No CrossRef data available.

Article contents

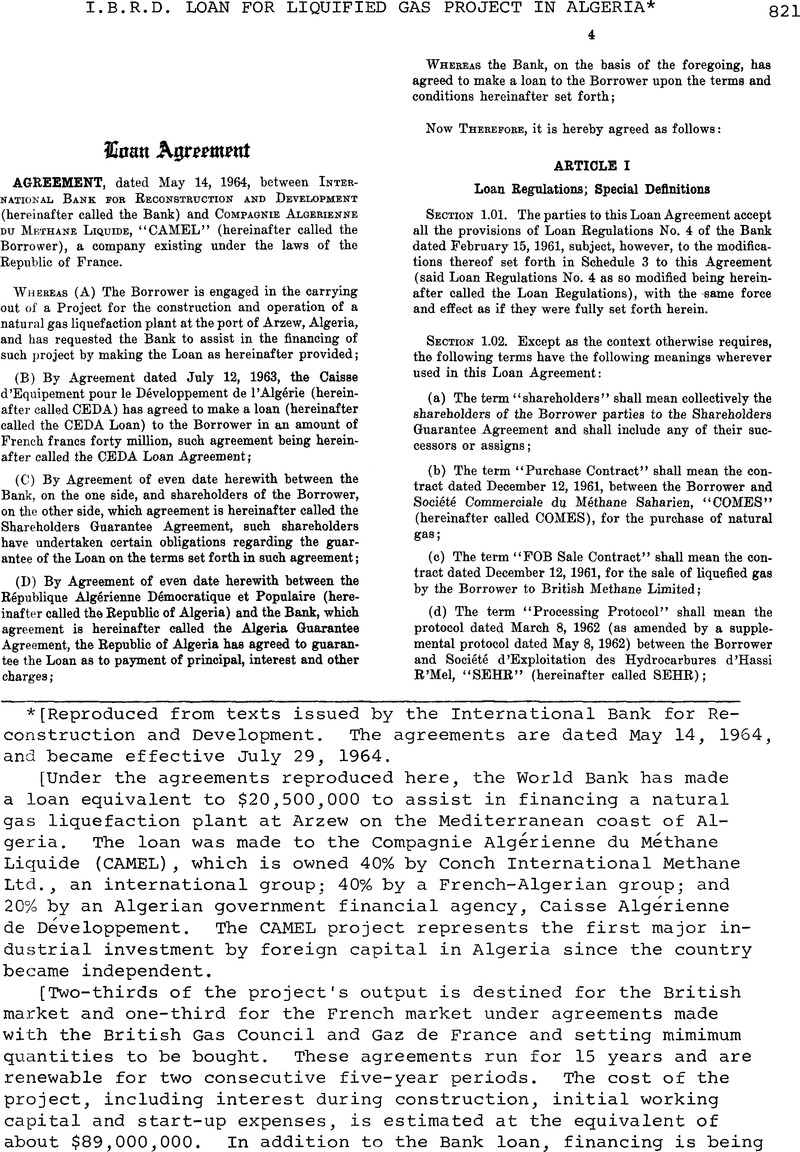

I.B.R.D. Loan for Liquified Gas Project in Algeria*

Published online by Cambridge University Press: 18 May 2017

Abstract

- Type

- Treaties and Agreements

- Information

- Copyright

- Copyright © American Society of International Law 1964

Footnotes

[Reproduced from texts issued by the International Bank for Reconstruction and Development. The agreements are dated May 14, 1964, and became effective July 29, 1964.

[Under the agreements reproduced here, the World Bank has made a loan equivalent to $20,500,000 to assist in financing a natural gas liquefaction plant at Arzew on the Mediterranean coast of Algeria. The loan was made to the Compagnie Algérienne du Méthane Liquide (CAMEL), which is owned 40% by Conch International Methane Ltd., an international group; 40% by a French-Algerian group; and 20% by an Algerian government financial agency, Caisse Algérienne de Développement. The CAMEL project represents the first major industrial investment by foreign capital in Algeria since the country became independent.

[Two-thirds of the project’s output is destined for the British market and one-third for the French market under agreements made with the British Gas Council and Gaz de France and setting mimimum quantities to be bought. These agreements run for 15 years and are renewable for two consecutive five-year periods. The cost of the project, including interest during construction, initial working capital and start-up expenses, is estimated at the equivalent of about $89,000,000. In addition to the Bank loan, financing is being provided by shareholders’ subscriptions to capital stock and subordinated advances, by a loan and a grant from the French Government’s Caisse d’Equipement pour le Developpement de l’Algérie (CEDA), and by suppliers’ credits. Under a special arrangement, the Société d’Exploitation des Hydrocarbures d’Hassi R’Mel, acting for Gaz de France, is contributing a third of the construction and start-up costs as part of an agreement whereby CAMEL undertook to enlarge the plant to process gas for the French market.

[The loan is for a term of 12 years and bears interest of 5 1/2% per annum including the 1% commission which is allocated to the Bank’s Special Reserve. Amortization will begin in May 1966. The loan is guaranteed by the Government of Algeria and, subject to certain conditions, by Conch International Methane Ltd. and by three shareholders in the French-Algerian group. The Shareholders Guarantee Agreement appears at page 83 7. The Algeria Guarantee Agreement appears at page 841.]

References

* [Reproduced from texts issued by the International Bank for Reconstruction and Development. The agreements are dated May 14, 1964, and became effective July 29, 1964.

[Under the agreements reproduced here, the World Bank has made a loan equivalent to $20,500,000 to assist in financing a natural gas liquefaction plant at Arzew on the Mediterranean coast of Algeria. The loan was made to the Compagnie Algérienne du Méthane Liquide (CAMEL), which is owned 40% by Conch International Methane Ltd., an international group; 40% by a French-Algerian group; and 20% by an Algerian government financial agency, Caisse Algérienne de Développement. The CAMEL project represents the first major industrial investment by foreign capital in Algeria since the country became independent.

[Two-thirds of the project’s output is destined for the British market and one-third for the French market under agreements made with the British Gas Council and Gaz de France and setting mimimum quantities to be bought. These agreements run for 15 years and are renewable for two consecutive five-year periods. The cost of the project, including interest during construction, initial working capital and start-up expenses, is estimated at the equivalent of about $89,000,000. In addition to the Bank loan, financing is being provided by shareholders’ subscriptions to capital stock and subordinated advances, by a loan and a grant from the French Government’s Caisse d’Equipement pour le Developpement de l’Algérie (CEDA), and by suppliers’ credits. Under a special arrangement, the Société d’Exploitation des Hydrocarbures d’Hassi R’Mel, acting for Gaz de France, is contributing a third of the construction and start-up costs as part of an agreement whereby CAMEL undertook to enlarge the plant to process gas for the French market.

[The loan is for a term of 12 years and bears interest of 5 1/2% per annum including the 1% commission which is allocated to the Bank’s Special Reserve. Amortization will begin in May 1966. The loan is guaranteed by the Government of Algeria and, subject to certain conditions, by Conch International Methane Ltd. and by three shareholders in the French-Algerian group. The Shareholders Guarantee Agreement appears at page 83 7. The Algeria Guarantee Agreement appears at page 841.]