Details

Section 1 provides an introduction with a motivation for the use of stochastic full balance sheet model.

Section 2 describes the use of firm’s regulatory and economic capital models, how these interact and their key constituent elements.

Section 3 sets out an overview of a full balance sheet model including its interaction and overlap with regulatory and economic capital models.

Section 4 sets out an example model based on annuity liabilities that will be used throughout the paper to demonstrate the techniques discussed.

Section 5 provides an introduction to proxy modelling and importantly, the roll forward techniques used to re-base proxy functions. The annuity example specified in section 4 is used to demonstrate a simple proxy-fitting process.

Section 6 shows how a proxy model can be derived to model changes in a firm’s solvency capital requirement (SCR). Techniques are demonstrated that may be used under either a variance covariance or copula simulation approach.

Section 7 demonstrates techniques that may be used to derive a proxy function to the risk margin (RM) and discusses an approach that may be used for transitional measures.

Section 8 brings together the example fits for the net assets, SCR and RM and uses these to show the risk exposure in the complete example model.

Section 9 discusses the challenges of realistically modelling changes to the discount rates applicable to VA, MA and pension scheme business.

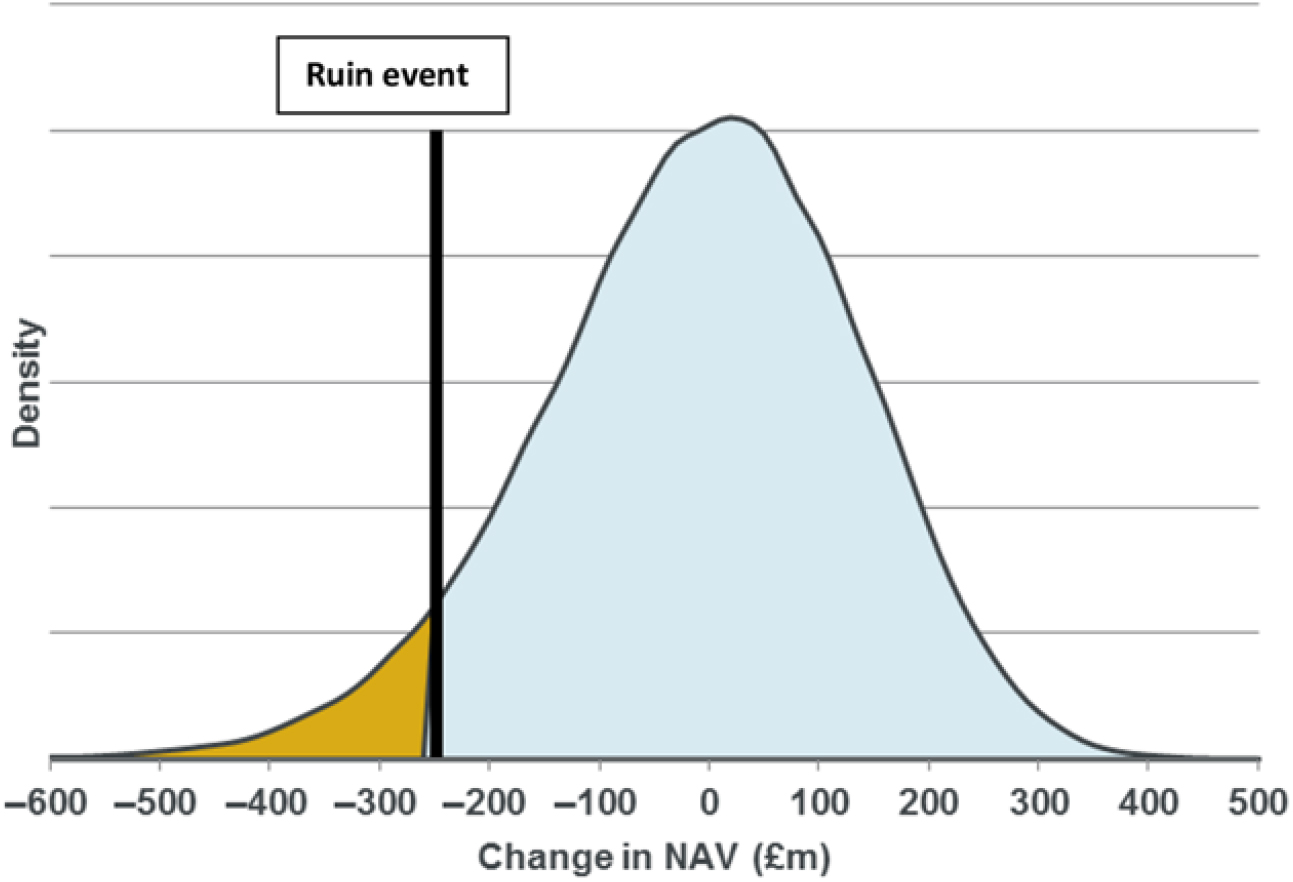

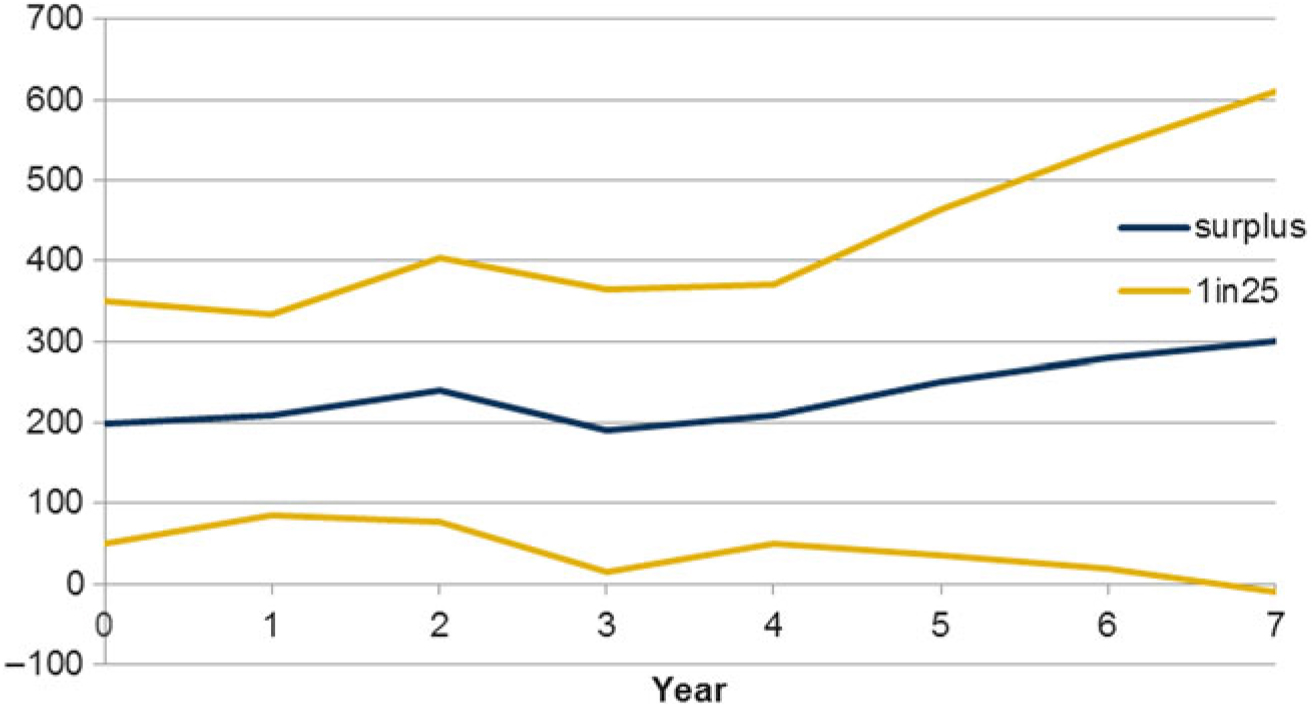

Section 10 shows how the proxy model derived may be used to generate risk appetite 1-in-X metrics and ruin probabilities.

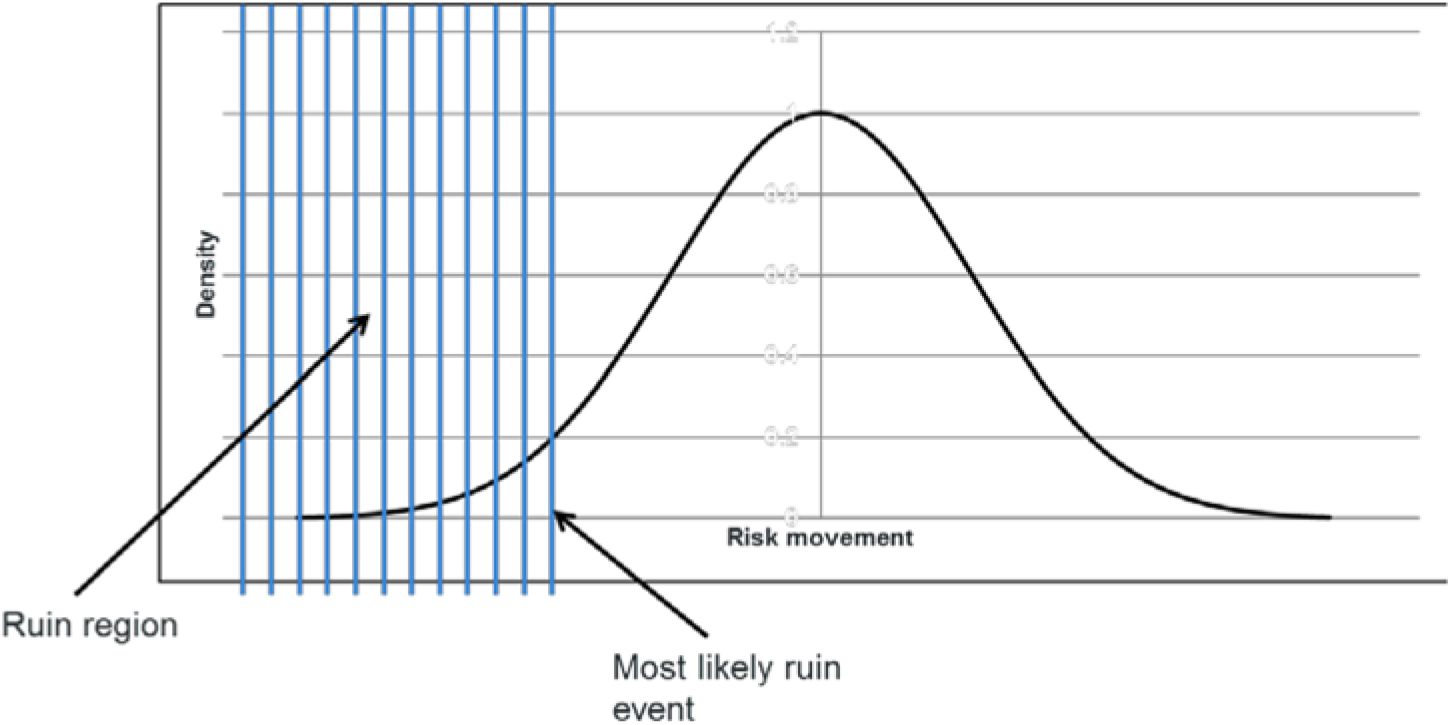

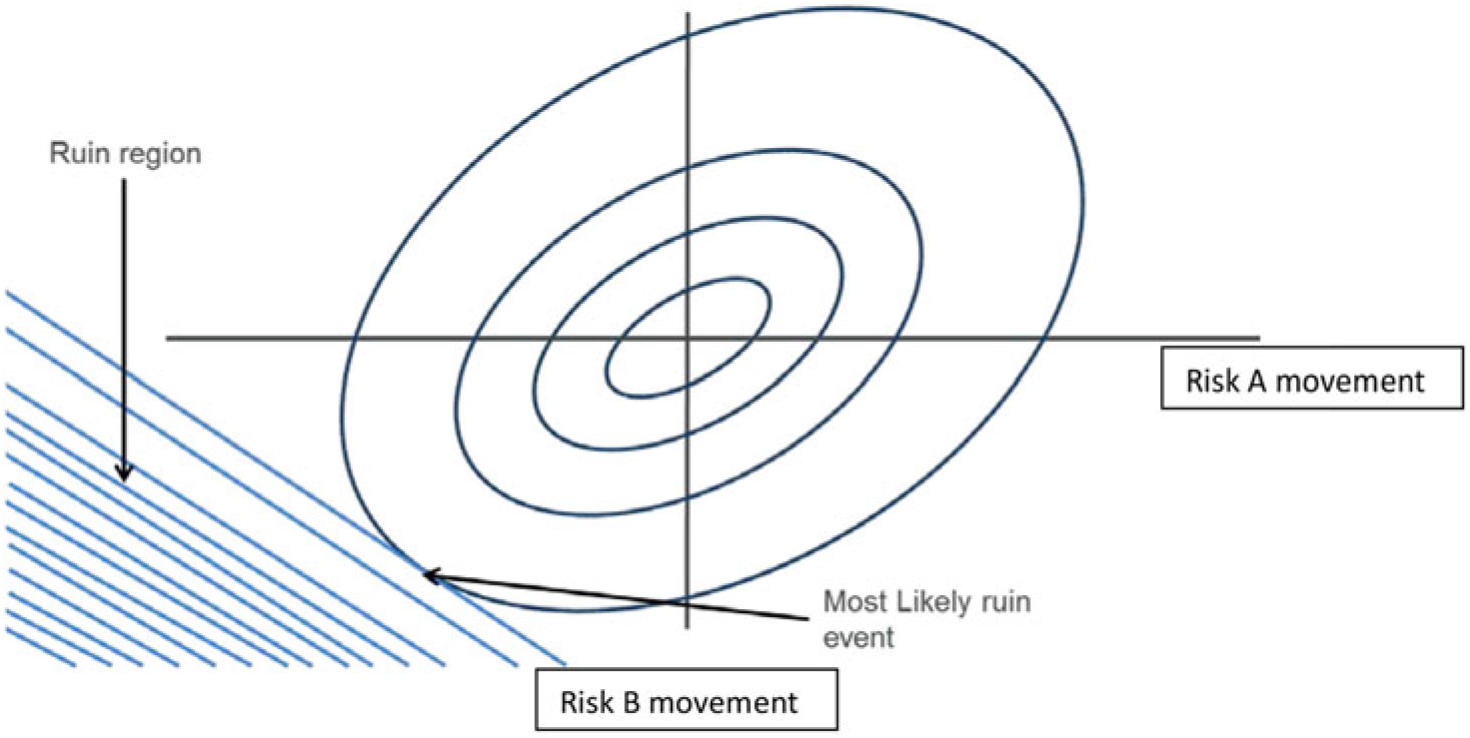

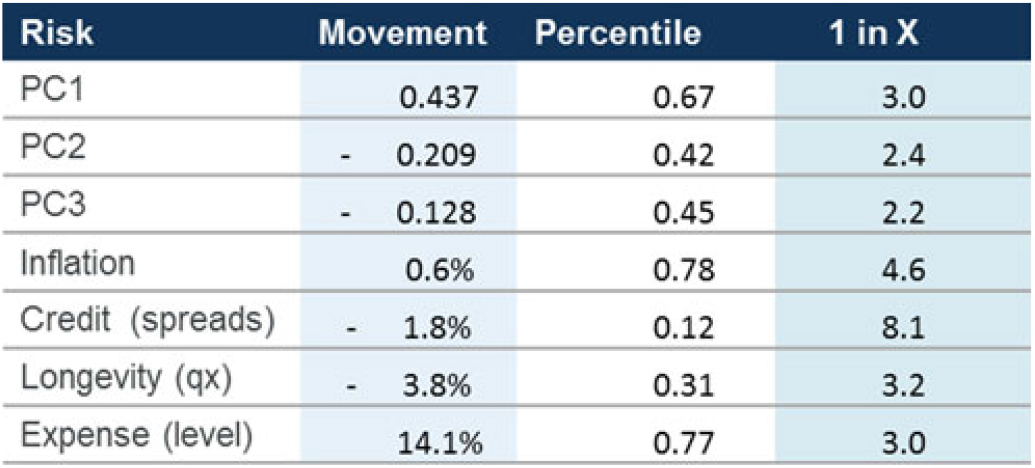

Section 11 focuses on the identification of ruin events and demonstrates how the focus on actual events such as this may be more useful for risk management purposes than standard capital allocation techniques. Within this section, techniques are demonstrated that can be used to derive the most likely ruin event.

Section 12 discusses the roll forward and projections of the proxy models in order that the model can remain current and also be used to understand how the stability of the balance sheet position is forecast to evolve over future years.

Section 13 concludes the paper with a summary of the key points that have been discussed and finally looks at the limitations of the model.

This paper is written with a focus on UK life insurance firms under the Solvency II regime. A number of the techniques discussed within are likely to be applicable in a wider context.

This paper is intended for UK or European Life actuaries who are interested in:

• Risk management

• Risk appetite

• Proxy modelling

• Own risk and solvency assessment (ORSA)

It is expected that the reader will have a working knowledge of the key aspects of Solvency II.

Disclaimer

The views expressed in this paper are those of the author and not necessarily those of the IFoA. The IFoA do not endorse any of the views stated, nor any claims or representations made in this paper and accept no responsibility or liability to any person for loss or damage suffered as a consequence of their placing reliance upon any view, claim or representation made in this paper.

The information and expressions of opinion contained in this paper are not intended to be a comprehensive study, nor to provide actuarial advice or advice of any nature and should not be treated as a substitute for specific advice concerning individual situations.

1. Introduction

1.1 Purpose

1.1.1 This section contains an introduction and a discussion of the main motivation for the use of a stochastic full balance sheet model.

1.2 Definition

1.2.1 For the purposes of this paper, a stochastic full balance sheet model is defined to be a stochastic model that describes changes in the full Solvency II balance sheet of an insurer.

1.3 Motivation for the model

1.3.1 A fundamental element of the risk management of an insurer relates to understanding the firm’s regulatory capital position as measured by its Solvency II surplus. A firm needs to ensure it has sufficient surplus currently and over future years so as to be able to meet its business objectives and its obligations to policyholders. It is important to be able to understand not just the strength of the capital position but also how stable the position is and the nature of the risks that affect it.

1.3.2 In recent years, there has been an increasing focus in the insurance industry on the use of risk appetite frameworks. The purpose of these frameworks is to enable firms to be able to understand the amount and types of risk that a firm is willing to assume in order to meet its business objectives. Risk appetite frameworks typically encompass a number of different elements such as earnings, liquidity and reputation. Perhaps the most important element is the capital risk appetite.

1.3.3 The capital risk appetite refers to the risk that a firm’s regulatory capital position may be insufficiently strong to meet its objectives. Firms typically hold a capital “buffer” in excess of the minimum amount of required regulatory capital as a defence against this risk. One approach that may be used to assess the amount of a buffer required is to apply stress tests to the balance sheet. An alternative approach is to stochastically model changes in the capital position over a 1-year time frame and therefore be able to quantify the probability of regulatory insolvency as a 1-in-X year amount.

1.3.4 In May 2018, the PRA released supervisory statement SS4/18 regarding financing planning and management by insurers. The statement sets out the PRA’s expectations regarding firm’s use of risk appetite statements including that:

“The insurer’s risk appetite statement is expected to include the risk appetite for the levels of capital that are to be maintained in reasonably foreseeable market conditions (e.g. as assessed through stress and scenario tests, or through some suitable alternative approach, to provide no more than a 1-in-X probability that Solvency Capital Requirement (SCR) coverage might fall below 100%)’’.

The statement also discusses the importance of allowing for non-linearity associated with combinations of adverse events and the use of reverse stress testing.

