1. Introduction

The establishment of the Eurozone in January 1999 marked a significant step towards the European Union’s (EU’s) goal of ‘ever closer union’. Notwithstanding, the absence of sufficient fiscal and budgetary coordination has created tensions between the diverse economies of the European Monetary Union (EMU) (Baldwin and Wyplosz Reference Baldwin and Wyplosz2012; De Grawe Reference De Grawe2012; Stiglitz Reference Stiglitz2016). These issues adversely impact the EU’s key priority of creating balanced economic growth, competitiveness and productivity (Atkinson Reference Atkinson2001).

The Eurozone’s economic problems have been growing since its inception in 1999 (Arestis and Sawyer Reference Arestis and Sawyer2012; Stiglitz Reference Stiglitz2016). A failure by policymakers to address asymmetries in productivity across European economies and difficulties in converging real economic factors has led to a gradual divergence in European inflation and competitiveness across member states (Arestis and Sawyer Reference Arestis and Sawyer2012). This situation is sub-optimal.

Previous literature has examined both the European debt crisis and the degree to which the Eurozone forms an optimum currency area (OCA) (Arestis and Sawyer Reference Arestis and Sawyer2012; Baldwin and Wyplosz Reference Baldwin and Wyplosz2012; De Grawe Reference De Grawe2012). The literature is yet to examine the scale of currency distortions within the EMU and survey how these have impacted on the real economies of Eurozone members. Accordingly, this paper seeks to estimate the extent to with which real exchange rates have deviated from equilibria within constituent states and whether these distortions have had a significant effect on gross domestic product (GDP), unemployment, budget positions and current account balances for individual Eurozone members.

This article has a twofold motivation. First, the EU has spent hundreds of billions of euros on ‘cohesion policy’ which seeks to balance European competitiveness and productivity (DG Regio 2017). These efforts are likely to have been undermined by the effect that currency distortions have on an individual nation’s competitiveness. For instance, Eurozone members have experienced asymmetric inflation since the late 1990s (Sinn Reference Sinn2014; Bernanke Reference Bernanke2015). In the absence of nominal adjustments, this has had a profound effect on the real exchange rates of EMU members. Consequently, Germany’s level of competitiveness has been abnormally strong, at the expense of peripheral members. This has been reflected in Germany’s record low unemployment, strong economic growth and enormous current account surplus (Eurostat 2017; Bohme Reference Bohme2018; Sachgau and Skolimowski Reference Sachgau and Skolimowski2018).

Second, the absence of fiscal integration within the Eurozone fails to conform to OCA theory. Without a large central budget, the EU is unable to make substantial fiscal transfers between surplus and deficit nations (Arestis and Sawyer Reference Arestis and Sawyer2012). This is problematic given the reticence of individual nations to provide transfer payments and a tendency for bailout packages to be linked with austerity measures (Arestis and Sawyer Reference Arestis and Sawyer2012; Kitsantonis Reference Kitsantonis2018). These views are valid given the problems associated with ‘free rider’ members when the burden of fiscal irresponsibility is shared. For example, Germany feels it is carrying the burden of Europe, in turn making it reluctant to provide debt relief to other EMU nations (Reuters 2017). Without proper fiscal integration, peripheral economies can only adjust their competitiveness through prices and wages. This will prolong a painful period of deflation, high unemployment and low productivity for deficit members (Arestis and Sawyer Reference Arestis and Sawyer2012; Eurostat 2018). A failure to address this issue will exacerbate distortions as peripheral economies become even less competitive (Stiglitz Reference Stiglitz2016).

Given the euro’s youthfulness compared with other major currencies, such as the United States dollar, and the dynamic process of OCAs, it is to be expected that the European Monetary Union will have a successful future. Addressing the issues considered in this article will facilitate this outcome.

This article makes several contributions to the literature. First, it estimates the magnitude of currency distortions within the EMU, which suggests that a large proportion of Germany’s recent economic success may well have come at the cost of fellow Eurozone members. Germany has benefited from the euro by amassing a significant current account surplus. Second, the article demonstrates how these distortions have manifested themselves in the Eurozone’s real economy, thereby undermining the effectiveness of European cohesion policies.

These findings have significant policy implications. If Europe is to achieve its goal of balanced competitiveness and productivity, policymakers should work towards greater budgetary integration through agreed mechanisms for fiscal transfers.Footnote 1 Transfer payments from wealthy members, such as Germany, should be viewed as rebalancing payments which offset the effect of currency distortions on national competitiveness. Notwithstanding, peripheral Eurozone members should continue to make structural reforms designed to improve their competitiveness in order to reduce future reliance on fiscal transfers. Overall, this article supports the literature on OCAs by reinforcing the need for greater fiscal integration within the political union.

