Published online by Cambridge University Press: 18 May 2017

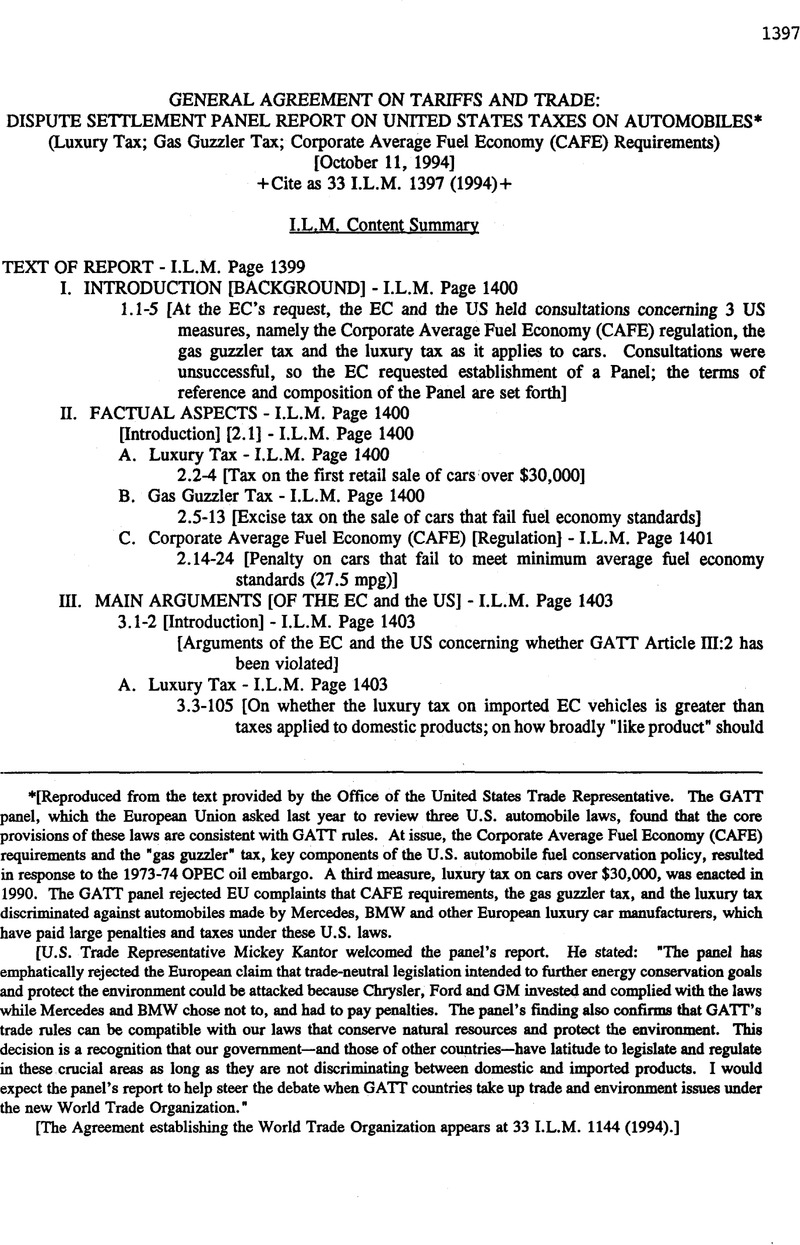

[Reproduced from the text provided by the Office of the United States Trade Representative. The GATT panel, which the European Union asked last year to review three U.S. automobile laws, found that the core provisions of these laws are consistent with GATT rules. At issue, the Corporate Average Fuel Economy (CAFE) requirements and the “gas guzzler” tax, key components of the U.S. automobile fuel conservation policy, resulted in response to the 1973-74 OPEC oil embargo. A third measure, luxury tax on cars over $30,000, was enacted in 1990. The GATT panel rejected EU complaints that CAFE requirements, the gas guzzler tax, and the luxury tax discriminated against automobiles made by Mercedes, BMW and other European luxury car manufacturers, which have paid large penalties and taxes under these U.S. laws.

