On June 25, 2003, the Federal Energy Regulatory Commission (FERC) revoked Enron's market-based rate authority—effectively its license to trade wholesale energy—ruling that the company's Oregon-based West Power division had manipulated neighboring California's wholesale electricity markets via various “gaming” practices.Footnote 1 As a consequence, Enron was found to have severely disrupted energy markets through the western states, contributing to a prolonged shortage of electricity supply that would ultimately become known as the California energy crisis. Five years previously, California had dramatically reconfigured its energy supply industry, splitting up the large monopoly utilities and creating markets for electricity to be traded between various participants. The move was the first of its kind within the United States, following widespread liberalization of other regulated industries like natural gas, and the system initially performed well following its inception in 1998. However, by the spring of 2000, supply problems began to appear, leading to sharp rises in the cost of wholesale electricity.Footnote 2 These problems would escalate dramatically over the following year, resulting in rolling blackouts across the state, multiple regulatory interventions, and ruinously high energy prices for both the state's citizens and its utility companies.

While similar practices were found elsewhere, Enron's manipulation of California's markets was particularly extreme.Footnote 3 Specifically, Enron's traders used their knowledge of the newly designed markets to artificially increase or decrease wholesale prices in their favor, which often involved submitting false supply-and-demand information, withholding available electricity, or scheduling energy they did not have. They also made use of flaws in the market's new computerized scheduling system, for instance, deliberately overloading parts of the grid to then receive payments for relieving it. Additionally, the FERC found that Enron had entered into undisclosed partnerships with numerous market participants, which allowed it to control energy scheduling and physical infrastructure. Not only did these actions exacerbate the state's high energy prices and supply issues, but they directly violated Enron's market-based rate authority and also contravened numerous rules set out in the protocols designed to govern the new system.Footnote 4 Perhaps most significantly, they led to the criminal guilty pleas of three of West Power's most senior traders: Timothy Belden, John Forney, and Jeffery Richter, who were convicted of intention to commit wire fraud. Belden's plea agreement acknowledged that “as a result of these false schedules, we were able to manipulate prices in certain markets, arbitrage price differences between the markets, obtain ‘congestion management’ payments in excess of what we would have received with accurate schedules, and receive prices for electricity above price caps.”Footnote 5

In this article, we engage with the organizational corruption literature as a specific theoretical basis for better understanding Enron's practices and involvement in the California energy crisis.Footnote 6 Corruption represents a misuse of one's position for personal or collective gain, and within a corporate context such behaviors tend to manifest as illicit transactions (e.g., bribery), agreements (e.g., price-fixing), deception (e.g., misleading investors), or manipulative practices (e.g., market abuse).Footnote 7 While the underlying social and economic causes of corruption have been extensively theorized, in-depth empirical investigations are less common, in part because of the challenges surrounding its observation. Accordingly, we have a fairly good idea about what makes organizations commit corrupt acts (often as a persistent and routine organizational practice), but we know relatively little about how corruption is conceived, managed, and coordinated over time. By extension, the role that outside organizations play is particularly unclear.Footnote 8 Clearly, acts like bribery or price-fixing involve external parties, but it is also conceivable that other forms of corruption extend beyond the context of a single organization. Given these gaps, as well as the regular calls for more empirical elaboration of the phenomena surrounding corruption, we provide a historical account of Enron's manipulation that is analytically structured around the elaboration of corruption as an organizational phenomenon.Footnote 9

As a concept, corruption is distinct from criminality or illegality, which depend on factors such as geographically specific laws, an appetite to prosecute or litigate, and a particular judicial interpretation. While corruption often involves the breaking of laws, it can also extend beyond the technically illegal to include wrongful activities that are judged to transgress broader social norms.Footnote 10 This is an important historical consideration, with legal proceedings subject to social, financial, and political conditions, as well as the evidence available at the time. Moreover, convictions for occupational crimes are comparatively rare, even when such behaviors were clearly widespread, because those behaviors often occupy an ambiguous space between ethically questionable and actively illegal.Footnote 11 Nonetheless, it has been widely recognized that Enron's actions in California deviated from acceptable social norms, both as a matter of ethical standard and as a point of law.Footnote 12 Thus, ours is an established case of wrongdoing, which offers an entry point from which to explore how organizational corruption was enacted over time within an organizational division and through its relationship to other market participants.

Our analysis of these activities offers several contributions, the first of which is to add historical insight into Enron's history. Because Enron is notorious for the extraordinary accountancy scandal that emerged in late 2001, its involvement in the 2000–2001 energy crisis has been somewhat overshadowed. Thus, focus has fallen primarily on its Houston-based executives and the firm's wider political and cultural significance. For instance, Malcolm Salter shows how its leadership created conditions that embedded self-interested behaviors and compromised the judgments of those faced with ethically uncertain decisions.Footnote 13 Similarly, Gavin Benke uses Enron as a lens through which to explore broader trends of neoliberalism and globalization, underscoring that “two separate debacles in 2000 and 2001—the California energy crisis and the revelation of accounting fraud—transformed the company into a symbol for all the ills of the deregulation.”Footnote 14

The history we present also contributes to the literature on organizational corruption, constituting a historically informed theoretical narrative with both historical veracity and conceptual rigor (what Mairi Maclean, Charles Harvey, and Stewart Clegg call “dual integrity”).Footnote 15 Empirically, we add insight into the workings of a corrupt organization and how corrupt practices evolve over time, something a historical approach is uniquely placed to provide. In particular, we show the extent to which normalized corruption can be embedded within interorganizational processes and the adaptation of these practices in the face of increased public and organizational scrutiny. Conceptually, we develop the particular nature of Enron's corruption, which, while orchestrated by Enron as the primary actor, nevertheless was facilitated by a network of partner firms around Enron and could not have taken place without the active involvement of these network partners.Footnote 16 We label this “network-enabled corruption,” a type of corruption in which a dominant organization (in this case, Enron) coordinates with a network of partner organizations to achieve illicit ends. This accounts for situations where corruption is primarily organized and enacted by a single organization but sustained by other organizations that are a removed, but nonetheless vital, component. Interorganizational corruption in this form is less likely to be seen horizontally among collusive competitors and, as in our case, can exist within ostensibly legitimate market relations of service provider and client.Footnote 17 Similarly, it differs from other notions of networked corruption, which revolve around illicit transactional activities like bribery or rent-seeking, generally between private and public actors.Footnote 18 Thus, our narrative presents a materially different way of looking at corruption as an interorganizational phenomenon.

In addition to its historical and theoretical contributions, this article also holds methodological novelty. That is, we demonstrate how digital-era primary sources can provide an unprecedented view into the workings of a historically important organization and how they can elaborate usually hidden or underrepresented historical events.Footnote 19 For business historians in particular, the growing importance of digital sources is particularly clear, as great swaths of organizational record-keeping and communication practice migrated to digital platforms from the mid-1990s onwards.Footnote 20 Indeed, it is quite conceivable that to fully understand historically important events like the emergence of the dot-com economy or the 2007 final crisis, historians will need to engage with these so-called born-digital sources.Footnote 21

Organizational Corruption

While corruption often represents an abuse of publicly mandated authority—necessitating the involvement of a legislative or executive office—the concept is relevant to a broad collection of social contexts.Footnote 22 Indeed, the conceptualization of wrongful organizational activities as corrupt has gained significant prominence, embodying what Blake Ashforth and colleagues refer to as “the illicit use of one's position of power for perceived personal or collective gain.”Footnote 23 Thus, while lawfulness is often an important consideration in cases of corruption, it is not a defining criterion, as is the case with white-collar crime, corporate fraud, or other related terms.Footnote 24 Instead, corruption focuses on the underlying social phenomena behind such activities, in that they deviate from accepted social norms, involve the misappropriation of entrusted position, and are enacted with a view to some form of undue benefit. Within an organizational context, actors leverage corruption either for the benefit of their organization at the expense of stakeholders or for themselves at the expense of their organization. We focus here on corruption as the former, focusing on wrongdoing that is collectively practiced and primarily enacted for organizational gain.Footnote 25

