1 Introduction

The gender wage gap has long been a major subject for study in economics. Although it has shown a decreasing trend over time, its persistence in developed countries challenges classical explanations based on differences in human capital, preferences and statistical discrimination (Blau and Kahn, Reference Blau and Kahn2000, Reference Blau and Kahn2017). Gender differences in negotiation have been put forward as an alternative explanation for the gender wage gap. Starting wages are often the result of bilateral negotiation. Moreover, wages are also affected by negotiations that come later in one’s career, e.g., for pay increases. If women are less likely to negotiate starting salaries and to ask for pay increases, and/or if women obtain worse deals when negotiating, this would clearly go some way towards explaining the gender wage gap (Azmat and Petrongolo, Reference Azmat and Petrongolo2014; Card et al., Reference Card, Cardoso and Kline2016; Sin et al., Reference Sin, Stillman and Fabling2020).

The stereotypical behavior in most real life bargaining settings is that men are better bargainers than women and so when differences are found the gender gap tends to be negative for women. In this paper we propose to switch the focus from whether there are gender differences to when they will be observed. Mazei et al. (Reference Mazei, Hüffmeier, Freund, Stuhlmacher, Bilke and Hertel2015) offer the most recent meta-analysis on gender differences in negotiation and their moderators, building on the previous work by Stuhlmacher and Walters (Reference Stuhlmacher and Walters1999). Men were found to achieve better outcomes than women, but these gender differences were found to depend on the context. One important moderating factor is what psychologists labeled structural ambiguity. Building on Mischel (Reference Mischel1977)’s notion of ambiguous (or weak) and unambiguous (or strong) situations, gender differences were mostly found in situations where people did not have a clear protocol or script for appropriate behavior. In these situations, people relied on more general behavioral schemata and available social norms, such as preconceived gender roles and stereotypes (Bowles et al., Reference Bowles, Babcock and McGinn2005; Major et al., Reference Major, McFarlin and Gagnon1984).Footnote 1

This paper studies the relationship between the existing ambiguity regarding the sharing norms and the existence of gender differences in bargaining. Going back to the opening paragraph; do we expect the same gender differences in wage negotiations when workers know exactly the salary each worker is getting (full transparency) or when workers lack any guidance related to the existing wage distribution (full ambiguity)? We propose using a controlled environment such as the laboratory, to study when gender differences will be observed in structured alternating-offer bargaining environments. The design of the experiment was registered at the AEA RCT registry, under the reference AEARCTR-0002029.Footnote 2 A laboratory setting allows researchers to study gender differences in bargaining environments that vary in the existing ambiguity regarding the sharing norm, which is our main treatment variable. In addition, the laboratory offers the possibility of measuring individuals’ self-assessment of their ability to perform a task and to bargain, as well as their risk and social preferences, which are hard, if not impossible, to control for when using observational data. Gender differences in those behavioral traits are known to be the mediating factor for gender differences (see Niederle et al. Reference Niederle and Vesterlund2011; Gillen et al. Reference Gillen, Snowberg and Yariv2019; Van Veldhuizen, Reference Van Veldhuizen2022).

We hypothesize that, ceteris paribus, the higher the ambiguity regarding the existing sharing norm, the more likely and stronger will be the gender differences.

We use a symmetric bargaining setting as a benchmark, where bargaining parties show equal strength so that a 50:50 split of the pie is the only expected sharing norm. The benchmark shows a bargaining setting with the lowest ambiguity. We hypothesize that in this benchmark setting, participants will follow the norm so that no gender differences appear.

We then modify the symmetric environment to introduce three common sources of asymmetries existing in the real world: empowerment (only the proposer has a positive outside option), entitlement (the proposer is entitled to a greater share than the responder), and informational asymmetry (only the proposer knows the actual size of the pie).Footnote 3 We chose these particular asymmetries because they are present in many economic-relevant situations such as in salary negotiations. For example, whenever any of the bargaining roles has an outside option (an employer with multiple potential employees or employees with multiple job offers) empowerment will be in play. In situations with a feeling of ownership of the surpluses on which the participants are negotiating, such as in negotiations about performance based promotions, entitlement is in play. Finally, employees almost never know the exact size of the salary or promotion that is attainable, generating an informational asymmetry. The existence of these asymmetries not only makes one bargaining party stronger (the proposer in our setting) and the other weaker (the responder in our setting), but also increases the ambiguity regarding what one could expect as the bargaining outcome. To put it simply, in all three asymmetric environments, the proposer is expected to get more than the responder, but it is not clear how much more. We hypothesize that these environments would be the ones in which gender differences in bargaining are likely to flourish. Lastly, in a final treatment variation, we aim to maintain the asymmetry in the bargaining environment but reduce ambiguity by providing participants with the modal agreements of other participants in past experimental sessions. We hypothesize that, if anything, gender differences should decrease when ambiguity is reduced.

Our laboratory study consisted of three main tasks. Subjects first performed a real effort task, where each subject obtained a score for productivity which then determined the pie to be shared. In the second task, subjects were randomly paired and had 3 minutes to bargain over the pie via alternating-offer. The bargaining task consisted of 10 bargaining periods of 3-minutes each with a different paired participant each time. Finally, in the third task, we elicited a set of beliefs to measure their self-assessed ability in the task and in bargaining, as well as risk and social preferences.

The laboratory design relied on random pairing of individuals to form the pairs that will bargain over a pie, and on men and women being ex-ante equally likely to be allocated to either the strong or the weak bargaining position. This design allowed us to study two main important questions on gender differences when bargaining. Firstly, we studied gender differences in three interconnected bargaining outcomes (probability of reaching an agreement, earnings conditional on reaching an agreement and overall earnings) in the symmetric and the asymmetric bargaining environments, with and without information about past agreements. Secondly, we tested whether men and women react differently to the presence of asymmetries and to the presence of information about past agreements in asymmetric bargaining environments, i.e., whether gender is an effect modifying factor. To do this, we compared gender differences in each asymmetric environment with those in the symmetric environment, together with gender differences in the asymmetric environments with and without information about past agreements.

In the symmetric bargaining benchmark, as expected, we find that the 50:50 split is largely followed. Indeed 69.1% of successful negotiations end up with the pie being split exactly equally, showing to be the bargaining setting with the lowest ambiguity. As conjectured, we find no hard evidence for gender differences. When asymmetries are introduced, we find important gender differences in the stereotypically expected direction. Firstly, men show a lower likelihood of reaching an agreement, a result that in our opinion has not been emphasized enough in the literature given its implications for efficiency, especially in the responder’s role. Secondly, when an agreement is reached, men show the ability to secure a higher share of the pie, especially in the proposer’s role. These differences are consistent with most findings both in economics and psychology. As these two differences have the opposite effect on overall earnings, it turns out that men and women do not show significant differences in either role when focused on overall earnings. However, overall earnings are lower when bargaining with men. When comparing gender differences across the three different bargaining asymmetric environments, we find that gender differences are strongest in those with empowerment and informational asymmetries. These are the environments in which ambiguity is highest. Third and finally, when past agreements are provided in the asymmetric bargaining environments, the fact that men show a lower likelihood of agreement is no longer significant, attenuating in part the existing gender differences.

With regard to gender as effect modifying factor, we compare gender differences in each asymmetric bargaining environment with those in the symmetric bargaining environment. Despite not finding significant results, we find all coefficients going in the expected direction, increasing gender differences when increasing ambiguity. Furthermore, when comparing gender differences in asymmetric environments with and without past agreements, again, although in the expected direction, we do not find hard evidence that gender is an effect modifying factor for the provision of past agreements. Finally, when we measure ambiguity in a continuous way using the distance between a particular split and the mean or modal split and interact gender differences with these ambiguity measures, we again find suggestive evidence that the higher the ambiguity the bigger the gender gap, although not always significant.

We further show three important robustness tests. First, we replicate the main analysis including individual level controls and, as expected, we find that the existing gender differences get attenuated when controlling for differences in confidence, stereotypical beliefs, and risk preferences (consistent with Niederle et al., Reference Niederle and Vesterlund2011; Gillen et al., Reference Gillen, Snowberg and Yariv2019; Van Veldhuizen, Reference Van Veldhuizen2022). Second, as experimental subjects were represented using gender avatars in the bargaining environment, experimenter demand effects may be at play. Having this concern in mind, we included a question at the end of the experiment (What was the purpose of the experiment?) to measure how many subjects indeed identified gender differences as the object of the study. In the robustness test, we show that this percentage is low (below 8% of the subjects) and we replicate the main analysis excluding those negotiations in which participated subjects who mentioned gender was the object of study, and the main results hold, although again the size and significance decreases, some of the results becoming now insignificant. However, notice that the number of observations also decreases significantly. We acknowledge this percentage may represent a lower bound and that therefore this offers an imperfect control for potential experimenter demand effects. Third and finally, we also observe an important deadline effect, as about a quarter of the negotiations were still going on in the last 10 seconds. We replicate the main analysis excluding those negotiations and the main results hold.