2. Theory Development

Europe does not completely satisfy the criteria of an OCA, particularly with respect to budgetary union. Instead, emphasis was placed on delivering inflation and interest rate convergence (Arestis and Sawyer Reference Arestis and Sawyer2012). Notwithstanding, a period of economic stability between the mid-1980s and 1992 led to the European Monetary System being hailed as ‘having achieved its goal of stabilizing exchange rates among member states of the EEC (European Economic Community), enabling them to move confidently forward to the next step of establishing a common currency’ (Neal Reference Neal2007, 102).

By the early 1990s, worrying signs were emerging as nations seeking to maintain a peg with the Deutschmark suffered as a result of Germany’s tight monetary policy stance. This forced Finland out of the Exchange Rate Mechanism (ERM), after which the Finnish Markka depreciated sharply. Similar tensions were experienced in Spain, Portugal and the UK whose currencies were either devalued or withdrawn from the ERM (Neal Reference Neal2007). Following withdrawal, the UK’s economy picked up as exports rebounded in response to a fall in the value of the pound. In contrast, France maintained the peg to the detriment of its economy, which was suffering from high unemployment and slow growth. By July 1993, France declared that the situation was untenable.

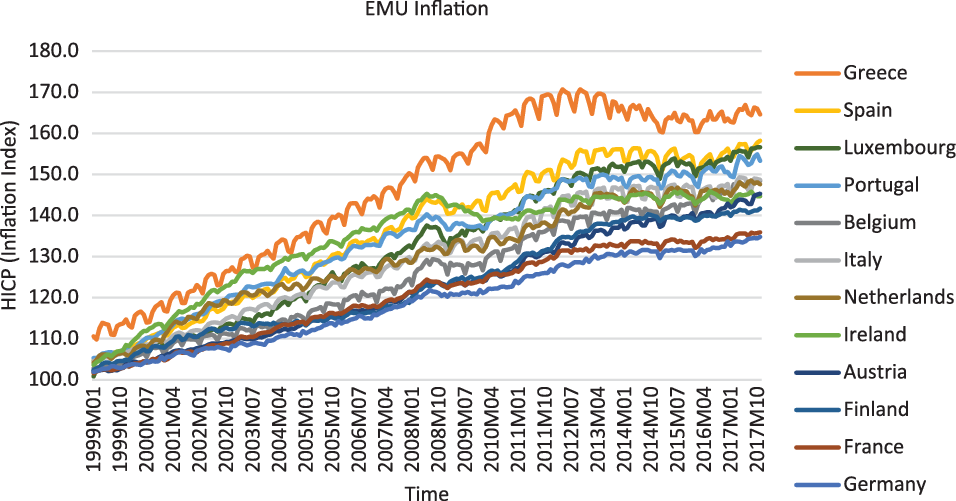

In the run up to the establishment of the EMU, interest rate spreads declined (Baldwin and Wyplosz Reference Baldwin and Wyplosz2012). This lowered borrowing costs, especially for many peripheral members, in turn stimulating investment, incomes, growth and inflation (Sinn and Koll Reference Sinn and Koll2000; ECB 2006; Sinn Reference Sinn2010; De Grawe Reference De Grawe2012). Southern European countries benefited from low borrowing costs given the introduction of a fixed exchange rate and commitment from other members to prevent their currency value from depreciating (Neal Reference Neal2007; James Reference James2012). This led to an unsustainable credit boom used to fund an increase in public sector wages and unemployment benefits rather than structural reforms to labour market rigidities (Neal Reference Neal2007). For instance, the price level in Greece increased by 67% between 1995 and 2008, 56% in Spain, 53% in Ireland and 47% in Portugal. Concurrently, Germany’s price level increased by only 9% given its tight fiscal policy stance (Sinn Reference Sinn2014; Bernanke Reference Bernanke2015). Divergence in the inflation levels of Eurozone members is illustrated in Figure 1. Sinn (Reference Sinn2014) argues that peripheral countries not only experienced high inflation, but also an appreciation in their currencies, prior to their exchange rates being irrevocably fixed to the euro.

Figure 1. Eurozone Inflation between 1999 and 2017 (to view this figure in colour please see the online version of this journal).

