Learning points

Description of types of regulated biomedical products covered in this book

Understand the technological base and application for each product type – diagnostics, drugs, and devices

Understand the industry context for development of new products in healthcare

Gain an overview of the technology trends and their potential to impact the delivery of healthcare

Understand the impact of information technology in biomedical product development

Analysis of industry sector competitiveness by value chain model and Porter’s Five Forces analysis

1.1 The healthcare industry components and large cycle trends

The healthcare industry and the health markets for services and products differ from the usual free-market industries such as consumer retail or industrial products. For example, while purchasing a retail product or a service in a competitive, free-market economy, the user is the primary customer and makes the purchasing decision from available choices. The user is given all appropriate requested information on the product and the user is then the payer. In the healthcare industry, the end user (patient) usually does not make the purchasing decision (the provider and other intermediary institutions like pharmacy benefit managers make that decision), the patient does not get all the information (the care provider typically gets the detailed briefing and information packages), and the patient is not the direct payer (the payer is the insurance company or government). In many developing countries, while the patient or user is usually the direct payer, the purchasing decision is still made by a more informed decision maker – usually the caregiver, who could be a doctor or nurse, the pharmacist, or a traditional medicine practitioner. In general, patients do not have the knowledge or training necessary to make an informed decision even if information is provided. The law of averages and pattern recognition built from experience is often the basis for selection and success of the therapy, and the reason why patients are partial to caregivers with the most experience.

Additionally, this marketplace is highly regulated, starting from the early product development stages to the preparation and dissemination of marketing information, and including the flow of payments, goods, and information. The government is also the largest single payer organization in the healthcare industry and thus has a strong influence on payment policies and procedures in the industry. Finally, and most significantly for manufacturers, the government and laws and policies enacted by the legislative bodies play a very important role in shaping the marketplace. Companies must be proactive in monitoring and interacting with legislators (elected representatives) in government and with regulatory agencies to monitor changes in policy that impact the market and to proactively educate and inform the drafting of such policy and regulation. Any commercialization plan for a new biomedical technology must be mindful of the context of this regulated and politically charged healthcare marketplace.

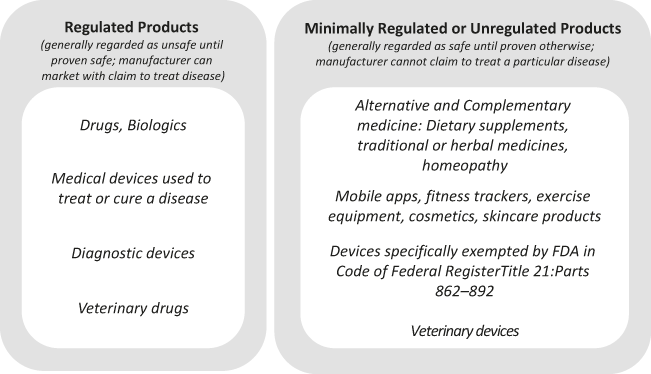

The healthcare marketplace (detailed in Figure 1.1) now must be seen in the broader context of how patients and caregivers make decisions, both for access to and purchase of therapies, whether reactive or proactive, prescriptive (driven by caregiver choice), or over the counter (driven by consumer choice).

Figure 1.1 Regulated human health products and minimally or unregulated human health products

The dynamics of power in this industry are now being challenged and changed by the recent increases in computing, making information available to the caregiver and the patient at the point of service. This information is made available as a synthesis or sum of experience and advice from machine learning or artificial intelligence (ML/AI) software that extracts patterns from large pools of “big data.” These same information analysis tools, which are available in more sophisticated and validated form for the caregiver, are making it possible to expand the context for healthcare to be broader than the individual experience, to the community knowledge, and even beyond to bring historical and global knowledge bases to the local point of care.

While social media and internet search engines may have made the patient a “google” doctor, in the end, these new computing methods and technologies may only be shifting some of the decision-power from the caregiver to companies that control the data and analysis. Data are still siloed among providers as a means of control over the patient, and access to potentially useful data is sometimes curbed by legal and business issues.

Advances in computing power are going to continue to impact the healthcare industry at many levels, from the patient to the regulators. In the end, the patient and society have to evaluate whether these and any other new technologies have improved health outcomes, and that will take time.

The rest of this chapter discusses the various product sectors involved in the larger healthcare industry and highlights methods to analyze and better understand their functional structures from a product development perspective.

1.2 Biomedical technology – definition and scope, applications

This book covers regulated biomedical products that go through the regulatory process (e.g. USA – Food and Drug Administration or FDA, Europe – European Medicines Agency or EMA, China – China Food and Drug Administration or CFDA, India – Central Drugs Standard Control Organization or CDSCO, Japan – Pharmaceuticals and Medical Devices Agency or PMDA) for marketing approval, including therapeutic or prophylactic drugs (the term includes small molecule and biologic drugs), diagnostics, and devices. The term biomedical technology will be used to refer to companies whose products need regulatory approval to get to market. The “technologies” include engineering and various sciences, including natural sciences (e.g. life sciences or biology) and applied sciences (e.g. materials science, computer science).

Proceeding through these first few chapters, it will become apparent that the terms biotechnology and device have blurred boundaries today, as an increasing number of leading medical device companies are incorporating drugs or biological therapeutics such as cells, DNA, or proteins, and pharmaceutical companies are tying their products to diagnostic or delivery devices. Such products, which are codependent or intermingled with other technologies, are called “combination products.” Some examples of combination products are the drug Herceptin (used to treat breast cancer), which has to be prescribed based on a diagnostic test for the gene Her2, drug-eluting stents, bioresorbable sponges with growth factors, skin grafts containing live cells imbedded in a bio-printed matrix, and insulin pumps with blood glucose monitors. Other examples of the changing technology landscape are the emergence of Software as a Medical Device (SaMD), where stand-alone software programs, apps, and so on are approved as devices for diagnosis or data analysis and decision-support. The following sections in this chapter define the specific product sectors in greater detail.

1.3 Drugs and biotechnology – definition and scope

Today, drugs are developed from one of two distinct technological platforms:

(1) Synthetic organic molecules – small molecules (preferred term used in this book) made de novo by synthetic chemistry processes or naturally occurring compounds which have been isolated or resynthesized in the lab. These are interchangeably called small molecules, drugs, or pharmaceuticals. Oligonucleotide-based drugs (RNA or DNA; composed of nucleic acids) made using synthetic processes are also included in this classification of small molecule drugs, as they have more in common with small molecule drugs than the large molecule biologic proteins.

(2) Biological molecules made by living organisms – using cells or other living organisms to produce therapeutic proteins or biological molecules. These are interchangeably called drugs, biotech drugs, biopharmaceuticals, large-molecule drugs, or biologics (preferred term used in this book).

Therefore, the term drugs will incorporate both biologics and small molecule pharmaceuticals in common usage and throughout this book. The US Food and Drug Administration (as per section 201(g) of the Federal Food Drug and Cosmetic Act) defines a drug rather broadly as “a substance recognized by an official pharmacopoeia or formulary, intended for use in the diagnosis, cure, mitigation, treatment, or prevention of disease, and is a substance (other than food) intended to affect the structure or any function of the body [emphasis added].”

The term biotechnology industry was used early on to refer to the growing biologics segment of the drug industry, but today is used rather broadly to refer to small-sized bio-pharmaceutical firms that are developing drugs (whether small molecules or biologics) or molecular diagnostics, as most of them are founded based on key inventions or discoveries in the life sciences. It is also important to note that biotechnology companies also develop products for other (non-health related) applications and industries (see Box 1.1). The definition of biotechnology (as per the Encyclopedia Britannica) is, in fact, “the use of cellular and molecular processes to solve problems or make products.”

