1. Introduction

The impact of domestic credit on economic activities and financial stability has been well-documented in both the finance and economics literature. The healthy availability of domestic credit promotes the rise of capital inflows to the private sector (Luca and Spatafora, Reference Luca and Spatafora2012), reduces the pressure of exchange rate risk on domestic firms (Fernández-Villaverde et al., Reference Fernández-Villaverde, Garicano and Santos2013), and raises real estate and stock prices (Mendoza and Terrones, Reference Mendoza and Terrones2012), all of which contribute to the betterment of a country's economic growth. Such positive impacts have aided in the rapid rise of domestic credit worldwide. For example, over the last few decades, the average domestic credit provided by the financial sector (as a percentage of GDP) in democratic countries has more than tripled from 31.62 per cent in 1960 to 121.01 per cent in 2014. However, one noteworthy point we observe is large cross-country variability in domestic credit in democratic countries. For instance, the mean domestic credit constitutes only 32.85 per cent in Romania, while it accounts for 183.24 per cent in JapanFootnote 1. Why is there such a large disparity in domestic credit, especially in influential democratic countries? Political ideology has been found to make a difference in determining a wide range of economic measures, including economic growth, real interest rate, unemployment, and taxes (Potrafke, Reference Potrafke2017). Could ideological differences in politics play a role in explaining the wide range of domestic credit? We study this issue using unbalanced panel data from 1960 to 2014 of 29 democratic countries.

Theoretically, partisan politics – left-leaning, centrist, or right-leaning – play an important role in shaping domestic credit since ideological differences of political parties can lead to differences in monetary and fiscal policy and the regulatory regime. Left-leaning governments are expected to prioritise redistributive programs and reduce unemployment, with many government interventions geared towards a government consumption-driven and expansionary economy (Boix, Reference Boix2000). In contrast, right-leaning governments aim to create an enabling private sector environment that engenders investments, invariably leading to low inflation and interest rates (Quinn and Shapiro, Reference Quinn and Shapiro1991). Building on this strand of theoretical connection, economies run by right-leaning governments are associated with laissez-faire market systems and economic incentives, such as tax cuts and waivers (Bara and Budge, Reference Bara and Budge2001). As political ideology shapes government policies about monetary issues such as the interest rate and inflation, as well as fiscal and regulatory policy, all of which can impact the behaviour of financial institutions and thus the allocation of domestic credit, we conjecture that such politics of the government matters in determining domestic credit allocationsFootnote 2.

Given this backdrop, we aim to answer three vital empirical questions: 1. Do differences in political ideology affect domestic credit allocation? 2. Do left-leaning governments allocate more credit to the public sector? 3. Do right-leaning governments promote the private sector by initiating favourable credit policy? To find strong support empirically, we employ a large, unbalanced panel data set spanning 29 countries from 1960 to 2014.Footnote 3 Further, the economic development, market system, and economic structure sampled economies are all distinct. Hence, the conclusions drawn from such a heterogeneous sample have a higher level of robustness and validity.

Our regression analysis shows that differences in political ideology significantly affect domestic credit allocation; in particular, a left-leaning government reduces domestic credit allocations. In line with our theoretical arguments, we also report that the governments with a right-leaning ideological orientation increase the domestic credit to the private sector (DCP) compared to their left-leaning counterparts. To put this in an economic perspective, we find that under a left-leaning government, the proportion of total domestic credit (TDC) to gross domestic product is about 6.5 percentage points lower than under a right-leaning government. However, when left-leaning governments are in power, domestic credit to the public sector (government) is 1.3 percentage points higher. DCP, on the other hand, is down 6.6 percentage in left-leaning governments relative to right-leaning governments. These results are robust to the alternative measure of political ideology and various econometric identifications. In our further analysis, we find no evidence to support the electoral view of politics on domestic credit, indicating that the electoral period has no major impact on the relationship between political ideologies and domestic credit.

Although we show a strong effect of political ideology on domestic credit, a caveat to our findings could be a concern about the causal effect between political ideology and domestic credit because of omitted variables and unobservable heterogeneity. To rule out these issues, we use country- and year-fixed effects in our baseline specifications. Moreover, partisan politics are endogenous because a country's financial stability may impact the ideologies of the political parties, implying reverse causality from credit lending to political commitment. Thus, to address endogeneity, we conduct identification tests. First, we use propensity score matching (PSM) to identify countries with a right-leaning government, which are indistinguishable from countries with a left-leaning government. In post-matching, we still find that differences in political ideology significantly affect the level of domestic credit. Additionally, one may argue that the level of contemporary domestic credit is mainly dependent on its previous year and this is biasing the results. Therefore, to address this, we use lagged model specifications. In a nutshell, the entirety of these results confirms the significant relationship between political ideology and domestic credit.

