Introduction

In the history of capitalism, durable goods and the durabilization of ever more commodities have played a pivotal role, in both consumption and production. Durables, that is, goods not confined to one-time use, can be associated with the general rise in industrial capitalism through the consumer-durable and equipment revolution in the structure of tangible wealth: “Equipment has increased relative to structures in both the business and the household sphere” [Vatter Reference Vatter1967, 13]. Durables became a more important item in household consumption, and the capitalist enterprise was built around the capital intensity of machinery. As Braudel observed, “the industrial revolution was above all a transformation of fixed capital: from now on, it would be more costly but more durable: its quality would be improved and it would radically alter rates of productivity” [Braudel Reference Braudel1982, 247]. In macroeconomic terms, durable goods became an important ingredient of overall business cycle movements and a major component of internationally traded goods.

But as important as the rise of durables may have been in the older, industrial capitalism, one could argue that several contemporary trends have decreased the share of durable goods in national accounts. One might mention here the rise of intangible assets [Goldsmith Reference Goldsmith1985], services and, more recently, intangibles, such as software, brands, and R&D––what has come to be known as “capitalism without capital” [Haskel and Westlake Reference Haskel and Westlake2017]. Not surprisingly, market sociology has shifted its attention to issues of “financialization” [Van der Zwan Reference Van der Zwan2014], “assetization” [Birch Reference Birch2017], and “intangibilization” [Haskel and Westlake Reference Haskel and Westlake2017].

Regardless of this current shift in the world economy, however, this article argues that a closer look at the relative durability of tangible goods can illuminate the organizational infrastructures of even the most detached, intangible financialized service economy, of which they remain an important physical anchor point. For instance, residential property remains the single most important collateral for backing financial products and housing, and tangible assets such as housing wealth have become ever more important as a share of household and national assets. Surprisingly, the tangible good of housing has had one of the highest rates of return, in the long run, higher than most financial assets [Jordà et al. 2019]. What is more, services and intangibles themselves still require the material infrastructure of durables—shops, equipment, server spaces, and many other things—such that even further increases in the prominence of intangibles will not change the omnipresence of material commodities, in relatively durable and nondurable forms, in everyday life. But what can a good’s relative durability tell us about its market organization?

In order to mobilize the explanatory power of this fundamental aspect of economic life, this paper revives the distinction between durable and nondurable goods—originally, a distinction made by neoclassical economics—which coincides with the most basic, often local, everyday economic sphere of the household [Braudel Reference Braudel1982]. It is this very concrete world of goods that a “financialized” sociology of markets has rather forgotten of late. But while economists have problematized goods’ durability with regard to firms’ market positioning [Coase Reference Coase1972] and rational decision-making [Bulow Reference Bulow1986], little is known about the relationship of durability to different types of market and their respective organization. However, this shortcoming not only affects mainstream economics; it is also a limitation in contemporary economic sociology and its study of market organization and fashioning [Ahrne, Aspers, and Brunsson Reference Ahrne, Aspers and Brunsson2015; Aspers, Bengtsson and Dobeson Reference Aspers, Bengtsson and Dobeson2020]. Thus, most overviews of economic sociology [e.g. Aspers and Beckert Reference Aspers, Beckert and Maurer2008; François Reference François2008] note that, while much research has been carried out on many individual empirical markets, this has led to few generalizations across markets that offer similar goods.

To remedy this unsatisfactory state of affairs, we argue that the ideal-typical distinction between durable and nondurable goods provides a useful analytical tool that may facilitate our understanding of how different markets are organized with regard to the socially expected durability of what is being traded. As the reference to social expectations indicates, however, a good’s durability is not set in stone. In contrast to neoclassical accounts that take the distinction between durable and nondurable goods for granted, we offer a dynamic sociological account that bases durability on both the physical and the social construction of goods, as much as on our expectations about them. Thus, how long a good is expected to persist through time is not simply a question of its physical features, but also of how we manipulate it socio-technically and what cultures and norms of use exist at a given point in time.

In order to illustrate our argument, an extreme-case comparison of housing and fish markets will allow us to flesh out the defining features in terms of which we can distinguish and generalize some organizational features that most markets for nondurables and durables share. Housing and fish, by their physical nature, allow us to introduce the static distinction most easily, but also lend themselves to describing how social construction can durabilize or dedurabilize them in a dynamic view.

We proceed as follows. First, we provide a brief overview of the way in which the relationship between markets and goods has been conceptualized in the sociological and economic literature. The fact that goods are not equal is nothing new to economic sociology, and different accounts have been proposed of how they are not equal. We aim to contribute to the sociology of markets by highlighting how material, as well as socially constructed durability, make a difference to market organization. We then begin our static analysis of durable and nondurable markets by shedding light on the different features of their market organization, using solid housing and fresh fish as illustrative case studies. We find that, when contrasted with their nondurable likes, the supply of durables is divided into a primary market and an aftermarket, which allows for multiple users of one good and multiple forms of tenure. A multitude of market intermediaries and a maintenance sector accompany a durable’s life. The more durable a good, the smaller the share of its new production, the tighter the link to credit and insurance markets, and the more volatile in the short-term but inert in the long-term the market will be. The age of durable products often correlates negatively with their holders’ social status, and the market price and the historical nature of the supply make quality assessments more difficult. Not all durable goods share all of these features to the same extent, of course, but there is a certain level of continuity and family resemblance. In turn, the less durable a good, the more likely it is to be traded downstream in a supply chain characterized by primary markets only. Nondurables are usually evaluated and traded “on the spot,” based on standardized quality indicators, between multiple buyers and sellers, but settle in fixed-role structures between sellers and final consumers at the end of the value chain. Prices are found through quality conventions. Ownership of nondurables is usually direct and passed on through auctions, and producer and final consumer markets. Finally, the economic value of nondurables depreciates fairly rapidly, or vanishes instantaneously with the act of consumption, implying a lack of aftermarkets.

The durability of even housing and fish is historically contingent and subject to technological and societal change. Hence, our dynamic analysis reveals how mechanisms of durabilization and de-durabilization can bring about changes in the market structure of housing and fish market segments: freezing and the fresh-fish movement altered the durability of fish and thus changed its accompanying market structure, whereas, as we argue below, the introduction of mobile homes altered the life-expectancy of housing and its market form. We propose some generalizations of the distinction to a broader range of goods and discuss the historically contingent socio-technical factors that determine different degrees of durability, even within markets. Our conclusion highlights the importance of the state, but also of business interests in determining goods’ durability.

Different worlds of goods and markets

The idea that not all goods are equal can be traced back to the dawn of modern economics. Since then different comparative distinctions have been established, a limited number of which we will refer to. Already Thorstein Veblen [1899/1931] identified luxury goods for “conspicuous consumption” as a specific subgroup of what later came to be known as “positional goods” [Hirsch Reference Hirsch1977]. By contrast, nonpositional goods—such as savings, pension funds, and insurance—are “unobservable” and thus do not gain their value in relation to other consumers’ choices [Frank Reference Frank1985]. Observable characteristics also play a role in experiential goods that, unlike credence goods, are less likely to create information problems in markets.

