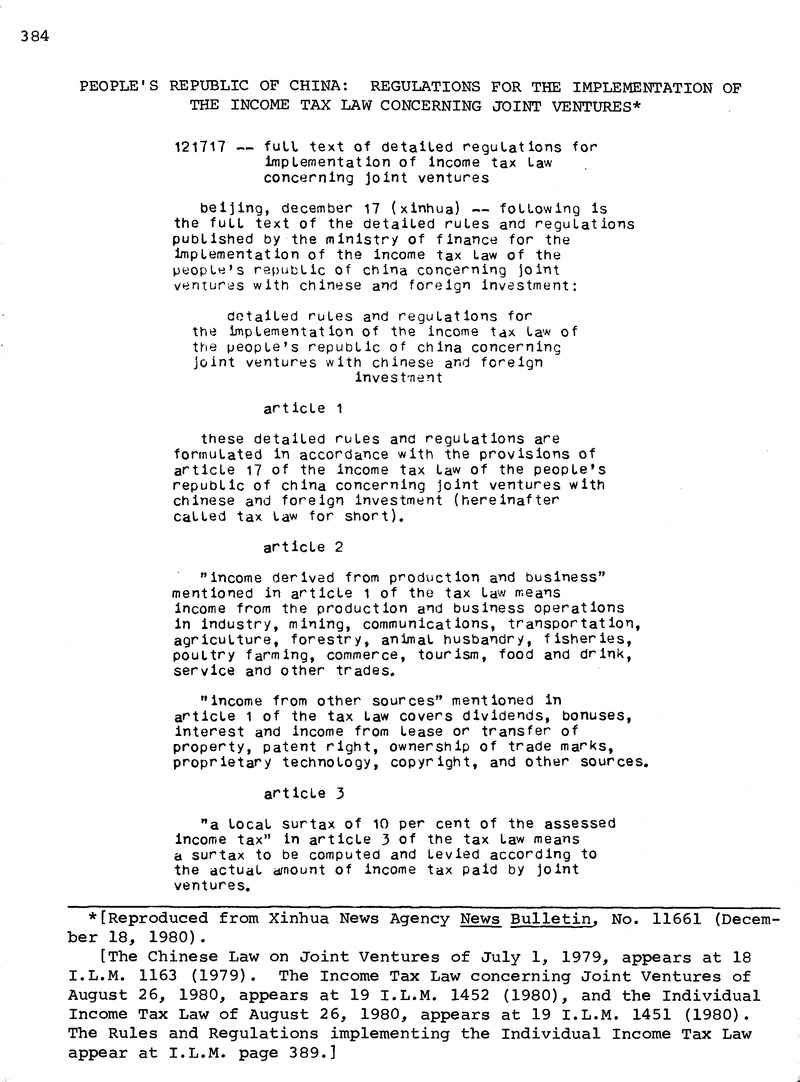

[Reproduced from Xinhua News Agency News Bulletin, No. 11661 (December 18, 1980).

[The Chinese Law on Joint Ventures of July 1, 1979, appears at 18 I.L.M. 1163 (1979). The Income Tax Law concerning Joint Ventures of August 26, 1980, appears at 19 I.L.M. 1452(1980), and the Individual Income Tax Law of August 26, 1980, appears at 19 I.L.M. 1451(1980). The Rules and Regulations implementing the Individual Income Tax Law appear at I.L.M. page 389.]

* [Reproduced from Xinhua News Agency News Bulletin, No. 11661 (December 18, 1980).

[The Chinese Law on Joint Ventures of July 1, 1979, appears at 18 I.L.M. 1163 (1979). The Income Tax Law concerning Joint Ventures of August 26, 1980, appears at 19 I.L.M. 1452(1980), and the Individual Income Tax Law of August 26, 1980, appears at 19 I.L.M. 1451(1980). The Rules and Regulations implementing the Individual Income Tax Law appear at I.L.M. page 389.]