Following fixation to the euro, differential levels of inflation between EMU members led to diverging levels of competitiveness. According to purchasing power parity (PPP) theory, countries with low inflation, such as Germany, should experience currency appreciation (Taylor Reference Taylor2003). Likewise, nations with higher relative inflation, such as Greece and Spain, should see their currencies depreciate in value. As currencies are irrevocably fixed within the EMU, this prevents important adjustments from taking place through movements in the nominal exchange rate. Instead, adjustments must be undertaken through ‘internal devaluations’ (European Commission 2011, 21).

Whilst sound in theory, internal devaluations are likely to manifest in damaging austerity measures, a trend observable in peripheral Eurozone nations since the debt crisis (Stiglitz Reference Stiglitz2016; Kitsantonis Reference Kitsantonis2018). Furthermore, prices and wages are sticky (Mankiw Reference Mankiw2008), making adjustments through the price mechanism slow and painful (Sinn Reference Sinn2014; Bernanke Reference Bernanke2015). Goldman Sachs Economics Research (2013) outlined how relative prices in Spain, Portugal and Greece need to fall by 25–35% for these nations to achieve debt sustainability. In contrast, relative prices in Germany would need to increase by at least 15–25%. Of concern, empirical evidence suggests that prices are failing to adjust (Eurostat 2018). This will have a profound effect on real exchange rates.

The European Central Bank’s (ECB) adoption of the New Consensus Macroeconomic (NCM) framework, which emphasizes price stability through manipulation of the rate of interest, has hindered the process through which adjustments can take place through the price mechanism (Arestis Reference Arestis2007; ECB 2018a). Given the ECB’s inflation target of just under 2% (ECB 2018b), price convergence would require peripheral EMU members to have lower levels of inflation than their richer counterparts. In such a low inflation environment, adjustments of the order of 20% would take at least a decade. Given that the ECB can only target inflation for the EMU as whole, consistently achieving the required inflation differentials amongst EMU members will prove extremely problematic and require coordination of fiscal policy. Essentially, low and stable inflation, promoted by NCM, restricts the ability of the price mechanism to realign differentials and restore competitiveness to peripheral members.

Distortions to real exchange rates, within the EMU, are extremely problematic given their effect on national competitiveness. Competitiveness is defined as ‘the degree to which, under open market conditions, a country can produce goods and services that meet the test of foreign competition while simultaneously maintaining and expanding domestic real income’ (OECD 1992, 237). It is enhanced by low real exchange rates. For instance, low German inflation resulted in a depreciation of its real exchange rate. This increased the relative competitiveness of German exports to the rest of the world (Collignon and Esposito Reference Collignon and Esposito2014). In contrast, nations with high inflation, such as Greece and Spain, experienced a reduction in competitiveness. This made southern European economies vulnerable to rapid decline and recession when the debt crisis unfolded (ECB 2012).

This has led to the emergence of considerable trade imbalances. Whilst the last decade has seen increasing pressure fall on China to revalue its currency, which has been historically undervalued to promote exports, less attention has been directed towards Germany’s trade surplus which has steadily increased since 2000 (IMF 2014; Bernanke Reference Bernanke2015). Lucey (Reference Lucey2017) outlines how Germany’s trade surplus, in 2016, exceeded that of China’s with a total value of approximately €260 billion or 9% of GDP (Eurostat 2018). Furthermore, Germany’s trade surplus accounts for nearly all the Eurozone’s surplus with the rest of the world. Whilst trade surpluses are a sign of a nation’s growing competitiveness and demand for its products, it is important to ascertain the extent to which Germany’s enormous surplus has resulted from the effective devaluation of its real exchange rate caused by the euro (Bernanke Reference Bernanke2015).

In the long term, current account surpluses are contrary to the EU’s Macroeconomic Imbalance Procedure, which sets a limit on current account surpluses at 6% of GDP (Deutsche Bundesbank 2013; European Commission 2012). Despite Germany frequently exceeding this threshold since 2006, German policymakers have failed to take sufficient action to reduce the surplus through increasing expenditure on infrastructure, raising German wages and introducing reforms that encourage greater domestic investment (Bernanke Reference Bernanke2015; Nienaber Reference Nienaber2018). Reluctance to decrease the surplus is exacerbating imbalances and placing European economic stability at risk by redirecting demand away from struggling Eurozone members (Bernanke Reference Bernanke2015).Footnote 2

Based on the foregoing analysis, I hypothesize that:

H1: In the absence of nominal adjustments, real exchange rates in the EMU have deviated from equilibrium.