Such behaviors have been seen as endemic within the late twentieth and early twenty-first centuries, aided by the emergence of increasingly ambiguous (de)regulation and a push for entrepreneurial innovation more generally.Footnote 26 However, there is plenty of historical precedence.Footnote 27 Within the early energy supply industry itself, the creation (and subsequent collapse) of the industry's utility holding companies was a significant contributor to the Great Depression, disintegrating the corporate empires of energy tycoons like Samuel Insull.Footnote 28 While not themselves illegal, their unregulated expansion became a context for widespread investor speculation, market manipulation, and embezzlement. Insull himself famously convinced the criminal courts that his actions, though flawed, were ultimately honest; others, like Howard Hopson of Associated Gas & Electric Co., were found to have committed numerous offenses, including mail fraud, conspiracy, and unlawful profitmaking.Footnote 29 As Edwin Sutherland's analysis of Associated Gas & Electric and fourteen other utilities shows, such cases were far from aberrations, with acts of collusion, financial misrepresentation, and misappropriation rife among the industry's executive elite.Footnote 30 Indeed, Sutherland's work on “white-collar crime” broke new ground, challenging the assumption that pervasive criminality was the preserve of the lower classes and their circumstances and showing that the well-to-do were more than capable of committing serious crimes, particularly through their organizational positions.Footnote 31 Though subsequently criticized for overfocusing on the offender (over the offense), his work made forensically clear the prevalence, severity, and social cost of wrongdoing in organizational and economic contexts.Footnote 32

While Sutherland's work centered around relatively senior executives, corruption within organizations often transcends villainized individuals like Hopson, permeating throughout an organization's structure and hierarchy. John Brooks's analysis of price-fixing between General Electric and other postwar heavy electrical equipment manufacturers illustrates that wrongdoing, even when expressly prohibited, can become a widespread and implicitly accepted practice.Footnote 33 Organizational corruption research highlights the importance of organizational characteristics and conditions (e.g., competition, resource scarcity) that coerce or facilitate a decision to act wrongfully.Footnote 34 While this is suggestive of a rational calculation of risk and return, such assessments—if consciously made at all—are invariably bounded by the incomplete information available to actors, along with their own cognitive limitations. Nonetheless, where structural conditions present the potential for reward (or forfeiture), they can create a criminogenic environment, which encourages or even compels misconduct. This was seen within the U.S. savings and loan industry, when regulations governing thrift institutions were relaxed, precipitating widespread fraudulent behavior.Footnote 35 Similarly, globalization and the neoliberal turn toward deregulation since the 1980s are often lamented for their catalytic effects on levels of corporate illegality and corruption.Footnote 36 Here, as with the 1929 stock market crash, a focus on financial innovation and global competitiveness was seen to blur accepted business norms and heightened expectations for extraordinary performance.Footnote 37

Within organizations, systemic characteristics such as culture, leadership, and incentives can facilitate corruption, encouraging and ultimately embedding it as an acceptable means to goal attainment. The process by which corrupt behaviors are normalized further shows how the mindful action of a limited few can become increasingly mindless and widespread as they are incorporated within an organization's structures and processes.Footnote 38 Even in cases where wrongdoers are aware of the transgressive nature of their actions, they often use alternative interpretations to rationalize them, reframing dissonant information in line with a self-deceptive but morally tolerable explanation.Footnote 39 Incumbent perpetrators also use rationalizations rhetorically to socialize newcomers into the group's particularistic world view. While these theories provide valuable interpretations of corruption as an organizational phenomenon, they generally focus on what engenders and maintains a willingness to act corruptly. In contrast, the practice of corruption remains largely hidden behind its clandestine nature, and we still need to empirically elaborate how it is actually incorporated and maintained within discrete organizational and industry contexts.

Furthermore, corruption as an interorganizational phenomenon remains particularly underexplored.Footnote 40 Beyond inherently interorganizational collusion like price-fixing, a wealth of evidence shows that criminal and unethical organizational practices often include actors from outside a single organization. For instance, analysis of the U.S. automobile industry shows that manufacturers were complicit in the illegality of their franchise dealers, incentivizing illicit sales practices by exerting superior market power.Footnote 41 Similarly, when Wall Street trader Dennis Levine embarked on an episode of sustained insider trading, it was a carefully maintained network of external co-conspirators that provided the information material to his scheme.Footnote 42 While interorganizational, the level of active collaboration in these cases remains relatively low, with incidents of corruption still occurring largely within discrete organizational settings. However, some industries—particularly those involving network technologies like electricity—necessitate far greater levels of interdependence between market participants, which in turn affects how organizations navigate institutional arrangements.Footnote 43 Where such settings are conducive to corrupt means, they present a highly relevant context from which to understand structural boundaries of corruption as a collective operational practice. This is the case for Enron.

Digital Sources

As highlighted recently by Armando Castro, Nelson Phillips, and Shaz Ansari, corruption presents a serious methodological challenge to management scholars, as the contexts in which it occurs are invariably clandestine and thus difficult to study directly.Footnote 44 We believe that historical approaches can add significant value as an alternative to the social-scientific methods that predominate this area. Indeed, business historians are well positioned to contribute to wider debates in the study of wrongdoing, as has already been seen in related areas like fraud and white-collar crime.Footnote 45 For such phenomena, the selection of a case or contextual setting is invariably in the past and events are often difficult to fully appreciate without sufficient hindsight.Footnote 46 Moreover, information released during subsequent judicial proceedings are often valued by those seeking to piece together and illuminate otherwise hidden aspects of organizational events and actions. These traces of the past often take the form of retrospective inquiry reports and judgments or submitted evidence like company records or social correspondence—materials highly suited to critical source analysis. Despite this, explicitly historical studies on organizational corruption are rare, and we suggest that a more historically cognizant treatment of organizational corruption has the potential to add significant empirical and theoretical understanding.

In this regard, more recent historical periods offer particularly rich opportunities for insight, as digital technologies such as personal computers and the Internet have changed the nature of those traces left behind. We use a uniquely rich collection of digital historical sources to empirically elaborate historical events in ways that would not have been otherwise possible.Footnote 47 This is because digital technologies preserve organizational life in ways that analog equivalents do not. In particular, communication technologies are very good at capturing the ephemera of daily life from varied organizational contexts, as compared with correspondence of high-level managers and executives who are more typically represented in traditional archives. For us, this provided a view that included both junior and senior divisional employees, as well as their day-to-day interactions, many of which were too fleeting to have survived as traditional historical sources. Such insights are of particular value to understanding wrongful behaviors, which are usually pieced together from trial proceedings rather than fly-on-the-wall views into their actual enactment.Footnote 48 In this sense, our research is illustrative of both the “digital shift” emerging within historical research generally and the specific affordances such sources offer to researching otherwise hidden organizational phenomena.Footnote 49

The sources we used were accessed primarily via the FERC's e-library (https://www.ferc.gov/ferc-online/elibrary), which provides online access to its public collection of regulatory proceedings and related records. In particular, we made use of telephone transcriptions relating to 380 time-stamped trading-floor calls. Obtained from Digital Audio Tape (DAT) recordings from each of Enron's trading desks, these capture the traders’ daily telephone interactions with various relevant parties, including colleagues, competitors, customers, and regulatory representatives.Footnote 50 The original recordings were created and used internally by Enron, primarily as means of recording oral offers and acceptances, but they were seized under federal subpoena, whereupon calls relevant to the case were transcribed and made public by the FERC. As a geographically dispersed and time-sensitive task, the trading and scheduling of wholesale energy relied heavily on telephone conversations, even more than alternative forms of digital communication like email. As such, these records offer an essential view into how managers at Enron organized corruption, both internally throughout the division and its hierarchy and with its partner organizations. Because only the tapes most relevant to the case were transcribed, the conversations made public are a relatively small sample of those originally obtained.Footnote 51 Nonetheless, they give a highly relevant sample of corruption-related interaction, centering around Enron's manipulation of California energy markets and the key events in the energy crisis.Footnote 52

