4.1 Introduction

Endowed with abundant fossil fuels, Canada has built one of the most carbon-intensive economies in the world. The implication is not only that Canada has a long way to go to net zero, but that in doing so it faces entrenched resistance from industry and citizens alike. Most Canadians commute to work from relatively large homes in personal vehicles. Although voters support climate action in theory, they are less enthusiastic about policies likely to increase their cost of living. There is similar resistance from energy-intensive industries, most notably the export-oriented oil and gas industry that accounts for the largest share of Canada’s emissions. Political opposition has been successful to date. Despite a succession of ambitious climate targets since 1990, Canada’s emissions increased by 21 per cent from 1990 to 2018 (ECCC 2020b).

Fossil fuels are not only integral to Canada’s economy but also to its federation. Provincial governments control publicly held ‘Crown resources’, on which they have relied both for government revenues and economic development. However, the distribution of resources varies greatly in such a geographically vast country. Some provinces have abundant hydro-electric potential, others fossil fuels. The resulting variation in the carbon intensity of provincial economies has yielded equally great variation in provincial governments’ climate ambitions and support for federal policies.

As provinces have responded to cycles in public attention to climate change, intergovernmental relations in the Canadian federation have varied over time. In this chapter, I identify three phases in Canadian climate federalism. From 1990 to 2006, a ‘joint decision trap’ prevailed in which the least ambitious (and most fossil fuel-dependent) provinces vetoed national solutions. From 2007 to 2015, a truncated innovation and diffusion dynamic emerged in a vacuum of federal inaction. Provincial leaders adopted more ambitious and, in some cases, innovative climate policies. However, action by the least carbon-intensive provinces did not prompt fossil fuel-dependent provinces to follow. Reductions hard won by provincial leaders were overwhelmed by emissions growth in recalcitrant provinces. The third phase, since 2016, is characterized by federal unilateralism. While the mere threat of federal action initially yielded provincial collaboration in an ambitious pan-Canadian climate plan, successful implementation of that plan ultimately turned on the federal government’s willingness to follow on its threat.

The history of Canadian climate policy underscores the finding of a broad scholarly literature that federalism has different effects under different conditions (Weaver Reference Weaver2020). In addition, one cannot attribute the success or (more often) failure of Canadian climate policy to any one factor, including federalism. Still, on balance I argue that from 1990 to 2015 federalism exacerbated the challenge of climate action in Canada. The combination of provincial governments’ defence of the fossil fuel industry and an informal norm of intergovernmental consensus yielded weak policies in fossil fuel-rich provinces and constrained both interprovincial and federal action. Evaluation of policy developments since 2016 is more complicated, however. Leadership by a subset of provinces facilitated a stronger federal role – though a change in the governing party at the federal level was also critical. At the same time, continued deference to the provinces resulted in a patchwork of inconsistent policies that diminished both the efficacy and cost-effectiveness of climate change mitigation, and achieved climate action conditional on increased fossil fuel exports.

