Book contents

- Frontmatter

- Dedication

- Contents

- Preface

- 1 Probability Distributions and Insurance Applications

- 2 Utility Theory

- 3 Principles of Premium Calculation

- 4 The Collective Risk Model

- 5 The Individual Risk Model

- 6 Introduction to Ruin Theory

- 7 Classical Ruin Theory

- 8 Advanced Ruin Theory

- 9 Reinsurance

- Appendix

- Solutions to Exercises

- References

- Index

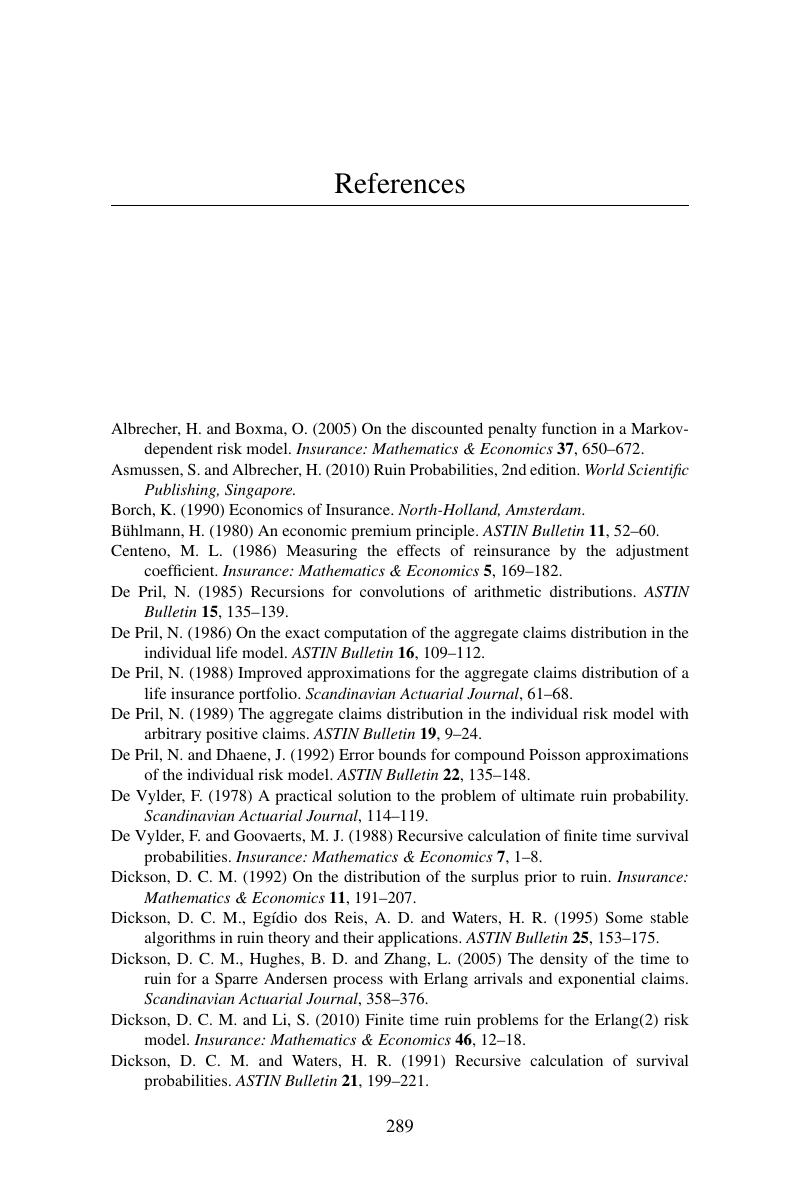

- References

References

Published online by Cambridge University Press: 17 November 2016

- Frontmatter

- Dedication

- Contents

- Preface

- 1 Probability Distributions and Insurance Applications

- 2 Utility Theory

- 3 Principles of Premium Calculation

- 4 The Collective Risk Model

- 5 The Individual Risk Model

- 6 Introduction to Ruin Theory

- 7 Classical Ruin Theory

- 8 Advanced Ruin Theory

- 9 Reinsurance

- Appendix

- Solutions to Exercises

- References

- Index

- References

Summary

- Type

- Chapter

- Information

- Insurance Risk and Ruin , pp. 289 - 291Publisher: Cambridge University PressPrint publication year: 2016