15 - Wealth and Income Distribution: New Theories Needed for a New Era

Published online by Cambridge University Press: 16 August 2023

Summary

Six decades ago, Nicholas Kaldor put forward a set of stylized facts on growth and distribution for mature industrial economies. The first and most prominent of these was the constancy of the share of capital relative to that of wealth in national income. At about the same time, Simon Kuznets put forward a second set of stylized facts: he stated that while the interpersonal inequality of income distribution might increase in the early stages of development, it declines as industrialized economies mature.

These empirical formulations brought forth a generation of growth and development theories, whose object was to explain the stylized facts. Kaldor himself presented a growth model that claimed to produce outcomes consistent with constancy of factor shares, as did Robert Solow. Kuznets also developed a model of rural–urban transition consistent with his prediction, as did many others.

KALDOR–KUZNETS FACTS NO LONGER HOLD

However, the Kaldor–Kuznets stylized facts no longer hold for advanced economies. The share of capital as conventionally measured has been on the rise, as has interpersonal inequality of income and wealth. Of course, there are variations and subtleties of data and interpretation, and the pattern is not uniform. But these are the stylized facts of our time. Bringing these facts to centre stage has been the achievement of research leading up to Piketty’s Capital in the Twenty-First Century.

It stands to reason that theories developed to explain constancy of factor shares cannot explain a rising share of capital. The theories developed to explain the earlier stylized facts cannot very easily explain the new trends, or the turnaround. At the same time, rising inequality has opened once again a set of questions on the normative significance of inequality of outcomes versus inequality of opportunity. New theoretical developments are needed for positive and normative analysis in this new era.

What sort of new theories? In the realm of positive analysis, Piketty has himself put forward a theory based on the empirical observation that the rate of return to capital, r, systematically exceeds the rate of growth, g; the famous r > g relation.

- Type

- Chapter

- Information

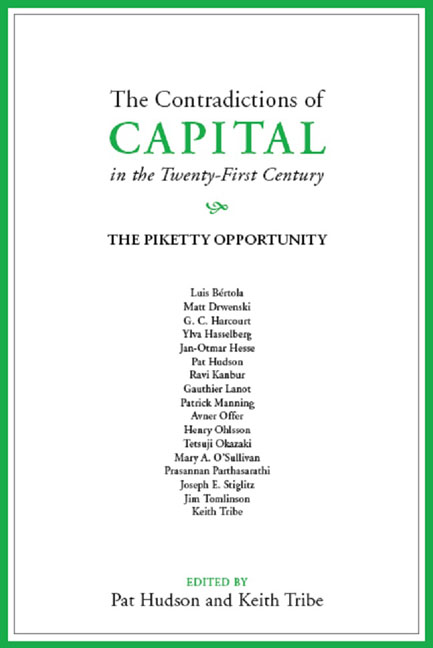

- The Contradictions of Capital in the Twenty-First CenturyThe Piketty Opportunity, pp. 283 - 288Publisher: Agenda PublishingPrint publication year: 2016

- 5

- Cited by