In an intriguing speech recorded by Josephus, Nicolaus of Damascus, the court historian of Herod, successfully advocated before the emperor Augustus’s son-in-law Marcus Agrippa for the protection of the rights of Judaeans to engage in transactions with God.Footnote 1 Although the speech itself may not be historically reliable, its claim that the economics of Judaeans’ ancestral worship (thrēskeia, eusebeia) operated according to the same rules as, and thus deserved the same protections as, Graeco-Roman forms of worship is revealing. In particular, Nicolaus argues that the money that Judaeans in Ionia transferred to the Jerusalem Temple was sacred money given to the god through piety just like transactions made by worshippers at Graeco-Roman temples. While there were some differences between the economics of worship at the Jerusalem Temple and other provincial temples, such as the diminutive role of euergetism and the participation of lay individuals in Jerusalem’s sacrifices,Footnote 2 Nicolaus was correct that the Jerusalem Temple was as much an economic organization as any polytheistic temple of the Roman East.

Like at other major urban temples in the eastern provinces and client-kingdoms, the priestly elites who controlled the Jerusalem Temple were instrumental in the economic and cultural integration of Palestine into the Roman Empire as well as the continuation of Judaeans’ indigenous religious traditions. As agents of God and brokers of the sacred, Jerusalem’s priestly elites were self-interested in maintaining traditional Judaean worship but also in increasing their own wealth and power. Through their progressively political positions within one of Jerusalem’s foremost economic organizations (the Temple cult), Judaean priestly elites played a part in specifying property rights, reducing their own transaction costs, and attaining profits from other worshippers’ transaction costs. They often derived divine support for their positions within Judaean society through particular interpretations of the Torah – that is, by harnessing ideological power.

This chapter investigates Jerusalem’s economy of the sacred as a site of elite power in provincial incorporation. “Economy of the sacred” is a term Beate Dignas has used to encompass a wide variety of economic activities associated with gods, temples, and worship practices. The economy of the sacred refers broadly to the interdependence of religious and economic activities in particular social contexts and more specifically to institutions that were identified as sacred (hiera) and were thus distinguished in various ways from other municipal, provincial, and imperial institutions.Footnote 3

Jerusalem’s priestly elites achieved greater political and ideological power within the city’s economy of the sacred through their enfranchisement in civic offices. The economic power of priestly elites increased as urban development in Jerusalem and Herod’s monumentalization of the Temple transformed Jerusalem into a robust pilgrimage city. Nevertheless, the institutional framework of the two primary sources of the wealth of priestly elites within the economy of the sacred – tithes and Temple taxes – did not change between the Hasmonean and Early Roman periods.

Religion and Economics in the Roman East

The Jerusalem Temple was unique in the Graeco-Roman world because it was the only place that most Judaeans publicly engaged in the worship of their one God through sacrificial rituals (although some Judaeans also worshipped at the rival temple in Leontopolis, Egypt). As an economic institution, however, the Jerusalem Temple did not differ significantly from the polytheistic temples in the urban centers of the Roman East.Footnote 4 Like these temples, the Jerusalem Temple received and stored sacred funds, distributed sacred land, and stimulated and regulated forms of commerce. And like these temples, the Jerusalem Temple was controlled by an organization of priestly elites who had disproportionate power in negotiating cultural change under the pressures of provincial incorporation. A brief investigation into institutional and organizational changes at two other famous urban temples – the temples of Artemis at Ephesos and Bel at Palmyra – illuminates the inseparability of religious and economic aspects of worship that also characterized the Jerusalem Temple.

What is often thought of as religion in modern scholarship was in antiquity inseparable from other aspects of ancient life, including economic behavior. As Anthony Saldarini pointed out, the modern notions of the separation of church and state and the individualistic and personal orientation of religion, among other things, were nonexistent in antiquity. In his words, “Religious belief and practice were part of the family, ethnic and territorial groups into which people were born. People did not choose their religion, nor did most social units or groups have members with different religions. Religion was integral to everything else and inseparable from it.”Footnote 5 Thus, there was no such thing as the “Jewish religion” or “Christian religion” in antiquity. As social entities, what scholars tend to describe as religions were considered ethnic groups, philosophies, cults, or voluntary associations in the ancient Mediterranean world.Footnote 6 The practices that scholars identify under the rubric of religion were often identified as “cultic acts” or “worship” (in Greek: thrēskeia, eusebeia, latreia, deisidaimonia, etc.).Footnote 7 In public urban settings, worship practices usually revolved around blood sacrifice and thus entailed processes of animal supply and demand, of production and consumption.

Much like primitivists have argued that we should not discuss the economy as a discrete sphere of activity in antiquity, some religion scholars have made the same claim about religion. Brent Nongbri has even observed a slippage in scholarly discourse: religion is often recognized as “embedded” but is then portrayed as an isolated domain nevertheless – as “embedded religion.”Footnote 8 Nongbri suggests that the category of religion should only be used in explicitly “redescriptive” analysis.Footnote 9 I share Nongbri’s reservations but am less optimistic about the prospect of distinguishing “descriptive” and “redescriptive” modes of analysis. It would be misleading to inject the terms religion and economy into translations of ancient texts, but it is also disingenuous to expect that historians can engage in descriptive analysis that is not shaped by modern questions, categories, and discourses.Footnote 10

The value of scholarship that problematizes ancient religion is that it illuminates the interdependence of religious ideologies and practices on other aspects of social identity and behavior in the Graeco-Roman world.Footnote 11 For the purposes of this study, I am more concerned with emphasizing the indivisibility of religious and economic practices and values than in circumventing the terms religion and economy and their cognates. Focusing on organizations, institutions, and the practices of social actors provides a historiographical frame of reference that does not rely as heavily on the isolated and essentializing categories of religion and economy but instead stresses the multiple and multiplicative bases of the dispositions and motives of social actors. Thus, the Jerusalem Temple was an institution of social intercourse, worship, and exchange that was controlled by a politically powerful organization of priestly elites. It should be understood as a social, cultural, religious, economic, ethnic, and political center even though no ancient Judaean would have described God’s one and only sanctuary in precisely these terms.

In his classic essays on the political power of priestly elites, Richard Gordon called attention to the ways that temple cults naturalized socioeconomic inequalities and facilitated provincial integration. Gordon described the “Romanization of religion” with special reference to the political enfranchisement of priestly elites in the Roman imperial state: “Very generally, we may say that the high priests were understood to be dynasts to be rewarded or punished as they served the interests of Rome, and all eventually turned into magistrates of the usual Graeco-Roman kind: high priesthoods became annual and were opened to the local aristocracy.”Footnote 12 By empowering indigenous priestly elites, Rome sought to preclude these local authorities from fomenting resistance among provincials. With the institutional support of the imperial state, priestly elites thus negotiated the forms and degrees of cultural change, simultaneously preserving traditional institutions and shifting them to suit their own interests.

The Temple of Artemis at Ephesos (Artemision), a wonder of the ancient world, serves as an excellent case study for path-dependent institutional change at major urban temples in the early stages of Roman incorporation.Footnote 13 Rebuilt several times since its original construction in the Bronze Age, its Hellenistic and Roman reconstructions preserved the plan and some of the decorative schemas of the Archaic temple. Following the annexation of Asia in 133 BCE and especially after Augustus’s naming of the city as the capital of the province ca. 29 BCE, the cult of this ancient Graeco-Anatolian goddess surged in political and economic power.

Literary and epigraphic sources indicate that the Temple of Artemis was one of the foremost economic institutions in the Roman East. Wealthy citizens of Asia and the empire deposited funds at the Temple and the Temple also issued substantial loans on which it collected interest.Footnote 14 Elites donated funds and goods to the Temple and designated the goddess as heiress in their wills.Footnote 15 Additionally, Artemis owned estates well outside of the city including vineyards that produced sacred wine, quarries, pastures, and salt-pans.Footnote 16 She also owned sacred herds, profited from some tolls on the fishing industry, and was paid fines by individuals who broke certain laws.Footnote 17 Among the many different officials involved in the cult of Artemis, there were special agents tasked with regulating financial transactions as well as a gerousia that oversaw their work.Footnote 18 Due to its fame, the Temple of Artemis also stimulated a tourist industry that figures prominently in Paul’s confrontation with the Ephesians in Acts of the Apostles (19:23–41): an association of silversmiths profited from selling miniature shrines of Artemis to pilgrims.Footnote 19 For all of these reasons, Thomas Broughton labeled the Temple of Artemis “the biggest bank in Asia.”Footnote 20 While the temple had economic functions in earlier periods, the economic power of Artemis and her agents became extensive under the Principate.

