No CrossRef data available.

Published online by Cambridge University Press: 04 April 2017

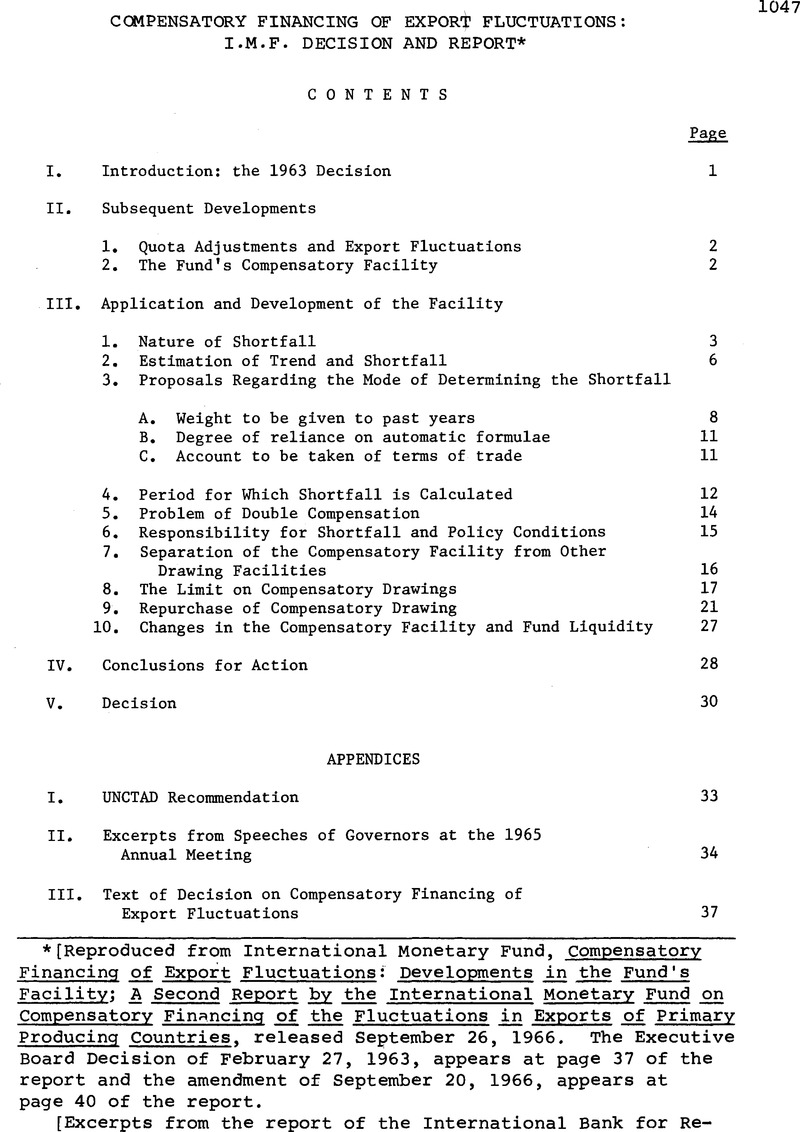

[Reproduced from International Monetary Fund, Compensatory Financing of Export Fluctuations: Developments in the Fund’s Facility] Second Report by the International Monetary Fund on Compensatory Financing of the Fluctuations in Exports of Primary Producing Countries, released September 26, 1966. The Executive Board Decision of February 27, 1963, appears at page 37 of the report and the amendment of September 20, 1966, appears at page 40 of the report.

[Excerpts from the report of the International Bank for Reconstruction and Development, Study on Supplementary Financial Measures (December 6, 1965), which also deals with the financing of export shortfalls, appear at 5 International Legal Materials 81 (1966).]

1/ Decision No. 1477-(63/8), adopted February 27, 1963, selected Decisions of the Executive Directors and Selected Documents (third issue, Washington, January 1965), pp. 40-43. See also Appendix III.

2/ The quotas referred to in these percentages are those applicable at the times the drawings were made.

3/ Staff Papers, Vol. VIII (1960-61), p. 9.

4/ J. Marcus Fleming, Rudolf Rhomberg, and Lorette Boissonneault, “Export

Norms and Their Role in Compensatory Financing,” Staff Papers, vol. X, (1963), pp. 97-149.

5/ Compensatory Financing of Export Fluctuationss pp. 17-18.

6/ The balancing of surpluses and deficits is far from perfect, however; in any five-year period there is likely to be either an excess of surpluses over deficits exceeding 50 per cent of gross surpluses, or an excess of shortfalls over surpluses exceeding 50 per cent of gross shortfalls. This, however, appears to be quite unavoidable. There is no way of defining a norm or trend consistently from year to year in such a way as to secure a perfect balance of surpluses and shortfalls over any given period.

7/ Calculations covering 48 countries show that almost 50 per cent of all shortfalls with respect to a norm defined as above last only one year, nearly 85 per cent no more than two years, and 96 per cent no more than three years.

8/ The “true norm” for exports, x, in any year t , i.e., ICY, is defined as Xt-2 + Xt-1 + xt + xt+1 + xt+2. The problem is to find weights w0, w1, w2, such that the estimated norm xt* = w2 xt–2 + w1 xt-1 + w0 xt provides the best approximation to x t, for all values of t. This is found by regression analysis for years in which the relevant export data are available.

9/ Compensatory Financing of Export Fluctuations, page 10.

10/ Summary Proceedings, Annual Meeting, 1965, pp. 153-54,

11/ Ibid., p. 207.

12/ See pp. 14-15.

13/ At present, a member that draws on its compensatory facility after having drawn its gold tranche and first credit tranche may in effect draw up to 75 per cent of quota on relatively easy policy conditions, while a member drawing on its compensatory tranche at an earlier stage could draw only up to 50 per cent on such conditions.

14/ It is, of course, impossible to establish in retrospect precisely what compensation would have been payable over the period 1951-64 either under the present scheme or with a higher limit, inasmuch as estimates of trend and shortfall would have been affected by qualitative appraisal as well as by formula.

15/ The relevant words of the 1963 Decision are: “The amount of drawings outstanding under this decision will not normally exceed 25 per cent of the member’s quota.”

16/ In accordance with the provision discussed on pp. 16-17 above, the terms in question would, of course, be determined by the Fund’s holdings of the member’s currency, exclusive of those arising from drawings outstanding under paragraph (5) of the Compensatory Financing Decision.

17/ Decision No. 102-(52/ll), adopted February 13, 1952, Selected Decisions of the Executive Directors and Selected Documents (third issue, Washington, January 1965), pp. 21-24.

18/ Under the “fixed-term” system, as the expression is used in this report, it is assumed that drawings are repurchased one half in the fourth and one half in the fifth year after the drawing, regardless of the level of exports.

19/ See Appendix III for the text of the Decision “Compensatory Financing of Export Fluctuations” adopted February 27, 1963, as amended by the Decision of the Executive Directors on September 20, 1966.