Our contributions to the literature are twofold. First, our study contributes to the understanding of how banks and financial institutions respond to the political agendas of various governments. Specifically, we show that in a country where a right-leaning government is in power, lenders are inclined to lend more loans to the private sector. However, lenders may be incentivised to make additional loans to the public sector, particularly in left-leaning countries. Therefore, consistent with prior studies (e.g. Barrell and Nahhas, Reference Barrell and Nahhas2020; Eichler and Sobański, Reference Eichler and Sobański2016; Jackowicz et al., Reference Jackowicz, Kowalewski and Kozłowski2013), our findings extend the literature in understanding the lending behaviour of financial institutions.

Second, to the best of our knowledge, we contend that this is the first study to investigate the role of political ideology on domestic credit. Existing research shows how political ideology affects various economic outcomes, such as unemployment and transfer policies (Hibbs, Reference Hibbs1994; Marx, Reference Marx2016; Picot and Menéndez, Reference Picot and Menéndez2019) and economic growth (Facchini and Melki, Reference Facchini and Melki2014), among others. Moreover, from a financial environment point of view, a few studies focus on the impact of political ideology and institutions on financial development (Khafagy, Reference Khafagy2017) and credit rating (Barta and Johnston, Reference Barta and Johnston2018). In addition, the role of political ideology on socio-outcomes is evident in the prior literature (e.g. Allan and Scruggs, Reference Allan and Scruggs2004; Bechtel and Füss, Reference Bechtel and Füss2010; Marx, Reference Marx2016; Picot and Menéndez, Reference Picot and Menéndez2019; Quinn and Shapiro, Reference Quinn and Shapiro1991). However, no prior study has examined how partisan politics affect domestic credit, which is a major issue in the debt market. Our study, in an analysis of 29 economies, provides empirical evidence on the relationship between political ideology and credit lending and extends research concentration from the impact of political ideology on obvious areas, i.e., economic growth, poverty, and unemployment, to the debt market, where a government does not have direct control. Hence, our study contributes a fresh perspective to the current literature.

The structure of the paper is as follows: The next section provides an overview of the theoretical background and hypotheses. Section 3 describes the data, measures of variables, econometric design, and pre-regression analyses for the empirical evaluation. Section 4 presents the results, while Section 5 concludes the paper.

2. Literature and hypothesis development

Governments around the world and across different time periods are commonly identified by the political ideology they follow.

Political ideology is defined by how governments pursue their agendas, identification of right and wrong, the interests of the main groups represented by the party, and other activities in society (Jost et al., Reference Jost, Federico and Napier2009; McClosky, Reference McClosky1964). While earlier scholars (Gerring, Reference Gerring1997; McClosky, Reference McClosky1964) attempt to classify political ideologies in a variety of ways (e.g., socialist ideology, liberal ideology), the left- and right-wing typologies are one of the most distinct classifications utilised in the literature.

In the case of economic policies, left-wing ideology is typically connected with more government intervention in the economy, such as more taxes, government spending, as well as regulation (Potrafke, Reference Potrafke2017). However, this simplistic definition can mask greater complexities, for example, that right-leaning governments may spend more on defence (Bove et al., Reference Bove, Efthyvoulou and Navas2017), or that governments on all sides of the political spectrum have pursued more economically liberal policies in the post-cold war era (Portrafke, Reference Potrafke2017). These ideological differences may manifest themselves in a generally more favourable environment for investment and private finance under right-leaning governments in the financial sector.

The ultimate impact of any ideological difference in the government also largely depends on the function of the institutional environment. As set out by (Berggren and Bjørnskov (Reference Berggren and Bjørnskov2019), the motivations and beliefs (ideology in our terms) of politicians and voters form a political programme whose real consequences are then affected by the political system and any crises that may occur at the time. In the case of domestic credit, a left-leaning government may be elected partly based on expanding the public sector, with the consequence of an increased supply of credit to the public sector, but the degree to which they can do this will be a function of the institutions of that nation. For example, Hodgson (Reference Hodgson2021) addresses the potential role of financial institutions for economic growth in the early stages of industrialisation, making the point that whilst ideas may matter, their interplay with institutions is important. A specific example is that those countries in the Eurozone are technically limited in their ability to run fiscal deficits; therefore, any left-leaning government proposing a period of fiscal expansion would be limited in what they could achieve. Along with formal institutions, Cruz-García and Peiró-Palomino (Reference Cruz-García and Peiró-Palomino2019) claim that informal institutions (e.g., social trust) are vital in determining the provision of private credit. Thus, institutional factors play an essential role in the overall effect, but our focus in this study is on establishing whether there is a consistent direction of effect due to the government ideology.

