1. Introduction

There is growing recognition within the financial services community that biodiversity loss is intrinsically linked with climate change, that it presents a material financial risk, and that there is an urgent need to deliver real-world impact and nature positive outcomes. These are outcomes which grow natural capital as well as Gross Domestic Product, preserve the ecosystem services on which we depend, and support better human outcomes. As the Dasgupta Review poignantly proposed, we must understand and accept that “we are embedded within Nature, we are not external to it.” (HM Treasury, 2021, p. 69)

To do so effectively, financial services firms require tools which enable them to better understand the impact that their business decisions have on biodiversity. This paper explores a selection of tools which actuaries could use to better understand and measure biodiversity loss, and identifies those which may be of most relevance to the actuarial profession. Some tools are more suited to certain sectors/roles than others, for example tools which can be used by investment teams to assess the biodiversity credentials of direct investments.

This paper is part of a series of deep dive papers developed by the IFoA Biodiversity and Natural Capital Working Party and is closely linked to a paper in the series titled “Natural Capital – An Actuarial Perspective”Footnote 1 , from which this paper builds and which we cross-reference to where relevant. We recognise that biodiversity may be a relatively new concept to the actuarial profession, and so set out below some of the key terminology which we refer to in this paper:

Biodiversity is “the variability among living organisms from all sources including, inter alia, terrestrial, marine and other aquatic ecosystems and the ecological complexes of which they are part; this includes diversity within species, between species and of ecosystems.” (CBD, 2018)

Ecosystem services are flows from natural capital assets (e.g. land, oceans, minerals) that enable living things to provide services such as crops, pollination, water filtration and recreation, which serve to benefit humans (POST, 2016)

A Natural Capital Approach integrates the concept of natural capital into decision-making. Thinking in “capital” terms enables comparison of many changes and decisions at the same time. The natural capital approach uses information from, and provides input to, many existing environmental management and analytical approaches (Natural Capital Coalition (2019)

Understanding the risk of biodiversity loss is relatively nascent within the actuarial profession and the uptake of the tools discussed in this paper is limited to date. Whilst some institutional investors have begun to develop approaches to considering biodiversity value as part of their investment decision making process, there is no universal consensus on the best approach to assign value to biodiversity and the tools which should be used to facilitate this.

There are other professions who use an existing suite of tools to assign and identify biodiversity value – for example local council planning officers, forestry management teams and environmental agencies. With this context in mind, this paper focuses on the extent to which the actuarial profession can leverage the existing suite of biodiversity valuation tools available, with or without possible modification?

2. Methodology and Limitations

Our research has centred on the biodiversity valuation tools referenced by the Department for Environment and Rural Affairs (DEFRA) in its publication “Enabling a Natural Capital Approach Guidance” (DEFRA, 2020a). This publication is seen as a comprehensive practical guide to natural capital and therefore was determined a sensible starting point from which to begin our research.

We recognise that there is an extensive range of biodiversity tools which exist beyond those identified by DEFRA. This paper is not intended to be an exhaustive catalogue of all biodiversity tools available in the market, but rather is intended to explore the types of tools which exist at present and how they could be applied to the actuarial profession. Our expectation is that this research will be incrementally built on over time, as our collective understanding of biodiversity valuation tools increases.

We also recognise that tools advocated by DEFRA naturally have a UK focus. We anticipate that this paper will be augmented with non-UK examples as our understanding of the range of biodiversity tools available increases.