The rest of the paper is organized as follows. Section 2 places our paper and results in the context of existing work. Section 3 describes the procedures and design of the laboratory experiment, the data, the identification strategy, and the hypotheses. Section 4 describes the main results. Section 5 concludes.

2 Literature review and contribution

Gender differences in bargaining have been studied by economists. For example, gender differences in negotiation were found by studying male proposers’ behavior in field experiments in which the gender of potential scripted buyers varied (Ayres, Reference Ayres1991; Ayres and Siegelman, Reference Ayres and Siegelman1995; Castillo et al., Reference Castillo, Petrie, Torero and Vesterlund2013).Footnote 4 To study gender differences in wage negotiation, Säve-Söderbergh (Reference Säve-Söderbergh2019) and Roussille (Reference Roussille2021) used wage bids and wage offers and find evidence for substantive gender gap in wages. Andersen et al. (Reference Andersen, Ertac, Gneezy, List and Maximiano2018) found that men obtain better deals than women among the members of a patriarchal society while the reverse was true for a matriarchal society. Biasi and Sarsons (Reference Biasi and Sarsons2022) compared the wage gap in salaries among teachers in Wisconsin after a law change from collective bargaining to flexibility in bargaining for individual salaries. They found that this increased the gender gap in wages.

Economists have also studied gender differences in controlled settings such as laboratories, mostly using the ultimatum game, which represents a reduced-form bargaining setting, as it allows for a single offer (or demand) and the response to it. Using face-to-face ultimatum games, Eckel and Grossman (Reference Eckel and Grossman2001) found that women are more likely to accept offers from women (solidarity) and that men are more likely to accept offers from women (chivalry). In an ultimatum game where gender is commonly known Solnick (Reference Solnick2001) found that women are more likely to accept offers from male proposers than from female proposers. Sutter et al. (Reference Sutter, Bosman, Kocher and van Winden2009) found much more competition and retaliation and, thus, lower efficiency when the bargaining partners had the same gender than when they had the opposite gender. Huang and Low (Reference Huang and Low2022) showed that gender differences can reverse when negotiating in a battle-of-the-sexes type setting when participants can use verbal communication as opposed to no communication.

Closer to our alternating-offer bargaining setting, Dittrich et al. (Reference Dittrich, Knabe and Leipold2014) used a laboratory face-to-face alternating-offer wage-bargaining game where the firm was empowered, and found that starting salaries offered by men to women were lower than those offered by women to men, resulting in significant gender interaction effects on wage-bargaining outcomes. Using data from a TV-show in which bargaining parties showed major asymmetries in all three dimensions (empowerment, entitlement and information), Hernandez-Arenaz and Iriberri (Reference Hernandez-Arenaz and Iriberri2018) found that the pairing between a male proposer (strong) and a female responder (weak) was the only one that differed from the rest, yielding higher profits for the proposer. Contrary to our findings here, they found significant interaction effects. However, this may be because their settings have more than one type of asymmetry simultaneously. Rigdon (Reference Rigdon2012) found that women demand less than men in a demand-ultimatum-game in the laboratory, and more interestingly, that this gap diminishes when previous demands are provided, similar to our treatment to reduce ambiguity. More recently, when studying gender differences in the choice to negotiate, Exley et al. (Reference Exley, Niederle and Vesterlund2020) included a baseline treatment, where subjects were forced to negotiate in an unstructured setting with limited time. They found that men and women achieve similar earnings.

Note that apparently contradictory findings can be rationalized through our hypotheses and results. Those studies that find gender differences in bargaining are those that show greater ambiguity with respect to which sharing norm is adequate. However, Exley et al. (Reference Exley, Niederle and Vesterlund2020) used a setting that, while asymmetric, displayed a clear sharing norm that dictated how the pie should be divided, as bargaining parties knew exactly how much of the pie each bargaining party contributed. Consequently, in line with our hypotheses and results, these studies suggest that gender differences are likely to flourish only in those situations that show enough ambiguity.

Our paper makes three contributions over existing work. Firstly, and most importantly, it proposes a way to determine when gender differences in bargaining can be expected: when ambiguity, proxied by the variance in bargaining earnings, is highest. This is confirmed by our experimental results and is consistent with other findings in the literature, both in economics and psychology. Regarding the contribution over the studies in economics, it is the first study that offers different ways to systematically manipulate the existing ambiguity, which is our main treatment variable, when studying bargaining outcomes in connection to gender differences. Regarding the work in psychology, we offer a framework to think about what structural ambiguity means or materializes into, providing the comparison of symmetric (no ambiguity) versus asymmetric environments that lack a clear sharing rule (highest ambiguity), and propose a way in which ambiguity can be reduced (through the provision of past agreements). Secondly, it proposes an experimental framework for studying gender differences in a rich structured bargaining environment such as the alternating-offer bargaining, bringing the environment closer to reality and at the same time being observable to the researcher. In this regard, we find a significant gender difference that has not been stressed enough in our opinion, despite having important consequences for efficiency, that of men showing a lower likelihood of reaching an agreement. This is due to the studied bargaining settings in the laboratory, mostly ultimatum-like settings, showed a reduced-form of bargaining. Finally, this paper offers a rationale for the most recent studies using observational data that show effective policy recommendations on how to reduce the gender gap in wages: transparency. Hospido et al. (Reference Hospido, Laeven and Lamo2019), Recalde and Vesterlund (Reference Recalde and Vesterlund2020) and Bennedsen et al. (Reference Bennedsen, Simintzi, Tsoutsoura and Wolfenzon2022) show that the more transparency with regard to when to apply for promotions and with regard to the salary increase involved in a promotion, the lower the gender gap. Transparency is clearly at the other extreme of ambiguity.

3 Experimental procedures and design

A laboratory experiment was run at the Bilbao Laboratory of Experimental Analysis (Bilbao Labean) at the University of the Basque Country and at the Experimental Economics Lab (LEE) at University University Jaume I, on a computer-based form using z-Tree experimental software (Fischbacher, Reference Fischbacher2007). Subjects were recruited through ORSEE (Greiner, Reference Greiner2015), with a total of 562 participants—278 (49.4%) men and 284 (50.6%) women—split into sixteen different sessions. Recruiting was carried out in such a way that the gender balance in each session was assured while subjects were unaware of this at the time of recruiting.

At the beginning of each session, subjects were provided with written general instructions, which informed them that the experiment consisted of 3 different tasks and that the detailed instructions would be displayed on their computer screens before the start of each task. All instructions, both written general instructions and detailed instructions regarding each of the tasks, were read aloud to ensure that the information was public knowledge. A translation of the instructions can be found in Online Appendix B. Each session lasted for about one and a half hours, including payment. Average earnings were 15.32 euro (s.d. 5.71) including a show-up fee of 3 euro, and total earnings ranged from 5 euro to 34.5 euro.

3.1 Design: treatments and time-line of the experiment

3.1.1 Treatments

Figure 1 summarizes the experimental treatments that aim to change the ambiguity regarding the sharing norms. Firstly, these bargaining environments differ from one another in terms of the existence of symmetry and, among the asymmetric bargaining environments, in terms of the source of the induced bargaining asymmetry (through empowerment, entitlement and information). In the symmetric environment, we expected the ambiguity to be lowest, as the only sensible sharing rule is the 50:50 split. In the asymmetric environments, we expected the ambiguity to be highest, as the 50:50 rule is no longer sensible and there is no other sensible sharing rule. In all of these sessions we provided no information regarding what other participants in previous sessions agreed on. Secondly, we aimed to reduce ambiguity with regard to the available sharing rules for Empowerment and Entitlement, providing subjects with the modal split of the pie in previous sessions. We decided not to carry out additional treatment for the informational asymmetry as it is the lack of information that is the source of the asymmetry, such that providing past agreements may result in canceling out the asymmetry itself.

Fig. 1 Treatments: varying ambiguity in the sharing rules

3.1.2 Time-line of the experiment

All sessions included three different tasks: a real effort task, an alternating-offer bargaining task, and a set of elicitation tasks. The real effort task and the elicitation tasks were identical in all sessions, but we varied the bargaining environment from one treatment to another, as described in Fig. 1. We now provide further details about each of the bargaining environments.