[U.S. Trade Representative Mickey Kantor welcomed the panel's report. He stated: “The panel has emphatically rejected the European claim that trade-neutral legislation intended to further energy conservation goals and protect the environment could be attacked because Chrysler, Ford and GM invested and complied with the laws while Mercedes and BMW chose not to, and had to pay penalties. The panel's finding also confirms that GATT's trade rules can be compatible with our laws that conserve natural resources and protect the environment. This decision is a recognition that our government—and those of other countries—have latitude to legislate and regulate in these crucial areas as long as they are not discriminating between domestic and imported products. I would expect the panel's report to help steer the debate when GATT countries take up trade and environment issues under the new World Trade Organization.”

[The Agreement establishing the World Trade Organization appears at 33 I.L.M. 1144 (1994).]

1 27 U.S.C. 4001 et seq.

2 26 U.S.C, 4064 el seq.Regulations contained in 40 C.F.R. Pan 600.

3 U.S.C 2001 et seq. Other legislative materials in H. Rep. No. 340. 94th Congress. 1st Session 3 (1975); and S. Rep. No 179, 94th congress, 1st session 6(1975). Regulations in 49 C.F.R. part 500.

4 Hereafter, “mpg” means“miles per gallon“.

5 26 U.S.C., §4064 (a)

6 The CAFE program establishes lower fuel economy requirements for light trucks which includes mini-vans.

7 15 U.S.C., §2002 (a)(l) and (b)

8 Id at§2001(8).

9 Id at 2001(9).(10)

10 Id at §2003(c)

11 Id at §2001(8)

12 Id at §2002. (c)(l)

13 Panel report adopted on 11 November 1989. Bisd 36S/345. para. 5.13.

14 Panel report adopted on 10 November 1987. Bisd 34S/83, para. 3.9(b).

15 The Luckey. Consulting Group. Inc., “U.S. Luxury New Car Tax. Gas-Guzzler Tax.& Cafe Discriminatory Impacts”, Final report September 1993.

16 BISD 34S/83. para. 3.10(a).

17 Id at para. 5.9(a).

18 Panel report adopted on 17 June 1987, BISD 34S/136, para. 5.1.9.

19 Panel report adopted on 19 June 1992, BISD 39S/206. para. 5.6.

20 BISD 34S/136. para. 5.1.9.

21 Panel report adopted on 18 Febraaiy 1992, BISD 39S/27.

22 Id at para. 5.30.

23 BISD 39S/206. para. 5.75.

24 Staff of Senate Committee on Finance, 103rd Congress. 1st Session, Fiscal Year 1994 Budget Reconciliation Recommendations of the Committee on Finance 86 (Comm. Print 1993).

25 BISD 34S/83, para. 4.6.

26 Report of the Working Party on Border Tax Adjustment. BISD 18S/102.

27 BISD 34S/83. para. 5.7.

28 Harmonized Tariff Schedule of the United States. USITC Pub. No. 2637 (1993).

29 USITC Pub. No. 1110. Inv. No. TA-201-44 (Dec. 1980).

30 BISD 28S/102. pan. 4.6

31 Prehearing Brief on Behalf of BMW of North America. Inc. (October 1980). Certain Motor Vehicles and Certain Chassis and Bodies Therefor. Inv. No. 201-TA-44. USITC Pub. 1110 (Dec. 1980).

32 Post-Hearing Brief of Mercedes Benz of North America. Inc.. Certain Motor Vehicles and Certain Chassis and Bodies Therefor, Inv. No. 201-TA-44. (Dec. 1980).