Given the effect of real exchange rates on national competitiveness and current account imbalances, my second hypothesis examines whether currency distortions have had a significant effect on the real economy of EMU nations:

H2: Currency distortions, in the EMU, have had a significant effect on the GDP, unemployment, balance of trade, and budget positions of Eurozone members.

3. Data

Exchange rate data for the original 12 EMU members between 1977Q3 and 2015Q4 were obtained from the Eurostat database (Eurostat 2018).Footnote 3 These data are used to forecast the hypothetical exchange rate values in the period following the establishment of the EMU. Monthly inflation data, based on the EU’s Harmonized Index of Consumer Prices (HICP), were also obtained from the Eurostat database. In addition, quarterly data for my four macroeconomic indicators: GDP, unemployment, balance of trade (current and capital account) and government debt were downloaded from Eurostat. Balance of trade data for Belgium and Greece, for the year 2007, were not available from Eurostat. Instead, these data were obtained from the OECD database and converted from United States dollars to euros using historic exchange rate data accessible through the OFX database (OECD 2018; OFX 2018). Therefore, all required data are accessible from official public databases where data quality is high and regularly monitored by European Commission authorities.

4. Research Design

4.1. Hypothesis 1

Answering Hypothesis 1 requires the generation of a set of counterfactual exchange rate values which represent the currency values of the original 12 EMU members had they not joined the currency union. Given the assumptions involved in forecasting hypothesized exchange rate values, it is acknowledged that my results are subject to limitations. To assuage such risks, several techniques are applied.

First, I utilize autoregressive time-series forecasting methods to generate hypothesized values for each of the original 12 EMU member’s currency values, against the Special Drawing Right (SDR), from 1996Q1 to 2015Q4. Whilst exchange rate data are available until January 1999 (2001 for Greece), initial examination identified that interest rates and exchange rates began to converge by the end of 1995. This followed the European Commission’s decision at the Madrid Council (European Parliament 1995), in the latter part of 1995, to form a single currency (commencing on 1 January 1999). In consequence, it is considered prudent to commence my forecasting in 1996Q1. This removes the convergence effect from my analysis, with currency values being forecast to 2015Q4.

In order to test the accuracy of each model, I reserved data for the period 1994Q1 to 1995Q4 which are compared with the values generated by the time-series model using data from 1977Q3 to 1993Q4. The results of these tests indicate that each of my models is strong with the greatest mean absolute percentage error and Theil coefficient being less than 8% and 0.04 respectively.

Despite confidence in the power of my forecasting models, time-series forecasts should not be utilized as a complete substitute for theory (Stock and Watson Reference Stock and Watson2011). Accordingly, I generated the hypothesized exchange rate values for each of the original 12 EMU members using the relationship between exchange rates and price levels or purchasing power parity (PPP).

To project the hypothesized exchange rate values using PPP, I utilized EU inflation (HICP) as the benchmark.Footnote 4 The inflation levels for each of the original 12 are then compared against the EU’s inflation using the formula:

This value is then utilized to generate hypothesized exchange rate values for each quarter between 1999Q1 and 2015Q4.

Once the exchange rate projections were made, using both the time-series and PPP approaches, I took the actual value (conversion rate to the SDR) less the projected values to create a currency distortion coefficient (forecast error). These values were then utilized to estimate the Root Mean Square Forecast Error (RMSFE) and percentage RMSFE (as a percentage of the conversion value) as a measure of currency distortion in answer to Hypothesis 1.

4.2. Hypothesis 2

In order to consider whether currency distortions generated by the EMU impacted the real economies of members, I took the forecast error developed in answering Hypothesis 1 and regressed these values on the GDP, unemployment, budget and balance of trade positions of the original 12 Eurozone members.

This is summarized in the following equation:

The analysis is conducted between the period 2007Q1 and 2015Q4 given that peripheral members originally benefited from access to cheap credit following their admission into the EMU. This is likely to have initially obscured the true impact of a common currency on national competitiveness. Furthermore, 2007 was the year of the Global Financial Crisis (GFC), which subsequently precipitated the 2010 European Debt Crisis. In the period 1999 to 2007, the EMU appeared to be a major success with member countries converging through rapid growth in peripheral members (Stiglitz Reference Stiglitz2016). However, the GFC exposed the EMU’s vulnerability to the asymmetric impact of economic shocks within a monetary union.

The test variable, currency distortion, is measured in two ways. Forecast is the conversion value less the value forecasted utilizing the time-series forecasting approach whilst PPP is the conversion value less the value projected by taking the difference between national and EU-wide inflation. In the interests of interpretation, both currency distortion coefficients are designed so that the values are positive when a currency is undervalued and negative when overvalued. These variables are obtained from my testing for hypothesis one.