Real effort task: Subjects were presented with a matrix filled with “0”s and “1”s similar to that in Fig. 2 and asked to count the number of ones.Footnote 5 Once a number was entered for a matrix and the subject confirmed the input, a new matrix appeared on the screen. Subjects performed this task for 5 minutes and the performance measure was the total number of matrices for which the correct number of “1”s was provided.Footnote 6 This task was not directly incentivized but subjects were informed that their performance in this task was important for determining their earnings in the bargaining task.Footnote 7 Consistent with previous findings, this task proved to be gender neutral in performance, with regard to the number of matrices attempted, and the precision rate.Footnote 8

Fig. 2 Example of a matrix shown to subjects during the real effort task

Subjects’ gender was elicited at the end of this task, just before taking on the bargaining task. In particular, they were presented with two avatars representing the silhouettes of a man and a woman and explicitly asked “Are you a man or a woman?”. As can be seen in Fig. 3, these avatars were chosen to elicit subjects’ gender in the most aseptic and neutral way possible, without giving any further cues such as facial expressions. These avatars were used to make bargainers’ genders common knowledge, as illustrated by Fig. 4.

Fig. 3 Gender avatars

Bargaining task: symmetric. Based on their relative performances in the real effort task, subjects were assigned a score for productivity, which determined the pie to be bargained over. Specifically, the top third of performers were endowed with a productivity of €15 , the middle third with a productivity of €10, and the bottom third with a productivity of €5. Subjects were only given precise details about this protocol after they completed the real effort task, but no information was provided about the actual number of matrices they solved correctly or about their individual productivities.

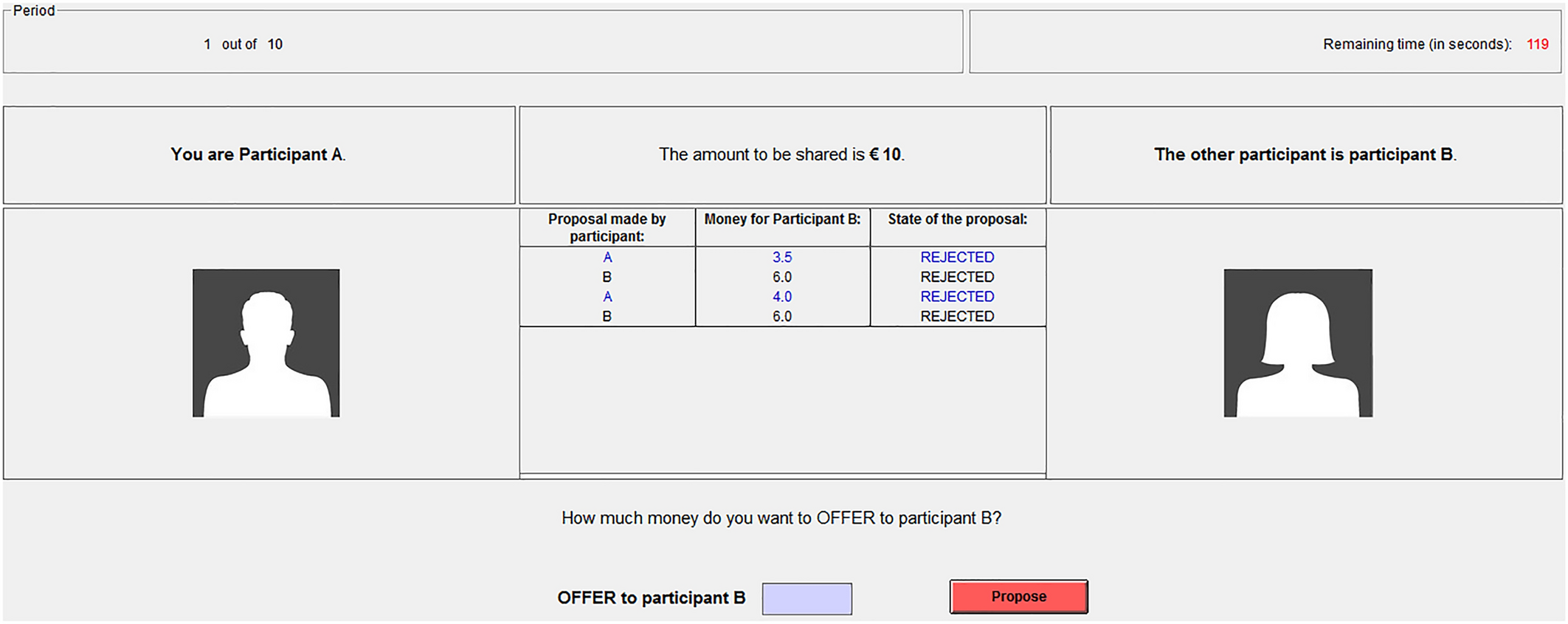

Each subject was then randomly paired with another subject. One was assigned the role of Participant A (hereafter referred to as the Proposer) and the other that of Participant B (hereafter referred to as the Responder). The Proposer was the paired subject with the higher score in the real effort task, although this protocol was not revealed.Footnote 9 Within each pairing, the pie to be bargained over was randomly drawn from the productivity of the proposer and that of the responder with equal probabilities. This means that the pie could be of €5, €10, or €15. Only once the pie size was randomly determined, this information was made public, so the bargaining parties do not know whether they will be bargaining over the pie determined by the proposer’s or the responder’s productivity. Each pairing had 3 minutes to reach a deal on how to split the pie through an alternating-offer bargaining process. During the bargaining, proposers decided on offers to responders while responders decided on demands from proposers. In other words, the whole bargaining process took place in terms of the amount of money that the responder would get. Proposers started the negotiation making the first offer to the responders. During the bargaining, the information available to all subjects consisted of their own avatar and that of the opponent (their gender and that of their paired partner), the size of the pie to be shared, and the bargaining history of offers and demands. See Fig. 4 for an illustration. Importantly, subjects could not see their own productivity or their opponent’s. If they reached a deal within the 3-minute limit, the agreed split was implemented. Otherwise they got 0.

Fig. 4 Screen seen by Proposers during the bargaining task (Symmetric Environment)

The whole bargaining process was repeated for 10 periods in all treatments, with a different paired participant each time.Footnote 10 Importantly, from one period to the next the role in the bargaining pairing (proposer or responder) and the pie to be split could change. For payment, subjects were informed that the computer would take two periods randomly—one from periods 1–5 and another from periods 6–10—and the resulting outcomes would be implemented.

Bargaining task: empowerment. Everything was the same as for the Symmetric bargaining, except that there was an outside option for the proposer. In particular, if a deal was not reached within the 3-minute limit, the proposer had an outside option while the responder got 0. The outside option available to the proposer was a random amount drawn from a uniform distribution between 50% and 85% of the pie. Both parties knew about the outside option but neither knew its exact value when bargaining.

Bargaining task: empowerment with past agreements. Everything was the same as for Empowerment bargaining, except that we provided subjects with past agreements, i.e., the most frequent amount (mode) agreed for the responder in the sessions with empowerment. These amounts depended on the pie to be shared: 1, 1.5 and 5 euro, when the pies were 5, 10 and 15 euro, respectively. This information was presented to subjects during the negotiation just above the dialog box about the offer/demand.

Bargaining task: entitlement. Everything was the same as for Symmetric bargaining, except that subjects were able to see their own productivity and that of their partners. This was public knowledge. This bargaining environment thus informed subjects of whose productivity determined the size of the pie. This was intended to generate a feeling of entitlement.Footnote 11 In the event of a tie, there is no entitlement effect, meaning that we do not consider those bargaining pairings in the analysis in the rest of the paper (note the lower number of observations in the entitlement treatment).Footnote 12

Bargaining task: entitlement with past agreements. Everything was the same as for Entitlement bargaining, except that we provided subjects with past agreements, i.e., the most frequent amount (mode) agreed for the responder in the sessions with entitlement. These amounts depended on the pie to be shared: 2.5, 5 and 7 euros, when the pies were 5, 10 and 15 euros, respectively. This information was presented to subjects during the negotiation just above the dialog box about the offer/demand.

Bargaining task: information. Everything was the same as for the Symmetric environment, except that only the proposer could see the actual size of the pie, while the responder only knew that it could be 5, 10 or 15 euro. This was public knowledge.

