Whenever economic conditions become really critical, the concept of helicopter money frequently re-emerges – and the recent COVID-19 crisis was no exception (Masciandaro Reference Masciandaro2020). The term ‘helicopter money’ originates from Milton Friedman, who famously imagined (without endorsing it) a hypothetical situation in which freshly issued central bank money would be randomly distributed to households.Footnote 1 Friedman's description, however, was characteristically short in detail on how such a monetary policy might be implemented concretely. As a result, while followers have agreed on the definition of helicopter money as ‘a money-financed fiscal stimulus … that … requires neither an increase in the stock of government debt nor higher taxes, current or future’ (Galí Reference Galì2020, p. 2), they have diverged in their views of the design of such a policy. On the one hand, most economists have interpreted helicopter money as a permanent increase in the liabilities of the central bank (see esp. Buiter Reference Buiter2014). As such a situation, which we might describe as ‘monetary-base helicopter money’, has actually occurred relatively often in history, it represents a less radical option than might appear at first sight. On the other hand, others have interpreted helicopter money as a permanent decrease in the assets (i.e. in the net worth) of the central bank (see esp. Masciandaro Reference Masciandaro2020). Such a situation, which we might describe as ‘net-worth helicopter money’, is a much more radical option than the previous one, and appears to have occurred only on exceedingly rare occasions in history.

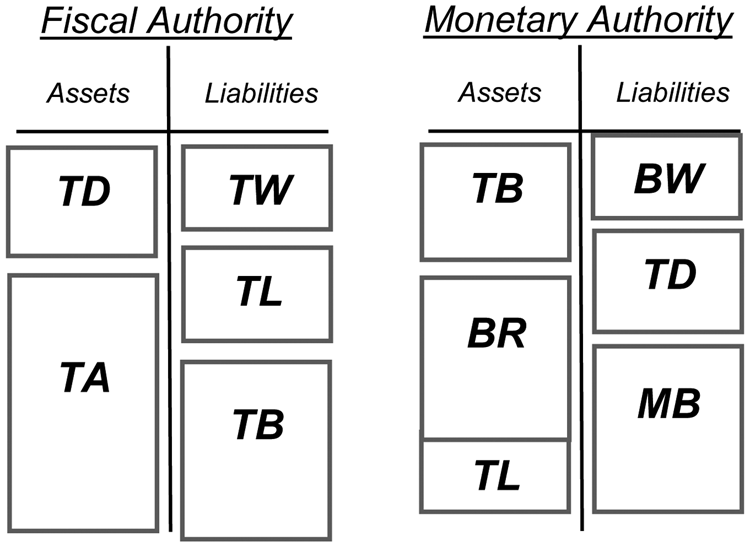

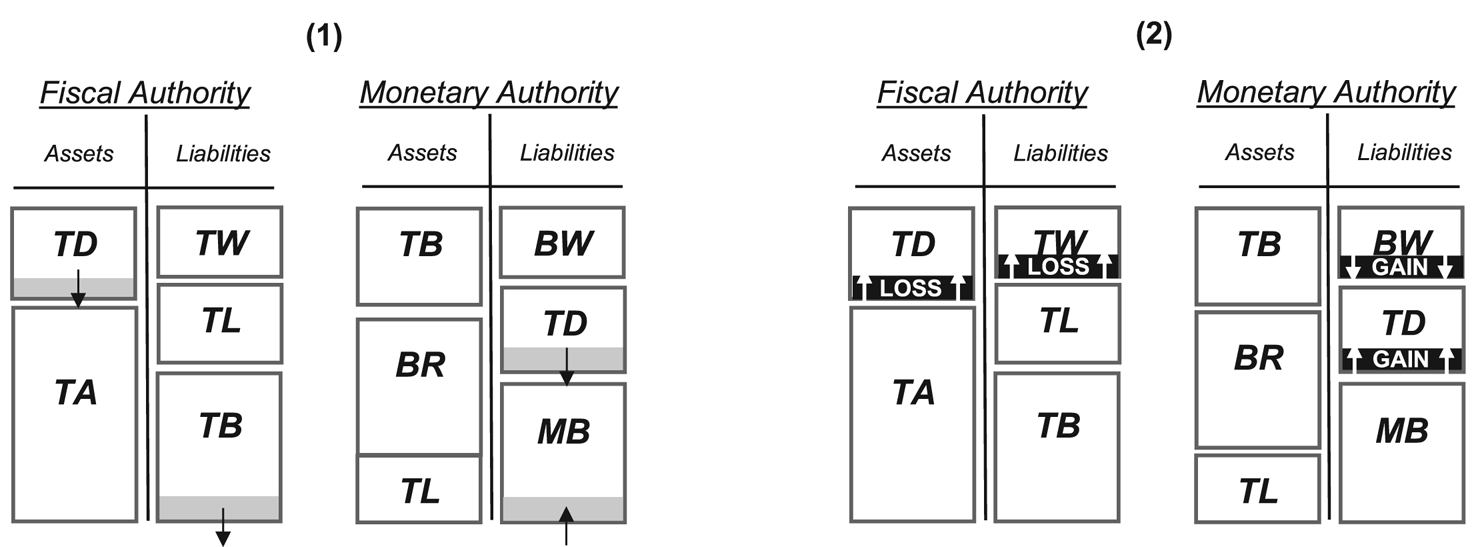

In order to better understand the difference between ‘monetary-base’ and ‘net-worth helicopter money’, imagine a stylized balance sheet of the public sector made up of the separate balance sheets of the fiscal authority (the Treasury) and the monetary authority (the central bank: see Figure 1). The fiscal authority's assets consist of Treasury deposits with the central bank (TD) and other Treasury assets (TA); its liabilities consist of the Treasury's net worth (TW), marketable government bonds (TB) and direct (unmarketable) loans from the central bank (TL). The monetary authority's assets consist of its portfolio of marketable government bonds (TB),Footnote 2 its bullion and foreign reserves (BR) and its direct (unmarketable) loans to the Treasury (TL); its liabilities consist of its net worth (BW),Footnote 3 the Treasury's deposits (TD) and the deposits of the private sector – i.e. the monetary base (MB).Footnote 4

