Published online by Cambridge University Press: 27 February 2017

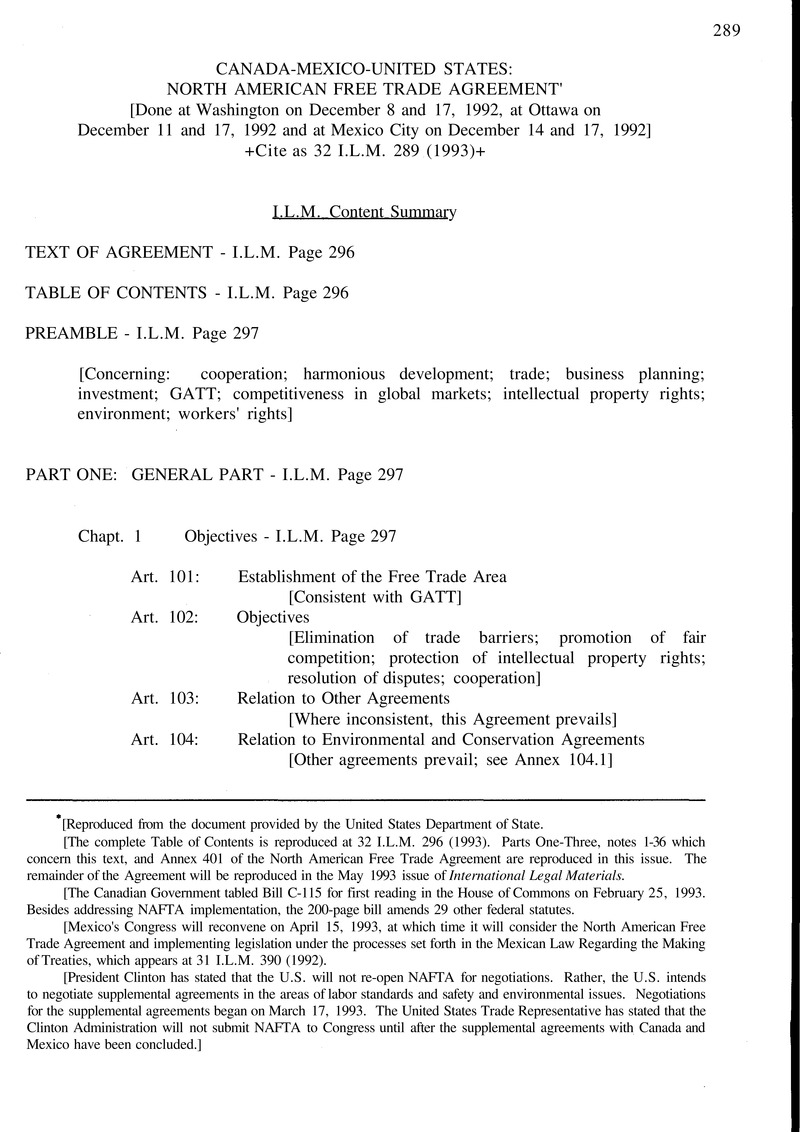

* [Reproduced from the document provided by the United States Department of State.

[The complete Table of Contents is reproduced at 32 I.L.M. 296 (1993). Parts One-Three, notes 1-36 which concern this text, and Annex 401 of the North American Free Trade Agreement are reproduced in this issue. The remainder of the Agreement will be reproduced in the May 1993 issue of International Legal Materials.

[The Canadian Government tabled Bill C-115 for first reading in the House of Commons on February 25, 1993. Besides addressing NAFTA implementation, the 200-page bill amends 29 other federal statutes.

[Mexico's Congress will reconvene on April 15, 1993, at which time it will consider the North American Free Trade Agreement and implementing legislation under the processes set forth in the Mexican Law Regarding the Making of Treaties, which appears at 31 I.L.M. 390 (1992).

[President Clinton has stated that the U.S. will not re-open NAFTA for negotiations. Rather, the U.S. intends to negotiate supplemental agreements in the areas of labor standards and safety and environmental issues. Negotiations for the supplemental agreements began on March 17, 1993. The United States Trade Representative has stated that the Clinton Administration will not submit NAFTA to Congress until after the supplemental agreements with Canada and Mexico have been concluded.]

1 R on the date of entry into force of this Agreement -S in five equal annual slaves commencing January 1, 1999.

2 R on the date of entry of this Agreement S in\~i\c equal annual stajR-s commencing January I,1999.

1 Of the 80,000,000 SME annual quantity of cotton or man-made fiber apparel imports from Canada into the United States, no more than 60,000,000 SME shall be made from fabrics which are knit or woven in a non-Party.

2 Of the 5,066,948 SME annual quantity of wool apparel imports from Canada into the United States, no more than 5,016,780 SME shall be men's or boys’ wool suits of U.S. category 443. 1.The 2,000,000 SME annual quantity of imports from the United States into Canada shall be limited to goods of chapter 60 of the HS.

