No CrossRef data available.

Article contents

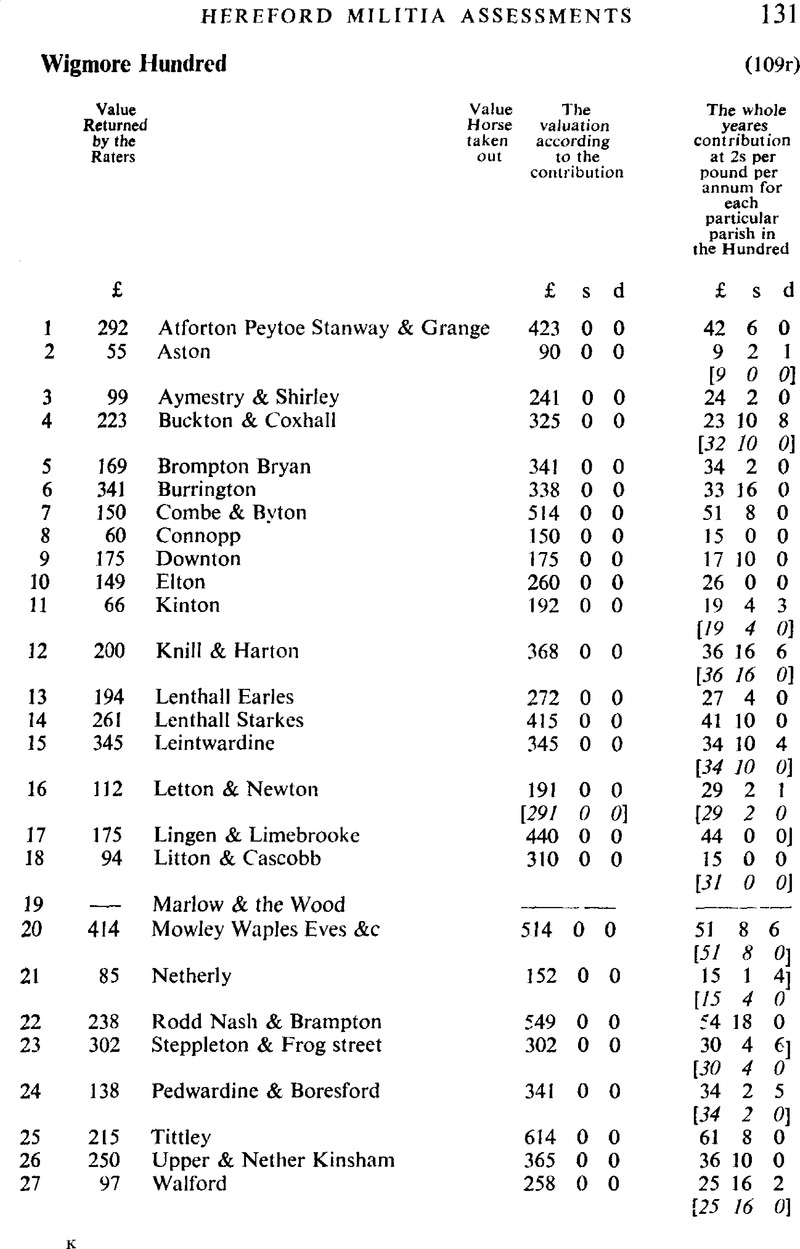

Wigmore Hundred

Published online by Cambridge University Press: 21 December 2009

Abstract

- Type

- The Militia Assessments

- Information

- Camden Fourth Series , Volume 10: Herefordshire Militia Assessments of 1663 , July 1972 , pp. 131 - 148