Figure 1. Stylized balance sheets of the fiscal and monetary authorities

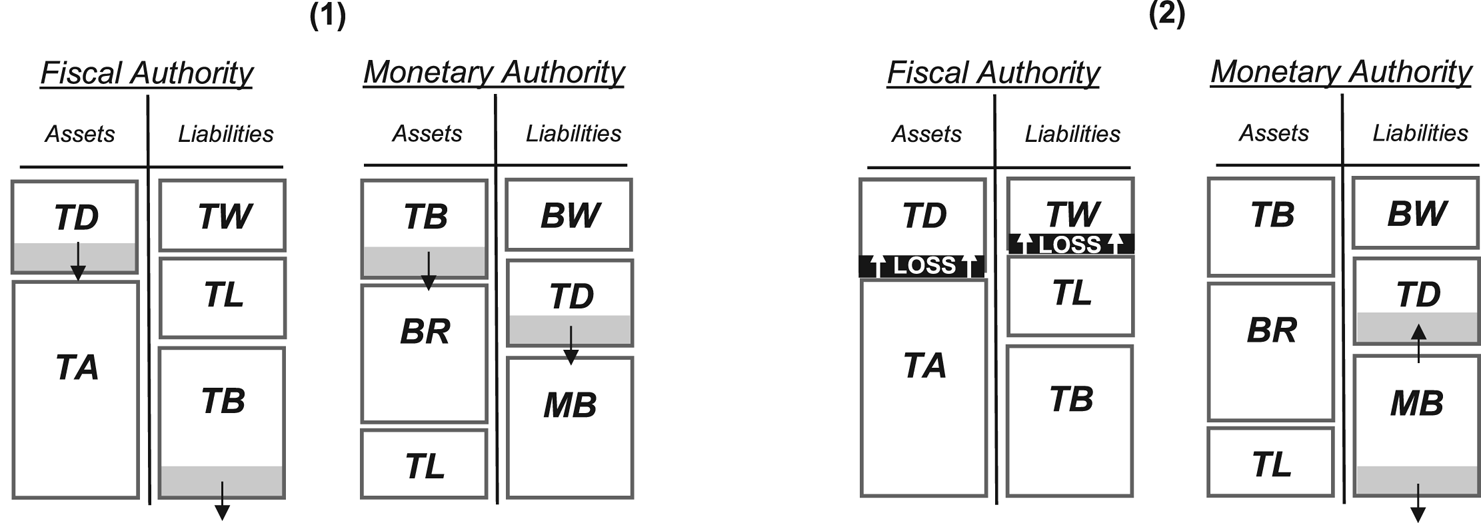

‘Monetary-base helicopter money’ occurs in two steps. First, the Treasury issues new bonds and these are all bought by the central bank (on either the primary or the secondary market), which allows for a temporary increase in Treasury deposits with the central bank (Figure 2). Then, the Treasury proceeds to spend this money, which ends up being held by the private sector: the monetary base hence increases. On the fiscal authority's balance sheet, the money-financed fiscal stimulus reduces the Treasury's assets without reducing any liability except the Treasury's net worth, and can therefore be regarded as a loss (Figure 2). On the whole, the difference between this ‘monetary-base helicopter money’ strategy and a classical fiscal expansion is quantitative rather than qualitative, as the boundary between the two is defined exclusively by the size of the government debt monetization by the central bank.

Figure 2. Balance sheet effects of a ‘monetary-base helicopter money’ strategy

By contrast, a ‘net-worth helicopter money’ strategy is qualitatively different from a classical fiscal expansion. Here, the fiscal authority instructs the monetary authority to credit money on the private sector's accounts with it. This increase in the central bank's liabilities should be theoretically matched by an increase in its assets – viz., in its direct loans to the Treasury (Figure 3). In truth, however, these loans simply do not formally exist – which is economically equivalent to a Treasury default on its direct borrowings from the central bank. As a result, the money-financed fiscal stimulus here reduces the monetary authority's (instead of the fiscal authority's) assets without reducing any of its liability except the net worth, and can therefore be regarded as a loss (Figure 3). From a long-term perspective, ‘net-worth helicopter money’ is therefore irreversible for the monetary authority, whereas ‘monetary-base helicopter money’ might potentially be (partially or totally) reversed by selling marketable Treasury bonds to the private sector. The biggest difference between the two is, however, short-term in nature, as ‘net-worth helicopter money’ fragilizes the solidity of the monetary authority and directly reduces its margins for manoeuvre in the management of the value of issued money, thus rendering it less able to counteract an inflationary outburst.Footnote 5

Figure 3. Balance sheet effects of a ‘net-worth helicopter money’ strategy

Theoretically, it is unclear whether one version of ‘helicopter money’ is always necessarily superior to the other. Empirically, the implementation of ‘net-worth helicopter money’ has been so rare in history that it has been practically impossible to analyse it. In this article, we study one rare historical episode in which ‘net-worth helicopter money’ appears to have actually been implemented. This happened in the Republic of Venice in 1629–31 – interestingly, precisely in the context of a full-fledged pandemic which bears many resemblances to COVID-19. We describe the historical context in which fiscal monetization took place, explain why it can be considered as an example of ‘net-worth helicopter money’, and analyse its consequences. In particular, we ask what were the political economy conditions which generated the choice of this very peculiar version of expansionary fiscal policy?

The remainder of this article is organised as follows. In Section I we briefly describe the Venetian monetary and fiscal systems during the first decades of the seventeenth century. In Section II we analyse the huge real economic shocks of 1629–31, as well as the containment policies put in place by the Venetian government during this period. Section III focuses on the ‘net-worth helicopter money’ strategy implemented in order to finance expenditure, and offers a political perspective to help explain why the Republic chose this radical option rather than more classical ones. Section IV concludes.

I

The Republic of Venice was run for centuries by a small and cohesive elite of oligarchs (‘patricians’) highly invested in mercantile activities. Citizenship did not automatically guarantee political rights, but it gave complete access to local welfare, guaranteeing protection in times of crisis. Residing and working in Venice were not sufficient conditions to gain access to public services, which only citizenship did ensure (Alfani and Di Tullio Reference Alfani and Di Tullio2019, pp. 59–60). In fact, only the patricians had political rights, assisted by the citizens, who carried out bureaucratic tasks; ordinary inhabitants, neither patrician nor citizen, were excluded from any political or administrative participation (Finlay Reference Finlay1980). Yet, although formally excluded from any involvement in politics and institutions, inhabitants used civil rituals, crowd behaviour and collective actions to influence patricians’ decision making, especially in times of crisis (van Gelder Reference van Gelder2018, p. 254; Judde de Larivière Reference Judde de Larivière, van Gelder and Judde de Larivière2020, p. 72).