4.2 Climate Change in Canada

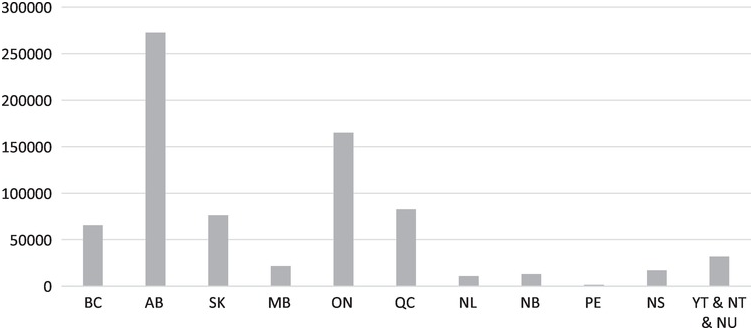

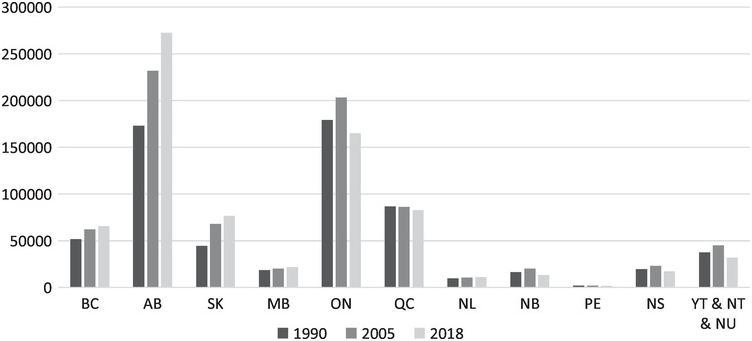

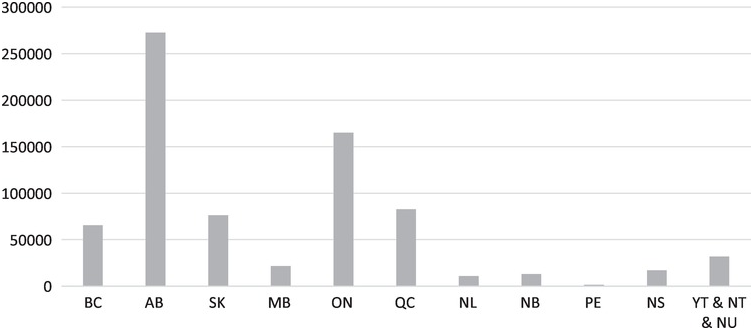

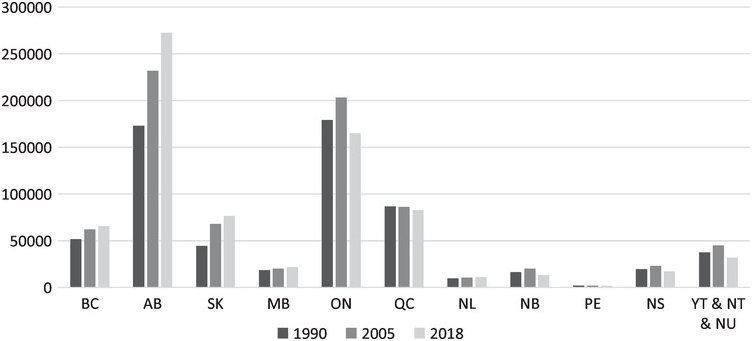

Canada ranks tenth globally in absolute greenhouse gas emissions, contributing 1.6 per cent of the global total, and eleventh in per capita emissions (Ritchie and Roser Reference Ritchie and Roser2020). As evident from Figure 4.1, however, there is significant variation in emissions across the ten provinces. In part this reflects the uneven distribution of the population: at one extreme, 39 per cent of Canadians live in Ontario, at the other just 0.4 per cent on Prince Edward Island. However, it also reflects significant differences in per capita emissions, as illustrated by Figure 4.2. With only 12 per cent of the population, Alberta contributes over 40 per cent of Canada’s emissions. Per capita emissions in 2018 ranged from 63 to 66 tonnes CO2e/yr, respectively, in the oil-producing provinces of Alberta and Saskatchewan to 10 tonnes/yr in hydro-rich Quebec. Figure 4.1 also reveals divergent emissions trends across the provinces. Although most provinces experienced emissions growth from 1990 to 2005, followed by stable or declining emissions thereafter, emissions in the oil-producing provinces of Alberta and Saskatchewan continued to grow. Oil and gas production now contributes the largest share of national emissions at 26 per cent, followed closely by transportation (ECCC 2020b).

As a polar-adjacent country, Canada is experiencing twice the global rate of warming (NRC 2019). Despite this, until recently Canada has been less affected by worsening heat waves than many countries by virtue of cold or temperate weather for much of the year and air conditioning enjoyed by 60 per cent of Canadian households (Statistics Canada [2015] 2021). A critical exception is Canada’s far north, which has already experienced more than 2ºC of warming, with consequences for the welfare and culture of remote Indigenous communities, wildlife and infrastructure (including roads that rest on ice and permafrost). The impact of climate change has become more apparent in western Canada as well, with regular summer wildfires and resulting unsafe air quality. A ‘heat dome’ in 2021 is believed to have resulted in roughly 600 deaths (Woo Reference Woo2021). The village of Lytton in British Columbia shattered previous Canadian temperature records at 49.6C, before burning to the ground the next day.

Mainstream political parties have embraced the scientific consensus of the IPCC (Intergovernmental Panel on Climate Change) (though pronounced differences remain among their supporters). A Progressive Conservative government ratified the UN Framework Convention on Climate Change in 1992, in so doing embracing the non-binding target to return emissions to 1990 levels by 2000. A Liberal government signed the Kyoto Protocol in 1997, committing Canada to a 6 per cent reduction below 1990 levels by 2008 to 2012. With failure looming, a successor Conservative government withdrew Canada from the Kyoto Protocol in 2011, but signed on to a Copenhagen Accord target to reduce Canada’s emissions 17 per cent below 2005 levels by 2020. In 2015, a Liberal government committed Canada to a 30 per cent reduction below 2005 levels by 2030. Time and again, Canada has committed to significant reductions, only to move the goal posts into the future.

In the absence of policy constraints, emissions continued to increase, most notably from oil production and motor vehicles. Throughout the 1990s and early 2000s, Canadian governments released many climate plans, but in practice implemented only ineffective voluntary programmes and modest subsidies (Harrison Reference Harrison, Harrison and Sundstrom2010; Simpson and Rivers Reference Simpson, Jaccard and Rivers2008). After 2005, national regulation of motor vehicle emissions constrained emissions growth, but a $15/tonne carbon price in Alberta had little impact on emissions from oil extraction, which continued to climb as a result of both increased production and a shift from conventional to heavy oil from the tar sands (also known as oil sands). Since 2016, however, national measures – including a proposed low carbon fuel standard, phase-out of coal-fired electricity, anticipated harmonization with forthcoming US motor vehicle standards, and a schedule to increase the national carbon price to $170/tonne by 2030 – held the promise that Canada may for the first time meet an international climate target (ECCC 2020a, 62–3). In April 2021, the federal government raised the bar, committing to a new target of a 40–45 per cent reduction below 2005 levels by 2030, which will require even stronger policy measures.

4.2.1 Varieties of Climate Federalism

Canada’s constitution, drafted in 1867, merged British parliamentary institutions with the American innovation of federalism. Adoption of a federal system reflected, among other factors, a distinctive francophone majority in what would become the province of Quebec. However, in the immediate wake of the US civil war, the drafters of Canada’s constitution intended a more centralized federation, exemplified by the federal government’s unlimited taxation powers and residual power to make laws for the ‘Peace, Order and Good Government of Canada’. In compensation for more limited tax powers, the provinces were granted control of ‘Crown lands’ as a source of income. In practice, however, decades of broad judicial interpretation of provincial authority with respect to ‘property and civil rights’ and the courts’ reluctance to resort to the federal residual power has yielded one of the most decentralized federations in the world (Dardanelli et al. Reference Dardanelli, Kincaid, Fenna, Kaiser, Lecours and Singh2019).

