No CrossRef data available.

Article contents

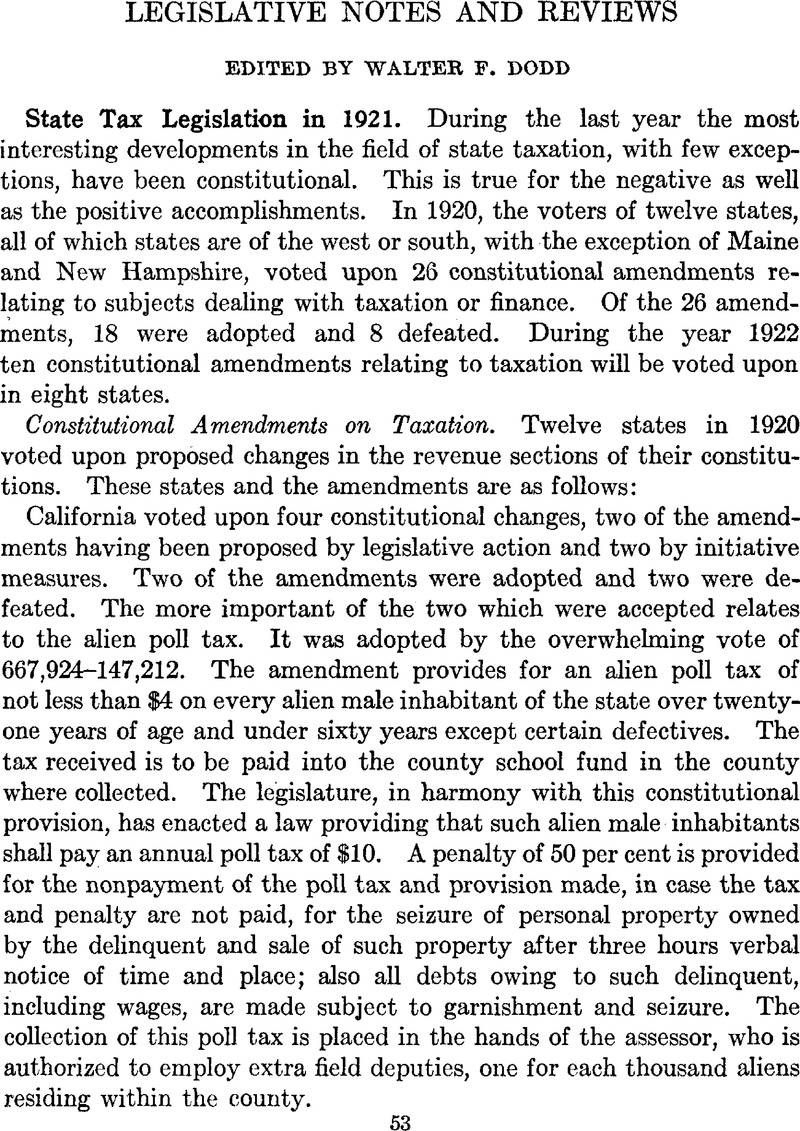

State Tax Legislation in 1921

Published online by Cambridge University Press: 02 September 2013

Abstract

- Type

- Legislative Notes and Reviews

- Information

- Copyright

- Copyright © American Political Science Association 1922

References

1 These taxes are as follows: (1) Tax of ½ of 1 cent for each 10 cents or fraction thereof paid for admission to any place after September 1, 1921; same rate to be paid by any person admitted free or at reduced rates except employees, municipal officers on official business and persons in the military or naval uniform and children under 12. (2) Upon tickets to theatres when sold at news stands, hotels and places other than the theatre ticket office at not to exceed 25 cents in excess of the price at the theatre ticket office, a tax of 2½ per cent on such excess and if sold for more than 25 cents in excess of the price at the theatre ticket office, a tax equal to 25 per cent of the total excess. (3) A tax of 25 per cent on tickets sold by the management of the theatre in excess of the regular charge. All such taxes being additional to those paid by the purchaser. (4) Persons having permanent use of boxes or seats in any theatre shall pay in lieu of the tax of ⅛ of 1 cent for each 10 cents, a tax of 5 per cent of the amount for which such box or seat is sold for each performance. (5) A tax of ¾ of 1 cent for each 10 cents or fraction thereof paid for admission to any roof garden, cabaret, or like place when such admission charge is wholly or or in part included in the price paid for refreshment or service. Amount paid for admission to be deemed 10 per cent of the amount paid for refreshment or service. Person paying for such refreshment or service to pay the tax. Exemption from this tax granted religious, charitable and educational institutions, military organization, societies for the prevention of cruelty to children or animals, musical organizations not for the profit of members and agricultural fairs. Every person paying the federal tax on admission shall pay an amount equal to 50 per cent of such federal tax. If such amount is paid the tax imposed by this act shall not apply. Proceeds of tax shall be divided one-half to the state and one-half to the counties.

Comments

No Comments have been published for this article.