No CrossRef data available.

Published online by Cambridge University Press: 27 February 2017

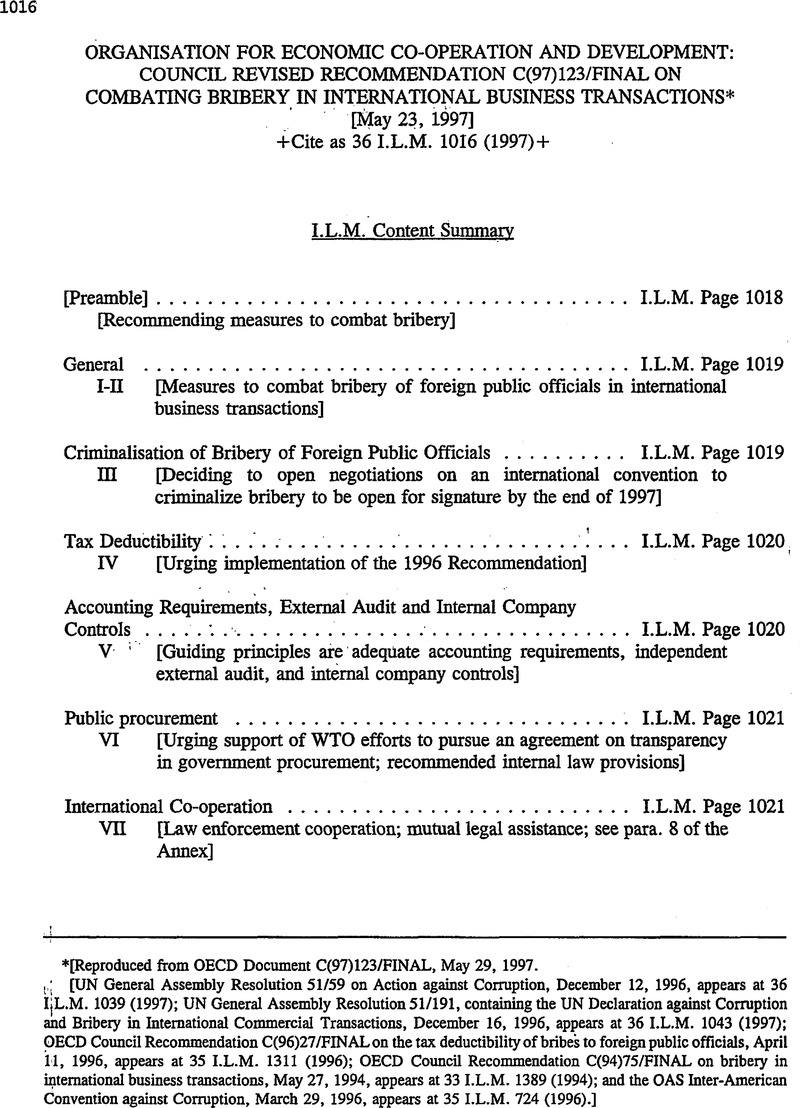

* [Reproduced from OECD Document C(97)123/FINAL, May 29, 1997.

[UN General Assembly Resolution 51/59 on Action against Corruption, December 12, 1996, appears at 36 I.L.M. 1039 (1997); UN General Assembly Resolution 51/191, containing the UN Declaration against Corruption and Bribery in International Commercial Transactions, December 16, 1996, appears at 36 I.L.M. 1043 (1997); OECD Council Recommendation C(96)27/FINAL on the tax deductibility of bribe's to foreign public officials, April 11, 1996, appears at 35 I.L.M. 1311 (1996); OECD Council Recommendation C(94)75/FINAL on bribery in international business transactions, May 27, 1994, appears at 33 I.L.M. 1389 (1994); and the OAS Inter-American Convention against Corruption, March 29, 1996, appears at 35 I.L.M. 724 (1996).]

1 Member countries’ systems for applying sanctions for bribery of domestic officials differ as to whether the determination of bribery is based on a criminal conviction, indictment or administrative procedure, but in all cases it is based on substantial evidence.

2 This paragraph summarises the DAC recommendation, which is addressed to DAC members only, and addresses it to all OECD Members and eventually non-member countries which adhere to the Recommendation.