The impact of the EMU on the real economies of the original 12 Eurozone members is captured through six macroeconomic measures.

-

GDP is the gross domestic product of the nation’s economy at market prices in millions of euros.

-

Unemployment measures the percentage of the active population which is not in full-time employment.

-

Y_Unemployment measures the percentage of the active population (15–24) that does not currently participate in the workforce.

-

Debt measures the government’s consolidated gross debt as a percentage of GDP.

Real exchange rates have a substantial effect on a nation’s balance of trade. In response, two balance of trade measures were employed.

-

Current_Account measures the nation’s current account in millions of euros.

-

Current_Capital measures the current plus the capital account in millions of euros.

In order to control for the impact of omitted variable bias, the first lag of the dependent variable is included in each regression. Inclusion of the first lag is important given the strong positive correlation of macroeconomic variables over time. Whilst other lags were considered, the first lag was selected across all models to provide consistency after examining the correlograms for each variable. Further, the small sample size places limitations on the number of variables that can be included in the analysis. Underlying determinants for each macroeconomic variable were not included as controls in the model for two key reasons. First, this paper is not seeking to construct a model of the factors that drive each macroeconomic variable. Second, inclusion of underlying determinants is likely to have resulted in a multicollinearity issue. My test variables, Forecast and PPP, are themselves a reflection of the drivers of a nation’s economic performance.

5. Results

5.1. Hypothesis 1

Hypothesis 1 posits that, in the absence of nominal exchange rate adjustments, real exchange rates amongst EMU members have deviated from their conversion values set on 1 January 1999.

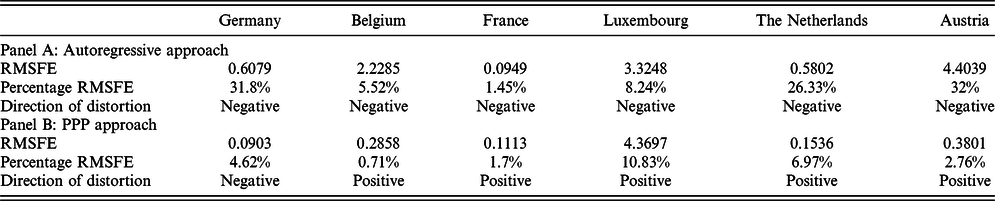

Table 1 summarizes the results for the original six core members of the EMU. This includes the RMSFE and percentage RMSFE using both the autoregressive time-series forecasting approach (Panel A) and the PPP approach (Panel B). The direction of distortion indicates whether my projections suggest that the nation’s currency has been over- or undervalued since its adoption of the euro. A negative distortion indicates that the currency is undervalued whilst a positive distortion suggests that the currency is overvalued.

Table 1. Degree of currency distortion for core EMU members.

The results in Panel A indicate that the currencies of core EMU members are undervalued by up to 30% in the extreme cases of Austria and Germany. This suggests that the economies of core members are benefiting from the EMU given the effect of a weak currency on export competitiveness. Whilst Panel A portrays a clear undervaluation of core member currencies, Panel B complicates the story. When PPP is utilized, only Germany has an undervalued currency where the magnitude of undervaluation is a modest 4.6%. The currencies of the other five core members are overvalued. This result is supported in my sensitivity test where German inflation is used as the benchmark rate of inflation. In this case, all other members, both core and peripheral, experienced higher levels of inflation than Germany in the period 1999Q1 to 2015Q4.

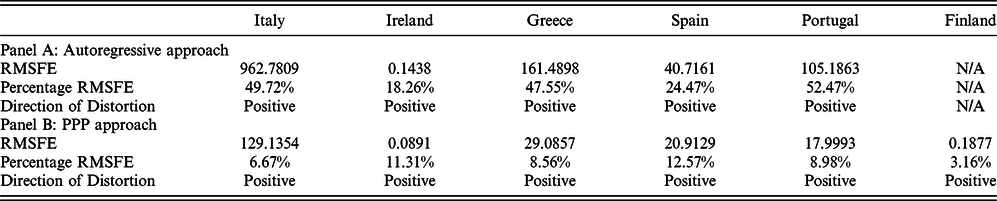

Table 2 summarizes the results for the original six peripheral Eurozone members. Panels A and B both suggest that the currencies of the original six peripheral members are overvalued with the projected values being weaker than the conversion values. Hence, the competitiveness of these nations is likely to have been adversely affected. Whilst the degree of distortion in Panel A is larger, confidence can be drawn from the qualitatively similar nature of my forecasts.

