No CrossRef data available.

Article contents

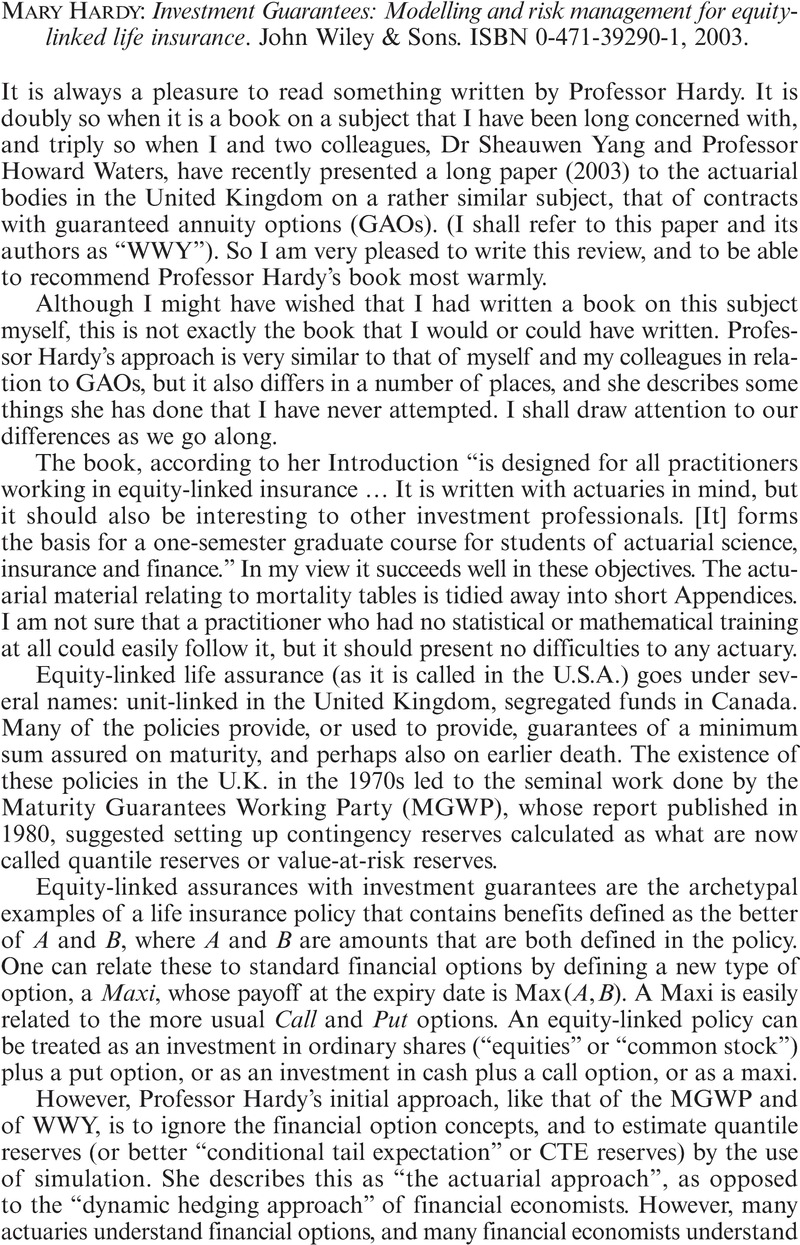

Mary Hardy: Investment Guarantees: Modelling and risk management for equity-linked life insurance. John Wiley & Sons. ISBN 0-471-39290-1, 2003.

Review products

Mary Hardy: Investment Guarantees: Modelling and risk management for equity-linked life insurance. John Wiley & Sons. ISBN 0-471-39290-1, 2003.

Published online by Cambridge University Press: 17 April 2015

Abstract

An abstract is not available for this content so a preview has been provided. As you have access to this content, a full PDF is available via the ‘Save PDF’ action button.

- Type

- Book Review

- Information

- Copyright

- Copyright © ASTIN Bulletin 2003

References

Boyle, P.P. and Hardy, M.R. (2002) Guaranteed annuity options. Working Paper, University of Waterloo.Google Scholar

Harris, G.R. (1999) Markov chain Monte Carlo estimation of regime switching vector autoregressions. ASTIN Bulletin

29, 47–80.CrossRefGoogle Scholar

Lee, R.D. and Carter, L. (1992) Modelling and forecasting U.S. mortality, Journal of the American Statistical Association

87, 659–671.Google Scholar

Maturity Guarantees Working Party (1980) Report of the Maturity Guarantees Working Party. Journal of the Institute of Actuaries

107, 103–209.CrossRefGoogle Scholar

Pelsser, A. (2002) Pricing and hedging guaranteed annuity options via static option replication. Working paper.CrossRefGoogle Scholar

Whitten, S.P. and Thomas, R.G. (1999) A non-linear stochastic asset model for actuarial use. British Actuarial Journal

5, 919–953.CrossRefGoogle Scholar

Wilkie, A.D., Waters, H.R. and Yang, S. (2003) Reserving, pricing and hedging of policies with guaranteed annuity options. British Actuarial Journal

9, forthcoming.CrossRefGoogle Scholar

Yang, S. (2001) Reserving, pricing and hedging for guaranteed annuity options, PhD Thesis, Heriot-Watt University, Edinburgh.Google Scholar