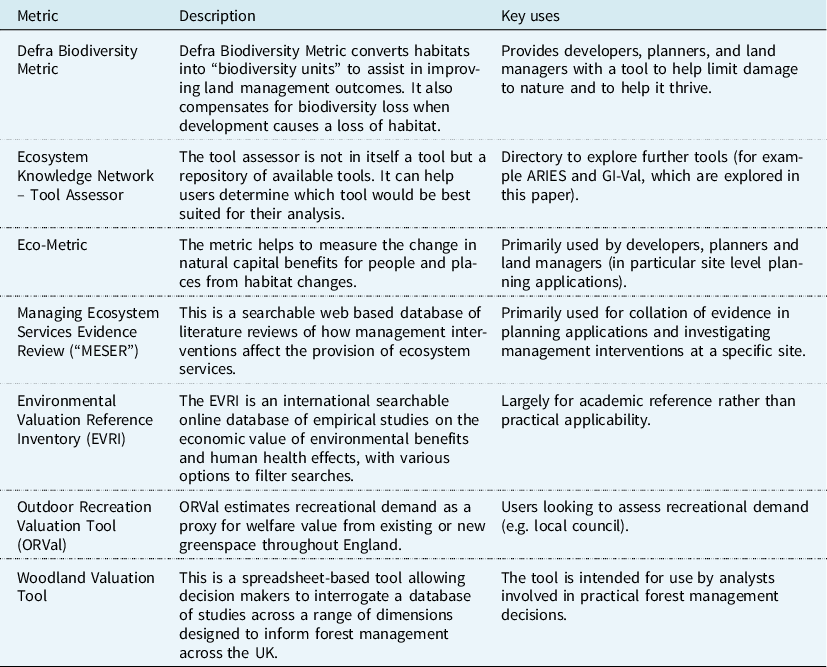

3. Overview of the Valuation Metrics and Tools Available

We set out below a summary of each of the tools which we have investigated. For those which are particularly applicable to the actuarial profession, we have provided a further deep dive with suggestions as to how they may be used in our work.

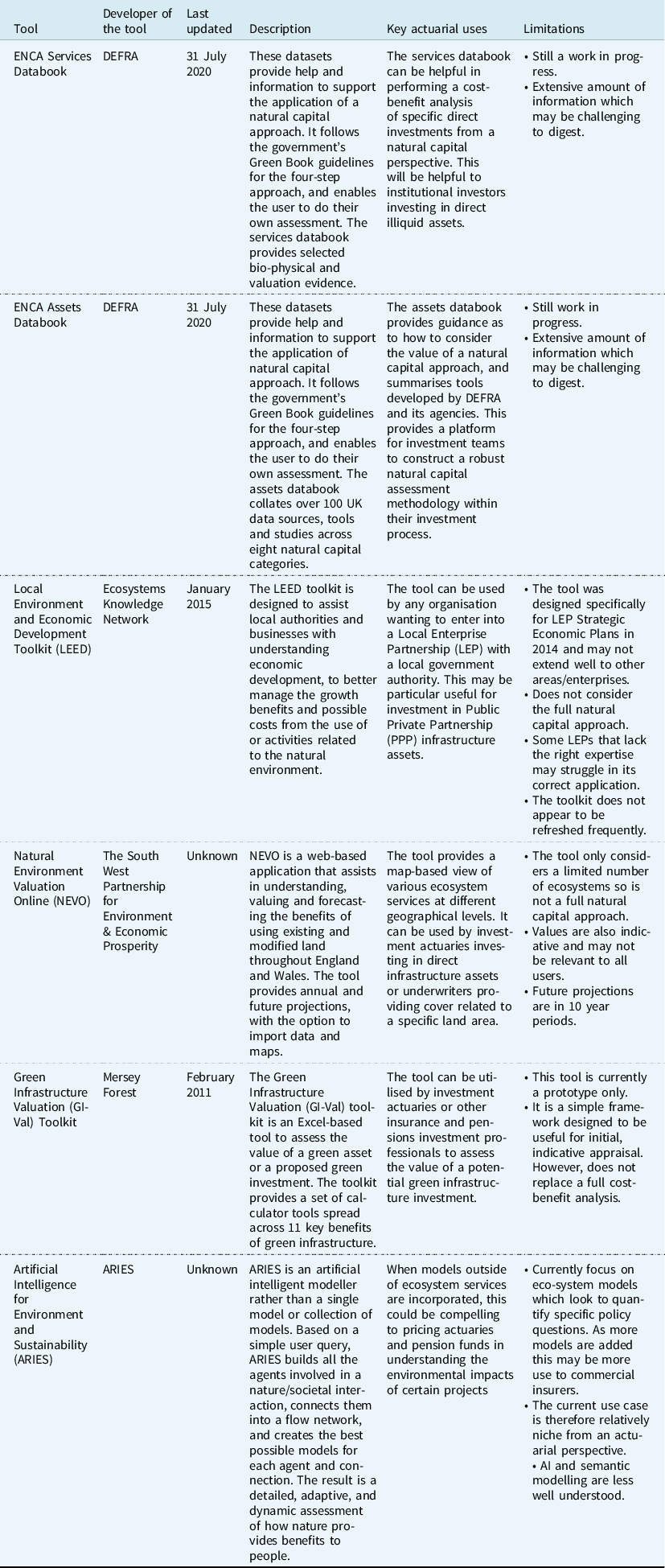

3.1. Tools Applicable to the Actuarial Profession

4. Deep Dive on Tools Applicable to the Actuarial Profession

In this section, we explore the possible applicability of each of the tools to the actuarial profession in further detail.