Box 1.1 Diverse applications of biotechnology

While “biotechnology” in this text focuses on life sciences–based products commercialized in the healthcare industries (needing US FDA approval), it is important to remember that many other applications of biotechnology also have great commercial value. In the popular media, the term biotechnology industry is also used to loosely refer to activities that may be based on a range of technologies unrelated to the life sciences, such as laboratory equipment manufacture, device manufacture, lab automation, reagent production, and synthetic chemistry with small molecules. Therefore, it is important to always understand the specific context in which the term biotechnology is being used.

The use of biotechnology processes at the organism, cellular, and molecular levels has many diverse applications, some of which are described briefly below but not covered any further in this book (e.g. even though biotechnology food products are regulated, they are not in the same market and approval paths as other biomedical products discussed here). A common technology base of tools and processes for manipulation and analysis of cells, DNA, and proteins ties all these diverse applications together across these different industries.

Healthcare

Discussed in main text

Environmental biotechnology

Engineered microbes and enzymes can efficiently clean up pollution, and application of the life sciences to this process is called bioremediation. Environmental applications also include biobleaching, biodesulfurization (removal of sulfur from oil and gas), biofiltration, biopulping, etc.

Industrial biotechnology

Engineered microbes and enzymes can be used as highly efficient components in many industrial chemical synthesis processes. Various industrial applications of biotechnology include the efficient use of enzymes to convert sugars to ethanol (transportation fuel), to make polymers such as polylactic acid (PLA) for consumer plastics production, and to improve processes in the production of fine chemicals, bulk chemicals, and commodity chemicals. Currently, efforts are underway to convert cellulose to sugars (and ethanol) on a large scale, thus harnessing biomass that would otherwise be discarded as waste products of food and grain processing.

Agriculture

Biotechnology has been used to engineer new plant and crop varieties that are pathogen-resistant, have greater yield, or add new nutritional benefits to existing crops. Some specific applications are in the development of new genetically modified plant and seed varieties, improved processing of grain products, and the development of biofertilizers. Basic biotechnologies are also used to improve livestock for food production and to provide new treatments for veterinary medicine. Genetically modified foods are already in widespread use in the US food supply. Agricultural biotechnology is arguably the oldest continuing application of life sciences and includes the manipulation of plants and microorganisms to enhance yield, add in new characteristics such as increased nutrition or taste, and reduce the use of toxic pesticides or fertilizers; these are all key goals of biotechnology in agriculture and in the food-processing industry.

Among the therapies produced by biological production processes (produced in cells or bacteria), the various classes of biotech human therapeutics (biologics) being developed for a large variety of diseases are:

Vaccines, another class of human therapeutics and prophylactics, are produced in biological systems such as chicken eggs or engineered cell lines.

Biologic drugs are based on large-molecular proteins or complex biological molecules such as growth hormones, enzymes, etc. Examples are insulin, growth hormone, enzymes, immunoglobulins. Erythropoietin (sold under Epogen and other brand names) was one of the first blockbuster biologic drugs, with over $7 billion of sales in 2015. Biologics are postulated to replace a large portion of the current small molecules due to higher efficacy in many diseases. These biologic drugs are most efficiently produced by cells or within other living organisms. Biopharmaceutical companies use bioreactors, where cells engineered to produce a specific type of protein are grown in large quantities. The proteins are then purified and most are formulated for intravenous delivery. For example, the human gene that makes insulin is inserted into yeast cells, which then produce insulin molecules similar to the ones humans make.

A monoclonal antibody (mAb), a particularly significant type of biologic drug, is a highly specific, purified antibody (protein) that is derived from only one clone of cells and recognizes only one antigen. Monoclonal antibodies (one class of biologics) are an ideally targeted therapy that will only affect the specific protein target against which this antibody is made. The wave of biologics was driven by mABs like Johnson & Johnson’s Remicade (infliximab); Roche/Genentech’s Avastin (bevacizumab), Herceptin (trastuzumab), and Rituxan/MabThera (rituximab); Bristol-Myers Squibb’s Erbitux (cetuximab); and Abbott’s Humira (adalimumab). In 2006, there were 18 mAB products on the market, and by December 2019 over 79 were approved (Lu et al., Reference Lu, Hwang and Liu2020), with over $300 billion in global sales projected by 2026 (Fortune Business Insights, 2021). Monoclonal antibodies, like most biologics, cannot be given orally (degraded by digestive enzymes) and hence are infused intravenously. New drug delivery technologies are also in development to allow oral administration.

Next-generation antibodies are already on the market (3 approved) with over 50 in clinical development in 2021. These next-generation antibodies (antibody-drug-conjugates or ADCs) combine the unique targeting capabilities of biologics with the cancer-cell-killing specificity of chemotherapeutics, radioactive isotopes, cytotoxins, or cytokines. The antibodies are directed against antigens that are differentially over-expressed in tumor cells. Potent cancer drugs are chemically linked to these antibodies, giving these antibody-conjugates a superior pharmacological efficiency with minimized side effects.

Cell-based therapies and tissue engineering are used for tissue and organ replacement or functional augmentation. The market for regenerative medicine worldwide is in the billions of dollars, primarily using autologous cells. Gene therapy holds many promises but has been hampered by limitations in delivery vehicles and side effects in some patients. In particular, cell-based therapies are attracting a great deal of attention for the truly regenerative potential of stem cells (embryonic and adult). The Japan and Asia-Pacific region is the fastest growing market for regenerative medicine.

Nucleic acid therapy is a particularly interesting and emerging class of drugs that mostly uses synthetic production processes but is usually included under the biologics sector due to the large size of the molecules:

Nucleic acid therapies include gene therapy, which is the introduction of specific genes or segments of nucleic acids appropriately into the body to modify tissues and the production of proteins that may be lacking or malfunctioning in the disease state. These therapies lie somewhere between small molecule and biologic drugs in size of molecules, with specific considerations for development driven by their larger size and limited uptake into the targeted tissue. Many different nucleic acid therapies are in development, with antisense therapeutics being the first approved in the USA. Other nucleic acid technologies, such as ribozymes, antisense oligonucleotides, siRNA (short interfering RNA, or ribonucleic acid, molecules), microRNA inhibitors, and triplex and chimeric endonucleases, have tremendous current commercial and scientific interest as seen by the awarding of the 2006 Nobel Prize to the discoverers (Andrew Fire and Craig Mello) of gene silencing by double-stranded RNA. This short interfering RNA (siRNA) interferes with gene expression and uses the cell’s own control mechanism for controlling production of specific proteins. While extremely promising for their targeted approaches, these nucleic technologies have complex development challenges – as seen by Merck’s acquisition of siRNA Therapeutics for over $1 billion in 2006 and subsequent sale a number of years later to Alnylam for $150 million, and Alynlam’s Phase III–level failure in 2016 as a result of seeing more deaths in the drug group than the control population.

Recent discovery of highly specific mechanism for gene editing and repair called CRISPR/Cas-9 [https://en.wikipedia.org/wiki/CRISPR] promises to yield a new class of biologics directed at modifying gene expression using transcription factors (proteins that bind to specific DNA sequences).