In Venice, the relative size of the public sector with respect to the domestic economy was extraordinarily high by coeval standards. In the real sector, the government, via the Grain Office and then the Fodder Office, was active in the grain market, in order to address and to stabilize the volatility in the supply and price of food, which was an extremely sensitive political issue. As for the financial sector, the financial district of Venice – the Rialto area – was entirely owned by the Republic, which rented benches to the private bankers at which they operated in what was in effect a public concession. Private bankers’ books were considered public records, the bank transfers being a legal way to discharge debt under Venetian law (Ugolini Reference Ugolini2017, pp. 37–9). Yet the ideal that inspired the Venetian government was that, as far as possible, the State should not replace private initiative in markets (Dunbar Reference Dunbar1892, p. 308). The Senate was the body that designed the Republic's economic policy, with its committees responsible for overseeing every aspect of production and distribution (Rapp Reference Rapp1976, p. 139). With the Republic firmly controlled by an oligarchy of merchants, the government's goal was just to provide the services that were essential for business but too expensive or too risky to be provided by the businessmen themselves (Ugolini Reference Ugolini2017, p. 38).

The Republic's tax system, featuring both ‘direct’ and ‘indirect’ taxes, was rather muddled and complicated. Reflecting the balance of power, the system had a marked ‘regressive’ nature. From the second half of the sixteenth century until the 1620s, the Republic of Venice gradually increased per capita taxation, and this growth accelerated much more markedly in the aftermath of the 1630 plague (Alfani and Di Tullio Reference Alfani and Di Tullio2019, pp. 24–33 and 147). The Republic had a long and generally good record with public debt management, which had been implemented since at least 1164. In early times, Venice had regularly resorted to forced loans from the patricians; by the seventeenth century a more market-friendly approach had prevailed thus increasingly attracting foreign investors, yet the government debt was still overwhelmingly held by the domestic upper class (Fratianni and Spinelli Reference Fratianni and Spinelli2006, pp. 262–3; Alfani and Di Tullio Reference Alfani and Di Tullio2019, p. 172).Footnote 6 The Republic issued both floating and funded (long-term) debt, though usually the role of floating debt was limited; in the course of the sixteenth century, the management of the funded debt had been entrusted to the State-owned Mint (Pezzolo Reference Pezzolo, Boone, Davids and Janssens2003a). In tranquil years, the Republic generated substantial fiscal surpluses in order to repay all its debt (a goal which had been fully attained, for instance, in 1600), thus enhancing its creditworthiness (Sissoko Reference Sissoko2002, p. 8; Fratianni and Spinelli Reference Fratianni and Spinelli2006, p. 263; Alfani and Di Tullio Reference Alfani and Di Tullio2019, p. 172). Therefore, at the beginning of the seventeenth century the state of public finance in Venice was good (Pezzolo Reference Pezzolo, Boone, Davids and Janssens2003a, p. 103), and the government borrowed at an interest rate which was substantially lower than the average rate of return from trade (Sissoko Reference Sissoko2007, p. 6).

By the seventeenth century, Venice had reached a degree of monetization unknown for centuries anywhere else. As usual in early modern times, the official monetary anchor consisted of commodity money (coins) issued by the Mint (Al-Bawwab Reference Al-Bawwab2021); however, inhabitants commonly used cheques and bank transfers (even among the lower-middle class), which allowed them to economize on coins (Mueller Reference Mueller1997, p. 24; Fratianni and Spinelli Reference Fratianni and Spinelli2006, p. 271). This had been made possible by the development of the private deposit banks operating on the Rialto square, but by the end of the sixteenth century all such banks had gone bust and no serious private initiative was any longer available for running the business on the conditions imposed by regulation (Ugolini Reference Ugolini2017, pp. 35–43). As a result, the State itself eventually stepped in, and on April 1587 Venice's first public bank (called ‘Banco della Piazza di Rialto’) started operations (Soresina Reference Soresina1889, p. 7; Roberds and Velde Reference Roberds and Velde2014, p. 19; Bindseil Reference Bindseil2019, pp. 207–10).

In theory, the Banco di Rialto was supposed to represent a case of quasi-narrow banking, given that it was obliged by law to accept only deposits in coins, and cash was always to remain available at the request of depositors (Anon. 1847, p. 564; Dunbar Reference Dunbar1892, p. 321), defining tendentially a policy of 100 per cent reserves (Sissoko Reference Sissoko2002, pp. 7 and 10); transfers had to be made simultaneously between creditors and debtors (Dunbar Reference Dunbar1892, p. 321; Roberds and Velde Reference Roberds and Velde2014, p. 20). In practice, however, because the coins into which the Banco's liabilities were formally convertible had been withdrawn from circulation in 1588, bank liabilities were de facto inconvertible into the new circulating coins (Roberds and Velde Reference Roberds and Velde2014, pp. 21–2; Ugolini Reference Ugolini2017, pp. 225–6). Coins were the main item on the asset side of the Banco's balance sheet, also private commercial debt was allowed to a certain extent (Ugolini Reference Ugolini2017, p. 44). In 1593 Banco liabilities became legal tender (Anon. 1847, p. 366; Roberds and Velde Reference Roberds and Velde2014, p. 21); by 1630, its deposits in represented 80 per cent of the overall volume of exchange settlements in Venice (Sissoko Reference Sissoko2002, p. 8; Roberds and Velde Reference Roberds and Velde2014, p. 21). During these years the two legal tenders – commodity and scriptural money – were imperfect substitutes, the conversion rate between the two being determined on the market (Dunbar Reference Dunbar1892, p. 318; Inclimona Reference Inclimona1913, p. 149; Fratianni and Spinelli Reference Fratianni and Spinelli2006, p. 271). The existence of a positive premium (agio) for Banco money with respect to coins was almost a constant in the Venetian experience (Siboni Reference Siboni1892, p. 291; Magatti Reference Magatti1914, pp. 285–9; Roberds and Velde Reference Roberds and Velde2014, p. 17). As a matter of fact, scriptural money at the time was safer for obvious reasons, and the quality of available commodity money was especially poor during the ‘bullion crisis’ of the late sixteenth and early seventeenth century (Dunbar Reference Dunbar1892, pp. 309, 321, and 330–1; Ugolini Reference Ugolini2017, pp. 225–7).