Within the field of New Economic Sociology, Karpik [Reference Karpik2010] has further distinguished non-singular from singular goods to underscore the specific nature of uncertainty for goods such as art or antiques in which actors rely on so-called “judgement devices,” such as guides, awards, and classification schemes, as a basis for economic decision-making. In a similar vein, Aspers [Reference Aspers2009] has distinguished between markets depending on whether a good’s value results from standard (benchmarking) or status rankings (social position of producers). These accounts share the view that valuation in markets is not simply a function of supply and demand, but contingent on a good’s social organization of valuation and exchange [Ahrne, Aspers, and Brunsson Reference Ahrne, Aspers and Brunsson2015].

Although economic sociological approaches underscore how social structures shape the valuation and exchange of goods under conditions of uncertainty, little has been said about the relations between a given market structure and the social life of its goods over time. In order to shed light on this question, we argue that a dynamic sociological reading of the original neoclassical distinction between durable and nondurable goods serves as a suitable starting point for our comparative analysis of market organization.

The distinction between durables and nondurables can be traced back to Alfred Marshall, who wrote that “a durable good, such as a piano, is the probable source of many pleasures, more or less remote; and its value to a purchaser is the aggregate of the usance, or worth to him of all these pleasures, allowance being made for their uncertainty and for their distance” [Marshall Reference Marshall1916, 123]. Standing in the tradition of Marshall’s early analysis, microeconomists have contributed a considerable amount of research on the parameter of durability [Waldman Reference Waldman2003]. Most economic research on the durability of goods, however, has been concerned mainly with questions of monopoly and profit-maximization problems [Bulow Reference Bulow1986; Coase Reference Coase1972], while their sociological potential for the study of markets and their social organization has been neglected.

Studying the social life of goods is particularly interesting for cases in which goods persist through time and travel across many contexts [Appadurai Reference Appadurai1986]. Studies of trash or rubbish are often a reflection of former durable-goods markets [Strasser Reference Strasser1999; Thompson Reference Thompson1979]. The same can be said of nondurable goods, such as fresh fruit and other perishables traveling long distances from production to consumption in global export markets [Cook Reference Cook2014; Fischer and Bensen Reference Fischer and Bensen2006]. In this light, we argue that the distinction between durable and nondurable goods helps us to understand the social organization that shapes different markets, from production to consumption. At the same time, our approach opens up space for comparisons across different markets by illuminating how social expectations about a good’s life expectancy shape decision-making under conditions of economic uncertainty [Beckert Reference Beckert1996].

In the following section, our static analysis will provide an analytical framework that highlights some general definitions and features of market organization for durable and nondurable goods, illustrated by our extreme-case comparison of durable housing and fresh fish. Then, our dynamic analysis shows how the distinction between durables and nondurables is nonetheless shaped by the socio-technical contexts of production and consumption, which may alter their socially expected durability and respective market organization. Hence, the comparison between fresh fish and durable housing will allow us to underscore the socio-technical shaping of durability by pointing at two, at first glance paradoxical, trends in both markets, namely durabilization and de-durabilization, which are driven by socio-technical changes, including innovations in production, transport, fashions, and changing lifestyles.

Durability and market organization

A durable good is storable and survives a single act of use in consumption or production. It thus has a shelf life or service years that depend crucially on three defining components: the brute nature of the material, the social construction of the artefact, and our social expectations about it. First, there is no denying that, despite technological advances, the physical depreciation rate is still important in understanding durability. Under given conditions of production and consumption, houses made from clay are more vulnerable to physical decay than houses made from stone. But second, and sociologically much more important, a large part of industrialization’s technical advances have dissolved this simple physical determinism by manipulating the storage and service life of goods. New technologies, particularly freezing for food, but also new or enhanced materials have been key in increasing service years. However, as the case of plastic materials reveals, for instance, the artificial lengthening of a good’s lifetime capacity does not necessarily increase its service years. This is due to the third component, the social construction of goods’ durability through social expectations. Numerous social norms govern our imagination as to what the expected lifespan of a product should be; only incidentally do they coincide with the materially programmed lifespan. On the production side, the optimal lifespan can be tied to profit considerations, whereas on the consumption side, considerations of social status or fashion trends can shorten the physically programmed lifespan as much as a repair culture or norms of frugality can lengthen it. Hence, the socially expected durability of goods is a central coping device for decision-making under conditions of uncertainty in markets [Beckert Reference Beckert1996], feeding back to objectively measurable life cycles of goods and specific market forms and conventions of durability in the economy.

The social nature of a good’s expected durability also helps us to understand that durability is not equivalent to consumption time [Warde Reference Warde2017, 66-77]. The time taken for consumption of a given good can, of course, vary according to customs of consumption [Warde et al. Reference Warde, Cheng, Olsen and Southerton2007]. More importantly, the intensity of prolonged consumption can feed back into the material component of a good’s durability: if I neglect to maintain my house, it may fall apart. The two dimensions of durability and consumption time often correlate—for services, even perfectly—because using something over a prolonged period presupposes that it persists in time. Their distinction, however, is necessary to refer to cases such as old wine or coal, highly durable goods that are nonetheless used up instantaneously in consumption or production.

The social nature of durability is further evidenced by the fact that durables are particularly suited to becoming objects of value [Boltanski and Esquerre Reference Boltanski and Esquerre2016]. The nature of durables with dominant use value is to decrease or depreciate in value over time, but this cost-side perspective can be overthrown by the demand side, as durable goods can serve as containers for the preservation of exchange value over time. Durables are goods subject to potential speculation; their supply can be stored and hoarded, and their being in time allows for speculation on future use and exchange value. This value dimension ranges from consumption goods that cannot even be resold for lack of value after the first purchase to investment goods bought for their potential high future resale prices. In between, there are consumption goods that have a simultaneous investment value, such as housing units in good neighborhoods. In these cases, the value stored can be both the use value of future consumption and the exchange value of a future resale.

The distinction between durable and nondurable goods is not categorical, but gradual. The more durable a good, the more it tends to display and realize the qualities we find below. Typical examples of more durable goods on the consumption side include land, housing, cars, or refrigerators. But even though this paper focuses mainly on consumer markets, production processes also can make use of durable, so-called capital goods—such as machinery or plant buildings—which survive single use in production. Typical nondurable goods, in turn, include most food and drink items, the typical supplies of local markets, but equally many perishable raw materials that have to be used up quickly in production processes.

As all goods share the property of persisting in time, in some way, we select two extreme cases—housing and fresh fish—for comparative illustration of the meaning and benefits of our static distinction, and suggest generalizations thereafter. As a prime example of a durable consumer good, solid housing can be consumed over a prolonged period and is even prone to becoming an investment good due to its relatively stable or even increasing value over time. Conversely, fresh fish builds an extreme case for illustrating the general tendencies of markets dealing with nondurable and naturally highly perishable goods. In contrast to other consumer goods, such as cheese, cigarettes, or wine, which can be stored and consumed over a relatively long period, the quality of highly sensitive raw materials, such as fresh fish, is intimately tied to its natural physical qualities, handling and processing, respectively.