33 Inv. No. 201-TA-44. USITC Pub. 1110 at 8-9 (Dec. 1980).

34 BISD 34S/83. pare. S.9

35 Id al para. 5.9(a).

36 BISD 39S/206. para. 5.25.

37 Id at para. 5.26.

38 Id at para. 5.73.

39 Id at para. 5.72.

40 Id at para. 5.72.

41 BISD 34S/83. para. 55(b).

42 BISD34S/83 para5.5(b)

43 Id at para. 5.5(a).

44 Id at para. 5.5(b).

45 BISD 39S/2O6. pan. 5.73

47 The EC added that at the Havana Conference, the drafters clarified that: Under the provisions of Article 18 regulations and taxes would be permitted which, while perhaps having the effect of assisting the production of a particular domestic product (say,.butter) are directed as much against the domestic production of another product (say domestic oleomargarine) of which there was a substantial domestic production as they are against imports (say, imported oleomargarine). (Reports of the Committees and Principal Sub-Committees, IC1TO 1/8, 64 (Geneva. Sept. 1948)).

48 BISD 34S/83, para. 3.9(a).

49 Id at para. 5.13

50 Id at para. 3.10(a).

51 Id at para. 5.7.

52 Id at para. 5.9(b).

53 1991 Ward's Automotive Yearbook, p. 209. United States-produced cars designated as luxury vehicles by Watd's Yearbook and the MSRP: Buick Electra ($20,775). the Chrysler Fifth Avenue ($21,410), Oldsmobile Toronado ($22,545), Buick Riviera (42J.5VOI. Chrysler Imperial i$26.G43>, Oldsmobile 9S ($27,345), Cadillac Dc Viiic ($27,510). Cadillac Brougham ($27,950). Lincoln Town Car ($28,541). Buick Reeana ($28.8851. Cadillac Eldorado ($29,045). Lincoln Mark ($29,801). and the Lincoln Continental ($29,997).

54 BISD 34S/83. para. 5.9(b).

55 Id at paras. 5.9(b). and 5.13.

56 Congressional Research Service. The Library of Congress. History and Economics of US: Excise Taxation of Luxury Goods. CRS. 17 June 1987. pg. 4.

57 BISD 34S/83. para. 5.9(c).

58 BISD 36S/34S, para. 5.14.

59 BISD 34S/136, pan. 5.1.9.

60 B1SD 34S/83. para. 5.11.

61 The EC recalled that the gas guzzler tax was considered part of a vehicle's sales price for purposes of the $30,000 luxury tax price threshold.

62 Tempte. Barker& Sloane. Inc.. “Economic Effects of the Automobile Luxury Tax”. (May 1991) pg 5.

63 Congressional Record S450 (February 2. 1988) (Statement of Senator D'Amato).

64 Report; if Commities and Principal Sub Committees: ICTTO 1/8 Geneva, September 943. p. 64, para. 54

65 BISD 19S/206. Dara. 5.25.

66 Id at para. 5.72.

67 The European Community noted that the United States subsequendy had stated that the Allante, which was manufactured in Italy, was in fact, an import.

68 EPA database of confidential sales information.

69 The United States noted mat in model year 1993, some of the foreign manufacturers that had two or more model types averaged at or above 22.5 mpg (not gas guzzlers), but at least one test vehicle below 22.5 mpg, were Audi, Nissan. Porsche. Toyota and Volkswagen.

71 49 C.F.R. S23.4. Automobiles capable of off-highway operation included an automobile with 4-wheel drive, a rating of more than 6,000 pounds gross vehicle weight, and other characteristics. C.F.R. 523.5(b).

72 United States Congress. Office of Technology Assessment, Improving Automobile Fuel Economy: New Standards, New Approaches. OTA-E-504 (Oct. 1991). pg. 32.

73 This article stated. “Recent technological advances have made [light-duty trucks) as easy to drive as an ordinary passenger car. as comfortable to ride in as a passenger car. and more convenient in terms of carrying space. Where once station wagons were the standard fare for suburban families, it's now utility vehicles and, especially in the last couple of years, vans. Where compact cars were what was largely seen in cities, now small pickup trucks are commonplace … Eventually, some industry experts predict, as much as 40 per cent - almost half - of the vehicles on the road will be light trucks, vans and utility vehicles … linked, there are a lot more light tnicks and off-road vehicles in up-scaic suburban communities like Chevy Chase, MD. than construction workers or back roads. Instead, the majority of the owners of such vehicles use them in eucdy the same way they would use a car … Phil Katcher. Where is the Market Going?, Automotive Marketing, June 1993. pg. 47.