In May 1619 the government created a new public bank – the Banco del Giro – with floating (short-term) public debt and coins on the asset side of its balance sheet and deposits on the liability side (Soresina Reference Soresina1889, p. 9, Siboni Reference Siboni1892, p. 288, Inclimona Reference Inclimona1913, p. 152, Roberds and Velde Reference Roberds and Velde2014, p. 24; Bindseil Reference Bindseil2019, pp. 215–17). In general, the State's creditors were likely to become floating debt holders using the transfer mechanism of the State bank. This sort of mechanism had been first introduced in the thirteenth century when the Grain Office and Salt Office had started providing transfers to their creditors, and also the Fodder Office had resorted to it from 1608 to 1614 (Pezzolo Reference Pezzolo, Boone, Davids and Janssens2003a, p. 63; Roberds and Velde Reference Roberds and Velde2014, p. 24; Ugolini Reference Ugolini, Battilossi, Cassis and Yago2018, p. 6). While the Banco della Piazza di Rialto was a deposit bank, the Giro bank was a device to make the public debt easily transferable, turning it into a means of payment (Roberds and Velde Reference Roberds and Velde2014, p. 22), and ‘paying deposits at the call of the depositor, like the existing Banco di Rialto’, with the possibility of deposit overdrawing, i.e. making loans (Dunbar Reference Dunbar1892, p. 325). The account holders were floating debt holders; the Giro bank was allowed to accept deposits of private individuals only after the closure of the Banco della Piazza (Sissoko Reference Sissoko2002, p. 11).

The functioning of the Giro bank was simple (Ugolini Reference Ugolini2017, p. 43): the government opened accounts to merchants in credit with the Republic and to public officials as well (Soresina Reference Soresina1889, p. 16, Inclimona Reference Inclimona1913, p. 1146), which could be converted into coins upon authorization; merchants and public officials became the Republic's debt holders. The credit of one account holder could always be freely transferred on demand to another account holder, and the corresponding amount would continue to circulate until the final repayment to the last bearer cancelled it out (Soresina Reference Soresina1889, pp. 12 and 16). Banknotes were not issued (Siboni Reference Siboni1892, p. 291). The Giro bank liabilities were legal tender for any payment greater than 100 ducats, while its clearing activity was possible also for payments lower than 100 ducats (Soresina Reference Soresina1889, p. 12). Moreover, from July 1627 the account holders could pay import taxes using Giro bank transfers (Soresina Reference Soresina1889, p. 20; Siboni Reference Siboni1892, p. 294). The convertibility promise on Giro bank deposits was based on the fact that in the State Mint an amount of commodity money served as a fund to back the operations of the Giro (Dunbar Reference Dunbar1892, p. 326), although backing was not 100 per cent. In fact, in June 1619 the Senate authorized on the one hand the creation of 150,000 ducats’ worth of coin reserves earmarked at the Mint for the Giro, and on the other hand 500,000 ducats’ worth of Giro balances to pay its creditors – i.e. the would-be Giro depositors (Soresina Reference Soresina1889, pp. 12–13; Roberds and Velde Reference Roberds and Velde2014, p. 23). Moreover, one part of the Mint's output was earmarked to repay Giro scriptural money using coins: the Banco's foundation decree actually ordered monthly transfers of 10,000 ducats from the Mint to the Giro for repayments, up to the limit of 50,000 ducats (Roberds and Velde Reference Roberds and Velde2014, p. 24; Soresina Reference Soresina1889, p. 15). On January 1620 the overall balance and the monthly transfers became respectively 700,000 ducats and 20,000 ducats; the monthly transfers eventually became 80,000 ducats in August 1625 (Soresina Reference Soresina1889, p. 17; Siboni Reference Siboni1892, p. 288; Roberds and Velde Reference Roberds and Velde2014, p. 24). The Giro balances were further increased in May 1621 – by 100,000 ducats – and in June 1621 – by 40,000 ducats (Soresina Reference Soresina1889, p. 18). Then, ‘as long as the monthly flow was sufficient to accommodate depositors’ requests, the bank's liabilities remained convertible …; the State … adjusted the monthly flows of cash from the Mint to service the redemption requests’ (Roberds and Velde Reference Roberds and Velde2014, p. 24).

All in all: in 1619 a duopolistic public banking system was born in Venice, where the liabilities of the two banks were treated as equivalent (Dunbar Reference Dunbar1892, p. 324; Ugolini Reference Ugolini2017, p. 44) and both granted the seizure exemption privilege, meaning that in no case did judicial courts have the power to seize their deposits (Soresina Reference Soresina1889, p. 8). Moreover, in their period of coexistence the two public banks were interconnected in some coin exchange operations; while the reciprocal clearing of their liabilities was forbidden, given the need to maintain separation between the two banks (Soresina Reference Soresina1889, pp. 9 and 13). The duopolistic setting ended in 1637, when the Banco della Piazza di Rialto was shut down, with the Banco del Giro remaining the only public Bank in Venice (Soresina Reference Soresina1889, p. 8; Dunbar Reference Dunbar1892, p. 324; Roberds and Velde Reference Roberds and Velde2014, p. 25; Fratianni and Spinelli Reference Fratianni and Spinelli2006, p. 271; Ugolini Reference Ugolini2017, p. 44). As we shall see, the Banco della Piazza was actually an unintended casualty of the 1629–31 crisis despite not being involved in the monetization of the fiscal response to the shock.

II

In 1628, the Republic of Venice got involved in the War of the Mantuan Succession.Footnote 7 In general, war, famine and epidemics (the so-called ‘Three Horsemen of the Apocalypse’) were often associated in the preindustrial world (Alfani Reference Alfani2013, p. 43), and this episode was no exception to the rule. Starting from March 1629, French and Imperial troops crossed the Alps to participate in the conflict (Alfani and Percoco Reference Alfani and Percoco2019, p. 1171). In the Italian states, the first decades of the seventeenth century were characterized by severe food shortages (Alfani Reference Alfani, Collet and Schuh2018, p. 152), and the already meagre supply of food was further jeopardized by war. In general, in Venice famine episodes were less intense than elsewhere thanks to the Republic's capacity to collect grain from the rest of the Mediterranean (Todesco Reference Todesco1989, p. 11), but this came at a sizable cost for the government, which sold the grain at subsidized prices to the population (Ugolini Reference Ugolini2017, p. 37). From a fiscal viewpoint, therefore, the war and famine already put considerable pressure on public finances. As early as April 1629, the governors of mainland cities were complaining to the central government about the severity of the famine and the high costs generated by it.Footnote 8