Nondurable and durable goods—a comparison

How a good’s socially expected durability matters for how its market is organized can best be illustrated by comparing such different goods as solid housing and fresh fish. The “natural” durability of these goods already differs strongly but, as we will demonstrate, handling and technology are crucial factors that co-constitute their socially expected durability and market organization. Moreover, within both markets there are vast differences that allow for further contrasts, such as between mobile homes and villas or between fresh luxury fish and canned anchovies, as the following will show.

Housing

The first striking social implication of housing’s durability is that houses tend to survive their builders or first-time buyers and can re-enter market supply. These second-hand or aftermarkets, indeed, make up the bulk of the housing supply that is annually put on the market and they are segmented into different vintages. In European countries, houses are said to last up to 100 years and new construction, at the replacement rate, represents only 1% of the entire housing stock. Preservation of historic buildings may also play an important role in a house's life expectancy. In urban housing markets, in turn, usually more than 10% of housing units are affected by households moving [Bonneval Reference Bonneval2016], which considerably exceeds the supply from new production. The size of this aftermarket obviously depends on the social durability of the good, all other things such as the frequency of moving being equal: the more durable a house a builder decides to construct, the longer the house will compete with new construction in the future. In addition, many more market features result from the simple division of supply into primary markets and aftermarkets.

A second implication is that the same house can have multiple uses and users through time: at the time of its destruction or redevelopment, we can look back on a sequence of many users. Such commodity biographies have indeed been written, for instance with respect to a Berlin housing block over a 300-year span [Geist and Kürvers Reference Geist and Kürvers1984]. But a biography can also be written from the user’s perspective: during the lifetimes, the average American will have moved 11 times, creating a sequence of housing statuses (US Census). This implies that durables allow much more for emotional ties to develop over time between the user and the same consumption object, even though individuals usually occupy several houses over their life course. The “housing ladder” refers to houses and prices increasing over a person’s life cycle and the age structure of the housing stock often structures the stratification of owners and tenants through price differentiation. Through these ladders, new housing units trigger vacancy chains and a market-liberal hope is that eventually new and better units will “filter down” even to those who initially cannot afford them [White Reference White1971]. Not accidentally, sequence analysis has been used to study housing careers, and one important status defined in these sequences is the ownership status of users. In housing markets, ownership—in direct or cooperative form—and renting (in private or social rentals) are, for instance, the most dominant forms of tenure [Wind and Hedman Reference Wind and Hedman2017]. While historically, in the 19th century, most societies were tenant societies—around 1900 up to 97% of Berlin’s market comprised rentals—homeowners prevail in most housing markets today [Kohl Reference Kohl2017]. Renting became an alternative to outright ownership in housing because it is less capital-intensive and allows for more flexibility, while owning and not using is an alternative for landlords to make money or, as in the “sharing economy,” provide capacity they do not need all the time.

A third implication concerns the organization of the housing aftermarket, which already at the local level can encompass special marketplaces such as auctions in real estate agencies, person-to-person websites, or social networks. These aftermarkets are switch-role markets [Aspers Reference Aspers2007] because most people can act and have acted as both buyers and sellers. Though they could enter into direct exchange, property acquisition is often accompanied by special intermediaries, such as real estate agents, property assessors, and notaries [Bourdieu and Christin Reference Bourdieu and Christin1990]. These intermediaries become necessary because households face the problem of evaluating the quality of existing houses: they have little experience due to the low frequency of purchases, they often cannot assess the historical nature of the product, they have moreover difficulties in discounting all future utility they expect to draw over the durable’s lifespan (how long will it last and serve the buyer’s purposes?), and they have to compare prices with a housing supply that is mostly latent. Besides these transaction intermediaries, and as housing is usually the most valuable household good, the financial sector is also involved in terms of mortgage-lending banks and property, and possibly other insurance. The lifetime of a house is moreover accompanied by all kinds of market actors concerned with its maintenance. The maintenance sector, consisting of both complementary products for the aging stock and repair work, can easily outweigh the primary market in business volume and did so when most countries reached the end of the post-war construction cycle. But other interest groups also form around the existing stock, such as tenant and landlord associations, for city or private/public rental stock, homeowner or cooperative associations, realtors or mortgage-bank associations.

Housing markets are characterized, fourthly, by lagged production cycles, already noted by Schumpeter’s study of general business cycles [Schumpeter Reference Schumpeter1939]: in the short-term, new production is prone to high levels of volatility, while in the long run the housing stock is subject to very incremental types of change. The volatility comes from two sources: first, as most offers for sale come from the existing stock, even small demand or supply shocks fall back on new production, which is relatively small in relation to the entire market, so that a doubling of production is not rare. These initial shocks—urbanization shocks, the pent-up post-war demand, baby- or divorce-booms or periodic government interventions—generate a bias in the age-structure of the future stock, translating into repeated supply shocks in replacement cycles. The second reason for higher production volatility lies in the time-lag that exists between the start of production and the initial offer. Housing has an inelastic supply, while income elasticity is relatively high [Glaeser, Gyourko, and Saiz Reference Glaeser, Gyourko and Saiz2008]. At the beginning of a cycle, for instance after income increases, households’ additional demand is not easily met and drives up prices. The lure of these higher prices thus leads to an oversupply and subsequent cyclical behavior of new production. This result is even more probable as the higher capital-intensiveness in the production of durables might lead to a more fragmented and therefore uncoordinated offer. Thus, distant historical events can stratify the cohorts in the existing stock into different layers and have regular repercussions on new demand.

Finally, while market volatility is more relevant to the short-term, long-term housing development is often characterized by inertia and path dependency. Historical homeowner regions or historical single-family-house cities tend to keep their place in interregional rankings, often for centuries [Kohl Reference Kohl2015]. One reason is that each new production needs to compete with the housing stock of all previous decades, which exerts a conservative influence on new building forms, designs, and equipment. Moreover, there are legal prescriptions concerning specific properties that new supply has to comply with, interest groups in control of the old supply alert to dangerous new competition, and cultural expectations growing around the old supply. Changes are most likely to occur incrementally, through the layering of new stock around the old or through the conversion of the existing use to a new one [Streeck and Thelen Reference Streeck, Thelen, Streeck and Thelen2005], for example, when social rentals are bought by sitting tenants.

Fresh fish

By contrast to housing, the lifespan of fresh fish is obviously very limited after its purchase, as it perishes rapidly and vanishes with the act of consumption. These physical features impact on the overall market structure, which is characterized by primary markets only. Hence, there is no second-hand market for fresh fish and the overall market structure typically consists of a production network in which raw materials swiftly move downstream from the catch through processing to retailers and final consumer markets. Hence, after the fish is landed, it is either sold directly to processors based on fixed-price contracts or offered on auction markets that build interfaces between fisheries and the processing sector [Acheson Reference Acheson1988: 115-132; Bestor Reference Bestor2004]. Further down in the production network, one can find competing end markets with different market niches and wholesalers, retailers, and restaurants, in which rival products compete for final consumers.