Elicitation tasks. After completing the 10 bargaining periods, subjects entered the third and last task of the experiment. We first asked the subjects explicitly: "What do you think the objective of this experiment is?." This answer was not incentivized and they were allowed to provide their answers in free format. One potential concern with the way we made subjects’ genders common knowledge is that this feature of the design could yield some type of experimenter demand effect, which we address in the robustness checks (at the end of Sect. 4.2). Furthermore, in this task we elicited beliefs about self-assessed relative ability both in the real effort task and the bargaining task. As far as the real effort task is concerned, subjects were asked to reveal which quartile of the performance distribution they thought they were in and to state which gender they believed had performed better (or whether there were no gender differences). Similarly, for the bargaining task, subjects were asked to reveal which quartile of the distribution they thought they were in based on the relative surplus obtained during the 10 negotiations and to state which gender on average had obtained a greater share of the pie over the 10 periods (or whether there were no gender differences). Finally, we also elicited risk attitudes following the methodology in Eckel and Grossman (Reference Eckel and Grossman2002) and social preferences via the primary slider measure items described in Murphy et al. (Reference Murphy, Ackermann and Handgraaf2011) and implemented for z-Tree by Crosetto et al. (Reference Crosetto, Weisel and Winter2012). All these measures were incentivized.Footnote 13 Table A1 in Online Appendix A shows the mean values for these control variables by gender. The main notable gender differences show up in risk preferences, where women appear to be more risk averse than men, and less confident in both their ability at the real effort task and in their bargaining ability. Figures A1 and A2 in Online Appendix A show subjects’ perceptions about the gender nature of the task and bargaining by gender. Perceptions about the gender nature of the real effort task are split, with slightly more male subjects tending to believe it is a male task, while slightly more female subjects put more weight on the task being a female task. However, both male and female subjects perceive bargaining to be a male task.

3.2 Data, hypotheses and identification strategy

3.2.1 Data

We gathered data on 2487 different negotiations from 562 different experimental subjects.Footnote 14 We focused on three important bargaining outcomes. The first outcome in a negotiation was whether the parties reached an agreement or not. The success rate measured the efficiency of bargaining: only when an agreement was reached could surplus be created. Another important outcome was earnings, measured as the share of the pie. This outcome, however, can be measured in two different ways: overall earnings, not conditional on reaching an agreement, and earnings conditional on reaching an agreement. For example, data from the field on labor markets usually involves the second one, as failed negotiations are rarely observed. However, from an efficiency point of view, the former variable is the most important, for example, when deciding whether to negotiate or in deciding on whom to delegate a negotiation. To sum up, we considered all three variables: probability of reaching an agreement, share of the pie conditional on reaching an agreement, and overall share of the pie or earnings.

3.2.2 Hypotheses

The experimental design consisted of a 2 (Male Proposer, Female Proposer)

![]() 2 (Male Responder, Female Responder)

2 (Male Responder, Female Responder)

![]() 6 (Symmetric, Empowerment, Empowerment with past feedback, Entitlement, Entitlement with past feedback, Information) factorial design. The first two factors allowed us to test for the existence of gender differences in each of the bargaining roles. Meanwhile, the third factor allowed us to check for the role of gender as an effect modifying factor between symmetric and asymmetric bargaining environments, and between environments with and without past agreements.

6 (Symmetric, Empowerment, Empowerment with past feedback, Entitlement, Entitlement with past feedback, Information) factorial design. The first two factors allowed us to test for the existence of gender differences in each of the bargaining roles. Meanwhile, the third factor allowed us to check for the role of gender as an effect modifying factor between symmetric and asymmetric bargaining environments, and between environments with and without past agreements.

Given the experimental design and treatments, we started by testing two different sets of hypotheses. Firstly, we tested for the existence of gender differences in each of the six environments considered.

We hypothesized that gender differences would be non-existent in the symmetric bargaining environment, where the 50:50 norm is prevalent (Hypothesis 1). Our symmetric bargaining setting is closest to the one modeled in Ma and Manove (Reference Ma and Manove1993), where players do not know with certainty whether their offer will be the last one. The reason is that, if they wait for too long, they might not be able to submit the offer and get a response from the other player, while if they send their offer too early, the opponent might send a counteroffer so that their offer is not the last one. In this framework, the expected division of the pie is unique and close to an even split.Footnote 15

We hypothesized that asymmetric bargaining environments without past agreements may yield gender differences in all three environments: empowerment, entitlement, and information (Hypotheses 2). Note that, by making the proposer the stronger bargaining party, asymmetries break the 50:50 sharing norm but in a way that an alternative clear sharing norm is absent. This lack of clear sharing rule also allows for enough ambiguity and wiggle room for the bargaining parties to show their bargaining abilities. In particular, for the empowerment setting we decided not to provide the exact value of the outside option so as not to make that amount too salient.Footnote 16 In the entitlement setting, although it was clear the proposer was entitled to a higher share of the pie, because their productivity was higher, it was not clear how much their share of the pie should be, because the pie was determined randomly by the productivity of only one bargaining party. Finally, in the informational asymmetry, bargaining parties might expect the stronger party to try to take advantage of the informational asymmetry.

In asymmetric bargaining environments with past agreements, we intended to maintain the strength of the proposer by breaking with the 50:50 split, but in a way that a new sharing rule arises by providing bargaining parties with past agreements. Under this scenario, we hypothesized that gender differences should be less pronounced and somewhere half way between the symmetric environment and the empowerment and entitlement situations without past agreements (Hypotheses 3).

Secondly, given the fact that we also varied bargaining environments to change the existing ambiguity regarding the available sharing norms, we tested the null hypothesis of whether gender is an effect modifying factor when changing from a symmetric to an asymmetric bargaining environment (Hypothesis 4), and when changing from a bargaining situation without past agreements to a setting with information on past agreements (Hypothesis 5). With this in mind, we compared each of the asymmetric treatments with the Symmetric one, and asymmetric environments without past agreements with those with past agreements.

3.2.3 Identification strategy

In order to test hypotheses 1–3 (whether gender differences exist in different bargaining environments), we started with the following specification:

where

![]() (

(

![]() ) takes a value of 1 if the Proposer

i (Responder

j) is a man and 0 for a woman. To control for the characteristics in which the bargaining between Proposer

i and Responder

j took place, the term

) takes a value of 1 if the Proposer

i (Responder

j) is a man and 0 for a woman. To control for the characteristics in which the bargaining between Proposer

i and Responder

j took place, the term

![]() includes session, period, and pie fixed effects. Specification (1) enables us to test whether gender differences in bargaining can be detected, i.e., whether men and women in the role of Proposer/Responder obtain different outcomes from bargaining or whether bargaining with men is different from bargaining with women. In this specification, our coefficients of interest are

includes session, period, and pie fixed effects. Specification (1) enables us to test whether gender differences in bargaining can be detected, i.e., whether men and women in the role of Proposer/Responder obtain different outcomes from bargaining or whether bargaining with men is different from bargaining with women. In this specification, our coefficients of interest are

![]() and

and

![]() .Footnote 17 The estimation results for these tests are shown in Tables 3, 4 and 5.

.Footnote 17 The estimation results for these tests are shown in Tables 3, 4 and 5.

To test hypothesis 4 (whether introducing asymmetries are gender effect modifying factors), we compared gender differences in each asymmetric environment (without including the treatments with past information) with the symmetric environment by running the following regression:

while to test hypothesis 5 (whether providing past information is a gender effect modifying factor), we compared gender differences in each asymmetric environment with the ones under the provision of past information:

where, as before,

![]() (

(

![]() ) takes a value of 1 if the Proposer

i (Responder

j) is a man and 0 for a woman and

) takes a value of 1 if the Proposer

i (Responder

j) is a man and 0 for a woman and

![]() incorporates session, period, and pie fixed effects into the analysis to control for the environment in which the bargaining took place. In regression 2, the omitted treatment is the symmetric one, while

incorporates session, period, and pie fixed effects into the analysis to control for the environment in which the bargaining took place. In regression 2, the omitted treatment is the symmetric one, while

![]() takes the value of 1 if the pair ij bargained in an asymmetric environment without past agreements. In regression 3, the omitted treatment is the asymmetric one without the past agreements, while

takes the value of 1 if the pair ij bargained in an asymmetric environment without past agreements. In regression 3, the omitted treatment is the asymmetric one without the past agreements, while

![]() takes the value of 1 if the pair ij bargained in an environment in which past agreements were provided. In regressions 2 and 3, the coefficients of interest are

takes the value of 1 if the pair ij bargained in an environment in which past agreements were provided. In regressions 2 and 3, the coefficients of interest are

![]() and

and

![]() whose sign and significance show whether the introduction of asymmetries/past agreements indeed modify gender differences with respect to the symmetric/without past agreement environments. The estimation results for these tests are shown in Tables 6 and 7.

whose sign and significance show whether the introduction of asymmetries/past agreements indeed modify gender differences with respect to the symmetric/without past agreement environments. The estimation results for these tests are shown in Tables 6 and 7.

Given our interest in understanding gender differences in the three main interdependent outcomes of probability of reaching an agreement, earnings conditional on agreement and overall earnings, the estimation is carried out by using Cragg’s two-part model (Cragg, Reference Cragg1971).Footnote 18 Cragg’s two-part model relies on the existence of a process that determines whether the outcome is positive or zero –i.e., whether the negotiation ended in agreement or not–, and on a different process that determines the participants’ share of the pie conditional on reaching an agreement.