Starting from spring 1630, an outbreak of bubonic plague (initially transmitted from the north by Imperial troops) started to spread first in the Duchy of Milan and then in the Venetian mainland, finally arriving in the city of Venice in late summer.Footnote 9 The massive outbreak in the city occurred between September and December 1630 – 20,923 deaths – with a peak in October 1630 (Ell Reference Ell1989, p. 130), and in total 43,088 deaths were recorded over just three years; the population of Venice was 141,625 in 1624 and sank to 102,243 in 1633, a reduction of nearly 30 per cent (Lazzari et al. Reference Lazzari, Colavizza, Bortoluzzi, Drago, Erboso, Zugno, Kaplan and Salathé2020, p. 3). Such figures are consistent with the 35 per cent estimated mortality in Northern Italy, and should be compared to an estimated average annual mortality of between 2.7 and 3.7 per cent in normal times (Lazzari et al. Reference Lazzari, Colavizza, Bortoluzzi, Drago, Erboso, Zugno, Kaplan and Salathé2020, p. 3). Many different indicators agree that the shock to the domestic economy was colossal, disrupting many diverse aspects of economic life including the arts industry – music production shrank by 40 per cent (Gonzaga Band 2018), while the average price of paintings collapsed by 81 per cent (Etro and Pagani Reference Etro and Pagani2010). While traditionally this epidemic has been considered a short-run disaster with limited long-run impact (Rapp Reference Rapp1976, p. 154), recent research points to the fact that this was a crucial turning point for the Venetian economy (Alfani and Percoco Reference Alfani and Percoco2019, p. 1197). More specifically, the 1630 plague provided a structural break in the way in which some macro-level variables – population density, urbanization and taxation per capita – affected wealth inequality (Alfani et al. Reference Alfani, Di Tullio and Fochesato2020); the plague put the Republic on a lower growth path, favouring the rise of Northern Europe as well as of the Sabaudian State within Northern Italy (Alfani Reference Alfani2020).

To address the pandemic, the Senate had to decide its policy action immediately. During the previous 1576 pandemic the Venetian government had reacted slowly, both denying the plague and downsizing the number and nature of deaths (Palmer Reference Palmer1978, pp. 238–75; Preto Reference Preto1979, p. 123). The first and most urgent issue consisted of protecting public health by designing and implementing a containment policy. In the Venetian territories urban mortality rates during 1630–1 were severe (ranging from 433 per 1,000 in Chioggia to 615 per 1,000 in Verona), while in Venice itself the mortality rate was 330 per 1,000, pointing to a certain success of the strict lockdowns implemented there (Alfani and Di Tullio Reference Alfani and Di Tullio2019, p. 115). Venice had passed its first legislation to address epidemics in 1423, and a Health Office had been established in 1490 (Palmer Reference Palmer1978, pp. 51 and 85). The Health Office used its authority to close shops, as well as to prohibit auctions and markets (Allerston Reference Allerston1996, p. 279). These measures hit the majority of Venetians, who became unable to work during epidemics (Pullan Reference Pullan1960, p. 26; Biraben Reference Biraben1973, p. 145; Cipolla Reference Cipolla1976, p. 42; Allerston Reference Allerston1996, pp. 292–5).

The containment measures ‘were carried into effect on a colossal scale with full resources of the state’ (Palmer Reference Palmer1978, p. 142). The government was aware of such negative effects on economic activity, so it then tried to alleviate the inhabitants’ losses (Pullan Reference Pullan1964, p. 410; Biraben Reference Biraben1973, p. 57; Cipolla Reference Cipolla1976, p. 41).Footnote 10 In normal times, social expenditures were very low in Venice: for example, available data for 1602 and 1633 – i.e. before and after the pandemic – show that social expenditures were negligible, amounting respectively to 0.2 and 0.4 per cent of total expenditures; in the same years the service of debt amounted respectively to 8.2 and 19.9 per cent (Alfani and Di Tullio Reference Alfani and Di Tullio2019, p. 167). But during a pandemic things were different. In practice, during the 1630 pandemic the government bought necessary goods from merchants to distribute to the confined population,Footnote 11 as it had already done during the 1575 plague (Pullan Reference Pullan1964, p. 409).Footnote 12 When districts were put into quarantine, their inhabitants were provisioned by the State (Palmer Reference Palmer1978, p. 143). The overall fiscal effort to help inhabitants included subsidies and other fiscal help given to affected communities, and distributions of free rations of grain (Alfani Reference Alfani, Collet and Schuh2018, p. 162). When decisions to destroy supposedly infected goods were made, compensation was paid – though not always in full (Pullan Reference Pullan1964, pp. 251 and 319; Allerston Reference Allerston1996, pp. 278 and 287). Moreover, the Venetian government influenced employment and nominal wages in the sectors under its total or partial control, including all the activities strictly related to health (esp. body clearers, who got paid huge salaries during pandemics: Allerston Reference Allerston1996, p. 296) and defence (esp. Arsenal workers, who had their wages paid despite being confined to their homes; Pullan Reference Pullan1964, p. 420). These fiscal transfers directly or indirectly helped inhabitants in trouble, particularly those in the lowest classes, which represented the largest part of the overall population: such people were often in debt, and at the greatest risk of crossing the boundary between subsistence and poverty (Alfani and Di Tullio Reference Alfani and Di Tullio2019, pp. 62–3). In the absence of subsidization, these people would have been most likely to revolt against the government's containment measures, as the opportunity cost of rioting would have been extremely low to them.

III

The 1629–31 famine and plague thus obliged the Venetian government to implement subsidies on a colossal scale, but how was such a huge fiscal expansion financed? Taxes were actually increased;Footnote 13 however, the plague had made tax collection more difficult, increasing the fiscal pressure (Pezzolo Reference Pezzolo, Chittolini, Molho and Schiera1994, pp. 322–3; Alfani and Di Tullio Reference Alfani and Di Tullio2019, p. 29). To help alleviate such pressure, the government also allowed Jews to lend on collateral outside the ghetto (Preto Reference Preto1979, p. 144; Allerston Reference Allerston1996, p. 293). But this was far from enough for financing the fiscal expansion. To deal with its worsening deficit, the Republic had to resort to fiscal monetization through the scriptural money issued by the Banco del Giro: in fact, the government paid its creditors by merely crediting their current accounts with the bank. The size of the Giro bank's liabilities, which had generally been less than one million ducats in the 1620s, rose to 2,071,168 ducats in April 1630, and surpassed 2,666,926 ducats in June 1630 (Soresina Reference Soresina1889, pp. 19, 23 and 29; Siboni Reference Siboni1892, p. 290; Roberds and Velde Reference Roberds and Velde2014, p. 24). While the Giro bank's liabilities kept increasing in concert with the famine and the bubonic plague (Soresina Reference Soresina1889, p. 29), the asset side of its balance sheet underwent a serious deterioration: the rise in scriptural money held by the public was theoretically matched by an increase in floating (non-marketable) government debt, but in reality such a debt did not actually exist, so that in fact the bank's assets were actually decreasing with respect to its liabilities. This situation, which de facto generated a loss for the issuing bank, precisely corresponds to the situation described in Figure 3. Fiscal monetization was actually decreasing the net worth of the monetary authority: in view of this, we interpret this episode as an historical illustration of the ‘net-worth helicopter money’ strategy.