The institutional structure of the cult of Artemis changed in two particularly important ways in the imperial era. First, the leaders of the cult took on civic offices and responsibilities and were recognized by the emperors as local and provincial authorities. Inscriptions from this period show that these priests of Artemis started to broadcast their loyalty to the empire in inscriptions a generation before there was a provincial imperial cult temple in the city. Moreover, the Kouretes were relocated from the Temple of Artemis to the city’s prytaneion under Augustus and started to be named as bouleutai (city councilors) in the first century CE.Footnote 21 Thus, these officiants of the Ephesian Artemis were increasingly politicized during the course of the first century. Some ancient sources emphasize that temple treasuries in general, and the treasury of the Artemis cult in particular, were kept separate from civic funds.Footnote 22 It is doubtful, however, that this ideal was upheld in practice. At the most, private funds deposited in the temple were the only funds that the cult personnel did not appropriate for their own portions or for cultic or civic expenses.Footnote 23 A decree of Paullus Fabius Persicus, the proconsul of Asia in 44 CE, indicates that the Artemision’s resources had been depleted due to the self-interest of magistrates who sold priesthoods to unworthy men who were seeking to harness power through the pretense of representing the goddess – probably a critique of nouveau riche public slaves and freedpersons.Footnote 24

Second, emperor worship became intertwined with Artemis devotion not only at the temple but throughout the city. This started to happen decades before the city received its first official imperial cult temple towards the end of the first century CE.Footnote 25 In 11 CE, for instance, the city’s Basilike Stoa was dedicated to Artemis, Augustus, Tiberius, and the city of Ephesos.Footnote 26 Guy Rogers has noted that, in the mid first century CE, the cult of Artemis became reorganized in such a way that a leading contingent of its officiants, the Kouretes, started to take the title philosebastoi, or devoted to the Roman emperors.Footnote 27 In the 50s CE, coins circulated in Ephesos that celebrated the marriage of Claudius and Agrippina as a marriage of the gods, or theogamia, on the obverse, while portraying the cultic statue of the Ephesian Artemis on the reverse.Footnote 28 Sometime between the early and mid first century CE, then, the worship of the Ephesian Artemis and the Roman emperors quite literally became two sides of the same coin.

Another instructive case study on the impact of provincial incorporation on the sacred economics of urban temples is the Temple of Bel at Palmyra. A cult of Bel was established in Palmyra by 44 BCE, but it is likely that the Hellenistic temple beneath the Roman period Temple of Bel was also dedicated (at least in part) to the worship of Bel.Footnote 29 Construction of the Roman period Temple of Bel, which was at least partially funded by wealthy Palmyrene and Greek traders (emporoi), had begun by 17/19 CE and was still ongoing in 108 CE.Footnote 30 According to an inscription from 44/45 CE, the temple was consecrated in 32 CE, probably about fifteen years after the city was formally incorporated into the Roman Empire.Footnote 31 The inscription names the gods of the temple as Bel (the Babylonian god) and his two attendants, the local Palmyrene sun god Yarhibol and moon god Aglibol.Footnote 32 Eventually, however, the whole temple complex was more exclusively identified as the “house of Bel” (Pal. bt bl; Gk. hieron tou bēlou).Footnote 33

Like the Kouretes at Ephesos, the priestly elites of Bel became more involved in politics over the course of the Roman period. Some of the priesthoods at Palmyra were apparently hereditary; the Bene Komare, or “sons of priests,” was one of the most important tribes in the city and cooperated with other tribes and traders to finance and construct the Temple of Bel.Footnote 34 Funerary reliefs and inscriptions point to the wealth and power of priestly elites in Palmyrene society.Footnote 35 Some inscriptions show that priests of Bel took on a number of civic offices. An inscription from 267 CE names the priest Septimius Verodes (Worod), for instance, as epitropos of the emperor, ducenarius, law-giver of the colonial metropolis, duumvir, and aedilis (market overseer), and also recognizes his munificence in escorting caravans at his own expense.Footnote 36 While this inscription may reflect a combination of civic offices that was enjoyed by some priestly elites only in a later period, it is clear that the high priests of Bel played some role in politics, and hence in controlling Palmyra’s immense trade, in the Early Roman period.

The chief priest (archiereus) of Bel was also known as the symposiarchos, the president of the confraternity (Pal. mrzḥ) of the priests of Bel.Footnote 37 The priests of Bel regularly gathered for sacred meals, which probably also had ritual components. Tesserae that served as invitations to the banquets thus often depict priests reclining at banquets.Footnote 38 Moreover, the rooms within the temple complex where many of these tesserae were unearthed were evidently used as banqueting halls where priestly elites and their guests would participate in a sacred meal.Footnote 39 Bel’s high priests probably lived in mansions close to the temple such as the late second- to third-century CE “patrician houses” just east of the temple.Footnote 40

Compared to the Artemision in the capital city of Asia, the Temple of Bel may not have been as closely tied to emperor worship. In fact, while there is some epigraphic evidence for an imperial cult temple at Palmyra, no traces of a new priesthood for the imperial cult have survived.Footnote 41 This makes it even more interesting that one of the only known inscriptions that betrays the presence of an imperial cult priesthood in the city indicates that a single person was both a priest of the Sebastoi and high priest of Bel in 166 CE.Footnote 42 While it is unlikely that the imperial cult played as significant of a role in Palmyra in the first century CE as it did in Ephesos, it is clear that its incorporation into civic and religious life had begun around the time that construction began on the Temple of Bel. Thus, in 18/19 CE, a legionary commander set up statues of Tiberius, his son Drusus, and his nephew Germanicus in the Temple of Bel.Footnote 43

The impact of the city council on the cult of Bel is more evident than the impact of the imperial authorities. A large ramp at the northwest corner of the temenos for leading animals into the temple for ritual slaughter leaves little doubt that blood sacrifice was one of the main activities of worship at this temple. This is noteworthy because a municipal tax-farmer (publicanus) collected taxes on sacrificial animals – taxes separate from import and export dues.Footnote 44 Ted Kaizer has suggested that the revenues from these taxes went into the city’s treasury, but he has also noted that this treasury may not have been fully distinct from the temple treasury.Footnote 45 These tax revenues were probably kept in the temple but allocated for civic projects. In addition to the animals and other offerings sacrificed at the temple, some cattle were apparently given to the temple as sacred dues.Footnote 46 Because Palmyra was an oasis in the desert and witnessed a regular flow of goods from elsewhere, the Temple of Bel may not have depended to the same degree as other large temples on sacred estates to supply its sacrificial needs.

We lack many details about the economics of worship at temples of the Roman East, but these two brief case studies should suffice to show that religious and economic practices were interdependent and indivisible. As Dignas has demonstrated, the idea that transmitting goods to (or through) a temple transformed them into the god’s property was widespread in the Hellenistic kingdoms and Rome’s eastern provinces.Footnote 47 While each temple involved distinctive institutions, most owned and distributed sacred land, received and allocated sacred money, and stimulated trade and commerce. The extent of their impact on broader trade networks is evident from what Taco Terpstra has described as “trading diasporas” in the West – that is, the presence of middlemen who facilitated trade with the East in cities like Rome and Puteoli. Terpstra has shown, for instance, that the Palmyrene temple in Rome was involved in trade with Palmyra.Footnote 48 We should suspect that diaspora synagogues played, to some degree, a similar role in facilitating trade with Judaeans in Palestine. As we will see, the collection of the Temple tax already created a flow of money from diaspora communities into Palestine. It is likely that other commodities moved through the same Judaean diasporic networks responsible for collecting the Temple tax (and Paul’s “Jerusalem collection”).

At both Ephesos and Palmyra, priestly elites gained political power in the Roman period. They became increasingly involved in civic offices and regularly defined property rights involving land and other forms of wealth, often in relation to the sacred, and accordingly sought to reduce their own transaction costs. They negotiated with Roman authorities to preserve their ancient forms of worship but only to the extent that these continued to legitimate their cultic authority and thus constitute the foundation for their political power. Like the officiants of Artemis and Bel, the priestly elites of the Jerusalem Temple formed an economic organization that facilitated imperial integration. In the early phases of Roman incorporation, Jerusalem’s priestly elites were responsible for maintaining indigenous institutions of worship while also adapting to changing imperial, provincial, and municipal institutions.

Jerusalem’s Temple Economy

Few scholars have paid much attention to the economic functions of the Jerusalem Temple in the Early Roman period because most have opted instead to explore its significance as a preeminent religious institution and theological symbol in Judaism and Christianity.Footnote 49 As a result, the Jerusalem Temple is often considered purely religious in character or is hastily characterized as the principal apparatus of imperial exploitation (i.e., “temple-state”). Both of these approaches undervalue the dynamic ways that priestly elites negotiated imperial, municipal, and traditional institutions while retaining some autonomy as an economic organization. The Jerusalem Temple was integral to the incorporation of Palestine into the Roman Empire, but it should not be reduced to an outpost of the imperial state.