The biotechnology/biologics segment of the pharmaceutical industry is about 40 years old (since early 1980s) and has seen its revenues grow at an average of 16% per year over the past two decades, to reach over $132 billion in global revenues in 2015 (Ernst & Young Annual Biotechnology Industry Reports, 2015–2020).

Biologics are a rapidly growing portion of the overall pharmaceutical industry, accounting for over 30% of the total pharmaceutical sales compared to 23% in 2014 (www.statistica.com, “Evaluate Biotech and Medtech 2020 in Review” report, 2021). The growth rate and strong product pipeline of the biologic drugs have attracted interest from investors and from the traditional pharmaceutical companies themselves. In particular, the biotech impact on the pharmaceutical industry has led to the industry naming itself the “biopharmaceutical industry,” as more large pharmaceutical firms (e.g. J&J, Novartis, Wyeth) have adopted biotechnology manufacturing platforms to make drugs.

The interest in the biotechnology sector lies in the future impact of this technology, as more and more biologic drugs are coming through the pipeline, with over 2,500 biotechnology drugs in the clinical development pipeline in 2021, for a variety of human diseases (www.bio.org/fda-approvals-clinical-development-pipeline). Another component of the interest in biotechnology (life sciences as a more general science platform) today is in the promise of forthcoming new discoveries, like the recent CRISPR mechanism discovery, which will lead to an even better understanding of normal and pathological (disease) processes in the human body, as discussed later in this chapter. The hope is that these new tools and discoveries will lead to new therapies that will truly aim to cure disease instead of merely offering palliative treatment or temporary symptomatic relief.

It is important to mention that a significant portion of the biotechnology industry is composed of companies that provide services or make nonregulated products such as research tools, reagents, bioinformatics programs or services, biomaterials, etc. that are sold to the drug or diagnostic companies or to the research community in general. The business models, product development cycles, and financial and investment profiles of these companies are very different from most of the companies discussed here. Examples of providers of tools and technologies are Thermo Fisher Scientific (Invitrogen, Applied Biosystems), Qiagen, Perkin Elmer, and Illumina.

1.4 Devices and diagnostics – definition and scope

1.4.1 Medical devices industry

Devices are defined by the US FDA as “an instrument, apparatus, implement, machine, contrivance, implant, in vitro reagent, … which does not achieve any of its primary intended purposes through chemical action within or on the body of man or other animals and which is not dependent upon being metabolized for the achievement of any of its primary intended purposes” [emphasis added] (www.fda.gov/medical-devices/classify-your-medical-device/how-determine-if-your-product-medical-device), i.e. achieve their purpose by mechanical action or placement, or now by data analysis if software. Medical device companies use traditional materials such as metals, plastics, or ceramic and advanced materials such as composites to produce devices that work by providing electrical, mechanical, or physical (not chemical) support and interaction with the human body. Some of these devices are implanted (defibrillators), some noninvasive (e.g. EKG monitors) and others minimally invasive (e.g. catheters). These companies have shorter product cycles and thus are more dynamic in product introductions than biotechnology companies.

Medical device products can be classified by two distinct types of markets – commodity products and innovative medical device products. The former are typically made by large mature companies like Johnson and Johnson, Becton Dickson, Welch Allyn, and others and feature a broad portfolio of products sold to clinics and hospitals. These products have a long life cycle in the market, and their development is marked by incremental innovations that do not change the product mix, merely adding specific features to the design. Profit margins for these products are typically low, as customers have high price sensitivity.

Conversely, innovative medical products such as implantable devices, minimally invasive surgical devices, and new imaging devices are made by both large and small companies, such as Medtronic, Guidant (bought by Boston Scientific and Abbott), Bard, Stryker, and many others. These innovative devices have a short product life cycle, with the next generation entering advanced development even as the first generation enters the market. Innovative medical devices command high profit margins by delivering greater life-saving benefits directly to the patient, but also require high investment in research and development (R&D) for continued improvement and incorporation of new technologies.

The medical device industry’s gross revenues grew to $371 billion in 2017. The industry is composed of a few large players that hold market access and brand name, and many small companies (80% have fewer than 50 employees) that have found niche markets in the device industry. The industry sales, broken into the various therapeutic and clinical areas, are summarized in Figure 1.2. Orthopedics and cardiovascular are the two largest device application areas, but others are growing too, as the population demographics shift.

1.4.2 Diagnostics – IVD industry

The diagnostics market is segmented broadly into the in vitro diagnostics (IVD) (in vitro means in the test tube, laboratory, or outside the organism) and in vivo diagnostics businesses (in vivo means within a living organism). This book will focus mainly on IVD, which are classified and regulated as medical devices by the US FDA.

In vivo diagnostics is a specialty market, with the key players being large instrument manufacturers of imaging or other instrumentation technology (GE, Phillips, Siemens). Examples of in vivo diagnostics are blood pressure screening, magnetic resonance imaging (MRI), thermometer, ultrasound, x-ray, and computed tomography (CT) scan. The development, sales cycles, and regulatory issues (e.g. radiation safety issues) are quite different from most of the products discussed here. However, it is important to keep in mind that most of these large companies (GE, Siemens, and Phillips) have all launched initiatives in molecular imaging diagnostics (which will be regulated as imaging agents or drugs). Thus, this exclusion (from the book) is on the basis of a specialty market segment, not an exclusion of specific companies.

In vitro diagnostics products are largely regulated as devices by the US FDA. There are two types of IVD products: devices (analyzers for samples such as blood, serum, urine, tissue) and reagents (chemicals used to mark or recognize specific components in the samples). All devices and reagents perform tests on samples taken from the body, and the applications can be divided into five broad types of IVD testing:

(1) General clinical chemistry – measurements of base compounds in the body, e.g. blood chemistry, cholesterol tests, serum iron tests, fasting glucose tests, urinalysis.

(2) Immunochemistry – matching antibody-antigen to indicate the presence or level of a protein, e.g. testing for allergen reactions, prostate-specific antigen (PSA) tests, HIV antibody tests.

(3) Hematology/cytology – study of blood, blood-producing organs, and blood cells, e.g. CD4 cell counts, complete blood count, preoperative coagulation tests.

(4) Microbiology/infectious disease – detection of disease-causing agents, e.g. streptococcal testing, urine culture/bacterial urine testing, West Nile virus blood screening.

(5) Molecular, nucleic acid tests (NAT), proteomic, metabolomic testing – study of DNA and RNA to detect genetic sequences that may indicate presence or susceptibility to disease, e.g. HER2/neu overexpression testing in breast cancer, fluorescence in situ hybridization (FISH) tests for prenatal abnormality testing, HIV viral load assays.

In vitro diagnostics companies are primarily one of four types:

(1) Large pharma with diagnostic divisions

(2) Diagnostic companies, which focus on manufacture, distribution, and marketing of diagnostic test kits (reagents) and devices

(3) Biotechnology (smaller startup) companies, which focus on discovery of technology devices/reagents for novel diagnostic methods or tests for specific diseases (e.g. a marker for cervical cancer)

(4) Clinical sample analysis laboratory services companies

In vitro diagnostics is a mature market with a high volume of clinical tests using immunoassays and simple blood tests that have not changed in decades. More than 20 billion blood tests are performed annually worldwide. The overall estimated IVD market was $65 billion in 2017. Industry segments by sales are shown in Figure 1.3.

Figure 1.3 In vitro diagnostics global sales by clinical category.

