Introduction

The concept of “scaling up” or “bringing to scale” is widely used by African agricultural policy experts; it is commonly deployed to address specific elements of agricultural development, for example, scaling up innovation (Hartmann Reference Hartmann and Linn2012; Wigboldus et al. Reference Wigboldus, Klerkx, Leeuwis, Schut, Muilerman and Jochemsen2016), scaling up technology (Ajayi et al. Reference Ajayi, Fatunbi and Akinbamijo2018), or scaling up investment (KAF/Meridian 2014). With reference to agricultural value chains, scaling up commonly refers to three interrelated objectives: increasing agricultural production and quality; expanding farmer engagement with markets; and adding greater value to commodities, which benefits all actors. The process of scaling up value chains refers to the specific activities, initiatives, and projects geared toward achieving these goals. Three major assumptions underlie the scaling-up concept. The first is that each of these goals can be achieved in a coordinated, linear fashion. The second is that all participants are committed to a market-based logic in which revenue maximization is a common goal. A third assumption is that the motivations and objectives of the actors can be analyzed with reference to these goals.

In this article, we question each of these assumptions and offer an alternative relational network approach that highlights the contingent and relational dynamics of agricultural value chains in which the behavior of the chain actors is conditioned by responses to power, risk, and conflict, all of which affect the scaling process. Our analysis focuses on a cashew value chain development project in Côte d’Ivoire called the Sustainable Cashew Growers Program (SCGP). The SCGP is a purportedly pro-poor value chain development initiative that links groups of cashew growers to a cashew processing plant owned and operated by the agribusiness giant OLAM in the city of Bouaké in central Côte d’Ivoire. Seeking to determine whether farmer participation in scaling-up projects leads to higher incomes and thus improved livelihoods, we focus in particular on the selling patterns of cashew growers enrolled in the SCGP under changing market conditions during the 2018 and 2019 market seasons to assess whether farmers benefit, first of all, from their engagement in OLAM’s group marketing program, and second, from higher market prices due to selling in shorter value chains during volatile market periods. More broadly, we ask how the market behavior of both buyers and sellers under changing market conditions affects chain coordination and thus the scaling process.

Our analysis calls into question the linear logic of the value chain model in mainstream development thinking. It demonstrates that under uncertain conditions, all chain actors seek to maintain flexible and non-linear market relationships which might protect them from losses but might also limit chain coordination. Their market behavior is informed by pre-existing relationships or social networks with actors who are not necessarily associated with the formal value chain. Consequently, at different times and under different market conditions, the interests of value chain actors might align with revenue-maximization, but they might also diverge around risk management as the actors scramble to make a profit or simply to stay above water. Thus, as our case study bears out, we have reason to be skeptical of linear, progressive development approaches because they beg a lot of questions about agency and process.

We begin by outlining our research methods. We then elaborate on the three interrelated objectives of the scaling up concept in the development policy literature. This is followed by an extended critique of the assumptions embedded within the concept. Finally, we offer an alternative theoretical approach that acknowledges the importance of “indeterminate encounters” (Tsing Reference Tsing2015) and draws on feminist political ecology concepts of “rooted networks” and “relational webs” (Rocheleau & Roth Reference Rocheleau and Roth2007) to highlight the non-linear dynamics of a value chain in which all players’ actions are informed by place-specific considerations of contingency and risk. The empirical discussion compares two different communities in two different time periods, producing and selling cashews under contrasting market conditions.

Research methods

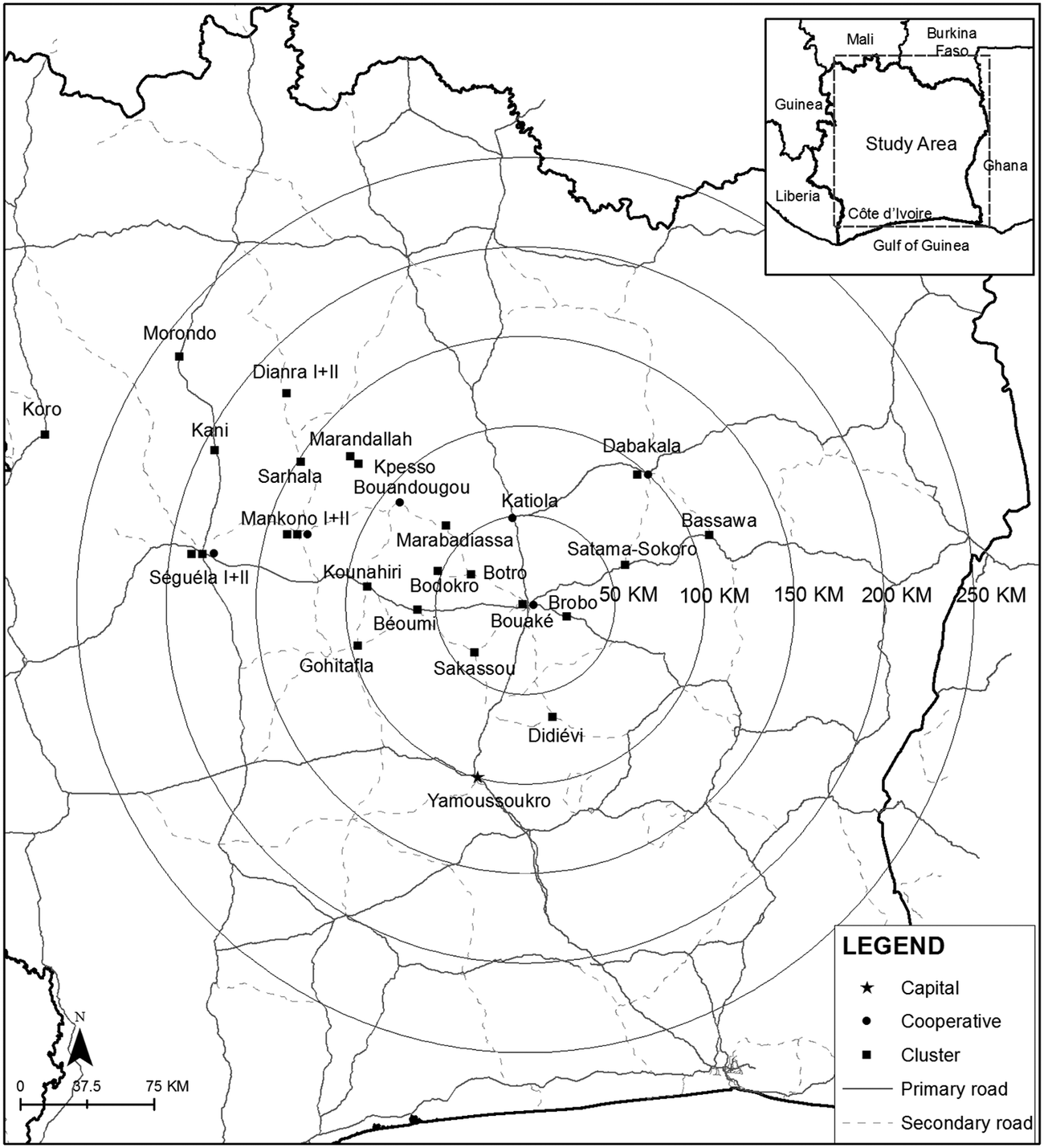

This case study draws on a five-year research project on the food security of households participating in the SCGP in central Côte d’Ivoire (Figure 1).Footnote 1 Given the strong relationship between women’s socio-economic status and household nutrition (Kennedy & Peters Reference Kennedy and Peters1992; FAO 2011), we worked with a sample of 120 women cashew growers: fifty who participate in the SCGP, thirty who do not participate but reside within the program area, and forty who do not participate because they live outside the program area. The sample is stratified by socio-economic status into three groups: upper-income, middle-income, and lower-income households. Given the focus of this study on the dynamics of scaling, we present data stemming from interviews with the fifty women cashew growers who participate in the SCGP. These informants reside in two communities that we have named Koffikro and Kouassikro. We interviewed farmers on five different occasions. In addition to questions on dietary diversity, our surveys focused on participation in the SCGP with emphasis on program benefits, cashew sales, and perceptions of the SCGP program. Our intersectional analysis provides insights into how differences among the women affect their participation in the value chains within and across their communities.