1.3.5 SS4/18 discusses that firms should take into account balance sheet sensitivity to key risk drivers and discusses how firms should understand their balance sheet volatility. In modelling such measures, it is important to take into account changes in the full balance sheet including elements such as the SCR and RM in addition to allowing for changes in the value of assets and liabilities. This draws a distinction between firm’s SCR capital models and a stochastic full balance sheet model that may be used for risk appetite purposes.

1.3.6 In addition to allowing for changes in SCR and RM, there may be other important areas of difference between a firm’s SCR model and a stochastic full balance sheet model. An example is the use of the volatility adjustment (VA). The UK regulator does not permit the SCR calculations to allow for changes in the value of the VA under credit stresses.Footnote 1 In practice, the VA will actually vary under credit stresses according to a predetermined formula. Therefore for a stochastic full balance sheet model to be realistic, it must take into account changes in the VA (including how this affects the liabilities and also the SCR).

1.3.7 In summary, a stochastic full balance sheet model provides the means by which firms can understand the nature of risks to their regulatory balance sheet. This has always been an important element of effective risk management but has taken on increasing importance more recently due to the focus within the industry on the use of risk appetite frameworks.

2. Types of group model

2.1 Purpose

2.1.1 Solvency II Pillar 1 uses a Value at Risk (VaR) framework over a 1-year time horizon. Under the Solvency II regime, firms typically have two main types of group model, the regulatory capital model and the economic capital model. This section discusses the nature of these models, their key components and their interactions.

2.2. Overview

2.2.1 A firm’s regulatory capital model is used to calculate its SCR and RM. These must be calculated either through the SII standard formula (SF) or through a firm’s internal model (IM) subject to regulatory approval. The purpose of the regulatory capital model is to calculate the amount of SCR and RM required to be held by the regulator. Where a firm uses the SF, the SCR and RM are calculated as per the formula prescribed in the SII delegated regulations. Where a firm uses an IM, a firm has its own model of its risks and exposures and uses a formula set out in its own documentation to calculate the SCR and RM.

2.2.2 A firm’s economic capital model is normally used in its ORSA. The model is used to form a firm’s own view of the capital required to meet its liabilities (which may be similar or different to its regulatory capital). The model may be used in any assessment of the appropriateness of the SF for a firm. The model would be expected to be used in business decision making.

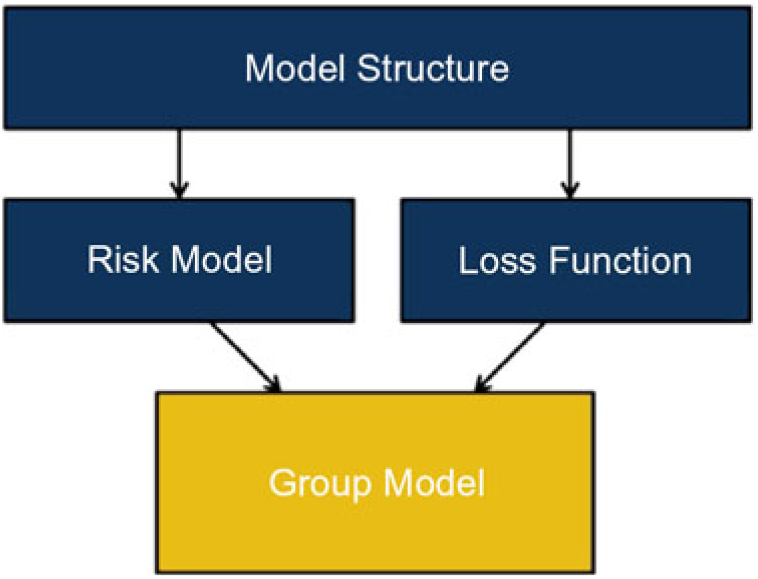

2.2.3 A group model has the following main components:Footnote 2

2.2.4 The model structure consists of the form of the model. The structure includes

• The risk measure (e.g. VaR over 1 year at the 99.5th percentile)

• The risks included in the model

• The elements we are calculating losses over (e.g. the assets and liabilities)

The model structure would be expected to remain stable over time other than for changes such as an emerging risk or a new product line.

2.2.5 For a 1-year VaR framework, the risk model represents our view of the joint probability distribution of the risk movements over the 1-year time frame. It therefore takes into account the marginal distribution of each risk and the way risks interact to form the joint distribution.

2.2.6 The loss function is a function that expresses changes in value (e.g. a firm’s net assets for an SCR model or firm’s balance sheet for a full balance sheet model), as a function of movements in the risks included in the structure. The loss function represents the “true” changes in value as a function of risk movements as calculated using full runs of a firm’s asset and liability models. A “proxy model” or “proxy function” is an approximation to the loss function. Proxy models are described in detail in section 5.

2.2.7 Loss functions may be used to describe changes in value at different business levels. For example, they may be used at the level of individual assets or product liabilities, or instead used for losses at an aggregate level (e.g. for a business unit or at a group level). A loss function at an aggregate level is composed of the sum of individual loss functions within, together with any allowance for effects such as tax or fungibility that can be calculated only at an aggregate level.

2.3 Regulatory Capital Model (SII IM)

2.3.1 Where a firm uses a SII IM, the model structure in this case is mostly specified by regulation. Elements that are prescribed in regulations include, for example, that:

• the SCR is calculated using a 1-year VaR approach at the 99.5th percentileFootnote 3

• firms may use a matching adjustment (MA) or VA according to specified rules

• The calculation of the RM is based on projected non-hedgeable risk SCRs, allowing for a 6% cost of capital charge

2.3.2 Other elements of a firm’s IM give greater freedom for the model structure. For example, the risks used are selected and defined by the firm.

2.3.3 For their risk model, the majority of IM firms use a copula (Embrechts et al., Reference Embrechts, Lindskog and McNeil2001; Shaw et al., Reference Shaw, Smith and Spivak2010) simulation approach. In this case the risk model is precisely specified by the risk distributions used and the copula.Footnote 4 The risk model is specified by each firm. However, there has been a significant convergence of risk calibrations and methodology within the industry as firms strive to remain in line with the market. As a result of this, there is a risk that firm’s IM calibrations represent a general market calibration rather than their true view.

2.3.4 A smaller number of IM firms use a traditional variance covariance formula rather than a copula simulation approach. Such an approach does not in itself imply the use of a particular risk modelFootnote 5 (i.e. we cannot infer what the joint risk distribution used is). For this reason, it may be appropriate for such firms to specify first the type of risk model they are assuming. Once specified, firms may then note that they are using a variance covariance formula to calculate their capital requirements under this model.

2.3.5 The loss function under IM represents changes in the values of net assets as a function of changes to the IM risks. Under a copula simulation approach, proxy functions are normally used to estimate the value of changes.Footnote 6

2.3.6 Where firms use a variance covariance formula, this formula is applicable where losses are a linear function of each risk with no allowance for cross terms (i.e. the cost of an event of two risks is the sum of the cost on each risk). The linear function is calibrated based on individual 1-in-200 stresses.

2.3.7 Firms that use a variance covariance formula may recognise the limitations of the formula and use a non-linearity adjustment (normally based on a single equivalent scenario technique). Under such an approach, the loss function in the model reflects the full movements in assets and liabilities, with the formula giving an approximation to these full movements.

2.4 Regulatory capital model (SII SF)

2.4.1 The SF is often thought of as being based on the use of normal distributions. However, the risk model (if any) used in the SF has never actually been articulated. The SF uses a variance covariance formula approach with a modular structure. Such an approach isn’t consistent with any form of risk distribution or loss function. Footnote 7 For this reason, the SF should be regarded as a formula for calculating a firm’s SCR and RM rather than a true group model.

2.4.2 Although the risk model has not been articulated, the calculations used in the SF are almost fully specified in the SII delegated regulations.Footnote 8 However, there are elements of the structure that are specified by individual firms. For example, firms may choose (subject to regulatory approval) to use the VA on part of their business. The detailed calculations required for liabilities valuation are also chosen by firms.

2.5 Economic capital model

2.5.1 The model structure to be used in an EC model is not prescribed in regulation and is therefore free to be determined by each firm. In practice, the model structure may be closely aligned with firm’s regulatory capital models (e.g. they are likely to use a 1-year VaR measure). There may also be important differences such as the inclusion of the RM or the percentile used to calculate VaR.

2.5.2 The risk model used in an EC model is typically closely related to that used in the regulatory capital model for IM firms. However, there may be differences in the risk model used (risk calibrations and correlations) as firms look to use fully realistic calibration in their EC. SF firms may include their own risk model to form their internal view of risks.

2.5.3 The loss function used in a firm’s EC model would typically be the same as for a firm’s IM regulatory capital model, other than where model structure differences exist (e.g. if a firm used a dynamic VA in EC but static VA in IM). SF firms may include their own loss function to form their internal views.

3. Design of the stochastic full balance sheet model

3.1 Purpose

3.1.1 Within this section, the stochastic full balance sheet model is described in detail.

3.2 Overview

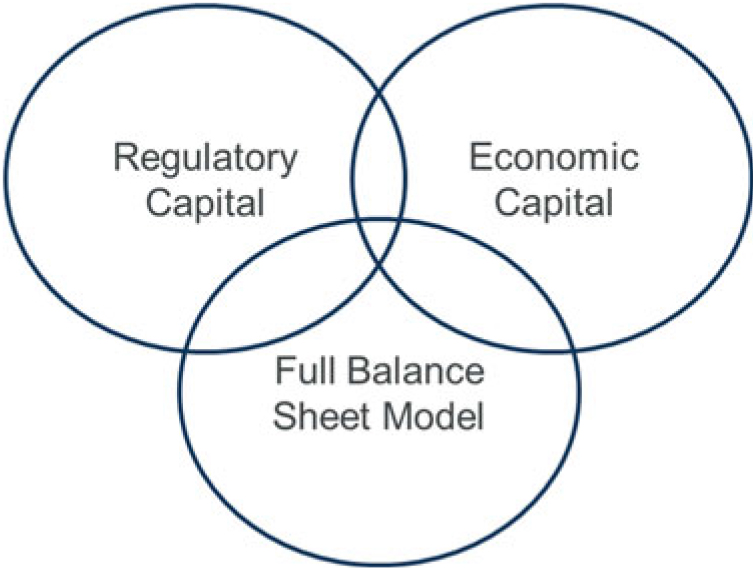

3.2.1 Of the models described earlier, the purpose of the regulatory capital model is to determine the level of SCR and RM to be held for regulatory purposes. These are the amounts required by the regulator to ensure policyholders have the appropriate level of protection.

3.2.2 The economic capital model by contrast represents a firm’s own view of the amounts required to give appropriate protection to policyholders. Where the economic capital results exceed regulatory capital results, firms would normally ensure they have sufficient capital to meet the higher amount.

3.2.3 Both the regulatory capital model and the economic capital model are concerned with the protection of policyholders. What neither of these are designed to do is to model the stability of the solvency position of a firm and to therefore ensure that it has sufficient regulatory surplus to meet its business objectives. This is the purpose of a stochastic full balance sheet model.

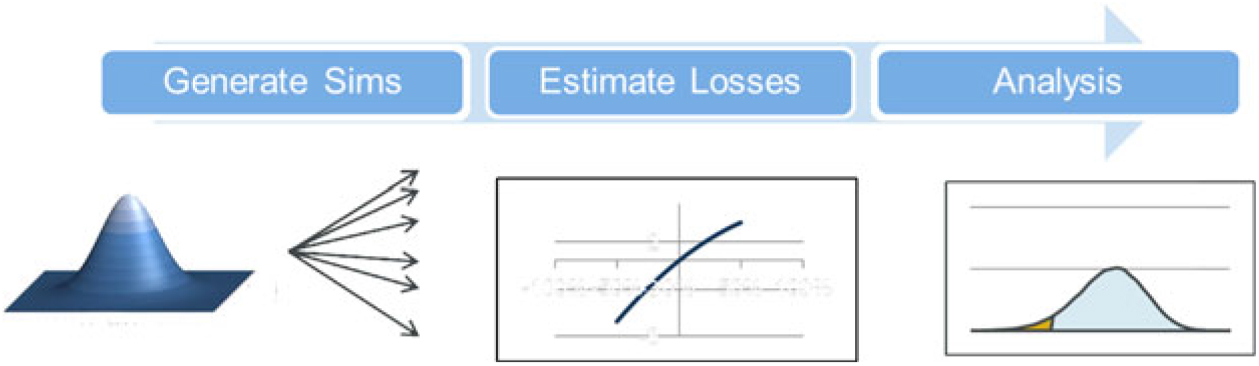

3.2.4 In practice, a stochastic full balance sheet model is a model in which stochastic real-world simulations are generated and, within the simulations, losses to the regulatory balance sheet surplus are estimated. The resulting simulations may be used for a variety of purposes including the calculation of 1-in-X buffer amounts for risk appetite purposes or finding the probability of ruin.Footnote 9

3.2.5 The stochastic full balance sheet model is intended to be a fully realistic assessment of how the regulatory balance sheet behaves. As such the model may be closely aligned to an EC or regulatory capital model in some areas. For other areas, there may be important differences. For example, for a book of annuities that use the VA, we may have:

• A regulatory capital model required to use a static VA

• An economic capital model that uses an illiquidity premium different to the VA

• The stochastic full balance sheet model which must realistically model the regulatory capital position

In order to realistically model the regulatory capital position, in this case, means that we need to consider the effects on the net assets, SCR and RM.

3.2.6 For the net assets, the best estimate liability (BEL) is affected by changes in the VA in response to market spreads. Therefore we need to incorporate a dynamic VA.

3.2.7 For the SCR, SCR calculations are based on the difference between the BEL and the BEL under stress events. As the BEL is affected by the VA, the SCR will also be affected by the VA (even though the stress calculations within that SCR are based on a static VA).

3.2.8 The RM is calculated without VA so the RM is unaffected.

3.2.9 In summary, the design of the stochastic full balance sheet model is likely to include elements of the design of both the regulatory capital and economic capital models. The degree of alignment to these models is determined by a balance between the need to include bespoke functionality for full balance sheet modelling against the desire to have alignment between models for reasons of cost and maintenance.Footnote 10

3.2.10 It is important to be clear on the distinction between a stochastic full balance sheet model and a true economic capital model. An economic capital model is intended to represent the true economic value of a firm’s assets and liabilities. In contrast, a stochastic full balance sheet model is intended to be used to understand how the regulatory requirements (the assets, BEL, SCR and RM) for the firm change under stress.

3.3 Stochastic full balance sheet model – Model structure

3.3.1 The structure of a stochastic full balance sheet model comprises elements such as the time frame, risk measure, risks included and the elements modelled (e.g. assets, liabilities, SCR, RM).

3.3.2 For practical reasons, models would be expected to use the 1-year VaR framework normally used in firms’ regulatory and economic capital models. The use of a 1-year VaR framework is also the metric required to provide 1-in-X year ruin event probabilities as set out in the PRA supervisory statement SS4/18. The use of a short time frame such as this means the model may not be suitable for understanding longer-term risks such as an economic downturn over many years.

3.3.3 Firms’ regulatory capital models use the 99.5th percentile as specified under the SII regulations. A firm’s economic capital may use a different percentile or indeed the results at a number of different percentiles. Typically, results from a stochastic full balance sheet model would be required at a variety of different percentiles depending on the purpose.

3.3.4 The risks included in the model should be those that are realistically expected to have a material effect on the firm’s solvency position. The risks would normally be the same as those included in a firm’s economic model. It should also be noted that there are some risks that cannot be practically incorporated in a firm’s model. Examples of these are set out in section 13.

3.3.5 The elements modelled need to include the components of the SII regulatory balance materially affected by the modelled risks. These elements include assets and liabilities, together with the SCR and RM. Further elements such as transitional measures may also be included. A key consideration in the design is to set the level of model granularity used appropriately. A detailed model comprised of a high number of individual proxy functions has a higher maintenance cost and run time than a simpler model but may give a more detailed insight into a firm’s risk exposure.

3.4 Stochastic full balance sheet model – Risk model

3.4.1 Within a stochastic full balance sheet model, a key element is the risk model. Typically UK insurers use a copula simulation model.Footnote 11 The elements required to parameterise the risk model are the distribution of each risk, together with the copula. To fully specify the risk model, it is necessary to specify the type of copula and the copula parameters (e.g. the correlation matrix).

3.4.2 A firm’s economic model represents the firm’s best view of the true nature of the risks it is faced with. For this reason, the risk model would normally be aligned with the economic model. One key question is whether the risk model should be at a Point in Time (PIT) or Through the Cycle (TTC).

3.4.3 A PIT model is calibrated to reflect conditions at the current time. For example, a PIT equity model may take into account current levels of market volatility. A TTC model is calibrated to reflect more general conditions over an extended period of time. For this reason, the calibration of a TTC model is stable over time (other than small changes to represent new data) whereas a PIT model calibrations may vary significantly. In practice, any model has an element of PIT calibration as the model will reflect the conditions in the data period for which it has been calibrated over.

3.4.4 Firms’ IM regulatory capital models are normally TTC. The key reason for this is that using PIT models for regulatory capital throughout the industry could lead to significant problems with pro-cyclicality. Economic capital models are also normally TTC as firms wish to maintain consistency with their IM models and maintain a stable level of EC.

3.4.5 For SF firms, no true risk model has been specified as set out earlier. However, the formula includes a symmetric adjustment mechanism to equity stresses that is equivalent to a change in risk model dependent on recent conditions. The symmetric adjustment mechanism’s purpose is to provide an element of anti-cyclicality rather than to represent a true PIT model.

3.4.6 For a stochastic full balance sheet model, a TTC calibration would normally be used as this has the benefits of giving alignment with firms’ (IM) regulatory capital and EC models.Footnote 12 A key output to the model may be a required level of risk buffer to be held for risk appetite purposes against the risk of regulatory insolvency. Using a PIT model for this purpose would give rise to a risk of pro-cyclicality in the industry for similar reasons as in firms’ regulatory capital models.

3.4.7 Whereas TTC calibrations may be considered the most suitable for calculating a risk appetite buffer, a PIT calibration is most suitable for firm’s realistic decision making, for example, where firms wish to estimate their true ruin probability over the coming year for risk management purposes. This can be estimated much more accurately using a PIT model.

3.4.8 In summary, a stochastic full balance sheet model would normally be calibrated with a TTC calibration to give alignment with its regulatory and economic models and for use in risk appetite calculations. However, it should be recognised and effectively communicated that the use of a TTC calibration in 1-year ruin probability calculation has limitations.

3.5 Stochastic full balance sheet model – Loss function

3.5.1 The overall loss function in a stochastic full balance sheet model needs to take into account changes in the value of net assets, SCR and RM. It may also take into account transitional measures on technical provisions (TMTP) if required. It is helpful to consider the SII balance sheet is in the following form.

3.5.2 The granularity of proxy models used is an important part of the model design. The granularity of assets and liabilities used in a stochastic full balance sheet model would normally be the same as used under a firms SCR model for practical purposes.

3.5.3 The proxy models used to represent changes in the value of assets would normally be the same as used under an IM SCR model.

3.5.4 The proxy models used to represent changes in the value of liabilities may need to be recalibrated compared to those used in IM SCR calculations to ensure they reflect realistic movements in the value of these under different risk events. A key example here is business for which the VA is used. The VA is not permitted to be changed under stress in the UK, whereas in practice it moves in response to credit spread changes. For this reason a separate calibration is required for use in a stochastic full balance sheet model. Section 9 gives further detail.

3.5.5 To model changes in the SCR, RM and TMTP, it is necessary to calibrate proxy functions that estimate how the value of these items realistically may change under stress events. As for other proxy functions, this typically consists of the use of a set of runs used to calibrate the model with a further set of runs used to test the fit performance. Sections 6 and 7 give further detail.

