No CrossRef data available.

Published online by Cambridge University Press: 12 April 2017

294 U. S. 240.

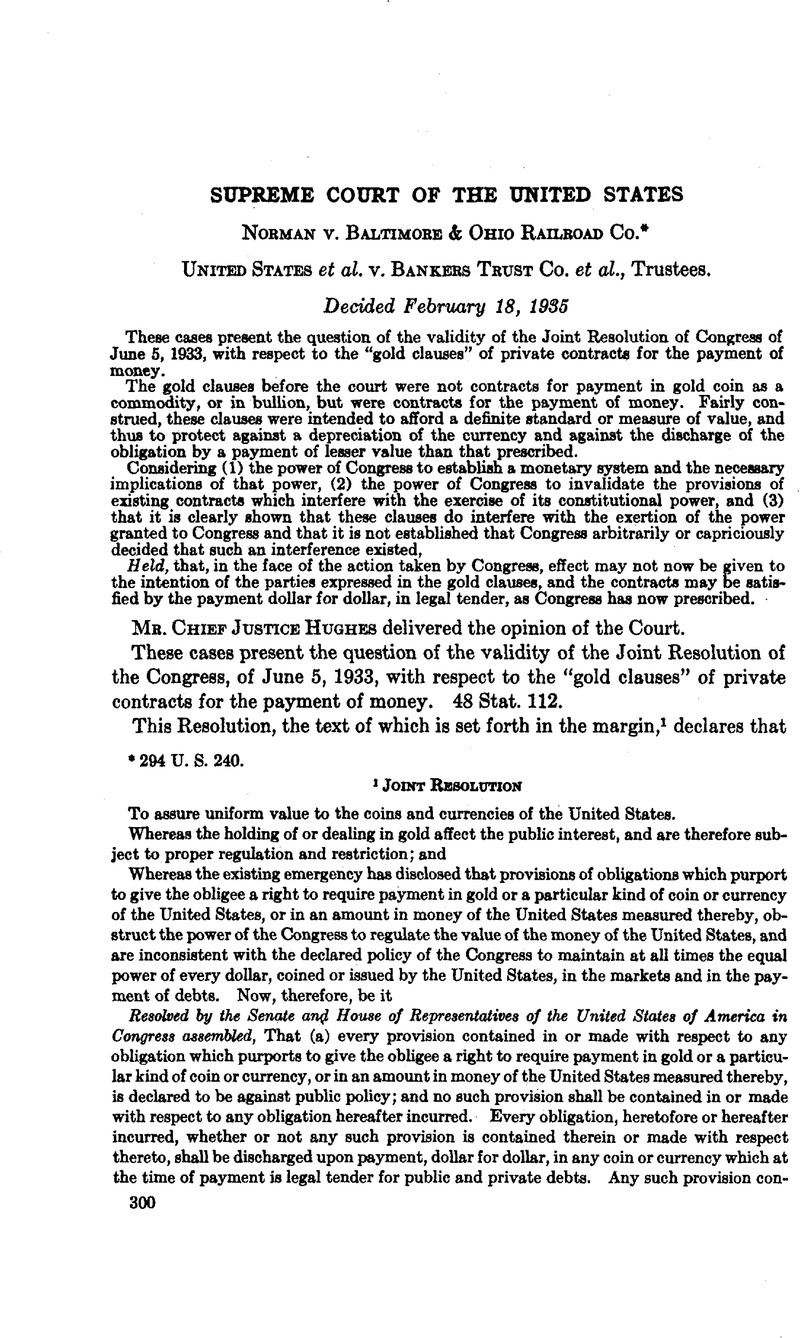

1 Joint Resolution

To assure uniform value to the coins and currencies of the United States.