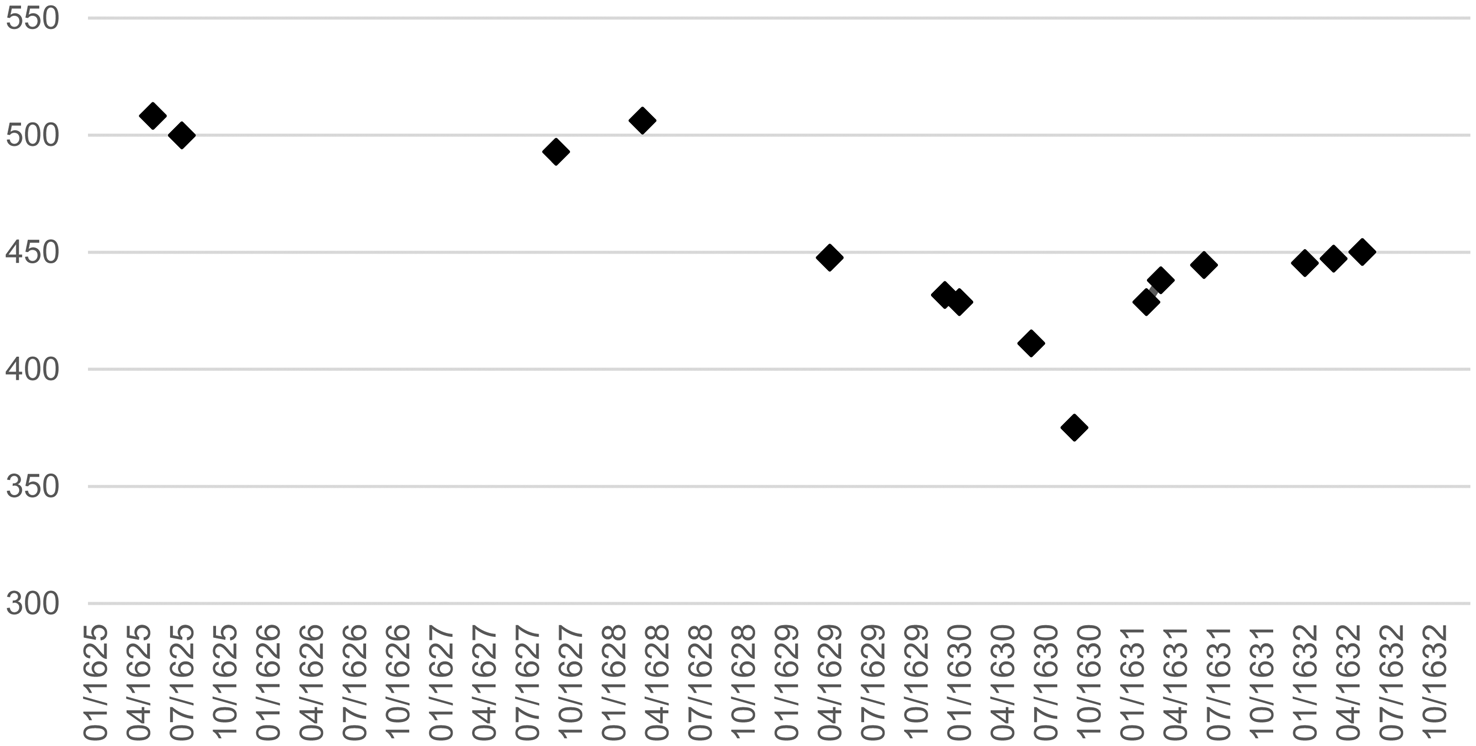

The choice of implementing such a radical strategy triggered a number of serious consequences. First, the government-induced growth of the Banco del Giro's business crowded out the activity of the Banco della Piazza di Rialto (Ugolini Reference Ugolini2017, p. 44). The balance sheet of the Banco della Piazza had reached its peak of 1.7 million ducats in 1618, i.e. one year before the establishment of the Banco del Giro; in 1630, the amount of deposits with the former had dropped to 56,185 ducats only, making the bank moribund until its final demise in 1637 (Siboni Reference Siboni1892, p. 290; Sissoko Reference Sissoko2002, p. 8; Pezzolo Reference Pezzolo, Costabile and Neal2018, p. 155). Second, the monetary expansion entailed a stark depreciation of the value of Giro bank money, which the bank had no way to counteract. Up to 1625 the premium between Giro bank money and coin had been positive and substantial; then from 1625 the premium began to fall, slowly at first and then precipitously in 1630, eventually turning negative (Soresina Reference Soresina1889, p. 29; Roberds and Velde Reference Roberds and Velde2014, p. 24): the agio was equal 20 per cent in 1624, then it dropped to 19.5 per cent in early 1629 and fell into negative territory (-10 per cent) in 1630 (Pezzolo Reference Pezzolo, Costabile and Neal2018, p. 156). The depreciation of Giro bank money can be confirmed by looking at its market value in terms of silver. As shown in Figure 4, during the 1629 famine Giro bank money had already lost 10 per cent of its silver value, and at the peak of the plague (in September 1630) it was down as much as 25 per cent with respect to its pre-crisis valuation.