We complement these sources with other company documents filed during the FERC's investigation, including memos, meeting minutes, and other stand-alone items of correspondence. These were generally digitized reproductions of printed documents that were submitted individually for their specific relevance to a particular legal assertion. We also used legal documents such as legal briefs and the testimony of expert witnesses, which provided an additional appreciation of the historical context and the various sources available within the elibrary. Additionally, we draw on a data set of Enron's emails, publicly released by the FERC in the fallout from the company's failure.Footnote 53 Unlike the other sources we use, the emails were published as a corpus for public and historical interest, not individually based on specific legal arguments. As such they represent a large, un-curated data set (over 500,000 emails from 150 accounts), and we limited our focus to accounts relevant to the Portland trading office.Footnote 54 Together, these company records represent important additional sources, adding details about the case and allowing us to better contextualize the often technical and partial nature of the surviving telephone correspondence.

In addition to the above primary sources, we also make use of summary reports and decisions that together concluded the various legal proceedings into California's energy crisis. While these provide valuable insight, they carry limitations as a source of historical record. For one, legal decisions are relatively atemporal, being structured around specific legal issues and only considering temporality when relevant to the case. This makes past actions and events difficult to understand without reinterpreting and reordering their findings with a view to historical knowledge creation. Additionally, as there were various proceedings relevant to this case, the understanding they provide is very dispersed. In this sense, reading a single report—even the FERC's final report—provides only a partial and relatively specific picture of the crisis and the action that contributed to it.Footnote 55 Moreover, these decisions themselves rely heavily on related briefs, exhibits, and testimonials to contextualize the summary discussion. Without synthesizing this body of supporting legal material, a full appreciation of the case would be extremely hard to achieve. Judicial process is also necessarily bound by a duty to determine legally relevant facts and apply the law. These circumstances mean that while Enron's involvement in California's energy markets has been heavily investigated as a point of legal interest, the historical and conceptual importance of this case remains largely hidden.

Enron and California's Energy Supply Reforms

The energy company Enron was formed by the merger of Houston Natural Gas and Omaha-based InterNorth in 1985, under the leadership of the former's CEO, Ken Lay. The new entity constituted a major player within the natural gas industry, controlling the largest system of transmission pipelines in North America.Footnote 56 Lay was a vocal advocate of free markets, and this quickly became a core aspect of Enron's public identity and its justification for liberalization within the energy industry.Footnote 57 Thus, when natural gas was deregulated in the late 1980s, Enron looked to capitalize. The company worked with then McKinsey consultant Jeffrey Skilling to develop a new, commodity-based form of natural gas trading, pitched as a “gas bank.” Skilling believed gas should be traded through a mediating partner rather than directly between buyer and seller, as was then the case.Footnote 58 Enron would continue to push the envelope of financial innovation, persuading the energy sector to embrace ever-greater levels of commoditization and financial service provision.Footnote 59

In 1990, Skilling left McKinsey to head up Enron's financial services division.Footnote 60 His experience in banking and finance influenced his commoditized vision of income generation, and he soon turned the gas bank into a success, solidifying his position within the firm.Footnote 61 Over the next few years, Skilling continued to champion financialization, introducing a variety of energy-related financial services and placing Enron as an interface between buyers and sellers of commoditized energy products.Footnote 62 Such activity was a stark contrast to the firm's historic focus on heavy assets like pipelines and power plants. However, with Skilling's success, the company increasingly resembled the organizations found on Wall Street rather than the gas company of its past. While the dynamic and innovative face of Enron sought to naturalize extraordinary growth, increasingly deceptive accounting practices—including the hiding of debt in complex subsidiary structures and the forward booking of unrealized profits—were concealing a troubling financial reality.

By 1997, Enron had gone from a significant, if globally obscure, natural gas company to an organizational phenomenon with substantial visibility and political sway. Young, aspirational, and bright graduates wanted to work for the company that promoted the importance of brains above age or experience.Footnote 63 Furthermore, its political presence as an advocate of deregulation was substantial, helped in no small way by Lay's connections to Washington.Footnote 64 Despite significant diversification, much of Enron's focus remained based in the energy sector; it was here that the firm directed its deregulation advocacy, seeing electricity markets as the greatest opportunity for new profit streams.Footnote 65 As political appetites increasingly aligned with Enron, government and industry alike looked with ever-increasing optimism to the role of competitive markets within the electricity supply.

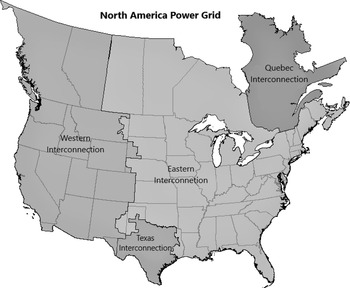

The distribution of the electricity supply to consumers (or ratepayers) relies on two key physical components: generation, or the ability to produce electricity; and transmission, or the capacity to transfer large amounts of it to its point of distribution. As excessive quantities of surplus electricity cannot be stored, it has the potential to overload system infrastructure. Conversely, too little energy will necessitate the limiting of voltage (brownouts) or the total absence of supply (blackouts). Thus, a precise balance between generated supply and electricity demand is needed, and it is achieved through scheduling: the advance planning of a base-level of generation, anticipating availability and demand at a given point in time (twenty-four hours ahead). If necessary, schedules are adjusted closer to the time of transmission (day-of or hour-ahead) and in some cases reserves might be called on to negate any unexpected shortfall.Footnote 66 Care must also be taken not to congest transmission lines by scheduling too much energy through particular paths. Using this combination of planning and redundancy, electricity can be reliably delivered to ratepayers while avoiding the risks of overgenerating.