According to Sattler (Reference Sattler2013), research on how political ideologies affect the financial sector demonstrates that the stock exchange, a key financial market, experiences a nosedive at the prospect of a left-leaning government. This illustrates how expectations about the direction of policy can matter as much as the actual implementation of policy. Similarly, Bernhard and Leblang (Reference Bernhard and Leblang2002) find a greater exchange rate volatility under left-leaning governments compared to the right-leaning. At the sectoral level, Bechtel and Füss (Reference Bechtel and Füss2010) report that differences in political ideology redistributed stock returns between the defence, pharmaceutical, and alternative energy sectors during 1991–2015 in Germany. Their results show high returns and volatility in defence and pharmaceutical stocks when a right-leaning government was likely to win the election. However, the renewable energy sector experienced high returns when a left-leaning government was predicted to win the election. This is likely linked to differences in spending priorities between governments of different ideologies, as discussed previously and supported by Bove et al. (Reference Bove, Efthyvoulou and Navas2017).

Political ideology also influences the lending activities of financial institutions, including interest rates and the allocation of funds for loans. Barta and Johnston (Reference Barta and Johnston2018) argue that financial institutions used ideological labels as indicators of the potential policies of a government. Since it is not prudent for financial institutions to vary lending policies quickly, ideological labels of the incumbent party become the best predictor of actual government policy choices, which need to be considered in designing lending activities. In a panel analysis of 23 countries, Barta and Johnston (Reference Barta and Johnston2018) find that the incumbent government's political ideology significantly affected the country's credit rating. They highlight that left-leaning executive governments are associated with a higher probability of negative rating changes. The study also argues that credit rating agencies' use of ideological labels gave markets a partisan signal. Eichler and Sobanski (Reference Eichler and Sobański2016) document that national politics, such as electoral cycles and government's political ideology affect bank stability in the Eurozone.

While the above studies show a range of ways in which political ideology matters in the financial world, one question that, to the best of our knowledge, remains unexplored is the impact of government political ideology on the supply of domestic credit. Domestic credit matters, because credit finances production, consumption, and capital formation, which in turn positively contribute to economic growth (World Bank, 2014). The most significant channel by which political ideology might impact the availability of domestic credit is the impact of monetary policy decisions. Governments may control this either directly, or if there is central bank independence, indirectly, via the mandate set for the central bank. Monetary policy is a determinant of domestic credit, through the direct incentive effect of interest rates, as well as effects on inflation, exchange rates, and wider economic performance (Furceri et al., Reference Furceri, Guichard and Rusticelli2012).

Potrafke (Reference Potrafke2017) reviews the literature which has at its heart the hypothesis that left-leaning governments pursue more expansionist policies that right-leaning governments, implying higher inflation (and lower unemployment) for a left-leaning government compared to a right-leaning government. The survey finds that left-leaning governments tend to have lower real interest rates (e.g., Boix, Reference Boix2000; Oatley, Reference Oatley1999), though this can depend on the specific institutional context. Quinn and Shapiro (Reference Quinn and Shapiro1991) attempt to answer whether voters in democratic countries have a genuine choice in macroeconomic policies. Their findings support that, there is indeed a difference in the USA, and that this is driven by ideological differences between the two main parties. Democrats (typically identified as a left-leaning party) have promoted growth via higher consumption, which has meant higher business taxes and lower real interest rates. On the other hand, Republicans have promoted growth via an investment-led strategy which has meant higher real interest rates and lower business taxes. Potrafke (Reference Potrafke2017) argues that left-leaning governments may have delegated monetary policy powers to central banks to deflect blame from their traditional voters when these central banks institute more right-leaning policies of tighter money.

Therefore, whilst there is evidence that there is an effect of political ideology on monetary policy, the result for domestic credit is unclear given the various channels of impact and the nuances of the political factors. The evidence for the effects of political ideology on monetary policy and inflation and in turn for the effect of these variables on the overall level of domestic credit led to our first proposed hypothesis:

H1: Differences in government ideology affect the allocation of domestic credit.

Whilst the effect of political ideology on the overall level of domestic credit may be hard to predict, clearer predictions can be made if we divide TDC into credit for the public sector, and credit for the private sector. Such division opens an interesting avenue for further exploration. As already discussed, the left-leaning governments are expected to expand the size and scope of the state to achieve their objectives relative to their right-leaning counterparts. There is supportive evidence for this hypothesis, such as Blais et al. (Reference Blais, Blake and Dion1993) and Cusack (Reference Cusack1997), who find that left-leaning governments have a higher level of government spending.

In terms of specific spending priorities, a right-leaning government has a negative impact on welfare state development. According to Picot and Menéndez (Reference Picot and Menéndez2019), left-libertarian parties address the interest of non-standard workers, whereas far-left parties are only vocal of the rise of non-standard workers. Klitgaard et al. (Reference Klitgaard, Schumacher and Soentken2015) find partisan effects in institutional welfare state reforms in a four-country study: Sweden, Denmark, Spain, and the Netherlands. Using data on 18 countries, Allan and Scruggs (Reference Allan and Scruggs2004) report that government partisanship affects welfare programs. They show an increase in welfare programs such as unemployment and sickness replacement benefits in left-leaning governments compared with the right-leaning government.