An interesting feature of two-part models is the interpretation of their coefficients, which provides us with a more comprehensive understanding of the impact of gender on bargaining. Firstly, the model allows us to compute the unconditional semi-elasticity (

![]() ), i.e., the percentage by which the overall earnings, taking into account failed negotiations, of men differ from that of women in role

), i.e., the percentage by which the overall earnings, taking into account failed negotiations, of men differ from that of women in role

![]() . Secondly, it allow us to decompose this overall average effect of gender into two different components. On the one hand, we can isolate how the gender of the subject playing in role z impacts the probability of reaching an agreement (

. Secondly, it allow us to decompose this overall average effect of gender into two different components. On the one hand, we can isolate how the gender of the subject playing in role z impacts the probability of reaching an agreement (

![]() ). On the other hand, it allows us to examine how the gender of the person in role z impacts the earnings of the proposer and the responder, conditional on reaching an agreement (

). On the other hand, it allows us to examine how the gender of the person in role z impacts the earnings of the proposer and the responder, conditional on reaching an agreement (

![]() ).Footnote 19 See Table A3 in Online Appendix A.

).Footnote 19 See Table A3 in Online Appendix A.

This decomposition is crucial to understand gender differences in bargaining as having a significant result on overall earnings could be due to different facts: because there are gender differences on the probability of reaching a deal or because there are gender differences in earnings conditional to close a deal. Even more importantly, the absence of gender differences in overall earnings does not necessarily imply the absence of gender differences. It could be the case that one gender in a particular role makes agreement less likely but captures more of the pie when an agreement is reached (for example, because this gender negotiates more aggressively). Since these two gender differences may have opposite effects on overall earnings, it is possible to find a non significant coefficient for the overall earnings despite the existence of gender differences in both parts of the process.

A few final observations are necessary to clarify the subsequent analyses.

First, each of the regression returns 5 closely linked outcomes: probability of reaching a deal, proposer’s earnings when a deal is reached, responder’s earnings when a deal is reached, proposer’s overall earnings and responder’s overall earnings. When talking about earnings, it is necessary to differentiate between proposers’ and responders’ ones. For conditional earnings, this is the case because as we work with the semi-elasticities, the percentage change that the gender of bargainer in role z causes on proposer’s and responder’s earnings will be different when the average earnings of proposers and responders differ (which, as will be shown below, is the case in all asymmetric treatments). Notice however that, despite the magnitude being different, it will always be, by construction, of opposite sign for proposers and responders, as the situation represents a zero-sum game. That is, if one party gets more then the other must get less. For overall earnings, we need to differentiate between proposers’ and responders’ earnings due to the fact that, overall, the game is not a zero-sum game since if the bargaining fail, both parties get zero. This means that for overall earnings, observing a gender in a role affecting the proposers’ overall earnings in certain direction does not imply that it affects the responders’ ones in the opposite direction.

Second, in all specifications for bargaining outcomes, we use a two-way clustering at the subject level, that is, at the proposer and responder level simultaneously (Cameron et al., Reference Cameron, Gelbach and Miller2011; Thompson, Reference Thompson2011; Gu and Yoo, Reference Gu and Yoo2019), such that the number of clusters is the same as the number of different subjects playing the role of proposer and responder respectively.Footnote 20

Finally, given the large number of hypothesis to be tested in the experiment, we also present the p-values corrected through the Romano-Wolf multiple hypothesis correction (Romano and Wolf, Reference Romano and Wolf2005a, Reference Romano and Wolfb, Reference Romano and Wolf2016).Footnote 21 Consequently, in Sect. 4, we will only consider that a gender coefficient is significant after taking into account this correction which involves, broadly, those coefficients that are significant at least at the 5% significance level without the correction.

3.3 Assessing the experimental design

We started checking for the suitability and validity of our experimental design to test for gender differences in bargaining settings that differ in their ambiguity with regard to the existing sharing norms.

We first assessed whether the pairing protocol generated a balanced gender pairing distribution. While the pairings between subjects were done randomly, the role assigned to each party was not. Specifically, although not publicly revealed to subjects, within each pairing the party with the higher score in the real effort task was the one that was assigned the role of proposer (see footnote 9). However, given the gender neutrality of the real effort task, we would expect that all pairings should be evenly represented.

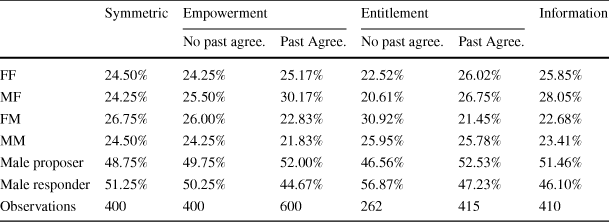

Table 1 Distribution of gender pairings across and within each treatment

|

Symmetric |

Empowerment |

Entitlement |

Information |

|||

|---|---|---|---|---|---|---|

|

No past agree. |

Past Agree. |

No past agree. |

Past Agree. |

|||

|

FF |

24.50% |

24.25% |

25.17% |

22.52% |

26.02% |

25.85% |

|

MF |

24.25% |

25.50% |

30.17% |

20.61% |

26.75% |

28.05% |

|

FM |

26.75% |

26.00% |

22.83% |

30.92% |

21.45% |

22.68% |

|

MM |

24.50% |

24.25% |

21.83% |

25.95% |

25.78% |

23.41% |

|

Male proposer |

48.75% |

49.75% |

52.00% |

46.56% |

52.53% |

51.46% |

|

Male responder |

51.25% |

50.25% |

44.67% |

56.87% |

47.23% |

46.10% |

|

Observations |

400 |

400 |

600 |

262 |

415 |

410 |

This is confirmed in Table 1, where it can be checked that, within each treatment, each different pairing accounts for close to 25%, the figure expected under full randomization. It can also be checked in Table 1 that within each treatment close to 50% of the pairings have a male proposer and 50% a male responder. In order words, men and women had ex-ante equal probabilities of being assigned the strong and weak bargaining roles. This allowed us to test for the existence of gender differences and gender interaction effects in bargaining.

Next, we checked whether the Empowerment, Entitlement, and Information treatments generated the ambiguity we aimed for, and whether the provision of past agreements in Empowerment and Entitlement reduced the ambiguity when compared to the sessions without past agreements. The distributions of responder’s share of the pie when an agreement was reached across the four different bargaining environments, showed the clearest evidence for this (Fig. A3 in Online Appendix A). Firstly, while there was a clear prevalence of the 50:50 sharing rule in the Symmetric setting, followed in 69.1% of the successful negotiations, no such rule existed in the asymmetric ones. Secondly, in the absence of a clear sharing rule, the responder’s pie shares showed much more variation in all three asymmetric bargaining settings. In a similar way, when comparing Empowerment and Entitlement with and without past agreements, we can see a reduction of the dispersion in the former environments, although this reduction is milder than the differences between the symmetric and the asymmetric bargaining environments.

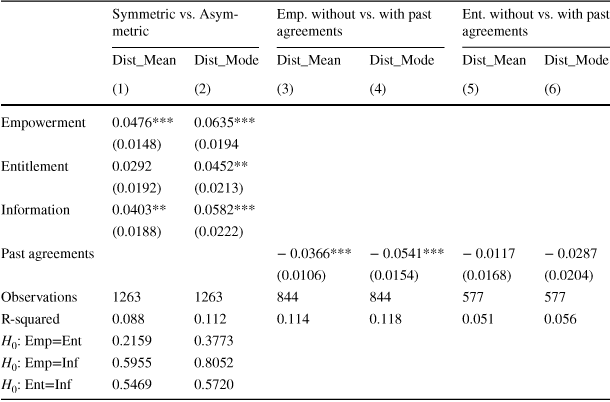

To test these impressions more formally, we used two measures of dispersion to measure the existing ambiguity: the absolute value of the difference between each responder’s share and the mean value of the responder’s share (adjusted by treatment and pie) and the absolute value of the difference between each responder’s share and the modal value of the responder’s share (adjusted by treatment and pie). Table A1 in Online Appendix A shows the mean values of these two ambiguity measures by treatment and by pie. The ordering is clear. The symmetric bargaining environment shows the lowest ambiguity values, while the empowerment and informational asymmetric bargaining environments show the highest, followed by the entitlement. The provision of past agreements shows intermediate ambiguity values, higher than the symmetric but lower than those without the provision of past agreements.

