No CrossRef data available.

Article contents

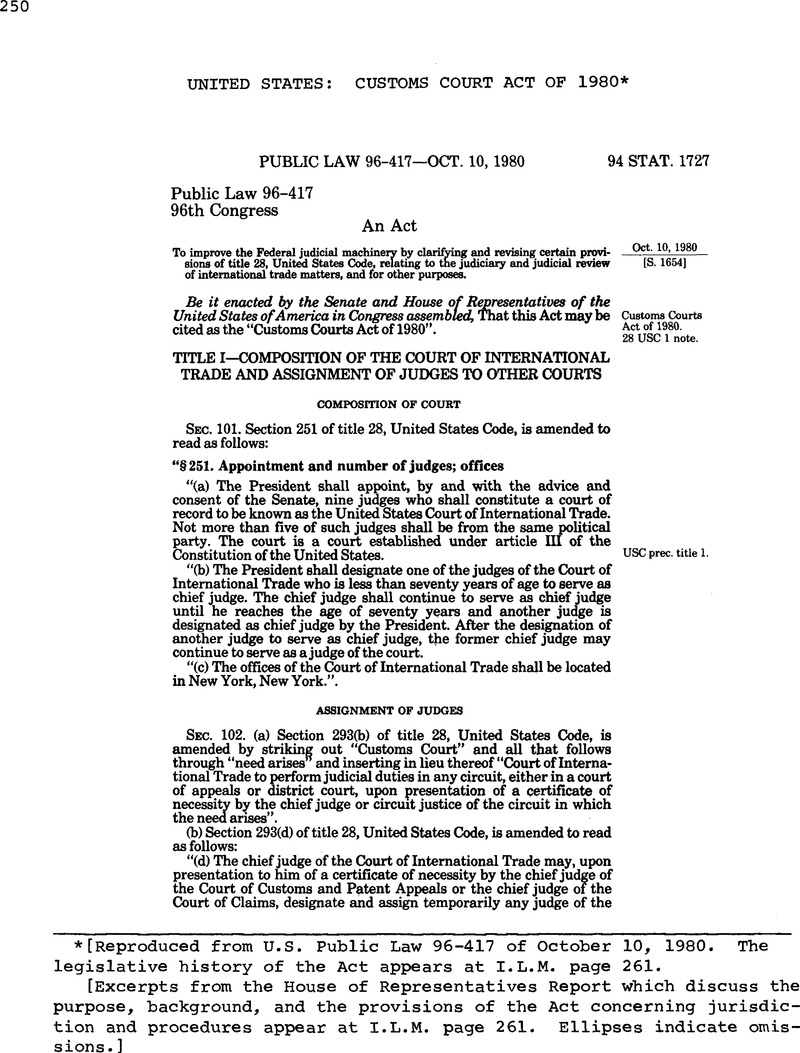

United States: Customs Court Act of 1980*

Published online by Cambridge University Press: 04 April 2017

Abstract

- Type

- Legislation and Regulations

- Information

- Copyright

- Copyright © American Society of International Law 1981

Footnotes

[Reproduced from U.S. Public Law 96-417 of October 10, 1980. The legislative history of the Act appears at I.L.M. page 261.

[Excerpts from the House of Representatives Report which discuss the purpose, background, and the provisions of the Act concerning jurisdiction and procedures appear at I.L.M. page 261. Ellipses indicate omissions.]

References

1 “Customs Courts Act of 1980.” Hearings before the Subcommittee on Monopolies ami Commercial Law. House Committee on the Judiciary, on II.R. 63-4. a bill to Improve the Federal Judicial machinery by clarifying and revlslnc certain provisions of Title 28 United States Code, relating to the Judiciary and Judicial review of international trade matters. 96th Con cress. 2nd session. Ser. 31. at 7 (1980).

2 Hearings, at 147.

3 See, e.g., Hearings, at 111.

4 Hearings, at 8.

5 28 U.S.C 251.

6 According to andrew P. Vance. It was politically Important for the Board of (Jeneral Appraisers to maintain a balance between members with a high tariff phllosonhy and members with a low tariff philosophy With a declining emphasis on the role of tariffs In International trade policy, it has become less necessary to maintain this political affiliation requirement. See Hearings, at 194.

7 Hearing at 13.

8 Letter from Richard K. Berg. Executive Secretary. Administrative Conference of the united States, to Chairman Peter W. Rodlno. Jr., June 2, 1980. “Customs Courts Act of 1980.”

