No CrossRef data available.

Published online by Cambridge University Press: 18 May 2017

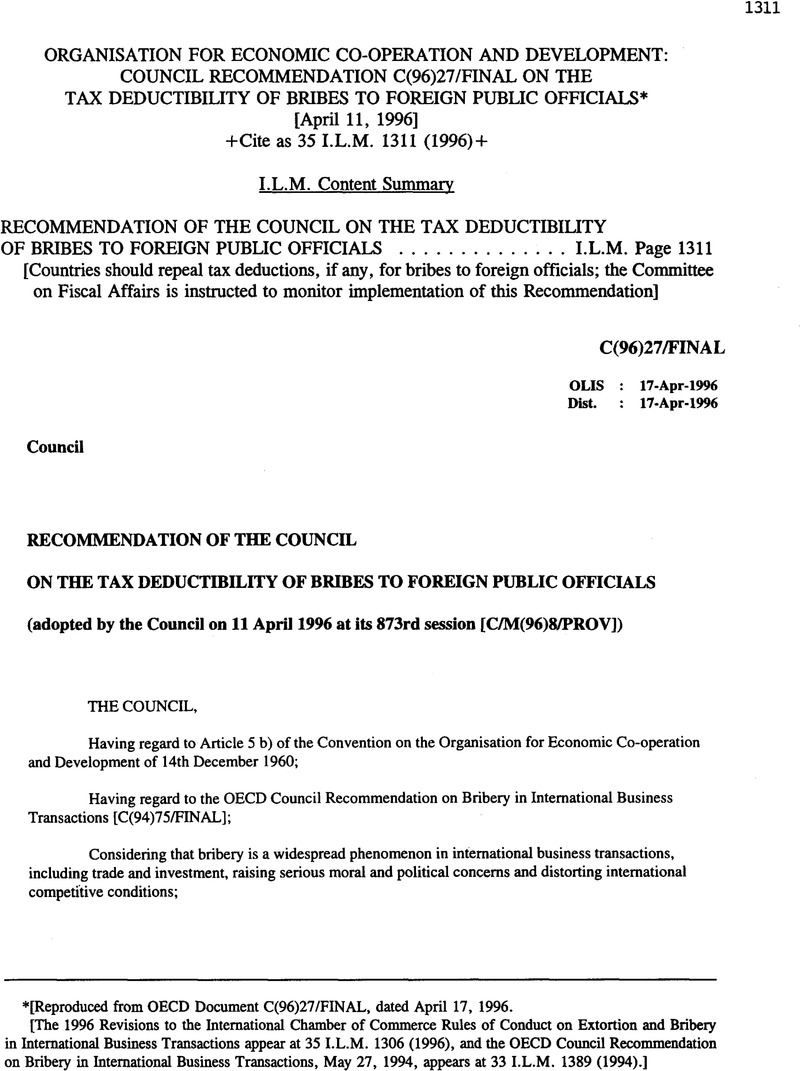

[Reproduced from OECD Document C(96)27/FINAL, dated April 17, 1996.

[The 1996 Revisions to the International Chamber of Commerce Rules of Conduct on Extortion and Bribery in International Business Transactions appear at 35 I.L.M. 1306 (1996), and the OECD Council Recommendation on Bribery in International Business Transactions, May 27, 1994, appears at 33 I.L.M. 1389 (1994).]

* [Reproduced from OECD Document C(96)27/FINAL, dated April 17, 1996.

[The 1996 Revisions to the International Chamber of Commerce Rules of Conduct on Extortion and Bribery in International Business Transactions appear at 35 I.L.M. 1306 (1996), and the OECD Council Recommendation on Bribery in International Business Transactions, May 27, 1994, appears at 33 I.L.M. 1389 (1994).]