As the scope of government activity has grown, overlapping federal and provincial powers has become the norm, including with respect to environment and climate. The provinces’ ownership of roughly 80 per cent of the land within their borders, and in most cases retention of rights to minerals beneath the remaining private 20 per cent, entails extensive proprietary power to protect or exploit those resources.1 Legislative jurisdiction with respect to ‘property and civil rights’ also provides clear provincial authority to regulate pollution sources within their borders, whether public or private. The federal government has jurisdiction with respect to interprovincial ‘works and undertakings‘, such as pipelines and electricity transmission lines, and products sold in interprovincial or international commerce, such as motor vehicles. Noteworthy for global climate change, however, there is no federal power to implement international treaties in areas of provincial jurisdiction. Two other federal powers do offer broader scope for climate change mitigation, though (Hogg Reference Hogg2008). The federal government has relied on its criminal law power, previously found to support federal regulation of toxic substances, to set sectoral standards for fuels, methane emissions and power plants.2 Finally, legal scholars have long argued that the federal power to make laws for the peace, order and good government of Canada could support regulation or pricing of greenhouse gases (Chalifour and Wormington Reference Chalifour, Oliver and Wormington2020), a question settled affirmatively by the Supreme Court only in 2021 (as discussed below). Persistent uncertainty with respect to its constitutional authority reflects the fact that until recently the federal government has introduced few climate change policies that could give rise to constitutional challenges.

Institutions, ideas in the form of intergovernmental norms and material interests (and resulting political incentives) in federal–provincial relations help to explain federal inaction. With respect to institutions, with only ten provinces and three territories it is feasible for representatives of all members of the Canadian federation to convene around a single table. That the provinces and federal government all have single member plurality elections, which tend to yield parliamentary majorities, also means that when ‘first ministers’ meet they usually are in a position to deliver on any agreements they reach. These institutional features have given rise to a practice known as ‘executive federalism‘, which is exemplified by federal–provincial relations concerning the environment. Federal and provincial environment ministers meet at least annually under the auspices of the Canadian Council of Ministers of the Environment. The federal minister sits as one among equals with their provincial counterparts, the chair rotating annually among them. By convention, discussions take place behind closed doors, with a further norm – though not a constitutional requirement – of consensus decision-making. Indigenous governments, who in many cases contest Crown ownership of their unceded, ancestral lands, are not invited.

With respect to interests, political incentives that flow from regional economic diversity and provincial ownership of natural resources present a critical backdrop to federal–provincial relations concerning climate change. Provincial governments historically have sought to create jobs and raise revenue by exploiting Crown resources, and to defend vulnerable local industries. However, climate policy disproportionately threatens the economies of ‘petro-provinces’ that are dependent on oil and gas extraction (Carter Reference Carter2020). Variation in provincial dependence on fossil fuel production also coincides with variation in public opinion and partisanship. Two provinces that account for 91 per cent of Canada’s oil production (NRC 2020), Alberta and Saskatchewan, are the only provinces where less than half of voters accept that climate change is caused by human activity (Mildenberger et al. Reference Mildenberger, Howe, Lachapelle, Stokes, Marlon and Gravelle2016). As in other countries, right-of-centre parties are more closely aligned with business. In the context of a major fossil fuel exporting country, that means stronger opposition to climate change mitigation from the Conservative Party of Canada and its provincial counterparts, which typically govern in Alberta and Saskatchewan.

Turning to ideas, cultural identity is also a factor in Canadian climate policy. Sensitivity to federal paternalism often prompts opposition from larger provinces, but that is especially true of Quebec, which fiercely guards its autonomy on behalf of a distinct francophone nation within Canada.

4.2.2 The ‘Joint Decision Trap’

The first phase of climate federalism, from 1990 to 2007, was characterized by a ‘joint decision trap’ (Scharpf Reference Scharpf1988), in which the norm of consensus decision-making enabled provinces with the most carbon-intensive economies to block joint provincial or federal action. The federal environment minister from 1993 to 1996 later recalled that ‘it became clear that the rule of “consensus” in the environmental agenda would mean moving to the lowest common denominator. There was no way that Alberta would agree to any reduction in fossil-fuel emissions’ (Copps Reference Copps2004).

Provincial resistance to climate action was reinforced by economic competition, though consistent with a ‘stuck at the status quo’ dynamic rather than an all-out ‘race to the bottom’ (Harrison Reference Harrison1996a; Olewiler Reference Olewiler and Harrison2006). Moreover, with greater international than interprovincial trade (Statistics Canada [2012] 2021), the status quo in question was set not by other provinces so much as the United States, Canada’s main trading partner. In advance of international climate negotiations in Kyoto in 1997, the federal and provincial governments agreed that Canada would commit to return its emissions to 1990 levels by 2010, matching the US target. When Canada subsequently agreed in Kyoto to a 6 per cent cut below 1990 levels, comparable to the US target of 7 per cent below, the provinces were outraged that the federal commitment was made unilaterally. Cooperation was restored, however, at a first ministers conference the next day. The prime minister reassured the premiers that Canada’s implementation plan would be developed in a joint process co-chaired by the federal government and Alberta, and that only therafter would a decision be made on ratification (Harrison Reference Harrison, Harrison and Sundstrom2010). The National Climate Process sponsored hundreds of meetings over the next four-and a-half years without reaching agreement on a plan to meet Canada’s Kyoto target.