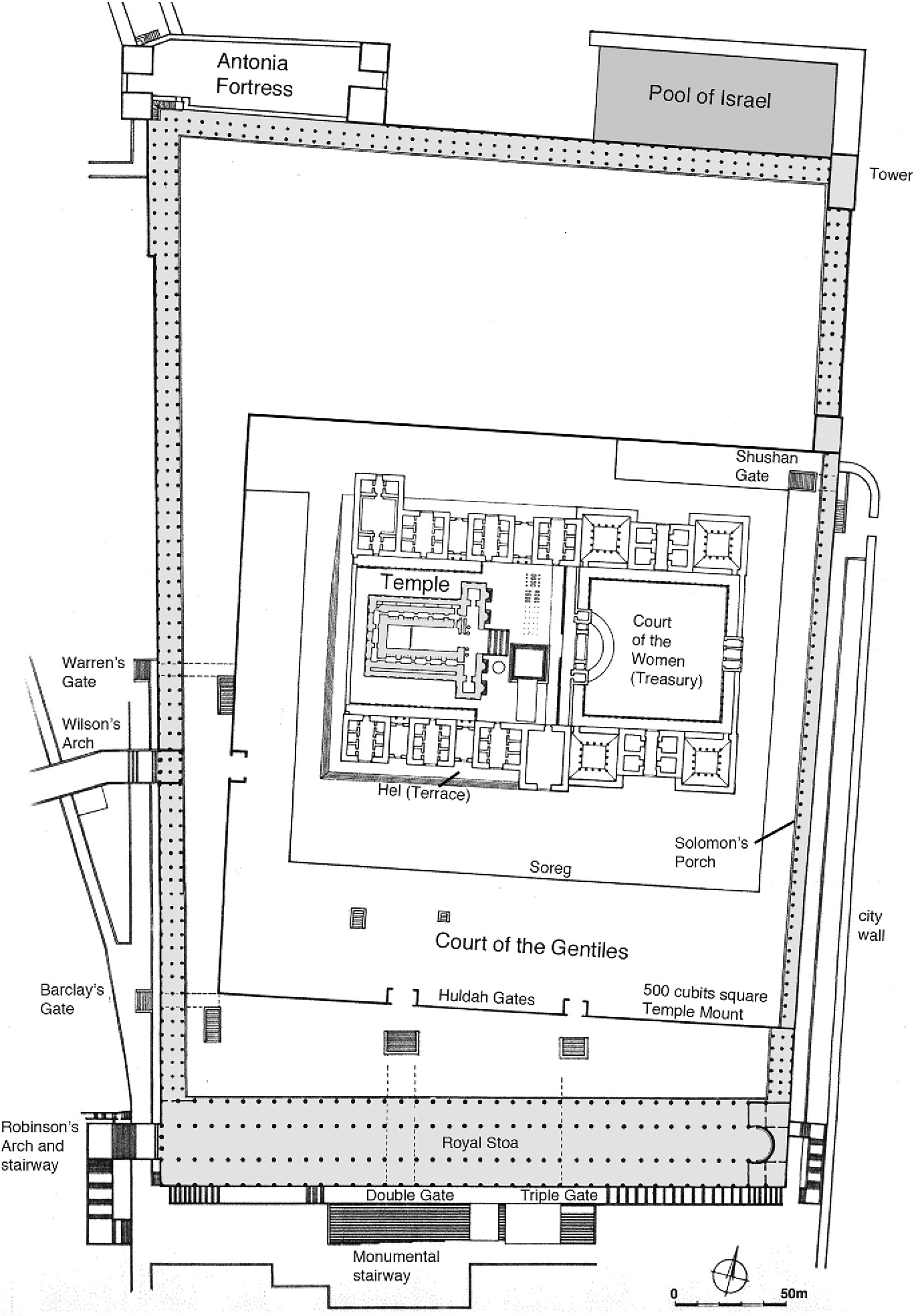

Herod’s rebuilding of the Jerusalem Temple fused Graeco-Roman architectural and decorative institutions with the Semitic characteristics of the Jerusalem Temple as defined in the scriptures (see Figure 4.1). Like the Temple of Bel, the Jerusalem Temple and its precincts were continuously under construction for nearly a century.Footnote 50 Its massive Graeco-Roman style temenos served as the agora or forum of the city, surrounded by porticoes on three sides and featuring the largest basilical hall in the East on the fourth side.Footnote 51 The Temple was thus the focal point of the social, commercial, and political center of the city.

Figure 4.1 Plan of the Herodian Temple Mount.

Whereas Herod procured the financial resources to build the Temple, private benefactors also contributed to the project as at other temples of the Roman East.Footnote 52 For instance, Nicanor of Alexandria donated a gate, Paris of Rhodes financed a pavement, and Alexander the brother of Philo donated gold and silver for the other Temple gates. Additional fragmentary inscriptions may commemorate other donations to the Temple construction.Footnote 53 While private benefactions may not have constituted the majority of the funds used for building the Jerusalem Temple, as was the case at the Temple of Bel, they betray the euergetistic interests of some wealthy Judaeans (particularly from the diaspora) in contributing to Herod’s project.

The Jerusalem Temple did not include elements of emperor worship, such as imperial statues, like many of the polytheistic temples of the Roman East. Many Judaeans were allegedly on the brink of revolt when the Syrian governor Publius Petronius sought to erect a statue of the emperor Gaius (Caligula) in the Temple as was a common practice at other temples.Footnote 54 At an earlier date, Herod’s construction of a golden eagle over the main gate of the Temple was similarly disputed by some Judaeans. Josephus suggests that the eagle was resented because it was a figural representation and hence an affront to the Judaean law, but it was more likely detested as a symbol of Roman domination and/or Herodian rule. These explanations are not mutually exclusive. In any case, it should be noted that only a small group of Judaeans seems to have contested the presence of this golden eagle, and it is unclear exactly what their motives were.Footnote 55 Details aside, there can be little doubt that statues representing Roman power and the imperial family had no place in the Jerusalem Temple.

In lieu of forms of emperor worship, the Jerusalem Temple was affected by imperial incorporation in other ways. Judaeans, for instance, showed their loyalty to the imperial state by offering daily (or twice daily) sacrifices at the Temple for the wellbeing of the emperor. These sacrifices were most likely funded by the emperor rather than the Temple cult.Footnote 56 James Rives has argued that sacrifice, as a universal practice in the ancient Mediterranean, served as a medium for imperial integration.Footnote 57 Through sacrifices for the emperor, the Jerusalem Temple acknowledged its loyalty to Rome. At the same time, the sacrifices offered by prominent Roman authorities such as Agrippa (15 BCE) and Vitellius (37 CE) at the Jerusalem Temple further underscored the political relationship between Rome and the Temple.Footnote 58 Thus, the cessation of sacrifices for the emperor played a part in provoking Rome at the outset of the First Revolt.Footnote 59

The Jerusalem Temple had been a significant economic institution in Judaean society long before Pompey first beheld its vast treasures,Footnote 60 but it amassed more wealth than ever in the Early Roman period. Most of this wealth came from Temple taxes, as we will see, but Temple functionaries also received and managed several other types of wealth. According to later rabbinic traditions, at least three permanent “treasurers” (Heb. gizbarim; Gk. gazophylakes) and seven special administrators were set in charge of the Temple’s finances.Footnote 61 Like at the Artemision, elites deposited money at the Temple for safekeeping.Footnote 62 According to Josephus, at the start of the First Revolt, Judaean elites deposited at the Temple the money they earned from selling their property. For this reason, Josephus described the Temple as “the general repository of Judaean wealth.”Footnote 63

The Jerusalem Temple also received funds for particular fines, as at the Artemision and other temples. Such a fine paid to the Temple was marked as qorban (“sacrifice,” “offering”) and put in a special qorban fund, which Josephus mentions.Footnote 64 Josephus also explains that those who wish to be relieved of a Nazirite vow, which renders them qorban to God, must make a fixed payment to the Temple treasury.Footnote 65 Several archaeological finds from the Early Roman period shed light on the payment of a qorban fine at the Temple. The first is a small limestone object that was found in the excavations in the shops along the western wall of the Temple Mount. It is inscribed qorban and incised with images of two upside-down birds. The editors of CIIP suggest that this was the handle of a stone vessel used in a sacrificial ritual involving doves at the Temple.Footnote 66 An inscription on a jar sherd from the Jewish Quarter (Area E) corroborates their assumption that a vessel would be labeled qorban: “Son of Jason, qorban. Q(orban).”Footnote 67

Another reason for considering this artifact part of a vessel is the following tannaitic tradition: “If a man found a vessel and on it was written ‘qorban,’ R. Judah says: If it was of earthenware the vessel is to be deemed unconsecrated but its contents qorban; and if it was of metal it is to be deemed qorban but its contents unconsecrated. They said to him: It is not the way of men to put what is unconsecrated into what is qorban. If a man found a vessel and on it was inscribed a qoph, this is qorban … ” (m. Maʿaś. Š. 4:10–11).Footnote 68 This later rabbinic tradition only asserts that a qorban was consecrated and could be transported in a vessel, however. It does not comment on what constitutes a qorban or its purpose. Yitzhak Magen, in fact, has argued that the size of the stone fragment inscribed with birds and the word qorban is not consistent with the handles of any known vessels.Footnote 69 Thus, this particular artifact may have had some other purpose. Magen suggests that it was used in a lottery of doves,Footnote 70 but it is more likely that it accompanied an offering paid as a fine to the Temple even if the offering was not contained in the vessel marked with this inscription.