Table 2. Degree of currency distortion for peripheral EMU members.

Overall, the results suggest that Germany has benefited from its adoption of the euro given that its conversion value is weaker than projections of its value had the mark been retained. Whilst the results in Table 1 Panel A suggest that the other five core members have also profited from the euro, Table 1 Panel B suggests otherwise. The results in Panel B indicate that Germany’s low inflation and dominance within Europe may have caused an abnormal proportion of benefits to flow towards it.Footnote 5 This explanation lends support to data showing that Germany’s trade surplus accounts for most of the EMU’s trade surplus with the rest of the world. However; when interpreting these results, it is important to stress that my forecasts should be treated as effective tools for understanding the direction of real exchange rate movements but not a precise estimate of magnitude.

5.2. Hypothesis 2

The second hypothesis predicts that currency distortions, within the EMU, have had a significant impact on the real economies of member states.

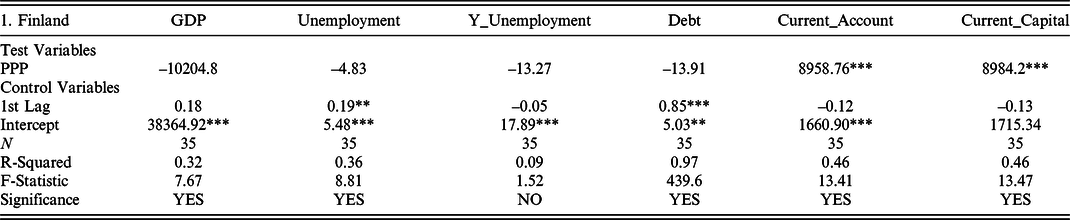

Table 3 summarizes the results for each of the EMU’s original 12 members. Given the nature of my research design, the test variables Forecast and PPP have positive values for undervalued currencies and negative ones for overvalued currencies. Therefore, I expected GDP to have a positive coefficient, unemployment variables a negative coefficient, debt a negative coefficient and balance of trade variables a positive coefficient.

Table 3. Effect of currency distortions on the real economies of EMU members.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors. Data for Capital Account in 2007 could not be obtained.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors.

* is significant at 10%. ** is significant at 5% and *** is significant at 1%. Estimated using HAC standard errors.

* is significant at 10%. ** is significant at 5% and *** is significant at 1%. Estimated using HAC standard errors.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors. Data for Capital Account in 2007 could not be obtained.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors.

* significant at 10%; ** significant at 5%; *** significant at 1%. Estimated using HAC standard errors.

Table 3 Part 10 summarizes the effect of my projected currency distortions on the German economy. In support of predictions for Hypothesis 2, Forecast has a positive coefficient, when regressed against GDP whilst both Forecast and PPP display negative and significant coefficients when regressed against Unemployment and Y_Unemployment. Reflective of expectations, Forecast has a significant negative coefficient when regressed against Debt whilst Forecast and PPP possess positive and significant coefficients when regressed against Current_Account and Current_Capital.

The results for Germany support the hypothesis that a lower currency value leads to improved GDP, lower unemployment, reduced debt and an improved trade position. However, the strength and consistency of my results weakens amongst the other five core EMU members. Whilst most results from the other five core members are consistent, albeit weaker, there are a number of anomalies. When I regress Forecast and PPP against GDP or Unemployment for Austria, Forecast has a positive and significant coefficient whilst PPP is negative and significant. Given that Forecast and PPP disagree as to whether Austria is under- or overvalued by the euro, conclusions cannot be drawn. Furthermore, Belgium, France, Luxembourg and the Netherlands each have positive and significant coefficients for Forecast when regressed against Unemployment. This suggests the counterintuitive conclusion that an undervalued currency leads to higher levels of unemployment.

A possible explanation is that Germany’s dominance pulls employment opportunities towards itself. Furthermore, the true magnitude of undervaluation for these other five core members may be large enough to positively benefit exports but insufficient to impact broader employment, especially in the context of technological advancements and migration of labour-intensive employment to Asia. Overall, results from core members, other than Germany, must be interpreted with particular caution in view of the imprecise nature of forecasting.

The results from Table 2 indicate that five of the original six peripheral members are overvalued on both measures of currency distortion. This is supported by the positive and significant coefficients on both Forecast and PPP, in Table 3, Parts 1–6, when regressed against GDP.