A rapidly growing segment of IVD markets is in vitro molecular diagnostics, or nucleic acid testing (NAT, or genetic testing), which analyzes DNA or RNA from a patient to identify a pathogen, a disease, or the predisposition of a disease. These genetic tests also have applications in the area of in vivo diagnostics in the emerging applications of molecular imaging and in the development of new drugs. Biotechnology processes are used to make NAT diagnostic reagents such as nucleic acid probes.

The lab testing industry in the USA has larger companies such as Quintiles, LabCorp, Covance, Roche, J&J, Abbott, Bayer, and others dominating market access, along with large independent companies such as Bio-Rad, Guerbert, bioMerieux, and Idexx. In terms of lab service revenues, the largest market share of about 60% is captured by hospital labs, while independent labs (also called reference labs) hold about 30% market share and 10% is with physician offices. Most small private companies either find a niche or get acquired, as they are typically unable to attain the market reach of the big players to sustain growth. Product sales are dominated by industry-leading companies such as Roche, Illumina, Thermo-Fisher, and Danaher.

1.4.3 Healthcare IT and digital therapeutics

The increased prevalence of computational tools (information technology, IT) with multiple interfaces – voice, visual, text, moving images, touch screen, etc. – for accessing larger databases, with automatically curated and contextualized access to information, makes it imperative to discuss the role of IT in biomedical product development and integration into the delivery of healthcare. The ability of faster and high-power computing cycles to find patterns in larger databases that could parse a variety of inputs, including audio, images, videos, and text, is called cognitive computing. Easier and cheaper access to this computing power is being made available for many healthcare applications through software such as IBM’s Watson platform and other machine learning algorithms being developed in open-source environments. The advent of the wireless internet with higher bandwidths and always-connected mobile devices, such as smartphones, tablets, and wireless sensors integrated into bracelets or clothing items, are all changing the way diseases can be managed and diagnosed. Previously, the hardware was the center, with software playing a minor role, but today, those roles are often reversed. Medical software applications are designed to give devices a range of functionalities. Medical software applications are also becoming increasingly independent of hardware (Software as Medical Device, digital therapeutics). The same software application can run on many different devices and have them perform the same functions. These applications can be downloaded from the Internet onto any connected device/computer/smartphone, making the same device able to do different tasks. The impact of these always-connected, readily programmable, multitasking mobile computers and sensors is driving development of new medical products and new business models for healthcare.

Drug product development is a completely new field of computational genomics developed in the late twentieth century with the sequencing of the human genome and expansion of proteomic analysis, creating tools to compile and search vast databases, accelerating the discovery of new targets. In the same time frame, “rational drug design” was driven by access to large, lower cost supercomputers and faster internet throughput that allowed access to distributed computing (carried out by people volunteering unused central processing unit [CPU] cycles on personal computers). This higher-level computing power was used for modeling every atom in a large protein and the mechanics of its movements and interactions with its neighboring atoms, water molecules, and new drug molecules. These advances and their application to biomedical science and technology spawned a discipline known as bioinformatics.

Today, IT is used at almost every stage of drug development, in target discovery from searching digitized scientific literature and genomic and proteomic databases, to automated image analysis of large numbers of cell cultures in drug-screening platforms, to compilation of large documents and analysis of large datasets, submitted electronically to the regulatory agencies for approval.

In medical device product development, the integration of software and hardware to make “intelligent or smart” devices continues, as higher-density, faster computing chips become more compact as seen in connected devices, augmented reality eyeglasses, retinal implants, implantable defibrillators, cameras in a pill, and other such devices. Information technology, in the form of software or firmware, runs microprocessors in the electronic components of devices, enables medical imaging networks, controls patient electronic records, etc. Devices such as a Halter monitor or a defibrillator are now connected to smartphones or the Internet all the time, making them useful as real-time monitors of conditions or patterns that signal or correct problems before they occur. This impact of IT on device design and functionality is profound, enabling or leading to significant new products such as a defibrillator that also measures physical activity levels and adapts its pacing or a retinal implant that processes images in situ and sends data directly into the brain or the optic nerve.

In diagnostics product development, automated and low-cost genomic sequencing has been made possible due to rapid and exponentially increasing speed, storage, and other advances in computing. Scientists are now able to rapidly analyze larger amounts of data and analytically simulate behaviour of not only individual molecules in a protein (e.g. drug discovery modeling) but also the many biochemical pathways in a cell as networks of dynamic connected systems. This capability makes possible new insights into diseases and personalized or precision medicine. Diagnostic tools go beyond the compiling of IVD or blood or cellular assay results, with larger companies now offering decision support, through machine learning and other IT tools that can help reduce errors and improve diagnostic outcome. Diagnostic sensors continuously sensing various body functions (e.g. wearables and smartwatches) can now be analyzed locally by connecting the data feed to mobile computing devices like smartphones or tablets, or uploaded to the Internet for discovery of patterns in the data that are predictive of various conditions; alerts can be sent out to care providers on the wireless Internet and to patients. The use of the Internet and access to large databases can obtain differential diagnosis by programs that look beyond the standard diagnostic assays and into multiple variables like social status, geography, life incidents, social media connections, emotional responses, or other indicators that may have an impact on disease health and may be relevant for assigning treatment options. The opportunities in this century are truly revolutionary with advances and insights coming faster and faster and regulators and caregivers are challenged to keep up.

1.5 Industrial value chains and industry analysis

There are many ways to analyze an industry with some of the more common methods discussed here. The questions addressed in this section are:

(1) How can you understand opportunity areas in an industry and set strategy to rise above the competition? Porter’s Five Forces analysis gives us a method to look at industry competitiveness through forces exerted by suppliers, buyers, substitute products, barriers to entry, and intrinsic industry rivalry. These five forces govern competitive advantage in an industry.

(2) What is the value chain for development of new products or services and the steps and elements that make up the industrial system?

1.5.1 Industry analysis databases

An important tool for evaluating economic metrics for an industry in North America is the NAICS (North American Industrial Classification System, also known previously as SIC – Standard Industrial Classification) codes. These codes are useful for accessing labor and economic trade databases and statistics by region or state. The codes for the biomedical industry are listed in Appendix 1.1.

1.5.2 What is an industrial value chain?

A value chain is a high-level model of the various steps involved in converting raw materials to finished products that are used by customers, as shown in Figure 1.4 and in the description, below. Looking at the value chain of an industry or product is a very useful way to understand the dynamics of the industry and to understand relationships between the company status and its competitive strategy. The individual product development stages and processes are discussed in greater detail in Chapter 5.

Figure 1.4 Typical biomedical industry value chain. Competencies and functions are added as the company grows toward commercialization of its first product.

As a product moves from basic R&D to market, each step increases the value of the work in progress, with the product reaching maximum value when it is finally sold in the marketplace to the end user. A value chain schematic is used to describe the steps in the development process and also to give an overview of the entire process of taking a concept to market. A supply chain, a common term in industry, is a part of the overall value chain. The supply chain model focuses on activities that get raw materials and components into a manufacturing operation and carries out specific operations on the raw materials to eventually convert them into a finished product. The goal is to deliver maximum value to the end user for the least possible cost, to analyze the specific functions of the company, and to define strategic advantage. Supply chain management is therefore a subset of the value chain analysis.