Additional archaeological and literary evidence supports the impression that one interpretation of qorban was as a fine paid to the Temple. At least three ossuaries have been discovered whose inscriptions include the term qorban:Footnote 71

CIIP I.1 287 (Aramaic): Whatever benefit a man may derive from this ossuary (is a) qorban to God from him who is in it.

CIIP I.1 466 (Aramaic and Hebrew): Any man who derives benefit from it (this ossuary) – qorban! Any man – qorban! Q(orban).

CIIP I.1 528 (Hebrew): Ḥananiya and Shalom. Ḥananiya. Any man (who) benefits (from this ossuary) – qorban! Ḥananiya and Shalom.

Like the funerary inscriptions in Ephesos that require fines for tampering with tombs to be paid to the Artemision,Footnote 72 these ossuary inscriptions consider profits from tomb-robbing to be sacrileges against God and his Temple. As Joseph Fitzmyer explains, the qorban vow “puts a ban on something, reserving it for sacred use.”Footnote 73 While it is unlikely that a payment of qorban fines to the Temple for tomb-robbing and other offenses was enforced, it is suggestive that profitable violations against the sacred were to be dedicated to God (through the Temple) as qorban.

New Testament evidence similarly identifies the qorban as something that is devoted to the Temple as a fine for violating a qorban vow. In Mark and Matthew, Jesus condemns the practice of qorban whereby what is dedicated to the Temple as qorban is deemed more important than care for one’s parents. The assumption in this polemic against the Pharisees is that what parents take from a son’s property that was protected by a qorban (Gk. korban in Mark 7:11) vow was immediately dedicated to the Temple because of the parents’ violation of that vow.Footnote 74 The Gospel of Matthew also depicts the chief priests deciding that the money Judas rejected for betraying Jesus could not be transferred to the qorban fund because it was “blood money.” They therefore decided to buy a potter’s field for burying strangers with it instead (i.e., Akeldama).Footnote 75 Acts of the Apostles 1:18–19, on the other hand, makes no mention of qorban and has Judas purchase the field himself with the payment he received from the priestly elites.Footnote 76 It seems that Matthew invoked the qorban institution in order to underscore that the chief priests recognized their guilt in the murder of Jesus – that the money they presumably took from the Temple treasury could no longer be returned to it because of their unholy deed. In doing so, the author of Matthew advanced his purpose of portraying the Judaean authorities as avaricious hypocrites. While much remains to be learned about the economics of the qorban institution, there can be little doubt that such fines were one source of the Temple’s wealth.Footnote 77

Another source of Temple wealth was sacred land. By sacred land, I mean properties owned, administered, and/or leased out by the Jerusalem Temple cult. These properties likely received tax exemptions of some sort as at other temples of the Roman East. In his recent dissertation on sacred land in Second Temple Judaism, Benjamin Gordon has taken up this topic at length, closely examining the meager source evidence. He determined that in the late Second Temple period, the Temple owned some land, and that this was considered by some Judaeans as a violation of the scriptural ideal in which priests do not own land. Moreover, Gordon has made the convincing argument that the Jerusalem Temple probably relied less on revenues from sacred land than other temples of the Roman East; even in the first century CE, the Jerusalem Temple probably only owned modest estates.Footnote 78

Only a few literary traces exist for land owned by the Jerusalem Temple. The most explicit source is Philo, who claims that the Temple owned portions of land (apotomas gēs), but that most of its revenues came from Temple taxes. Philo, however, says nothing about the extent, location, or administration of these sacred estates. It could be that the Alexandrian elite simply assumed that the Jerusalem Temple owned land in the same way as temples in Egypt (including the Judaean temple at Leontopolis).Footnote 79 Another intriguing source is Josephus’s rewriting of the Seleucid king Demetrius I’s letter to Jonathan in 1 Maccabees 10. In the original source, Jonathan refuses the king’s dedication to the Jerusalem Temple of the revenues from the city of Ptolemais and its hinterland (10:39).Footnote 80 Josephus, however, does not mention the offer of revenues from the countryside of Ptolemais and has Demetrius set free “all those taking refuge in the Temple in Jerusalem or in any place belonging to it (ta ap autou chrēmatizonta).”Footnote 81 Josephus thus seems to acknowledge that the temple owned land, but admittedly not much information can be extracted from this statement.Footnote 82

Gordon has shown that texts among the Dead Sea Scrolls assume that the Temple owned land. The Damascus Document, likely composed in the Hasmonean period, for instance, makes noteworthy revisions to the laws of land consecrations in Leviticus 27. In particular, it views the revenues of consecrated lands as sources of the wealth of the Temple rather than funding for landless priests – a subtle but important distinction according to Gordon.Footnote 83 The later sectarian document known as the Temple Scroll also seems to assume that the priestly elites in Jerusalem inappropriately claimed the profits from sacred land. It calls for a return to scriptural ideals, admonishing that a priest “shall not crave a field, a vineyard, any wealth, a house, or any valuable thing in Israel.”Footnote 84 These scanty literary clues suggest that in the Hasmonean and Early Roman periods, priests derived some profits from land dedicated to the Temple beyond the lawful resources they were guaranteed by the Torah.

Archaeological evidence may further support the theory that the Temple owned some land in the Early Roman period. The presence of columbaria (dovecotes), for instance, points to the presence of sacred lands. Another intriguing clue is the presence of ritual baths (miqvaʾot) adjacent to agricultural installations. Lapin has suggested that these baths indicate that goods produced at these agricultural estates may have been intended for Jerusalem’s priestly consumers.Footnote 85 Due to the rapid spread of concerns for ritual purity in Palestine’s Judaean contexts in the late Second Temple period, however, it is unclear that ritual baths at agricultural compounds should be tied to priests (as Lapin admits). Even if we may assume that these sites produced goods for the Temple, it still remains a question whether the estates were owned by the Temple or private landowners who were involved in the Temple economy through contracts or liturgies.Footnote 86 While our evidence for the Temple’s estates in the Early Roman period is slim, it is clear that at least some of the offerings made at the Temple were produced on the Temple’s sacred lands.Footnote 87 Presumably, some of these plants and animals would have been used for the Temple’s mandatory sacrifices and others would have been sold to pilgrims in Jerusalem’s markets for voluntary sacrifices.

In two recent studies, Hayim Lapin has developed a sophisticated model for quantifying the economy of the Jerusalem Temple in the first century CE. Lapin’s model is based on Judaean literary and archaeological evidence but also incorporates scholarship on the Roman Empire and other agrarian societies (e.g., Mandate Palestine) on agricultural practices, demography, and GDP. The sacrificial laws from the Torah, and especially Numbers 28–9, constitute the basis for Lapin’s model. Lapin thus assumes, following Philo and Josephus, that the laws for fixed sacrifices in the Torah were observed in the Early Roman period.Footnote 88

Table 4.1 displays Lapin’s calculations of the minimum annual requirements for the Temple’s mandatory sacrifices and accompanying wine, oil, and grain offerings.

Table 4.1 Minimum Fixed Sacrifices for the Jerusalem Temple

| Sheep | Rams | Goats | Cattle | Wine (hin) | Oil (hin) | Wheat (tenth epha) | |

|---|---|---|---|---|---|---|---|

| Daily (365 × 2) | 730 | 183 | 183 | 730 | |||

| Sabbath (weekly) | 104 | 26 | 26 | 104 | |||

| New Moon (monthly) | 84 | 12 | 12 | 24 | 37 | 37 | 144 |

| Unleavened Bread/Passover (7 days) | 49 | 7 | 7 | 14 | 22 | 22 | 105 |

| Sacrifice accompanying ʿomer | 1 | 1 | 0.33 | 2 | |||

| Firstfruits/Shavuʿot | 7 | 1 | 1 | 2 | 3 | 3 | 15 |

| Trumpets | 7 | 1 | 1 | 1 | 3 | 3 | 12 |

| Atonement | 7 | 1 | 1 | 1 | 3 | 3 | 12 |

| High Priest’s Atonement Ritual | 2 | 1 | |||||

| Sukkot (7 days) | 98 | 14 | 7 | 70 | 64 | 64 | 336 |

| ʾAtseret | 7 | 1 | 1 | 1 | 3 | 3 | 12 |

| Showbread (weekly) | 1248 | ||||||

| TOTAL: | 1094 | 37 | 32 | 114 | 345 | 344.33 | 2720 |

Lapin has estimated that 7,971 hectares of land would have been required to produce the Torah’s mandatory sacrifices and offerings at the Temple.Footnote 89 The Temple cult was responsible for procuring the resources for these offerings. Temple officials also had to secure the supply of an enormous quantity of wood for the sacrificial rituals, although some individuals contributed wood offerings to the Temple.Footnote 90 It is also possible that the Temple was responsible for supplying the sacrifices for the emperor – two sheep and one bull per day – but it is more likely, as noted above, that Rome covered the expenses for these sacrifices.