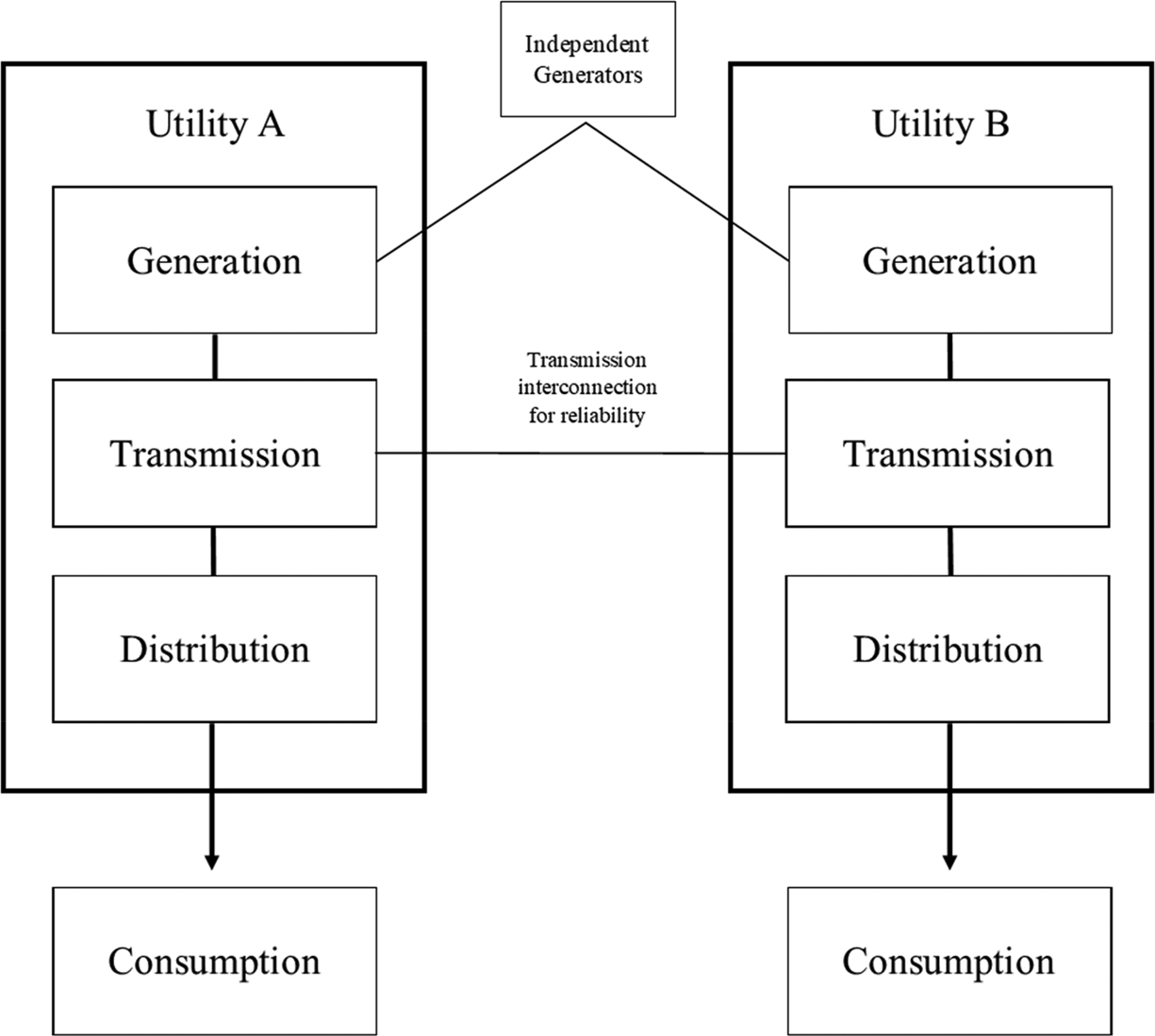

Energy supply, like other core public service industries, has long been at the heart of contestation over government's role in the intervention and regulation of business. In California (as in other U.S. states) the pre-1998 grid was made up of vertically integrated utility companies that supplied captive consumers in a geographic area, predominantly using their own generation and transmission infrastructure (Figure 1).Footnote 67 This arrangement—established in New Deal movements toward institutional economic policy—encouraged the naturally monopolistic tendencies of networked technologies, leaving utilities to internally coordinate the interdependent functions required for a reliable and safe electricity service.Footnote 68 Nonetheless, no one utility exists in isolation. Rather, they are connected directly to others as a regional system (or interconnection), which is itself then connected to other interconnections. Thus, California is a single, if substantial, area within the Western Interconnection, which is itself part of the North American grid. From their position within this macrogrid, California's utilities could undertake limited import and export arrangements and mitigate potential reliability issues (Figure 2).

Figure 1. Representation of pre-reform energy supply. (Source: Christopher Weare, The California Electricity Crisis: Causes and Policy Options [San Francisco, 2003], 11.)

Figure 2. Map of North American energy interconnections. (Source: Image adapted, with permission, from the Western Electricity Coordinating Council [WECC], https://www.wecc.org/epubs/StateOfTheInterconnection/Pages/The-Bulk-Power-System.aspx.)

Though the integrated utility structure had endured, global events and the economic realities of capital-intensive infrastructure projects had blurred this framework over time. Specifically, legislation in the late 1970s encouraged independent, private generation, which was then sold to utilities through generous long-term contracts.Footnote 69 By the late 1980s, the cost of maintaining both these contracts and their own generation infrastructure was contributing to higher operating costs for utilities and Californians were paying more for their electricity than consumers in any other state. Moreover, as independent (nonintegrated) generation was prevalent within the grid, many questioned whether vertical integration was still required.Footnote 70 This added weight to the arguments of those who believed government's presence in industries like energy was stifling innovation and impeding competitiveness. In line with broader political trends of the time (and encouragement by companies like Enron), regulators widely agreed that integrating competition would address many of their issues. Such initiatives had already been initiated elsewhere, for instance, in the United Kingdom, where a mandatory wholesale “pool” market had been implemented in the early 1990s.Footnote 71 Thus, on September 23, 1996, the state agreed to restructure its electricity system, setting in motion a radical departure from the predominating vertically integrated supply model (Figure 3).Footnote 72

Figure 3. Representation of post-reform energy supply. (Source: Christopher Weare, The California Electricity Crisis: Causes and Policy Options [San Francisco, 2003], 11.)

Though widely referred to as deregulation, this process did not represent the wholesale adoption of market forces. Instead, the regulatory framework governing energy was substantively reconfigured, introducing competitive elements to an otherwise regulated system.Footnote 73 Specifically, the bill required utilities to sell and purchase power on a newly created spot market, the Power Exchange (PX), rather than generating for their own demand. It also curtailed their ability to enter bilateral contracts with independent generators, making the PX the main mechanism of domestic and interstate market exchange. To manage the physical delivery of electricity, the California Independent Systems Operator (ISO) was created to manage statewide transmission and held responsibility for contingency and adjustment administration. As such, the ISO would receive the PX's market information, ensuring enough power was available. If transmission lines were congested, its automated computer system would set artificial price adjustments to incentivize the required change in scheduled flow. Finally, caps were introduced to reduce consumer rates by 10 percent, freezing them for a four-year transition period and ensuring the public saw an immediate positive outcome from the reforms.Footnote 74

An Illicit Path to Profit

Throughout the 1990s Enron had increasingly developed an aggressive performance focus, and with profits from natural gas waning, the firm looked to electricity to sustain its profitability.Footnote 75 To this end, Enron acquired Portland General Electric (PGE) in July 1997, providing a route into the Western Interconnection and California's new markets.Footnote 76 The state's reforms were the culmination of a sustained public relations campaign by Enron, and its executives were naturally eager to capitalize on these efforts, seeing an opportunity to leverage Enron's knowledge of financial markets and trading in an untapped market.Footnote 77 To this end, the goals for the acquisition were closely tied to its interest in energy deregulation and an ethical climate that valued profit maximization in an increasingly competitive business environment. This entry point would encourage the initial interrogation of California's new regulations for weakness and provide the initial grounding for gaming as an acceptable trading practice.

Following the acquisition, Enron created the West Power division, locating it in the same building as PGE in Portland. This new division's role was to buy and sell wholesale electricity and manage trading activities for other parties.Footnote 78 As its senior traders worked to understand the complex new systems, it became clear that the rules and protocols California had devised contained flaws, offering potentially profitable opportunities to anyone with the knowledge and inclination to use them. While Enron was by no means the only company interested in leveraging the new regulations, its distinctive presence as a financial entity and an unambiguous prioritization of profit encouraged a particularly unsympathetic pursuit of their variabilities.Footnote 79 To this end, the division's leaders would begin to analyze the rules and, by late 1997, start actively exploring the market's exploitable weaknesses with a view to generating operational income in the process.Footnote 80

At this time, Enron was approached by others keen to exploit such “loopholes.” Among them was George Backus, a consultant associated with Perot Systems, the information technology provider that had designed California's new automated market protocols.Footnote 81 In designing these protocols for both the ISO and PX computer systems, Perot Systems had amassed a substantial working knowledge of the new markets’ features, limitations, and flaws.Footnote 82 Using this knowledge, Backus promoted his consultancy services, offering market participants a privileged view into the new regulatory landscape within which they would operate. A fax sent by Backus to utility companies highlights the extent to which these opportunities for profit were morally complicated, noting, “There may be ethical issues related to ‘the end justifying the means’ but there is a large region of opportunities between what is ethically viable (profitable) and ethically dangerous (illegal).”Footnote 83 Though he also suggested they “destroy [the fax] or black out selected sections after you have read it,” his endeavors did not go unnoticed for long. In October, the head of the ISO chastised Perot Systems not only for its “violations of basic norms of business ethics” and “bad faith dealing” but also for having risked “seriously eroding the integrity of the California market system.”Footnote 84