Resistance from Canadian business and more carbon-intensive provinces was strengthened by US President George W. Bush’s announcement in 2001 that the USA would not ratifiy the Kyoto Protocol. Federal–provincial conflict came to a head in the spring of 2002, by which time Alberta was considering legal action to block federal ratification (Macdonald Reference Macdonald2020). When the federal government unilaterally released its own implementation plan, even the two provinces that supported ratification, Quebec and Manitoba, signed a unanimous statement by the provinces condemning federal unilateralism (Harrison Reference Harrison, Harrison and Sundstrom2010). Alberta withdrew from the joint process, and released a provincial plan that welcomed continued emissions growth.

The federal government had rejected the premise of the joint decision trap in finalizing a unilateral federal plan and ratifying the Kyoto Protocol in December 2002. However, as with previous moments of environmental assertiveness, the federal government failed to follow through. Implementation of the federal plan stalled in anticipation of Prime Minister Jean Chretien’s retirement. Chretien’s successor, Paul Martin, produced a new plan in 2005, which sought to restore federal–provincial harmony with the promise of billions of dollars of federal funding for the provinces. However, the Martin plan also failed to get off the ground before the Liberals lost the 2006 election.

The Conservative government led by Stephen Harper was still less threatening to carbon-intensive provinces by virtue of weaker climate goals (Harrison Reference Harrison, Harrison and Sundstrom2010). The new government immediately abandoned Canada’s Kyoto target, and later withdrew from the treaty. Although it promised a strategy of sector-specific regulations, the Harper government only regulated two sectors. Motor vehicle emission standards matched those adopted by the USA, an essentially costless strategy since Canada manufactures vehicles and parts for an integrated North American market. Regulations adopted for electricity generators would not affect existing facilities for two decades (McCarthy Reference McCarthy2012). The Conservative government declined to regulate the oil industry, though it accounted for most of Canada’s emission growth.

4.2.3 Leaders without Followers

As federal inaction persisted, a new federal–provincial dynamic emerged as some provincial governments took climate policy into their own hands. Provincial actions are potentially important for two reasons. First, provincial ‘laboratories of democracy’ can produce innovative approaches that inform policies of other jurisdictions (Boyd and Olive Reference Boyd and Olive2021). Second, and arguably more important, is leadership in the context of economic competition. The challenge of climate policy is less that governments don’t know how to reduce emissions (ideas), than that they are reluctant to impose costs on local actors should their actions not be matched by other jurisdictions (interests). Provincial leadership thus held the promise of reassuring provinces that were reluctant to act lest industry relocate, but not actively seeking to attract investment with lax standards (Harrison Reference Harrison1996b).

With respect to innovation, it was Alberta, ironically, that took the lead in adopting output-based carbon pricing for tar sands producers in 2007. British Columbia followed in 2008 with a revenue-neutral carbon tax (Harrison Reference Harrison2013). In 2014, Quebec joined California in the first emissions trading scheme to extend coverage to small sources (Houle, Lachapelle, and Purdon Reference Houle, Lachapelle and Purdon2015). Less innovative but potentially important in reassuring other provinces was Ontario’s leadership in closing its five remaining coal-fired power plants between 2003 and 2015 (Harris, Beck, and Gerasimchuk Reference Harris, Beck and Gerasimchuk2015).

Two features of this second phase of Canadian climate federalism bear emphasizing. With the exception of Alberta’s generous pricing of tar sands emissions – which, as discussed below, was motivated by defending the oil industry’s reputation and pre-empting federal action – provincial leaders were those that already had the lowest per capita emissions in Canada. Moreover, provinces with more carbon-intensive economies did not match the leaders’ actions. Provinces dependent on fossil fuel extraction continued to resist both federal actions and interprovincial collaboration. Alberta and Saskatchewan thus blocked consensus on a national cap and trade scheme in 2008 (Howlett, Laghi, and Séguin Reference Howlett, Laghi and Séguin2008; White and Greenberg Reference White and Greenberg2008). Even Ontario was selective in its climate leadership. As the home of Canada’s automobile manufacturing industry, Ontario vetoed calls for stricter exhaust standards until US regulations forced Canada’s hand (Howlett and Keenan Reference Howlett and Keenan2008).

In this second period, Canadian federalism generated innovation without diffusion and leadership without followers. From 2005 to 2018, British Columbia, Quebec and Ontario collectively reduced their emissions by 38 million tonnes/yr CO2e,3 but Alberta and Saskatchewan increased theirs by 49 million tonnes/yr.

4.2.4 The Federal Backstop

The third phase of Canadian climate federalism was characterized by unprecedented federal unilateralism. Following election of a Liberal government in 2015, the federal government extended provincial leaders’ actions Canada-wide, in so doing rejecting the norm of granting all provinces, including those dependent on oil production, a veto over Canadian climate policy. Carbon pricing, which was central to this third phase, is explored in the next section.

4.3 Carbon Pricing in the Canadian Federation

Carbon pricing holds promise to achieve reductions targets more cost-effectively than traditional regulation but with a tradeoff of strong public opposition, especially in the case of carbon taxes. Indeed, the strength of public opposition has led some scholars to suggest that carbon pricing is not politically feasible at the level required to drive deep reductions (Green Reference Green2021; Jaccard Reference Jaccard2020). This section considers how the three phases of Canadian climate federalism affected carbon pricing, with both negative and positive consequences for effective climate policy.