In addition to the regular sacrifices paid for out of the Temple treasury, individuals personally procured the resources for other types of offerings. These voluntary offerings were made by pilgrims and were widespread at Passover in particular. Calculating the quantity of these offerings is especially difficult because such calculations depend on estimates of population size and participation within Judaea as well as among diaspora pilgrims. For 100 percent of a 600,000 person Judaean population, Lapin estimates that approximately 15,000 pairs of birds and 27,000 lambs were sacrificed.Footnote 91 These sacrifices would have cost approximately 286,000 denarii.Footnote 92

Lapin has demonstrated that between 83,330 and 158,420 hectares of land were required to supply Jerusalem with its subsistence needs as well as the Temple’s mandatory and voluntary offerings. These figures indicate that Jerusalem consumed much more than the produce of its immediate hinterland.Footnote 93 Columbaria (dovecotes) for rearing doves (columbae) for the Temple have been found in abundance in Jerusalem’s immediate environs, but they have also been found at rather considerable distances from the city.Footnote 94 There can be little doubt that the Gospels of Mark, Matthew, and John are correct in their depiction of Jesus encountering merchants selling doves in the Temple precincts. It is surprising that only John includes people selling cattle and sheep, since these must also have been sold at the Temple.Footnote 95 The stone fragment mentioned above, which depicts two dead doves, is further proof of the significance of dove sacrifices at the Temple. Zooarchaeological data from Jerusalem’s city dump suggests that doves were used for sacrifices but were not regularly eaten by Jerusalem’s residents.Footnote 96 Moreover, the majority of caprids sacrificed at the Temple came from the desert regions and thus many caprids were raised at great distances from the Temple in order to be sold to pilgrims in the city.Footnote 97

Because the Jerusalem Temple became a major center of pilgrimage for Judaeans during Herod’s reign, its economy involved much more than benefactions and offerings.Footnote 98 Again, it is impossible to be sure how many Judaeans made pilgrimage to Jerusalem and how often they did so.Footnote 99 For lodging and meals, Lapin estimates that the total annual pilgrim expenditure by Judaeans would have been between 173,704 and 347,408 denarii.Footnote 100 This tourism industry benefited Jerusalem most of all, but also brought some modest revenues to sites that served as accommodation for pilgrims on their way to Jerusalem. Once pilgrims arrived in Jerusalem, they not only spent money on accommodation and their voluntary offerings, but they also engaged in commerce. In some cases, they also engaged in currency exchange, where they faced additional transaction costs. As we will see, the Torah required that Judaeans spend their “second tithe” in Jerusalem. At least some pilgrims would have invested in souvenirs to remember their pilgrimage. These souvenirs would not have been figural representations of God like the “idol shrines” of Artemis, but rather items like stone vessels and Herodian lamps, or in some cases, more expensive luxury items. Through pilgrimage, Jerusalem’s Temple economy thus stimulated some economic and cultural integration well beyond the city’s walls.

Sacrificial rituals at the Jerusalem Temple involved less lay participation than those at other temples of the Roman East. Whereas non-priestly worshippers often played a part in making offerings and eating sacrificed meat at other temples, at the Jerusalem Temple only the priests had these privileges.Footnote 101 Notable exceptions included “peace-offerings” and the sacrifice for the festival of Passover. For Passover, groups of pilgrims dined on lambs that they had brought to, or purchased at, the Jerusalem Temple for sacrifice.Footnote 102 The majority of sacrifices, however, were fully consumed by fire. Those that were not, such as sin offerings, were consumed by priests rather than the individual who made the offering.Footnote 103 Given the scale of these offerings, a sizeable quantity of sacrificed meat must have been sold on Jerusalem’s markets with its profits going to the Temple’s priestly elites.Footnote 104

Like at the Temple of Bel, Jerusalem’s priestly elites would have had special rooms where they engaged in banquets with other elites. It is unclear, however, whether these banquets would have involved special rituals as in Palmyra. Joseph Patrich and Schlomit Weksler-Bdolah have argued that a “Banqueting Hall” building located to the west of Wilson’s Arch about 25 meters from the western wall of the Temple Mount was used for the banquets of priestly, royal, and civic elites.Footnote 105 This independent structure was built just prior to the construction of Wilson’s Arch (ca. 22 BCE) and was used until it was damaged sometime in the first century CE, perhaps by an earthquake in the 30s CE.Footnote 106 Formerly known as the “Free Mason’s Hall,” this building included two triclinia (Rooms 21 and 23) with permanent couches along the walls. These dining rooms were separated by an elaborate fountain (Room 22) whose walls were decorated with engaged pilasters crowned with Corinthian capitals from which water flowed forth. The building is located between the Temple Mount and the location of two of the most important administrative buildings in the city, the bouleutērion and “Xystus.”Footnote 107

This Banqueting Hall is a setting in which we glimpse a material representation of the growing power of priestly elites in the Early Roman period. As at other temples of the Roman East, the political influence of priestly elites in Jerusalem reached beyond the Temple. Not only were the high priests appointed by the Herodian kings and Roman governors, but some priestly elites also held municipal offices of various sorts. Families of priestly elites in Jerusalem were wealthy and owned land outside of the city, yet they still benefited from their privileged positions within Jerusalem’s economy of the sacred. It is this political enfranchisement that provoked the ire of other elites and sub-elites, such as the scribes who produced the polemical portrait of Jerusalem’s priestly elites in the Testament of Moses, a text arguably written in Greek between 6 and 30 CE but preserved only in a sixth- or seventh-century Latin palimpsest:Footnote 108

And pestilent and impious men will rule (regnabunt) over them [i.e., God’s people], who proclaim themselves to be righteous. And they will excite their wrathful souls; they will be deceitful men, self-complacent, hypocrites in all their dealings, and who love to have banquets each hour of the day, devourers, gluttons, [about seven lines missing] destroying … , who eat the goods of the poorFootnote 109 (….rum bonorum comestores), saying they do this out of compassion … destroyers, complainers, liars, hiding themselves lest they be recognized as impious, full of crime and iniquity, from sunrise to sunset saying: “Let us have luxurious seats at the table (discubitiones et luxuriam),Footnote 110 let us eat and drink. And let us act as if we are distinguished leaders.” And their hands and minds will deal with impurities, and their mouth will speak enormities, saying in addition to all this: “Keep off, do not touch me, lest you pollute me … “

While every aspect of this vitriolic condemnation should not be considered accurate, two points fit with the other evidence of the changing positions of priestly elites in the Early Roman period. The first is that priestly elites engaged in a distinctive class culture in which they competed for status. They are explicitly depicted as involved in the type of banqueting that would have taken place in the triclinia at the Banqueting Hall near the Temple Mount and in the Jerusalem mansions. The second is that these ruling men are cast as using their positions of power – they are distinguished leaders, they say they do things out of compassion, and they claim to be concerned with purity – in order to “eat the goods” of God’s people.

It is clear that the authors of the Testament of Moses viewed Jerusalem’s priestly elites as politically, ideologically, and economically powerful. The text also alludes to the sources of their wealth by denouncing them for eating the goods of the people. This line points to two sources of the wealth that priestly elites earned through their priestly status and positions within the economic organization of the Temple: the consumption of tithes and the consumption of sacrificed meat. The following sections focus on these sources of the wealth of priestly elites – both on the tithes that benefited priestly elites and the Temple taxes that priestly elites allocated to procure the plants and animals offered at the Temple. Both tithes and Temple taxes were institutions that did not change fundamentally in the Early Roman period but appeared to some Judaeans as exploitative because of the political enfranchisement and growing wealth of priestly elites.

Tithes

The priestly contingent of Palestine’s elites profited from the Judaean institutions of tithing and Temple taxation even more than from the institutions of direct and indirect taxation. Because they were not imperial or municipal taxes that directly supported the activities of the state or cities, tithes and the Temple tax should be treated as separate from the structures of direct and indirect taxation that were examined in the previous chapter. While for many Judaeans these cultic impositions were as, if not more, burdensome than state and local taxes, they were technically not obligatory and were far less standardized and regulated.