Figure 1. SCGP clusters and cooperatives in the Bouaké region, 2019.

Source: OLAM

In addition to cashew growers and SCGP group leaders at the village level, we also interviewed value chain actors at other scales and locations. We conducted semi-directed interviews with SCGP field agents and program managers in the Bouaké region, with OLAM’s staff at the Bouaké processing plant and at its regional headquarters in Abidjan, with Cotton and Cashew Council representatives at the regional and national levels, with local and regional cashew merchants, and with aid donors and non-governmental organizations (NGOs) associated with the SCGP. These multi-actor interviews formed part of our relational network approach. They were also critical to our understanding of how value chains actually work.

Scaling up agricultural value chains

Value chain approaches currently dominate the business and development literature (Webber & Labaste Reference Webber and Labaste2010). Their popularity stems from the role given to the private sector and market-oriented growth in neoliberal development planning. Proponents conceptualize economic development as a value-adding process that takes place at different nodes in a chain of production and trade activities. Their basic assumption is that private sector investment will spur economic growth and reduce poverty (Humphrey & Navas-Alemán Reference Humphrey and Navas-Alemán2010). Public-private partnerships (PPPs) are the privileged vehicles of value chain development, in which business drives the development process. This retooling of business as a development agent is consistent with aid-to-trade policies of donors, which promote economic growth by channeling investments from the public to the private sector.

Contextualizing the Scaling Literature

Value chain interventions originally focused on industrial development. But the approach is now common within the agricultural realm, as governments and donors seek ways to increase national food security and farmer incomes through a greater engagement with agricultural markets (Gengenbach et al. Reference Gengenbach, Schurman, Bassett, Munro and Moseley2017). In the development policy literature, value chains are defined as “the sequence of all production and marketing steps, ranging from primary production through processing and distribution up to the retail sale of the product and finally to its end users” (GIZ 2013).

This literature engages two broad but important conceptual considerations in framing value chain analysis, each of which comprises a critical element of “scaling up.” One consideration is the “upgrading” strategies of specific chain actors, through which they try to improve their own chain position in order to capture more value or increase their competitiveness (i.e., changing what they do) (USAID 2008). The other is “innovation,” which refers to efforts to change institutions or techniques in order to achieve greater efficiencies in the generation and addition of value (i.e., changing the ways in which they do it). For many analysts, agricultural intensification is by definition innovative, and the challenge of scaling up value chains is to advance the best panoply of innovations (institutional, technological, and organizational) to optimize the value created in the value chain (Pingali Reference Pingali2012; WEF n.d).

The concepts of “scaling up value chains” or “bringing value chain projects to scale” build on this diagnostic, strategic, and conceptual framework to focus attention on ways to optimize the impact of market-based development initiatives, especially with respect to alleviating poverty and transforming rural society (IFAD n.d.; Bellu Reference Bellu2013; USAID 2008). The overarching developmental objective of scaling up is “to reach a greater number of rural poor” by “expanding, replicating, adapting and sustaining successful policies, programs or projects in geographic space and over time” (Linn Reference Linn2012, quoted in Hartmann et al. Reference Hartmann, Kharas, Kohl, Linn, Massler and Sourang2013:1).

In this context, scaling up value chains entails three inter-related dimensions of value chain development. The first dimension is scaling up farmer participation. This dimension focuses on the amount of resources that a particular farmer contributes toward the production of the particular commodity, that is, how much of his or her land, labor, time, effort, finances, technology, and so forth an individual farmer apportions to the production of that commodity (in this case cashews). Scaling up can be measured in terms of both increases in production and increases in productivity; for example, any activity or initiative that contributes to either of these outcomes can be considered a scaling up activity.

The second dimension entails scaling up market size. This dimension focuses on the amount of the commodity that is marketed; therefore, the more cashews the chain actors produce, buy, and sell, the more scaled up the cashew market is. Scaling up market size involves those strategies and actions that enable producers and companies to generate more income by putting more products (nuts) into the market. Such strategies are generally shaped by such considerations as price, quality, number of producers, and amount of land under cultivation. Any activity or initiative that contributes to an increase in any of these considerations can be considered a scaling up activity, and the impact of scaling up market size can be measured in terms of the revenues generated by this link in the value chain.

The third dimension is scaling up value added/transformation. This dimension focuses on increasing or expanding the types of products that can be derived by transforming the primary commodity. In general, this either means transforming the product for new kinds of uses (for example, cashew fruits to juice) or transforming parts of the primary material that were previously discarded or understood to be unusable into new desirable products (as in using the cashew nutshell to produce oil for brake liners). Any activity that increases such transformations and puts them into the market can be considered a scaling up activity.

In the context of these three dimensions, scaling up a value chain can be understood as a collection of activities, initiatives, or projects geared toward one or more of these dimensions. Different actors are involved in these activities, often focusing on different points in the value chain, and also at different scales of value chain governance or development. For example, a government agency might oversee the entire value chain operation, while a development NGO might only work on increasing the number of farmers involved in a project; similarly, a seed scientist cares only about the techniques of biofortification and not about the conditions under which the farmer sells the product that the seed produces.

The model of scaling up value chains assumes that each of these dimensions of the value chain can be scaled up in a coordinated and linear fashion, based on a common (market) outcome-based logic. In addition, the model assumes that all actors in the value chain understand that there are benefits to be gained from their participation and thus in “scaling it up.” Consequently, their motivations and objectives are geared toward the success of the scaling up efforts and can be adequately analyzed in these terms. As such, the model assumes that relations among actors in the value chain are governed by the logic of the chain itself, and that scaling projects can expand the value chain, as Anna Tsing (Reference Tsing2015:38) puts it, “without changing their framing assumptions.”

Critique of the Scaling Framework

The problem with the value chain approach is that it cannot be assumed that the scaling process is linear, or that all aspects of the value chain are scalable and produce a cumulative welfare-enhancing effect. The early literature on global value chains (GVC) argued that value chains are shaped by patterns of coordination between value chain players (Gereffi & Korzeniewicz Reference Gereffi and Korzeniewicz1994; Gibbon Reference Gibbon2001). Some value chains are tightly coordinated, often driven by a lead firm (generally a buyer) that constrains the behavior and decision-making of the upstream actors (generally suppliers). Other chains are more weakly coordinated, either because there is no pre-eminent lead firm or because the number of suppliers is so large that they are difficult to manage, or because no single actor (or small group of actors) is able to manage crucial information effectively enough to influence all of the actors’ decision-making. Though the early GVC literature tended to highlight the power of corporations to shape the dynamics of value chains, more recent literature has highlighted the contingency of corporate power (Freidberg Reference Freidberg2018). As Jennifer Bair and Marion Werner (Reference Bair and Werner2011) have noted, effective value chain governance cannot be taken for granted, because the power of buyers does not preclude the agency of suppliers. In addition, a number of scholars have emphasized the importance of the farmers’ and rural entrepreneurs’ own knowledge, motivations, and values in affecting the flow of power through value chains (Knickel et al. Reference Knickel, Brunori, Rand and Proost2009; Dawson et al. Reference Dawson, Martin and Sikor2016; Gabre-Madhin & Haggblade Reference Gabre-Madhin and Haggblade2004).