Figure 4. Market value of Giro bank money (in silver grains)

Source: Mandich (Reference Mandich1957, p. 1173)

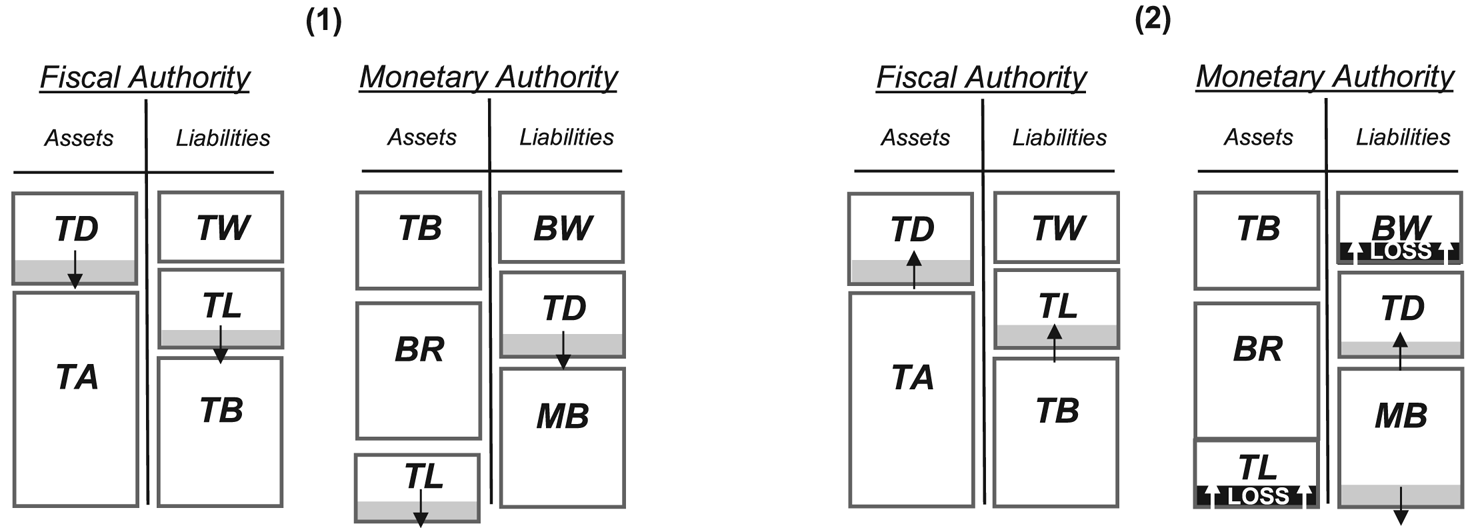

The overexpansion of the money supply thus quickly triggered a substantial monetary depreciation, which the bank had no means to counteract in view of the weakness of its balance sheet. This depreciation forced the government to backtrack on its ‘net-worth helicopter money’ strategy and reform its monetary policy setting. Already in July 1630, a monetary committee (Inquisitori del Banco Giro) had been established, with the aim of reducing the bank's liabilities (Soresina Reference Soresina1889, p. 23; Siboni Reference Siboni1892, p. 290; Roberds and Velde Reference Roberds and Velde2014, p. 24). The reform proposed by the committee was made effective on 24 September 1630. Under this plan, the accounts of a number of separate administrations and public concessionaries – worth 716,652 ducats – were removed from the Giro bank and transferred to the Mint, which was the division of the Treasury charged with the management of the public debt (Pezzolo Reference Pezzolo, Boone, Davids and Janssens2003a). Private depositors were moreover invited to convert their Giro bank liabilities into ‘Mint deposits’, paying 7 per cent interest (Soresina Reference Soresina1889, pp. 25–6; Siboni Reference Siboni1892, p. 290, Roberds and Velde Reference Roberds and Velde2014, pp. 24–5). As the so-called ‘Mint deposits’ were not current account deposits but inscribed bonds (Pezzolo Reference Pezzolo, Boone, Davids and Janssens2003a), this amounted to the conversion of unremunerated sight liabilities into interest-bearing long-term bonds. Furthermore, Mint revenues from sales of life annuities at 14 per cent were applied to the Giro bank (Soresina Reference Soresina1889, p. 26; Roberds and Velde Reference Roberds and Velde2014, p. 25) to strengthen its financial position. In accounting terms, this means that the Treasury first increased the outstanding government debt in order to raise the liquidity that allowed the bank to withdraw some of the money it had issued (Figure 5), then it gratuitously provided it with the resources transferred to it: in so doing, one of the Bank's liabilities was reduced without any asset being diminished, which de facto entailed an increase in the Bank's net worth (Figure 5). All in all, this amounted to transferring the loss previously generated on the monetary authority's balance sheet (Figure 3.2) back to the fiscal authority's balance sheet (Figure 5): differently said, the September 1630 reforms de facto reversed the ‘net-worth helicopter money’ strategy implemented since the beginning of the macroeconomic shock.

Figure 5. Balance sheet effects of the September 1630 reform

These combined operations reduced the Giro balance sheet and then the money supply, thus allowing for a reappreciation of the bank money (see Figure 4) – although at the price of an increase in the funded public debt. The new monetary policy strategy brought down Giro balances to 1.4 million ducats at the end of 1630 (Soresina Reference Soresina1889, p. 29; Roberds and Velde Reference Roberds and Velde2014, p. 25), but it was not sufficient to restore convertibility on demand of Giro bank liabilities (Dunbar Reference Dunbar1892, pp. 327 and 330). Moreover, the government was not able to stabilize the Giro balance sheet below 900,000 ducats until 1638 (Roberds and Velde Reference Roberds and Velde2014, p. 25), which from then on represented the usual amount of the Giro bank balance sheet (Pezzolo Reference Pezzolo, Ortalli, Gullino and Ivetic2021, p. 96). Ex post, price instability – ‘an unprecedented rise in prices has been the worst blow of all’, as argued by a contemporary observer (Cohen Reference Cohen1988, pp. 134–5) – and currency devaluation (Roberds and Velde Reference Roberds and Velde2014, p. 23) had been the macroeconomic outcomes of the ‘net-worth helicopter money’ strategy. So, it is unlikely that such a strategy was socially optimal, especially in view of the fact that the relatively severe indebtedness of the Giro bank was not particularly dramatic compared with the Republic's fiscal income (Pezzolo Reference Pezzolo, Boone, Davids and Janssens2003a, p. 64).Footnote 14 Meanwhile fiscal dominance was in place, with the Venice Senate completely controlling the Giro bank governance (Anon. 1847, p. 364; Soresina Reference Soresina1889, p. 8; Dunbar Reference Dunbar1892, pp. 312 and 321). So why did the Venetian authorities choose to implement such a suboptimal strategy – only to quickly backtrack from it? To answer this question, it is necessary to examine possible links between fiscal monetization and political pressure.