Despite this, Backus and his team continued to offer services based on this information to various market participants, including Enron's West Power traders. A presentation entitled “Profit Maximization under U.K. and U.S. Deregulation” contained a section on “using California PX/ISO and FERC rules in the best advantage.”Footnote 85 Here, the presenters were quick to naturalize such activity, arguing that “market distortions are inevitable” and “distortions ‘force’ gaming to ‘clear’ the market.” In contradiction, however, “gaming” (i.e., taking unfair advantage of the rules and procedures) was explicitly prohibited by the new markets’ rules.Footnote 86 Nonetheless, the presentation went on to identify ways that various automated protocols would behave in different market conditions and the best tactics for capitalizing on them. Among those in attendance was the then director of Enron's California trading desk, Tim Belden. His handwritten notes on subsequent tutorial handouts allude to his particular interest in these vulnerabilities.Footnote 87

In the months that followed, the division's senior traders remained in contact with the consultants, clarifying details and further developing their understanding of market vulnerabilities.Footnote 88 Belden remained convinced of their value, and in an email to a superior reflecting on his personal performance, he was explicit in seeing gaming as a core aspect of Enron's trading strategy: “California gaming—we always say that we need to increase this activity but we never do. Need to work more closely with cash, scheduling, and real time [desks] to maximize opportunities.”Footnote 89

Such activity was still largely exploratory at this time, with occasional internal trading notes highlighting trades as “PHONY,” with the cited goal to “see if we could [successfully deploy the phony trade] and take advantage of buying power at the Ex-Post price.”Footnote 90 They also alluded to the involvement of Enron's clients, with traders seeking case-by-case partnerships to trial particular games. Thus, Enron had entered a period of incremental testing, probing the regulations to find those practices its traders might successfully implement on a larger scale. In addition to providing technical insight, these efforts provided an initial precedence for the integration of gaming practices within the division's operational processes, going so far as to formally document them for review by Enron superiors.Footnote 91

The most notable example of testing occurred in May 1999, when Belden conducted what he would later characterize as a market “experiment.”Footnote 92 On the morning of May 24, Belden bid to supply 2,900 megawatts of power for the next day to the California PX from a Nevada-based generation source. In order to provide this, he scheduled transmission through a small path called Silver Peak. Although theoretically within the ISO's transmission network, Silver Peak was a small capacity line installed solely for the transfer of power from a generator in Nevada through to California. In what one expert witness called a “proof of concept scheme,” Belden had orchestrated a situation whereby only 15 megawatts of the 2,900 megawatts of power the ISO thought it was getting could actually be delivered.Footnote 93 In effect, he had purposefully congested a path, allowing him to observe what happened when the ISO's system intervened to decongest it.

Once submitted to the ISO, Belden's schedule triggered operational procedures that Perot Systems had helped create, and the system automatically set about rebalancing the congested path.Footnote 94 The schedule had also created significant variance between anticipated and actual supply, and this was remedied by increasing out-of-state imports, using reserve power, and reducing demand in the day-ahead market through increased prices. Belden's experiment demonstrated that it was possible to influence prices using California's congestion protocols and to receive payments for relieving purposefully created congestion—in this case, costing Californian ratepayers an estimated $4.6 million to $7.0 million in the process.Footnote 95 However, the episode did not go unnoticed; following a lengthy investigation, the PX concluded that Belden's actions violated its scheduling and control protocols and showed “disregard for [its] primary goal of maintaining efficient and fair markets.”Footnote 96 Enron also conducted its own internal investigation, sending the director of regulatory affairs to interview Belden. In addition to advocating his case, she encouraged him not to report a similar trade he had made in January, lest the PX realize Silver Peak was not an isolated incident.Footnote 97 Enron ultimately settled with the PX for a modest $25,000, which reflected the firm's cooperative attitude during the investigation and the PX's limited regulatory jurisdiction to apply further penalty.Footnote 98

Enron also agreed that such conduct would not be substantially repeated; however, its traders now had much of the information they needed and were already looking to operationalize it through more sustainable means. Belden had not actually tried to hide his actions. Moreover, he did not intend to repeat them, at least not in their current form. Instead, Silver Peak constituted an isolated act, albeit one that would precipitate future normalization of related practices. As such, it was indicative of the relatively isolated, emergent nature of gaming activity within the division at that time. Enron's defense of Belden during Silver Peak had also positively sanctioned such activity, presenting gaming as concordant with the company's wider culture and ethical position. Even if the operational particularities of manipulative energy trading were largely bound within the division, Enron's executives saw the leveraging of California's new system as vital to the company's financial prosperity.

Normalizing Corruption

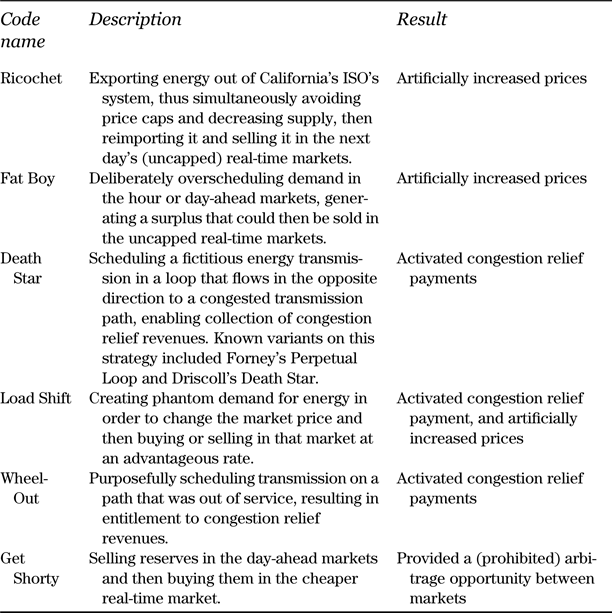

By late 1999, Belden was running the whole West Power division.Footnote 99 Additionally, a trader responsible for a small-scale gaming scheme in Canada, John Lavorato, was now Belden's superior. In Lavorato, Belden had a boss who understood the potential gaming offered and shared similar ethical views on its use.Footnote 100 While experiments like Silver Peak had proved enlightening, they were unsubtle, so traders began incorporating this knowledge into more covert “trading strategies” (Table 1).Footnote 101 These were predefined formulas that exploited vulnerabilities in California's systems while disguising the traders’ true intent. They could be used many times, allowing senior traders to embed and routinize gaming as a widespread, consistent practice within the division. In this way, the end of 1999 saw reports of preliminary success in exploiting the ISO's flawed system. One of the division's traders even cited “gaming California's congestion management system” among his accomplishments, noting that the practice had “captur[ed] significant value in the process.”Footnote 102 During this time such gaming activities were, therefore, increasingly normalized, moving beyond the instigating actors and into the everyday activities of the wider division.