The value chain concept is useful in analyzing the specific primary and secondary activities the organization performs, and thus understanding how the organization can use technology better in specific areas, or reduce costs, or reconfigure operations to add value. A value chain can be used to compare a firm’s position with its competitive strategy to assess any strategic gaps. Competitive advantage is gained by product differentiation or cost advantage. A cost advantage for a firm can come from either reducing the cost of individual value chain activities or reconfiguring the value chain to its advantage. Product differentiation can be achieved by changing individual value chain activities to increase uniqueness in the product or by reconfiguring the value chain. As a startup company in the life sciences goes through product development in the life sciences, it reaches further down the value chain, and the primary and secondary functions start to grow with the addition of procurement, production, and distribution tasks. The value chain analysis can also help in reviewing the business model, wherein a specific organization’s business model can be analyzed by its current and planned location in the value chain.

In a knowledge-based or science-based industry like that of medical devices, drugs, and diagnostics, the product is much more than the fabrication of the physical product (i.e. information and knowledge about its effects and side effects on customers are the key to why regulators will approve and customers will buy). The primary functions in the value chain thus focus on product (knowledge) development, compared to the typical primary functions in a value chain in other industries, which are (1) inbound logistics – which manages the incoming supply chain and vendors and includes warehousing and inventory functions; (2) operations – such as manufacturing, fabrication, packaging, and other steps to convert the raw materials into product; (3) outbound logistics or distribution – such as processing orders, warehousing finished goods, and delivery; (4) marketing and sales – such as identification of customer needs and sales functions; and (5) after-sales service – maintaining product after sales.

Secondary or support activities that a company has to perform and decide on whether those are important to build in-house or buy are: (1) general management – such as business processes, organizational structure, etc., which can be a strong source of competitive advantage; (2) human resource management – identifying the right needs, people, and training development and compensation activities; (3) technology development – improving the product and process through all parts of the company; and (4) procurement – purchasing inputs for raw materials, equipment, or labor. These primary and secondary activities and their interactions with one another are systematically reviewed in a value chain analysis to assess their significance in providing customer value, contributing to profit margin, and maintaining strategic advantage.

Examining the industry’s functional segments through this value chain perspective also reveals a view of the business models prevalent. Some companies focus on the supply of specialty raw materials, others specialize in manufacturing the active pharmaceutical ingredient (API), others may only do filling of capsules or injections or contract manufacturing work for regulated products, while some work on value-added distribution services for injectable drugs. Some areas of the value chain – discovery research, for example – are very fragmented, with universities, startups, and contract research organizations (CROs), while others have high barriers to entry and thus see few large players – manufacturing of biologics, for example. Quantifying various measures (e.g. profit margins, return on investment) of these companies and of the incremental value built into the value chain would allow one to understand the highest value-added component of the value chain and the dynamics of each process that involve multiple stakeholders.

The following general descriptions represent some typical value chains in the various segments of the biotechnology industry, acknowledging that there can be specific products and developments that take radically different routes. For example, some companies can license in technologies at one point in the value chain and sell them out at another point, capturing the incremental value represented by that intermediate development step.

1.5.3 Drug development process

The drug development value chain shown in Figure 1.5 (discussed in greater detail in Chapter 5) begins with a discovery or hypothesis of a potential drug target’s key involvement in a disease. The target is usually a protein, an enzyme, or a receptor in a cell or tissue that has been discovered to play a central role in the development of a disease or its symptoms. The drug can be a synthetic chemical small molecule that binds to the target and inhibits or activates its function, or it can be a biological molecule that replaces or corrects the faulty or defective enzyme or protein. A large part of the effort in preclinical research work is to verify the validity of the target (to verify that interventions aimed at the target will have the desired effect on the system) and to develop a molecule that can become a drug compound. This preclinical research stage then ends with the key milestones or gates (see Chapter 5 for more details) passed: (1) validation of a therapeutic effect of the drug in animal models of the human disease, (2) satisfactory safety profile as seen by clearance of formal toxicology and other (absorption, distribution, metabolism and excretion profile, other in vivo behavior) testing, and (3) validation of reliable, repeatable manufacturability at scale meeting regulatory guidelines.

The clinical trial process is carried out in specific development steps, Phase I–IV clinical trials, each with specific goals:

- Phase I

Toxicity in normal healthy volunteers (usually) and behavior of drug in humans (pharmacokinetics and pharmacodynamics)

- Phase II

Establish that the drug works to treat the disease (efficacy, dosage)

- Phase III

Establish efficacy in larger population (statistical validity of drug effects)

Figure 1.5 Drug discovery process and value chain

Once the clinical trials are complete, the results are analyzed and submitted to the FDA for approval to market the drug. The review by the FDA can take up to two years. Post-approval clinical studies (Phase IV) may be required or may be conducted for new indications once the drug is on the market.

- Phase IV

Post-marketing surveillance (usually required by the FDA after approval, to further validate efficacy or safety with longer-term or broader population exposure to drug), or may be conducted to expand use of drug to new indications/diseases or population (e.g. children).

The entire process of drug development can take from 12 to 16 years and hundreds of millions of dollars. New drugs have a high failure rate in chemical compound development (slightly lower for biologics), with only an estimated 1% of compounds that enter early preclinical screening successfully becoming drugs for a given disease. An estimated cost of developing a new drug, published by Tufts Center for Study of Drug Development in 2014, is $2.6 billion, which includes out-of-pocket costs of other drug molecules dropped at various stages of development and the cost of lost returns on alternate investments that could have been made with that capital. Another estimate, published by the London School of Economics, puts the cost of new drug development at a more reasonable $59 million. In either case, companies that can find ways to reduce costs by reconfiguring their business models and value chain components can find a significant edge over others. For example, some companies choose to focus on generic drugs, which have a much shorter and cheaper clinical trial period; others differentiate themselves by developing more complex generic drugs that require specialized distribution (e.g. generic biologic drugs or biosimilars) or manufacturing skills (e.g. cytotoxins for chemotherapy).

1.5.4 Medical device and diagnostic development process

The medical device and diagnostics industry value chain, represented schematically in Figure 1.6, typically starts with an R&D project where a concept is developed around some core innovative technology or biological or physiological insight. A project team then develops a design, which is then used to make a working proof of concept prototype, iterating the design process with insights gained at each step. For IVDs, assay development takes place at this stage and a prototype assay protocol and/or reagents are developed. Prototype testing at this stage is typically in vitro or laboratory testing. In IVDs, at this point, the test is placed in the context of usage and a test principle is chosen (the technology platform for the specific assay is chosen). Feasibility testing for IVDs is typically done in cells or in archived human clinical samples to which the company has access. At this point, the IVD company can start to generate revenues by the sale of specific reagents for “research use only” to a selected group of certified laboratories.

Figure 1.6 Biomedical device value chain

The final medical device prototype is then refined for manufacturability and scalability (sometimes in parallel with the design iterations). A refined prototype is then tested in animal models or possibly on humans, as appropriate, for proof of concept of therapeutic benefit. This feasibility study is usually accompanied or closely followed by various laboratory-based or in vivo animal-based safety tests. Human testing follows with pilot and then pivotal clinical trials. New IVD tests are typically first validated retrospectively in clinical trials using any available tissue or blood samples and then more rigorously through prospective clinical trials. False positive and false negative outcomes are a concern in the safety evaluation of a new IVD. The final medical device product, with manufacturing processes and designs locked in, is then put through final steps along all of the above functions. The results of safety and efficacy testing are submitted to the FDA, and on approval, the device can be distributed and marketed. This entire process can take from two to six years and from a few million to tens or hundreds of millions of dollars (time and costs vary widely due to the diverse nature of products in this industry). Product development stages are discussed in greater detail in Chapter 5. Specific steps for product development in the diagnostics industry are shown in Figure 1.7. Diagnostics offer several intermediate steps for commercialization as the industry has a large market for nonregulated supplies – hence the product development value chain for diagnostics is shown in a different format here.