Table 2 Average treatment effect on ambiguity

|

Symmetric vs. Asymmetric |

Emp. without vs. with past agreements |

Ent. without vs. with past agreements |

||||

|---|---|---|---|---|---|---|

|

Dist_Mean |

Dist_Mode |

Dist_Mean |

Dist_Mode |

Dist_Mean |

Dist_Mode |

|

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

Empowerment |

0.0476*** |

0.0635*** |

||||

|

(0.0148) |

(0.0194 |

|||||

|

Entitlement |

0.0292 |

0.0452** |

||||

|

(0.0192) |

(0.0213) |

|||||

|

Information |

0.0403** |

0.0582*** |

||||

|

(0.0188) |

(0.0222) |

|||||

|

Past agreements |

− 0.0366*** |

− 0.0541*** |

− 0.0117 |

− 0.0287 |

||

|

(0.0106) |

(0.0154) |

(0.0168) |

(0.0204) |

|||

|

Observations |

1263 |

1263 |

844 |

844 |

577 |

577 |

|

R-squared |

0.088 |

0.112 |

0.114 |

0.118 |

0.051 |

0.056 |

|

|

0.2159 |

0.3773 |

||||

|

|

0.5955 |

0.8052 |

||||

|

|

0.5469 |

0.5720 |

||||

OLS for the mean effect of each treatment on Dist_Mean and Dist_Mode for successful agreements. Dist_Mean is the absolute difference between the responder’s share and the mean value of the responder’s share by treatment and pie. Dist_Mode is the absolute difference between the responder’s share and the mode of the responder’s share by treatment and pie. The omitted environment in columns (1) and (2) is Symmetric, while in columns (3) to (6) is the bargaining environment without past agreements. All regressions control for Pie Size, Period and Session fixed effects. Standard errors are clustered at the subject level using two-way clustering. ***p < 0.01, **p < 0.05, *p < 0.1

Table 2 shows the average treatment effect on the ambiguity in a regression analysis. As intended by the design, the results in columns (1) and (2) of Table 2 show that all three asymmetric bargaining environments increased significantly the ambiguity in implemented sharing rules, such that the dispersion is increased. The magnitude of the increase in Entitlement seems to be more moderate, but as can be seen at the bottom of the table, we cannot reject the fact that the magnitudes on the increased dispersion are comparable across the three asymmetric environments. In addition, columns (3) and (4) show that the provision of the modal amount agreed in Empowerment indeed reduces ambiguity when compared to Empowerment without past agreements. Finally, in a similar vein, columns (5) and (6) show that this reduction also occurred for Entitlement, although again this effect seems to be more moderate.

In summary, asymmetric bargaining environments led to more variation on splits of the pie, as intended. This allowed us to test whether gender is an effect modifying factor when moving from a symmetric to an asymmetric bargaining environment. In addition, the provision of past agreements in Empowerment and Entitlement did bring a reduction in ambiguity. Therefore, we would expect gender differences to be most important in the Empowerment, Entitlement and Information bargaining settings (without past agreements) compared to the symmetric environments. In addition, we would also expect that the provision of past agreements would decrease gender differences in the case of Empowerment and Entitlement. The treatment effects on ambiguity are strongest in Empowerment and most moderate in Entitlement, which will also be important when commenting on the results on gender differences.

4 Results

4.1 Estimation results 1: gender differences in bargaining

When do men and women obtain different results in alternating-offer bargaining? When does it matter whether one bargains with women or men? To find out, we started by testing for gender differences in bargaining environments that differ in ambiguity with respect to sharing norms.

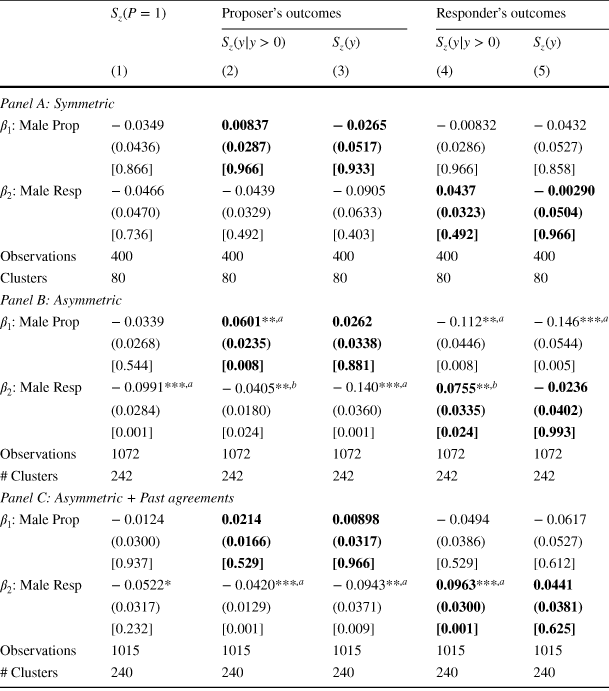

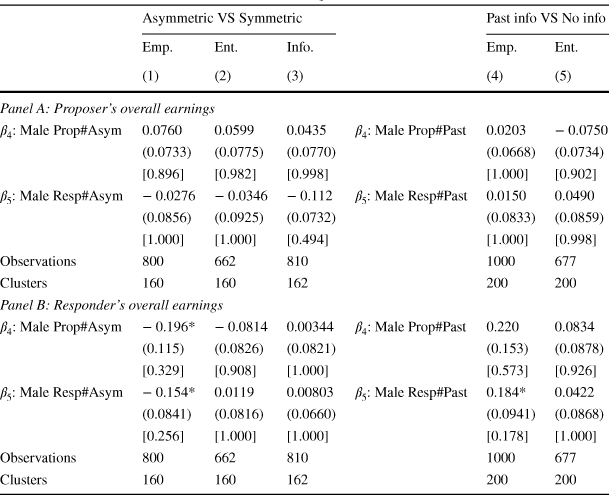

Table 3 shows the aggregate results in the symmetric environment (panel A), in asymmetric environments (panel B), and in asymmetric environments with past agreements (panel C). The first column shows of how gender in each role affects the probability of reaching a deal, an outcome that is jointly determined by both proposers and responders, and therefore common to both. It represents the cooperative part of the bargaining and, thus, measures the effect of gender on the efficiency of the bargaining process. Columns (2) and (4) show the results, for the proposer and the responder respectively, for the share of the pie conditional on reaching an agreement. Finally, columns (3) and (5) show the results for overall earnings (taking failed negotiations into account) for the proposer and the responder respectively.

Notice that the coefficients in column 3 (column 5) are, by construction, the sum of the coefficients from columns 1 and 2 (columns 1 and 4) for the proposer (responder), i.e.,

![]() . Also take into account that, as semi-elasticities are reported, coefficients should be interpreted as the percentage change in the bargaining outcome variable when there is a male proposer/responder compared to a female proposer/responder. Finally, note that two different channels can be found through which gender can affect earnings (columns 2–5). The first is direct effects, namely the impact of the gender of the bargainer on their own outcomes (i.e. the effect of being a male bargainer vs. a female bargainer). This is the case of the coefficients

. Also take into account that, as semi-elasticities are reported, coefficients should be interpreted as the percentage change in the bargaining outcome variable when there is a male proposer/responder compared to a female proposer/responder. Finally, note that two different channels can be found through which gender can affect earnings (columns 2–5). The first is direct effects, namely the impact of the gender of the bargainer on their own outcomes (i.e. the effect of being a male bargainer vs. a female bargainer). This is the case of the coefficients

![]() : Male Prop. in regard to proposer’s outcomes (columns 2 and 3) and of

: Male Prop. in regard to proposer’s outcomes (columns 2 and 3) and of

![]() : Male Resp. in regard to responder’s outcomes (columns 4 and 5). The second channel is indirect effects, namely the impact of the gender of the bargainer on the other party’s outcomes (i.e. the effect of bargaining with a male bargainer vs. a female bargainer) which corresponds to

: Male Resp. in regard to responder’s outcomes (columns 4 and 5). The second channel is indirect effects, namely the impact of the gender of the bargainer on the other party’s outcomes (i.e. the effect of bargaining with a male bargainer vs. a female bargainer) which corresponds to

![]() : Male Resp. when looking at the proposer’s outcomes (columns 2 and 3) and to

: Male Resp. when looking at the proposer’s outcomes (columns 2 and 3) and to

![]() : Male Prop. in regard to responder’s outcomes (columns 4 and 5). This distinction is important to separate the impact of gender in bargaining as it might be the case that, no evidence of gender affecting own outcomes is found but there is evidence of gender impacting other party’s outcomes (or vice versa). To stress the existence of these two different channels, Table 3 shows the direct effects in bold.

: Male Prop. in regard to responder’s outcomes (columns 4 and 5). This distinction is important to separate the impact of gender in bargaining as it might be the case that, no evidence of gender affecting own outcomes is found but there is evidence of gender impacting other party’s outcomes (or vice versa). To stress the existence of these two different channels, Table 3 shows the direct effects in bold.

