Book contents

- Frontmatter

- Contents

- Acknowledgements

- Table of authorities

- 1 Introduction

- 2 What is tax policy?

- 3 Tax policy in action: gender budgeting

- 4 Corporate social responsibility and the possibility of common aims

- 5 Tax policy in context

- 6 Tax policy applied

- 7 Tax policy in systems revisited: families, tax law and the interaction of institutions

- 8 Putting into the system: gender, markets and tax policy

- 9 Conclusion

- Bibliography

- Index

Index

Published online by Cambridge University Press: 06 December 2010

- Frontmatter

- Contents

- Acknowledgements

- Table of authorities

- 1 Introduction

- 2 What is tax policy?

- 3 Tax policy in action: gender budgeting

- 4 Corporate social responsibility and the possibility of common aims

- 5 Tax policy in context

- 6 Tax policy applied

- 7 Tax policy in systems revisited: families, tax law and the interaction of institutions

- 8 Putting into the system: gender, markets and tax policy

- 9 Conclusion

- Bibliography

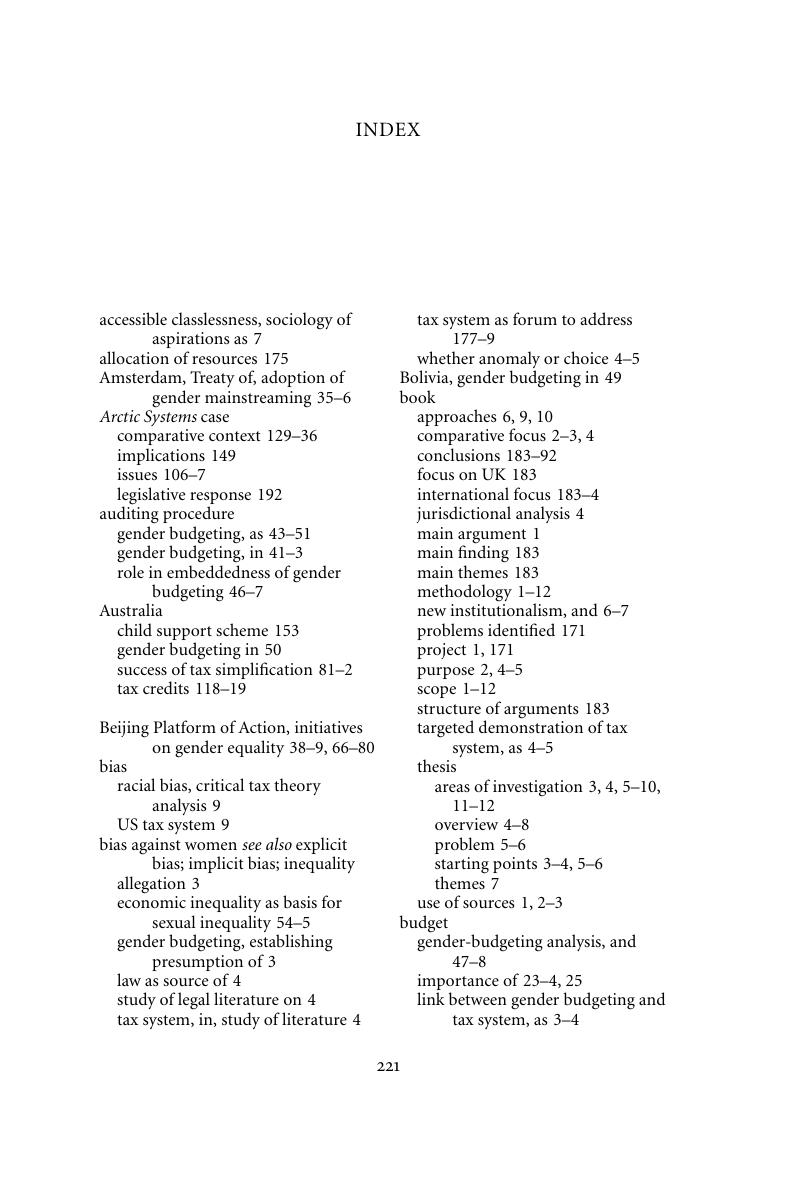

- Index

Summary

- Type

- Chapter

- Information

- Tax Policy, Women and the LawUK and Comparative Perspectives, pp. 221 - 234Publisher: Cambridge University PressPrint publication year: 2010