4.3.1 Federal Retreat, Provincial Laboratories of Democracy

A proposal for a carbon tax was floated in the early 1990s in the course of developing a national ‘Green Plan’, but the idea was quickly withdrawn in the face of opposition from Alberta and the oil industry (Hoberg and Harrison Reference Hoberg and Harrison1994). Interest in carbon pricing in the form of emissions trading emerged following the launch of the EU Emissions Trading Scheme (ETS) in 2005. The Martin government’s 2005 Kyoto plan, Project Green, proposed to create a national emissions trading scheme, but would only have required industrial emitters to cut their emissions by 12 per cent below business as usual, a far cry from the more than 30 per cent reduction below projected emissions across all sectors Canada needed to meet its Kyoto target (Harrison Reference Harrison, Harrison and Sundstrom2010).

The promised emissions trading scheme was soon abandoned by the Harper government. In the meantime, however, provincial governments began to adopt their own carbon pricing policies. In 2007, Alberta adopted its Specified Gas Emitters Regulation (SGER), which gave large industry sources an option either to pay a carbon levy of $15/tonne or purchase offsets for emissions in excess of a 12 per cent intensity reduction. While innovative, the weaknesses of the system included a price too low to drive significant reductions from the oil industry, authorization of offsets that had already happened up to six years earlier, and the absence of any plan to increase either the price or intensity target. All in all, this suggests that the motive was less to deliver emissions reductions than to defend the reputation of Alberta’s oil industry and pre-empt any federal regulatory or trading scheme. A further advantage was to keep the oil industry’s payments in the province, including by authorizing offsets only within Alberta. It is telling that Alberta’s 2008 Climate Change Strategy projected emissions that would still be above the province’s 1990 Kyoto Protocol baseline in 2050.

Next up, British Columbia (BC) announced a revenue-neutral carbon tax in 2008, increasing to $30/tonne in 2012 (Harrison 2012, Reference Harrison2013). The BC tax was celebrated internationally for its application of a consistent price to both industry and household emissions; and corresponding cuts in income taxes that promised to stimulate the economy (Partington Reference Partington2013). Pundits speculated that BC’s novel policy would rapidly spread to other provinces (Simpson Reference Simpson2009). However, the emergence of public opposition, the onset of a global recession and rejection of a similar carbon tax proposed by the Liberals in the 2008 federal election later quickly laid that optimism to rest (Harrison Reference McCarthy2012). When no other provinces matched BC’s price, the province’s carbon tax was frozen at $30/tonne in 2012.

During this period, Canadian provinces also proposed to collaborate with US states to limit impacts on cross-border competitiveness. BC, Manitoba, Ontario and Quebec committed to join seven US states in the Western Climate Initiative (WCI) emissions trading plan. However, as it became clear that there would be no federal trading scheme to extend carbon pricing to non-WCI members in either country, all states and provinces but California and Quebec withdr (Houle, Lachapelle, and Purdon Reference Houle, Lachapelle and Purdon2015). The two remaining members launched their own schemes in 2013, initiated cross-border trading in 2014 and extended coverage to fuel distributors in 2016.

During this period a handful of provinces adopted novel policies. Of particular note are Quebec and California’s extension of emissions trading to transportation and heating fuels, and BC’s revenue-neutral carbon tax. However, other provinces’ failure to embrace those innovations suggests that the underlying challenge was less how to design carbon pricing policies than how to protect local economic interests. Although Ontario’s phase out of coal-fired power reflected political leadership rather than innovation, it too was not matched by other coal-dependent provinces. The lack of policy diffusion ultimately undermined the ambition of provincial leaders. BC froze its tax at $30/tonne, and all but one province that had committed to WCI withdrew when it became clear that a federal backstop would not be forthcoming to protect their economies from laggard states and provinces. Ontario belatedly joined WCI trading in 2018, but withdrew the following year following election of a populist Conservative government (Raymond Reference Raymond2016), which simultaneously relaxed the province’s emissions target.

The third phase in Canadian carbon pricing was triggered by two critical elections in 2015. The October federal election yielded a return to government for the Liberal Party, now led by Justin Trudeau. The stage for the Trudeau government had been set, however, by the May election of the first left-of-centre government in Alberta in eighty years. The Alberta New Democratic Party (NDP) government ran on a promise of stronger climate policies, but like its predecessors was keen for Alberta to set its own agenda in advance of an anticipated change in the federal government and an expected international agreement at COP21 in Paris. A Climate Change Advisory Panel was struck to devise a new provincial climate plan before the federal election. In parallel, secret negotiations between industry leaders and environmentalists had been ongoing since 2014. That group’s agreement to cap oil sands emissions at 100 MT/yr, roughly 50 per cent higher than current emissions, was subsequently built into the Alberta climate plan (World Bank 2017). The government also committed to phasing out coal-fired power by 2030 (an NDP election promise) and on the recommendation of the Advisory Panel, to revising SGER to eliminate benefits for more carbon-intensive facilities, raising the carbon price to $20/tonne in 2017 and $30/tonne in 2018 and, most controversially, extending carbon pricing to households via a carbon tax on transportation and heating fuels. In a remarkable though brief moment of consensus, Alberta Premier Rachel Notley was joined on stage by leaders from the oil industry, environmental groups, labour and First Nations when she announced Alberta’s Climate Leadership Plan in November 2015 (Boyd Reference Boyd2019).