74 Minivans from Japen,Inv no.522, USITC pub July 1992, pg 5.

75 BISD 34S/83. para. 5.5.

76 Id at para 5.8

77 GATT Analytical Index, Article III-IO, L/520 12 September 1956; see also GATT Doc. L/599, 16 November 1956 (U.S.objection TO Chilean tax on automobiles).

78 Report of the Panel on United States Measures affecting alcoholic and mail beverages, adopted on 19 June 1992, BISD 39S/2O6. para. 5.30.

79 RE. Hudec. Enforcing International Trade Law: The Evolution of the Modern GATT Legal System (1983), pg. 438.

80 “Case 112/84. Humblot v. Directeurdes Services fiscaux, 1985. EC.R. 1367 (1985). The United States added thai the ECJ had created a judicial exception to Article 95, under which the prohibition of discriminatory taxes did not prevent states from adopting a system of taxes that increase progressively according to an objective criterion, provided that the system pursued economic policy objectives which were themselves compatible with Treaty requirements. Such compatible objectives included heavier taxation of luxury products or vehicles with high fuel consumption.

81 BISD 34S/83. para. 5.9(a).

82 “Reducing the Deficit: Spending and Revenue Options', Congressional Budget Office (Report to the Senate and the House Committees on the Budget). February 1992. pg. 352.

83 Environmental Protection Agency Technical Report: Light-Duty Automotive Technology and Fuel Economy Trends Through 1993, May 1993. pg. 5 and 25. The European Community added that the American Council for an Energy-Efficient Economy also iccugnizeij this disparity, noting “the increasing share o( light [tucks with their poorer fuel economy” was a significant factor a. uu. United States Governments failure to reduce overall fuel consumption. Options for Reducing Oil Use by Light Vehicles: An Analysis of Technologies and Policy (Dec. 1991). pg. 34.

84 H.R. Conf. Rep. 1773, pg. 45.

85 Not adopted. 3 September 1991. BISD 38S/155. para. 5.22.

86 BISD 29S/105. paras. 4.8-4.14.

87 BISD 29S/105. paras. 4.8-4.14.

88 Panel report adopted on 22 March 1988. BISD 3SS/98, para. 4.6. 89 Id at para. 4.6

90 United States - Section 337ofthe Tariff Act of 1930, BISD 36S/345. para. 5.11. “

91 Pane! report adopted on 16 May NO, BISD 37S/132. paras. 5 1, 5.9

92 51 Fed. Reg. 35.603 (October 8. 1986).

93 See National Highway Traffic Safety Administration. Automotive Fuel Economy Program. Report to Congress. 58 Fed. Reg.

94 51 Fed. Reg. 35.603 (October 8. 1986).

95 BISD 39S/206. para. 5.30

96 BISD 39S/206. para. 5.30

97 Department of Transportation, NHTSA. Environmental Assessment for the CAFE Standards for Passenger Automobiles, Model Years 1987-1988. (January 1986) pg. 3.

98 Inside EPA's Clean Air Report (August 26, 1993). pg. 5.

99 H.R. Rept. No. 94-221, 94th Congress. 1st Session, p. 14 (1975).

100 Report of die Panel on United States - Measures affecting alcoholic and malt beverages. BISD 39S/206, para. 5.30.

101 U.S.C.§2OO3(b)(l).

102 Id M S2OO3 (b) (2XE1; 40 C.F.R. 600.511-80. The EC added that since the 1965 US-Canada Auto Pact, the Big Three had essentially integrated their US and Canadian operations. Thus, US law treated Canadian auto production as US for most regulatory and tax purposes.

103 Automotive Fuel Economy, pg 184.

104 BISD 36S/345, para. 5.13.

105 Mat para. 5.13.

106 Panel report adopted on 25 July 1983. BISD. 30S/140. para. 5.9.

107 Panel report adopted on 16 May 1990, BISD 37S/197, para. 5.21.

108 53 Fed. Reg. 10.194 (March 29, 1988): DOT. Notice of Proposed Rulemaking, CAFE Standards for Model Years. 1989-1990. 53 Red. Reg. 33.080 (August 29. 1988).