2 Of the 65,000,000 SME annual quantity of imports from Canada into the United States, no more than 35,000,000 SME may be in goods of chapters 52 through 55, 58 and 63 (other than subheading 6302.10, 6302.40, 6303.11, 6303.12, 6303.19, 6304.11 or 6304.91) of the HS; and no more than 35,000,000 SME may be in goods of chapter 60 and subheading 6302.10, 6302.40, 6303.11, 6303.12, 6303.19, 6304.11 or 6304.91 of the HS.

3 Of the 24,000,000 SME annual quantity of imports from Mexico into the United States, no more than 18,000,000 SME may be in goods of chapter 60 and subheading 6302.10, 6302.40, 6303.11, 6303.12, 6303.19, 6304.11 or 6304.91 of the HS; and no more than 6,000,000 SME may be in goods of chapters 52 through 55, 58 and 63 (other than subheading 6302.10, 6302.40, 6303.11, 6303.12, 6303.19, 6304.11 or 6304.91) of the HS.

1 The new tariff items created for purposes of Chapter Four are shown in the table following Section B.

2 See also Annex 703.2. Section A(10) and (11) and Section B(9) and (10) for heading 12 02

3 See also Annex 703.2, Section A(10) and (11) and Section B(9) and (10)

4 See also Annex 703.2, Section A(10) and (II) and Section B(9) and (10).

5 See also Annex 703.2, Section A(10) and (11) and Section B(9) and (10) for Canadian tariff item 2106.90.21, U.S. tariff item 2106.90.12 or Mexican tariff item 2106.90.05.

6 In applying the provisions of Article 405 to goods of heading 24.02, the reference to “seven percent“ shali be replaced with “nine percent”.

7 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

8 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

9 If the good provided for in subheading 4010.10 or heading 40.11 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

10 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

11 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

12 See also Annex 300-B (Textile and Apparel Goods), Appendix 6(A)

13 See also Annex 300-B (Textile and Apparel Goods), Appendix 6(A).

14 For definition of “average yarn number” see Annex 300-B. Section 10.

15 If the good provided for in subheading 7007.11. 7007.21 or 7009.10 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply

16 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

17 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

18 If the good is for use in a motor vehicle of Chapter 87. the provisions of Article 403 may apply.

19 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

20 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

21 If the good provided for in subheading 8414.59 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply

22 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

23 If the good provided for in subheading 8421.39 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

24 If the good provided for in subheading 8481.20, 8481.30 or 8481.80 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

25 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

26 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

27 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

28 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

29 If the good provided for in subheading 8483.40 or 8483.50 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

30 If the good provided for in subheading 8501.10, 8501.20, 8501.31 or 8501.32 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

31 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

32 If the good provided for in subheading 8511.30, 8511.40 or 8511.50 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

33 If the good provided for in subheading 8512.20 or 8512.40 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

34 If the good provided for in subheading 8519.91 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

35 If the good provided for in subheading 8527.21 or 8527.29 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

36 If the good provided for in subheading 8536.50 or 8536.90 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

37 If the good provided for in subheading 8537.10 is for use in a motor vehicle of Chapter 87. the provision.1, of Article 403 mav apply.

38 If the good provided for in subheading 8539.10 or 8539.21 is for use in a motor vehicle of Chapter 87. the provisions of Article 403 may apply.

39 If the good provided for in subheading 8544.30 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply

40 The provisions of Article 403 apply.

41 The provision. of Article 401 apply.

42 The provisions of Article 403 apply.

43 The provisions of Article 403 apply.

44 The provisions of Article 403 apply.

45 The provisions of Article 403 apply.

46 The provisions of Article 403 apply.

47 The provisions of Article 403 apply.

48 The provisions of Article 403 apply.

49 The provisions of Article 403 apply.

50 The provisions of Article 403 apply.

51 The provisions of Article 403 apply.

52 The provisions of Article 403 apply.

53 The provisions of Article 403 apply.

54 The provisions of Article 403 apply.

55 The provisions of Article 403 apply.

56 The provisions of Article 403 apply.

57 The provisions of Article 403 apply.

58 The provisions of Article 403 apply.

59 The provisions of Article 403 apply.

60 The provisions of Article 403 apply.

61 The provisions of Article 403 apply.

62 The provisions of Article 403 apply.

63 The provisions of Article 403 apply.

64 The provisions of Article 403 apply.

65 If the good is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

66 If the good provided for in subheading 9032.89 is for use in a motor vehicle of Chapter 87, the provisions of Article 40/! may apply.

67 If the good provided for in subheading 9401.20 is for use in a motor vehicle of Chapter 87, the provisions of Article 403 may apply.

68 9506.31 U.S. and Canada classify golf clubs, whether or not in sets, in subheading 9506.31. Parts of golf clubs are classified in subheading 9506.39. Mexico classifies in subheading 9506.31 only complete sets of golf clubs; individual golf clubs and parts of nolf clubs are classified in subheading 9506 39 under tariff item 9506.39.01