Strategies and processes for scaling value chains may themselves disrupt the value chains’ linear development. Not all aspects of a chain are scalable, and the relationship between scalable and non-scalable elements can affect the operation of the entire chain. For instance, increasing the production of a particular commodity through intensification may disrupt the organization and supply of labor in ways that generate intra-household or localized conflicts; inasmuch as the work of scaling involves innovation, it is inherently disruptive (Tsing Reference Tsing2015).

At the same time, small-scale producers are frequently engaged in multiple markets other than the value chain commodity, such as local food markets, and shifts in one market may affect their commitments to other market relationships. For instance, a sudden increase in food prices may motivate producers to abandon cotton and expand their maize production. Neil Dawson and colleagues (Reference Dawson, Martin and Sikor2016:205, citing Agarwal Reference Agarwal2014) note, “In a context in which agriculture has already been exposed more to variability in market prices and climate, farmers might be characterized as increasingly resistant to changes that are perceived to further reduce their control over food production.”

In effect, value chain development involves engaging pre-existing processes and relationships that are subject not only to coordination and collaboration, but also to conflict and contestation. Moreover, the project of scaling up value chains involves a wide variety of actors performing specific roles on the ground. These participants include corporations and other buyers, service delivery NGOs, monitoring-and-evaluation specialists, and extension agents and trainers. Consequently, relationships among these actors are frequently multivalent and cross-cutting, and specific actors have connections with other actors, both “vertical” and “horizontal,” which may be contingent on the ways in which those relationships overlap or intersect with each other. For instance, a farmer’s relationship with a trader may be shaped not only by the expectation that the trader will offer a fair price but also by a variety of other factors: the expectation that the trader can leverage extension or training through a third-party NGO; or the ability of women farmers to gain access to credit; or the assumption that the buyer will turn up and pay on time. Thus, power does not simply flow through a value chain, but instead it eddies through relationships and connections in nonlinear as well as linear ways, some contested and some not.

As such, the operation of a value chain is subject to “a much broader range of potentially destabilizing forces, not all of them overtly oppositional” (Freidberg Reference Freidberg2018:5). Moreover, particular interactions between chain actors are place- and time-specific; they may be affected by sudden dips in commodity prices, or unexpected disruptions in weather patterns, or outbreaks of disease. Specific interactions between different actors in the operation of the chain are subject to uncertainty, contingency, and what Anna Tsing (Reference Tsing2015) calls “the indeterminate encounter.” Under different conditions, chain actors may shift their decision-making priorities (for instance, from scalable to non-scalable considerations) in ways that affect their relationships with other chain actors. Different chain actors have different matrices for calculating risk, which might affect the ways in which they negotiate chain relationships under varying circumstances. As a result, their commitment to the chain, and their participation in it, is invariably subject to some level of uncertainty and indeterminacy that affects its actual operation.

An Alternative Perspective

The conditions of variability, contingency, and indeterminacy that characterize “pro-poor” value chains call into question the scaling literature’s assumptions of progressive development, constructed around value-addition, which conceptualize value chain actors as connected in a linear fashion like links in a chain. An alternative view invokes an alternative approach in which value chains are understood as complex assemblages, linked both vertically and horizontally through what Dianne Rocheleau and Robin Roth (Reference Rocheleau and Roth2007) call “rooted networks” and “relational webs.” These networks are not equally linked into—or rooted in—the chain. Some network parts are more strongly connected than others, and some network actors are able to move (or withhold) their resources more easily than others. For instance, female farmers may have less access to labor or land resources than male farmers, even though they have the same access to buyers. High-volume-producing communities may be preferred over low-producing communities by institutional buyers in a value chain because of the lower attendant marketing costs.

Each of these conditions reflects the play of power, hierarchy, risk, and flexibility that governs the relationships and commitments of value chain actors. The practices of specific actors are, of course, informed by their position within the chain. But in a weakly structured chain, or one subject to high levels of contingency, an unexpected jerk in the chain (e. g., a sudden drop in demand or a shift in prices) can disrupt interactions in different ways, often making encounters among chain actors less determinate or predictable. In order to mitigate their vulnerability to such disruptions, value chain actors draw on “particular resource-use systems” (Birkenholtz Reference Birkenholtz2012:303) that include ancillary relationships and social connections, or “rooted networks,” which are peripheral to the value chain at one point but may become central to its reconfiguration if conditions change. Some of these relations may be rooted in preexisting social or cultural ties, or in parallel markets. But even though they are not directly embedded in the value chain structure, they are highly consequential to its operation because they provide mediating structures through which chain actors manage the shifting dispensations of power and risk. The methodological challenge for understanding the dynamics of a value chain, then, is to make sense of how the different chain actors negotiate “indeterminate encounters” (Tsing Reference Tsing2015) within relatively structured and power-laden value chain relationships, in other words, to “incorporate the constant interplay of structure and practice” (Rocheleau & Roth Reference Rocheleau and Roth2007:436).

To address this challenge, we adopt an approach that analyzes value chains as bundles of relationships between chain actors that are informed by local endowments of material, cultural, and political resources. This approach calls attention to shifts in the types, terms, and strengths of connections between network actors (Rocheleau & Roth Reference Rocheleau and Roth2007:434) as they negotiate indeterminacy and seek to manage risk under changing conditions. Actors in different chain positions, with differential amounts of power, calculate and manage risk in ways that not only alter their interactions with other chain actors but also reconfigure the wider dynamics of chain relations in response to changing conditions and network connections.

Côte d’Ivoire’s cashew economy

Côte d’Ivoire is currently the world’s largest producer of raw cashew nuts. In 2020, farmers marketed an estimated 888,000 metric tons.Footnote 2 More than 90 percent of these nuts are exported unshelled and processed in other locations, principally in Vietnam and India.Footnote 3 The goal of the Ivorian government is to transform the cashew economy from being primarily an exporter of unshelled cashew nuts to being a major exporter of processed nuts (kernels). The government’s cotton and cashew regulatory authority (Conseil Coton et Anacarde) supports domestic cashew processing by taxing unshelled nut exports and paying processors XOF400 (USD0.68) per kilogram of kernels exported (RCI 2015).Footnote 4 The local processing industry is in its early stages but steadily expanding. Between 2015 and 2020, Côte d’Ivoire kernel exports grew by 40 percent, rising from 6,661 to 13,500 metric tons.Footnote 5

Every year the cashew council sets a producer floor price for unshelled cashew nuts, based on its calculations of the CIF price for a ton of raw cashew nuts exported to Asian processors minus a series of costs and charges.Footnote 6 For example, in 2019, the council set the floor price at XOF375 (USD0.64) for a kilogram of unshelled nuts, based on a CIF price of USD1,300/ton minus costs and charges that amounted to XOF355 (USD0.61)/kg. The 2019 producer floor price was slightly higher than the 2016 price (350FCFA/kg) but much lower than the 2018 floor price of XOF500 (USD0.90)/kg (FIRCA 2019). The taxes and charges levied on cashew exports increased by almost a third between 2015 and 2019.Footnote 7 This increase put downward pressure on producer prices but supported cashew processing companies, whose numbers increased from ten to eighteen between 2017 and 2019.Footnote 8