4.1. ENCA Services Databook and ENCA Assets Databook

The ENCA Service and Assets Databooks identify relevant content regarding natural capital for a range of users. The two databooks (Services and Assets) provide a wealth of selected references, commentary and detailed guidance, and physical and valuation metrics across a wide range of environmental effects and asset categories (DEFRA, 2020b).

Components of the respective databooks which may be most applicable to the actuarial profession include:

Urban Natural Capital Tool: This tool is used to assess and monetise many of the financial, social and environmental benefits of blue-green infrastructure. Green infrastructure refers to an array of multi-use green space, both urban and rural, which is able to deliver a variety of environmental and quality of life benefits for local communities. Blue infrastructure are likewise water-based areas (rivers, canals, lakes, ponds). (Cumulus Consultants, 2014).

For example, it can be used to understand and quantify the wider value of sustainable drainage schemes and natural flood management measures. This can support investment decisions and has been adopted by national government in Australia and the Netherlands.

Specific datasets within the ENCA Services Databook: There are a number of specific datasets which could be utilised as part of the investment and/or underwriting process, although the scope of such datasets is relatively narrow. For example, agricultural datasets articulating land value may be used to price insurance products for the farming industry, whilst flood data is available which can be used to assess the impact of flood damage on particular geographical areas.

4.2. Local Environment and Economic Development Toolkit (LEED)

The LEED toolkit is a qualitative approach to a SWOT (Strengths, Weakness, Opportunities and Threats) analysis of relationships between the environment and the economy. The toolkit can be customised to the needs of the user, with three levels of engagement and analysis to produce the outcomes. The toolkit can be extended to any area or section of significance.

The tool can be used by any organisation to assist with making decisions about local strategic economic developments and environmental planning, as it identifies important operational and strategic aspects related to the environment as an investment option. It could be useful to any organisation considering an investment in social infrastructure or to evaluate the risks and benefits of such an investment (DEFRA, 2020b).

It can also be useful in analysing the impact of risk mitigation such as:

The extent to which flood risk is reduced through the introduction of green and blue infrastructure, or through more sustainable drainage systems (Cumulus Consultants, 2014).

Investing in technology or initiatives that reduces an organisation’s carbon footprint by reducing waste output, use of solar energy and water recycling plants (Black Country Local Enterprise Partnership, 2014).

Assisting local farmers with pest control and disease management to reduce their reliance on crop insurance claims.

4.3. Natural Environment Valuation Online (NEVO)

NEVO is a web-based application that assists in understanding, valuing and forecasting the benefits of using existing and modified land throughout England and Wales. The tool provides annual and future projections, with the option to import data and maps.

The tool consists of a map-based view of the various ecosystem services such as agriculture, recreation, forestry, carbon emissions, biodiversity, water and air quality, measured at different geographical levels. A user can then view a specific service, or change several factors to determine the impact on the service, or analyse interactions between different services (DEFRA, 2020b).

The NEVO tool can be used by an organisation’s investment team to analyse the financial gain of investment in a specific region’s environmental service or the interaction of several of these services, or across various regions. An example would be assessing the value derived from developing recreational facilities such as parks in a specific county or local authority (see the reference to ORVal in Appendix), or the cost-benefit analysis of converting agricultural land to recreational land and how there may be trade-offs between reduced greenhouse gas emissions and recreational value (Exeter, n.d.).

In particular, the Alter and Optimise features of the tool can be used to evaluate the impact of any modifications to specific parameters.

The tool would also be useful to a general insurer in assessing risk from natural disasters such as flooding. In addition, the cost of mitigation can be assessed, by using the “Alter” mode of the tool to test the effect of natural flood management in a specific regional area by converting farmland to forest (Ecosystems Knowledge Network, n.d.).

The NEVO tool can estimate the increased flood protection derived from this as well any benefits derived from improvement in water quality and reduction in greenhouse gases (Ecosystems Knowledge Network, n.d.).

Another example of use could be by a life insurer considering investing in methods to improve air quality, for e.g. by investing in land rehabilitation and what the impact would be on health risks.

Source: Natural Environment Valuation Online tool (NEVO) – The South West Partnership for Environmental and Economic Prosperity (sweep.ac.uk) © University of Exeter; reproduced with permission.

4.4. Green Infrastructure Valuation (GI-Val)

Well-designed, well-planned and well-managed green infrastructure can be a key tool in the economic recovery of the UK, as the public and private sector work together to “build back better”.