- Copyright

- Copyright © Royal Historical Society 1972

References

1 Hearth Tax return, Lady Day, 1664:

The royal aid charges eventually levied each quarter on each parish in this hundred were: Atforton, £10 6s 4d; Aston, £2 [10s] 7d; Aymestrey, £6 5s 7d; Buckton &c, £7 17s 4d; Brampton Bryan, £8 5s 7d; Burrington, £8 4s 1d; Combe &c, £12 12s 2d; Downton, £3 2s 10d; Elton, £6 6s; Kinton, £4 10s 10d; Knill &c, £8 19s [9d]; Leinthall Earls, £6 12s 1d; Leinthall Starkes, £10 2s 4d; Leintwardine, £8 4s 10d; Letton &c, £7 0s 7d; Lingen &c, £10 14s 10d; Litton &c, £7 [1s]; Marlow &c, £3 8s 10d; Mowley &c, £1212s 2d; Nether Lye, £3 13s lid; Rodd £12 12s 2d; Stapleton, £9 10s 2d; Pedwardine &c, £7 14s 10d; Titley, £12 12s 2d; Kinsham, £9 10s 2d; Walford, £6 3s 10d; Witton &c, £5 2s 1d; Wigmore, £8 8s; Willey, £9 10s 2d; Yetton, £6 13s 9d; Loan 29/49, pf. 4, no, 69/14. These charges suggest that the figures in the right-hand column of the hundred schedule in Harl. 6766 for Buckton, Letton and Litton are incorrect. Connop was normally taxed with Shobdon in Stretford hundred. While the parish charges as proportions of the hundred charge were mostly the same for the royal aid as for the 1677 assessment, the proportions in Harl. 6766 are not quite the same. A partial explanation of this is the omission of a charge on Marlow, which, if it were the same as the final royal aid charge, would produce a greater similarity. The adjusted hundred total would therefore be about £970.

* Actual charge in brackets.

2. HT 1664 (3).

3. JP 1655; Subs. 1663 (lands £2); HT 1664 (9).

4. HT 1664 (5).

5. In 1646 the real estate in the county of Roger Garnons was put at £20 a year and his personal estate at £5; Loan 29/15, pf. 2. James Garnons was assessed on lands of £2 and as a recusant in the Subs. 1663; he was charged on 6 hearths in 1664.

6. A former parliamentary officer. HT 1664 (8).

7. In 1645 the income of Sir Robert Harley (1579–1656), father of Sir Edward, was estimated to be £1,500 a year; Harl. 911. Sir Edward Harley (1624–1700), K.B. 19 Nov. 1660, governor of Dunkirk, 14 July 1660 to 22 May 1661; DNB. JP q 1660; DL 1660; a man of keen antiquarian interests; the Harley Papers (Loan 29) show him to have been very active in the administration of the county militia. FP 1661 (£50 paid); Subs. 1663 (lands £20 assessed with Thomas Harley); HT 1664 (17)

8. Thomas Cole, rector, FP 1661 (30s).

9. The largest HT charge in 1664 was on Francis Walker (8).

10. Subs. 1663 (goods £5).

11. Bringewood Forge.

12. The hearth tax return for Lady Day, 1664, contains: (chargeable)—James Pirie (4), Thomas Sanimeli (2), Francis Knoke (2), Thomas Fletcher (3), Thomas Griffitts (1), Thomas Penny (2), Thomas Bent (1), John Blackbatch (1), Wm Harvy (1), Edward Sanimeli (1), Elenor Blackbatch (1), Owen Hawes clerke (2), Thomas Woodhouse (5), Richard Weaver (5), James Woodhouse (5), Wm Woodhouse (3), Wm Hill (1), James Woodhouse sen (2), Evan Davies (1), Wm Phillipps (1), Phillip Taylor (1), Wm Woodhouse glover (1), John Man (1), James Evans (1), Henry Willcox (1), Richard Browne (1), Wm Stannage (2); (not chargeable)—Richard Davis (1), Jonas Blayney (1), Richard Dymber (1), Thomas Preece (1), Elenor Phillipps (1), Thomas Morgan (1), David Williams (1), Richard Woodhouse (1), Thomas Griffitts (1), Richard Hinton (1), Thomas Fletcher sen (1); (chargeable hearths 52).