The cashew council’s push to develop a domestic processing industry is a classic economic development strategy aimed at increasing the value added in the national economy. Processing should lead to job creation in processing factories for the urban unemployed and theoretically to higher incomes for rural producers by creating shorter supply chains. OLAM International, the largest exporter of Côte d’Ivoire’s cashew nuts, took a lead role in establishing Côte d’Ivoire’s processing industry when it created a 30,000-metric ton processing factory in Bouaké in 2012. OLAM created the Sustainable Cashew Growers Program (SCGP) in 2010, with the goal of establishing a “sustainable supply system” within a 200 km radius of its processing facility. The SCGP is promoted as a pro-poor agricultural value chain that seeks to scale-up smallholder cashew production. It aims to establish and maintain a network of producers organized into marketing groups who sell unshelled nuts directly to the Bouaké factory. Cashew growers, who are also subsistence farmers cultivating yams and manioc as staple food crops, are attracted by the prospect of a guaranteed market and by other benefits such as extension services, social development projects, and commissions for village-level marketing activities like weighing and storing nuts for pick up by OLAM agents. Farmers are also attracted to the SCGP by a potentially higher price obtainable from selling directly to the OLAM factory. The shorter value chain associated with the SCGP contrasts with the much longer chain of intermediaries that is characteristic of Côte d’Ivoire’s cashew economy. Figure 1 shows the distribution of cashew producers participating in the SCGP.

The Sustainable Cashew Growers Program

The potentially win-win relationship linking smallholder growers to the Bouaké processing plant led OLAM to create the SCGP, drawing on public-private partnerships (PPPs) with aid donors and private foundations. The SCGP emerged from three distinctive partnerships and phases. The first PPP was formed in 2010 between OLAM and the African Cashew Initiative (ACi), a German aid program focused on promoting agricultural value chains in Africa. The second linked OLAM with the German bilateral aid donor GIZ. The most recent partnership associated OLAM with the Dutch Sustainable Trade Initiative known as IDH.

Within the SCGP, producers are organized at the village level into informal and formal groups. OLAM aggregates these groups, which are spread across different villages, into “clusters” composed of twenty to twenty-five groups. The company employs three field agents to manage each cluster: two agents coordinate extension and buying activities, while the third concentrates on extension and traceability. The average orchard area cultivated by SCGP cashew growers amounts to four hectares.

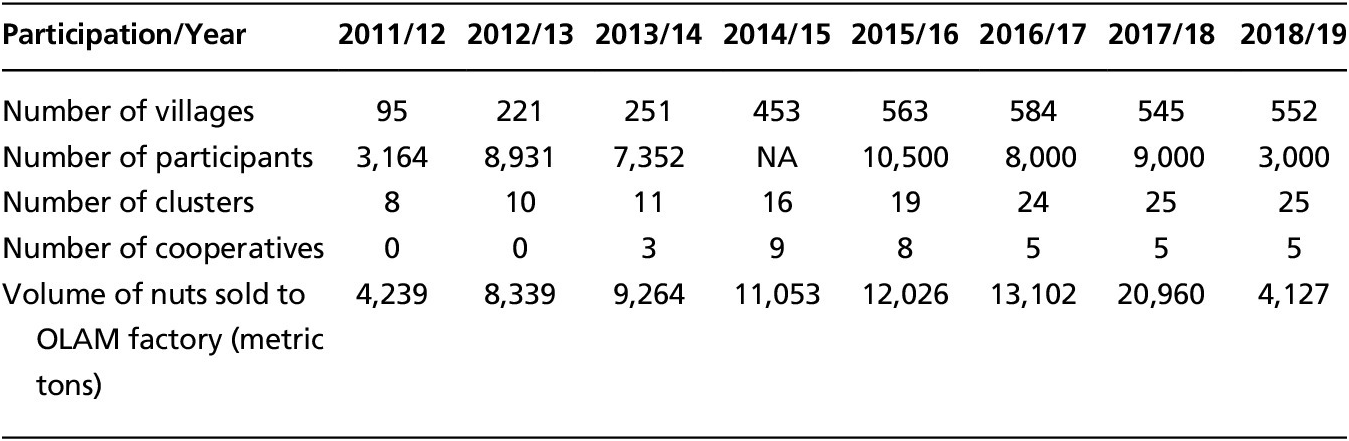

OLAM also works with regional traders to supply its Bouaké factory. These relationships were especially important in the early years of the factory’s operation when the SCGP was just getting started (Table 1). OLAM classifies its regional traders into two groups: Local Buying Agents (LBA) and the Warehouse Buyers Model (WBM). The LBA are large-scale traders who sell more than 5000 metric tons of unshelled nuts each year. The WBM group is comprised of medium-scale traders who sell around 500 tons annually. These buying agents sign a code of conduct and financial contracts with OLAM. For example, they must agree to buy nuts at or above the cashew council’s mandated floor price and from households that do not use child labor. OLAM provides financing to both groups to buy nuts.Footnote 9 The importance of regional traders as suppliers to the OLAM factory declined as the SCGP program grew (Table 1). However, they continue to play an important role in OLAM’s risk management strategy, as evidenced in 2019 when market conditions worsened (see below).

Table 1. Participation in the Sustainable Cashews Growers Program and volume of nuts sold by SCGP to OLAM’s Bouaké factory.

Source: OLAM; SCGP partners

There is considerable variation within the SCGP in terms of the size of informal and formal groups and the quantity of nuts they sell each year to OLAM. In our case study villages, Koffikro had 35 members and marketed 18 tons in 2018. Kouassikro, in contrast, had 119 members and sold 100 tons to OLAM that year. At the beginning of the buying season (January to March), OLAM advances money to each group so that it can buy nuts from its members. The buying season officially opens in mid-February, when the government announces the floor prices for that year. The producer floor price for unshelled nuts in 2018 was XOF450/kg, or USD0.81/kg.