4. Example model

4.1 Purpose

4.1.1 In order to demonstrate the techniques discussed in this paper, an example model will be used as specified in this section. The example model uses a simple annuity book to demonstrate the techniques that may then be applied to more complex company models.

4.1.2 Different approaches are required depending on whether a firm uses an IM or the SF. For completeness, both these approaches will be covered in the example.

4.2 Liabilities

4.2.1 The example book contains 100,000 identical annuitants with the following features:

• Annuity amount – £1,000 p.a. paid annually in arrears, no escalation

• Age – 60

• Expenses, £100 p.a. increasing with RPI

4.2.2 Mortality assumptions

• Mortality rates are as per an example table set out in Appendix B.

4.2.3 Economic assumptions

• Yields 2% at all durations

• RPI 1.5% at all durations

4.2.4 Discount rates

The base version of the example assumes the annuities are discounted using the yield curve only. However, an allowance for a VA is introduced in section 9. The VA takes a base value of 0.18%.

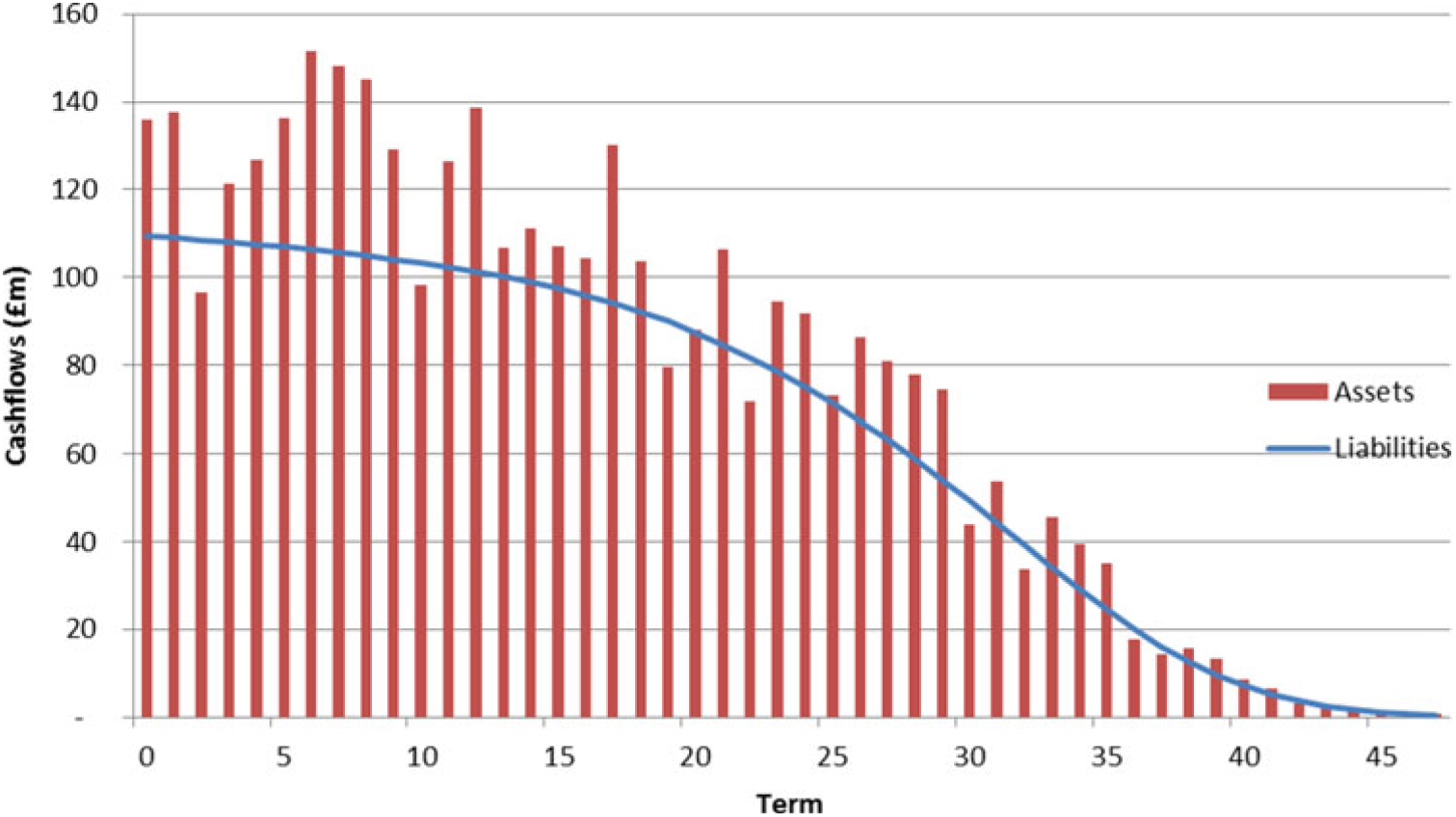

4.3 Assets

4.3.1 The annuities are assumed to be backed by risk-free fixed interest cash flows (e.g. using gilts) with a pattern that broadly covers the run-off of the liabilities. The asset cash flows have a small excess over the expected liability run-off at most terms. The following graph shows the pattern of assets compared to the liabilities:

4.4 Model structure

4.4.1 A single period model using a 1-year time frame is used. The model includes the following risks:

• Longevity L – applied by multiplying the assumed mortality rates by (1+L)

• Expense E – applied by multiplying the assumed expenses by (1+E)

• Inflation I – applied as an addition to RPI at all terms

• Credit Cr – applied as an increase to all spreads of Cr

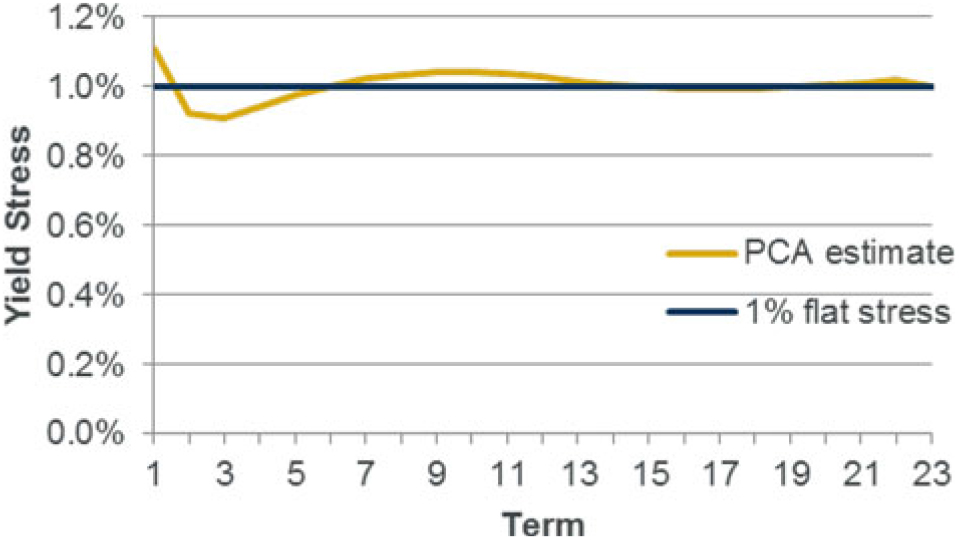

The model also includes an allowance for interest rate risk. In common with many UK firms, interest rate risk is modelled through the use of principal components analysis (PCA; Abdi and Williams Reference Abdi and Williams(2010))Footnote 13 to describe changes in the yield curve.

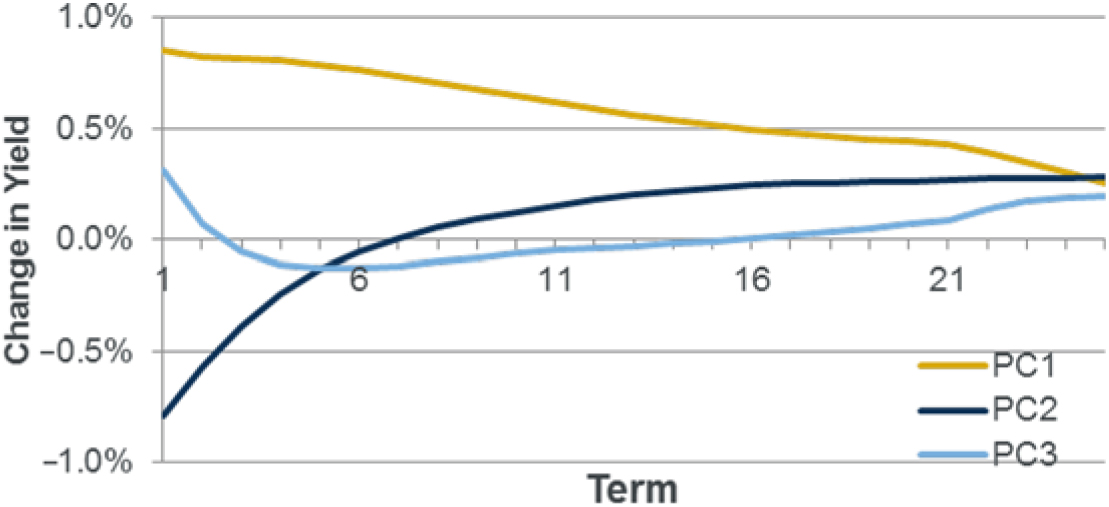

4.4.2 The PCA eigenvalues and eigenvectors used in the example model are set out in Appendix C. The model structure applies a vector change to the spot yield curve defined as

Where A, B, C are the risk coefficients for PC1, PC2, PC3

Eval1, Eval2, Eval3 are the eigenvalues set out in Appendix C

Evec1, Evec2, Evec3 are the eigenvectors set out in Appendix C

The shape of the principal components can be seen in the following graph:

4.4.3 The elements the loss function applies to are the changes in net assets (the assets and liabilities defined earlier), changes in SCR and changes in RM.

4.4.4 The RM is calculated as the projected value of future non-market risks, allowing for a 6% cost of capital charge as prescribed in the SII regulations. A risk driver approach is used to estimate the future longevity and expense risk. The future longevity risk is estimated using the BEL as a risk driver. The future expense risk is estimated using the BEL in respect of expenses only as a driver.Footnote 14

4.5 Risk model

4.5.1 The risk model is that the risks have a joint normal distribution. The distribution is specified through marginal risk distributions combined using a Gaussian copula. The marginal risk distributions are specified as follows:

Longevity L ∼ N(0,7.76%) (1-in-200 is 20%)

Expense E ∼ N(0,19.41%) (1-in-200 is 50%)

Inflation I ∼ N(0,0.78%) (1-in-200 is 2%)

Credit Cr ∼ N(0,1.55%) (1-in-200 is 4%)

PC1 A ∼ N(0,100%)

PC2 B ∼ N(0,100%)

PC3 C ∼ N(0,100%)

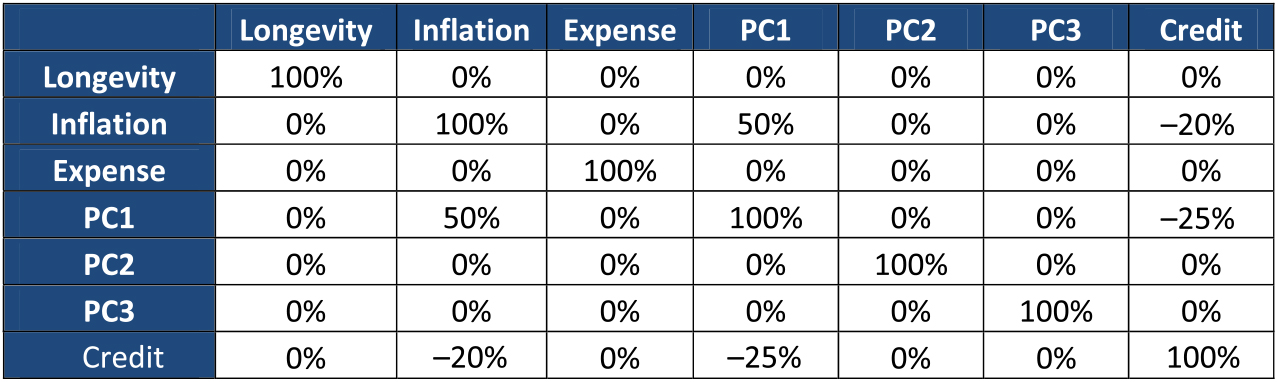

The correlation matrix used in the Gaussian copula is as follows:

4.6 Loss function

4.6.1 The loss function in the model is the sum of individual loss functions on the net assets (simply the assets and liabilities set out earlier), the SCR and the RM. In sections 6 and 7, the SCR and RM will be calculated as per the SII SF. Section 6 also shows an example of how to allow for an IM SCR calculated using a copula simulation approach.

4.7 Starting surplus

4.7.1 It is assumed that the model firm has a regulatory surplus on its SII balance sheet of £250m.

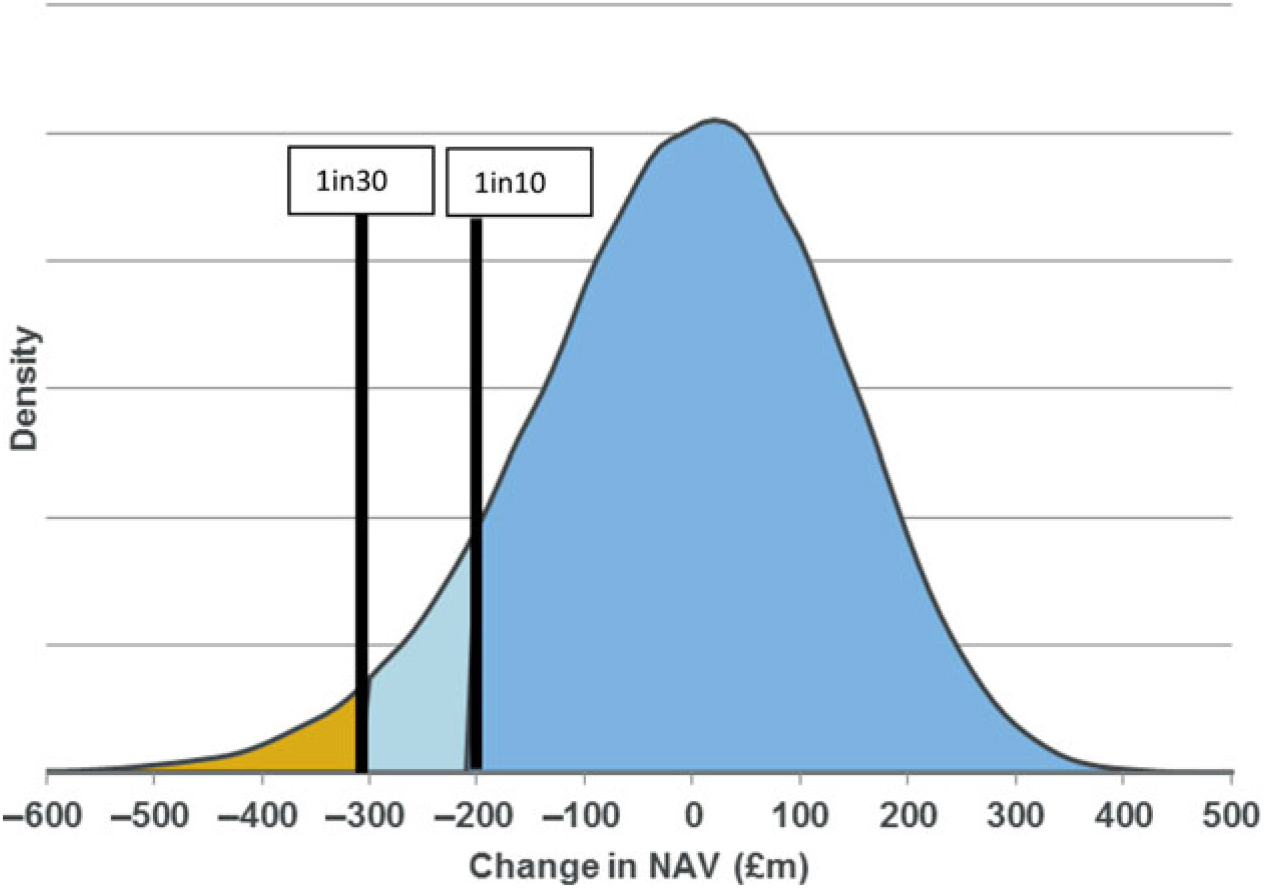

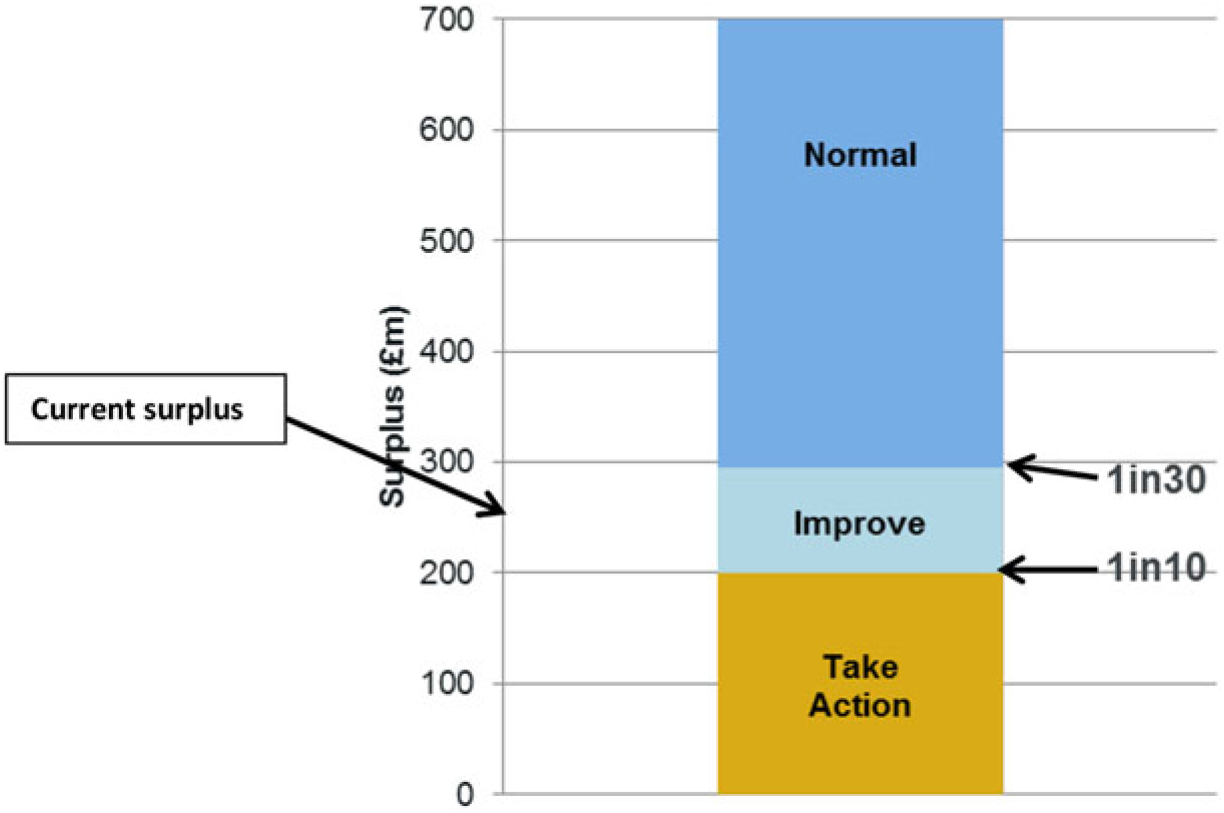

4.8 Risk appetite

4.8.1 It is assumed that the model firm has a risk appetite framework whereby it plans to be able to have a surplus buffer sufficient to withstand a 1-in-30 shock over a 1-year time horizon. A fall below a 1-in-10 level triggers urgent corrective action.