Whilst the evidence on this issue is not conclusive, with authors such as Bräuninger (Reference Bräuninger2005) and Busemeyer (Reference Busemeyer2009) finding no discernible effect of government ideology on overall government spending patterns, there is enough weight of existing evidence to support that a left-leaning government would on average expand the public sector. Our second hypothesis is therefore:

H2: Left-leaning governments make policy which leads to a higher level of credit for the public sector.

By contrast, a right-leaning government is expected to promote the private sector by defending property rights, lowering taxes, lessening the regulatory burden, and privatising state-run businesses. Researchers have also found that political ideology matters for regulation and state-ownership. Belloc et al. (Reference Belloc, Nicita and Sepe2014) find that OECD countries have broadly moved in a pro-market direction (more privatisation and liberalisation), but that right-leaning governments have emphasised privatisation, whereas left-leaning governments have emphasised liberalisation. This challenges the stereotype of left-leaning governments as always anti-market, whilst maintaining that ideology continues to matter. Other researchers focus on specific sectors, with Duso and Seldeslachts (Reference Duso and Seldeslachts2010) finding that right-leaning governments were more likely to liberalise the mobile telecommunications markets of a range of European countries. Potrafke (Reference Potrafke2017) argues that the trend for privatisation and deregulation in the 1970s and 1980s, driven mainly by the Reagan administration in the USA and the government of Margaret Thatcher in the UK, are two of the clearest examples of ideologically motivated economic policy.

Our third hypothesis is therefore:

H3: Right-leaning governments make policy, leading to a higher level of credit for the private sector.

3. Data and method

3.1 Data and sample

To investigate the effect of political ideology on domestic credit, we choose 29 sample countries: Australia, Austria, Belgium, Bulgaria, Canada, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Great Britain, Greece, Hungary, Iceland, Ireland, Italy, Japan, Luxembourg, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Spain, Sweden, and the USA. Similar to prior studies (e.g. Frankenreiter, Reference Frankenreiter2018), our measure of political ideology comes from the Government Partisanship database of Seki and Williams (Reference Seki and Williams2014). This dataset better captures government ideologies yearly and on a continuous scale, unlike the other coding on political ideology, such as the Database of Political Institutions (DPI). Our sample period spans 1960–2014, with 2014 being the most recent year for which data from Seki and Williams's (Reference Seki and Williams2014) dataset is accessible. Also, we use other data sources for measures of domestic credit, alternative measures of political ideology and control variables, such as World Development Indicators and the DPI, respectively.

3.2 Empirical measures

3.2.1 Measuring political ideology

Table 1 summarises the definitions of all variables used in the analysis, including those used in the additional analyses and robustness checks. Our measure of political ideology is the score of Seki and Williams (Reference Seki and Williams2014), and we label it as SWSCORE. This yearly varying score ranges from 1 to 5, where a government is classified as 1 for right-wing dominance (share of seats in government and supporting parties in parliament held by right parties is larger than 66.6 per cent), 2 for right-centre complexion (share of right and centre parties in government and supporting parties is between 33.3 per cent and 66.6 per cent each), 3 for a balanced situation (share of centre larger than 50 per cent in government and parliament; or if left and right form a government together not dominated by one side or the other), 4 for left-centre complexion (share of seats of left and centre parties in government and supporting parties in parliament between 33.3 per cent and 66.6 per cent each), and 5 for left-wing dominance (share of seats in government and supporting parties in parliament larger than 66.6 per cent).

Table 1. Definitions of variables

This measure has several useful features for this analysis. Firstly, it is based on objective measures of political party ideology found by analysing the manifestos of the parties for reference to key ideas associated with left-leaning or right-leaning political ideology. For example, more favourable regards to a free-market economy will have a political party more likely to be coded as right-leaning. Whilst it may not be possible to be truly objective on such measures, this is a robust methodology which is applied consistently across the various countries in the data and is testified to the many uses of this data in the existing literature on the effects of political ideology (see Potrafke (Reference Potrafke2017) for a review). Secondly, the variable captures not just the political ideology of the parties but their power within government, which then can translate into the policy effects we are interested in. The ruling party of a country may be left-leaning, for example, however, if they are a minority government supported by a centrist party, their ability to implement policy will be weaker than if they had a substantial majority, and we would not expect to see such a strong outcome on actual policy.

3.2.2 Measuring domestic credit

To capture domestic credit, we consider three measures. Our first measure is TDC, defined as domestic credit provided by banks and financial institutions as a percentage of GDP (i.e., all credit to various sectors). Monetary authorities and deposit money banks, as well as other financial corporations, make up the financial sector. Our second measure is domestic credit to the government (DCG), defined as the sum of financial resources provided to the government by financial institutions domiciled in the country as a percentage of GDP. Our third measure is DCP, defined as the sum of financial resources provided to the private sector by financial institutions domiciled in the country, such as through loans, purchases of non-equity securities, trade credits, and other accounts receivable, that establish a claim repayment as a percentage of GDP.