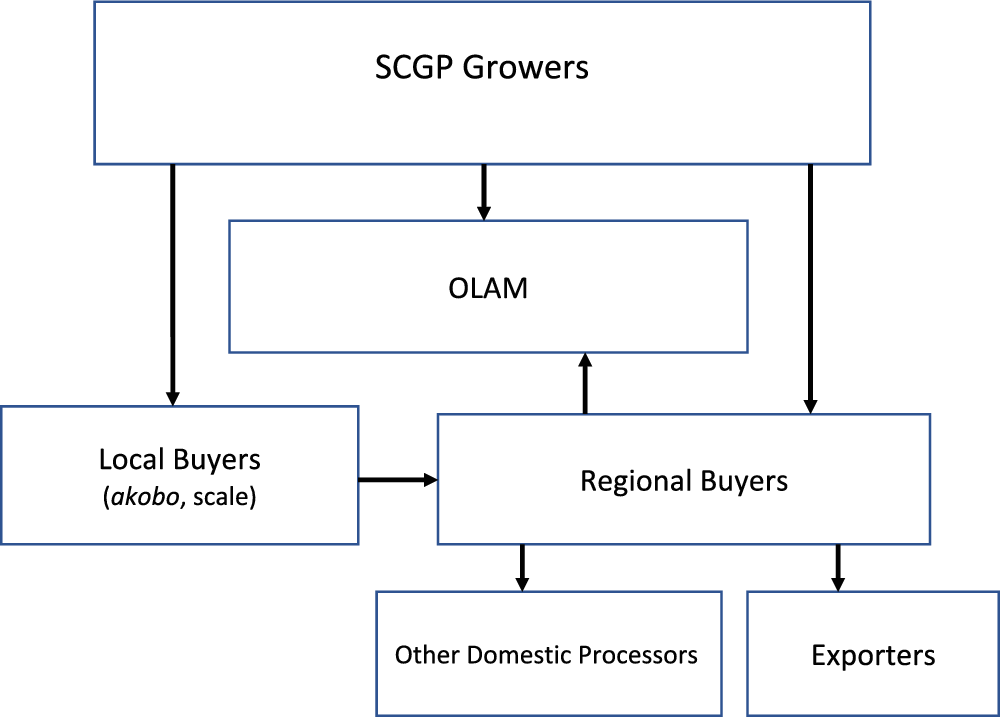

OLAM is not the only buyer to whom SCGP members sell their crops. Cash-strapped growers will sell to local and regional traders if OLAM is not buying at the moment. Local traders work on their own account or in relationship with regional buyers who advance them money. Regional buyers, in turn, work for themselves and/or in relationship with exporters or processors such as OLAM, who advance them money. Thus, SCGP producers engage in both long and short value chains, depending on their cash needs and whether OLAM is currently buying.

The marketing practices of these traders differ sharply. Local traders either use a scale to weigh nuts by the kilogram or use a large tomato can as a measure. The can holds about 1.5 kilograms of unshelled cashew nuts. When nuts are weighed on a scale, farmers are paid by the kilogram. In the tomato can system, known locally as akobo, farmers are paid by the can. The akobo price/kg is typically lower than the scale price.

Local traders who use the akobo system buy nuts anytime and pay cash, which makes them attractive to sellers with immediate cash needs. Traders who weigh nuts with a scale typically pay cash also, but some buy on credit and only pay the seller when they have sold their product. Such transactions pose higher risks to sellers because some traders are unable to sell their stock and fail to pay the sellers. For this reason, growers will sometimes sell to an akobo trader rather than to a buyer who uses the scale system, despite the lower average price per kilogram. This local/regional trading system offers SCGP members an alternative outlet for their crops when OLAM is slow or refuses to buy within the SCGP value chain (Figure 2). It can also present market competition to the SCGP when it offers higher prices than those offered by OLAM.

Figure 2. The different buyers of unshelled cashew nuts sold by farmers participating in OLAM’s Sustainable Cashew Growers Program. The amount of nuts flowing to each buyer varies according to market price variability and the risk management capacities and strategies of different value chain actors.

SCGP members repeatedly stated how much they relied on local traders to meet their immediate cash needs. One woman from an upper-income household stated, “I sell to local traders (des pisteurs) to have money quickly to buy condiments and to hire farm workers.” Women from middle- and low-income households similarly stated, “I sell to local traders for urgent money needs,” and “If I am in a jam, I sell to the first buyer.”Footnote 10 Low-income women sold more often to local traders than women in upper- and middle-income households. One-fifth (21 percent) of upper-income women and one-half (53 percent) of middle-income women reported selling to local traders. In contrast, 70 percent of low-income women who participated in the SCGP program also sold to local traders.

In summary, cashew growers remain connected to their pre-existing trade networks despite their participation in the SCGP. These alternative markets provide some security to households with immediate cash needs and/or when OLAM is slow or refuses to buy nuts from SCGP members. Two examples illustrate this contingent nature of value chain relations and their non-linear character. The first is the introduction and subsequent elimination of OLAM’s loan program to SCGP members. The second is the scaling up and then scaling down of OLAM’s buying from SCGP members. Both examples show how value chain actors seek to keep their options open under changing circumstances but also how these responses are conditioned by different amounts of power, risk, and flexibility. Ultimately, these examples demonstrate the non-linear operation of the SCGP and call into question the underlying assumptions of coordinated and progressive value chain development.

OLAM’s Short-lived Farmer Loan Program

In 2015, OLAM created a loan program to attract more growers to affiliate with the SCGP. OLAM agents observed that cashew growers relied upon local traders and shopkeepers for preharvest loans to meet a variety of cash needs. Farmers repaid their loans in kind with cashew nuts at a price agreed upon at the time of the loan. To increase its acquisition of locally produced nuts, OLAM created a small loan program to compete with the existing trader and shopkeeper loan system.Footnote 11 In effect, it sought to scale up the value chain.

In 2016–17, a high number of women (21/50, or 42 percent) in our sample procured loans prior to the harvest. Women obtained loans from three different sources: OLAM, bush traders, and “others.” OLAM provided the greatest number of loans (52 percent), followed by local traders (24 percent), “others” (19 percent), and combined OLAM/local traders (5 percent). Nearly two-thirds (64 percent) of all loans were obtained to meet health- and education-related expenses. The remaining loans funded funerals (17 percent), off-farm labor (14 percent), and diverse other problems (5 percent).Footnote 12

In the OLAM loan program, group leaders informed SCGP members about the initiative and transmitted their requests to the cluster agents. Members who sold large amounts of nuts to the SCGP were eligible for larger loans.Footnote 13 Cluster agents transmitted group requests to the program office in Bouaké, with recommendations based on the quantity of nuts marketed by the group.Footnote 14 Koffikro, a lower-volume marketing group, received just USD1000 for its loan program. The amount advanced to individual growers ranged from USD15 to USD80. Given the link between production and loan levels, women in upper- and middle-income households received a larger share of OLAM loans than women in low-income households.Footnote 15

OLAM required farmers to repay their loans early in the dry season, when market prices are typically low and quality is high. If individual farmers defaulted on their payments, the group had to make up the difference. The Koffikro growers paid back all of their loans, but some Kouassikro farmers engaged in freeriding. They sold their crop to local and regional traders with whom they had existing exchange relationships rather than selling through the SCGP. This allowed them to maintain some flexibility in managing their budgets. The Kouassikro group leaders viewed the loan program as a liability. First, the group had to reimburse OLAM for its freeriding members. Second, it saw its membership and volume threatened by the freeriding. As a result, the Kouassikro group did not request loans in 2017–18.Footnote 16

The freeriding problem and a decline in growers participating in the SCGP led OLAM to discontinue the SCGP loan program in 2019. Rather than capturing a larger share of locally grown nuts, the program had resulted in USD22,000 in outstanding debt and farmers fleeing the SCGP.Footnote 17 This rise and sudden end of OLAM’s loan program demonstrates how value chains do not operate independently of existing social relations of production and exchange. Rather, they become necessarily embedded in these relational webs, which can disrupt value chain coordination and objectives such as scaling-up cashew nut marketing to the SCGP.

Seller-Buyer Relations in 2018

The contingent nature of value chain relations is further demonstrated by comparing cashew sales by SCGP members in Koffikro and Kouassikro in 2018 and 2019. As in previous years, the Koffikro group began selling nuts to OLAM in mid-February of 2018. Cluster agents initiated the sale. OLAM was quick to pick up the nuts because they are typically of excellent quality at this time (mid-dry season). Although the cargo had already been weighed by the village group, the agents weighed it a second time to confirm its weight. Since nuts become dry and lose weight over the course of the dry season, this second measurement is typically lower than the first. The result is that the group sells its crop to OLAM for less than for what it paid to the group members. This differential weight, called missing weight (poids manquant) locally, causes tensions between SCGP leadership and OLAM cluster agents. OLAM agents initiated a second sale in early March, while nut quality still remained high.