109 Panel report adopted on 14 March 1978, BISD 25S/49. para. 4.6.

110 Id at para 4.6

111 BISD 35S/98, para. 4.6.

112 BISD. 36S/345. para. 5.13.

113 Id at. 5.27(c).

114 BISD 35S/98, para. 4.6.

115 Id at para. 4.6.

116 National Transportation Statistics”, Annual Report. 1990 and 1992, U.S. Department of Transportation, Research and Special Programs Administration.

117 international Energy Agency, Energy Efficiency and the Environment (1991) pg. 80, 135, 159.

118 54 Fed. Reg.21989(May 22, 1989)

119 National Research Council, National Academy of Sciences, “Automobile Fuel Economy: How Far Should We Go?“ National acadamic press(1992)pg. 170.

120 BISD 35S/98. para. 4. 6.

121 Options for Reducing Oil Use by Light Vehicles: An Analysis of Technologies and Policy (Dec. 1991). pg. 34.

122 H. Rep. No. 340, 95lh Congress. 1st Sess. 86 (1975).

123 BISD 36S/387.

124 BISD 39S/27. para. 5.24

125 report of the Panel an Japan - Customs duties, taxes and labelling practices on imported wines and atcuhotu beverages. B1SD 34s/83 para 5.9

126 Id at para. 5.7.

127 US - Section 337 of the Tariff Act of 1930. BISD 36/345. para. 5.11 and Canada Import, distribution and sale of certain alcoholic drinks by provincial marketing agencies. BISD 39S/27. p. 59.

128 Report of the Panel on United States - Measures affecting alcoholic and matt beverages, adopted 19 June 1992, DS23/R. BISD 39S/206

129 Report of the Working Party on Border Tax Adjustments, adopted on 2 December 1970, BISD 18S/97. 102.

130 Report of the Panel on Japan - Customs duties, taxes and labelling practices on imported wines and alcoholic beverages, adopted on 10 November 1987 (U6216) BISD 34S/S3 at 115, pan. 5.5

131 This term “shows the logical result or purpose of an action done in a specific manner” (Webster's Third New International Dictionary of the English Language (Unabridged)). This meaning is also reflected in the French authentic text of Article 111:1 which uses the expression “de manière à”

132 Report of the Panel on United States Taxes on petroleum and certain imported substances, adopted 17 June 1987 (L/6I75) BISD 34S/I36 at 58. para 3.1.9; referring to the Report of the Working Party on Brazilian Inlemai Taxes, adopted on 30 June 1949. BISD 11/181 at 185 para 16: same view in Report of the Panel on United States - Measures affecting alcoholic and malt beverages adopted on 19 June 1992 (DS23/R) BISD 39S/206 at 271. para. 5.6

133 Energy Tax Act of 1978, 26 U.S.C4064 at seq.

134 Internal Revenue Code §4064(b)(l)(B)

135 Energy Policy and Conservation Act. 15 U.S.C. §2001 (8). (9)

136 Id at § 2O03(c)

137 Id at §2007, §2008

138 Id at §2001(2)

139 Id at §2002(b)

140 Id at§2OO2(c)1

141 Idat§2OO3(b)(l)

142 40C.FR. Ch. 1 §600.511-80

143 Id at §2OO3(a)(1)

144 40C.FR. Ch. 1 §600.010-86(d)

145 Id at §2002(1)(1)(A)

146 Id at §2007

147 Id at §2008(bXl)(A)

148 Report of die Panel oh Italian Discrimination against imported agricultural machinery, adopted 23 October 1958, BISD 7S/60, 64 at para. 12

149 Report of die Panel on United States - Section 337 of the Tariff Act of 1930, adopted 7 November 1989, BISD 36S/345. para. 5.10

150 Report of the Working Party on Border Tax Adjustments, adopted on 2 December 1970, BISD 18S/97.

151 Report of die Panel in Canada-Measures affecting exports of unprocessed Herring and salmon. L/6268, adopted 22 March 1988. 3SS/98. 114. para 4.6