3.2.3 Measuring controls

Following prior studies (e.g. Beck et al., Reference Beck, Demirgüç-Kunt and Levine2006; Weill, Reference Weill2011), we control for the following set of macroeconomic variables: SAV, defined as domestic savings as a percentage of GDP; RIR, defined as the annualised real interest rate to control for the cost of borrowing; GDPG, defined as gross domestic product growth rate; GDPPC, defined as gross domestic product per capita; SEMP, defined as the number of self-employed persons as a percentage of total employment; TRD, defined as the amount of import and export on domestic credit as a percentage of GDP; FDI, defined as a foreign direct investment; and EXP, defined as gross national expenditure as a percentage of GDP. Additionally, we consider a number of political factors that may have an impact on government activity: FMK, a continuous variable measuring a party's preference on a free-market; WEL, a continuous variable measuring a party's preference for providing welfare; ECO, a continuous variable measuring a party's preference on how an economy should work; FED, a dummy variable equal to 1 if a country operates federal government system and 0 otherwise; and TOG, a continuous variable ranging from 1 to 6 where a country's government varies from single-party government to caretaker government.

3.3 Econometric modelling

We use the following baseline regression models as in Equations (1), (2), and (3). In Equation (1), we regress the amount of TDC to both the private sector and government (TDC) on the political ideology of the government in power and the complete set of the controls. Since each political ideology favours either a government-led economy or a private sector-led economy, in Equations (2) and (3), we explore how the political ideology impacts the DCP and DCG, respectively.

where i, and t index country (i = 1,2…….29), and year (t = 1960,1961,……….2014), respectively. To account for country-wide and year fluctuations in domestic credit, we add the country (ψi) and year (ωt) fixed effects in all specifications.

3.4 Pre-regression analyses

3.4.1 Summary statistics

Table 2 shows summary statistics for all samples (mean, standard deviation; and the three quartiles: p25, median, and p75 for all samples, while Appendix provides summary statistics for each sampled economy. The mean value of TDC is 82.13 per cent, with a standard deviation of 53.80 per cent. However, the cross-country differences in TDC vary from 32.85 per cent for Romania to 183.24 per cent for Japan. On average, the amount of credit given by domestic financial institutions to the private sector (i.e., DCP = 79.68 per cent) is almost equal to the GDP of the country. The average value of SWSCORE is 2.84, and this greatly varies among the sampled countries. For instance, in comparison to France, which has the lowest average SWSCORE of 1.93, signalling the dominance of right-leaning ideological parties in French politics, Austria has the highest SWSCORE of 3.65, showing that left-leaning political parties have controlled the government. The controls are also found to be relatively standard.

Table 2. Summary statistics

Note: This table provides the summary statistics (mean; standard deviation denoted by Std. Dev.; and the three quartiles: p25, median, and p75) of the variables used in the bassline analysis.