Table 3 Gender differences: aggregate results

|

|

Proposer’s outcomes |

Responder’s outcomes |

|||

|---|---|---|---|---|---|

|

|

|

|

|

||

|

(1) |

(2) |

(3) |

(4) |

(5) |

|

|

Panel A: Symmetric |

|||||

|

|

− 0.0349 |

0.00837 |

− 0.0265 |

− 0.00832 |

− 0.0432 |

|

(0.0436) |

(0.0287) |

(0.0517) |

(0.0286) |

(0.0527) |

|

|

[0.866] |

[0.966] |

[0.933] |

[0.966] |

[0.858] |

|

|

|

− 0.0466 |

− 0.0439 |

− 0.0905 |

0.0437 |

− 0.00290 |

|

(0.0470) |

(0.0329) |

(0.0633) |

(0.0323) |

(0.0504) |

|

|

[0.736] |

[0.492] |

[0.403] |

[0.492] |

[0.966] |

|

|

Observations |

400 |

400 |

400 |

400 |

400 |

|

Clusters |

80 |

80 |

80 |

80 |

80 |

|

Panel B: Asymmetric |

|||||

|

|

− 0.0339 |

0.0601**

|

0.0262 |

− 0.112**

|

− 0.146***

|

|

(0.0268) |

(0.0235) |

(0.0338) |

(0.0446) |

(0.0544) |

|

|

[0.544] |

[0.008] |

[0.881] |

[0.008] |

[0.005] |

|

|

|

− 0.0991***

|

− 0.0405**

|

− 0.140***

|

0.0755**

|

− 0.0236 |

|

(0.0284) |

(0.0180) |

(0.0360) |

(0.0335) |

(0.0402) |

|

|

[0.001] |

[0.024] |

[0.001] |

[0.024] |

[0.993] |

|

|

Observations |

1072 |

1072 |

1072 |

1072 |

1072 |

|

# Clusters |

242 |

242 |

242 |

242 |

242 |

|

Panel C: Asymmetric + Past agreements |

|||||

|

|

− 0.0124 |

0.0214 |

0.00898 |

− 0.0494 |

− 0.0617 |

|

(0.0300) |

(0.0166) |

(0.0317) |

(0.0386) |

(0.0527) |

|

|

[0.937] |

[0.529] |

[0.966] |

[0.529] |

[0.612] |

|

|

|

− 0.0522* |

− 0.0420***

|

− 0.0943**

|

0.0963***

|

0.0441 |

|

(0.0317) |

(0.0129) |

(0.0371) |

(0.0300) |

(0.0381) |

|

|

[0.232] |

[0.001] |

[0.009] |

[0.001] |

[0.625] |

|

|

Observations |

1015 |

1015 |

1015 |

1015 |

1015 |

|

# Clusters |

240 |

240 |

240 |

240 |

240 |

Cragg’s hurdle model for the pie share captured by the proposer and by the responder. Semi-elasticities are reported.

![]() in column (1) refers to the effect of gender in the probability of reaching a deal.

in column (1) refers to the effect of gender in the probability of reaching a deal.

![]() in columns (2) and (4) refers, for the proposer and the responder outcomes respectively, to the effect of gender in the share captured conditional on reaching a deal.

in columns (2) and (4) refers, for the proposer and the responder outcomes respectively, to the effect of gender in the share captured conditional on reaching a deal.

![]() in columns (3) and (5) refers, for the proposer and the responder outcomes respectively, to the effect of gender in the overall share captured (including fail negotiations) such that

in columns (3) and (5) refers, for the proposer and the responder outcomes respectively, to the effect of gender in the overall share captured (including fail negotiations) such that

![]() . All regressions control for each bargaining environment, Pie Size, Period, and Session fixed effects. All fixed effects are interacted with each bargaining environment. Direct effects displayed in bold. Standard errors are clustered at subject level using two-way clustering. Romano-Wolf multiple hypothesis corrected p-values in brackets with 1000 bootstrap replication. ***p < 0.01, **p < 0.05, *p < 0.1 for standard p-values. a

p < 0.01, b

p < 0.05, c

p < 0.1 for Romano-Wolf multiple hypothesis corrected p-values

. All regressions control for each bargaining environment, Pie Size, Period, and Session fixed effects. All fixed effects are interacted with each bargaining environment. Direct effects displayed in bold. Standard errors are clustered at subject level using two-way clustering. Romano-Wolf multiple hypothesis corrected p-values in brackets with 1000 bootstrap replication. ***p < 0.01, **p < 0.05, *p < 0.1 for standard p-values. a

p < 0.01, b

p < 0.05, c

p < 0.1 for Romano-Wolf multiple hypothesis corrected p-values

Table 3 shows important patterns regarding the sign of the female coefficients. Firstly, men are found to be less likely to reach an agreement. Note that in every environment and bargaining role, the male coefficient is systematically negative for the probability of reaching an agreement (column 1), impairing both men’s overall earnings and the overall earning of those bargaining with men. This negative effect is particularly strong when men are in the weaker bargaining position in asymmetric environments (

![]() in panel B). Secondly, the male proposers’ coefficient in column (2) and male responders’ coefficient in column (4) are always positive, showing that men obtain a higher share of the pie conditional on reaching an agreement. In short, men are less likely to close a deal but aresssable to secure higher shares when reaching an agreement, thus direct effects of gender on overall earnings (

in panel B). Secondly, the male proposers’ coefficient in column (2) and male responders’ coefficient in column (4) are always positive, showing that men obtain a higher share of the pie conditional on reaching an agreement. In short, men are less likely to close a deal but aresssable to secure higher shares when reaching an agreement, thus direct effects of gender on overall earnings (

![]() in column 3 and

in column 3 and

![]() in column 5) are not statistically different from zero. However, the indirect effect on overall earnings (

in column 5) are not statistically different from zero. However, the indirect effect on overall earnings (

![]() in column 3 and

in column 3 and

![]() in column 5) is always negative, suggesting that men do not earn more overall, but bargaining with men is worse than bargaining with women.

in column 5) is always negative, suggesting that men do not earn more overall, but bargaining with men is worse than bargaining with women.

Turning the focus to when these gender differences are significant, Table 3 also shows evidence of the hypothesized effect of ambiguity on gender differences (hypotheses 1–3). In the symmetric environment (Panel A), which is the benchmark, and consistently with Hypothesis 1, we find no evidence for gender differences.

In line with Hypothesis 2, in asymmetric environments (Panel B), we find ample evidence of gender differences. Most importantly, having a male responder lowers the probability of reaching an agreement by 10%. A look at the proposer’s side shows that when men close a deal, they get 6% more than women. This translates into an indirect effect such that when responders negotiate with men they obtain 11.2% less than when they deal with women. Since the effect of a male proposer on the probability of closing a deal is negative (although not significant), the direct effect of male proposers on overall earnings is attenuated while the indirect effect is enhanced. Thus, in an asymmetric environment and in terms of overall earnings, male proposers do not obtain significantly higher profits, but negotiating with a male proposer reduces total earnings by 14.6%. We find a similar effect when we turn our attention to responders. Male responders show a direct effect of 7.5% and an indirect effect of −4% but, as they reduce the probability of reaching an agreement by 10%, the direct effect on overall earnings is not significant, while the indirect effect is negative and significant with a size of −14%. In sum, men’s negotiating strategies in asymmetric environments do not favor them on average, because although they obtain more when they are successful, they are less likely to reach deals. However, men’s more aggressive bargaining behavior results, on average, in their bargaining counterpart obtaining lower overall profits.

Finally, panel C provides evidence in favor of Hypothesis 3. It can be seen that when information about past agreements is made available to bargainers in order to reduce ambiguity, having a male responder does not significantly lower the probability of reaching an agreement. Moreover, all the effects on the proposer’s side (direct and indirect) vanish, but on the responder’s side male responders are still observed to obtain more when reaching a deal and, although their lower probability of reaching an agreement is no longer significant, this translates into lower overall earnings for proposers when bargaining with male responders.

In Table A4 in Online Appendix A, we show results complementary to those in Tables 3 but with added individual level controls (self-confidence, risk attitudes and social preferences).Footnote 22 As one would expect, the main results hold, but they become weaker in terms of both the size and significance of gender coefficients, particularly in panel B, as mediating factors such as confidence and risk aversion are now controlled for. In other words, controlling for individual characteristics, where women are found to be more risk averse and less confident in their ability to perform the task and to bargain, as shown in Table 9 in Appendix A, attenuates the estimated gender differences in bargaining. Thus, as shown in the context of gender differences in competition (Niederle et al., Reference Niederle and Vesterlund2011; Gillen et al., Reference Gillen, Snowberg and Yariv2019; Van Veldhuizen, Reference Van Veldhuizen2022), gender differences in bargaining seem to be primarily driven by other well known gender differences other than pure ability to perform in negotiations, such as risk tolerance and self-confidence. Comparing the results for Tables 3 and A4 in Online Appendix A, it is further shown that these dimensions matter more when ambiguity is greater, as it is precisely in this situation where results change more when controlling for individual level traits.