5. Proxy models

5.1 Purpose

5.1.1 The purpose of this section is to give a high-level introduction to the use of proxy modelling in group stochastic models (such as those used in many firm’s IM SCR calculations). The section gives details of how such models may be calibrated and validated, together with how a roll forward process may be used to allow for how the models may change in response to events.

5.2 Overview

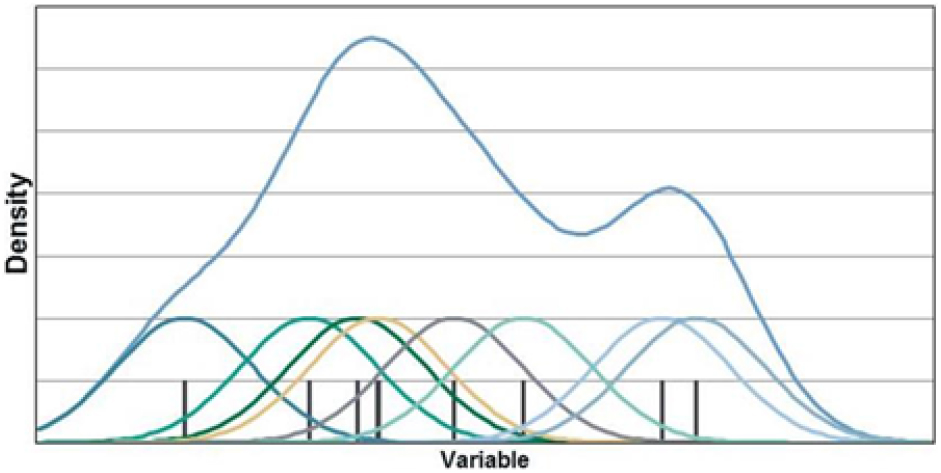

5.2.1 Group stochastic models in the UK typically use a copula simulation approach over a 1-year time frame. A copula approach is normally used as this allows firms to specify a probability distribution for each risk, together with the copula which is then used to combine these to form the joint risk distribution. Within the models, a high volume of real-world simulations (e.g. one million) are generated according to a specified copula and marginal risk distributions. Within the output, it is then necessary to estimate the changes in the value of the firm’s net assets in each of the simulations. The results of this are used to form the probability distribution of net assets which may be used to derive results such as the 99.5th percentile VaR.

5.2.2 Within a group stochastic model, it will therefore be necessary to estimate changes to the value of assets and liabilities under a large number of different risk events, each of which consists of changes to parameters for each risk in the model. Given unlimited time and resources, this could be achieved by running the firm’s full asset and liability models. Of course this cannot be practically achieved. Therefore proxy models are used to provide an approximation to the results that may be obtained from the full models. In practice, the key uses of proxy models are within IM firms’ Solvency II SCR calculations (including the use of these models for business decision making).

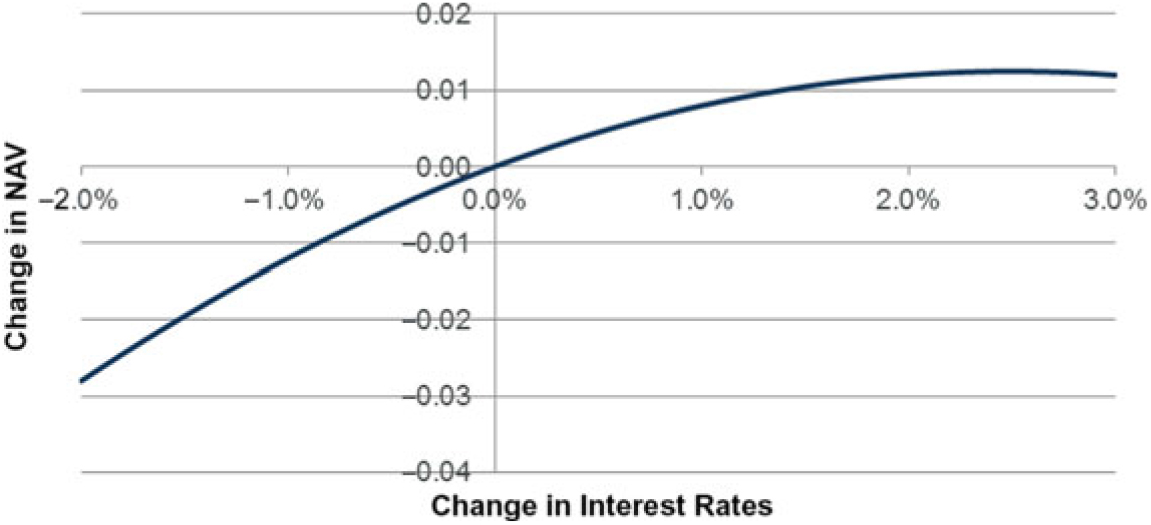

5.2.3 A proxy model used in group risk modelling is a function that approximates the changes in net assets as a function of the risk movements included in the model. The following example shows a proxy function in a single risk. In practice the net assets are exposed to a number of risks.

5.2.4 A proxy model may take a number of different forms. The most common approach is to approximate changes in net assets through a polynomial function of the risks. The polynomial would include terms for individual risks as well as “cross terms” to allow for the interaction between two or more risks.

5.2.5 A proxy model often takes the form of a sum of individual proxy functions (applied to particular assets and liabilities). There may be exceptions for features such as tax, fungibility or management actions that need to be applied at portfolio level, on particular portfolios of assets and liabilities.

5.2.6 A key requirement for a proxy function is that it must be able to be rapidly executed in order that it be evaluated a large number of times in a group stochastic model. Before a proxy model can be used, a process of calibration and then validation must be carried out.

5.3 Calibration set

5.3.1 Calibration of a proxy model requires the use of a set of runs to parameterise the model. The calibration set should give a suitable coverage of the range of different values each risk may take. It is important that the proxy model performs accurately in a range of scenarios. For example moderate stresses may be important for solvency monitoring, extreme stresses for capital calculations and reverse stress testing.

5.3.2 An important part of model calibration is the specification of the calibration set. This may be done through judgement, taking into account the materiality of each risk and the extent to which we may expect cross terms (e.g. we normally expect interactions between longevity risk and interest rate risks).

5.3.3 An alternative technique commonly used to specify fitting runs is to use a Sobol Reference Sobol(1967) sequence. The Sobol sequence is used to efficiently partition the risk space used for the calibration to ensure the fitting runs give a good coverage of all risk combinations. A Sobol sequence is generally a lot quicker to use where specifying a large number of calibration runs. It would normally be expected to give a stronger performance than using judgment-based runs, but this is not always the case as it does not for example take into account the materiality of each risk.

5.4 Model selection

5.4.1 Model selection is the process by which the form of model is selected (e.g. the maximum order of polynomial used for individual and combined risks). Once the form of model is selected, the model parameters can then be fitted (typically by a least squares regression). The model selection process may typically be carried out by identifying the most appropriate polynomial form up to a given maximum order. If a good fit cannot be achieved, alternative models may be considered. The process is typically repeated over each of the individual proxy functions to be calibrated.

5.4.2 A simple approach to model selection is to produce graphs and other analysis to determine the model to be used. For example, if graphs showed losses plotted against longevity were close to a straight line then a proxy function with a linear longevity term would be used.

5.4.3 A key objective in the model selection process is to ensure the model uses only the terms necessary to achieve a good fit and no more. The “in sample fit” (the least squares result over the calibration set) can almost always be improved through using more terms. However, the use of an excessive number of terms can lead to problems with “overfitting” whereby the model fit in the calibration set is very close but performance outside this set is poor (see validation later).

5.4.4 A more sophisticated approach is to use a model selection algorithm (Efroymson, Reference Efroymson, Ralston and Wilf1960). A number of such algorithms are available which provide a sequential approach to automatically select the variable terms to be included in the model. Perhaps the most commonly used approach is a stepwise regression. The approach is designed to include terms within the model provided their inclusion is statistically significant.

5.5 Validation

5.5.1 The purpose of proxy model validation is to be able to assess the performance of the proxy models as measured by how closely they reproduce the underlying full model results.

5.5.2 The strongest approach to proxy model validation is to use an out of sample (OOS) test set of runs. The accuracy of the proxy model over the test set can be assessed using a range of statistics such as the average error and average squared error.

5.5.3 Firms may use a variety of different approaches to derive the OOS test set to be used. It is important that such approaches take into account combined risk events rather than just individual risks and give appropriate focus to all areas for which the model may be used. For example, if the OOS runs are focused only on fit performance in the kind of scenarios that give 99.5th percentile losses, then they may be untested on the more moderate kind of events used for purposes such as roll forwards or stress testing.

5.5.4 A useful approach to OOS testing is to use randomly generated simulations from the group risk model so that overall expected error statistics can be calculated. Similarly, simulations close to the 99.5th percentile losses can be used to estimate the expected error in the SCR.

5.5.5 It is important that the OOS testing is truly independent of the selection process. For example, if different step regression algorithms are used and the one giving the best OOS results is selected, this means the OOS set is now part of the calibration process and cannot be used to give an independent performance assessment.

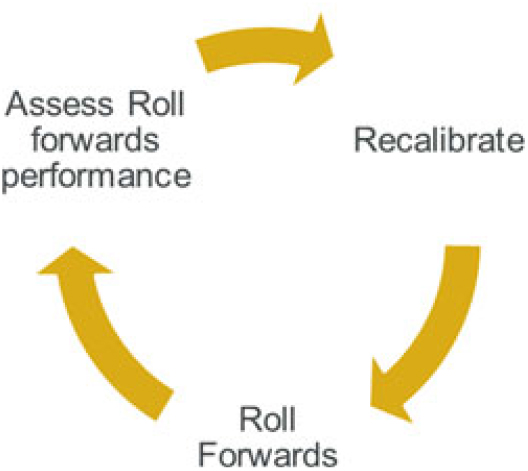

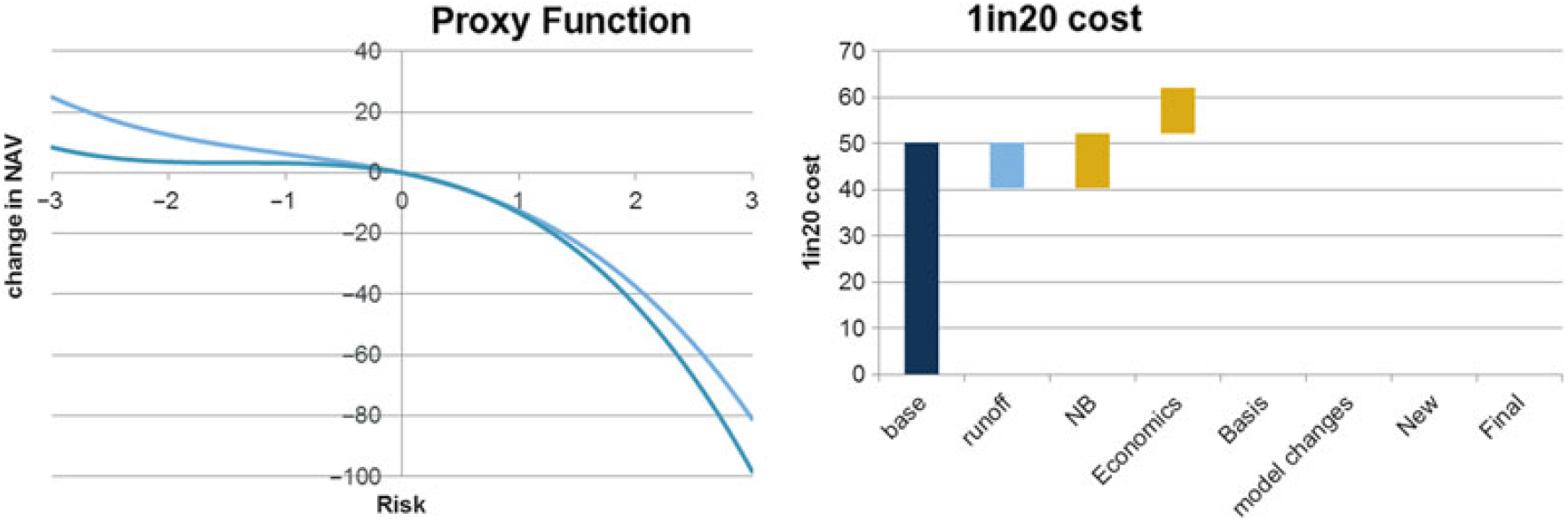

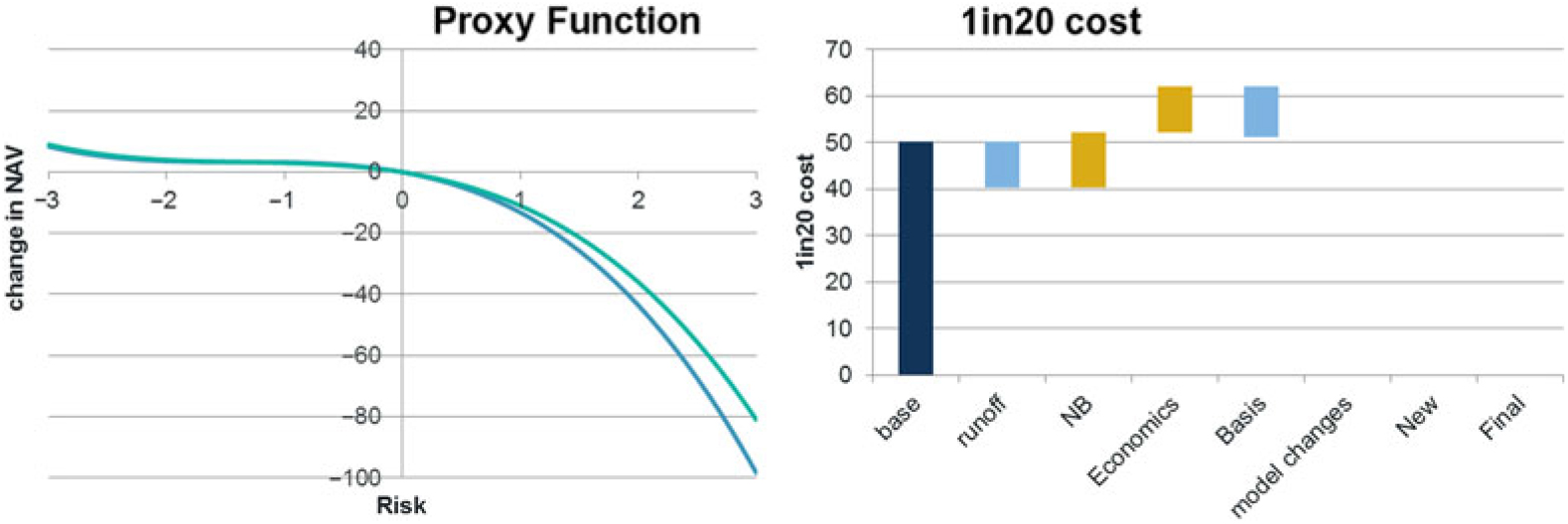

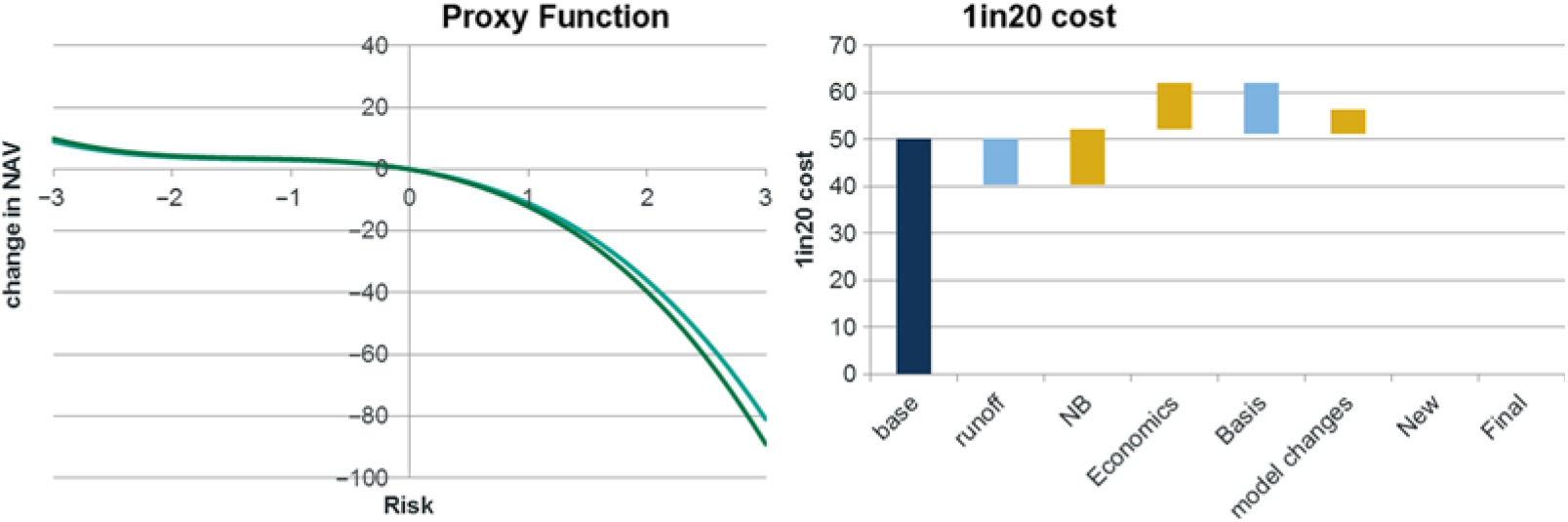

5.6 Roll forwards overview

5.6.1 Proxy model calibration is an intensive process that may take place, for example, once or twice a year (different individual elements of the overall proxy function may be calibrated at different times). Roll forward is the process by which a model calibrated to a particular date is rolled forward to give an up-to-date model.

5.6.2 A roll forward process would be expected to take into account changes in the loss function (as represented by a proxy function) and the risk model. Changes to the proxy function need to reflect the updated balance sheet response to risk movements. Changes to the risk model would be used, for example, to take into account a change in an equity risk distribution that has taken place since the calibration date.Footnote 15

5.6.3 A roll forward process would normally take into account features such as the run-off of business, risk movements (e.g. economic changes) and new business. Within the roll forward process, actual movements experienced in the above items are allowed for.

5.6.4 A projection process is very similar to a roll forwards process. The key difference is that projection assumptions are used rather than actual movements. Where projections are carried out over a long time frame (e.g. several years), it is important to consider the limitations of proxy modelling for this purpose. Section 12 gives further details.

5.6.5 There are a number of different techniques that may be used to approximate the effects of the above features; for example, expected run-off could use a simple scaling factor for each loss function to reflect expected business run-off, or instead a more sophisticated approach could be used to reflect the changing risk characteristics of the business as it runs off.

5.6.6 In order to model 1-in-X type movements in the SII balance sheet, a key focus is on the ability to model changes in SCR and RM under different risk movements. Risk movements are equivalent to economic variances, demographic variances and basis changes in the above list.Footnote 16

5.7 Roll forwards risk movements

5.7.1 Under a roll forward process, for risk movements, the first task is to map economic and demographic variances, together with basis changes onto values of the coefficients for each risk. As an example, within a model containing a single equity risk (rather than different risks to represent different equity markets), over the roll forward period, different equity markets will have different returns. A weighted average of these returns can be used to derive a representative equity risk movement for the period.Footnote 17 For a 1-year period, the movement represents an observation from the equity risk distribution.

5.7.2 For basis changes, these can be mapped to a value of each risk movement precisely in some cases but approximately for others. In the annuity example above, a 5% reduction in the probability of death at all ages simply corresponds to a longevity risk movement of −5%. If, for example, a change in mortality was only applied beyond age 70, this does not directly correspond to the definition of the risk. An approximate risk movement can be found through approximations such as solving for the risk movement that corresponds to the change in BEL that has occurred.