Figure 1.7 Diagnostics commercialization value chain. CE Mark is the label carried on devices approved by the European Commission and European Medicines Agency; 510(k) is one of the FDA medical device approval pathways; PMA = premarket approval, which is the FDA authorization to market novel medical devices; ASR = analyte specific reagents.

1.6 Competitive analysis of an industry or sector with Porter’s Five Forces model

In Michael Porter’s Five Forces model of industry analysis (Porter, Reference Porter1985), the five dominant forces of supplier power, barriers to entry, buyer power, threat of substitutes, and industry rivalry can be analyzed to understand the best way to gain competitive advantage in that industry. This method is a commonly used strategic planning and analysis tool and is summarized briefly below and shown as a schematic in Figure 1.8.

Figure 1.8 Porter’s Five Forces analysis methodology. When applied to an industry, it provides a perspective as to strategic positioning and attractiveness for a new entrant.

For a given industry, gather market data and analyze various inputs to determine:

Supplier power – How much influence do suppliers have in the industry and how is it exerted? Are there many smaller suppliers with a standard set by an industry group or are there a few large suppliers that establish a de facto standard by volume? If the latter, is there a need to consider a strategy that includes the supplier as a partner?

Buyer power – How much influence does an individual buyer have in the industry and how is it exerted? What is the price sensitivity among various buyer groups? Is there a concentration of buyers or an aggregator that has price setting or bargaining power? Is there a need to consider a strategy that includes the buyer as a partner?

Threat of substitutes – Is there a switching cost for buyers to switch to a rival’s products and what are the trade-offs and comparisons between alternatives/substitutes? Are they looking for stability or innovation? Does a new differentiated technology offer a strategic advantage in this market or is the competition fairly established on the basis of cost alone? Are there multiple “me-too” products already established in the market?

Barriers to entry – If a barrier to entry (patents, large investment, specialized materials, or manufacturing know-how) is identified, how can you cross it and then keep it up to slow down competitors? What are specific factors that would attract new entrants? Can you excel in or address those factors and grow your advantage?

Industry rivalry – What are exit barriers, product differences, brand power, growth rate in industry, fixed costs among firms, concentration of firms in market share, etc.?

Unfair competitive advantage is a perspective used by many investors to evaluate the prospects of a new enterprise or project along each of the above components of competitiveness in an industry. This unfair advantage can come through technology, exclusive partnerships, business model, geography, government contract, patent position, etc. By going through each segment of strategic competitiveness in an industry and addressing the dynamics and specific issues in that segment, a picture of the industry and direction for development of competitive advantage in the industry can be created. A summary analysis for each product type (device, drug, diagnostic) is presented here. These analyses serve as general overviews for the industry. A specific analysis around an innovative product allows one to focus strategic attention and resources on the primary basis of competition and the specific competitive advantage in the product market of interest.

1.6.1 Competitiveness summary for the pharmaceutical industry

Suppliers to the biopharmaceutical companies for small molecule drugs are typically bulk chemical processing manufacturers. Switching costs are low as there are many well-established bulk chemical producers and these suppliers have low power in this industry. On the other hand, buyer power has been steadily increasing, with consolidation among payers or increasing regulation and oversight on cost increases in healthcare. Distributors in retail markets and specialty dispensation companies are concentrated geographically or over many markets and thus have a sway over the decisions on which drugs to offer as priority for their patients and market partners. State and federal governments (buyers) are also placing tremendous pricing pressure on the larger pharmaceutical industry. Substitute products are typically generics; generics manufacturers enter markets when a patent expires but have recently been using legal mechanisms to enter markets before anticipated patent expiration, reducing profits to innovator drug companies. Biosimilars are also coming to market, and competition will continue to grow even in this highly complex drug product area, as this segment of the drug market has grown significantly in the past two decades. Lastly, some governments in developing countries have started to void global patents, licensing local manufacturers to bring out new medicines at a lower price. Hence, substitute power is high in this industry. While the long and expensive product development cycle is a barrier to entry, companies also have time to create follow-ons and me-too products to take market share after the primary product launch. The long and expensive development path leads to alliances among biopharmaceutical firms and brings larger pharmaceutical companies to access innovation developed more inexpensively at smaller innovator biotech firms. In addition, many large pharmas have started partnering with buyers to reduce pricing pressure, tying the value of the new drugs to clinical benefits in the population served. Merger and acquisition activity in this sector continues, with larger players capturing development pipelines and market share. The competition within the industry is fierce and follow-on products to a new innovation or drug target emerge rapidly (18 months or less). However, the attrition rate for new products in development is high at all stages. In summary, industry rivalry is a strong (high) competitive force.

The pharmaceutical industry is thus under tremendous pressures from many interfaces (forces). The increased sophistication of external contract research organizations (CROs) could give rise to a stabilizing factor, building scalable discovery engines while using contracts to reduce their risk, and potentially reducing the cost and time for development of a single drug. Even with a few large players owning the path to commercialization, smaller firms can still survive and succeed through innovation and intellectual property capture; niche drugs can allow smaller companies to address focused markets. Small innovative companies will continue to play a role in this industry as generators of new technology and translators of innovation from academia to industry. Access to capital remains a differentiator and a barrier to entry among smaller firms as product development is very long and expensive.

Biologics face similar pressures from these various forces (as compared to overall small molecule drug industry), with a few key differences – the supplier power for raw materials in this sector of the drug industry is low. The manufacture of proteins and monoclonal antibodies requires specific cell lines, and maintaining consistent productivity and product requires a specialized degree of process know-how. The power of substitutes (biosimilars, generics) is rather low at this point due to a poorly defined regulatory path forward for biogenerics and a more complex and expensive set of studies required for biosimilars compared to small molecules, but biosimilars have entered the market and in 2016, there were about 50 seeking approval from the FDA. Barriers to entry are high, requiring investment in specialized production facilities and access to established cell lines. Biosimilar alternatives see an approximately 15% price drop from the original drug, rather than the typical 80–90% price drop typically seen with small molecule generics, a sign of the higher cost to bring a biologic to market.

The Porter’s Five Forces analysis can also be carried out at the company level, from the perspective of either a large pharmaceutical company or a small biotechnology company, not focused around a specific product, but focused around the company. Each of these perspectives will yield variations in the analysis and outcome.

1.6.2 Competitiveness summary for the biomedical device industry

Due to the diversity of firms and technologies in the device industry, a general analysis is presented here, with a focus on products that are innovative, implanted devices. Box 1.2 contains a specific example of strategic competitiveness assessment using Porter’s Five Forces methodology.

Box 1.2 A competitive analysis for a novel medical device using Porter’s Five Forces

The example product is a vena cava filter, a metal filter placed in the large vein near the heart to block an embolus (blood clot) from going to the brain or lungs where it could cause death. The following analysis identifies the key competitive forces in this market, using Porter’s Five Forces model.

Supplier power – Supplier bargaining power is a weak competitive force, as the device companies are taking up commodity materials and adding high value processing to make the filters.

Buyer power – Buyer bargaining power is a strong competitive force with high impact in this industry due to the small number of decision makers (physicians) at each purchasing hospital. Therefore, the firms all compete for the attention of these physicians, and the buyers can exert significant force in the sales process. Buyers will become more powerful as the type and number of filters increases. The mix of payers and buyers is different in emerging economies such as in Brazil, Indonesia, or India, where physicians and patients make the purchasing decision due to out-of-pocket payment rather than through third-party payers.