To sum up, when we find gender differences, they go in the stereotypically expected direction: men prove to be tougher bargainers, bringing a higher likelihood of failure, but they obtain better deals than women when an agreement is reached. The higher likelihood of negotiation failure is especially strong in highly asymmetric bargaining environments, making it undesirable to bargain with men. In addition, the ability to secure a higher share of the pie when an agreement is reached is canceled out in most cases by the always (significant or not) higher probability of failure, meaning that men and women end up with similar overall earnings. When the three types of bargaining environments (symmetric, the three asymmetric environments and the asymmetric environment with past agreements) are compared, we find evidence in the hypothesized direction: gender differences are strongest in asymmetric environments (hypothesis 2), followed by asymmetric environments with past agreements (hypothesis 3), and finally symmetric environments, where ambiguity is lowest (hypothesis 1).

4.2 Estimation results 2: disaggregated results

In the aggregate analysis, in Table 3, the estimated figures reflect an average gender difference across all three different asymmetric bargaining environments (in panel B) and in the two different bargaining environments with past agreements (in panel C). We now turn to the treatment-by-treatment analysis, ending with a test of whether gender is an effect modifying factor when ambiguity manipulations are compared across different environments.

Table 4 shows the gender coefficients in the probability of reaching an agreement (Panel A) and in proposer’s and responder’s earnings conditional on reaching an agreement (Panel B1 and B2, respectively) for each of the 6 bargaining environments in each column.Footnote 23

Table 4 Gender differences: disaggregated results, probability of agreement and conditional earnings

![]() and

and

![]()

|

Symm. |

Asymmetric |

Asymmetric

|

||||

|---|---|---|---|---|---|---|

|

Emp. |

Ent. |

Info. |

Emp. |

Ent. |

||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

Panel A: probability of reaching a deal (

|

||||||

|

|

− 0.0349 |

− 0.0565 |

− 0.0385 |

− 0.00847 |

0.0117 |

− 0.0511 |

|

(0.0436) |

(0.0487) |

(0.0463) |

(0.0383) |

(0.0413) |

(0.0431) |

|

|

[0.926] |

[0.805] |

[0.926] |

[0.997] |

[0.997] |

[0.805] |

|

|

|

− 0.0466 |

− 0.125**

|

− 0.0531 |

− 0.103***

|

− 0.0740 |

− 0.0166 |

|

(0.0470) |

(0.0578) |

(0.0537) |

(0.0336) |

(0.0477) |

(0.0368) |

|

|

[0.885] |

[0.090] |

[0.885] |

[0.009] |

[0.471] |

[0.995] |

|

|

Observations |

400 |

400 |

262 |

410 |

600 |

415 |

|

Clusters |

80 |

80 |

80 |

82 |

120 |

120 |

|

Panel B: conditional earnings (

|

||||||

|

Panel B1: proposer |

||||||

|

|

0.00837 |

0.0818**

|

0.0712* |

0.0235 |

0.0308 |

9.92e− 05 |

|

(0.0287) |

(0.0339) |

(0.0406) |

(0.0430) |

(0.0202) |

(0.0255) |

|

|

[0.997] |

[0.053] |

[0.299] |

[0.985] |

[0.500] |

[0.997] |

|

|

|

− 0.0439 |

0.00793 |

− 0.0606 |

− 0.0864***

|

− 0.0312** |

− 0.0590**

|

|

(0.0329) |

(0.0244) |

(0.0417) |

(0.0307) |

(0.0149) |

(0.0240) |

|

|

[0.671] |

[0.997] |

[0.562] |

[0.019] |

[0.119] |

[0.048] |

|

|

Observations |

400 |

400 |

262 |

410 |

600 |

415 |

|

Clusters |

80 |

80 |

80 |

82 |

120 |

120 |

|

Panel B2: responder |

||||||

|

|

− 0.00832 |

− 0.245**

|

− 0.0880* |

− 0.0354 |

− 0.108 |

− 0.000116 |

|

(0.0286) |

(0.104) |

(0.0503) |

(0.0642) |

(0.0720) |

(0.0298) |

|

|

[0.997] |

[0.053] |

[0.299] |

[0.985] |

[0.500] |

[0.997] |

|

|

|

0.0437 |

− 0.0234 |

0.0748 |

0.130***

|

0.108** |

0.0689**

|

|

(0.0323) |

(0.0724) |

(0.0508) |

(0.0444) |

(0.0514) |

(0.0291) |

|

|

[0.671] |

[0.997] |

[0.562] |

[0.019] |

[0.119] |

[0.048] |

|

|

Observations |

400 |

400 |

262 |

410 |

600 |

415 |

|

Clusters |

80 |

80 |

80 |

82 |

120 |

120 |

The dependent variables are: The probability of reaching a deal (

![]() , Panel A) and earnings conditional to reaching a deal (

, Panel A) and earnings conditional to reaching a deal (

![]() )) for the proposer (Panel B1) and the Responder (Panel B2). Semi-elasticities are reported such that

)) for the proposer (Panel B1) and the Responder (Panel B2). Semi-elasticities are reported such that

![]() . All regressions control for Pie Size, Period, and Session fixed effects. Standard errors clustered at subject level using two-way clustering in parentheses. Romano-Wolf multiple hypothesis corrected p-values in brackets with 1000 bootstrap replication. ***p < 0.01, **p < 0.05, *p < 0.1 for standard p-values.

. All regressions control for Pie Size, Period, and Session fixed effects. Standard errors clustered at subject level using two-way clustering in parentheses. Romano-Wolf multiple hypothesis corrected p-values in brackets with 1000 bootstrap replication. ***p < 0.01, **p < 0.05, *p < 0.1 for standard p-values.

a p < 0.01,b p < 0.05, c p < 0.1 for Romano-Wolf multiple hypothesis corrected p-values

The first point to be considered is the probability of reaching an agreement (Panel A of Table 4). The first noticeable fact is that, except for the treatment of empowerment with information on past agreements (column 5), having a male bargainer always decreases the probability of reaching a deal. However, this effect is only significant in the treatments of empowerment and information (columns 2 and 4), i.e. when ambiguity is strongest. In particular, having a male responder facing an empowered party decreases the probability of reaching a deal by 12.5%. When the proposer holds more information, the drop is 10.3% with respect to female responders. Thus, having male bargainers hurts the overall efficiency of the bargaining process, especially when men occupy weak positions in highly asymmetric bargaining environments and there are no salient sharing norms.

What happens when bargainers reach a deal? Panel B1 of Table 4 shows that, despite its coefficient being always positive, male proposers are only able to capture significantly more than female proposers –8.2 % more– when they can exploit an advantage in environments with empowerment without past agreements (column 2). This direct effect implies that, as shown in Panel B2, responders bargaining with empowered male proposers get 24.5% less than when they bargain with female proposers. However, when the asymmetry in empowerment is maintained but information about the modal agreement is provided, the effects of gender (both direct and indirect) decrease to the point where they are no longer significant (column 5).

Regarding the effects of gender in the role of responder (

![]() ’s), we find that male responders obtain a 13% greater share than their female counterparts when they bargain with a more informed proposer, as shown in Panel B2, column (4). This translates into an indirect effect in Panel B1 by which proposers obtain 8.6% less when bargaining with a male responder. Under a situation with entitlement and information about past agreements (column 6), male responders were found to be able to secure 6.8% more of the pie (Panel B2), which means that proposers obtain 5.9% less pie when bargaining with men (Panel B2).Footnote 24

’s), we find that male responders obtain a 13% greater share than their female counterparts when they bargain with a more informed proposer, as shown in Panel B2, column (4). This translates into an indirect effect in Panel B1 by which proposers obtain 8.6% less when bargaining with a male responder. Under a situation with entitlement and information about past agreements (column 6), male responders were found to be able to secure 6.8% more of the pie (Panel B2), which means that proposers obtain 5.9% less pie when bargaining with men (Panel B2).Footnote 24

Overall, Table 4 shows that when men bargain the probability of reaching a deal is decreased, especially when they are placed in the weak position at the bargaining table and when there are no clear sharing norms helping to reduce ambiguity but, at the same time, they are able to secure a greater share of the pie when they reach a deal. The next question that arises naturally is whether this strategy pays off.

Table 5 Gender differences: disaggregated results, overall earnings

![]()

|

Symm. |

Asymmetric |

Asymmetric

|

||||

|---|---|---|---|---|---|---|

|

Emp. |

Ent. |

Info. |

Emp. |

Ent. |

||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|