Table 1 Summary of Key Trading Strategies

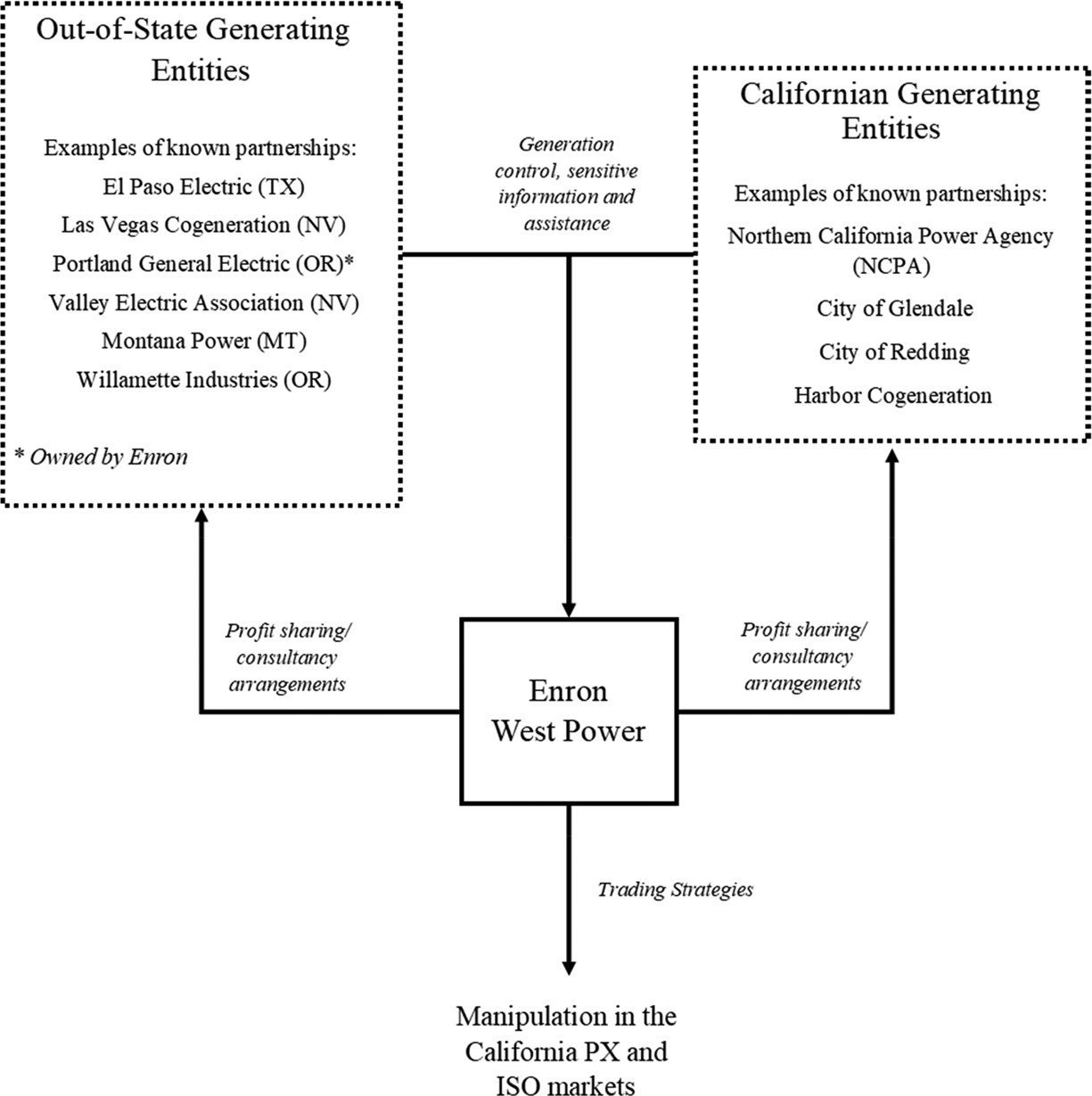

As part of this escalation, traders also began to further embed these manipulative routines into Enron's external service relationships, providing the control of generation and transmission scheduling needed to actually execute their strategies.Footnote 103 For instance, to utilize one particularly effective strategy, known as “Fat Boy,” traders used the control of partners’ generation output and scheduling to misrepresent demand for electricity in the day-ahead market, on the basis that this would give them excess generation to sell in the higher real-time markets.Footnote 104 As such, traders would make regular calls to partners, instructing them to turn units on or off, and on occasion, partners would even contact traders to let them know when they were in a good position to use the strategy.Footnote 105 Thus, cooperative arrangements between Enron and other parties allowed the illusion of normal trading activity, when in reality it was implemented for ulterior reasons. By increasing the division's integration into its partners’ operational activities and decision making, Enron's existing business model provided traders with the means to enact their gaming strategies.Footnote 106 Ultimately, these “consulting arrangements” allowed traders to convert their knowledge of the market's flaws into something they could implement in a discrete and repeatable manner. In return, the partner firms generally received a predefined percentage share of the traders’ returns, benefiting from Enron's superior trading expertise that they themselves lacked.Footnote 107

Despite the openness and regularity with which Enron pursued these relationships, the undisclosed nature of these collaborations breached market rules designed to limit the very market power that they were now providing Enron's traders. One of the earliest and most prominent of these partnerships was Enron's relationship with Texas-based utility El Paso Electric.Footnote 108 Enron had maintained a close relationship with El Paso for several years, and when the opportunity to profit from California materialized, the utility signed on to the traders’ plans.Footnote 109 An example of the sort of arrangement between the two firms can be seen in an email sent by the head of real-time trading, John Forney, to staff in early February 2000, when he reports a new arrangement for the “Wheel Out” strategy:

We have struck a deal with El Paso where we buy from them PV [Palo Verde] and sell to them 4C [Four Corners] for a $10 spread. They don't flow any power because they have the rights at both points, and they collect a check—no risk to them. . . . Today, we have been paid in the mid-forties to relieve congestion. With approx. $4 of expenses, we make $31 no risk margin.Footnote 110

Accordingly, by working with companies like El Paso, traders could create an apparently legitimate schedule, the sole purpose of which was to trigger congestion relief payments.Footnote 111 Enron also ran a large proportion of El Paso's scheduling activity, providing control of generation and privileged information, which it used to affect levels of energy available to the Californian markets. It was the success of this early relationship with El Paso that would ultimately inform the development of a wider network of partners, serving “as a model for many of Enron's other relationships.”Footnote 112 Traders also leveraged Enron's ownership of PGE, contravening the requirement to remain operationally distinct from the acquired utility and controlling large portions of its operations instead. Through these means, a network of facilitative organizations began to emerge, with each affiliated firm embedded in the actions of Enron as a dominant corrupt organization.Footnote 113 Thus, as Figure 4 illustrates, by leveraging partners’ physical assets, information, and assistance, West Power traders were able to pursue profit for Enron and its partners, via collectively enabled market manipulation.

Figure 4. Structure of Enron's network of market participants. (Source: FERC, “Initial Decision,” 119 FERC ¶ 63,013 [2007], 18–20, 36-38.)

As traders developed more strategies, they created code names to distinguish them, further embedding their usage in the collective memory and language of the division and its network of partners. While many of the names appear to stem from internal actors (some even naming them eponymously), it is clear that some external actors also used and understood them, even participating in their development. For instance, in April 2000, Forney was in the initial stages of coordinating a new congestion strategy with the Californian utility City of Redding, when he included his counterpart in the naming of their new game, suggesting the now notorious “Death Star.”

John [Forney]: OK what do you want to call this project—we have to have a catchy name for that?

Trader: Project—ah—I was going to say project loop—but I don't want that to go out in the world.

John: How about you know something friendly like Death Star?

Trader: (Laughter) How about reduce the debt—debt star—because we are trying to reduce our debt here. Whenever we make money it reduces our debt.Footnote 114

Consistent with other accounts of collective wrongdoing, such interactions also allude to the excitement that surrounded the new strategies, with code names compounding their novelty.Footnote 115 Others were simply illustrative of their process. In this way, a “Ricochet” involved the rebounding of a scheduled out-of-state energy back into California, simultaneously reducing apparent supply and avoiding the state's price caps. Thus, code names made complicated gaming processes easily identifiable and engaging, helping to embed them into accepted trading activity.