3.4.2 Correlation matrix

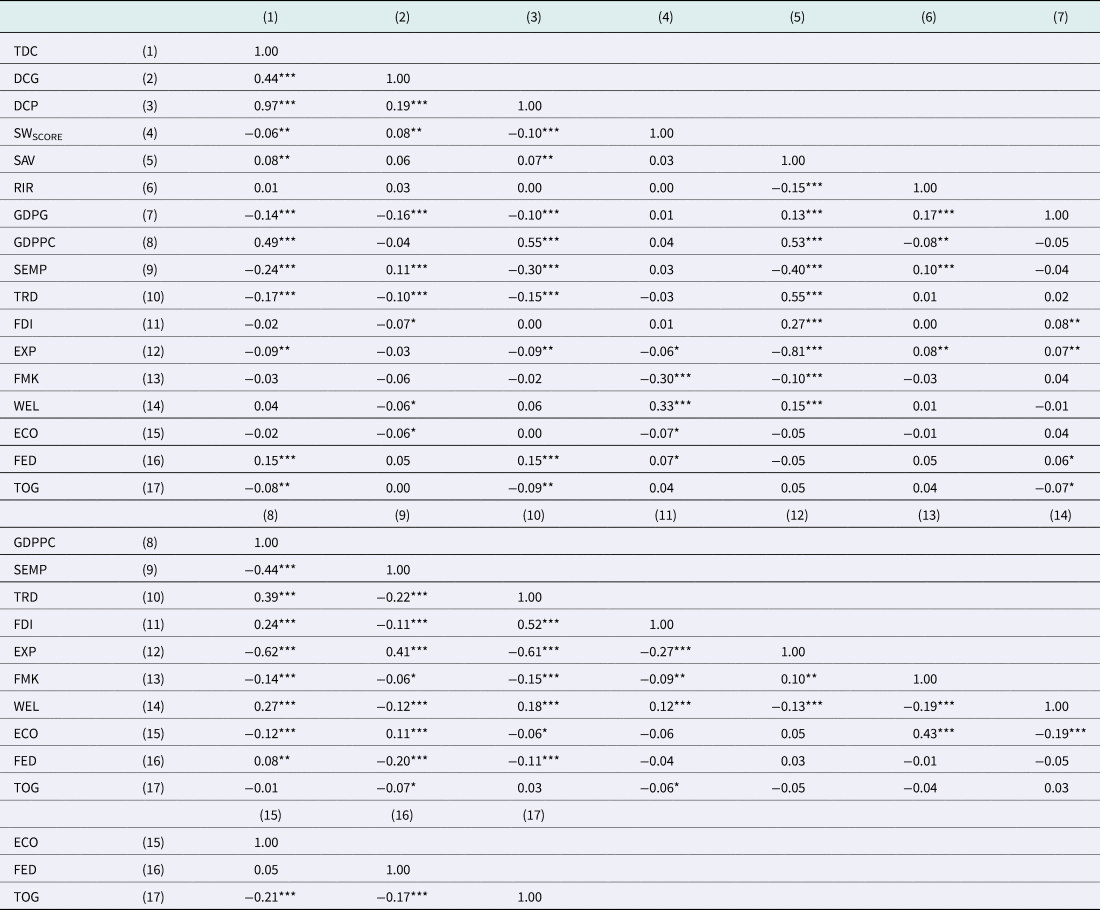

Table 3 presents a Pearson pairwise correlation matrix for the variables used in the baseline analysis. The correlation with TDC is significant at the 5% level and is negative. In keeping with the hypotheses, there exists a significantly positive correlation between SWSCORE and DCG at the 5% significance level, whereas the correlation coefficient of SWSCORE and DCP is significantly negative (at the 1% level of significance). This preliminary evidence reveals a strong association between political ideology and domestic credit and initial support for our hypotheses.

Table 3. Correlation analysis

*** p < 0.01, ** p < 0.05, * p < 0.1. All variables are defined in Table 1.

To further investigate the issue of multi-collinearity among the variables, we check the magnitude of correlation coefficients, which are all less than 0.54, except for the correlations among the measures of domestic credit (Tabachnick and Fidell, Reference Tabachnick and Fidell2013). As there is a significantly high correlation between TDC and DCP (coefficient: 0.97), we use all our measures of domestic credit in separate regressions rather than using the highly correlated measures together in the same regression. Therefore, multicollinearity is unlikely to be a problem in our model specifications.

4. Empirical findings and discussion

4.1 Main results

Table 4 reports the regression results of domestic credit for various specifications. In Columns 1–6, we begin our empirical investigation by estimating an ordinary least square (OLS) specification. In Columns 1, 3, and 5, we regress TDC, DCG, and DCP only on SWSCORE with the country (ψi) and year (ωt) fixed effects. These models consist of 1,067, 814, and 854 country-year observations and show that the coefficients of SWSCORE are −3.615 (p < 0.05), 1.638 (p < 0.01), as well as −5.589 (p < 0.01), respectively. The results demonstrate that a government with a stronger left-leaning political ideology has a significantly negative impact on TDC and DCP and a positive impact on DCG.

Table 4. The role of political ideology on domestic credit

*** p < 0.01, ** p < 0.05, * p < 0.1. All variables are defined in Table 1.

Next, in Column 2 of Table 4, we base our OLS on a full model specification (Equation (1), regressing TDC on SWSCORE and controls with the country (ψi) and year (ωt) fixed effects. The coefficient of SWSCORE is −6.519 (p < 0.01). This evidence documents a significantly negative effect of political ideology on TDC, proving H1 that differences in government ideology affect the domestic credit allocation. This implies a drop in domestic credit in a country where a left-wing government is in power.

In Column 4 of Table 4, we estimate Equation (2) by regressing DCG on SWSCORE and controls with the country (ψi) and year (ωt) fixed effects to test H2 that stronger left-leaning governments will result in more credit for the public sector. The coefficient of SWSCORE is 1.346 (p < 0.01), indicating a significantly positive relationship between left-leaning political ideology and DCG. This evidence supports H2 that left-leaning governments borrow more from domestic credit than right-leaning governments.

In Column 6 of Table 4, we regress DCP on SWSCORE and controls with the country (ψi) and year (ωt) fixed effects (Equation (3)) in order to test H3 that stronger right-leaning governments will lead to increased credit to the private sector. If our argument is correct in the assumption that right-leaning governments favour DCP more than the left-leaning governments, we should expect a negative relationship between DCP and SWscore. The coefficient of SWSCORE is −6.646 (p < 0.01), indicating a significantly negative relationship between political ideology and DCP. This evidence lends strong support to H3. The finding that a left-leaning government leads to a lower overall level of domestic credit is a novel finding, which combined with our other findings suggests that the positive effect of a stronger left-leaning government on credit to the government, is outweighed by the negative effect on credit to the private sector.