A second defining feature of fresh fish markets is that ownership is direct and ends with the final act of consumption, without the existence of multiple users or uses. Throughout the value chain, however, the ownership of raw materials typically changes multiple times. After processing, the fish is sold through brokers or direct contracts to retailers or large national wholesale markets in which fishmongers, restaurant owners, and other smaller to medium sized customers buy their share [Bestor Reference Bestor2004; Bird Reference Bird1958; Graddy 2006]. In contrast to housing, however, ownership of fresh fish is unlikely to develop emotional attachments over time, even though a certain brand of fish could serve as a more stable replacement. Thus, while the value and identity of nondurables typically changes multiple times throughout the value-chain, they are simply replaced by new goods after being sold on or consumed, enabling fairly swift adaptation of market behavior with regard to supply and demand and radical institutional change instead of incremental change, as in markets for durables, respectively.

Thirdly, the organization of fresh fish markets differs significantly from housing markets. After the catch is landed, exchange of fresh fish takes place in switch-role markets [Aspers Reference Aspers2007], with processors and sales agents acting both as buyers and sellers of raw materials. The closer the raw material comes to the end of the value chain, however, exchange is limited to fixed-role structures between sellers and final consumers as the social life of fresh fish enters its last phase before it vanishes with the final act of consumption. Furthermore, competition between producers can be fierce and fueled by price competition, triggering differentiation of goods such as “farmed salmon” as a direct competitor to its “wild” counterpart [Hébert Reference Hébert2010] or “line caught fish” in distinction to conventional industrial capture techniques [Grundvåg, Larsen, and Young Reference Grundvåg, Larsen and Young2013]. While transactions in final consumer markets are direct and based on the buyer’s liquidity, market intermediaries can be important in production networks, in which the supply of raw materials is based either on direct contracts between fishers and processors or auction markets. In these markets, processors have to engage in competitive bidding to ensure a steady input of raw materials, which can fluctuate tremendously due to changing political regulations or weather conditions. Despite their volatility in supply, however, fresh fish markets are relatively low risk. Moreover, quality can be controlled through intermediaries throughout the production network and depends highly on capture technology and handling [Dobeson Reference Dobeson2019: 163-187]. While the catch is directly processed and chilled on large freezing trawlers, smaller to medium sized vessels deliver their haul to processors or auction markets in which quality is evaluated by buyers “on the spot.” With increasing digitalization of production networks and the emergence of electronic auction markets, however, network ties between fishers and processors are weakened, and quality uncertainty is increased on the buyer’s side [Graham Reference Graham1998]. To substitute for the lack of interpersonal trust based on long-term relations and contracts in spatially dispersed markets, commercial buyers welcome the use of digital tracking websites that allow for real-time surveillance of individual vessels and the “scopic” valuation of quality [Dobeson Reference Dobeson2016]. In the final consumer market, knowledge and expertise in quality assessment are typically low, and consumers generally have to rely on their personal judgment of the physical appearance of the fish or on “judgment devices” [Karpik Reference Karpik2010], such as best-before dates and the reputation of brands, labels, or fishmongers.

Fourthly, although perishables can be subject to strong price fluctuations, the overall effects of external events are considerably stronger than in the case of durable goods. In particular, the supply of raw materials for fresh fish processing and production can be limited due to exogenous factors. For instance, fish stocks can move or be depleted, or fishing efforts can be limited by political regulations and conservation measures [Dobeson Reference Dobeson2018]. Nevertheless, markets for fresh and chilled fish allow smaller to medium sized companies without substantial storage facilities to engage in flexible adaptation and just-in-time production. External factors, such as bad weather, however, can lead to short-term shortages, and producers can replace their production with another species if one becomes unavailable due to external factors.

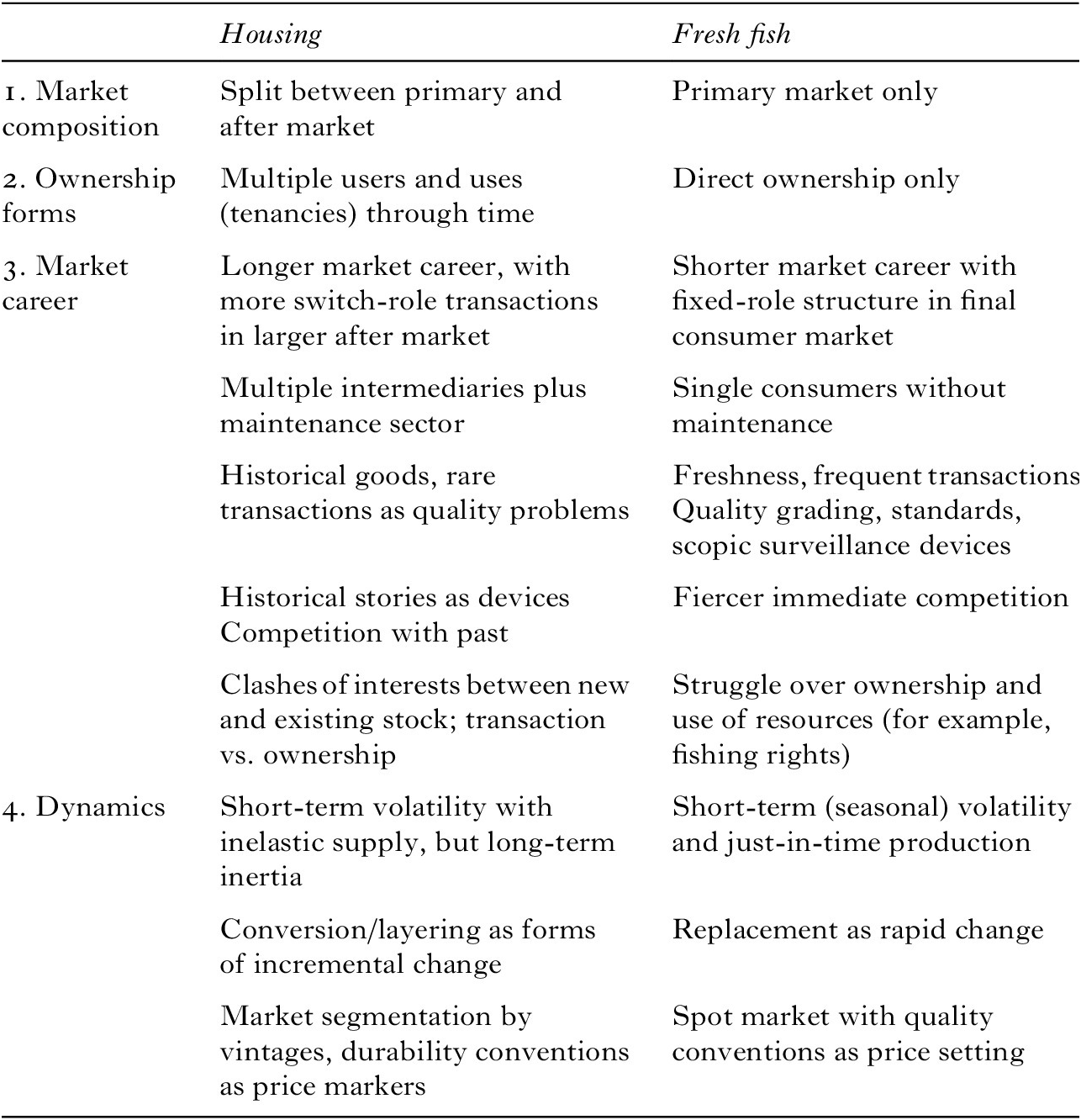

We summarize the main dimensions of the stylized case comparison in Table 1.