Once arrangements were established for a particular strategy, senior traders used the formal structures to disseminate instructions to traders within the division, who were responsible for much of the day-to-day implementation and coordination with partners. Indeed, trial evidence suggests at least seventy-two of the division's one hundred employees were involved in these strategies, along with as many as thirty generators, who supported Enron and shared in its profits.Footnote 116 Expectations were openly communicated in meetings and reference materials, with the real-time division's service handbook providing detailed instructions for market manipulation, specifying the generation units, transmission paths, and participants to use in the process.Footnote 117 Here, the level to which manipulation had become a routine part of trading is highlighted in the FERC's comments on the use of such handbooks:

If prices in the California market are high, the Enron employee would refer to the handbook section entitled “Who do you call and what action to take?” The Enron employee first decides if the price is high enough to be profitable to the “customer.” If it is profitable, the Enron employee would: “generate or import and fake, or increase, load.” In this situation, the Enron employee could call, for example, Glendale or Valley Electric and instruct them to increase imports into the California ISO control area; the Handbook lists the transmission paths to be used.Footnote 118

The ability to use trading strategies appropriately became an explicitly articulated performance criterion, with an agenda from a staff meeting even referencing formally monitored proficiency tests.Footnote 119 The agenda goes on to update the group on current strategy options and even introduces three new employees (referred to as “players”), illustrating the overt nature of managerial expectation and the speed at which new traders were socialized into the use of corrupt practices.

Once normalized, market manipulation was neither spontaneous nor occasional. A network of actors from multiple organizations had formed around Enron, with the collective aim of exploiting California's regulations. While Enron was the linchpin, its traders’ corruption had clearly moved beyond this single organization, evolving to include a network of corruption-enabling partner organizations.

Rationalizing in Response to Crisis

By spring 2000, senior traders had normalized corruption in the form of gaming throughout the division and its network of partner organizations; however, this normalization was still susceptible to disruption. Before the crisis, traders had deployed their strategies within a relatively uneventful market environment, where minimal price volatility and supply issues had kept electricity in the back of public consciousness. However, from May, the price utilities paid for electricity started to rise significantly, consistently reaching the ISO's wholesale cap of $750/MWh during that month and beyond, into the summer.Footnote 120 While the causes were unclear, new regulations, unseasonable weather conditions, and suspicions of opportunistic behavior by companies such as Enron were variously singled out for blame. At this point, Enron's traders and their network of partners increasingly used rationalizing techniques to account for the unfolding crisis, attempting to portray their acts as acceptable based on certain ideological positions.Footnote 121 For instance, when discussing the situation in California with Belden, his superior notes, “It's just [expletive] unfortunate—we're going to have repercussions of all this stuff, and not necessarily ’cause we do anything wrong. . . . You take this much money out of a market, I think that there's um, you know, they just [expletive] like try to find somethin’.”Footnote 122 Such views followed the pre-crisis logic, underpinning its initial exploration of vulnerabilities—that is, a belief that its actions were a legitimate part of participation in a flawed market. Accordingly, in the same way Backus had argued that gaming was a natural stage in the process of deregulation, trading strategies were an uncomplicated route to profit maximization. Thus, the view prevailed that “if they're going to put in place such a stupid system, it makes sense to try to game it.”Footnote 123 Accordingly, when the system started to fail, this too was added to a collective interpretation of acceptability.

Arguably, the crisis was something of a perfect storm, with multiple factors together creating an exceptional situation.Footnote 124 First, there were several supply and demand issues. Low rainfall contributed to drought conditions in the Northwest, which limited the hydroelectric generation California could import. Coupled with the state's low domestic output, this meant that available generation was lower than in previous years. On the demand side, hot weather increased air-conditioning and refrigeration-based consumption, adding to demand. This compounded an existing trend of demand increase, caused by the state's economic development (particularly Silicon Valley) and greater domestic consumption. These factors significantly contributed to the shortage and, thus, the price increases. The new regulations did not help this situation. The cap on consumer rates had essentially decoupled demand from the cost of supply, and with this, the economic situation became problematic for utilities. Forced to pay a heightened price for wholesale energy, they were unable to pass any of this increase on to ratepayers. In turn, the ratepayer had no financial incentive to use less energy. There was minimal opportunity to reduce the price through economically incentivized demand reductions.

As summer progressed, the economic and infrastructural situation in California deteriorated further. Supply shortages resulted in the first set of rolling blackouts on June 14, representing a significant escalation of the problem for California's citizens.Footnote 125 Ratepayers had been largely protected by the consumer price caps, but intersections without traffic lights, elevator trappings, and forced industry downtime brought the public dependence on reliable power into sharp focus. Additionally, San Diego had left the consumer-rate-cap arrangement early and, with utilities passing high energy prices on to ratepayers, public anger was swelling.Footnote 126 Energy companies were increasingly being suspected of foul play by citizens and politicians alike.Footnote 127 Moreover, Enron was singled out, partly for the company's vocal advocacy for the reforms, but also because it was increasingly seen by many as a self-interested, out-of-state opportunist.Footnote 128

By late summer, the situation in California had deteriorated further, and with ever-increasing wholesale prices and suspicions of foul play, utilities pressed the FERC to investigate whether manipulation had occurred within the new market. Until now, Enron had been happy to support the West Power traders, content that their endeavors were bringing in record earnings. However, the FERC inquiry prompted Enron's risk management team to launch their own investigation into the division's practices, the details of which Houston was largely still unaware. Though their investigation revealed the trader's strategies, code names and all, Enron's lawyers ultimately permitted its traders to continue, albeit with notice that their strategies remained a concern.Footnote 129 In November, the FERC also reported back on its investigation, finding that a combination of supply-and-demand imbalance and flawed market design had caused the “unjust and unreasonable rates for short-term energy.”Footnote 130 Claiming insufficient time and a lack of data, the report failed to substantiate any specific incidents of manipulation, but it acknowledged the opportunity was there and that market data suggested such abuses may have already occurred.Footnote 131 In California the FERC's decision, seen by many as a failure to act on blatant exploitation, was widely criticized.Footnote 132

Despite the report's findings, the crisis continued to create complications for Enron's traders, with some partners becoming increasingly reluctant to engage in the inflammatory gaming activities. This, in turn, frustrated the traders' ability to maximize opportunities effectively, as the use of alliances was key to their trading strategies. As the political risk increased, some could not reconcile the risk of being found complicit in the worsening problems. Such reluctance was particularly strong among Enron's public partners who, irrespective of their own views, feared others might see their actions as unacceptable. In one case, a partner describes the “nasty political situation” that would result for a public agency found to have exported energy out of California, exacerbating the problem while others were trying to solve it.Footnote 133 Thus, rather than failing to rationalize their actions, for some the crisis appeared to tip the balance of political risk and financial reward, making participation more of a liability than an opportunity.

Despite traders’ efforts to encourage continued involvement, the reluctance by some to continue was clearly a frustration as, throughout Enron's network, partners were split on whether to continue.Footnote 134 From an internal perspective, the risks surrounding California came to a head on December 12, when Enron's legal team returned to Portland, where ultimately they ordered the cessation of the traders’ strategies.Footnote 135 At least a partial suspension was subsequently apparent from communications, with some traders seeing the move as a prudent one and others eager for a resumption.Footnote 136 However, this state of inactivity did not last long, and it is clear that manipulation activity resumed just a few weeks later. Indeed, the increased political and legal scrutiny had encouraged Enron's traders and their network of partners to incorporate new, clandestine behaviors into their normalized practice. Again, Enron's traders led the way, encouraging the use of cell phones and chat rooms to avoid monitored official telephone and email channels.Footnote 137

In January 2001, Forney moved to Houston and his colleague Bill Williams was promoted as his successor. At this time, some of the original trading strategies remained suspended, with political risk and market illiquidity issues continuing to limit traders’ use of them.Footnote 138 Despite the risks, Williams was keen to continue the work his predecessor had instigated, noting his desire to “take the shackles off and get after it again.”Footnote 139 However, Forney cautioned Williams that they needed to limit their activity until the crisis had settled, also warning him that personal liability was an increasing issue for them. Accordingly, Enron's focus on actual trading strategies such as the Death Star reduced somewhat, with the company instead working with partners to physically withhold energy from California, increasing prices throughout the western markets in the process.Footnote 140

In California, the financial implications of the crisis were reaching a critical point. The creditworthiness of indebted utilities meant generators were unwilling to sell power to their de facto creditors, the PX and ISO.Footnote 141 While such credit issues were a genuine liability for anyone selling into California, this was not the only reason the state was struggling to acquire energy. By physically withholding energy, market participants were able to maintain high prices within the Western Interconnection, offering continued profit for companies like Enron.Footnote 142 Indeed, such withholding was actively pursued within Enron West Power, with the FERC finding that the division “used its ability to control and withhold large amounts of generation to manipulate the market.”Footnote 143 To do this, it also needed to mitigate the ISO's new federal powers, which allowed the ISO to compel generators to offer electricity supply during shortages.Footnote 144 In this way, Enron's traders encouraged its partners to find increasingly elaborate ways to avoid selling to California.