The Green Infrastructure Valuation (GI-Val) Toolkit has been developed in response to these challenges to help stakeholders make good decisions, when comparing competing investments. It provides a simple framework to identify and assess the key benefits of proposed green infrastructure investments and existing green assets. The toolkit is intended to help bridge the current gap between what is required as evidence to increase investment in green infrastructure and what is available in practice. It has been developed for the UK market only at present.

The GI-Val toolkit is a simple Excel-based, self-contained resource, which can help land managers, developers and other organisations such as investment teams (of life insurance companies or pension funds) investing in local sustainable development to do a broad assessment of the key benefits of a particular investment. It uses practical methods to value the benefits of green infrastructure projects, making it easier to:

understand and make the case for investment across a broad suite of partners

compare the benefits from green infrastructure with other developments

prioritise between the different opportunities that are available

The toolkit looks at how the range of green infrastructure benefits deriving from an asset can be valued in:

monetary terms: applying economic valuation techniques where possible

quantitatively: for example, with reference to jobs created, hectares of land improved or increase in number of visitors

qualitatively: referencing case studies or research where there appears to be a link between green infrastructure and economic, social or environmental benefit but where the scientific basis for quantification or monetisation is not yet sufficiently robust (Bendell et al., Reference Bendell, Collinge, Sadiq and Walker2011).

The toolkit includes a user-guide as well as a set of individual spreadsheet-based tools to assess the value of green assets or projects across 11 potential areas of benefit including climate change, health and property values. For example, within property values, one could estimate the uplift to land and property values as a result of green investment.

Source: https://www.merseyforest.org.uk/files/GI-Val_Calculator_v1.6.xlsx © The Mersey Forest; reproduced with permission.

4.5. ARIES

ARIES uses artificial intelligence to pair ecosystem models with spatial data in order to quantify ecosystem flows for a study area. The software will prioritise specific process-based models and revert to simpler models where required. It is based on k.LAB technology (ARIES, n.d.) which allows researchers to contribute models and scientific data that simulate and integrate environmental and socioeconomic systems.

Collaborative information is hosted on a network and when provided with a user query, ARIES automatically builds all the agents involved in the nature/society interaction, connects them into a flow network, and creates the best models for each agent and connection. The system to be analysed is defined by selecting a spatial context on the map and setting the spatial and temporal resolution. This allows for a detailed and dynamic assessment of how nature provides benefits to people.

ARIES has global models for carbon storage, sediment regulation, pollination, crop production, nature-based tourism, outdoor recreation, and monetary valuation of forest ecosystem services through spatially explicit meta-analysis. ARIES prototypes are currently available for experienced modellers (training is recommended), and a web-based ARIES Explorer (k. Explorer) suitable for non-technical users was released in 2018.

The application of this tool for actuaries requires further investigation. The concept of an open source, artificially intelligent modeller that looks to choose the best model for the question asked by the user, could pave the way for how future models can be used and transparent collaboration across industries. ARIES is already being used by governments and NGOs, suggesting there is potential for the tool to be used within the insurance and pensions industries. Given the complexity of this tool, our view is that attendance of ARIES training sessions would be necessary to determine the use case for the actuarial community.

5. Conclusion

Based on our initial research in UK specific biodiversity tools, there appear to be a number of tools which have potential application to the actuarial profession. The application of these tools is primarily limited to insurance and pensions investment teams, particularly with respect to direct infrastructure assets.

For example, NEVO focuses primarily on land assets in the UK (and the ecosystem services that this land supports), GI-Val helps the user to value the benefits of green infrastructure projects in the UK, and LEED is most applicable to UK social infrastructure assets which benefit from some form of local or national government support.

Within the pensions industry specifically, the use of these tools is most likely limited to those working with the largest pension schemes and to those working in direct infrastructure fund management firms.

For these tools to be more widely adopted by actuaries, further research is necessary to understand:

-

(i) The specific actuarial use case for each of these tools such that it is clear how they can be meaningfully integrated into the investment decision making process

-

(ii) The extent to which these tools are limited in application to infrastructure assets only, or whether they can be extended to a broader range of asset classes.

-

(iii) Whether these tools have non-UK equivalents or can be readily extended to consider non-UK investment opportunities

This additional research will require further exploration of the biodiversity tools available, both in terms of breadth and depth. This will enable actuaries to have a complete understanding of the biodiversity tools available, and their relative strengths and weaknesses.

Acknowledgements

This paper has been prepared by the Biodiversity & Justice work stream which forms part of the Biodiversity and Natural Capital Working party, a volunteer group working under the Sustainability Board. The authors would like to thank the anonymous reviewers who helped improve this paper.

Appendix: Other tools researched deemed less applicable to the actuarial profession