The exception is Ireland where Forecast has a negative and significant coefficient when regressed against GDP and a positive and significant coefficient when regressed against Unemployment. These results are counterintuitive because they suggest that a lower currency value leads to lower GDP and higher unemployment.

This effect may be due to advances in productivity, which add noise to the results. They may also relate to my time-series forecast predicting excessive depreciation of the Irish pound. In practice, Ireland benefited from high levels of foreign investment during the ‘Celtic Tiger’ period between the 1990s and 2008 (Kirby Reference Kirby2002, Reference Kirby2010). This may have moderated the extent to which the Irish pound depreciated (Eurostat 2018).

PPP supports the expected relationship between currency distortion and Ireland’s macroeconomic indicators. This result is intuitive given that the ‘Celtic Tiger’ period caused economic variables to skew from long-term trends, thereby restricting my model’s ability to accurately forecast real exchange rate deviation. In contrast to the time-series forecast, PPP is constructed from theoretical foundations that were able to capture the effect of Ireland’s economic boom. Using PPP, GDP has a positive and significant coefficient, my measures of unemployment have negative and significant coefficients and balance of trade measures have positive and significant coefficients. The positive coefficient for Debt is likely to reflect rapid growth in the Irish Economy, which caused debt, as a proportion of GDP, to fall despite appreciation in Ireland’s real exchange rate (Trading Economics 2020).

In the case of Spain, Forecast also has a positive and significant coefficient when regressed against Unemployment and Y_Unemployment. This may be due to foreign capital inflows creating employment opportunities.

With the exception of Ireland and Spain, results for unemployment concur with expectations. PPP has a negative and significant coefficient when regressed against Unemployment and Y_Unemployment, suggesting that undervaluation leads to lower levels of unemployment. Hence, overvaluation amongst the peripheral members is reflected through higher levels of unemployment in their respective economies.

Results for Debt comply with expectations where significant coefficients for both Forecast and PPP possess negative values. This indicates that nations with overvalued currencies experience greater levels of indebtedness.

The impact of my projected currency distortions on the trade positions of peripheral nations is contrary to hypothesized expectations in four of the six countries.Footnote 6 Across Greece, Italy, Portugal and Spain, the coefficients of both Forecast and PPP take on negative and significant values when regressed against Current_Account and Current_Capital. This suggests that nations with overvalued currencies experience more favourable trade positions. In theory, nations with an overvalued currency have an incentive to import greater quantities of goods and services. Notwithstanding, the negative and prolonged impact of currency distortions on peripheral members of the EMU may have diminished their ability to fund imports.Footnote 7 When coupled with the austerity measures enforced on many peripheral economies, it is likely that peripheral members with overvalued currencies, weak economies and high levels of austerity would have significantly diminished import capacity. In turn, this creates a situation where Germany funds its export driven model through loans to peripheral members.

6. Conclusion

Overall, this paper provides valuable insights into the effect of currency distortions, generated by the EMU, on the competitiveness and real economies of Eurozone members. Whilst Germany has clearly benefited from its adoption of the euro, the magnitude of benefits that have flowed towards the other five original core EMU members is less pronounced. Furthermore, my results support the argument that peripheral members may have suffered from their adoption of the euro. This is reflected through lower GDP and generally higher levels of unemployment and debt. The results suggest that peripheral members have been unable to afford large current account deficits. This leads to the situation where Germany largely funds its own exports through the provision of credit to peripheral governments. This parallels the relationship China has with major trading partners such as the United States.

7. Policy Implications

Formation of the EMU caused real exchange rates to deviate from their conversion values, subsequently impacting the competitiveness of its members. Core members, notably Germany, benefited at the expense of peripheral members such as Greece, Spain, Portugal and Italy. Johnson (Reference Johnson1969) outlines how a common currency can disadvantage certain regions by opening them up to sudden competition in product and factor markets. Whilst this situation is usually alleviated on a national scale through fiscal transfers, the degree to which this can take place in Europe is hindered by current fiscal arrangements within the EMU (De Grawe Reference De Grawe2012). Austerity measures have stalled economic recovery by decreasing rather than promoting competitiveness within struggling members (Stiglitz Reference Stiglitz2016). Proponents of austerity argue that, in order to maintain stability and minimize cross-subsidy, protections on borrowing and fiscal discipline are required within a common currency bloc. Nevertheless, the use of austerity must be applied carefully to ensure that weaker regions avoid a dangerous contractionary cycle, which will undermine cohesion efforts and the EU’s objective of ‘ever closer union’ (Lapavitsas et al. Reference Lapavitsas, Kaltenbrunner, Lindo, Michell, Painceira, Pires, Powell, Stenfors and Teles2010). To maintain prosperity and competitiveness within the global economy, Europe should consider mechanisms that would expand its capacity to make timely fiscal transfers between members within existing frameworks.