Tithes were technically distinct from the Temple’s sources of wealth because they directly benefited priests and did not go towards Temple expenditures. Nevertheless, tithes were received and administered by the same economic organization that controlled the Temple’s other finances. The institutional structure of tithing in the Early Roman period had its basis in the Torah but was beholden to a particular interpretation of the Torah that emerged in the Hasmonean period. Tithing in the Early Roman period was also path dependent on institutional changes that occurred when the Hasmoneans reorganized the Seleucid tithe. The following sections examine the development of the institution of tithing that was inherited by the priestly elites of the Early Roman period.

Conflicting Institutions in the Torah

The structure of tithing finds its basis and justification in the Torah, yet there is nothing uniform about the scriptural prescriptions. The tithe, Hebrew maʿaśer and Greek dekatē, literally refers to a payment of one-tenth of the products of the land, and it appears with various functions in ancient Near Eastern and Mediterranean states.Footnote 111 The origins of Israel’s tithing practices do not concern us here, but their codification does. This section focuses specifically on agricultural tithes because they were simultaneously the least “voluntary,” most regularly practiced, and most burdensome of the numerous offerings the sources record the priests receiving (e.g., the gifts of first fruits, heave-offerings, firstborn animals, dough, and wool).

There are two divergent – even contradictory – systems of tithing in the Torah, the Deuteronomic and that in the Holiness Legislation. Most scholars agree that Deuteronomy and the Holiness Code are independent sources that were produced in more-or-less distinctive social settings and convey dissimilar ideologies. The precise relationship between these sources remains a matter of debate, but several scholars have recently made strong arguments in favor of the view that Deuteronomy is the earlier source and served (along with the Priestly source known simply as P) as the basis for the revisionist law of the Holiness Code.Footnote 112 What matters for our purposes, however, is only that these sources were originally independent and thus have distinctive emphases that have inflected their particular prescriptions about tithes.

Tithing in Deuteronomy involves setting aside a tenth of agricultural produce in each of six years, but only a small portion of this went to the Levites and nothing was reserved for the clan of Aaronide priests. Deuteronomy 14:22–9 commands that every year, a tithe of grain, wine, and oil should be set aside. Deuteronomy calls for farmers to consume their agricultural tithes as well as the firstlings of their flocks and herds in the “place” that is in the presence of God – that is, in Jerusalem. They may sell their tithes and firstlings if the journey is too long to transport them, but then they should spend this money for whatever they desire at their destination. In the third and sixth years of the seven-year sabbatical cycle, however, these tithes should be put into storage locally and then handed over to local Levites, resident aliens, orphans, and widows (14:27–9; cf. 26:12).

The Holiness Legislation, unlike Deuteronomy, unabashedly appoints Levites and priests as the primary beneficiaries of tithing. Leviticus 27:30 declares that, “all tithes from the land, whether the seed of the ground or the fruit from the tree, are the Lord’s; they are holy to the Lord.” The longer exposition in Numbers 18:21–32 explains that all of these tithes must be given to the Levites in return for their service and because they are not allotted landed property from which to support themselves and their families. The Levites are to eat this produce wherever they wish, make their sacrifices and offerings from it, and then set aside a “tithe of a tithe” (maʿaśer min hammaʿaśer) or “heave-offering” (terumah) from this to present to the priest Aaron (Num 18:26–9). Generally, then, the priestly ordinances stipulate that all who reside in the land of Israel, which is holy and effectively leased out by God to the Israelites, should pay one tenth of their agricultural products to Levites each year except for the sabbatical (and jubilee) years – that is, 8.6 percent as an annual rate. The Levites must then hand over one-tenth of the tithes they receive to the priests. Leviticus 27:32–3 adds that domestic animals should also be tithed.

Changes under the Hasmoneans

Over the course of the Second Temple period, these conflicting scriptural injunctions were variously disputed, harmonized, or disregarded. There is not enough data available to track precisely the changing institutions of tithing during the Second Temple period, but a flurry of literary references suggests that tithing was indeed practiced by some Judaeans throughout the era. The most significant shifts in the institutions of tithing that shaped their practice in the Early Roman period transpired during the late Hellenistic period. Under the Hasmonean priest-kings, two changes occurred: a fourteen-tithe system (per sabbatical cycle) was introduced and Aaronide priests began taking the Levitical tithes.

When the Hasmoneans gained fiscal independence from the Seleucid kingdom, they reformulated the Seleucid institution of tithing in light of the scriptural traditions. The Hasmoneans made tithes a source of revenue for both the Temple and the state. Throughout their kingdom, the Seleucids collected land taxes from cities, temples, and peoples that included proportional tithes (dekatai), which often, but not necessarily, amounted to a tenth of the produce.Footnote 113 For instance, an inscription from 163 BCE mentions the Sidonians of Jamnia paying a tithe to the Seleucid king Antiochus V Eupator.Footnote 114 In addition to other agricultural taxes, Jerusalem also had to pay tithes to the Seleucids on behalf of the Judaeans.Footnote 115 As Bezalel Bar Kochva has argued, after gaining independence in 141 BCE, the Hasmoneans seem to have replaced the external Seleucid taxes with the internal “first tithes,” using much of their revenue to employ mercenaries.Footnote 116 The difference between the Seleucid and Hasmonean institutions of tithing may have been little more than ideological, especially if the Seleucid tithe was also regulated by the Temple.

In the Hasmonean era, observant Judaeans paid two tithes. The “first tithe” (maʿaśer riʾshon) was based on the Holiness Legislation and the “second tithe” (maʿaśer sheni) was based on Deuteronomy. E.P. Sanders has shown that Tobit, Josephus, and possibly Jubilees each assume a fourteen-tithe system. Judaeans paid the “first tithe” to the Levites or priests and used the “second tithe” for personal expenditure in Jerusalem six years out of the seven-year cycle (i.e., twelve tithes per seven years). In years three and six, they also paid a “third tithe” which was intended for the poor, widows, and orphans (i.e., two additional tithes per seven years for a total of fourteen tithes over seven years).Footnote 117 Since the “second tithes” were consumed by their contributors (six tithes per seven years), only eight tithes of 10 percent each were given away over a seven-year cycle, amounting to an annual burden of 13.33 percent.Footnote 118

This is similar to the rabbinic system, except that the third tithe becomes the “tithe for the poor” (maʿaśer ʿoni) and fully replaces the “second tithe” in years three and six, yielding a twelve-tithe arrangement but with the same annual rate for tithes given away.Footnote 119 The rabbis also stipulated that, prior to the separation of tithes for Levites (from which the tithe for the priests is taken), farmers must give a separate heave-offering (terumah) to the priests in the amount of somewhere between one-thirtieth and one-sixtieth depending on one’s economic stability (m. Ter. 4:3). Especially since there is no solid scriptural basis, it is doubtful that separate heave-offerings were given to priests in the Second Temple period.Footnote 120 Even the tithes of livestock, which are based on Leviticus 27:32–3, were apparently not regularly offered by most Judaeans.Footnote 121 The ambiguity of the Torah on tithes resulted in a diversity of tithing customs and even conflict over proper procedure. Jesus’s indictment of the Pharisees in Q 11:42 for tithing mint, dill, and cumin is one example of such a dispute.

Aside from the types, amounts, and frequency of tithes, Judaeans also contested whether the beneficiaries of the “first tithe” should be Levites or priests. As early as Ezra-Nehemiah, priests are found closely supervising Levites as they collected tithes. The Levites even deserted their Temple duties at one point, retreating to their fields in protest because they did not receive their portion of the tithes (Neh 13:4–13).Footnote 122 By the Hellenistic period, the majority of references to tithes list their recipients as “priests and Levites” or just “priests.”Footnote 123 Because tannaitic sources credit “Yoḥanan the high priest,” presumably referring to John Hyrcanus I (but possibly to Hyrcanus II), with doing away with the avowal “I have given it to the Levites” (Deut 26:13), it has become conventional to assume that the Hasmoneans were responsible for arrogating the Levites’ tithes for the priests.Footnote 124 Udoh has pointed out, however, that scholars have marshaled from these sources incompatible theories of the purpose and conditions of this reappropriation.Footnote 125 Did the Hasmoneans reroute “first tithes” to themselves (i.e., the state coffers), or to all of the priests? Was the change a reaction to priests taking tithes or the introduction of this practice? The late rabbinic sources are unable to answer these fundamental questions.