A critical feature of the Alberta carbon pricing plan little noted in all the attention to the 100 MT oil-sands cap and carbon tax on households was a decision to match the price rather than targets of other jurisdictions. Ontario and Quebec had previously announced targets to reduce their emissions by 37 per cent and 37.5 per cent, respectively, below 1990 levels by 2030. Even the Harper government had announced a pre-Paris target for Canada of a 30 per cent reduction below 2005 by 2030. However, the Alberta Climate Leadership Plan rejected a province-wide emissions target in favour of an alternative approach of matching the highest extant carbon price in Canada: BC’s $30/tonne. Since a carbon price would not have a significant impact on oil-sands production below roughly $70/tonne, the effect was to allow continued growth in Alberta’s emissions to about 2030, consistent with the 100 MT cap.4

4.3.2 The Pan-Canadian Framework

The federal Liberals promised in anticipation of a fall 2015 election that they would build on the carbon pricing policies of British Columbia, Alberta (at that point SGER only), Quebec and Ontario (which had promised to join WCI) to establish a consistent, but unspecified, national carbon price. While that was encouraging for climate-concerned voters, others were simultaneously reassured by two other aspects of the Liberal platform. The promise to build on provincial actions suggested deference to provincial jurisdiction and sensitivity to regional interests. Moreover, the Liberal platform stressed the need to get ‘Canada’s resources to market’ – a thinly-veiled promise to approve at least one additional export pipeline among several under review at the time.

The Liberals formed a majority government a month before COP21 and quickly convened a first ministers conference. A few months later, federal and provincial governments unanimously announced the ‘Vancouver Declaration’, through which all provinces and territories agreed to collaborate on a climate plan that would ‘build on the leadership shown and actions taken by the provinces and territories’ in four areas, one of which was ‘carbon pricing mechanisms adapted to each province’s and territory’s specific circumstances’ (Prime Minister of Canada, Justin Trudeau Reference Mildenberger, Howe, Lachapelle, Stokes, Marlon and Gravelle2016). In late 2016, the first ministers unveiled the new pan-Canadian Framework on Clean Growth and Climate Change (PCF). Although the USA had just elected a president expected to withdraw from the Paris Agreement, Canada’s first ministers forged ahead. It was a stark contrast to 2002, when the USA’s withdrawal from the Kyoto Protocol strengthened provincial opposition. All provinces and territories but Saskatchewan signed onto the agreement.5 In so doing, they endorsed Canada’s Paris Agreement target of 30 per cent below 2005 by 2030, and committed to undertaking complementary actions specific to federal and provincial jurisdiction. Carbon pricing was highlighted as the ‘central component’ of the plan. The PCF recognized provincial leadership on carbon pricing, but incorporated the federal government’s recent announcement of a carbon pricing benchmark, which included several elements:

An option for provinces to devise their own carbon pricing plans in the first instance, with the expectation that the federal government would enact its own backstop should a province fail to meet all elements of the federal benchmark.

A condition of broad coverage, consistent with the application of BC’s carbon tax to both industry and households.

Acknowledgement that provinces could embrace either a carbon tax or a cap-and-trade scheme. Provinces that opted for the former were expected to meet or surpass $10/tonne CO2e in 2018, rising steadily to $50/tonne in 2022. Those opting for cap-and-trade would be expected to set a 2030 provincial reduction target at least as ambitious as Canada’s Paris Agreement target, and caps before 2022 consistent with reductions that would be expected within the province under a tax at the federal benchmark price.

A commitment by the federal government to return any carbon pricing revenues it might collect under the federal backstop to the province of origin.

Federal–provincial agreement on the PCF carbon pricing plan rested on three factors. The first was Alberta’s new-found climate ambition. Although the province had long been an impediment to Canada-wide action on climate, the 2016 Alberta Climate Leadership Plan became a template for the PCF, including a price- rather than target-based federal benchmark. Therein lay a poison pill, however. While Alberta could embrace price competitiveness as an alternative to a provincial emissions target, Canada’s price benchmark ultimately would need to meet its international target under the Paris Agreement. In fact, the federal benchmark in the PCF was inconsistent: cap-and-trade provinces were expected to commit to a cap at least as ambitious as Canada’s Paris target, while carbon tax provinces only needed to commit to a price of $50/tonne in 2022. The PCF’s admission – consistent with two decades of modelling efforts (Simpson, Jaccard, and Rivers Reference Simpson, Jaccard and Rivers2008) – that the first phase of the plan would not be sufficient to meet Canada’s Paris target implied that a price well above $50/tonne would be required. However that was never agreed to by first ministers nor made explicit in the pan-Canadian plan.

A second factor critical to federal–provincial agreement was unprecedented federal government resolve. The Liberals set out their broad approach in the 2015 election, but had not specified either a price level nor timing. The prime minister announced details of the federal benchmark, subsequently embedded in the PCF, in the House of Commons in October 2015, even as federal and provincial environment ministers were meeting (Harris Reference Harris2016). Taken by surprise, ministers from Saskatchewan, Nova Scotia and Newfoundland left the meeting in protest, while other provinces, including Alberta, withheld their agreement (Macdonald Reference Macdonald2020).

The third condition was brokerage deals with individual provinces, each of which entailed relaxing the federal benchmark. Nova Scotia got a special deal to extend coal-fired power generation, while BC got federal approval of an LNG export project (Macdonald Reference Macdonald2020). However, the PCF keystone was Alberta, which consented to match the federal benchmark of $50/tonne only in exchange for federal approval of a pipeline to gain access to new markets for Alberta oil.6 Access to ‘tidewater’ was viewed as critical by the Canadian oil industry, which historically had shipped all of its exports to the USA, which was now less eager for Canada’s oil amid booming production of its own shale oil. The federal government approved the Trans Mountain Expansion Project, a new pipeline to carry 590,000 barrels per day of bitumen from Alberta to the BC coast, days before federal–provincial agreement on the pan-Canadian Framework was announced.