Overall, our analysis suggests that left-leaning governments reduce domestic credit allocations (TDC), left-leaning governments increase domestic credit to the public sector (DCG), and right-leaning governments boost credit to the private sector (DCP). The relationship between ideology and domestic credit has not been investigated before, but these results are consistent with research finding that left-leaning government expand the size of the government (Blais et al., Reference Blais, Blake and Dion1993; Cusack, Reference Cusack1997) and that right-leaning governments have policies which are more conducive to private investment (Bjørnskov, Reference Bjørnskov2005).

4.2 The electoral view of politics on domestic credit

In the previous section, we tested the ideological partisanship hypothesis on domestic credit. In this section, we examine whether there is any significant impact of an electoral view of politics on the relationship between political ideology and domestic credit. Governments of all ideologies may favour greater levels of government spending, hence more credit to the public sector during an election period. To build trust and maintain mass support to win elections, political parties adopt new strategies during elections. Hence, it is plausible for a diversion from a political party's core ideology to get votes during an election period (Asongu and Mohamed, Reference Asongu and Mohamed2013; Leguil-Bayart, Reference Leguil-Bayart2009). Asongu and Jellal (Reference Asongu and Jellal2020) show that governments use more discretionary policies during the electoral year. Similarly, Quinn and Shapiro (Reference Quinn and Shapiro1991) suggest that parties in power are likely to influence the economy to improve voter wellbeing during election periods. For instance, a right-leaning government that will usually prioritise the private sector in terms of borrowing may use temporary policies to divert DCG to undertake some ad hoc projects to win elections.

From the supply side, elections present a high level of political uncertainty because financial institutions may be in limbo on who wins the election and its effect on the financial sector (Bitar et al., Reference Bitar, Hassan and Walker2017; Englmaier and Stowasser, Reference Englmaier and Stowasser2017). For example, Englmaier and Stowasser (Reference Englmaier and Stowasser2017) show that elections affect the lending policies of savings banks in German. Jackowicz et al. (Reference Jackowicz, Kowalewski and Kozłowski2013) claim that state-owned banks report lower interest ratios during parliamentary elections. Consequently, electoral periods can moderate the association between political ideology and domestic credit. To investigate this, we assign a dummy variable (Election) with a value of 1 for the electoral period and 0 otherwise, and a two-way interaction term between electoral period and political ideology (SWSCORE × Election) to moderate the effect.

Building on the view that elections can shape lending activities of the banks and borrowing strategies of government, we expect a significant coefficient of SWSCORE × Election. However, as in Columns 1 to 3 of Table 5, our results imply that election insignificantly affects all three measures of domestic credit. Consequently, we argue that governments keep to their core political ideology, even during the electoral periods, and their domestic credit strategies stay constant. From the banking perspective, our findings contradict those of Elichler and Sobanski (Reference Eichler and Sobański2016), Englmaier and Stowasser (Reference Englmaier and Stowasser2017), and Jackowicz et al. (Reference Jackowicz, Kowalewski and Kozłowski2013), who claim that elections influence bank lending policies.

Table 5. The role of an election on political ideology and domestic credit

*** p < 0.01, ** p < 0.05, * p < 0.1. All variables are defined in Table 1.

4.3 Accounting for endogeneity

Although we show a strong effect of partisan politics on domestic credit, a caveat to our finding could be a concern about the causal effect between political ideology and domestic credit for two reasons. First, some unobservable factors may influence credit lending, resulting in a spurious correlation. Second, partisan politics is likely to be endogenous because a country's financial stability may impact the political parties' ideologies, implying causality from credit lending to politics. Notably, countries that focus on citizen welfare with many government interventions may demand stronger left-leaning governments, while countries aiming to create an enabling private sector environment may expect right-leaning governments into power. Moreover, one may argue that the level of contemporary domestic credit depends largely on its prior year, thus biasing the results. To mitigate the issue of endogeneity, we conduct two tests: PSM and lagged variable models.

First, to run the PSM, we implement a two-step PSM strategy, as per prior research (Alam et al., Reference Alam, Atif, Chien-Chi and Soytaş2019). In the first stage, we construct a group of treatment and control by sorting country-years based on political party score and assign one (zero) if a country-year belongs to the right-leaning (left) party, where the right-leaning (left) party is the treatment (control) group. In Column 1 of Table 6, our logit model with similar controls captures significant coefficients in most cases. In addition, the overall model produces a pseudo-R 2 of 24.4 with the p-value from the χ2 test below 0.01, suggesting a significant amount of variation in the choice of the variables.