5.7.3 Demographic variances are unlikely to have a material impact on the group model results under normal circumstances (e.g. a month of higher than normal mortality has little impact on the group balance sheet aside from any accompanying basis change). An exception may be in the event of a mass lapse or mortality catastrophe event. Should these have occurred a risk movement can normally be derived from the percentage of policyholders affected.

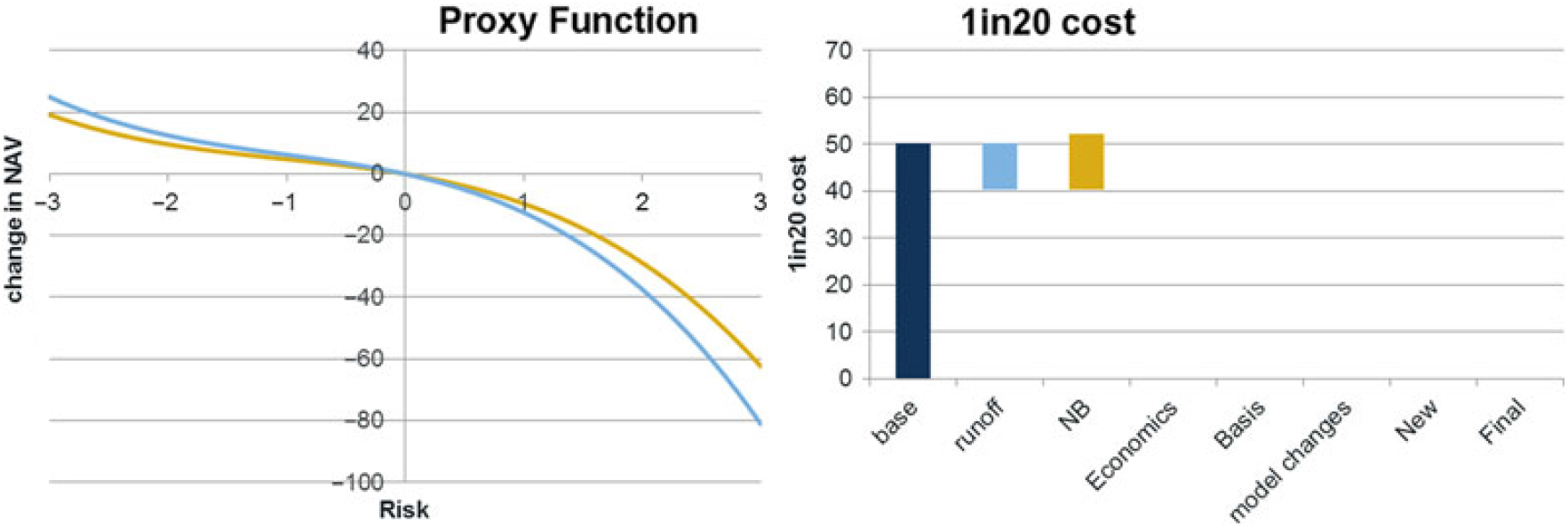

5.8 Roll forwards update of proxy function

5.8.1 A key part of the roll forward process is to be able to model the manner in which a proxy function changes following a risk movement. As an example, a proxy function would be expected to show greater exposure to longevity risk following an interest rate fall due to the decreased amount of discounting.

5.8.2 Provided the proxy function has been appropriately calibrated,Footnote 18 it can be used to derive a re-based proxy function that shows the new changes in net assets as a function of the risk movements.

5.8.3 The approach used to derive re-based proxy functions depends on the definition of each risk. There are two main ways in which a risk can be defined: an additive risk or a multiplicative risk. An example of an additive risk is the credit risk model specified in section 4. In this model, spreads are calculated as the current spread, plus Cr - the credit risk value. An example of a multiplicative risk is longevity in the example model. The probability of death at age x = q x (1 + L) where L is the longevity risk value.

5.8.4 As an example of how a re-based proxy function is derived for an additive risk, consider a proxy function including just interest rates (as a flat stress). In this example, the proxy function is specified as follows:Footnote 19

Consider a 1.6% change in interest rates. This is equivalent to redrawing the axes of the graph at the 1.6% point.

to give:

5.8.5 Mathematically, the new re-based proxy function f’(x) can be expressed as

f’(x) = f(x + a) – f(a) where a is the movement amount (1.6% in this example).

The subtracted term f(a) is required here as proxy functions represent the change in NAV compared to the current position. The current position is equal to the base position with the addition of f(a).

In this example

\[\begin{array}{*{20}{l}} {f(x)}&{ = x - 20{x^2}{\mkern 1mu} {\rm{we}}\,{\mkern 1mu} {\rm{have}}}\\{f(x)}&{ = {\rm{f}}(x + a) - f(a)}\\{}&{ = (x + a) - 20{{(x + a)}^2} - (a - 20a2)}\\{}&{ = (x + a) - 20{x^2} - 40ax - 20{a^2} - a + 20a2}\\{}&{ = (1 - 40a)x - 20x2}\\{}&{{\rm{For}}\:a\:{\rm{is}}\:1.6\% {\mkern 1mu} {\rm{we}}\:{\rm{have}}\:f'\:(x) = 0.36x - 20x2}\end{array}\]

\[\begin{array}{*{20}{l}} {f(x)}&{ = x - 20{x^2}{\mkern 1mu} {\rm{we}}\,{\mkern 1mu} {\rm{have}}}\\{f(x)}&{ = {\rm{f}}(x + a) - f(a)}\\{}&{ = (x + a) - 20{{(x + a)}^2} - (a - 20a2)}\\{}&{ = (x + a) - 20{x^2} - 40ax - 20{a^2} - a + 20a2}\\{}&{ = (1 - 40a)x - 20x2}\\{}&{{\rm{For}}\:a\:{\rm{is}}\:1.6\% {\mkern 1mu} {\rm{we}}\:{\rm{have}}\:f'\:(x) = 0.36x - 20x2}\end{array}\]

5.8.6 For multiplicative risks, in addition to the effects shown for additive risks of moving around the loss function, there is also the multiplicative element to the risk movement that needs to be taken into account. As an example, we may model expense risk as a multiplicative risk such that the expense following a stress is:

IE (1 + E) where IE is the initial expense amount per policy, E is the expense stress.

An example proxy function is:

change in NAV = −rE r is a constant

Under an extreme example, if E is −100%, then we no longer have any expenses and so the rebased proxy function is zero. On the other hand if E is 100%, expenses have doubled and so any further expense risk movements also have doubled the effect due to the multiplicative nature of the risk.

The rebased proxy function is:

Change in NAV = −2rX

5.8.7 In general, for multiplicative risks, the rebased loss function is specified as:

In the above expense example, where expenses double and so a is 1 the rebased loss function is

\[\begin{array}{*{20}{l}}{{\rm{f'}}(x)}&{ = {\rm{f}}((1 + a)x + a) - {\rm{f}}(a)}\\{}&{ = {\rm{f}}((1 + 1)X + 1) - {\rm{f}}(1)}\\{}&{ = {\rm{f}}(2X + 1) - {\rm{f}}(1)}\\{}&{ = - r(2X + 1) + r.1}\\{}&{ = - 2rX - r + r}\\{}&{ = - 2rX}\end{array}\]

\[\begin{array}{*{20}{l}}{{\rm{f'}}(x)}&{ = {\rm{f}}((1 + a)x + a) - {\rm{f}}(a)}\\{}&{ = {\rm{f}}((1 + 1)X + 1) - {\rm{f}}(1)}\\{}&{ = {\rm{f}}(2X + 1) - {\rm{f}}(1)}\\{}&{ = - r(2X + 1) + r.1}\\{}&{ = - 2rX - r + r}\\{}&{ = - 2rX}\end{array}\]

5.8.8 The above examples have considered proxy functions in a single risk only. In general, a proxy function for a number of risks may have a combination of additive and multiplicative risks. In this case the rebased function takes the additive or multiplicative form for each risk.

e.g. for risks x additive and y multiplicative, with movements a and b respectively, the rebased loss function is specified as:

$${\rm f'}( {x,y} ) = {\rm f}( {x + a\,( {1 + b} )y + b} ) -{\rm f}( {a,\!b})$$

$${\rm f'}( {x,y} ) = {\rm f}( {x + a\,( {1 + b} )y + b} ) -{\rm f}( {a,\!b})$$

5.8.9 One final type of risk that requires a different approach is catastrophe type risks typically modelled through a frequency and severity model. Examples of these risks are operational risk and general insurance catastrophe risks. For these risks, normally no changes in the proxy function would normally be allowed for in response to risk movements.

5.8.10 The cost of an operational risk event may actually depend on other risks (e.g. interest rates if the operational risk event has a long-term cost). These effects should in theory be taken account of through a proxy function that allows for operational risk losses as a function of different risks and can therefore be used in the roll forward process. However, firms’ operational risk models are unlikely to fully allow for this level of detail.

5.9 Proxy model example – Calibration

5.9.1 Using the annuity model specified above, it can be demonstrated how a simple proxy function can be calibrated to the net assets. In this example, the process has used:

• A calibration set consisting of 1,023 runsFootnote 20 according to a Sobol sequence on the modelled risks

• A candidate set of terms consisting of all individual and combined risk terms up to order 4 polynomials

• A stepwise regression algorithm is used with p value 5%

• No VA assumed

For the calibration runs, the assets and liabilities have been revalued and a proxy function fitted to the results.

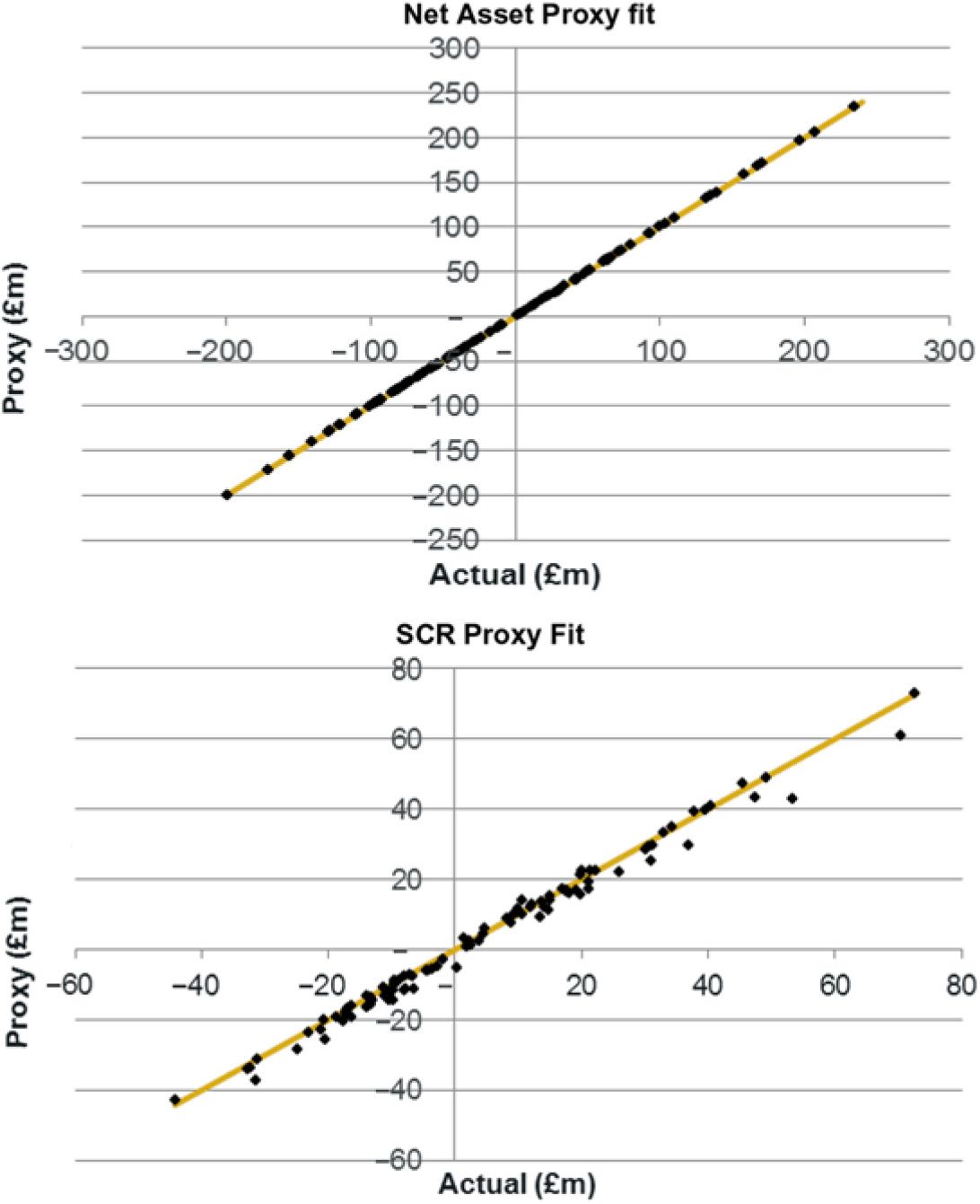

5.10 Proxy model example – Validation

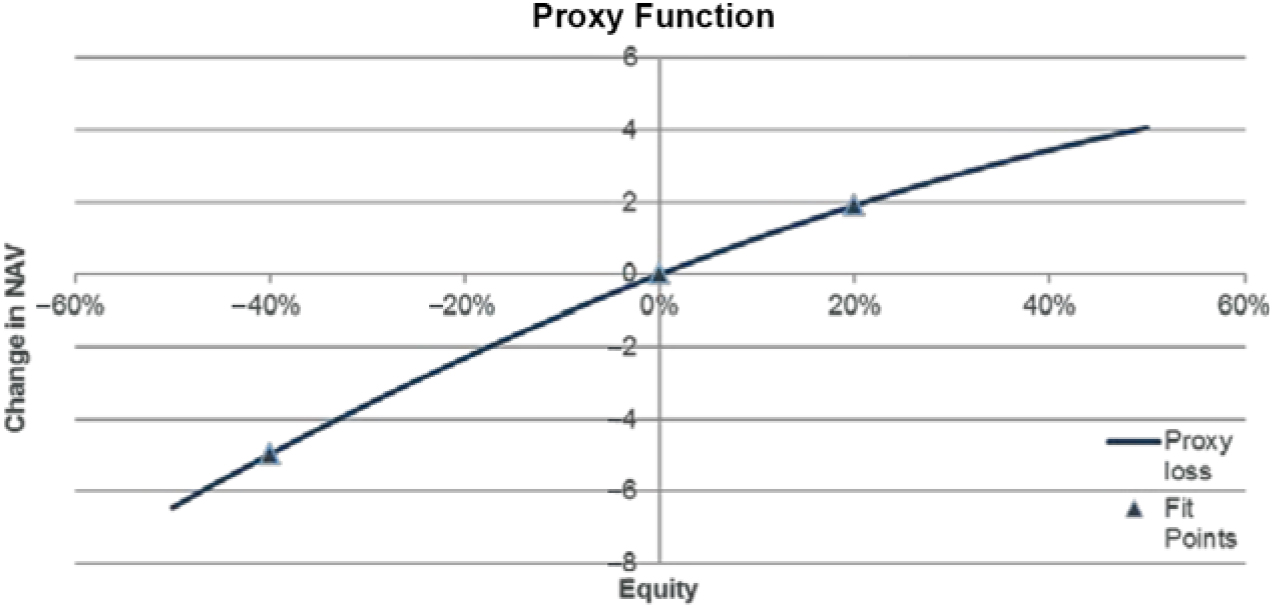

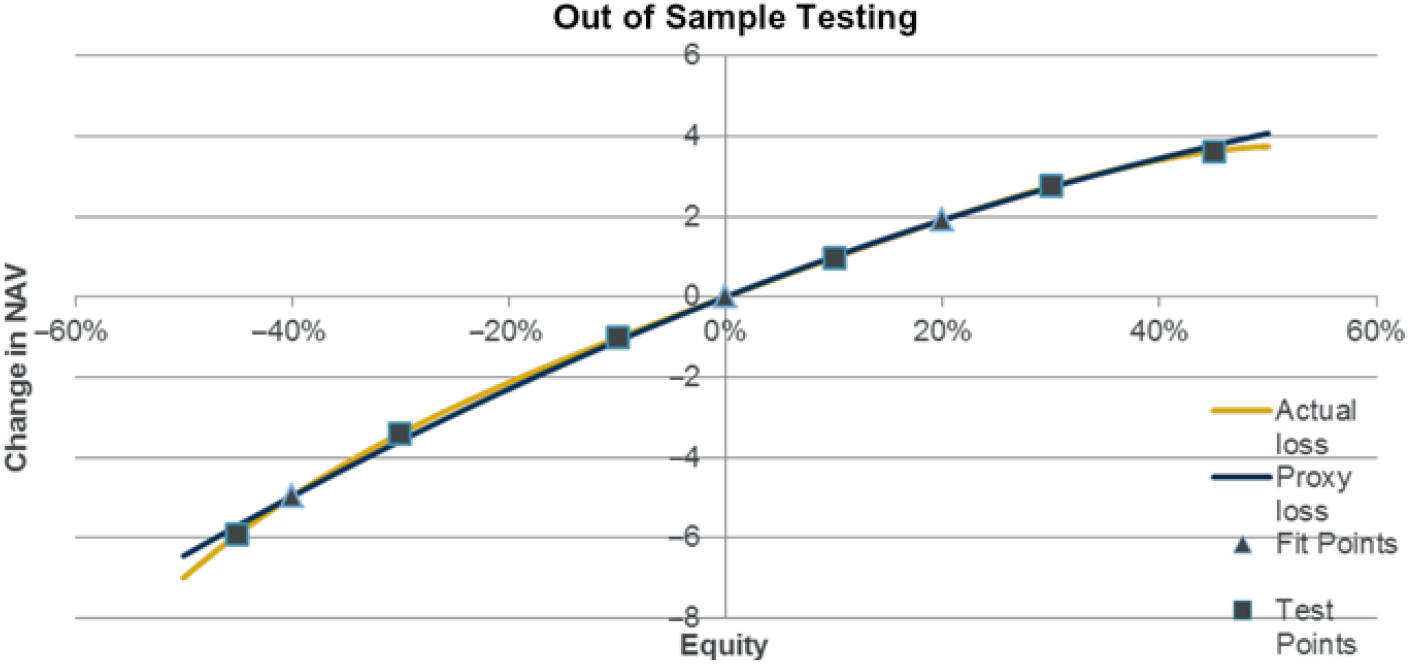

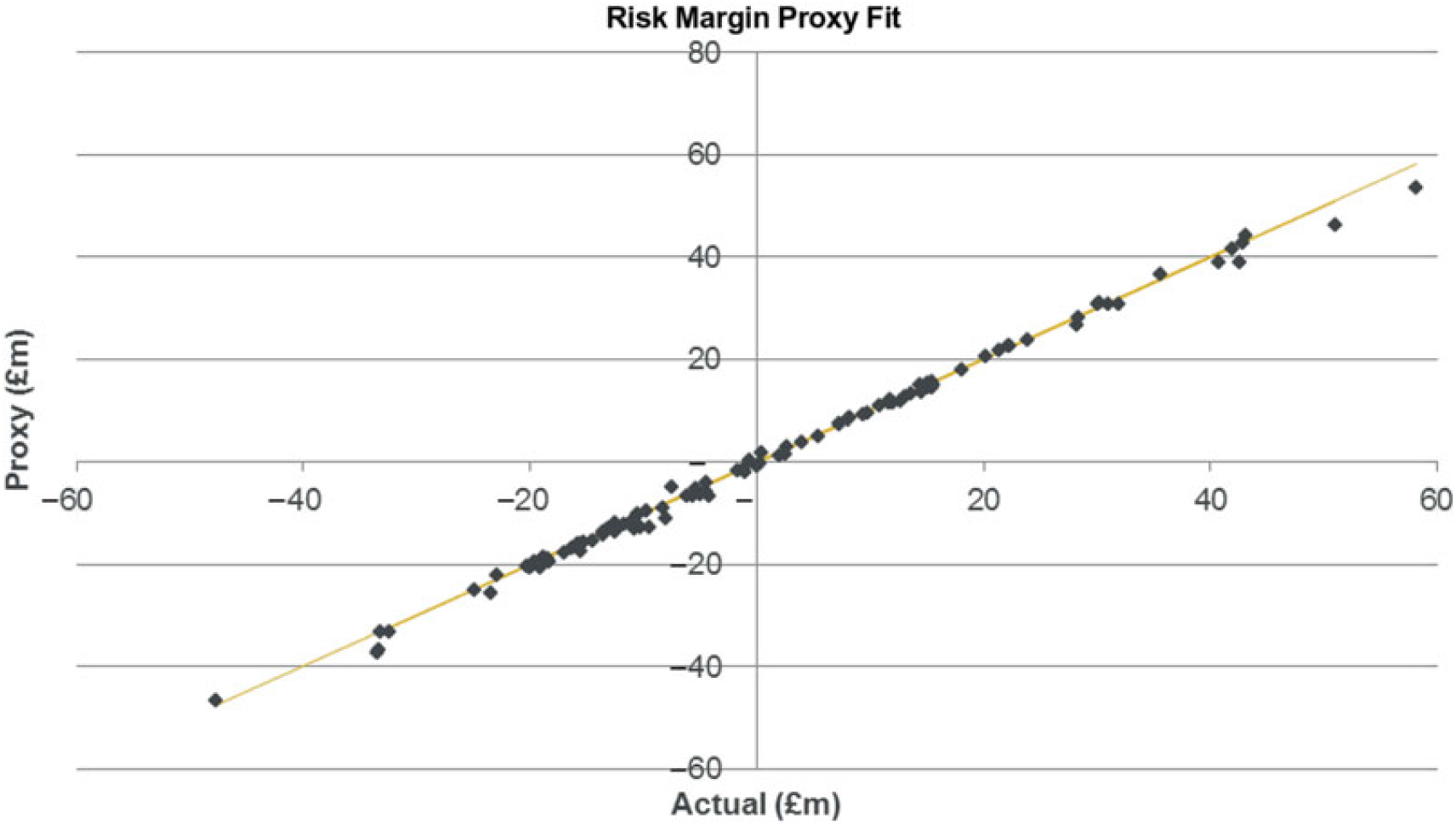

5.10.1 Validation of the model has been carried out using a test set of 100 OOS points drawn at random from the joint probability distribution. A comparison of the predicted versus actual results is shown below:

The graph (supported by error statisticsFootnote 21) shows a very close fit, and so the proxy model has been accepted.