Table 1. Market organization of durable and nondurable goods.

General features of markets for durables and nondurables

Solid housing and fresh fish are, of course, extreme cases. One might therefore reasonably question the extent to which other goods or even market segments correspond to these two extremes. We suggest that not all properties need to be shared, but that one can observe a continuum of these features, depending on their socially expected durability. This continuum can be approximated, albeit imperfectly, by the average number of service years during which a good can be in use. The purchasing price minus residual price divided by service years yields the average depreciation rate, a durable’s annual loss of value. The longer the lifespan, the lower the depreciation rate, given that the residual value is constant. This relationship is depicted with empirical numbers for US markets in Figure 1. In this scatterplot, perishables such as fish are not even depicted because they lie mostly below the one-year lifespan with extreme depreciation rates in the upper left corner. Durables such as housing tend towards the lower right corner, beginning with the 20-year average duration of a mobile home and ending with, on average, 80 years for new one to four-unit buildings.

Figure I Service-life and depreciation rates of durable goods [BEC 2003].

The general regularity of depreciating goods is, however, broken by a subclass of durables whose residual value can grow so that investment value exceeds depreciating use value. These goods can be purely investment goods, such as stocks or bonds, but also material goods, such as certain houses, antiques or luxury goods. An approximation of those durables turned into goods of value-conservation can be found in the attempt to trace price developments in the luxury good segment as represented in Frank Knight’s luxury investment index which reports annual value changes for goods such as art, wine, watches, coins, stamps or Chinese ceramics (Knight Reference Knight2017). This subgroup of durables largely coincides with the “enriched objects” described by Boltanski and Esquerre (Reference Boltanski and Esquerre2016).

The sociology of valuation [Lamont Reference Lamont2012] has extensively discussed this subgroup of durable goods to answer the question of why some durables turn into holders of value, while others just depreciate. There are important background conditions, such as the rise of surplus capital in need of a safe haven, distrust in inflationary currency and intangible assets. Moreover, as reported in this research, there is the “singularization” of goods, for example, a singular vintage model that at one time was just an ordinary car. Stories told about such goods represent another mechanism, for example when a simple chair gains in value once the purchaser learns that Tsar Peter once sat on it [Bogdanova Reference Bogdanova, Beckert and Musselin2013]. Besides imaginaries about the past, fictions about the future are likely to make ordinary and depreciating objects attractive equivalents of gold, such as promises that they will retain their value through uncertain times [Beckert Reference Beckert2016]. In what follows, we try to generalize our case-study findings across other types of predominantly depreciating durables and nondurables.

Durables

Much like—and above all—housing, many other durable goods in general have aftermarkets, albeit smaller ones. Nonetheless, an estimated half of all US cars sold each year are used cars [Ohlwein Reference Ohlwein1999: 34]. On a more global scale, many discarded consumer durables spend the second half of their lives in countries of the Global South in spite of protectionist measures against them [Hansen Reference Hansen2000]. “In the 1980s–1990s, the global export of second-hand clothing increased more than sixfold. In Sub-Saharan Africa, a third of all textile imports were second-hand in these years” [Trentmann Reference Trentmann2016]. In addition, US exports of used cars amounted to one-third of all cars in 1999 [Czaga and Fliess Reference Czaga and Fliess2004]. The historically recent rise in Western standards of living tends to obscure the fact that many durable household products, from clothing to knives, have an afterlife beyond their first user and are passed on to the next generation or used as collateral in pawnshops in Europe [Lemire Reference Lemire2012]. Many smaller durable products have specific marketplaces (specialized dealers, flea markets, online exchanges, antiquarian bookstores, charity shops) for their later lives, different from the primary-market circuits.

Although the chain of multiple users and uses might be shorter than in the case of housing, many other durables are not used by one person in one mode of use only through their lifetime. Consumer durables, such as cars, also display different forms of tenure—owning, renting, sharing—as do many investment durables: 30% of commercial aircraft today, for instance, are leased [Gavazza Reference Gavazza2010], two-thirds of all US machine tools in the 1960s were used ones [Waterston 1964], and more than 50% of traded trucks were used ones in the United States in 1977 [Bond Reference Bond1983].

The aftermarkets for other durable goods also have specific market intermediaries and maintenance sectors of considerable size. For component producers in the bicycle industry, for instance, production for aftermarkets can be so important that they decide overall market shares [Isely and Roelofs Reference Isely and Roelofs2004]. In automobile manufacturing in Soviet countries, a tendency to repair durable goods tended to lead to higher average service years [Gerasimova and Chuikina Reference Gerasimova and Chuikina2009]. But also on the finance side of durables, one could argue that consumer and mortgage credit rose in the course of the spread of cars, household appliances, and homeownership among households. In addition, smaller objects such as clothes, jewelry, or furniture are among the typical items found in pawnshops, the collateral of last resort [Fontaine Reference Fontaine2008]. Next to the credit sector that emerged for the acquisition of durables, the insurance sector accompanied durables in its development to insure them after acquisition. The main modern forms of insurance, which emerged from the 18th century onwards, were all tied to the insurance of durable merchandise (marine insurance), consumption (property, car) or production goods, not least the insurance of the production factor “labor” (life, health, unemployment, accident insurance).

Short-term volatility and long-term inertia also characterize other durables: in OECD countries between 1973 and 2006, for instance, “the standard deviations of raw materials and durable goods [in exports] [were] respectively 7.78% and 6.54%, but only 2.86% for nondurable goods” [Engel and Wang Reference Engel and Wang2011]. Much as in the construction industry, there are well-known production cycles in the car industry, which have made up 25% of overall GDP volatility in the United States since the 1970s [Ramey and Vine Reference Ramey and Vine2006]. Consumer durables, as recorded since the 1950s, also show strong overall volatility, often driven by consumer sentiment.