The International Monetary Fund and European Commission have been particularly critical of Germany’s tight fiscal stance, which is contributing to not just European but global economic imbalances (Nienaber Reference Nienaber2018). Accordingly, policymakers need to consider substantial changes to the manner in which the Eurozone is administered to ensure the long-term economic and political unity of Europe.

Bernanke (Reference Bernanke2015) outlines how Germany can help ease current account imbalances by increasing investment in domestic infrastructure. This would have a dual effect. First it would increase the quality of German infrastructure and put Germany on a trajectory of improved growth (Connolly, Reference Connolly2018). Second, it would increase German wages and inflation, which would in turn increase German income and consumption. An increase in German inflation will soften the adjustment process necessary to rebalance European competitiveness whilst increasing economic activity within the entire Eurozone (Bernanke Reference Bernanke2015).

Foremost, in accordance with OCA theory, the EMU ought to move towards increased fiscal, budgetary and banking integration capable of reconciling differences generated by the asymmetric productivity of members (Arestis et al., Reference Arestis, Ferrari, Fernando de Paula, Sawyer, Arestis and Fernando de Paula2003; Arestis and Sawyer Reference Arestis, Sawyer, In Mitchell, Muysken and Veen2006a, Reference Arestis, Sawyer and In Vernengo2006b, Reference Arestis, Sawyer, Arestis and Sawyer2006c). Without a system of substantial fiscal transfers, the EMU creates tensions that undermine the EU’s efforts to create an economically and politically balanced region (Collignon and Esposito Reference Collignon and Esposito2014).

It is critical that fiscal transfers are carefully directed towards initiatives that increase productivity and lower unemployment within peripheral members. Sinn (Reference Sinn2014) argues that current account and spatial imbalances can only be overcome through fundamental improvements in the productivity and competitiveness of peripheral members. This will reduce the requirement for long-term fiscal transfers.

Whilst greater fiscal federalism offers a way forward, the absence of cultural homogeneity makes enhanced economic union problematic, with Germany and other northern members remaining cautious of a common budget (Deutsche Bundesbank 2013; Rankin Reference Rankin2018). Furthermore, regional differences in unemployment and incomes, within EMU member countries, diminishes the appetite for cross-border fiscal transfers. For instance, a study by the German Economic Institute found that Germany had the greatest wealth inequality in the EMU (Oltermann Reference Oltermann2014; DIW Berlin 2014). This has created resistance towards calls for a European finance minister and central budget (Pinnington Reference Pinnington2018; Rankin Reference Rankin2018). Critics of a central budget argue that the allocation of resources by unelected bureaucrats in Brussels undermines the fundamental democratic principle of ‘no taxation without representation’ (Baldwin and Wyplosz Reference Baldwin and Wyplosz2012; Rankin Reference Rankin2018). A first step towards overcoming resistance to fiscal integration is to address inequalities within EMU members.

As the European Monetary Union and European Union are relatively young institutions, time will be required for more robust political and economic systems to be developed. Fiscal integration is a complex process which reduces the autonomy of nation states and risks decision-making being made at high levels that are detached from the requirements of individual regions within EMU members. While I argue that fiscal integration would alleviate some of the economic challenges currently faced by the Eurozone, such assimilation requires careful management and protections to ensure that capital is appropriately directed.

Acknowledgements

I thank my late supervisor Dr Alex Morris whose kindness and passion for the use of economics to enact positive change are a continual inspiration.

Conflict of Interest

The author declares he has no conflict of interest.

About the Author

Christopher Day is a PhD student at the University of Sydney Business School. Formerly, Christopher was a researcher for the Department of Industry, Innovation and Science at the Australian Embassy in Washington, DC, where he undertook research in the areas of spatial economics and innovation policy. Prior to this, Christopher worked as a consultant for an economics and public affairs consultancy in London where he focused on industrial policy and productivity. Before moving into industry, Christopher was an academic in Sydney, where he taught in the areas of quantitative business analysis, corporate evaluation and international financial management and conducted research in the fields of corporate finance and accounting. Christopher holds a Master of Philosophy from the University of Cambridge and graduated with First Class Honours and the University Medal from the University of Technology Sydney.