13. Gent., Subs. 1663 (lands £2).

14. Rector, FP 1661 (20s paid).

15. Chief constable of Wigmore, 1663; Loan 29/49, pf. 4, no. 69/15. Subs. 1663 (lands £2).

16. Gent., Subs. 1663 (lands £2).

17. Gent., Subs. 1663 (goods £3).

18. HT 1664 (6).

19. HT 1664 (10).

20. Probably included Patchfield.

21. The largest HT charge in 1664 was on John Mapp (7).

22. Gent., Subs. 1663 (lands £2).

23. Gent., Subs. 1663 (lands £2).

24. HT 1664 (4).

25. Margery Palfrey.

26. Included Lower Harpton; Upper Harpton was in Radnorshire. The hearth tax return for Lady Day, 1664, contains: Knill (chargeable)—John Walsham Esq (5), John Watkins (2), Roger Lide (3), Rowland Stephens (1), Richard Knill (1), Jenkin Knill (2), Francis Stephens (1), Edward Griffiths (1); (not chargeable)—John Thomas (1), Thomas Dayos (1), Roger Lewis (1), Wm Reece (1); (chargeable hearths 16). Herton (chargeable)—Thomas Woodcock (6), Mary Bull widow (3), Elenor Lyde widow (1), Ann Morrice vid (1), John James (1), Hugh Paine (1), James Frees (1), Richard Bull (1), John Pricherd (1); (not chargeable)—Thomas Powell Gough (1), Edward Powell Gough (1), Wm Jones (1), John Gough (1), Richard James (1), Herbert Jorden (1), Elizabeth Williams (1); (chargeable hearths 16).

27. Subs. 1663 (lands £3).

28. Roger Lyde, Subs. 1663 (lands £2).

29. Subs. 1663 (lands £4).

30. In 1646 Sir Sampson Eure's real estate was valued at £60 a year and his personal estate at £10; Loan 29/15, pf. 2. Lady Eure was charged on 11 hearths in 1664. A survey and valuation in 1666 for the additional aid gave these valuations: Lady Ewers £80, Tho. Oakeley £35 10s, James Land £8 15s, Rich. Browne and his tenants £35 10s, The Old Field £28 10s, Mr Rob. Davis £24 10s, Math. Langford for the Lo. Bishop's land £21 10s, Mr Rob. Tayler for the Mynd £2 10s, Mr John Davis and his sonne £21 ICs, Clarkes tithes £17 10s, Tho. Croone £14, Mary Hopkins wid £12 5s, John Beddoes £4 5s, Sheappards lands £4 15s, Edw. Edwards £2 10s, John Elliotts £1 15s, Mr Whittle for tithes £5 5s; total £320; Hereford CRO, Galley Park MSS. The 1677 assessment on half the ‘new’ quota appears at £13 7s 10d to follow the charge in Harl. 6766 rather than the 1666 revaluation: E.179/119/490.

31. Widow of Sir Sampson Eure, former attorney in Wales, who bought Gatley Park from the Crofts in circa 1634 and who died in 1659. Subs. 1663 (lands £3). She died in 1673; Robinson, , p. 172.Google Scholar

32. Subs. 1663 (lands here and in Cowarne £2).

33. HT 1664 (6).

34. In 1646 his real estate in the county was put at £40 a year and personal estate at £19; Loan 29/15, pf. 2.

35. Probably Sir Walter Long of Whaddon, Wilts, created baronet 26 March 1661, died 1672; Baronetage, iii, p. 181.Google Scholar

36. In 1664 an assessment on Leintwardine parish for church repairs charged the constituent townships: Walford £6 9s; Adforton £6 2s 10d; Peyto £4 5s; Letton and Newton £7 15s 3d; Witton and Trippleton £5 18s 9d; Kinton £4 9s; Marlow and the Wood £3 8s 6½d; Leintwardine £9 6s 9d; Broxop and Brakes £2 5s 5d; Jay and Heath £3 17s 10d. Even if the last two townships are assumed to be included in the Leintwardine militia return, this church lewn was distributed differently from the militia valuations. Church assessments may well have been conventionally based on township allocations rather than rated equally across the parish; Hereford CRO, Diocesan Archives, Court Papers, I. and O.P., Box 485.

37. William, Earl Craven, 1606–1697 (DNB); his manor of Leintwardine had been bought by Robert Thorpe (CCC, ii, p. 1625Google Scholar), but he had apparently recovered it.

38. The largest HT charge in 1664 was on the widow Harper (6).

39. Subs. 1663 (lands £2); HT 1664 (4).

40. The largest HT charges in 1664 were on William Rodd, gent., and John Cocke (4 each).

41. Will proved 19 June 1664 (PCC).

42. Subs. 1663 (goods £3).

43. The hearth tax return for Lady Day, 1664, contains: (chargeable)—John Williams (1), Reese Davis (2), John Davis (1), Elenor Pugh (3), Henry Hurston (1), Meredith Davis (1), Thomas Howld (4), Johan Howld (2), James Meredith (1), Edward Powell Gough (3), Edward Howld clerke (2), Elenor Morris widow (2), Hugh Pugh (2), Peter Pugh (1), Lewis Jones (1), Marga: Thomas (1), Evan Jenkin (1); (not chargeable)—Thomas Meredith (1), Phillip Morris (1), Howell Frees (1), Hugh ap Thomas (1), David Morgan (1), John Prichard (1), Thomas Sherman (1), Miles Evans (1); (chargeable hearths 29).