Nut quality begins to decline in the latter part of the dry season (April to June) when humidity levels begin to rise. The higher humidity is linked to the onset of the rainy season and/or poor storage practices. At that time, OLAM agents inspect nuts more closely for their moisture levels and for the presence of rotten nuts.

Because of declining nut quality, OLAM agents were less motivated toward the end of the mid-dry season to buy nuts from SCGP members. Another reason for their reduced interest was that the producer price kept rising in the context of intensifying competition with other buyers. In mid-March, OLAM agents indicated they would pay XOF550/kg. But when Koffikro group leaders informed them that local traders were paying XOF600 per kilogram, OLAM had to match the higher price. The group had eleven tons ready for pickup for the third sale in mid-March, but OLAM agents only bought two tons. The agents conducted nut humidity and quality tests and determined that product quality was low. They did not share the results of the tests but simply advised the Koffikro group to dry their nuts better and to sort out the rotten ones. The company came two more times in April, when it paid the highest prices of the season due to intense competition (see below).

OLAM pays SCGP groups a supplemental amount of XOF10 (about USD0.02) per kilogram of raw cashew nuts for their marketing expenses; for the Koffikro group, this amounted to USD360 for 2018. Rather than divide this small sum between growers and committee members (USD0.01/kg to each group), the Koffikro group decided to use the money to pay for committee members’ travel expenses to Bouaké for training meetings and to provide micro-loans to group members.

In contrast to Koffikro, the Kouassikro group sells large quantities (more than 100 metric tons) of high-quality nuts to the SCGP. It also receives a higher (XOF25/kg) commission for its village marketing activities. In addition to the XOF10 marketing commission, it receives an additional XOF15 for storing large quantities of nuts in its modern warehouse. OLAM financed the construction of the warehouse as a social development project in recognition of the Kouassikro group’s high production and quality levels. Kouassikro’s large producer status has earned it additional social development projects such as new roofs on the homes of village schoolteachers, a new well, individual bonuses (such as fans and televisions) to producers of more than ten tons of nuts, and special recognition to the top female producers (invitation to a reception in Bouaké, along with gifts of cloth).

The high market prices in 2018 stemmed from a confluence of market and regulatory forces. Increased cashew consumption in the U.S., European Union, and India and the presence of many buyers licensed by the Cotton and Cashew Council led to stiff competition for raw cashew nuts. The cashew market also benefited from a prolonged drought in California, which greatly reduced the almond crop. Cashews had replaced almonds in world nut markets over the previous few years, and Vietnamese and Indian cashew processors had contracts to fill and needed nuts.Footnote 18

However, in the middle of the marketing season, the bottom fell out of the market. World market prices dropped, and Vietnamese processors stopped buying nuts from Côte d’Ivoire. Caught between the rock of high prices in Côte d’Ivoire and the hard place of falling world market prices, Vietnamese processors refused shiploads of nuts and paid penalties for breaking contracts.Footnote 19 In turn, Ivorian exporters stopped buying nuts from Ivorian traders. When traders arrived at the port with truckloads of nuts, they were turned away or had to cut their losses by selling below the cashew council’s floor price for the port.Footnote 20 Producer prices plummeted below the official floor price. Uncertainty and instability set in, leading to debt, bankruptcy, and even imprisonment among traders who were stuck with large quantities of nuts and unpaid loans. At the end of the 2018 season, 17 percent of the harvest had not been sold. Market analysts expressed concern about these nuts being carried over to the 2019 market season and the prospects of even lower producer prices.Footnote 21

The SCGP groups in Koffikro and Kouassikro repeatedly called OLAM agents to come collect their nuts, but no one answered the phone. The President of the Koffikro group heard that OLAM wasn’t buying “because the quality of the crop was poor and because its warehouses were full.” At the same time, OLAM was buying nuts from regional traders, breaking with its established practice of only buying from SCGP groups within the SCGP zone. SCGP leadership in both Koffikro and Kouassikro felt as though they had been abandoned by OLAM’s new policy. “We had the product, but they refused to buy it from us” exclaimed the president of the Koffikro group.Footnote 22 The group discussed whether it should start selling to local traders and not exclusively to OLAM under these changing market conditions. The market data for 2018 show that SCGP members decided to sell to buyers other than OLAM (Table 2).

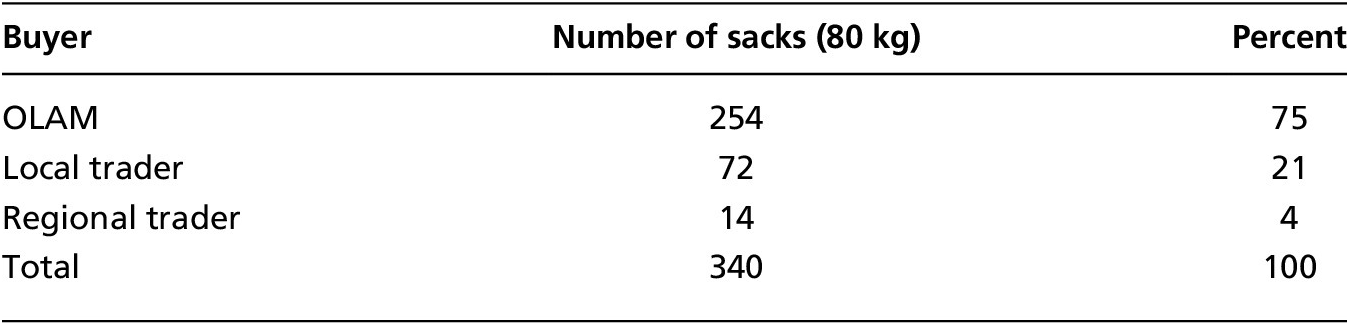

Table 2. Number of 80 kg sacks of unshelled cashew nuts sold to different buyers from the SCGP sample in Koffikro and Kouassikro, 2018.

Source: Field data 2018

SCGP members sold 75 percent of their nuts to OLAM in 2018 and the remaining 25 percent to local/regional traders. Informants indicated that they sold nuts through the trader network throughout the marketing season, not just toward the end of the season when OLAM stopped buying. Nearly one-third (32 percent) of these sales took place between SCGP members and local and regional traders during the beginning and middle marketing periods. Akobo sales accounted for 44 percent of the transactions during these two periods. The most common reason given for these non-OLAM sales were: OLAM wasn’t buying; the sellers needed money quickly; it was more convenient; they got a good price; and the buyers used a scale.

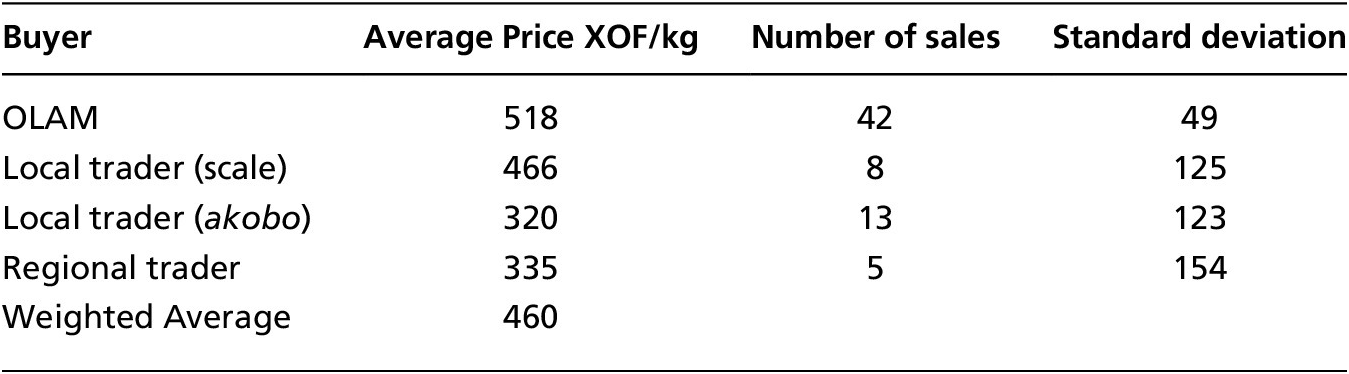

As the diverse reasons for selling to non-OLAM buyers indicate, price is not the only factor influencing to whom SCGP members sell their crop. That said, SCGP members received the highest prices from OLAM. Table 3 shows the mean price received by SCGP members from different buyers.