Threat of substitute products – Substitute products are a weak force, as the only other option to the filter is a blood-thinning drug. Many people cannot take blood thinners for long periods of time, and in fact blood thinners are a complementary product. There are no other known innovations in development at this time. Competition from substitutes is likely to be very low.

Barriers to entry (or new entrants) – New entrants are a weak force in this industry, as brand recognition, limited access to decision makers (physicians), and high regulatory requirements and long development times combined with high development costs of clinical trials keep new entrants away. Current products have good clinical outcomes with high efficacy, and thus new innovations do not have much room for improving on the existing solutions, making it more difficult to enter the market

Rivalry – Rivalry among competitors is very strong as each competitor fights for market share in a mature market that has seen no significant growth. A combination of incremental innovations in product and aggressive sales methods is used to compete for market share. Rivalry will increase in the future.

In summary, the main competitive forces in the vena cava filter market are thus rivalry among competitors and buyer influence on purchasing decision. Rivalry is likely to grow and gaining competitive advantage will continue to hinge on product innovations that show significant clinical utility and positive clinical outcome.

A competitive analysis for in vitro cancer diagnostics using Porter’s Five Forces

The five-year survival rate for people who are diagnosed with late- stage non-small-cell lung cancer is less than 15%. Early stages of lung cancer are usually asymptomatic, and no good diagnostic is currently available. The survival rates for advanced lung cancer have not changed much in the past 40 years. One company developing an early stage diagnostic assay is assessed here.

Supplier power – Components for diagnostic assays and the platform used to carry out the diagnostic assay are highly specialized, and these suppliers are typically large companies with specialized product lines. There is a high switching cost for constituent components of the test, once qualified and validated. Many new diagnostics will be based on some established reference platform technology, such as PCR, which large equipment manufacturers control. Hence suppliers have high power over the smaller diagnostics companies.

Buyer power – Customers are usually governments and large healthcare management organizations or insurance companies who decide on reimbursement and coverage for specific tests. If not reimbursed, patients must pay out of pocket and then must be convinced by the physicians, who become the target of marketing from the company. Thus, buyer power is high, creating a greater burden of proof of cost savings or clinical validation from the diagnostic assay.

Threat of substitutes – Computer tomographic or magnetic resonance imaging, nuclear antibody tagged imaging, and other advanced medical imaging techniques are available at a relatively high cost, and this used only when there is reasonable suspicion of lung cancer prevalence. In addition, there are many false positives as screening protocols are not yet clearly established. The option of “no diagnosis” must be considered here, especially if it is perceived that there is no effective treatment anyway. Hence, unless adopted as early stage screening assay, there is moderate threat of substitutes with established imaging techniques.

Barriers to entry (or new entrants) – Many universities, large diagnostic imaging companies, and medical institutes are engaged in developing various methods for earlier detection of cancer, such as antibody-tagged imaging methods and detection of blood-circulating cancer cells. There is continued strong government support for cancer research in lung cancer with discoveries made at universities being spun out into companies making competitive diagnostic products. This R&D spending by a private company cannot create a barrier to entry. Regulatory barriers exist, and other companies must build quality systems to address manufacturing consistency and reliability requirements. Cancer diagnostics are classified as Class III risk products in Europe, Canada, and the United States and require clinical trials. Thus, bringing a cancer diagnostic to market takes significant time and money, creating a barrier to entry for all firms. Access to clinical validation specimens, patents filed by universities and other companies, and setting up channels for the distribution of diagnostic assays are all further complexities and barriers to entry. In summary there are moderate to high barriers to new entrants in this industry.

Rivalry – Rivalry among competitors is low to moderate. Companies are pursuing many different approaches, so it may seem like high rivalry, but the market is large enough and has room for growth for effective products. Firms pursue approaches such as immunohistochemistry, cytometry, image analysis, blood markers, protein markers in urine, and breath analysis. Very different solutions could emerge for various aspects of the types and stages of lung cancer. Market growth in the diagnostics industry continues to remain strong. There are high switching costs between diagnostic platforms and tests, as test labs and physicians need to be convinced of validity and clinical outcome by developing experience with the specific assays.

In summary, the cancer diagnostics industry does not look attractive. Although rivalry is low and moderate, the other four of Porter’s Five Forces are high. From this objective review, cancer diagnostics development is a high-risk proposition. The effort is extremely expensive, taking a long time with significant risk of newer technology or methods replacing the diagnostic. Patent landscape is likely highly occupied and, even if a test reaches market, there are enormous difficulties and hurdles in distributing it and having it adopted as part of standard practice. On the other hand, the market need is significant and will continue to be a large market opportunity, looking attractive to the firm that believes it has significantly better technology with effective patent protection.

Buyer power tends to be medium, since larger purchases by hospitals or group purchasing organizations can sometimes be offset by individual physician preferences at a hospital. However, buyer power is very high in the case of commodity products (such as syringes). For new innovative products the manufacturer may have substantial negotiating power due to the limited market monopoly that the patent provides. Device firms typically buy relatively common parts and materials and transform them with knowledge and processes to provide extensive value added. Consequently, supplier importance and power are generally relatively low. The multi-year, multimillion-dollar process to take a product to market through FDA approval creates a barrier to entry in the industry, but the path through FDA approval can be relatively short in many instances. Patent protection reduces competition for many new products and first-mover advantage has been noted in many medical device markets. Consequently, a firm that is first to market and/or temporarily controls a market due to patent protection is well placed to dominate the market with brand recognition on expiry of the patent. However, there has been a tendency for established products to become commodities in the device industry. These commodity product markets are highly competitive, low-margin markets with a focus on reducing manufacturing costs.

1.6.3 Competitiveness summary for the diagnostics market

The diverse nature of this product type also limits this segment to a more generalized review and analysis of this section of the industry. Thus, more qualitative discussion is presented here to cover various issues in the diagnostics industry.

The customers (buyers; hospitals, central labs, and clinics) have been gaining bargaining power over the past few decades due to the formation of hospital buying groups and large health maintenance organizations (HMOs) that use the power of scale to choose specific tests and reimbursement levels. This buyer power is also high since most approved diagnostic tests are done in a centralized core lab with selection of specific tests. Buyer power is medium to high in the diagnostics segment of the biomedical industry. Another buyer is the insurance company or government health insurance program – the decision to accept a new diagnostic test for reimbursement coverage is not made easily, with the onus on the test provider to show clinical utility in the coverage population.

Supplier power is medium to low, depending on the type of reagent (monoclonal antibodies are specialized products; basic chemical reagents are not) or device used. For example, a new diagnostic test may have to be run on a platform from another established supplier in the centralized core lab.