5.11 Proxy model example – Key exposures

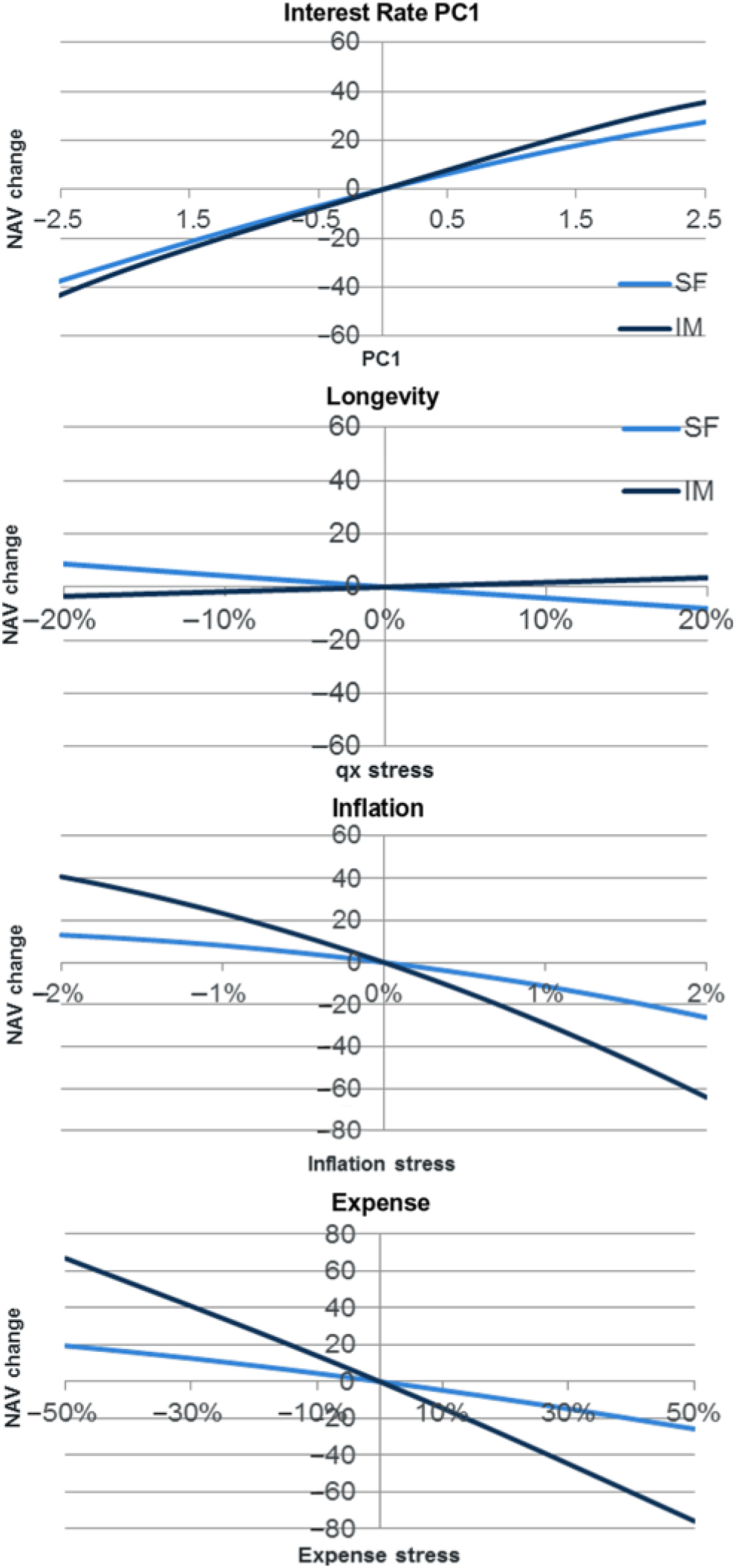

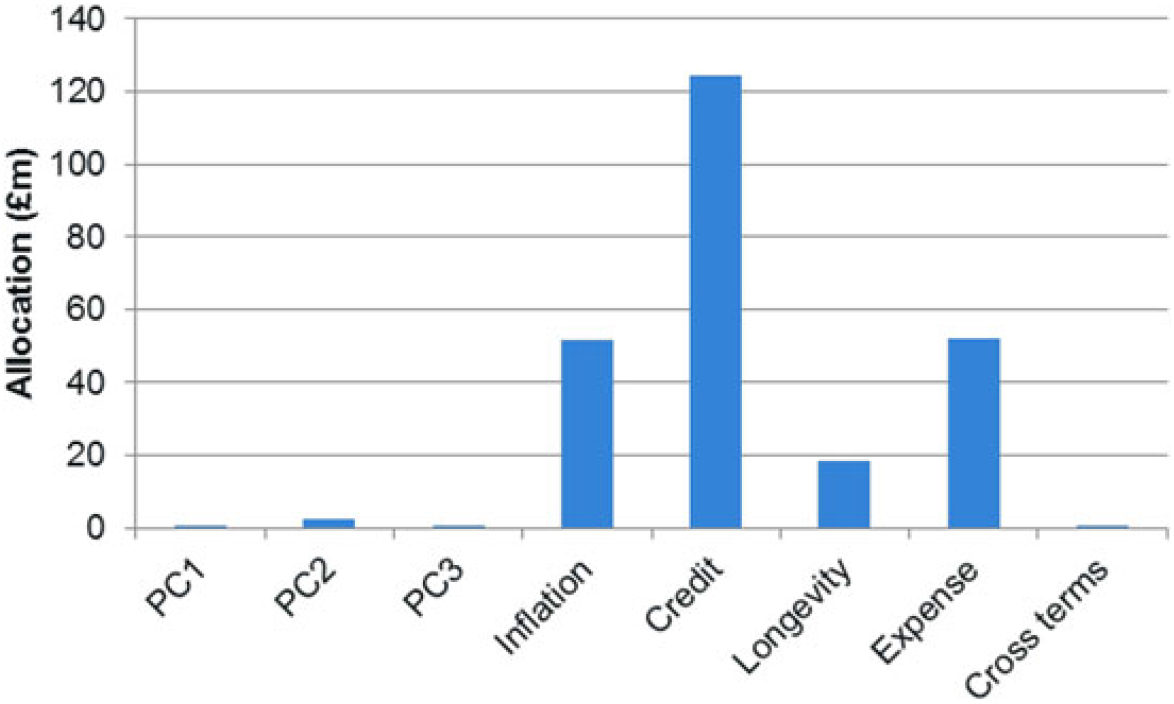

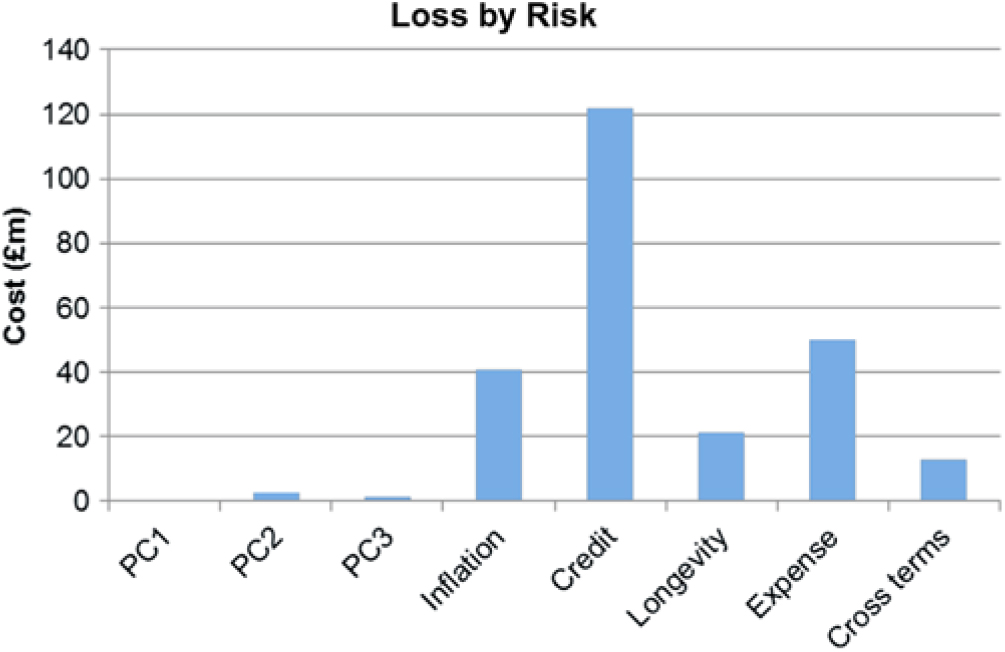

5.11.1 The key risk exposures in the model can be seen in the following graphs:

5.11.2 The results show, as expected, that the annuity book is exposed to increases in expenses, inflation and life expectancy (falling q x). The interest rate exposure is to increasing yields (PC1 broadly reflects an increase in the level of the curve). The reason for this directional exposure is that there is a small excess of assets over liabilities which gives a cost as interest rates rise. This result is specific to the example being used. More generally the direction of interest rate exposure of an annuity book depends on the matching position of the assets used to back the liabilities.

5.12 Proxy model example –Joint risk exposures

5.12.1 Whereas individual risk exposures can be easily graphed as above, to visualise the effects of two risks at a time requires 3d or contour-style graphs. The following graph shows the combined exposure to interest rate PC1 and longevity (represented by q x changes). Of course there are important exposures to many other risk combinations.

5.12.2 In this plot, the proxy function is represented by the shaded areas, the boundaries of which represent combinations of PC1 and q x that give a constant loss. The threat direction arrows are perpendicular to the lines of constant loss and are used to show the direction of increasing losses.

5.12.3 The graph shows exposure to rising interest rates and falling q x as shown in the individual graphs. The graph also shows a change in the threat direction close to the bottom of the graph. This shows that under a significant reduction in q x, the interest rate exposure actually goes from an exposure to increases in yield to a more neutral exposure. This reflects a change from a position of excess assets to liabilities to a closer match following a large longevity event. It should be noted that this effect is specific to the example given and that the nature of the exposures depends on the specific details of the assets and liabilities.

6. SCR proxy fitting

6.1 Purpose

6.1.1 Within this section, the complexities of fitting proxy functions to allow for changes in SCR are discussed. In order to calibrate proxy functions for changes in SCR, the approach to be used is different depending on whether a firm uses a variance covariance formula method (as is used in the SF) or copula simulation approach.

6.2 SCR fitting –Variance covariance formula – Overview

6.2.1 As with all types of proxy model fitting, fitting to the SCR is carried out by initially evaluating changes to the SCR under a calibration set. Once complete a proxy function can be fitted to the results and validation can be carried out using standard approaches as described above. In practice, this may mean several hundred revaluations of the SCR under different stresses. As the SCR itself may be made up of multiple stresses (approximately 25 stresses for the SF), to fully revalue the SCR several hundred times is likely to be impractical.

6.2.2 In order to be able to practically revalue the SCR several hundred times, an approach that may be used is to use the existing proxy model and roll forward process. The key to achieve this is to be able to estimate the 1-in-200 stress results for each risk in the SCR using the proxy model. The roll forward process then may be used to estimate how the 1-in-200 results change following stress events.

6.2.3 Where there is alignment between the risk definitions used in the proxy model and those used under the SCR, this may be relatively simple; however, where differences arise, an alternative approach may be required.

6.2.4 One further point of consideration here is whether there are any changes in the risk model following a stress. Section 2 discusses whether the SF could be considered to have a true risk model. Notwithstanding this point, the equity stress used under the SF contains a symmetric adjustment mechanism in which the stress varies depending on recent equity returns. This is equivalent to a change in the risk model following a stress.

6.2.5 In addition to considering the equity stress, a further point of discussion in the SF is the interest rate stresses. These are specified as multiplicative factors to apply to different points on the spot curve. The interest rate-up stresses are subject to a minimum level of 1%. No stresses are applied where rates are negative. This specification means that the interest rate element of the risk model differs depending on the level of the curve. Therefore, the SF risk model changes following an interest rate stress.

6.2.6 Under a more general variance covariance formula approach, any features such as those discussed above under the SF will need to be taken into account where material.

6.2.7 The approach used to revalue the SCR under stress would be expected to vary depending on the nature of the business and model. To illustrate some of the techniques that may be used, a proxy function will be used to calibrate to the annuity model above. The firm is assumed to calculate its capital requirements using the SII SF.

6.3 SCR fitting – Variance covariance formula SF example

6.3.1 Within the annuity model, exposure exists to longevity, expenses, inflation and interest rates. Under the SII SF, inflation risk is not separately captured and so no stress calculation is required. The approach used for longevity, expense and interest rates is discussed below.

6.3.2 Under the SF, the longevity risk 1-in-200 event is specified as a 20% fall in qx. This event definition is in line with the model structure set out in section 4 above. Therefore, the cost of a longevity 1-in-200 stress may be found by using a value of −20% in the proxy function.

If we specify the proxy function as f(L, I, E, Cr, A, B, C) where the terms represent the risks as defined in section 4 (A, B, C represent interest rates PC1, PC2, PC3), we may calculate the 1-in-200 longevity capital as −f(−20%, 0, 0, 0, 0, 0, 0).

6.3.3 The SF expense stress is made up of an increase to the level of expenses of 10%, together with a 1% increase in expense inflation. The SF stress is therefore not consistent with the model structure used in the example model. However, the SF stress can be simply calculated by applying an expense stress of 10% and an inflation stress of 1% in the loss function. The expense capital amount is therefore equal to –f(0, 1%, 10%, 0, 0, 0, 0).

6.3.4 The SF interest rate stresses consist of an up and down stress, specified as multiplicative changes to the spot yield curve subject to at least 1% (for the up stresses). No changes are applied for negative rates. The form of the SF stresses is therefore substantially different from that used in the example proxy model. The key differences are as follows:

• Specified up and down stresses (in vector form) are used rather than principal components.

• Multiplicative changes are used rather than additive.

• A floor of 1% is applied on the up stresses.

• The levels of the stresses are different.

6.3.5 Despite these differences, it is still practical to be able to estimate the SF stresses using the existing proxy model. The steps to do so are as follows:

1. Using the current yield curve, derive the SF stress curves (allowing for the 1% floor) and compare against the base curve to get the yield curve stress specified as an additive (vector) change.

2. Express the vector change as a linear combination of the proxy model principal components. Therefore derive the interest rate PC combination equivalent to each of the SF up and down stresses.

6.3.6 With regards to the second of these steps, PCA is used to break down changes in a yield curve (or other measure) so that rather than modelling individual points on the curve, the changes can be expressed in terms of its principal components (representing the main shapes of the changes). Therefore, using PCA we can approximate any yield curve movement as a linear combination of the PCs.

As an example, using the example model (with PC values shown in Appendix B), the following approximation to the SF yield down stress under a 2% base yield can be constructed:

The SF yield down capital (for 2% yield) may therefore be estimated as:

It should be noted that this process will be required for each of the calibration run stresses as the SF yield stresses vary as the yield curve changes.

6.3.7 Once the capital amounts for the longevity, expense and interest rate stresses have been derived, the SF capital amount may be derived using the SF aggregation formula.