Table 3. Mean prices/kg for unshelled cashew nuts received by SCGP members in Koffikro and Kouassikro by buyer, 2018.

Source: Field data, December 2018

The average price for all transactions (XOF460 [USD0.83]/kg) was slightly higher than the cashew council’s floor price (XOF450) for 2018. In sum, despite the abrupt end of the market in early May, farmers received, on average, a reasonable price for their product. SCGP members received the highest price from OLAM when it bought from them. The volatile market and diverse needs of farmers led SCGP members to sell to other buyers, including the lowest-paying akobo trader. As the next section shows, market conditions continued to deteriorate in 2019, leading buyers and sellers to reconfigure their market relations in ways that led to a re-scaling of the SCGP.

Seller-Buyer Relations in 2019

The downward slide of the 2018 cashew market continued into 2019. The cashew council began the year by lowering the producer floor price for raw cashew nuts from XOF450 (USD0.81/kg) in 2018 to XOF375 (USD0.64/kg). The council’s calculations considered world demand and market prices as well as the levies it imposed on each kilogram of unshelled nuts exported from the country (RCI 2019). The biggest change for the SCGP members of Koffikro was that OLAM did not buy a single nut from the group in 2019. The company bought nuts twice from Kouassikro at the floor price of XOF375F/kg. Despite multiple calls to the program’s cluster agents, OLAM refused to buy nuts at Koffikro and later at Kouassikro on the grounds that “the floor price is too high, it is not in our interests.”Footnote 23

Cashew market reports noted that there were very few buyers in the cashew growing area throughout the early and middle marketing periods. At the end of February, when the market is usually very active, market analysts observed that instead it was “very calm for lack of international demand.”Footnote 24 Few exporters had signed contracts with regional traders, which meant that local traders lacked the capital to buy nuts, which were overflowing in village storehouses. Traders who used their own capital bought nuts below the official floor price at XOF250-325/kg. By mid-April, market analysts reported that Côte d’Ivoire’s cashew market had collapsed. Producers were desperate to sell their stocks to finance the upcoming agricultural season. Under these difficult market conditions, SCGP members in Koffikro and Kouassikro had little choice but to sell their nut crop below the official floor price. The head of the Kouassikro group reported:

When OLAM refused to buy…we tried to negotiate with other people [buyers]. But given the rotten price (le prix gaté), people came and proposed their own price…they offered 200 francs, 225 francs, some even proposed 175 francs. We asked ourselves where do we go from here? We decided it was preferable that each farmer find his/her own buyer.Footnote 25

Table 4 shows the mean prices received by program participants in both communities in 2019. The average price of XOF250 (USD0.43)/kg indicates that the cashew council was unable to enforce its floor price of XOF375 per kilogram. The combined data from field observations and market reports also indicate that a parallel cashew market was flourishing in the shadows of the cashew authority’s regulated market.

Table 4. Mean prices/kg for unshelled cashew nuts received by SCGP members in Koffikro and Kouassikro by buyer, 2019.

Source: Field data May-June 2019

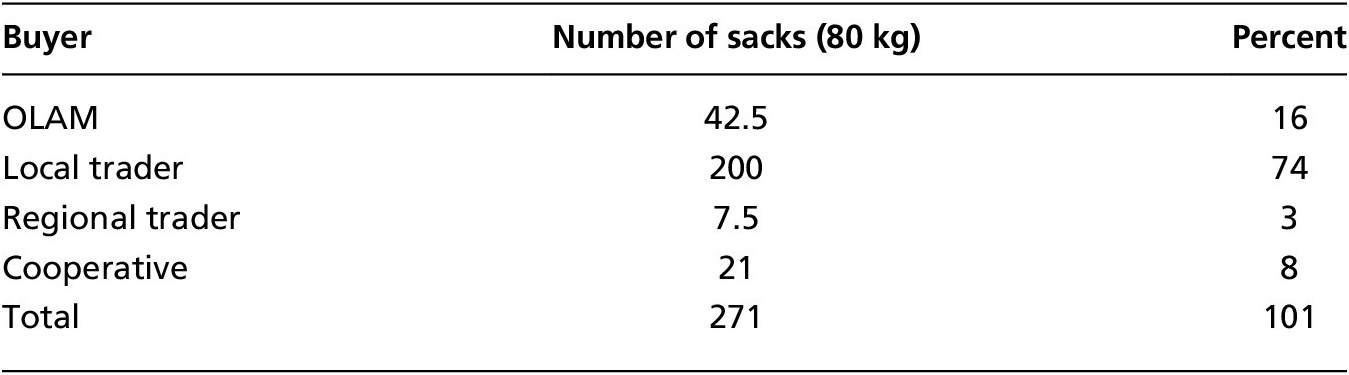

Market data collected from the sample of SCGP participants (or would-be participants!) illustrate the dynamics of the depressed market. Table 5 shows the distribution of sales by SCGP members to different buyers in Koffikro and Kouassikro for 2019. This sales pattern stands out for being the mirror opposite of the 2018 pattern. The quantity of sacks sold to OLAM dropped from 75 percent in 2018 to just 16 percent in 2019, while the number of sacks sold to local/regional traders rose from 15 percent in 2018 to 74 percent in 2019. SCGP leaders in both communities decried this development, in which local/regional traders bought nuts at XOF200 (USD0.34)/kg.

Table 5. Number of 80 kg sacks of unshelled cashew nuts sold to different buyers from SCGP sample in Koffikro and Kouassikro, 2019.

Source: Field data May-June 2019

The SCGP value chain was in a tailspin, at least temporarily. Viewing the cashew council’s producer floor price as excessively high, OLAM shifted from provisioning its Bouaké processing plant from SCGP members (Plan A) to sourcing from within its regional trader system inside the SCGP supply zone (Plan B), where it was able to negotiate more advantageous prices.Footnote 26 This marked a dramatic shift in OLAM’s value chain strategy. By redirecting its buying practices away from SCGP members toward an alternative trader supply chain, it not only demonstrated a weak commitment to supply chain coordination, but it also scaled down its sourcing from the SCGP rather than scaling up the value chain.

For their part, sellers who were now unable to market their nuts with OLAM had to respond to this disruption or deviation in the chain by seeking out other buyers through their relationships with local and regional traders. Members reported selling to such traders because they “were the first to approach me” or “they had the best price”Footnote 27 (Figure 3). Yet, not all SCGP producers were equally affected by OLAM’s shifting sourcing strategies. High-volume-producing growers in Kouassikro succeeded in selling nuts to OLAM on two occasions because of their large supply and the trust that existed between them and OLAM. SCGP members in low-producing Koffikro did not sell any nuts to OLAM in 2019 because the company never turned up to buy. Under pressure, the Koffikro community group itself encouraged its members to find their own buyers. This situation deepened Koffikro’s mistrust of the company and also strengthened its commitment to maintaining a variety of lateral marketing relationships.