Several large players in the IVD industry have established technology platform standards and control distribution channels. For example, Bayer/Chiron are market leaders in blood testing and Roche still controls a large part of the nucleic acid testing (NAT; or molecular diagnostics) markets due to its proprietary position and established standard base of the polymerase chain reaction (PCR) technology. A pioneer in molecular diagnostics, Gen-Probe, which was an industry-leading developer of molecular diagnostics tests (sold to Hologic in 2012), had to establish distribution and sales collaborations with Chiron, bioMérieux, and Bayer. Companies that have diversified product menus and strong commercialization infrastructure (channel access and established technology platforms) are positioned for the long term to capitalize on the opportunities in the diagnostics markets. Competition is intense at the market level and is focused on cost in the clinical diagnostics area. Industry rivalry is high, and barriers to entry into the traditional markets (central labs or physician clinic labs) for a young company are high, as market access is controlled by a few standard-setting large firms. However, in the molecular diagnostics market segment, patent rights on innovative tests or new techniques of genetic sequencing may allow smaller companies to establish themselves. A lowering of the regulatory bar also lowers the barrier to entry, and these firms can start earning early revenues by selling their tests for “research use only” as specific reagents directly to the clinical laboratories. The emergence of molecular diagnostics tests puts emphasis on innovative content in the IVD market. In particular, about half (49%) of the industry is composed of small companies, with fewer than 20 employees. Another 17% have fewer than 100 employees. Smaller firms are usually focused on specific disease areas or even on single diseases, but larger companies have a diverse portfolio and account for a large part of the revenues. For example, in the molecular diagnostics market ($9.3 billion in 2020 [Molecular diagnostics market – growth, trends, COVID-19 impact, and Forecasts Report (2022–2027), report published by Mordor Intelligence (2021)]), the top 10 companies account for almost 89% of the revenues, but there are many smaller startups with active merger and acquisition activity.

Manufacturers of device platforms (devices that analyze specimens) also command a significant margin in this industry, giving rise to strong marketing power for established platforms on which multiple different assays can be run.

Most IVD tests are used in reference labs (national centers with high volume), centralized labs in hospitals (accounting for 60% of IVD industry revenue) or nursing homes, or physician practice labs. Access to these customers requires building a sales force or partnering to gain access to markets, which limit routes for rapid and successful commercialization of IVD tests. Innovative proprietary tests, which are based on the many emerging insights and discoveries into the human genome and proteome, will always command a premium and interest in the market, but could take time to reach commercial success as described below. A growing area of application is point-of-care (POC) diagnostics, where a simpler version (requiring no training to carry out or interpret) of a diagnostics test is sold for use at home or in a physician’s office or emergency room setting.

Significant barriers to widespread adoption of molecular diagnostics exist, lock-in by specific test platforms, reimbursement issues (Chapter 7), changing regulations, education and awareness of the clinical utility of a test, the inability to fully interpret test data, and the fact that (in some cases) gene patents are hindering adoption of the tests by routine clinical laboratories and also preventing competitive development that would be good for increased market development. Unclear or changing regulatory environments and reimbursement practices that create disincentives for innovation, particularly for the new molecular diagnostics tests, remain as key impediments to successful commercialization of new IVD tests. Acceptance of a new test by a few leading academic research clinical centers may be rapid, but adoption in the larger volume markets typically takes time. These market hurdles could be overcome as more biomarkers are being clinically validated and familiarity with molecular diagnostics testing is growing through the new tests that are being launched. For example, new tests that result in improved outcomes in diseases such as cancer by helping identify genetic or other biomarkers of the disease to select optimal treatments are seeing substantial market pull due to demonstrable clinical utility.

1.7 Technology trends in biomedical device and drug development

In-depth information in an area of biology builds momentum, as multiple iterations are made to better understand a phenomenon or a technology, ultimately leading to better tools and new applications and products. These new applications, tools, or products eventually lead to new information that enters the cycle shown in Figure 1.9. The spark of curiosity of humans and the intensified, globally competitive research activities of this century are the drivers for innovations, new technologies, and applications entering the market. New technology breakthroughs in adjacent fields also play a role in offering new or better tools, enabling innovations that were not possible before. An example is the development of high-speed computing chips in more and more compact form with greater processing power available at distributed sites, not just at a central large computer. This breakthrough and ongoing momentum in denser, more efficient, computing capabilities have transformed diagnostics (e.g. camera in a pill for ease of endoscopic diagnosis), medical devices (e.g. implanted cardiac defibrillators that adaptively adjust to activity of the patient), drug delivery (implanted insulin pumps with active sensing of glucose and calculation of insulin dose), and many aspects of the delivery of medical care.

Figure 1.9 Technologies link curiosity, discoveries, and new applications in a cycle of innovation

1.7.1 Drug development technology trends

Technology has played an important part in drug development and discovery over the years, either by discovering new targets for better treatments or by speeding up the process of developing drugs. Most early drugs were derived as extracts from natural sources. After their clinical utility was recognized, the components of these extracts, when purified, were identified and synthesized using chemical synthesis methods to yield a reproducible active compound. While small molecule discovery essentially derives from trial and error and serendipity (despite the claims of “rational drug discovery,”) drug product design is carried out by medicinal chemists who take some guidance from molecular modeling of drug–protein interactions. Additional technology gains have been made in the field of biomarkers and advanced sequencing (proteins, RNA, DNA) to better identify and confirm the mode of action of a compound. However, the biggest change in drug development in the industry was the advent of biotechnology drugs (biologics) and the totally different methods of discovery, development, and production used for these new drugs.

These biotechnology drugs, typically proteins that are enzymes or antibodies (monoclonal antibodies), are produced using genetically engineered living cells. The biotech industry started off with two basic technologies in 1975, recombinant DNA (rDNA) and monoclonal antibody (mAb) production from hybridomas, and has now accumulated several breakthroughs in its technology platforms, leading to an ever-increasing range of applications going beyond basic manufacturing techniques to enhance the entire supply chain in drug and diagnostic development (Figures 1.10 and 1.11). Figure 1.10 overlays the actual revenue figures for the biotechnology drugs-based segment of the pharmaceutical industry with a few selected technology milestones. These technology and commercial milestones are meant to be representative and not comprehensive.

Figure 1.10 Biotechnology industry development technical milestones

Figure 1.11 Technologies used in the drug discovery and development industry are increasing and the process is more complex.

The next set of emerging technologies includes stem cells, tissue engineering (including 3D printing of tissue components), gene therapy, siRNA, and in silico biology. This new generation of human therapeutics will likely require the development of new production and delivery technologies.

Additionally, advanced material technologies will also influence the pharmaceutical sector throughout the production value chain, from R&D and drug discovery to manufacturing and packaging. New emerging applications, which include nano-structured polymers (dendrimers) for advanced drug delivery, analytical life sciences instrumentation, biochips, membranes, bioreactor design, coatings, and fine chemicals, will all impact the future development of new classes and types of drugs.

In 2019, the US pharmaceutical industry spent $83 billion dollars on R&D. (data from US Congressional Budget Office, https://www.cbo.gov/publication/57126), with a record number of 59 new small molecule drugs approved in 2018. While the industry has improved its productivity over the last 14 years (28 new drugs approved in 2004), the average cost to bring a new drug to market is three times more than what it was in 2003. One possible explanation for the increased cost is that the explosion of information and new targets with a paucity of historical data on their validity over the past four decades (since 1980s – see Figure 1.11) has led to a net loss of productivity in drug development due to increased complexity and need to assess more and more parameters. Paradoxically, individual technologies promise better productivity. IT systems integration and data integration processes have increased computational intensity in drug discovery and development. The general feeling is that pharmaceutical companies continuously work to integrate a large number of emerging new technologies, insights, and methods that have been shown to individually have great promise in discovering targets or drugs that can lead to a cure for diseases. It is possible that the expected outcome of these new insights will not emerge in the form of real curative medications for some years hence. However, the increasing number of targeted therapies (monoclonal antibodies, drugs that target specific cell-signaling mechanisms) and therapies that require pre-selection of patients using genomic diagnostics indicates that a new and exciting era of precision medicine is emerging.

1.7.2 Medical device and diagnostics technology trends