4.3.3 The Federal Backstop

In 2018, the federal government passed the Greenhouse Gas Pollution Pricing Act, which set out a two-pronged approach: a fuel surcharge (carbon tax) for households and other small sources, and an output-based pricing system for large industrial sources. The federal government would apply one or both only if a province or territory failed to meet the federal benchmark or requested federal administration of carbon pricing. The output-based pricing system applies the scheduled carbon price to emissions in excess of a sector-specific baseline, a design intended to protect competitiveness of trade-exposed industries. Where the federal policy was necessitated by provincial non-compliance with the federal benchmark, revenues are returned to the province of origin via programmes to support industry transition, rather than to provincial governments themselves.

For households, the choice of a carbon tax in the form of a fuel surcharge, rather than emissions trading, reflected the federal government’s expectation in early 2018 that the backstop would apply only in one province, Saskatchewan.7 For one fairly small province, a federal tax was simply easier. Ninety per cent of fuel surcharge revenues are returned to households in the form of equal dividends to households of equal size, with the remaining 10 per cent set aside to support small business and public sector institutions such as schools and hospitals.8 The commitment to return revenues to the province of origin raised the prospect of very different per capita dividends given dramatic variation in provincial emissions intensity.

The federal government called on provinces to submit their carbon pricing plans for review in mid-2018. Neither Saskatchewan nor Ontario submitted plans. Manitoba committed only to maintain a $25/tonne carbon price through 2022, while New Brunswick proposed to create a provincial carbon tax by reducing an existing fuel tax by the same amount. The federal government responded by implementing its carbon pricing backstop for both industry and households over the objections of those four provinces in April 2019, despite a federal election looming later that year. When the Alberta NDP government was defeated in May 2019 by the United Conservative Party, the new government immediately rescinded that province’s carbon tax. The federal government applied its carbon tax in that province as well in January 2020.

The federal government’s unilateralism met with vehement provincial opposition. Two of the provinces where carbon pricing was imposed by the federal government, Alberta and Saskatchewan, had a long history of opposition to federal climate initiatives. All five provinces were governed by conservative parties. Federal and provincial conservatives railed against a federal ‘tax grab’, posting images on social media of themselves refuelling large vehicles the day before the federal carbon tax took effect (Maclean’s 2019).

Alberta, Saskatchewan and Ontario all challenged the constitutionality of the federal greenhouse gas pricing law, arguing that the subject matter was exclusive provincial jurisdiction, and that the balance of powers in the federation would be imperilled should the federal government be authorized to regulate any release of greenhouse gases (Chalifour, Oliver, and Wormington Reference Chalifour, Oliver and Wormington2020). Quebec intervened in support of provincial challenges of the federal Act. Although Quebec is one of the most ambitious provinces on climate, it is invariably among the most defensive of provincial jurisdiction. British Columbia was the only province to intervene in support of the federal government.

Following mixed decisions in lower courts, the Supreme Court of Canada upheld the federal carbon pricing law in March 2021.9 The court found that the federal government has authority to establish a minimum national carbon price backstop within its power to make laws for the ‘Peace, Order, and Good Government’ of Canada. Central to the Court’s ruling was recognition that provincial governments face a collective action problem: inaction by one or more provinces can undo (and has undone) hard-won gains by others, an outcome that cannot be overcome through cooperation among provinces that have no authority over each other. The court thus incisively diagnosed and handed the federal government a delimited power to overcome the economic competition and provincial vetoes that have long undermined Canadian climate policy.

4.3.4 A Pan-Canadian Patchwork

Beyond the courts, the federal policy also was tested in a national election in October 2019, in which the opposition Conservatives promised to eliminate the federal carbon pricing backstop. The Liberals lost seats but held on to a minority government. Alberta, Ontario and New Brunswick all subsequently received federal approval of their pricing schemes for industry, but only New Brunswick sought and received approval to implement its own carbon tax. As of 2021, the resulting carbon pricing landscape in Canada is complicated indeed. Two provinces (Quebec and Nova Scotia) have unlinked emissions trading schemes, four have provincial carbon taxes (British Columbia, Newfoundland, New Brunswick and Prince Edward Island), and four are subject to the federal carbon tax on households (Alberta, Saskatchewan, Manitoba and Ontario). Federal pricing for industry applies in three carbon-tax provinces (Prince Edward Island, Saskatchewan and Manitoba) while all others have their own industry pricing schemes (British Columbia, Alberta, Ontario, New Brunswick, Newfoundland.)

Although the federal government took a hard line with provinces that openly defied federal expectations, it interpreted other provinces’ carbon pricing proposals with considerable flexibility (Dobson, Winter, and Boyd Reference Dobson, Winter and Boyd2019). The Nova Scotia premier boasted that his province’s stand-alone trading scheme would result in a gasoline price increase of $0.01 rather than the federal carbon tax increase of $0.11 per litre (Laroche Reference Laroche2018). While that presumably reflects the ease of meeting a cap in a province experiencing business-as-usual emissions decline, it is hard to see how a lower Nova Scotia carbon price met the federal requirement that provincial emissions trading schemes must deliver the same reductions as would be achieved by the federal carbon tax. (In contrast, Quebec could achieve comparable reductions at a lower price by purchasing credits from California.) The carbon taxes of Prince Edward Island, New Brunswick and Newfoundland all waived application to home heating and partially reduced other provincial fuel taxes in compensation. Both New Brunswick and Ontario technically met the federal benchmark for coverage and pricing for industry, but undermined the intended stringency via generous baselines for individual facilities (Rabson Reference Rabson2020). The result was a patchwork of policy instruments, coverage and prices (Sawyer et al. Reference Sawyer, Stiebert, Gignac, Campney and Beugin2021), in which provincial variation did not merely tailor solutions to local circumstances, but rather undermined climate policy ambition.