In any case, “first tithes” were evidently a priestly prerogative by at least the Hasmonean era. Scholars who have not opted for a version of the Hasmonean appropriation hypothesis have gone to great lengths to explain away the literary references to priests receiving tithes. Joseph Baumgarten, for instance, has argued that the terms for tithe (maʿaśer/dekatē) maintained their fundamental meaning of one-tenth of produce for Levites but also started to be used in a general sense to refer to heave-offerings and other offerings given to priests.Footnote 126 Thus, the terminology became more general, but scriptural law remained the rule. Udoh has mostly followed Baumgarten on the terminology, but he concluded instead that both priests and Levites received tithes in their hometowns throughout the Second Temple period and that no priestly appropriation occurred.Footnote 127

Udoh is right to problematize the idea of a dramatic alteration in tithing under the Hasmoneans, but he has overlooked two significant issues. First, Caesar’s decree of 47 BCE explicitly restores the authority of Hyrcanus and his sons to receive and administer tithes. For Udoh, this does not imply that the Hasmoneans had appropriated tithes but only that through Hyrcanus’s position as head of the Temple-state, Caesar confirmed the traditional practice of tithing to Levites and priests.Footnote 128 Yet, the language of the decree explicitly returns to Hyrcanus and his sons a privilege that they formerly enjoyed: “they shall also pay the tithes to Hyrcanus and his sons, which they also paid to their forefathers.”Footnote 129 That Caesar’s decrees intended to recognize not only Hyrcanus’s supervisory power over tithing but also the authority and privileges specific to the priesthood of which Hyrcanus was a part is evident in the previous decree: “Gaius Caesar … has granted that both [Hyrcanus] and his sons shall be high priests and priests of Jerusalem and of their nation with the same rights and under the same regulations as those under which their forefathers uninterruptedly held the office of high priest.”Footnote 130

These decrees conceptualize tithes as the property of “Hyrcanus and his sons” – a circumlocution for the “high priests and priests of Jerusalem,” who are connected by office and genealogy to their forefathers.Footnote 131 It is plausible that the decrees, because they represent an outside perspective, overlooked differences between the priestly orders or employed dekatai broadly as “offerings.” But it is difficult to accept that these decrees entirely mistook the position of the Hasmonean priests as beneficiaries of ample revenue from the people on the basis of their office and lineage, particularly considering that Caesar’s decrees are concerned on the whole with establishing an official balance sheet between Hyrcanus II and Caesar for Judaea’s finances. The implication is not that the Hasmoneans took over the administration of tithing but that, by virtue of their position, the high priests had always personally profited from tithes. The decrees do not clarify whether the Hasmoneans apportioned part of the tithes they collected for initiatives not related to the Temple, but it stands to reason that they did.

Second, Udoh’s explanation that Levites and priests shared rights to tithes assumes that there was a lower order of priests who self-identified as Levites throughout the Second Temple period, but this is not so clear. Levites are nowhere to be found outside of literary, often polemical, constructions in the Hellenistic and Early Roman periods. In the New Testament, for instance, the Levite in Luke’s Good Samaritan parable appears along with a priest as reluctant to help a person who may convey impurity (10:32) – a theological device in a story navigating the nexus of halakhah on priestly purity and neighbor-love.Footnote 132 In John, Levites appear once in unison with priests as representatives of “the Judaeans” (1:19) while Hebrews asserts that Jesus as high priest brought to perfection what the Levites could not (7:1–28). Furthermore, Acts of the Apostles 4:36 describes the Cypriot Barnabas as a Levite who owned land. Here again, Luke may characterize a Levite as owning land, contradicting the Torah, in order to cast his selling of the land to support the apostles as symbolic of covenant restoration.Footnote 133 Aside from these references,Footnote 134 Levi and Levites are invoked in texts such as the Aramaic Levi Document, Jubilees, the Testament of Moses, and the sectarian literature from Qumran to critique the current Temple priests and articulate a priestly identity separate from them.Footnote 135 Levites are nowhere to be found in the Maccabean books.

The only time Josephus mentions Levites separately from priests outside of his rewriting of the scriptures is when the Levites sought and received the approval of Agrippa II and the synedrion to wear the same linen garments that priests wear.Footnote 136 “Levites” here is a metonym for those priests who were “singers of hymns” (hymnōdoi) at the Temple. To be sure, Josephus conveys with this incident his elitist contempt that those priests he deemed socially inferior would wear the same garments as he and his colleagues wear, but he only labels them as Levites in order to invoke the Torah as evidence that special garments should be reserved for priests of his own stature. The story itself suggests the opposite, that priests responsible for more remedial tasks in the Temple worship were self-identifying not as Levites but as priests.

Levites are also absent from the Early Roman epigraphic record. This absence is striking since the title “priest” often appears on ossuaries. Moreover, it is suggestive that a priest and not a Levite appears to be the recipient of a tithe according to a curious ostracon from Masada inscribed maʿeśar kohen (“the priest’s tithe/tenth”).Footnote 137

Altogether, it is difficult to escape Cana Werman’s conclusion that “there were no Levites in the Second Temple period.”Footnote 138 The only descendants of Levi were the Aaronide/Zadokite priests. Even if some Judaeans claimed lineage through Levi that was distinct from Aaronide descent, this was not the basis for an entire social order within the priesthood. Especially because the Torah mandates that Levites receive tithes, which involved a great deal of revenue, it is remarkable that our Hellenistic and Early Roman sources almost never portray Levites acting apart from priests. Whenever the title Levite was invoked or elevated, this figure performed some sort of halakhic, polemical, or functional distinction from priests, but there was no organized order of Levites that self-identified as inferior to priests.Footnote 139 Thus, Udoh’s conclusion that tithes were given on an individual basis to Levites or priests as a person saw fit may be too quick to accept that Levites were a concrete part of the social fabric of Palestine. On the contrary, priests alone received tithes because there were no socially distinct Levites.

Tithing in the Early Roman Period

As the beneficiaries of tithes, the position of priests within the institutional structure of tithing remained relatively unchanged with the beginning of the Early Roman period. That Caesar guaranteed Hyrcanus II’s role in the administration of tithes does not imply that tithes were not offered in Pompey’s wake but only that they did not systematically benefit the state as they had when the Hasmonean rulers had political autonomy. Under Herod, tithes still enhanced the power and wealth of the priestly elites, but now the leading priestly families were empowered by and loyal to Herod. There is, however, no indication that the Herods appropriated any of the revenue from tithes.

Instead, the repositioning of priestly elites within the institutional structures of taxation and land tenancy in the period between Herod and the Temple destruction rendered tithes unnecessary and ostensibly exploitative in the opinion of certain critics. Flaunting his wealth and magnanimity, Josephus crows in his Vita that, “I scorned all presents offered to me as having no use for them. I even declined to accept from those who brought them the tithes, which were due to me as a priest.”Footnote 140 Just earlier in this work Josephus relates that some of his fellow priestly elites, who joined Josephus in procuring the support of the boulē of Tiberias for demolishing the palace of Antipas, had “amassed a large sum of money from the tithes which they accepted as their priestly due” (63). It was not from the tithes alone that these priests became wealthy, for these influential priests were undoubtedly landowners like Josephus himself.

For the people tithing, little would have changed in the Early Roman period in terms of the amount of the tithes or their beneficiaries and collection. As in earlier eras, priests primarily collected first tithes at the Jerusalem Temple and deposited them in central storage facilities there, but they must also have engaged in some local collection by making use of storehouses in cities and villages.Footnote 141 From the storehouses in Jerusalem and presumably elsewhere, tithes were doled out to priests, who would have consumed some of their portion and sold any surplus through local markets. Judaeans practiced tithing across the geopolitical divisions of Eretz Israel, including in the Galilee,Footnote 142 but it is doubtful that diaspora communities sent some form of tithes to Jerusalem in addition to the Temple tax.Footnote 143

Since tithing was technically a voluntary obligation of the Temple, not the state, it is safe to assume that not all Judaeans tithed.Footnote 144 However, in the run-up to the First Revolt, Josephus reports that,

Now the high priest Ananias daily advanced greatly in reputation and was splendidly rewarded by the goodwill and esteem of the citizens; for he was able to supply them with wealth. At any rate, he daily paid court with gifts to Albinus and the high priest [Jesus]. But Ananias had servants who were utter rascals and who, combining operations with the most reckless men, would go to the threshing floors and take by force the tithes of the priests (tas tōn hiereōn dekatas); nor did they refrain from beating those who refused to give. The high priests were guilty of the same practices as his slaves, and no one could stop them. So it happened at that time that those of the priests who in olden days were maintained by the tithes now starved to death.Footnote 145

Although we should be skeptical of Josephus’s claim that some priests died because of the cupidity of Jerusalem’s priestly elites, it is indeed plausible that there were less wealthy (though not destitute) priests who were not given their fair share by the priestly elites of Jerusalem.Footnote 146 Perhaps this situation is best understood as specific to the economic circumstances leading up to the revolt; yet Palestinian amoraic sources purport to preserve a similar situation in which certain priests took tithes by force in the Hasmonean era.Footnote 147

At any time, there were likely to have been more powerful priests who sought out a greater portion of the tithes to the detriment of other priests. Josephus’s detail that the high priests’ slaves – perhaps the same slaves who collected certain direct and indirect taxes for the priestly elites – took the tithes belonging to the priests “by force” indicates that this violence was directed against those who produced the tithes at local threshing floors before the produce was transmitted to local priests. This violent economic relationship may not have been the norm, but it demonstrates that tithing was often more than a voluntary halakhic duty for Judaeans.