Table 6. Endogeneity test: Propensity score matching

*** p < 0.01, ** p < 0.05, * p < 0.1. All variables are defined in Table 1.

In the second stage, we use the propensity scores to form one-to-one matched pairs and end up with 220 country-year observations for treatment and control pairs with the closest propensity scores. In Column 2 from Table 6, the logit model shows insignificant coefficients. This implies that no observable different trends exist in domestic credit between the two groups. In addition, the pseudo-R 2 drops substantially from 0.2440 to 0.0043 with insignificant p-values for all post-matched samples. This suggests that PSM removes all observable differences other than the difference in partisan politics. Finally, in Columns 3–5 of Table 6, we regress three measures of domestic credit on SWSCORE and controls with the country (ψi) and year (ωt) fixed effects based on a matched sample. In most cases, post-matching still shows that partisan politics has a significant impact on domestic credit, implying that the change in domestic credit is attributable to the change in partisan politics rather than to the differences in other variables.Footnote 4

Second, we use lagged measures of political ideology and domestic credit. In Panel A of Table 7, we check the influence of political ideology in year t-1 (SWSCOREt−1) and year t-2 (SWSCOREt−2) on the change in domestic credit (i.e., TDC, DCG, and DCP). In Panel B of Table 7, we estimate regressions of domestic credit lagged by one-year (i.e., TDCt−1, DCGt−1, and DCPt−1) and by one-year (i.e., TDCt−2, DCGt−2, and DCPt−2), relative to the measure of political ideology. In Panels A–B, we find qualitatively similar results that provide additional support for the causal association between political orientation and domestic credit.

Table 7. Endogeneity test: Lagged variables

*** p < 0.01, ** p < 0.05, * p < 0.1. All variables are defined in Table 1.

4.4 Robustness checks

In this section, we employ various tests to check the robustness of the effect of partisan politics on domestic credit. First, to confirm the significant impact of political ideology on domestic credit, we use DPI political ideology score (PartySCORE) as an alternative measure to SWSCORE. The variable, PartySCORE, ranges from one (right-leaning party) to three (left-leaning party), while two indicate a centrist party. Second, to avoid the issues associated with distributional properties of the data series, we transform all proxies of domestic credit (i.e., TDC, DCG, and DCP) into natural logarithms and regress on Ln(TDC), Ln(DCG), and Ln(DCP). Third, we re-estimate the regression Equations (1), (2), and (3) after excluding the observations from the GFC (Global Financial Crisis) period (i.e., 2008 and 2009), where the GFC caused an economic slowdown and corporate failures around the world. Additionally, to mitigate the issue of differing political ideologies among nations, we separate our country-year observations into two groups: federal versus non-federal governments and high versus low civil liberties countries. The results presented in Tables 8 and 9 hold, regardless of the various checks employed.Footnote 5

Table 8. Alternative measures and the exclusion of GFC period

*** p < 0.01, ** p < 0.05, * p < 0.1. All variables are defined in Table 1.

Table 9. Sub-sample analysis

*** p < 0.01, ** p < 0.05, * p < 0.1. All variables are defined in Table 1.

5. Conclusion

The existing literature on partisan politics has widely investigated how political ideologies affect numerous national performance indicators (e.g., economic growth, unemployment, taxation, public finance, and spending) in areas under the realm of direct government control. However, there is a lack of understanding where the government's focus is less obvious, specifically how the large variations in the political ideology of the government affect banks' behaviour towards domestic credit. This study, thus, extends the literature on the relationship between political ideology and domestic credit by providing novel empirical evidence from 29 countries during 1960–2014.

Using unbalanced panel data, we first show a negative association between left-leaning governments and the level of domestic credit. Second, we find that right-leaning governments provide more credit to the private sector, while left-leaning governments favour an increase in domestic credit to the public sector. Additionally, we document an insignificant role of electoral periods on the relationship between political ideology and domestic credit. Overall, our evidence indicates the significant role of political ideology on domestic credit in private and public sectors. These findings are robust to an alternative measure of political ideology and other robustness tests. Moreover, our identification strategies, using PSM and lagged model specifications, still hold after controlling for endogeneity, confirming that the causality runs from political ideology to domestic credit. Thus, our empirical results provide strikingly strong and unambiguous backing regarding the impact of political ideology on domestic credit.

This study's key policy implication is that, even in the wake of globalisation and integrated financial markets, political ideology has a significant impact on the credit market due to the differences in policies and actions. Our results also imply that financial institutions model lending activities according to the ideological difference of the political parties; banks selectively allocate more credit to the private sector if the right-leaning political party is in government. Thus, players in the domestic credit market (e.g., credit lending institutions and borrowers) should focus on the differences in policies between left-leaning and right-leaning governments since differences in ideology affect the demand and supply of funds in the domestic debt market.

Although our findings provide an important understanding of the impact of political ideology on domestic credit, we acknowledge that measuring political ideology cannot be completely objective, especially considering differences across time and between countries. However, we have alleviated most of such concerns by employing the most accurate measure available and ensuring the robustness of our findings. Further, because of the scope of this work, we focus only on domestic debt. Therefore, future research may investigate how ideological differences affect government negotiation in international debt. Thus, future studies may extend our work in scale and scope when better data becomes available.

Appendix

Summary statistics (mean values) by country