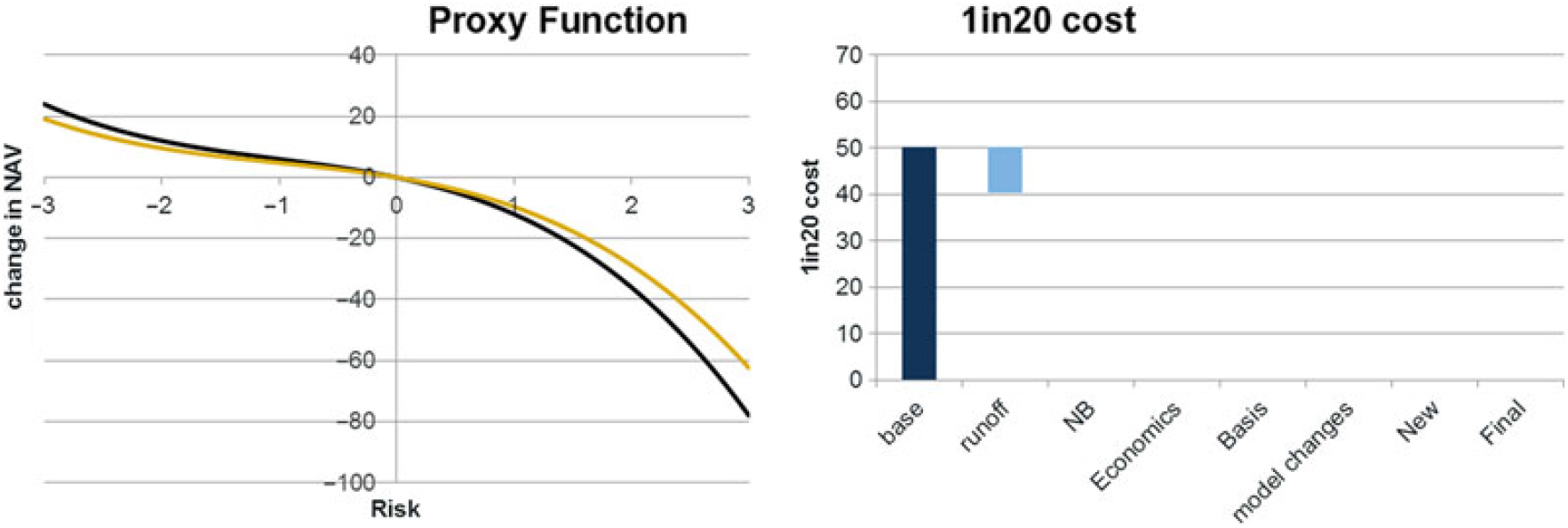

6.4 SCR fitting – Variance covariance formula SF example results

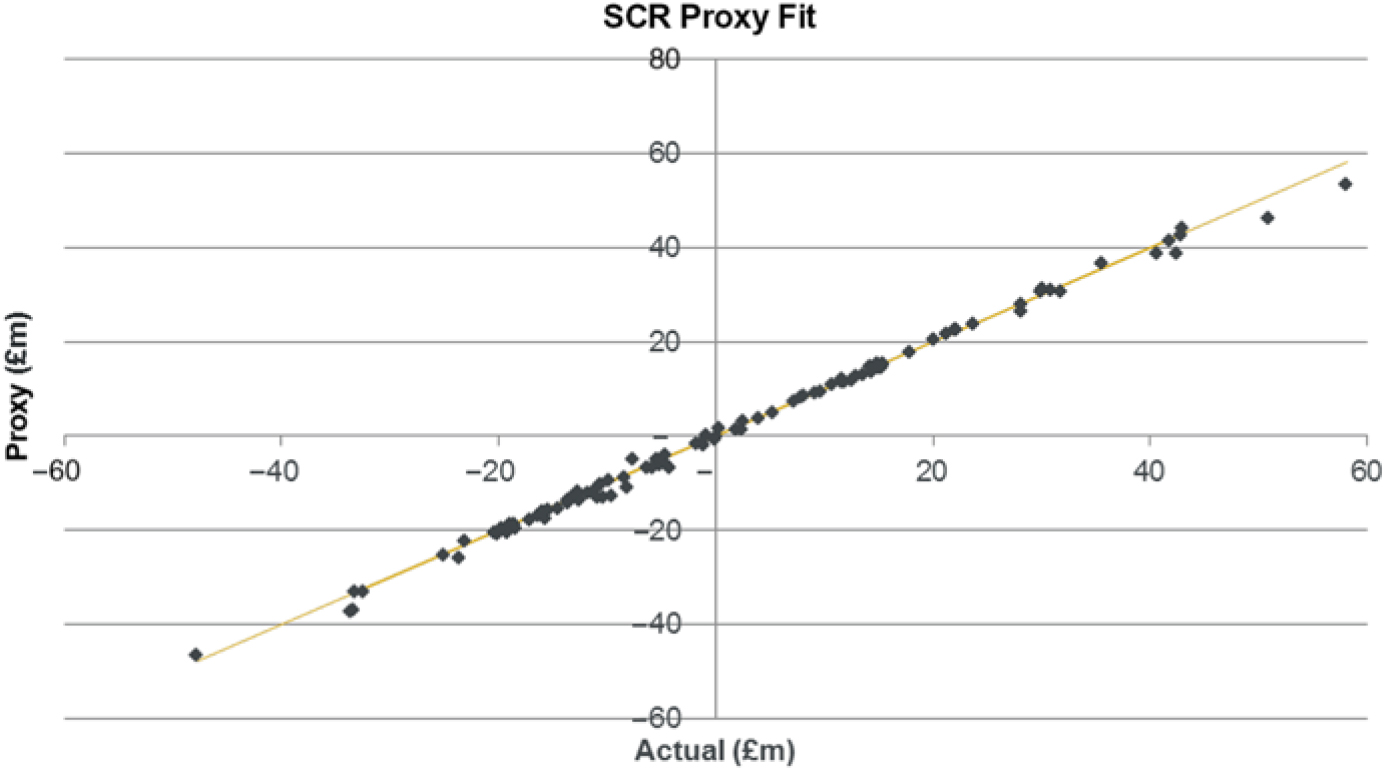

6.4.1 Using the same calibration parameters as used in the net assets example in section 4, the following calibration graph can be obtained.

6.4.2 Note, in this case, that there are two levels of proxy modelling, the proxy fitting used to derive the net assets (assets and annuity liabilities) exposure, followed by the use of this proxy function to estimate the SF SCR. It is important in this case that the “actual” values in the above graph are derived from a full revaluation of the SCR under stress rather than being taken from the SCR estimated from the proxy function.

6.4.3 The above graph (and accompanying analysis) shows that the SCR proxy fit is suitably accurate. The OOS analysis above has been completed using 100 test points. In practice it may be necessary to use far fewer points for practical reasons.

6.5 SCR fitting – Variance covariance formula SF example – Key exposures

6.5.1 The following graphs show the key risk exposures for the SF SCR example. Here the graphs show how the SCR element of the overall surplus changes in response to risk movements (the graphs show the effect on the NAV).

6.5.2 As may be expected, the results show the SCR increases under increased inflation and expenses. This is simply that these increase the value of the expense element in the model, therefore increasing the cost of stresses.

6.5.3 The exposure of the SCR to interest rates is down (the opposite to the exposure of the net assets). The key reason for the exposure is that as interest rates fall, all the cash flows used in the calculations are discounted at a lower rate leading to an increase in the SCR. For this reason, it is very common for the SCR to be exposed to falling interest rates.

6.5.4 The exposure to longevity is unusual in that the exposure of the SCR is to increasing q x. Normally it may be expected that falling q x gives rise to greater annuity liabilities and therefore a greater SCR. However, due to the nature of the asset and liability position in the specified example, the fall in q x actually lead to a closer matching position between assets and liabilities. This has the effect that the interest rate capital in the SF SCR is reduced.

6.5.5 The analysis demonstrates how a proxy function can be fitted to give the estimated change in the value of the SCR. The results show that the effect can be material and the exposure may not be as expected.

6.6 SCR fitting – Copula simulation example

6.6.1 The above example demonstrated how a proxy function may be fitted to the SCR under a variance covariance approach as is used under the SF. Within this section, an approach that may be used for an SCR calculated by copula simulation model is discussed.

6.6.2 In practice, where a company uses a copula simulation model to calculate its IM SCR, there is likely to be close alignment between the risk model structure used in the regulatory capital model for SCR and the risk model structure used in an EC model and used in a stochastic full balance sheet model. This would mean the risks used and their definitions are the same (the calibrations could be different).

6.6.3 In most cases, in addition to alignment between the risk model structures used between the regulatory capital and stochastic full balance sheet models, there would normally be alignment between the loss function used for assets and liabilities in the different models. For example, under a 1% fall in yields, the cost to net assets this gives in the SCR model would be expected to be fully realistic. Therefore, that same cost would apply to the regulatory capital and stochastic full balance sheet models.

6.6.4 There are circumstances for which the loss function used in a stochastic full balance sheet model would be expected to differ from those used in the regulatory capital model. A key example to this is the use of the VA. The VA is not permitted to move under stress in the UK, whereas it does actually move in response to credit stresses. As the stochastic full balance sheet model is intended to model fully realistic changes in the balance sheet, it must take into account that the VA changes under stress, but the SCR calculations are on the basis of a static VA. Complexities around the use of the VA are discussed in further detail in section 9.

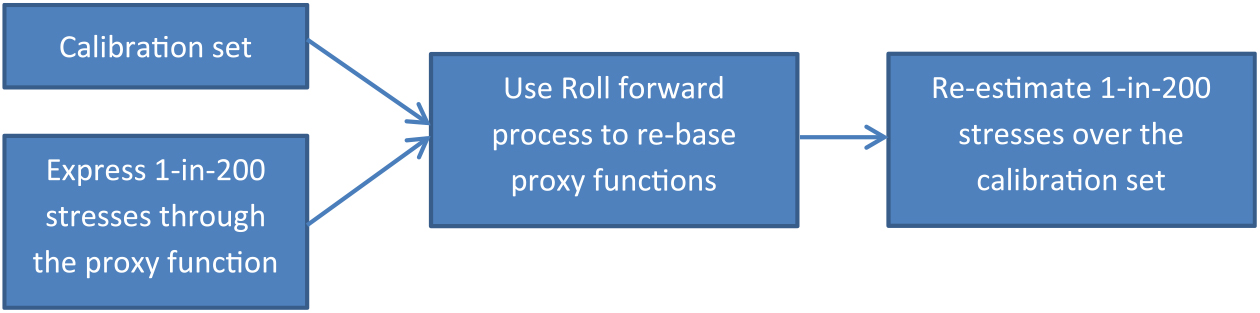

6.6.5 On the assumption that the risk model structure and the loss function are the same as in the regulatory capital model, the roll forward process may be used to adjust the proxy functions under each stress. The process may be carried out as follows:

6.6.6 Of course, the SCR model may be time-consuming to run, and so there may be practical difficulties with running a large calibration set. An approach that may be used to mitigate this is to run the SCR model with a reduced number of simulations. It may be helpful to use a different random seed for each run in order that any simulation error is spread across the different runs.

6.7 SCR fitting – Copula simulation example results

6.7.1 Using the annuity model example above, the assumption is now made that the SII SCR will be calculated using a copula simulation model over 10,000 simulationsFootnote 22 with the risk model and calibrations as set out in section 4 above. No VA is assumed.

6.7.2 A calibration set of 255 Sobol runs has been used rather than 1,023 as used previously (a smaller number is used to take into account the time required to carry out SCR runs). Other than this, the same approach to fitting as previously has been used. The fit performance results are set out below:

The fit performance has been considered to be suitably accurate.

6.8 SCR fitting – Copula simulation example – Key exposures

6.8.1 The following graphs show the key risk exposures. For comparison, the results are shown against the equivalent SF results set out above.

6.8.2 The IM results show a greater exposure to expense and inflation risk than for the SF. This reflects the fact that the expense and inflation risks (1-in-200s are 50% and 2%, respectively) included in the copula-simulated SCR have a stronger calibration than the expense stress used in the SF (expense risk has a 10% expense level increase and 1% increase to expense inflation). Of course, the SF stress applies the expense level and inflation stresses together, whereas in the copula simulation model diversification between the risks is allowed for.

6.8.3 Longevity risk in the copula-simulated SCR is of the opposite exposure to under the SF SCR. The copula-based exposure is as would be normally expected (policyholders living longer give greater BEL and so higher SCR). The reasons for the SF SCR exposure being in the opposite direction are set out in section 6.5 above. Much of the reason for the difference in direction is due to the SF SCR in this case being heavily influenced by the interest rate up 1-in-200 shock, whereas the copula simulation approach allows for interest rate exposure over all parts in the distribution.

6.8.4 Interest rate exposure is similar between the two sets of results. The slightly higher exposure in the IM copula simulation SCR reflects the SCR itself being slightly higher.

6.8.5 This example shows there may be significant differences in exposure depending on whether an SCR is calculated using a variance covariance approach such as that used in the SF or a copula simulation approach (as typically used in an IM). Of course, the nature of the differences depends on the respective calibrations used within the example model, and so this example should not be used to infer conclusions on the merits of an IM or SF approach.

7. RM and TMTP proxy fitting

7.1 Purpose

7.1.1 The purpose of this section is to discuss the challenges inherent in calibrating a proxy function to represent changes in a firm’s RM and TMTP. An example is used to demonstrate how this may be done for a firm using a variance covariance formula approach (in this case the SF). The same techniques are applicable for firms using copula simulation approaches.

7.2 RM overview

7.2.1 The RM is calculated by projecting future SCRs in respect of non-hedgeable risks, before applying a 6% p.a. cost of capital charge and discounting the results back to the valuation date at the risk-free rate. The most common approach used by firms to allow for future SCRs is a risk driver technique in which risk drivers such as the BEL or sum at risk are used to project the 1-in-200 risk capitals for each product and (non-hedgeable) risk used in the calculation.

7.2.2 Therefore, in order to fit a proxy function to the RM, the approach used is equivalent to that used for an SCR; however, some key differences must be taken into account:

• The RM calculation takes into account non-hedgeable risks only

• Changes in the risk free discount rate under stress need to be allowed for

• Changes in the run-off of risks (assuming a driver approach is used)

• The RM is calculated assuming no MA or VA is included

7.2.3 The exclusion of hedgeable risks from the calculation can be easily carried out. The modelling challenges concerning the MA and VA are discussed in detail in section 9 below. This section is therefore concerned with allowance for the changes in risk-free rate and run-off.

7.2.4 The allowance for changes in the risk-free rate used in the RM calculation is relatively simple. It can be carried out by applying the interest rate risk model over the base curve being used.

7.2.5 The allowance for changes in risk drivers may have a significant effect on the results. A key example is where a longevity event takes place in an annuity book. This has the effect that the run-off of future SCRs is slower leading to a higher RM. There are a number of different techniques that may be used to allow for changes in the run-off rate. For example, an approximation factor could be calculated so as to spread the run-off over a greater (or fewer) number of years for material risks.

7.2.6 The most simple and accurate approach to allow for run-off is simply to recalculate the drivers under each of the calibration runs. This may lead to a large number of runs, but these may actually be readily available. For example, using the annuity model, the calibration of the proxy function to assets and liabilities provides 1,023 runs from which the run-off of the BEL and other drivers may be obtained. Using these same 1,023 runs in the RM proxy calibration means the run-offs have already been produced.

7.2.7 Perhaps the most important exposure of the RM is to falling interest rates. These tend to have a compounding effect as the effects of falling interest rates normally increase the level of SCR (as seen in section 6) and, of course, reduce the discounting of the future SCRs. There may also be a smaller effect on the risk drivers’ run-off.

7.3 RM fitting SF annuity example

7.3.1 Using the annuity example SF model (without VA) above, the following approach has been used to calculate the RM.

1. Calculate the SF SCR in respect of the expense and longevity risks only (to represent the non-hedgeable risk).

2. The RM (as set out in section 4 above) is determined by projecting the longevity risk SCR using the BEL as a driver and the expense risk SCR using the BEL in respect of the expense cash flows only.

3. The RM is then calculated using the standard SII approach of discounting the future SCRs allowing for a 6% cost of capital charge.

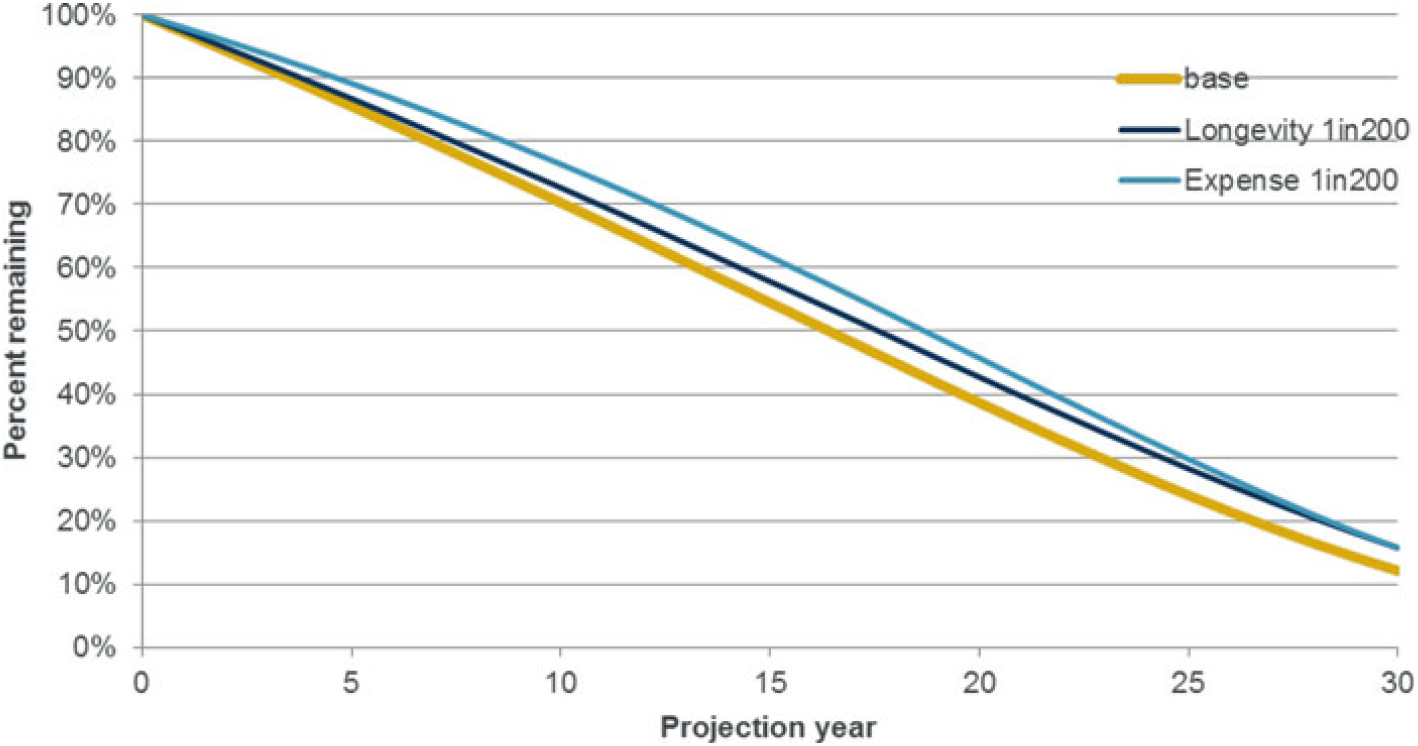

7.3.2 In order to calculate an RM proxy function, the allowance for the change in risk drivers under stress is required. For this purpose, the actual run-off of the drivers has been used as described above. The following graph shows examples of the extent to which the run-off rate is affected by stress events:

The results show that the run-off rate may be significantly slowed down under a longevity or expense stress. (The graph also highlights the differences that may arise to the shape of the run-off.) The longevity event and expense event have similar effects over the longer terms, whereas the expense stress effects are strongest at the shorter terms. Although the graph shows non-market risks, the effects of market risks such as inflation or interest rates may also be significant.

7.3.3 In addition to the risk drivers, the other key elements of the calculation are the valuation of time zero SCRs and the discount rate used to discount the future projected SCRs. To derive these, the approach described above for the SF SCRs (section 6) has been used (allowing for longevity and expense risk only in the SCR calculations). For the discounting, the discount rates under stress have been calculated to allow for the interest stresses as defined.

7.4 RM fitting SF example – Results

7.4.1 A proxy function has been fitted to changes in the SF RM for the annuity model. The approach used is the same as that set out for the SF SCR in section 6 (using 1,023 calibration runs). The fitting results graph is as follows:

The results have been considered sufficiently accurate, and so the calibration has been accepted.

7.5 RM fitting SF example – Key exposures

7.5.1 The following graphs show the key exposures of the RM:

7.5.2 The results show a significant exposure to falling interest rates as a result of increased projected longevity and expense capital, together with lower discounting. Exposure to expense and inflation increases are also significant due to changes in the projected expense risk capital.

7.5.3 There is an exposure to longevity risk due to increases in the projected expense and longevity capital together with changes in the run-off. The exposure is smaller than for expense or inflation risk due to differences in the run-off pattern. The run-off graph above shows inforce volumes are much higher for expense risk than longevity at the 10-year point, but they converge by the 30-year point.