As institutions that sustained socioeconomic inequalities under the rubric of divine mandates, tithes required all farmers to transfer a considerable portion of their products – a total of 8.6 percent annually for “first tithes” – to those who could not abandon the worship of God to afford their own subsistence. But the Torah made no provision for what to do if priests became wealthy through land tenancy and taxation and thus did not actually rely on tithes. Therefore, tithing continued through the Early Roman period and beyond. As with the Roman land tribute, those particularly burdened by tithing were smallholders and tenants. Non-priestly large-scale landowners in sharecropping arrangements took a hit, since tithes were separated before the landowner and tenant split their portions. Landowners who leased their land through fixed rent contracts shouldered less of the burden since fixed-rent tenants usually paid the tithes; yet allowances for tithing constrained the amount of rent they could exact from their tenants. As Michael Satlow has detected, tithing gave priestly landowners a significant economic advantage over other landowners since their land was not only tithe-exempt, but they were eligible to receive tithes from others despite their own holdings. A theoretical check on this system, however, was that the more land priests owned, the less tithes they received.Footnote 148

Tithes seem to have always been institutions of inequality that facilitated the transfer of resources to a politically influential minority. These tithes, however, were ideologically construed as institutions of equality that gave priests access to those resources they forfeited in order to preside over the Temple worship on behalf of the people. Once priestly elites gained greater power as the beneficiaries of the institutions of the polis, land tenancy, direct taxation, and indirect taxation, however, the continued collection, or even forceful exaction, of tithes only widened the inequality gap. Temple and Torah were the sources of authority that facilitated this unequal economic relation.

The Temple Tax

The payment of an annual half-sheqel Temple tax by Judaeans in the homeland and diaspora emerged relatively late, towards the middle or end of the Hasmonean period. In this way, it differs from the other institutions analyzed thus far.Footnote 149 This did not stop its priestly beneficiaries, however, from interpreting it as an obligatory payment of sacred money to support the ancient and divinely mandated worship at the Temple.

The Temple tax was a Hasmonean innovation of an earlier practice referenced in the Torah and other sources. Its earliest mention is in Exodus 30:13: “This is what each one who is registered shall give: a half-sheqel according to the sheqel of the sanctuary (the sheqel is twenty gerahs), a half-sheqel as an offering to the Lord.”Footnote 150 In connection with a (military) census of the Israelites in the wilderness, this tax’s explicit intent was to be “a ransom for their lives to the Lord, so that no plague may come upon them for being registered” (Exod 30:12). It should be paid once-for-life by each of the “children of Israel,” regardless of whether they are poor or rich (Exod 30:15). In the early Second Temple period, a version of this tax was collected for the maintenance of the Temple, but its rate was one-third of a sheqel and it was an annual (bashanah) tax “for the service of the house of our God” according to the prescriptive testimony of Nehemiah (Neh 10:32 [LXX 10:33]).Footnote 151

The Temple tax is not mentioned again in our sources until Cicero discusses it at the very beginning of the Early Roman period. In Cicero’s words, “It was the practice each year to send gold to Jerusalem on the Judaeans’ account from Italy and all our provinces, but Flaccus issued an edict forbidding its export from Asia” (Flac. 28.67). After referring to this edict issued by his client L. Valerius Flaccus in 62 BCE as proconsul of Asia, Cicero goes on to describe all of the gold Pompey observed but did not plunder when he entered the Temple in 63 BCE, implying that this gold was exported from Italy and the provinces to the Temple.Footnote 152 The hefty sum of gold sent by the Asian Judaean communities, which Cicero reports was confiscated in several assize-cities (Flac. 28.68–9), may not have been just the usual Temple taxes but rather an emergency fund gathered in response to the news of Pompey’s subjugation of Palestine.Footnote 153

There are, however, several reasons to conclude that Cicero was referring to Temple taxes. Cicero presumes a connection between the gold of the diaspora communities and the gold Pompey witnessed in the Temple. He also specifies that Judaeans were accustomed to sending money on an annual basis (quotannis). Additionally, Strabo comments that Mithridates captured 800 talents of gold that Judaeans from Egypt (or Asia, according to Josephus) had stored in Cos in 88 BCE, insinuating that it too was in transit to the Temple.Footnote 154 These references betray the financial interest of diaspora Judaeans in the Temple prior to 63 BCE, and Cicero’s understanding of the transaction as an annual practice points distinctly to the Temple tax, even if the 62 BCE transfer was a special instance.

Further corroboration that the Temple tax was collected in the Hasmonean period is the implicit rejection of the tax in several of the Qumran documents, which follow the Torah in considering the tax a once-for-life payment. As Jodi Magness has argued, those in the Qumran community (and their associates outside Qumran) likely paid a once-for-life Temple tax upon becoming initiated into the community, or “registering” therein.Footnote 155 Prior to Pompey’s conquest, probably as a Hasmonean initiative, a half-sheqel started to be collected annually from all Judaeans.Footnote 156

The cost of the Temple tax in the Early Roman period was half of a sheqel, or 2 Attic drachmae/Roman denarii, for each non-priestly male Judaean over the age of 20 per year (Exod 30:14).Footnote 157 The majority of information that has survived regarding the logistics of this institution comes from Mishnah Šeqalim. Although recorded a century and a half after the Temple destruction, this tractate contains many details that may have plausibly characterized the Second Temple practice.Footnote 158 According to this source, the Temple tax was paid in one of three ways: personally at the Temple (particularly during the pilgrimage festivals) (3:2), through a messenger (2:2), or as a communal collection (especially for Judaeans living far from Jerusalem, like the community of Asia) (2:1). Philo of Alexandria similarly noted in the early first century CE that representatives called hieropompoi were tasked with transmitting the Temple taxes of diaspora communities (among other offerings) to the Jerusalem Temple.Footnote 159

According to Mishnah Šeqalim, the tax was used by the Temple priests to purchase animals for public sacrifices and goods for other types of offerings (1:1; 4:1). It could also be used for broadly defined infrastructural development to prepare Jerusalem for the influx of pilgrims during festivals. This included preparing miqvaʾot and marking trench graves (so as to prevent pilgrims from walking over them) as well as maintaining roads, the aqueduct, city-walls and towers, and supporting other Temple-related and municipal projects (1:1; 4:1–5).Footnote 160 Josephus mentions, for instance, that Temple funds were used to initiate a street paving project after the Temple construction had been completed.Footnote 161 He also notes that, at the time of the First Revolt, the Temple’s foundations were being repaired using cedars imported from Lebanon.Footnote 162 Jerusalem’s urban development was thus partially funded by this cultic tax, and Jerusalem’s priestly elites (and probably also the Herods to some degree) had control over how these funds were deployed.

The control of the Temple’s priestly elites over the funds from the Temple taxes was not, however, always respected by the Romans. As governor of Syria, Marcus Licinius Crassus, for instance, expropriated 2,000 talents from the Temple in 54 BCE to pay for his Parthian campaign.Footnote 163 Similarly, the Syrian governor Varus’s financial procurator Sabinus took 400 talents from the Temple treasury during the unrest following the death of Herod in 4 BCE.Footnote 164 The prefect Pontius Pilatus drew on the Temple’s qorban fund to build an aqueduct, reportedly causing much discontent.Footnote 165 And on the brink of the First Revolt, Florus took 17 talents from the Temple funds to fulfill the “requirements of Caesar.”Footnote 166 While the priestly elites technically controlled the revenues from the Temple taxes, the Roman provincial authorities in some instances also appropriated these funds for their own projects. It seems, however, that these were exceptional events and that the Roman governors were not regularly interfering with the revenues from the Temple taxes.

Donald Ariel and Jean-Philippe Fontanille have contested the widespread scholarly assumption that the Temple tax had to be paid in Tyrian sheqels. They have noted that Mishnah Šeqalim nowhere says that the Temple tax had to be paid in silver Tyrian coinage. The rabbinic source that may make this connection is Tosefta Ketubbot: “Silver mentioned in the Pentateuch is always Tyrian silver: What is Tyrian silver? It is Jerusalemite” (13:20).Footnote 167 But the context of this statement involves wedding contracts, not taxation, and this connection signals only that Tyrian silver was exchanged in Jerusalem.