Nondurables

The overall defining feature of all markets dealing with nondurable goods is that they are limited to single users and uses only, which entails the absence of second-hand and aftermarkets. Consequently, the market careers of perishables such as fish, milk, and vegetables or of other nondurables, such as cigarettes or toiletries, end with the final consumer market. Depending on the goods’ relative durability, however, shelf life may vary significantly. Within the fresh fish market, for instance, the time span between harvesting and consumption is usually only a few days, while in the case of other fish products, such as smoked, frozen, or canned fish, durability can be measured in weeks and months, if not years [Albrecht Reference Albrecht2007].

Market organization for nondurables involves a comparatively decentralized producer market with fixed-role structures between, typically, numerous buyers and sellers. Moreover, the shorter a good’s lifespan, the less prone a market is to be dominated by cartels and monopolies, as is typical for durable goods markets [Ward and Watkins, Reference Ward and Watkins1946]. Hence, major suppliers of perishables, such as oranges and milk, cannot control the market by storing and dumping large quantities in order to gain a competitive edge when prices are high [Hoffman and Libecap Reference Hoffman and Libecap1991]. Furthermore, uncertainty about quality structures the interaction between buyers and sellers, who must engage in valuations based on the core physical features of the produce. Either producers engage in long-term contractual relations with buyers or offer their produce in short, daily to weekly intervals on spot markets. These markets can range from local small farmers’ and weekly final consumer markets to larger “Dutch” auction markets with falling prices, in which large quantities of nondurables, such as strawberries, are traded to market intermediaries and retailers [Garcia-Parpet Reference Garcia-Parpet, MacKenzie, Muniesa and Siu2008]. Moreover, product gradings provide information on quality, which is of particular importance in electronic markets, in which buyers and sellers remain spatially separated [Graham Reference Graham1999].

Typically, market dynamics for nondurables are characterized by short-term fluctuations. Agricultural goods in particular show high price volatility [Huchet-Bourdon Reference Huchet-Bourdon2011] due to seasonal variations and external shocks, but overproduction and the famous “hog cycles” [Harlow Reference Harlow1960] are comparatively short-term phenomena, which can be adjusted by production stops or price regulation. Historical evidence indicates that technological innovations, such as refrigeration, have stabilized prices and integrated markets for nondurables, such as butter, over time [Goodwin, Grennes, and Craig Reference Goodwin, Grennes and Craig2002].

Reorganizing markets: the mechanisms of durabilization and de-dedurabilization

Our purely static comparison so far has been across markets and goods. However, it is important to note that within any market more or less durable forms of the same good can exist simultaneously and change over time. We have already seen that houses can be offered along a range from containers or mobile homes to solid stone houses and skyscrapers, and that fish comes in varieties ranging from fresh to canned. Over time, US houses have increased in service years, while those of many other consumer durables have declined [BEC 2003]. These examples indicate that the physical durability of a good and its socially expected durability are not set in stone, but manufactured within its historically contingent socio-technical context and market organization.

In line with our material and social definition of durability, how durable a good is and how durable people think it should be, can change. Even though the two market cases from our static comparison have potentially been less subject to change than other markets, we can still point to significant mechanisms of durabilization and de-durabilization even in these markets. Raw fish can be transformed into canned, frozen, or chilled fish, whereas houses range from mobile homes to solid conventional ones. These changes in durability, so our argument goes in this dynamic analysis, are key to understanding the internal differentiation and segmentation of markets and their respective social organization. Durability itself becomes the dependent variable in market competition. Accordingly, new production networks and market niches can be created by increasing or decreasing a good’s life expectancy. In the following, however, we will show that this is not merely the consequence of the technical manipulation of a good’s physical features, but related to how technologies of durability are institutionalized within the context of broader societal developments, such as norms of use, fashion cyrcles, and changing lifestyles.

Making goods durable

Historically speaking, raw fish has been a staple good in many local economies for thousands of years. But only by increasing its physical lifespan through artisanal conservation methods, such as salting and drying, together with the development of more reliable sea transport could it become the building block of international trade, as the remarkable social history of the codfish tells [Kurlansky Reference Kurlansky1999]. However, although the demand for relatively cheap protein from the sea has been high ever since, many fishery economies remained “latecomers to modernization” [Sverisson Reference Sverisson2002: 253], with many coastal states relying largely on small, low-capital and artisanal fishing fleets with a relatively low degree of specialization that allowed for buffering seasonal fluctuations by relying on other sources of income [Apostle et al. Reference Apostle, Barret, Holm, Jentoft, Mazany, McCay and Mikaelsen1998: 23]. Within these local truck economies in which fishers were often dependent on the merchant’s monetary resources, “the merchant preferred to leave fishing and preservation to the fishermen, while he himself concentrated on trade of the finished product” [Apostle et al. Reference Apostle, Barret, Holm, Jentoft, Mazany, McCay and Mikaelsen1998: 30]. Thus, merchants could use their power over the often indebted fishers to keep prices low in order to maximize their profits and gain more influence in the fishing communities as major creditors, as a result of which they became part of a wide ranging network of privileges, rules, and regulations.

This small-scale production based commercialist order was prevalent until the rapid emergence of a new global mass market for frozen fish in the 1930s and 1940s. Hence, developments in mechanical freezing allowed the radical durabilization of raw fish for storing and transport. In contrast to the production of dried and salted fish, the production of frozen fish required a higher degree of organized management and formal control that not only transformed practices in retail and marketing, but also dictated the means and ends of production. Thus, the restructuring of the production process required “larger investment requirements that followed the introduction of modern technology in fishing (trawlers) and production (mechanized filleting and freezing),” which fostered the comparatively belated breakthrough of large-scale Fordist industrialism, in which fewer vertically integrated firms with large freezing trawlers control the global mass markets for frozen fish [Apostle et al. Reference Apostle, Barret, Holm, Jentoft, Mazany, McCay and Mikaelsen1998: 59-84]. At the same time, the durabilization of raw fish through freezing technologies revolutionized not only the supply chain, in which large producers shifted more and more from local and wholesale markets to direct supply of contracted sellers, such as supermarkets, but also the diets of Western consumers, who now had access to relatively fresh raw fish, regardless of their proximity to the sea. However, while the freezing industry established relatively stable consumer markets for fish products, economies of scale fueled price competition, making highly specialized large firms more vulnerable to bankruptcies. Moreover, although the breakthrough of markets for frozen fish created a boom in many coastal communities across the North Atlantic, its intensity and form varied relative to the local embeddedness and organization of production, ranging from pure capitalist enterprises to cooperatives [ibid.]. At the same time, seemingly infinite opportunities for growth by increasing the capture capacity of freezing trawlers soon ran up against the reality of marine resources, resulting in the collapse of cod stocks, the introduction of moratoriums, and the reorganization of the industry through fishing quotas across the North Atlantic in the 1980s and 1990s [Eythorsson Reference Eythorsson1996; also see Hersoug Reference Hersoug2005].

