No CrossRef data available.

Published online by Cambridge University Press: 27 February 2017

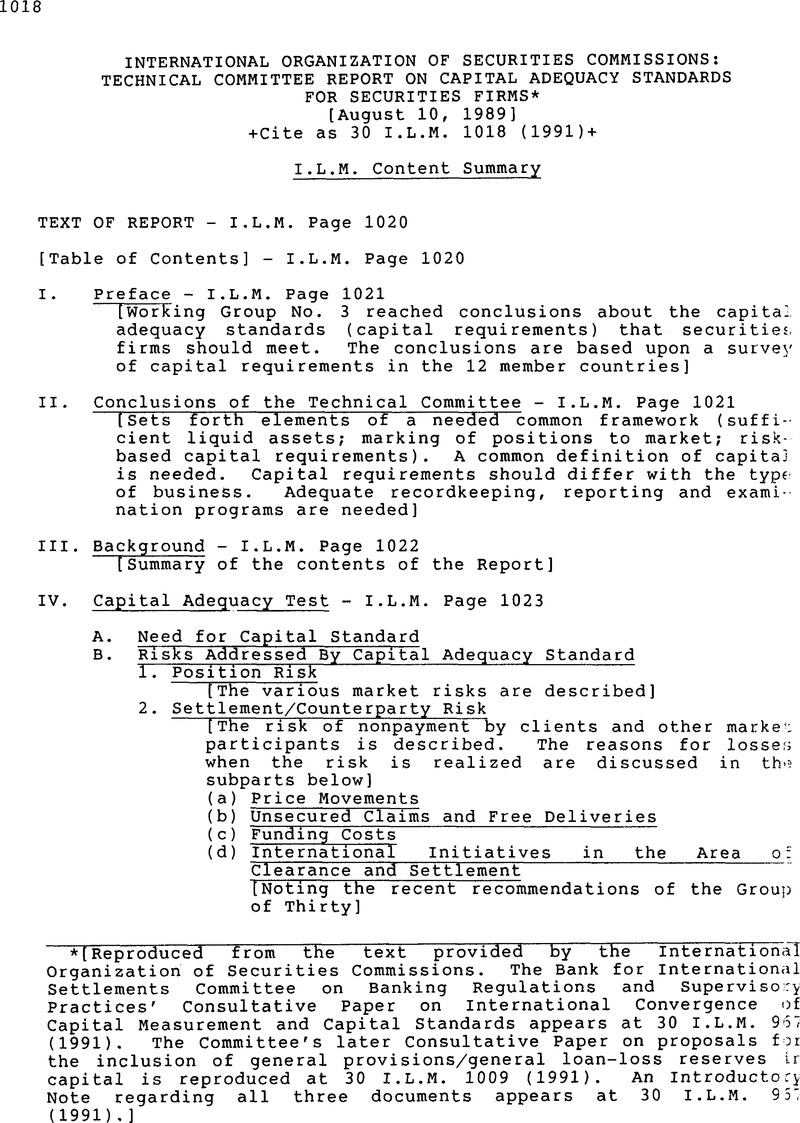

* [Reproduced from the text provided By the International Organization of Securities Commissions. The Bank for International Settlements Committee on Banking Regulations and Supervisory Practices' Consultative Paper on International Convergence of Capital Measurement and Capital Standards appears at 30 I.L.M. 967 (1991). The Committee's later Consultative Paper on proposals for the inclusion of general provisions/general loan-loss reserves for capital is reproduced at 30 I.L.M. 1009 (1991). An Introductory Note regarding all three documents appears at 30 I.L.M. 957 (1991).]

1/ The twelve countries are Australia, Canada, France, West Germany, Hong Kong, Italy, Japan, the Netherlands, Sweden, Switzerland, the United Kingdom, and the United States.

2/ The Technical Committee believes that minimum requirements should not be regarded as a substitute for risk-based requirements.

3/ Securities firms engage in a wide variety of other activities such as: (1) managing or participating in underwriting of public offerings of securities; (2)arranging for private placements of securities issues; (3)assisting and participating in mergers and acquisitions of companies; (4)lending and borrowing securities; (5)engaging in repurchase and reverse repurchase transactions; and (6)engaging in foreign currency and interest rate swap transactions. However, in some countries, certain financial activities may not be covered by the securities laws. For example, in one country, the securities laws are not applicable to firms dealing solely in foreign currency or interest rate swaps. Thus, these activities may be carried on in that country in unregulated affiliates of a securities firm. However, if these activities arc carried on in the regulated securities firm, the capital adequacy standard of that country would apply. This paper does not deal with capital requirements for firms engaged solely in providing investment advice or managing investments.

4/ Clearing house guarantee arrangements would also become extremely expensive in the absence of an adequate financial responsibility framework.

5/ In a buy-in transaction, the firm failing to deliver has to pay the price difference. In practical terms, however, buy-ins will not work unless a market exists in which a panicular security can be purchased at a fair price. For example, the market for a panicular security may be so thin that a fair buy in price cannot be established.

6/ If there were doubts about a firm's capital and the funds were not made available by lenders, the firm could experience difficulty.

7/ seeGroup of Thirty Report on Clearance and Settlement in the World's Securities Markets.

8/ If a firm incurs substantial losses, it might have to take action such as liquidating some positions or increasing its capital in order to remain in compliance with a net liquid assets test.

9/ Some regulators make some allowance for property which secures a loan.

10/ Of course, the level of risk associated with the conduct of an investment business (such as position risk and settlement risk) can vary depending upon the nature of the securities market and related clearance and settlement systems. Securities regulators would, of course, take these differences into account in establishing the risk-based standards.

11/ Different ways can be used to provide for this cushion. For example, one country ties the required cushion to a firm's volume of business measured by criteria such as customer receivables, total liabilities (other than subordinated liabilities), or position risk. Other countries tie it to a proportion of firm expenditures (££ one quarter of a firm's annual expenditures).

12/ Short-term and long-term subordinated loans are permitted as capital under certain conditions. Subordinated loans are subordinated to the claims of all present and future creditors, including customers.

13/ Excess margin securities are a portion of securities bought by customers on credit which are in excess of the amount of securities which the securities firm may pledge with a bank to finance the customer's credit purchase.