Such activity was illustrated most prominently when Williams asked a generator, Las Vegas Cogeneration, to “get a little creative . . . and come up with a reason to go down.”Footnote 145 Here, his contact agreed to stop generation for maintenance, meaning a plausible excuse accompanied its withholding of electricity. This allowed Enron to avoid a schedule already committed to California, while the state again was forced to implement emergency procedures. Similarly, on January 19, the ISO used new powers to order Enron to notify it of all its available generation in the whole Western Interconnection. On receiving the order, the trader on duty immediately called numerous colleagues; between them, they constructed a way to minimize the amount of energy they would have to declare.Footnote 146 In this way, market manipulation had escalated from trading strategies that unfairly exploited the rules to actions that actively contravened the federal orders implemented to mitigate the crisis.

It was not until June that a fall in prices gave the first suggestion the crisis was abating, by which time it had already brought about the bankruptcy of both the PX and the major Californian utility Pacific Gas and Electric.Footnote 147 The FERC had extended emergency regulation, requiring all generators in the Western Interconnection to bid available power into California, whether on or off peak. This closed many of the remaining opportunities for interstate manipulation and by the end of summer the prices had returned to pre-crisis levels.Footnote 148 For Enron's traders, the significance of the energy crisis was dramatically eclipsed by the company's bankruptcy and fraud scandal just months later. As the various companies within its network entered a period of lean post-crisis market conditions, Enron was making ever more dramatic headlines. The impact this had on the Portland-based traders was naturally significant, and after months of forced inactivity because of its poor credit rating, the group was largely disbanded before being sold off in the fallout from Enron's bankruptcy.Footnote 149

Conclusion

When California deregulated its energy industry, it materially changed the environment of electricity generation and supply throughout the western states. Not only did it separate the previously integrated processes of generation, transmission, and distribution, but the experimental market structure encouraged the entry of new market participants, who offered their financial expertise to incumbents unused to operating within competitive markets. Among these, Enron's West Power division was found by the FERC to have conceived and exploited various illicit strategies, both manipulating the new markets and contributing to the ensuing crisis.Footnote 150 This article develops an analytically structured history and argues that Enron normalized corruption in the form of market manipulation, developing and maintaining a facilitative network of partner organizations that were used to enable its traders' illicit strategies. Enron's manipulation of the California energy markets thus highlights that some cases of corruption are difficult to understand without considering routine interorganizational involvement as a fundamental component, even when the wrongdoing itself is concentrated around a single corrupt organization.

While it has been assumed that corrupt organizations often require a level of external involvement to enable corrupt behavior, the dynamics of such arrangements have largely been omitted in favor of organization-level analysis.Footnote 151 Our analysis shows how the strategies employed by Enron would not have been feasible without its network of partners, who held structurally different positions from Enron and owned the generation assets that traders needed to execute their strategies. In this way, Enron's use of network-enabled corruption was embedded within the division's core business model, providing financial services to market participants and evolving partnerships over time to increase control of resources beyond the scope of their legitimate market relationship.Footnote 152 Far from discrete and unambiguous rule breaking, this alternative conceptualization of interorganizational corruption shows how such abuses often mutate from the normal pursuit of competitiveness and profitability, and, as our analysis shows, this can extend to include an organization's network of ostensibly legitimate market relations.

While illicit cartels represent an alternative form of interorganizational corruption, these are notably different than the concept we introduce here. Within such networks, scope for collaboration is narrowly focused (on price-fixing) and generally disconnected from legitimate market structures.Footnote 153 As such, price-fixing is generally an intermittent and covert practice—Brooks talks of GE managers periodically going to surreptitious lunches and holding euphemistic discussions with colleagues—that, even when widely practiced and accepted, is generally forbidden officially by the organization(s) involved.Footnote 154 Bribery and rent-seeking relations are similarly unambiguous in their wrongfulness and, also like cartels, involve corruption committed across a network rather than through one dominant organization. In contrast, our case elaborates a form of corruption that closely aligned with normal operational activities, representing illicit means by which multiple organizational commercial interests were directly or indirectly realized. Thus, traders communicated their practices in an uncomplicated and explicit way, even highlighting their gaming achievements and discussing their strategies and partnerships openly. It was only with the worsening energy crisis and the FERC's investigation that their corruption took on a more clandestine form.

In this regard, our analysis of Enron also shows the normalization of corrupt “gaming,” whereby market manipulation became a core component of day-to-day operations and the deliberate pursuit of organizational profit.Footnote 155 While the process of normalization has been described empirically—most notably in Diane Vaughan's ethnographic history of deviance within NASAFootnote 156—detailed analysis of corruption remains largely theoretical. Normalization within Enron and its network emerged from intricate patterns of network interactions that, while not necessarily of individual significance, collectively showed the embedding and routinization of deviant behaviors over time. Sustained inquiry into the psychology of wrongdoing also shows that actors often frame their decisions around self-deceptive rationalizations, which can themselves contribute to the process of normalization.Footnote 157 While this is primarily seen as a cognitive process, the everyday organization of corruption shows how these rationalizations are also developed through the interactions and collectively constructed beliefs and responses of participating individuals.Footnote 158 In this way, the collective interpretation of, and response to, the crisis was mediated through regular informal interaction, and the clandestine norms later instigated by Enron traders provide a key example of the socially organized responses to changing market and regulatory circumstances.

California's reforms clearly provided a facilitative context for corruption, constituting a form of criminogenic environment.Footnote 159 Within Enron, exploitable loopholes directly influenced the strategic direction of the West Power division, with traders working to expose and operationalize these lucrative flaws. For its partners, the reforms markedly changed the nature of energy supply, adding new risks, opportunities, and uncertainty that they addressed through their relationships with Enron. These responses were bound within a fledgling commercial landscape, where ambiguity and emergent norms further compromised ethical decision making.Footnote 160 Though the regulations were breaking new ground in the energy industry, they were also symptomatic of wider trends of the period, and Enron's network of partners illustrates how some chose to navigate these conditions within this particular industry context. Here, understanding the manipulation of California's energy markets requires an appreciation of the integrated nature of both physical and market-based elements of the energy supply industry. Indeed, the network characteristics of energy supply highlights that while individual organizations are often singled out as culprits, the complexity and interconnectedness of some industries can precipitate more cooperative, market-based responses to criminogenic conditions.

Within this article, we combine a conceptual elaboration of organizational corruption with a rich empirical account of what is usually a hidden and difficult-to-observe setting. This historically situated view extends our temporal appreciation of corruption beyond existing theorizing and elaborates how it actually occurs as an organizational and market phenomenon over time. This is significant as corruption is often highly complex in nature, blurring legitimate business practices with abuses of authority and the privileges conferred through participation within a given commercial context. This makes it an important area for business historians to explore further, and extensions such as network-enabled corruption highlight the affordances that historical approaches present to understanding how organizational actors go about exploiting such behaviors over time. In providing our history of Enron and the California energy crisis, we elaborate the day-to-day practices and networks of relationships that enabled a corrupt organization to function and, in doing so, demonstrate how corruption became a normalized and highly integrated part of organizational life.