It has become clear that durabilization was at the heart of the industrial breakthrough of modern fisheries that enabled the organization of global mass markets. The fishing industry, however, remains only one of many examples that illustrate the mechanisms of relative durabilization for the development of industrial capitalism, in particular in food production. Generally speaking, two sorts of factors can affect durability: technological changes affect simple physical durability, and social constructions, such as norms about hygiene or social status related to consumption, can change a good’s socially expected durability and the ways in which its market is organized.

Relatively recently, technological developments, particularly conservation techniques such as freezing technology or the development of more robust materials in the canning of goods, such as less oxidizing steels, have considerably increased the lifespan of both consumption and production goods. Moreover, the history of refrigeration shows how technological innovations, such as cooling and storing technologies, tend to induce the rapid transformation of production, marketing, and consumption [Rees Reference Rees2013; Thévenot Reference Thévenot1979]. Once made more durable, trade in food could be extended beyond the traditionally traded varieties and volumes of goods, which were often bound to local markets.

Closely related to the groundbreaking developments of durabilization in processing and manufacturing, the transport revolution was another important encompassing technological mechanism that radically transformed nondurables in local markets into global commodities. Historically, perishable goods, such as raw meat and fresh fruit, were often restricted to local markets. However, with the use of steam in continental railway and sea transport, starting in the 19th century, they became globalized [Freidberg Reference Freidberg2009, 50]. Furthermore, the availability of storage space and storage costs impact on the amount of durable goods. Similarly, the standardized container was an important driver in moving durables in globalized trade from the 1960s onwards [Levinson Reference Levinson2006].

Finally, the relative durabilization of formerly non-durable goods is key to understanding the rise of financial markets. Only with increasing durability do nondurables, in particular agricultural commodities, eventually become attractive as investment goods. For instance, the emergence of grain futures was tightly linked to the invention of the grain elevator as storage, allowing traders to distinguish between different quality gradings and close deals on the future delivery of crops [Cronon Reference Cronon1991: 120; Pinzur Reference Pinzur2016]. Likewise, the emergence of futures markets for dairy products at the Chicago Butter and Egg Board in 1898 began with trading in relatively durable products, including cheese [1929], that could be kept in cold storage, whereas financial products for more volatile products, such as raw milk, are a rather new phenomenon [Peterson Reference Peterson2010]. Again, another striking example of the link between durabilization and finance can be found in the fishing industry. In this case, however, the “assetization” [Birch Reference Birch2017] of fish stocks was made possible only through the socio-technical construction of markets for fishing rights [Holm and Nolde Nielsen Reference Holm, Nolde Nielsen, Millo, Callon and Muniesa2007], in the form of so-called Individual Transferable Quotas or ITQs, which today allow for the collateralization of one of the most fragile and nondurable goods in the volatile world of global finance [Arnason Reference Arnason2008]. These rights, however, like all asset, options, and futures markets remain intimately tied to the tangible world of nondurables: without more or less sustainable fish stocks as a basis for harvesting, processing, and trading tangible goods, their value would be nil.

Making goods less durable

By contrast, an instance of the considerable de-durabilization of housing markets has been the emergence of the mobile home sectors in the US, which currently amount to about 7% of all US housing stock. Mobile homes dedurabilized conventional homes, reducing durability to about 20 years, compared with the more than 80 years for conventional family houses (see Figure 1). They have done so by durabilizing trailers, whose durability was previously much shorter, more akin to that of cars. The case shows that a good’s durability is subject to technological, as well as social conditions, and that changes in durability entail changes in the social organization of the market.

The technological background of mobile homes is the emergence of industrial pre-fabrication. While prefabrication techniques go back to 19th century settlements, war shelters, and catalogue houses, it was the demand for temporary housing (trailers) during World War II and the spillover of automobile-factory techniques into housing that created the take-off for this market segment after 1945. Trailer-building split into the construction of trailer vehicles and more fixed-site mobile homes. Mobile home production became a car-like, concentrated industry based on factory production and a retail selling system. But as well as technological and organizational maturation, social conditions also enabled the emergence of this form of housing. On the supply side, builders discovered they could be used to circumvent restrictive building codes. They could also be produced by lower-skilled workers in factories, without recourse to union-organized craftsmen [Drury Reference Drury1967]. By decoupling house structures from underlying land ownership, they extended the market for aspiring homeowners to the lower end. As a result, each housing affordability crisis has led to an increase in the mobile home rate.

On the demand side, in turn, the dream of becoming a homeowner, even only of cheaper structures and without land, was just as important as the normative change of what legitimately and legally counts as a house to buy. Even if mobile homes have not yet replaced their residents’ aspiration to conventional homes [Fehl Reference Fehl, Schildt and Sywottek1988], they have at least established themselves as a de facto form of permanent living, distancing themselves from the threatening stigma of mere “trailer” living [Kusenbach Reference Kusenbach2009]. This image was inherited from temporary war-time trailer parks, the recurrence of bad examples at the lower end of the market, and the sight of collapsing homes in the face of high winds [Thornburg Reference Thornburg1991]. The traditional high-durability building industry has also tried to reinforce this negative image to avoid low-durability competitors. The construction of durability was further enhanced through a government norm for mobile homes that standardized their physical features [Hart, Rhodes, and Morgan Reference Hart, Rhodes and Morgan2002, 128]. This standardization in turn facilitated the use of mobile homes as collateral for bank mortgages, even government secured ones. It also helped to create a market for property insurance, and this tie to the financial markets in turn helped to institutionalize the mobile home market.

The decrease in both physical and socially expected durability changed the market organization of this housing segment significantly. First and foremost, the secondary market is relatively small and, not surprisingly, mobile homes are overrepresented in the new-construction statistics, making up more than 20% of new single-family houses. It still allows for different forms of ownership, such as owning both structure and land, only owning the structure and renting the land, from individuals or trailer parks, or renting both. With the loss in durability comes increased depreciation, both physical and, even more so, monetary. Mobile homes make for one of the worst housing investments. Nevertheless, they are durable enough to be tied to the mortgage and insurance market. In comparison with solid houses, there are fewer users over the life cycle of a unit. The market form is also different: units are much more standardized and transactions more frequent, so that quality uncertainty is less of a problem; with newly built units making up more of the supply, the fixed-role relationship between mobile home manufacturers (or retailers) and the final consumer gains in importance at the expense of sales between consumers. Actors along the “lifespan” of a mobile home unit are also less important: there is less maintenance of structures, less logistical activity and fewer transactions. Despite their name, mobile homes are in most cases not even moved from their first out-of-factory location, due to their instability, high transport costs, and low-income residents. The owners of trailer-park land are for that reason the most powerful actors and organizers of the second-hand market [Hart, Rhodes and Morgan Reference Hart, Rhodes and Morgan2002, 80]. Finally, changes occur also as conversions: the change from wood to synthetic materials, for instance, diffused quickly and made older units obsolete. But abrupt replacement of structures equally becomes a form of change, as when suburban growth makes underlying land more valuable and trailer-park sales to developers more likely [Sullivan Reference Sullivan2018].