The 2016 pan-Canadian Framework acknowledged that additional actions would be needed to close the gap to Canada’s 2030 Paris Agreement target. The federal government signalled that it would release a plan to close the gap by the end of 2020. After decades of failed plans, expectations were muted. However, judicial and electoral survival of its core climate policy, carbon pricing, appears to have emboldened the federal government. In its December 2020 plan, the federal government unilaterally committed to increasing the backstop price to $170/tonne in 2030 (ECCC 2020a; Harrison Reference Harrison2020). In contrast to 2016, the federal government does not appear to have consulted provinces (at least not all of them) in advance. Ontario, Alberta and Saskatchewan expressed shock and outrage. While the 2020 plan was expected to meet Canada’s original Paris Agreement target of a 30 per cent reduction between 2005 levels by 2030, in the spring of 2021 the federal government upped the ante, unilaterally announcing a new Paris target of a 40–45 per cent reduction over the same period. Within months, the minority Liberal government (with NDP support) passed the Net Zero Climate Accountability Act, which reinforces unilateralism by mandating federal accountability for meeting national emission targets.

The federal government’s 2020 carbon pricing announcement, 2021 Paris Agreement target, and new net zero accountability law all reject the expectation of federal–provincial consensus that historically prevailed in Canadian climate and environmental policy. The Liberals’ subsequent re-election in the fall of 2021 locks in a more assertive federal approach for the foreseeable future.10

4.4 Conclusion

Per capita, Canada has contributed more than its share of global emissions. Yet for that very reason climate change mitigation represents a significant political challenge. Voters with carbon-intensive lifestyles call for governments to ‘do something‘, but not to them. Carbon-intensive industries resist the imposition of costs that threaten a long-standing comparative advantage, inexpensive energy. The export-oriented fossil fuel industry, which contributes the largest share of Canada’s emissions, has resisted both domestic and global action. Mitigation costs unevenly distributed across regions further concentrate costs and reinforce political opposition. Against that backdrop, care is warranted not to attribute policy success or failure only or even primarily to federalism.

Still, the question remains whether federalism has exacerbated or moderated the challenge of climate action in Canada. Two features of Canadian federalism clearly reinforce the challenges noted above: constitutional empowerment of defenders of regional economies, and provincial ownership of fossil fuels.

On each of the three dimensions introduced in the introductory chapter – tailoring, backup and innovation – the disadvantages prevailed over the benefits in the Canadian federation from 1990 to 2015. The period from 1990 to 2006 reveals the perils of reliance on provinces tailoring solutions to their own circumstances in a context of environmental spillovers and economic competition. Fossil fuel-dependent provinces’ ‘local preferences’ were for continued expansion of fossil fuel production, which resulted in unchecked growth in carbon emissions. The most carbon-intensive provinces not only failed to act on their own or in concert with other provinces, but also blocked federal action.

From 2007 to 2015, provincial innovation and leadership presented the possibility of both cross-provincial learning and provincial leadership to fill a void of federal government inaction. Carbon pricing policies adopted by British Columbia and Quebec and a coal-power phaseout by Ontario were possible only through decentralized authority. The benefit of those provinces’ actions was muted, however, by a lack of uptake by other provinces. The Canadian federation gave rise to innovation without diffusion and leaders without followers. Reductions achieved by provincial leaders were overwhelmed by emissions growth from fossil-fuel producing provinces. As observed by Weaver (Reference Weaver2020), a laboratory of democracy dynamic rests on shared values and/or common political incentives, neither of which was present as Canadian provinces confronted climate change. The diversity of regional economic interests ensured sustained provincial opposition to climate mitigation among the provinces expecting the greatest costs. That opposition was amplified by an informal institution of federal–provincial consensus that allowed carbon-intensive provinces to veto federal action.

More ambitious climate policies since 2015 were the result of a strong federal commitment to climate action and willingness to reject the norm of intergovernmental consensus. Anticipation of federal action contributed to stronger action by a newly elected Alberta government in 2015. Thereafter, a unilateral federal benchmark was critical to federal–provincial agreement on a collaborative pan-Canadian plan in 2016. The federal government’s follow through on that threat was necessary in 2019 when a subset of provincial governments reneged on prior commitments. Contrary to McDonald’s characterization of federal unilateralism as ‘inept diplomacy’ that ‘needlessly antagonized provinces’ (2020), belated progress in Canadian climate policy has turned on what Gordon has called the ‘firm hand’ of federal coercion, rather than the ‘handshake’ of federal–provincial cooperation (2015). The benefits of the federal government’s rejection of a long-standing norm of intergovernmental consensus are a reminder that cooperation in a federation is not the end in and of itself and, indeed, can undermine policymaking in the national interest.

If federalism exacerbated already significant obstacles to effective climate policy in Canada from 1990 to 2015, what about the period since 2016? One can argue that the foundation laid by carbon pricing policies already adopted by the four most populous provinces made it easier for the federal Liberals to propose a national carbon price in 2015. However, a decentralized approach yielded a patchwork of inconsistent policies and an ambition gap in carbon tax provinces, predicated on approval of a new pipeline. One of the challenges of studying the impact of federalism is determining the counterfactual (Weaver Reference Weaver2020): what might the Trudeau government have done in 2015 in a unitary system? Perhaps the incremental process of regional buy-in was a politically necessary step towards stronger federal commitments in 2020 and 2021. Then again, in a unitary state the government of Canada might have adopted more ambitious and consistent climate policies decades earlier.