Whereas the holding of or dealing in gold affect the public interest, and are therefore subject to proper regulation and restriction; and

Whereas the existing emergency has disclosed that provisions of obligations which purport to give the obligee a right to require payment in gold or a particular kind of coin or currency of the United States, or in an amount in money of the United States measured thereby, obstruct the power of the Congress to regulate the value of the money of the United States, and are inconsistent with the declared policy of the Congress to maintain at all times the equal power of every dollar, coined or issued by the United States, in the markets and in the payment of debts. Now, therefore, be it

Resolved by the Senate an# House of Representatives of the United States of America in Congress assembled, That (a) every provision contained in or made with respect to any obligation which purports to give the obligee a right to require payment in gold or a particular kind of coin or currency, or in an amount in money of the United States measured thereby, is declared to be against public policy; and no such provision shall be contained in or made with respect to any obligation hereafter incurred. Every obligation, heretofore or hereafter incurred, whether or not any such provision is contained therein or made with respect thereto, shall be discharged upon payment, dollar for dollar, in any coin or currency which at the time of payment is legal tender for public and private debts. Any such provision contained in any law authorizing obligations to be issued by or under authority of the United States, is hereby repealed, but the repeal of any such provision shall not invalidate any other provision or authority contained in such law.

(b) As used in this resolution, the term “obligation” means an obligation (including every obligation of and to the United States, excepting currency) payable in money of the United States; and the term “coin or currency” means coin or currency of the United States, including Federal Reserve notes and circulating notes of Federal Reserve banks and national banking associations.

Sec. 2. The last sentence of paragraph (1) of subsection (b) of section 43 of the Act entitled "An Act to relieve the existing national economic emergency by increasing agricultural purchasing power, to raise revenue for extraordinary expenses incurred by reason of such emergency, to provide emergency relief with respect to agricultural indebtedness, to provide for the orderly liquidation of joint-stock land banks, and for other purposes,” approved May 12,1933, is amended to read as follows:

“All coins and currencies of the United States (including Federal Reserve notes and circulating notes of Federal Reserve banks and national banking associations) heretofore or hereafter coined or issued, shall be legal tender for all debts, public and private, public charges, taxes, duties, and dues, except that gold coins, when below the standard weight and limit of tolerance provided by law for the single piece, shall be legal tender only at valuation in proportion to their actual weight.”

Approved, June 5, 1933, 4:40 p. m.

2 One appeal was allowed by the District judge and the other by the Circuit Court of Appeals.

3 As illustrating the use of such clauses as affording a standard or measure of value, counsel refer to Article 262 of the Treaty of Versailles with respect to the monetary obligations of Germany, which were made payable in gold coins of several countries, with the stated purpose that the gold coins mentioned “shall be defined as being of the weight and fineness of gold as enacted by law on January 1,1914.” Reference is also made to the construction of the gold clause in the bonds before the House of Lords in Feist, appellant, and Société Intercommunale Belge d’Electricité, respondents, L. B. (1934) A. C. 161,173 [this Journal, Vol. 28 (1934), p. 374], and to the decisions of the Permanent Court of International Justice in the cases of the Serbian and Brazilian loans (Publications of the Permanent Court of International Justice, Series A, Nos. 20/21) where the bonds provided for payment in gold francs.

* Infra, p. 316.

4 Mr. Justice Miller also dissented in Trebilcock v. Wilson, 12 Wall., pp. 699, 700, upon the ground "that a contract for gold dollars, in terms, was in no respect different, in legal effect, from a contract for dollars without the qualifying words, specie, or gold, and that the legal tender statutes had, therefore, the same effect in both cases.”

5 Compare New York Central & Hudson R. R. Co. v. Gray, 239 U. S. 583; Calhoun v. Massie, 253 TJ. S. 170, 176.

6 See Note 1.

7 Treasury Statement of May 26, 1933.

8 The Senate Committee on Banking and Currency, in its Report of May 27,1933, stated: “By the Emergency Banking Act and the existing Executive Orders gold is not now paid, or obtainable for payment, on obligations public or private. By the Thomas amendment currency was intended to be made legal tender for all debts. However, due to the language used doubt has arisen whether it has been made legal tender for payments on gold clause obligations, public and private. This doubt should be removed. These gold clauses interfere with the power of Congress to regulate the value of the money of the United States and the enforcement of them would be inconsistent with existing legislative policy.” Sen. Rep. No. 99, 73d Cong., 1st sess.