Figure 3. SCGP member selling her crop to local/regional traders after OLAM stopped buying in 2019.

Photo: Author

As a result of these reassembled value chain linkages, the proportion of nuts processed at OLAM’s Bouaké plant coming from the SCGP dropped steeply from twenty thousand tons in 2018 to three thousand tons in 2019 (see Table 1). Combined with the commercialization data for the 2018 and 2019 marketing seasons from Koffikro and Kouassikro (see Tables 2 and 5), these sourcing data point to a significant re-scaling of the SCGP value chain that highlights its structural indeterminacy. Indeed, by comparing the operation of the value chain in two different communities and at two different time periods under contrasting market conditions, our analysis demonstrates how none of the local chain actors is fully committed to the linear organization of the value chain. Indeed, all the actors—including OLAM, the core actor—seek to manage the risks and contingencies associated with the market by maintaining flexible and non-linear relationships that might help to protect them from losses. Yet their strategies also limit chain coordination. Thus, the actual operation of the value chain challenges the progressive development logic of the scaling-up concept.

The Interplay of Structure and Practice

In much business and development literature, the lore of the market is that it provides a structured and relatively stable framework for economic transactions that increases transparency and reduces unpredictability. Coordination within the value chain “smooths out” relations among chain actors and improves market efficiency. These expectations underpin the assumptions and the goals of recent pro-poor value chain development strategies. These strategies assume that by shortening the value chain and increasing coordination among value chain actors, everyone would be better off, and more value would be captured locally. The case of the SCGP challenges this view.

In Côte d’Ivoire, the cashew market is characterized by high levels of contingency and risk that complicate and subvert the conception of the value chain as a structured, linear, and stable set of relationships between chain actors (principally sellers and buyers) that can be readily scaled up in a progressive fashion. One key constraint, as we have shown here, is that none of the chain actors is fully committed to such a progressive scaling up of the value chain. This is true even of OLAM, the putative chain driver and the actor most firmly embedded in the scaling-up project. Because OLAM wants to “smooth out” market relations on its own terms, it is apt to change the terms and strength of its connections with the other value chain actors. In doing so, it inevitably changes the configuration of its supply chain network, as it did in 2019 when it (re)strengthened its ties with regional traders at the expense of the SCGP.

For their part, cashew growers within the SCGP seek to limit their dependence on OLAM—whom they have learned they cannot trust to reliably buy their nuts. They do so by maintaining flexible and non-linear networked relationships with akobo and other traders. Indeed, as the failure of OLAM’s loan program demonstrated, some farmers used their lateral networks to avoid paying back their loans to OLAM. Moreover, as the 2019 experience of Koffikro showed, the informal community groups were caught awkwardly in the middle, unable either to convince OLAM to buy the village’s nuts or to funnel growers into OLAM’s market stream when the company seemed unreliable. Under these conditions, both the company and the community organization—the actors most heavily tasked with coordinating and structuring the value chain—encouraged individual growers to find their own buyers. These actions resulted in weak and shifting network connections, undermining the ideal model of an efficiently structured value chain.

This lack of commitment to a progressive scaling up of the cashew value chain reflects a deep tension in what Rocheleau and Roth call “the constant interplay of structure and practice.” First, it reveals that, in the hands of value chain actors, the effort to scale up is neither systematic nor unidirectional; it is at best episodic and fragmentary. Second, the practices of the chain actors militate against the premise of the value chain model, which claims that the shorter the chain the greater the value added and benefits to participants. As OLAM’s adoption of Plan B in 2019 reveals and the poor farmers’ free riding in the loan program underscores, under certain circumstances, value chain actors sometimes see themselves as better off operating within a longer value chain. Third, each of the different actors has some capacity and interest in maintaining the flexibility of market participation that inhibits the multi-dimensional scaling up of the value chain that the model posits. As we have shown at length, they act accordingly. The effect is that, structurally, the cashew market is itself an assemblage of relatively flexible, multi-directional and multivalent relationships, rather than a set of coordinated linear linkages between chain actors. Each of the dimensions of scaling up that we introduced at the beginning of the article—farmer participation, market size, and value-addition—can in fact be disrupted or subverted by the actions of different actors with unequal amounts of power to minimize the risks of their participation in the value chain itself.

Conclusion

Our analysis points toward several broader conclusions concerning the scaling up of agricultural value chains. First, the literature assumes that scaling up occurs as value chain actors’ interests align around the benefits of the market. Yet, as we have seen, the scaling process is confounded by the shifting evaluations of the chain actors. At different times and under different market conditions, the interests of value chain actors might align around revenue maximization that nurtures a coherent and coordinated path of value production; but they might also diverge around risk management as actors scramble to make a profit, meet other urgent needs, or simply stay above water. Thus, the commitment of different actors to scaling up is place- and time-specific, and, as within the SCGP, scaling up is likely to be a highly differentiated process.

Second, where chain actors seek to mediate their relationship to the value chain by maintaining lateral networks and relationships, their interactions with other chain actors are likely to be characterized by indeterminacy. For instance, if farmers cannot be sure that OLAM can be counted on to buy their nuts, or they confront fluctuating prices offered by local or regional traders, their interactions with those chain actors are inevitably indeterminate or uncertain. Indeed, one could argue that the higher the level of contingency that shapes the market, the more indeterminate the interactions between chain actors are likely to be. The more indeterminate the interactions are, the greater the tendency of chain actors to act on the basis of risk mitigation rather than revenue maximization. The decision by Koffikro’s community group to recommend that their growers find their own buyers in 2019 is a good example of this logic, as is the tendency of poorer women farmers to maintain stronger relationships with akobo and local traders rather than seek security in the OLAM-dominated marketplace.

Third, our analysis shows that power does not flow uniformly through the value chain’s market institutions; instead, it circulates through relationships among the value chain actors. None of the actors—not even OLAM—is able to coordinate the value chain effectively. Different actors with different amounts of power calculate risk differently, which affects not only the ways in which they negotiate chain relationships under varying circumstances but also the ways in which other actors negotiate their own chain relationships. For instance, OLAM’s self-protective shift to Plan B in 2019 influenced the decision-making matrix of SCGP members in Kouassikro and Koffikro, as well as the regional and local traders from whom OLAM was now buying. These reverberations in chain relationships have an impact on each actor’s commitment to scaling up the value chain. Indeed, under conditions of uncertainty and market variability, value chain actors may seek to scale down one dimension, or set of relationships, of a value chain in order to scale up or simply maintain another. Patterns of trust and cooperation among actors in the value chain are likely to reflect this uncertainty and these scaling processes.

This study demonstrates that the assumptions that underpin the scaling-up model of agricultural development provide an inadequate foundation for understanding the actual operation of agricultural value chains. In order to capture how value chains work more accurately, analysis must acknowledge that there is no teleology to scaling up. It must take greater account of the indeterminacy of encounters in which market transactions occur. Such indeterminacy, as we have argued, is a marker of the chain actors’ perceptions of risk and vulnerability that inform their decisions and behavior. Moreover, as chain actors act to mitigate risk in the context of market interactions, they draw strategically on local network connections that are not firmly embedded in a linear chain structure. Under changing conditions, these strategies can significantly reconfigure chain dynamics. Thus, agricultural value chains themselves are best understood not as linearly coordinated chain-like structures between value-adding actors, but rather as assemblages of multivalent, multi-directional, and power-infused relationships.