44. HT 1664 (3).

45. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Andrew Greenly (5), Phillip Greenly (5), John Fletcher (1), Edward Hudson (2), Francis Ricards (1), Symon Griffitts (1), James Astley (5), John Hunt (6), Phillipp Bleeke(1), Robert Woodhouse (4), Walter Frizer (3), John Greenly (1), Thomas Fletcher (1), Elenor Steade (1), Thomas Lewis (1), Wm Fletcher (1), Wm Frizer (2), Wm Sevan jun (1), David Lochard (1), John Badland (4), Henry Williams (4), Mary Stead (1), Beniamin Bryan (2), James Sevan (1), John Stinson (1), Peter Kinge (1), John Phillipps (1); (not chargeable)—James Thomas (1), Wm Bevan (1), Elizabeth Higgins (1), Thomas Greenly (1), Richard Powell (1), Wm Glover (1), Sibili Greenley (1), Thomas Davis (1), Edward Greenly (1), Thomas Godwyn (1), Richard Phillipps—, Wm Tuder (1), John Bevan (1), Robert Morris (1), Thomas Parker (1); (charge able hearths 58).

46. Anne Hunt was assessed to the Subs. 1663 on lands of £3 (on 1 May).

47. Of Ashley and of Bircher; will proved 1671 (PCC).

48. This estate was the subject of a marriage settlement in 1656; Hereford City Lib., Local Collection. Subs. 1663 (lands £2).

49. Of Stansbach; will proved 1672 (Hereford).

50. Subs. 1663 (lands £2); HT 1664 (4).

51. Subs. 1663 (lands £2).

52. The hearth tax return for Lady Day, 1664, contains: Rodd (chargeable)—Richard Rodd Esq (10), James Rodd (3), Walter Evans (2), John Lyde (1); Nash, (chargeable)—Henry Pyvinch (5), John Lyde (3), Wm Connopp (4), Roger Badland (2), Richard Stead (1), Evan Watkins (2); Brampton, (chargeable)—Francis Owen (5), John Browne (3), Henry Pyvinch (3), Richard Lyde (1), Tamberlaine Passey (1), Thomas Scudamore (2), Peter Lewis (1), Mr Owens mill (1); Rodd, Nash & Brampton, (not chargeable)—Evan Powell (1), John Rees (1), Richard Lewis (1), Ann Thomas (1), Elenor Powell (1), Sibili Powell (1), Margaret Meredith ap John (1), Wm Thomas (1), Edward Woodhouse (1), Wm Trooper (1), Joan Ashley (1), John Clerke (1), David Steephens (1); (chargeable hearths 49 struck through becoming 50).

53. His real estate in 1646 was valued at £80; Loan 29/15, pf. 2. Subs. 1663 (lands £3).

53. For Heads land.

54. For Passey's estate.

56. Possibly Baugh.

57. Subs. 1663 (lands £2).

58. (1610–1694), brother of John Badland of Staunton.

59. Subs. 1663 (lands £2).

60. Subs. 1663 (for Massey's land £2).

61. Vicar of Presteigne from 1660. He gave £20 to the FP 1661 and is there described as rector, although it is likely that he did not recover the rectory until 1664; Lord Rennell of Rodd, Valley on the March (London, 1958), p. 246.Google Scholar

62. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Thomas Cornewall Esq (8), Wm Jones gent (7), John Price gent (7), Thomas Wheeler (3), Richard Gronows (2), Robert Younge (3), Wm Ruston (1), John Hill (2), John Younge (1), Robert Clerke (2), Richard Rodd gent (1), James Ruffe (1), Thomas Younge (2), Wm Pyvynch (1), Edward Hill (2), Richard Hill (1), Thomas Vaughan (1), John Fox (1), Thomas Davis (1), Peter Younge (1); (not chargeable)—none; (chargeable hearths 48).

63. Baron of Burford, lord of the manor of Stapleton; JP q 1660. Subs. 1663 (lands £6). A manorial rentroll of 1681 shows that his rents from Stapleton and Frogstreet were lesst han £13 a year; Shrewsbury Borough Library Deeds 2603.