7.6 TMTP fitting

7.6.1 The TMTPs are the transitional measure designed to allow for changes between the Solvency I and Solvency II regimes amortised over a 16-year period. The amount of TMTP reflects key differences such as the inclusion of the RM under SII and differences in the BEL such as allowances for illiquidity premia. The amount of TMTP steps down using increments of ![]() ${1 \over {16}}$ each year over the transition period. The TMTP amount may be recalculated subject to regulatory requirements and approval. The amount of TMTP is subject to the financial resources requirement (FRR) test designed to ensure firms are not better off than under SI allowing for the TMTP.

${1 \over {16}}$ each year over the transition period. The TMTP amount may be recalculated subject to regulatory requirements and approval. The amount of TMTP is subject to the financial resources requirement (FRR) test designed to ensure firms are not better off than under SI allowing for the TMTP.

7.6.2 If the TMTP amount was not be expected to be recalculated, it would not be necessary to include the TMTP in a stochastic full balance sheet model as it is not risk dependent. The simplest approach to the allowance for any TMTP would therefore be to assume no recalibration.

7.6.3 In practice, the TMTP would be expected to be recalculated under specific circumstances. The PRA has indicated that it expects TMTP to be recalculated every 2 years or following a material change in risk profile.Footnote 23

7.6.4 A material change in risk profile could arise from a large risk movement such as a significant interest rate fall. Firms may have documented practice that sets out what criteria they consider represents a material change in risk profile. However, any recalculation would still be the subject of regulatory approval.

7.6.5 In view of the above, firms may consider that the 1-in-X type of events included in their risk appetite statements would constitute a change in risk profile; therefore, it would be necessary to include an allowance for TMTP changes in their full balance sheet model. Alternatively, firms may consider it inappropriate to speculate that TMTP may be recalculated as this may then give the firm a reliance on recalculation when this may not happen in practice (or may not happen quickly enough). In either case, it is important for firms to consider whether their stochastic full balance sheet model should allow for changing TMTP in order that risk appetite or other risk management modelling can be effectively carried out. Firms may choose to investigate results both including and excluding a TMTP recalculation.

7.6.6 Should an allowance for TMTP recalculation be made in the stochastic full balance sheet model, it is necessary to identify a suitable approach to allow for it. For many firms, the most significant element may be the RM. This may be easily allowed for as the TMTP amount represents the ![]() ${a \over {16}}$

of the RM where a reflects the number of year of transition remaining. However, there are some complexities that need to be taken into account such as that the TMTP applies only on business written before the 1st January 2016.

${a \over {16}}$

of the RM where a reflects the number of year of transition remaining. However, there are some complexities that need to be taken into account such as that the TMTP applies only on business written before the 1st January 2016.

7.6.7 Where other elements of the TMTP are material, the approach used to allow for them would differ depending on the nature of the model. The allowance for the FRR test (where this has an effect) may be complex to allow for.

7.6.8 In the example model, no changes in the value of TMTP are taken into account.

8. Combined results – SF model

8.1 Purpose

8.1.2 In the above sections, proxy functions for the net assets, SCR and RM under the SII SF have been derived. This short section shows how the results combine to give the overall balance sheet exposure.

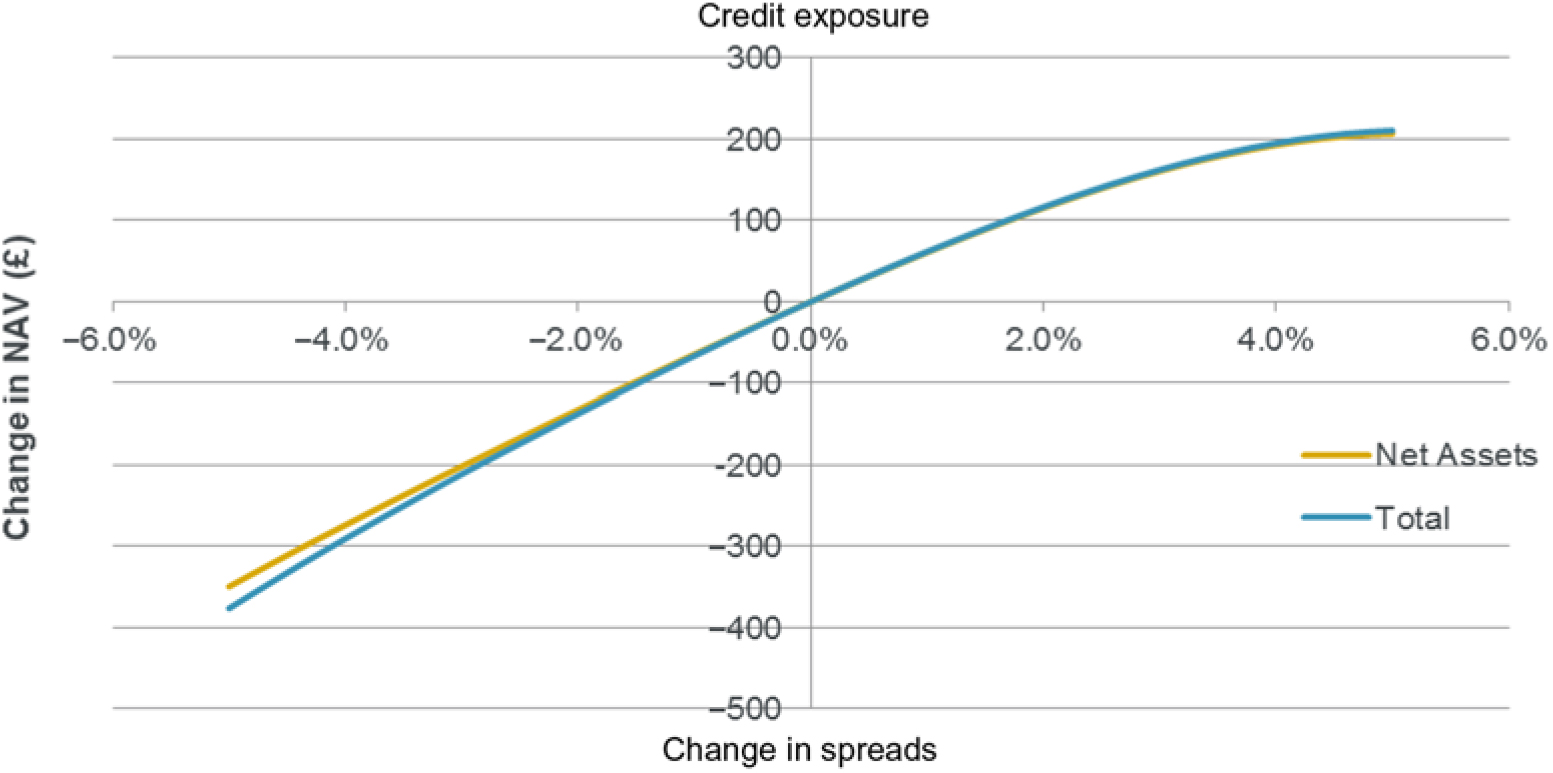

8.2 Key exposures

8.2.1 The following graphs show the key exposures of the model. For comparison purposes, the graphs show the full balance sheet exposure and also the net asset exposure (just the changes in assets and liabilities) so that the importance of modelling all elements of the balance sheet can be seen.

8.2.2 The results show a significant difference in interest rate exposure for the full balance sheet as compared to the net assets only. The reason for the difference is the significant exposure to falling interest rates in the SCR and RM.

8.2.3 Longevity results show the full balance sheet exposure is very close to the net asset exposure. This is due to the SCR and RM elements being in opposite direction in this particular example.

8.2.4 The inflation and expense exposures are significantly increased in the full balance sheet model compared to the net assets. This is because increases in inflation or expenses give increases to SCR and RM as well as the cost of the annuities.

8.2.5 It should be noted that these exposures are very specific to the example used. Each model or set of parameters could possibly give very different results (e.g. longevity exposure in a full balance sheet model may be more onerous than the net assets results suggest).

9. Discount rates modelling

9.1 Purpose

9.1.1 The purpose of this section is to discuss the effects of changes in key discount rates in a stochastic full balance sheet model in order that their effects may be realistically quantified. The key features discussed are the VA, MA and pension scheme discount rates.

9.2 Volatility adjustment

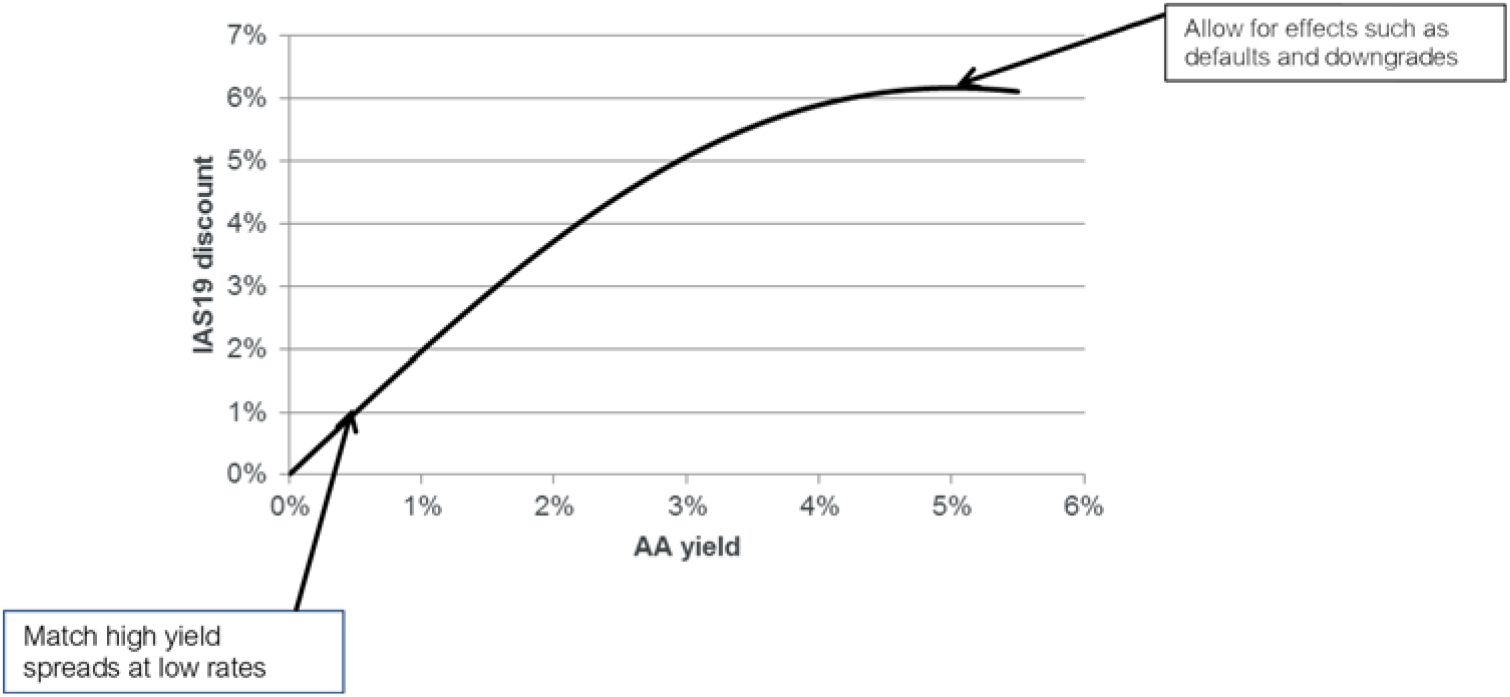

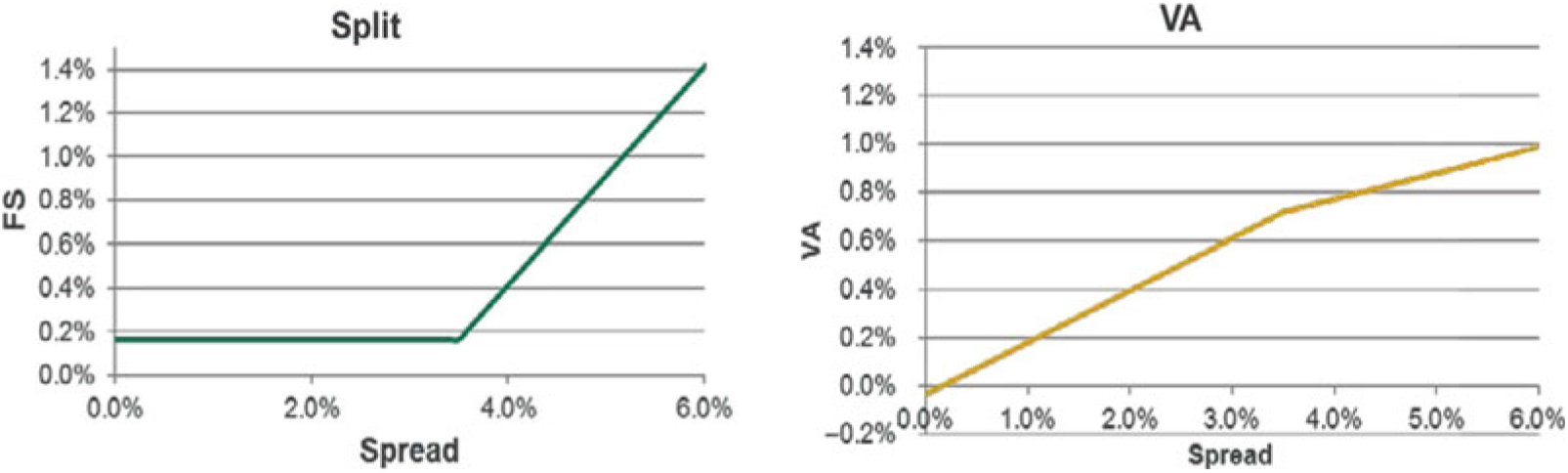

9.2.1 The volatility adjustment or VA represents a flat addition to the discount rate for applicable long-term liabilities.Footnote 24 The VA was introduced as part of EIOPA’s long-term guarantees (LTG) package alongside other features such as the MA and transitional measures. The VA is designed to prevent pro-cyclicality by removing “artificial volatility” from the Own Funds of insurers.

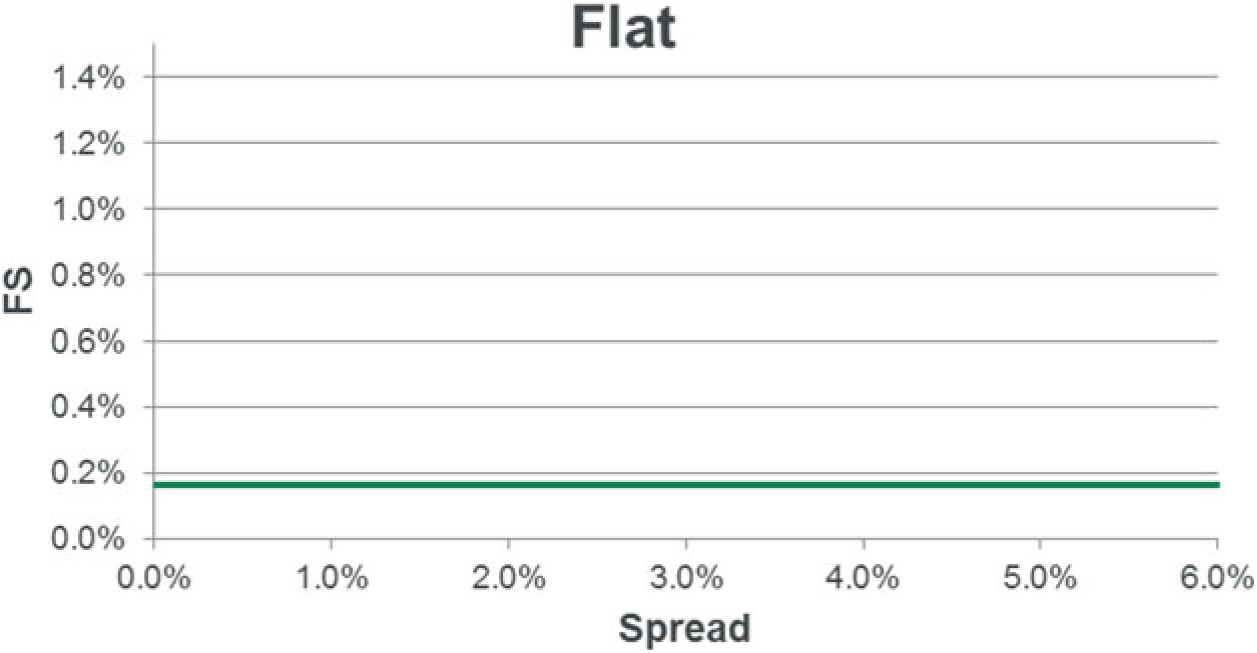

9.2.2 The VA is calculated using 65% of the spread between the interest rate of the assets in a reference portfolio and the risk-free rate, allowing for a fundamental spread (FS). The FS represents the element of the spread attributable to default and downgrades.

9.2.3 The VA is published monthly by the European Insurance and Occupational Pensions Authority (EIOPA) according to a defined formula. The calculation is carried out separately by duration and rating with the results used to derive a single VA. Allowance is also made for separate country-specific effects where significant.

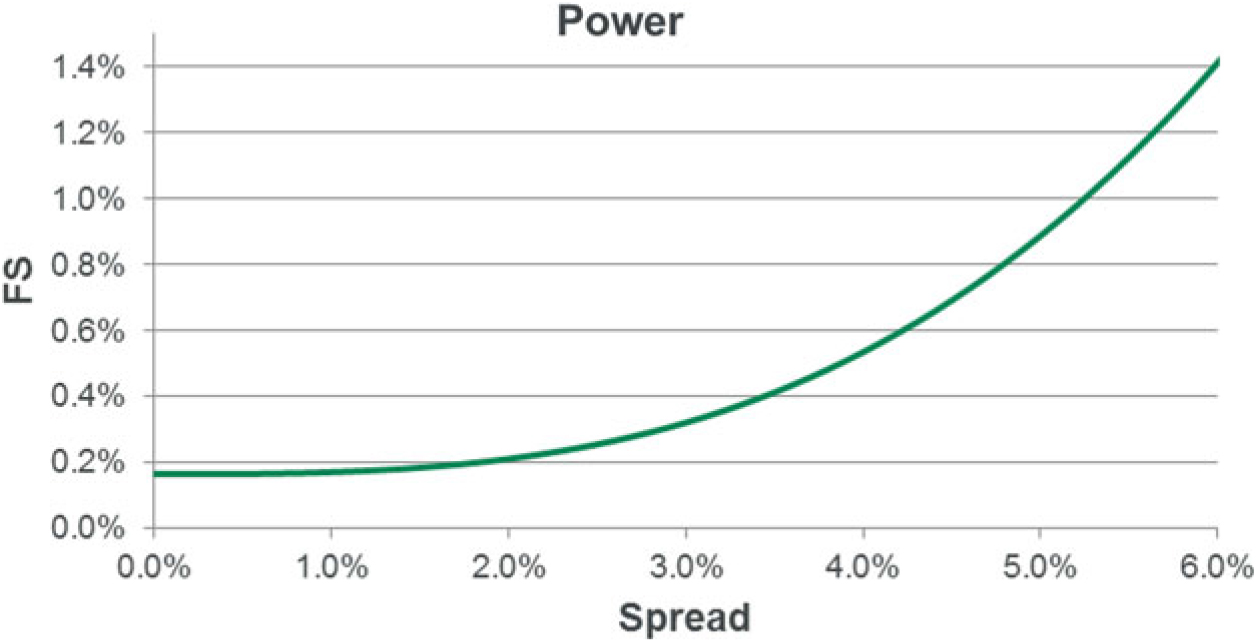

9.2.4 The VA may be used by firms on specific areas of business subject to regulatory approval. Firm’s RM calculations are required to exclude the VA.