Rather counterintuitively, another striking example of de-durabilization are markets for perishables whose industrial breakthrough in global capitalism was tightly linked to processes of durabilization through technological revolutions in storing and infrastructure (see above). Today, de-durabilization has become a valuable business strategy and the cornerstone of market differentiation through the construction of premium “quality” market segments for a broad range of perishables, such as tropical fruit and fresh fish. It is for this reason that, in recent times, fresh produce has surpassed electronics as a luxury good in the valuable air freight business [The Economist 2017]. These developments are particularly vibrant in the fishing industry, in which new socio-technical infrastructures have revolutionized rural production networks that allow the organization of new premium niche markets for “fresh” and “chilled” fish, successively replacing the declining traditional salt fish markets in Southern Europe, while at the same time achieving higher prices than the frozen market segment [Dobeson Reference Dobeson2019:163–187]. Hence, new socio-technical infrastructures allow even smaller to medium sized producers on the rural periphery to cater to the growing global appetite for fresh and chilled fish. Although the global rise of this “raw fish movement” can partly be explained by dietary fashions set in cosmopolitan centers such as Tokyo and New York around dishes such as sushi, the growing demand for luxurious raw fish products presupposes the reorganization of the producer market around specific socio-technical infrastructures, and new norms of handling and storing fish [Bestor Reference Bestor2001]. As a consequence, a new, more volatile market based on just-in-time production and involving smaller volumes, has been enabled by air freight transport. Furthermore, the implementation of quality control and socio-technical surveillance regimes have been key to carving out a new market niche for highly perishable but premium priced fresh fish products.

What these cases show is that a good’s physical durability can dynamically undergo processes of dedurabilization with ensuing changes in market organization. Generalizing these cases, three mechanisms of change through dedurabilization can be distinguished. First, technological change can not just increase, but also decrease the lifetime of goods. Any technological innovation leads to the technological obsolescence of older competitors, whose lifespan is thus radically cut short [Slade Reference Slade2006]. The faster the pace of innovation, the shorter the social use of a product becomes. When a product is complementary to a primary one that is replaced, this can feed back on the former. “Planned obsolescence” refers to the deliberate attempt by a company to decrease a product’s physical lifetime to increase overall demand [Ober et al. Reference Ober, Dell’Anno, Dréze, Herrmann, Luciano and Maltry2017]. Another factor producing lower physical lifetimes is the materials used: with the plastic revolution and new types of wood fabrication, for instance, average use times per product decreased, as physical depreciation became higher.

Second, and sociologically no less interesting, there are social factors that reduce socially expected durability. Even if the physically expected durability of products can be high, social uses and norms can decrease the average service time of a product, both per person and in terms of general service time. Status consumption, for instance, requires consumers to upgrade their consumer goods once they move into a higher income group, while conspicuous consumption may also lead to dysfunctional replacements of durable goods. Another classic explanation refers to fashion cycles: even if clothing still fulfills its basic functions, its symbolic function of displaying the newest trends or social status might make it obsolete.

Thirdly, going hand in hand with socio-economic transformations, cultural factors have decreased the socially expected durability of goods significantly. This can be explained not only by lower quality and prices, but also by rising incomes and a change in consumer mentality towards durable goods. In a “throwaway society,” care and respect for every single object declines and might thus even reduce its actual service years. Certain technical devices, such as smartphones in the United States, had already reached replacement rates of about 50% in 2014 [Trentmann Reference Trentmann2016], even though this might not be a clear-cut trend [Wieser Reference Wieser, Mugge and Bakker2017]. Moreover, a “repair culture” is also a reinforcing cultural mechanism for a functioning second-hand market; once the skills of repairing a car or a fridge or of sewing and knitting used clothing are lost, purchase on the primary market becomes inevitable. Finally, the production of waste with regard to nondurables, such as household food, is ingrained in the routines and practices of daily life, as the sociology of consumption has shown [Evans Reference Evans2012].

Conclusion

In this paper, we have argued that socio-material causes of different durabilities between or within groups of goods is key to a comparative sociology of market organization. But whatever the broader mechanisms that bring about markets for durables, once in place—and this is the main claim of this paper—markets for durables have a social organization distinct from markets dealing with nondurable goods. As our static analysis reveals, durable-goods markets are split into primary and aftermarkets, allow for multiple ownership forms, organize the “social life of goods” differently, and show different market dynamics. This static analysis provides students of the sociology of markets with an analytical tool to situate their own market case in a comparative framework, as summarized in Table 1. The suggestions for dynamic analyses, in turn, permit us to think about changing markets in terms of how market actors and socio-technical processes make a good’s durability a crucial variable for new markets or market segmentation. While our examples explore the world of goods mainly through the lens of consumer durables, starting from housing and fish markets, we see capital goods such as machinery and equipment or potentially even job positions in organizations as a promising extension of our analysis.

The dynamic cases also implicitly point to the importance of the state and business interests in defining durability, which can be subject to social struggles. Governments can take an interest in how durable goods are when they want to stimulate macroeconomic demand by incentivizing consumers to buy more new products earlier. Ever since London’s popular pamphlet about state-planned obsolescence during the Great Depression, states have toyed with this policy idea, for instance, by promising subsidies only for purchases of new products or by tightening regulation on existing ones. This regulation might equally be used by governments for environmental or customer welfare purposes, as when old generations of polluting or unsafe cars become the target of restrictions on use. Governments might also encourage more rapid turnover because they are aware of the social role of secondary markets, in which durables trickle down income hierarchies. Corporate interests, in turn, can line up with government-sponsored increases in demand through higher turnover, and planned obsolescence is today rather associated with business practices, including the introduction of new models, fashions, and software updates than government policy [Slade Reference Slade2006; Strasser Reference Strasser1999]. But regulatory measures or subsidies can also divide markets or entire sectors internally into the producers of new units versus the maintenance sector or into those profiting from many transactions versus those profiting from holding property.

Theoretically, the distinction between durable and nondurable goods markets can be fruitfully connected to existing concepts in the sociology of markets: thus durables, as they are traded among users, are particularly likely to be switch-role markets, while consumers on markets for nondurable goods have largely fixed roles as final consumers [Aspers Reference Aspers2007]. Consumers of durables tend to use voice; those of nondurables exit. Many goods and services on the markets for singular goods [Karpik Reference Karpik2010] exist over extended stretches of time or require time in the production or development of skills, while mass-produced goods often correspond to the nondurable end, in our dimension. Status markets [Aspers Reference Aspers2009] are much more likely to exist for durable goods, while standard commodity markets are much more likely for nondurables. However, these types of markets might not always correlate, but rather produce more complex typologies. More empirical comparative studies of markets—for which comparative data are so difficult to obtain—could help create clusters of social characteristics in the organization of markets. It goes without saying that the research proposal of a comparative sociology of durable and nondurable goods is far from being exhausted and leaves us with intriguing puzzles about the relations between a good’s socially expected durability and the social organization of its market, as well as its place in the capitalist economy more generally.