64. Subs. 1663 (lands £2).

65. Will proved 1669 (Hereford).

66. Yeoman, will proved 1682 (Hereford), inventory £118.

67. Yeoman, brother of Edward, will proved 1669 (Hereford).

68. Will proved 1666 (PCC).

69. HT 1664 (3).

70. HT 1664(3).

71. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Thomas Traunter gent. (7), Andrew Greenley gent. (5), John Knight jun (6), Wm Passey (5), Wm Scandrett (4), John Greyms (3), Edward Greenous (3), Richard Hill (3), Wm Wolfe (1), John Watkins (3), Wm Rodd (2), Anne Passy (1), John Davis (2), Walter Higgins (1), Wm Griffitts (1), Mary Byrd (1), Mary Godwyn (1), Evan Powell (1), Symon Higgins (1), Phillipp Davies (1), John Deykes (1), Wm Greenly (2), John Williams (1), Thomas Foxall (1), George Llewellyn (2), Rice Evans (1), Jenkin Lewis (1), Richard Greenley (1), John Angell (l); (not chargeable)—none; (chargeable hearths 63).

72. Subs. 1663 (lands £2).

73. Subs. 1663 (lands £2).

74. Subs. 1663 (lands £2).

75. Buried 20 Aug. 1665.

76. Thomas Parris alias Pace, administration granted 19 Oct. 1665 (Hereford).

77. Buried 18 May 1665.

78. Titley manor extended over the eastern part of the parish; it had belonged to Winchester College since the early 15th century; Winchester College MSS.

79. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Thomas Blayney Esq (8), Richard Greenhouse (6), Wm Price (1), James Woodhouse (3), Ralph Tippins (2), Roger Derand (1), — Hunt widow (1), Wm Davis (1), Phillipp Hew (1), Henry Brians (I), James Price (1), Anthony Harris jun (1), Bridget Tyler widow (1), John Smith (1), John Duppa (1), Wm Sims (1), Anthony Harris sen (1), James Starr (2), Anthony Tippins (1), Richard Mason (1), Robert Yabins (1), Luke Hanford (1), Thomas Wheeler (4), John Derand (2), Richard Derand (1); (not chargeable)—Johan Jenkins (1), Sibili Walton (1), Stephen Meredith (1), Elenor Edwards (1), Richard Price (1), Margaret Harris (1), John Phillipps (1), Joshuah Davis (1); (chargeable hearths 45).

80. Lord of Kinsham manor; in 1681 his rents therefrom totalled £1; Shrewsbury Borough Library Deeds 2603.

81. JP 1660; FP 1661 (£6 13s 4d paid); Subs. 1663 (lands £2). Buried 10 Jan. 1666/7.

82. Buried 6 Dec. 1663; will proved 11 Mar. 1663/4 (PCC); he owned land in Kinsham, Mowley and in Worcestershire and Warwickshire.

83. Subs. 1663 (goods £3).

84. Subs. 1663 (lands £2).

85. clerk.

86. Subs. 1663 (lands £2).

87. HT 1664 (6).

88. Sheriff 1649; custos rotulorum 1655; S.P. 18/95/72 (ii). FP 1661 (£10 unpaid); Subs. 1663 (lands £4); HT 1664 (8).

89. HT 1664 (7).

90. HT 1664 (7).

91. With Richard Hopkins he was charged to the Subs. 1663 on lands of £3.

92. The hearth tax return for Lady Day, 1664, contains: (chargeable)—Charles Vaughan (3), John Vaughan (4), Roger Presser (3), Thomas Childe (3), Edward Legge (2), Richard Millichopp (5), Edmund Hacklett (3), John Powell (2), Wm Paine (1), Wm Gittins (2), Owen Powell (3), John Woodhouse (1), Peter Hill (3), Thomas Davis (2), Walter Powell (2); (not chargeable)—David Prees (1), Henry Kedward (1), Lucy Davies widow (1), Alice Griffiths (1), John Higgs (1); (chargeable hearths 39).

93. Elizabeth Vaughan of Stocking, Subs. 1663 (lands £1).

94. Subs. 1663 (lands £2).

95. Subs. 1663 (goods £3).

96. Anne Weaver, Subs. 1663 (lands £3). Robert Weaver Esq bore the largest charge to the HT 1664 (8).

97. Chief constable of Wigmore, 1663; Loan 29/49, pf. 4, no. 69/15.