9 Proponed flections 1581(d) and 1581(e) of H.R. 6394, the initial House version of th.’ Customs Courts Act of 1980, read as follows :

“(d) (1) After the decision of the President has become final and has been published In the Federal Register, the Court of International Trade shall have exclusive jurisdiction of any civil action commenced to review the advice, findings, recommendations, and determinations of the International Trade Commission under section 131. 201. 202. 203. 304. 406. and 503 of the Trade Act of 1974. section 336 and 338 of the Tariff Act of 1930. and section 22 of the Agricultural Adjustment Act, solely for the purpose of determining the procedural regularity of such actions.

(2) If no advice, findings, recommendations, or determinations have been provided to the President bv the International Trade Commission, the Court of International Trade shall have exclusive Jurisdiction to review the advice, findings, recommendations, and determinations of the Commission under the sections specified In paragraph (1) of this subsection, solely for the purposes of determining the procedural regularity of such action, (e) After the decision of the President has become final and has been published In the Federal Register, the Court of International Trade shall have exclusive Jurisdiction to review any action of the Office of the United States Trade Representative under section 302(b)(1) or 304 of the Trade Act of 1974. solely for the purposes of determining the Procedural regularity of such action.”

10 See, e.g., sections 131. 201, 202, 203, 304, 406, and 503 of the Trade Act of 1974.

11 Hearings, at 75 and 141.

12 Hearings, at 75.

13 Hearings at 264.

14 Letter f rom Willim K. Casey. President. Natlonal Custom. Brokers & Forwards Association of America. Inc.. to Chairman Peter W. Kodlno. Jr.. “Customs Courts Act or 1980.’’

15 Hearings , at 282.

16 Hearings, at 16.

17 Hearings, at 17.

18 Hearings, at 67.

19 Hearings, at 67. M Hearings, at 187. See also letter from David M. Cohen, Director, Commercial Litigation Branch. Civil Division. Department of Justice Cohen, Director, Commercial Litigation Branch. Civil Division. Department of Justice, to Chairman

20 The suspension of proceedings In a number of cases under a test case la one of the unique practices In customs Utication. This is due to the fact that the Imported merchandise similar In all material respects to that In the test case may be Involved In shipments ? IS us ‘n , ters and the same claims are made as to the valuation or classification or the goods. Because of the statute of limitations, importers (He a protest and may dnrtmen a C,TU a c t l o n tts to all entries which have been liquidated or are liquidated “EJng the pendency of the test case.

. . The suspension process Is a method by which the court has avoided a multiplicity ot trials. It provides that the other actions may be suspended pending a final decision in the “St case. After a final decision In the test case, if the importer's claims are sustained. In wnole or in part, the suspended actions are then submitted to the court on the basis of an agreed statement of facts. If the importer's claims are overruled, the suspended action is tried on Its merits or abandoned.

The suspension procedure facilitates the disposition of actions, thereby eliminating the necessity of trving the same Issue over and over. That also dispenses with the need to fl\e complaints and answers In civil actions which in all likelihood will never he tried The result being the conservation of judicial resources and a savings In litigation costs to Private litigants and the Government.

21 Hearings, at 67.

22 Hearings, at 106.

23 Hearings, at 97.

24 Hearings, at 131.

25 Hearings, at 71.

26 Letters from Wayne Jarvls of Wayne Jarvis. Ltd.. to Leo M. Gordon. Counsel. Subcommittee on Monopolies and Commercial Law. Committee on the Judiciary, “Customs Courts Act of 1980.” Hearings, at 312-323.

27 Letter from Leonard Lehman, Chairman. ABA Standing: Committee on Customs Law. to Chttrman Peter W. Rocitno. Jr.. “Customs Courts Act of 1980.” Hearings, at 203.

28 See proposed section 1581(d). as contained in section 201 of Title II of H.R. 7S40.

29 28 U.S.C. J 2631(a).

30 ™eke cker Li Corp. v. United State: 78 Cust. Ct. 192. 432 F. Supp. 1347

31 HcarlneB. at 77.

32 Ibid

33 Hearings, at 189.

34 Cohen letter, tupra note 19. a t 79.

35 Letter from Richard K. Berg. Executive Secretary. Administrative Conference of the . to Chairman Peter W. Rodlno. Jr., “Customs Courts Act of 1980.” Hearings.