In the Republic of Venice, wealth inequalities were extreme, both between the lower and middle class and between the middle and upper class (Alfani and Di Tullio Reference Alfani and Di Tullio2019, pp. 105–12). This reflected the distribution of political rights, which were strictly reserved for the upper class. However, when calamities occurred, the patricians had to take into account the expectations of the lower classes. Urban populations were watchful of rulers, and they were ready to riot if they became convinced that the government was not doing all it could, (and should) have done to ensure the availability of food, guaranteeing the ‘right to bread’ (Alfani Reference Alfani, Collet and Schuh2018, p. 162). Politicians had much to fear, also in terms of personal safety, from riots motivated by distributional reasons – ‘injustice’ – so that incentives to act were really strong. Indeed, most popular riots in early modern Venice seem to have been caused by ‘political’ claims. Inhabitants’ preferences mattered, although even full citizenship did not guarantee full political rights, as those were reserved for the patriciate (Alfani and Di Tullio Reference Alfani and Di Tullio2019, pp. 13 and 61).

The extraordinary money-financed fiscal stimulus implemented in Venice during 1629–30 can be considered optimal from the perspective of poor inhabitants, who benefited from real subsidies without being sensitive to the ‘monetary externalities’ generated by the policy.Footnote 15 In this respect, the government decision can be considered consistent with the aim of pleasing the majority of inhabitants during a big macroeconomic downturn, thus enhancing consensus and avoiding riots. The theoretical framework behind this interpretation is illustrated in the Appendix (available online). At one point, however, monetary instability became too strong and the government risked losing control of the useful monetization mechanism. At that point, those that were mostly sensitive to ‘monetary externalities’ (i.e. the ruling upper class) were ready to accept some ‘sacrifices’ in order to put an end to currency depreciation. The ‘sacrifices’ consisted of accepting a conversion of liquid sight debt (Giro bank money) into illiquid long-term debt (the ‘Mint deposits’). Acceptance of this conversion (somewhat akin to a debt restructuring) by patricians made it possible to reverse part of the monetization and put an end to instability. Importantly, the ‘sacrifices’ were only short term, as in the long term high interest rates were duly paid to the holders of the newly created funded debt. Because the conversion was actually financed through earmarking future tax revenues, and because the tax system was strongly regressive in Venice, the short-term redistribution in favour of the poor was offset by a long-term redistribution in favour of the wealthy. Indeed, the 1629–30 money-financed fiscal expansion did not cause a permanent change in the condition of poor inhabitants, since analysis of income distributions shows that, contrary to the Black Death of 1348, the bubonic plague of 1630 did not trigger a phase of sustained inequality decline (Alfani and Di Tullio Reference Alfani and Di Tullio2019, p. 116; Alfani Reference Alfani2020, p. 204).

In view of all this, we can tentatively provide some speculative interpretations as to why a ‘net-worth helicopter money’ strategy was first implemented and then abruptly reversed in Venice during the 1629–31 shock. At the beginning of the shock, the ruling class (which held the overwhelming share of Venetian public debt) was apparently unwilling to see the funded debt increase, thus forcing the Treasury to monetize the politically inevitable stimulus. After realizing the substantial costs of excessive monetization, however, consensus was found among patricians on the need for the funded debt to grow in order to limit money depreciation. Contrary to the ‘monetary-base helicopter money’ strategy, the ‘net-worth helicopter money’ might have prevented the long-term government debt from growing in the short term, but the latter's impact on monetary stability was probably much more violent than the former's. As a result, the ‘net-worth helicopter money’ strategy had to be quickly reversed and replaced by a much more conservative policy.

IV

Recently, monetary policy theory highlighted the relevance of the way interventions are orchestrated between the central bank's and the government's balance sheets (Sims Reference Sims, Sinn, Widgrén and Köthenbürger2004; Reis Reference Reis2015; Orphanides Reference Orphanides2016; Benigno and Nisticò Reference Benigno and Nisticò2020). In particular, radical options like the so-called ‘net-worth helicopter money’ have been discussed as a possible strategy to cope with extraordinary macroeconomic shocks such as pandemics. However, episodes in which the ‘net-worth helicopter money’ strategy has been actually implemented appear to be very rare in history. In this article, we have focused on one historical example in which a pandemic recession was actually addressed through the implementation of this strategy.

In the Republic of Venice, the 1629 famine and the 1630–1 plague caused a unique negative macroeconomic shock, that the oligarchic government addressed using a particularly radical form of fiscal monetization that corresponds to the modern notion of ‘net-worth helicopter money’. As a matter of fact, the expansion of the bank of issue's liabilities was associated with a deterioration in the quality of its assets, thus producing capital losses to the issuer and reducing its net worth. This policy entailed monetary depreciation and instability, so that the government had to reverse it very quickly – i.e. before the end of the macroeconomic shock. Backtracking on the ‘net-worth helicopter money’ strategy implied transferring the losses suffered on the monetary authority's balance sheet to the fiscal authority's balance sheet: this actually took place through a de facto government bailout of the bank of issue, as the bank's sight liabilities were converted into long-term public debt.

Why did the government choose to implement this suboptimal strategy? We argue that they did so to avoid political disturbances and popular rioting, while also preventing the long-term government debt from growing. Thus, in the short term, potential political and social consequences of the macroeconomic shock were minimized by implementing a redistributive policy from the rich to the poor. But in order to keep the monetization mechanism viable and prevent a complete debasement of bank money, the quality of the assets side of its balance sheet had to be restored: losses had to be covered through a de facto bailout, which made the inevitable growth of long-term government debt eventually occur. However, it is worth underlining that in the long term, the conversion of sight bank liabilities into long-term debt actually reversed the distributional effects triggered by the ‘net-worth helicopter money’ strategy: as taxes were strongly regressive in Venice, the ensuing conservative fiscal policy which allowed the debt to be repaid entailed a redistribution of resources from the poor to the rich.

The history of the Venetian reaction to the 1629-31 famine and pandemic echoes many aspects of the COVID-19 crisis. For one thing, it proves that current extraordinary fiscal expansion to cope with a pandemic is far from unprecedented. Moreover, it suggests that the refusal of central bankers nowadays to embark on a ‘net-worth helicopter money’ experiment may have been a good idea after all. More generally, the Venetian experience with ‘net-worth helicopter money’ highlights the redistributive implications of the design of macroeconomic policies, as well as the importance of political economy factors in the choices underlining such designs.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/S0968565021000214.