36 Jarrls letter (Feb. 19. 1980) tupra note 26. at 315.

37 Letter from Homer B. Hoyer. Jr.. Oeneral Counsel of the United States Department at jL0“““: to Chairman Peter W. Rodlno. Jr.. “Customs Courts Act of 1980.” Hearings.

38 Letter from andrew P. Vance, on behalf of the Association of the Customs Bar. to nalrman Peter W. Rodlno. Jr.. “Customs Courts Act of 1980.” Hearings, at 212.

39 Letter from Richard H. Abbey. Chief Counsel. United States Customs Service. Department of the Treasury, to Chairman Peter W. Rodlno, Jr.. “Customs Courts Act of 1980,” Hearings, at 88-90.

40 See, e.g.. Hearings, at 129. a

41 Letter from David M. Cohen. Director. Commercial Litigation Branch, Civil Division. Department of Justice, to Leo M. Gordon, Counsel, Subcommittee on Monopolies and Commercial Law, Committee on the Judiciary, “Customs Courts Act of 1980,” Hearings, at S&-87.

42 For a detailed explanation of the expansion of section 514 of the Tariff Act of 1930, see section 604(a) of the provisions section of this report.

43 See. E.g. proposed sections 2631(b), 2632(b), 26.16(b), 2637(b). 2030(a)(1), 2639(c) and 2640(a)(2). as contained In section 301 of Title III of this bill.

44 See. e.g., proposed sections 2631(c), 2632(c), 2636(c), and 2640(b), as contained in action 301 of Title III of this bill.a Current jurisdiction for this type of case lies In section 250 of the Trade Act of 1974 (19 U.S.C. i 2322).

45 See sections 251 and 271 of the Trade Act of 1974 (19 U.S.C. if 2341 and ‘2371).

46 Hearings, at 24.

47 Proposed station 1581(1). an contained iu section 201(a) of H.R. B394 read as follows:

(1) In addition to the jurisdiction conferred upon the Court of International Trade by subsections (a) through (h) of this section and subject to the exceptions set forth in subsection (j) oi this section, the Court of International Trade shall have exclusive jurisdiction of any civil action against the United States, its agencies, or its officers, which-— (1) arises directly from an import transaction ; and (2) (A) involves the Tariff Act of 1930, the Trade Expansion Act of 1962, the Trade Act of 1974, or the Trade Agreements Act of 1979; or (B) involves a provision of— (i) the Constitution of the United States ; (ii) a treaty of the United States ; (ill) an executive agreement executed by the President; or (iv) an Executive order of the President, which directly and substantially involves international trade.”

48 See proposed section 1581(1) (3), as contained in section 201 of Title II of this bill. Subsection (1) (3) reads as follows :

“(3) embargoes or other quantitative restrictions on the importation of merchandise tor reatone other than the protection of the public health or safety.” (Emphasis added.)

49 The term “Interested party” is defined In proposed section 2631(k), ut contained In section 301 of Title III of this bill, and in to be accorded the same definition as set forth in section 771(a) of the Tariff Act of 1930 (1) U.K.C. i 1C77). H Standing for workers under this section Is identical to that under section 250 of the Trade Act of 1974b, I.e., “a worker, croup of workers, certified or recognized union, or an authorized representative of such worker or croup.”

Standing for firms under this section is identical to that under section 251 of the Trade Act of 1974, i.e., “a firm or Its representative.” Standing for communities under this section Is identical to that under section 271 of the Trade Act of 1974. i.e., “a polltloal subdivision of a State (hereinafter in this part referred to as a ‘community’), by a group of such communities, or by the Oovernor of a State on behalf of such communities.”

50 The definition of a “party-at-lnterest” is found In proposed section 2631 (k), as contained in section 301 of Title III of this bill.

51 The court's jurisdiction over these cases is found in proposed section 1581(g). as contained in section 201 of Title II of this bill.

52 Pursuant to Reorganization Plan No. 3 of 1970. the functions of the “administerlnc authority” were transferred from the Department of the Treasury to the Department of Commerce. 44 Fed. Rec 69273 (1979).

53 See Knickerbocker Liquors Corp., supra note 30.

54 See section 514(c)(1) of the Tariff Act of 1930 (18 U.S.C. 11014(c)(1)).

55 See section 778(b) of the Tariff Act of 1030 (19 U.S.C. I 1677(b)).